CoinDesk: Korean Crypto KOL Sparks $USELESS Trading Frenzy

TechFlow Selected TechFlow Selected

CoinDesk: Korean Crypto KOL Sparks $USELESS Trading Frenzy

Coinbase launches Coinbase Payments, a new platform enabling merchants to accept stablecoins, further strengthening its position in the global payments market.

Author: Sam Reynolds & AI Boost

Translation: TechFlow

Key Takeaways:

-

South Korea's influence in the altcoin market remains evident, with the rise of the $USELESS token driven by key opinion leaders (KOLs) and retail investors.

-

President Trump supports the GENIUS Act, aiming to regulate stablecoins and strengthen U.S. leadership in digital assets, though the bill's path through the House remains uncertain.

-

Coinbase launches Coinbase Payments, a new platform enabling merchants to accept stablecoin payments, further solidifying its position in the global payments landscape.

Good morning from Asia—here’s the latest market update:

Welcome to the *Asia Morning Brief*, your daily summary of key news and market movements during U.S. trading hours. For a more detailed overview of U.S. markets, check out CoinDesk’s Daybook US.

South Korea has long been known for its outsized impact on the altcoin market—from last year’s frenzy that sent XRP soaring 400%, to today’s obsession with a token literally named “USELESS.”

According to Bradley Park, Seoul-based analyst at DNTV Research, speaking to CoinDesk, the $USELESS surge is closely tied to Korean crypto KOLs.

At the center of it all is Yeomyung, a South Korean KOL and liquidity provider. He invested early in $USELESS, held through a 50% drawdown, and now enjoys substantial paper gains.

I now hold 2.8% of $USELESS, officially surpassing @theunipcs as the largest holder.

Yet, I still won’t sell.

The era of BONK and USELESS is coming.

$pump has always been “useless.”

——Yeomyung (@duaud9912)

"He made massive profits during the Trump coin craze, and with $USELESS, he benefited from early liquidity provision," Park told CoinDesk. "Now he’s just holding, waiting. They’re all waiting for a centralized exchange (CEX) listing because without it, there’s no real exit."

Park tracked Yeomyung’s wallet activity and noted that his early conviction sparked copy-trade behavior among South Korean retail investors. Wallets linked to insiders of Solana’s Jupiter platform (JUP, currently $0.40957) are also holding $USELESS—a sign of broader shifts in Korean market behavior.

"I truly believe Korean users are no longer just ‘bagholders’ in this market," he said. "They’re understanding the game and evolving into genuine global players."

Another key figure in this narrative is Bonk Guy, an early promoter of BONK. As $USELESS rebounds, he’s resurfaced with enthusiastic tweets. However, some Korean traders, including Park, question his sincerity.

"Bonk Guy was the first to push LetsBONK," Park said. "But when the price crashed, he went silent. Now that $USELESS is recovering, he suddenly shows interest again."

Park also noted that the rise of Hyperliquid, Kaia, and now Solana-based memecoins like $USELESS signals that South Korea is no longer a secondary market.

Unlike the XRP rally—which relied on narratives around U.S. regulatory clarity and deregulation under Trump—the $USELESS frenzy reflects a more authentic shift in market attention and fatigue, rather than mere chaos.

No roadmap, no utility, no pretense of grand vision—$USELESS embodies a meme-ified disillusionment: a collective shrug at traditional crypto promises and a satirical bet on “nothingness.” Paradoxically, this bet feels more honest than many tokens claiming to change the world.

Trump Backs the GENIUS Act

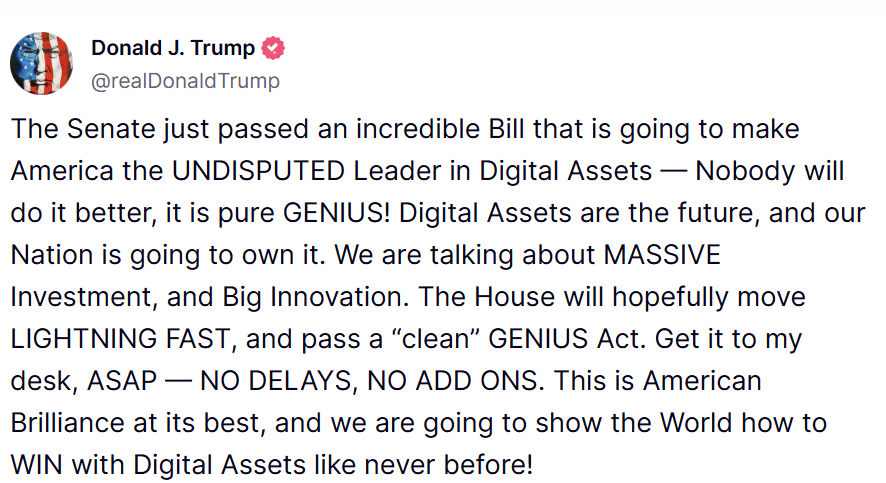

Tuesday saw President Trump post on Truth Social in support of the GENIUS Act—legislation already passed with bipartisan support in the Senate. He called it a critical step toward securing U.S. leadership in digital assets.

Trump urged the House to pass the bill “at lightning speed,” insisting it reach his desk “without delay, without amendments” for immediate signing.

This marks strong executive backing for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers—and stands as the first major crypto legislation to clear the Senate.

Trump described the bill as vital for unlocking “massive investments” and “major innovations,” positioning the U.S. as the global leader in digital assets.

Despite strong bipartisan support in the Senate, the bill’s fate in the House remains unclear.

Democratic lawmakers are considering potential revisions, including stricter oversight of foreign-issued tokens and limitations on eligible issuers.

Still, the bill faces criticism. In a recent CoinDesk op-ed, Georgetown finance professor James J. Angel argued the GENIUS Act is flawed—citing fragmented oversight across 55 regulators, redundant processes, exclusion of interest-bearing stablecoins, and inefficient joint rulemaking mechanisms.

Coinbase Launches Merchant Payment Platform

On Wednesday, Coinbase (ticker: COIN) unveiled Coinbase Payments—a new merchant payment solution built on Base, its Ethereum Layer 2 network.

As reported by CoinDesk, the platform is designed for global e-commerce platforms like Shopify, enabling 24/7 acceptance of USDC (the dollar-pegged stablecoin) without requiring merchants to understand blockchain. Features include gas-free stablecoin checkout, an e-commerce API engine, and on-chain payment protocols.

Coinbase aims to replicate traditional payment rails while reducing costs and offering round-the-clock settlement. The move positions Coinbase at the forefront of competition with fintech giants like Stripe and PayPal, all vying to modernize payments using blockchain infrastructure.

The launch also strengthens Coinbase’s partnership with Circle (ticker: CRCL), issuer of USDC. Following the announcement, Circle’s stock surged 25%, while Coinbase shares rose 16%. Coinbase noted that stablecoins processed $30 trillion in transactions last year—triple the prior year—and is betting that programmable, dollar-linked payments will continue reshaping global finance.

Market Update:

-

Bitcoin (BTC): Despite escalating tensions between Israel and Iran, Bitcoin staged a V-shaped rebound, climbing back above $105,000. According to CoinDesk Research technical data, strong ETF inflows and a key support level at $103,650 highlight institutional confidence amid volatility.

-

Ethereum (ETH): Ethereum rose 4%, holding firmly above $2,500. Despite Middle East tensions, record staking levels and sustained accumulation signal growing investor confidence during turbulent times.

-

Gold: Gold dipped 0.19% to $3,383.11. The Federal Reserve held rates steady at 4.25%-4.5%, with Chair Powell indicating no near-term policy changes and emphasizing economic strength despite trade tensions.

-

Nikkei 225: Japan’s Nikkei 225 fell 0.27% Thursday, as Asian markets diverged under pressure from the Fed’s pause on rate hikes and Israel-Iran tensions.

-

S&P 500: The S&P 500 edged down 0.03% to 5,980.87. The Fed held rates steady, with Powell adopting a wait-and-see stance, while uncertainty lingers over Trump’s tariff policies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News