Trading's Biological Trap: Why Small Wins Are More Reliable Than 100x Gains?

TechFlow Selected TechFlow Selected

Trading's Biological Trap: Why Small Wins Are More Reliable Than 100x Gains?

The biological mechanism of winning is almost encoded in the genes of all living organisms.

Author: VKTR

Translation: Luffy, Foresight News

After a long break, I've recently started actively trading perpetual options again. It reminded me of when I first began trading back in 2018. Back then, some of my favorite traders shared knowledge that permanently changed how I view the markets. I'm not good at writing, but I’ve always been grateful to those who came before me, and I’d like to pass on what I've learned. Here goes.

One truth has stayed with me ever since: the biological mechanism of winning is almost hardwired into every living creature.

When two lobsters fight, the winner experiences a surge of hormones. His serotonin and testosterone levels spike, making him stand tall and proud—a "alpha lobster." The loser, meanwhile, curls up, sulks, and retreats into a “beta lobster” consolation mode.

This isn’t just made-up nature documentary fluff. Jordan Peterson, despite being somewhat unhinged, was fundamentally right about this. And he had good reason to talk about it. Victory literally reshapes your brain—you stand taller, feel more confident, and start seeing opportunities instead of threats. This is millions of years of evolution at work. Your brain doesn't care whether you're fighting for territory or market share—it reacts the same way.

The logic of trading works exactly the same way.

Every small win gives you a rush. Every profitable trade sharpens your focus and prepares you for the next victory. But from my experience, most novice traders do precisely the opposite.

They chase overnight miracles instead of accumulating boring gains; they brag about screenshots rather than actual profits; they proudly hold through 80% drawdowns calling it "conviction"; they revenge-trade after losses instead of stepping back calmly; they compare their own tiny 2% unrealized PnL to some KOL’s alleged 10x insider trade.

The real winners are quietly stacking up unexciting profits and letting time do the repetition.

Why Your Brain Wants You To Go Broke

When you lose, your serotonin plummets, your shoulders slump, and everything looks threatening. Your risk assessment completely breaks down because your brain believes you’re now at the bottom of the dominance hierarchy.

So what does a broke trader do? He tries to win it all back in one trade. He increases position size and chases the next meme coin under $60K market cap. He takes signals from some ex-Fortnite scammer on Telegram.

Great traders do the exact opposite. They take the loss, spend maybe five minutes figuring out what went wrong, then move on. They know one down day amid twenty up days is just noise. They protect their psychology more aggressively than their portfolio.

I see this scenario all the time—someone loses a trade and immediately goes all-in with 20% of their capital on junk coins, like someone repeatedly punching themselves in the face while wondering why their nose hurts.

Compounding Is Always Underestimated

Most people can’t grasp compounding because it starts slow and feels boring. Making $50 on a $10,000 account? You think, “What’s the point?” But that’s exactly why it works: boredom makes money, excitement costs money.

Einstein called compounding the “eighth wonder of the world.” Think about it—the guy who gave us relativity revered basic math so much.

You don’t need to crush it every single day. That’s not how markets work. Sometimes you make 1%, sometimes you make nothing, sometimes you lose a bit. The key is that over time, your net gains should exceed your net losses.

Take @gametheorizing as an example. I remember reading on @thiccyth0t’s blog that he caps his net worth growth at around 2x per year and then goes “with the flow” the rest of the time. He ensures he doesn’t overtrade or peak too early. Those who make 100x often can’t keep it—just like lottery and casino winners—they don’t know how to handle wealth.

What Actually Works

Take profits early. Forget diamond hands. The market doesn’t care about your conviction—it cares about supply and demand. Always take profits, even if only partially.

Record your wins. Screenshot every successful trade, create a folder, and look at it when you're feeling down. Your brain needs tangible proof that you’re a winner, not just an abstract memory of having made money once. Sharing realized PnL is fine; sharing unrealized PnL is usually a bad idea—ask any veteran.

Control your leverage. Start with 1x or 2x. Only increase leverage after proving you can profit without it. Leverage magnifies everything—including your stupidity.

Set daily goals—but keep them realistic. Don’t trade just to trade. Trade to reach your goal, then step away. Go outside, get some fresh air. The market will still be there tomorrow—and it might look completely different.

Track your win rate. Use a simple spreadsheet or tools like @CoinMarketMan, @tradestream_xyz, or @AxiomExchange’s PnL tracker. If your win rate drops below 60%, your strategy has issues—fix it fast.

Create rituals. Same setup, same time, same routine. Your brain loves patterns. Build a pre-trade ritual that puts you into a winning mindset—whether it’s drinking coffee, reviewing your rules, or doing push-ups.

The Hardest Part About Small Wins

Most people make a critical mistake when starting with small wins: you must ensure your losses are small too. Small wins mean you also control your losses.

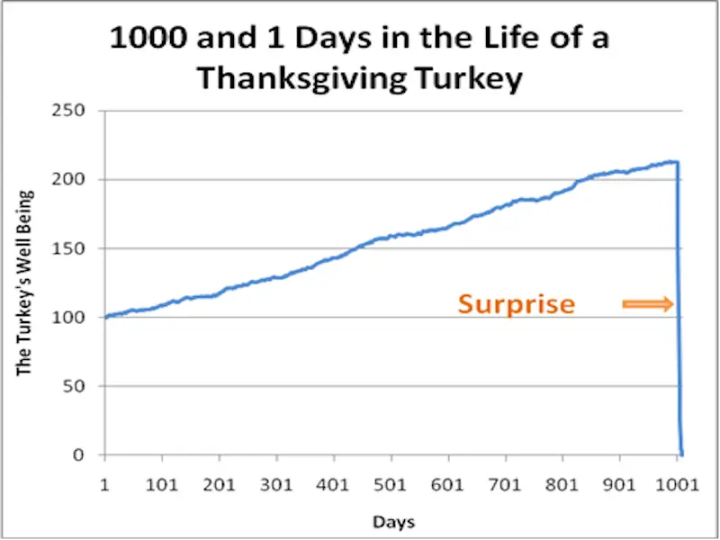

I struggled with this early on. My equity curve looked like a Thanksgiving turkey—small gains followed by one massive red candle wiping out weeks of progress. This may be the hardest part of the entire strategy, but it’s non-negotiable. A strategy with small wins and large losses will slowly destroy your account.

Losers do this: blame market manipulation. Change strategies every week. Join Discord servers hunting for “alpha.” Treat trading like gambling, not a business.

Winners do this: accept losses, extract lessons, and prepare for tomorrow. They understand trading is a marathon, not a sprint. They know consistency matters more than excitement.

One loss among dozens of wins barely affects the final outcome.

The Real Path To Success

While others are betting on the next Doge-L1, you might be building a genuinely effective strategy. While they obsess over open interest all day, you’re hitting targets and heading to the gym.

Real edge isn’t some secret trading tactic—it’s discipline. Treating trading like a business, not a casino. Understanding that the goal isn’t to be right, but to be profitable.

Most traders trade to be right; winners trade to make money. There’s a huge difference.

Getting rich slowly is boring. Not flashy. Your dumb social media posts won’t go viral from steady profits. But you know what’s even less exciting? What’s even less cool? Being broke at 30 because you spent your 20s chasing mythical 100x “conviction holds” that never came.

Most people flashing Lambos on social media are broke. They got one “moonshot,” flexed online, then lost it all—principal and profits.

Sure, there are exceptions. But in most cases, real winners are invisible.

Just Win

Small wins build momentum. Momentum leads to flow state. Lock in profits, build confidence, become the lobster who owns the rock.

Stop trying to prove how smart you are. Start proving how disciplined you are. Either win, or stay poor.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News