After missing out on the payment industry for a decade, is Richard Liu poised to launch JD's "second payment revolution" with stablecoins?

TechFlow Selected TechFlow Selected

After missing out on the payment industry for a decade, is Richard Liu poised to launch JD's "second payment revolution" with stablecoins?

Stablecoins have become an important part of JD.com's international business.

Author: Golem (@web3_golem)

After disrupting the food delivery industry, JD.com is accelerating its move into the payments sector.

On June 17, Richard Liu, chairman of JD Group, said, "JD hopes to apply for stablecoin licenses in all major currency countries globally. Through these licenses, we aim to facilitate cross-border corporate settlements, reducing global cross-border payment costs by 90% and improving efficiency to within 10 seconds. Currently, business remittances take an average of two to four days and are quite expensive. After establishing ourselves in B2B payments, we will gradually expand into C2C payments, with the ultimate goal that one day consumers around the world can use JD's stablecoin for purchases."

Liu’s remarks reveal JD’s ambitious vision for its stablecoin in cross-border payments. While most major Chinese Web2 companies have only made limited strategic or overseas experimental investments in blockchain and other Web3-related areas—treating them as peripheral ventures—JD stands out as a relatively early and serious explorer in blockchain and stablecoins.

As early as July 2024, JD’s subsidiary, JD Blockchain Tech (Hong Kong), was selected as a participant in Hong Kong’s “Stablecoin Issuer Sandbox” program, signaling that stablecoins have already been integrated into JD’s core strategic development blueprint.

Yesterday, just hours before the 6·18 shopping festival peak, Richard Liu shared with media at Building 1 of JD’s Yizhuang headquarters in Beijing: "We will continue rolling out several new projects, including the already-launched stablecoin. JD does not plan to create entirely new business models anymore. Instead, we will deepen and strengthen our existing seven or eight supply-chain-centric business models, along with international expansion. That, roughly speaking, is our strategy." This underscores the significance JD places on its stablecoin initiative.

Missed Opportunity to Become a Payment Giant—Richard Liu’s Biggest Mistake

Why is Richard Liu placing such emphasis on stablecoins? Beyond the inherent advantages of stablecoins—such as instant settlement and reduced remittance costs—it may also stem from a desire to correct past mistakes in the payments arena.

In earlier years, Liu publicly admitted: "The biggest mistake I ever made was failing to build our own payment system after securing investment. We used to believe payments weren’t valuable. But with the rise of quick payments in recent years, it’s become clear that growing financial product user bases requires first developing a strong payment infrastructure."

In hindsight, this decision has indeed proven costly. Data shows that in 2024, China’s third-party internet payment market processed approximately ¥33.9 trillion in transaction volume. In terms of market share, UnionPay商务 led with 26.63%, followed by Alipay at 20.70%, and WeChat Pay at 18.31%. JD Pay captured only 1–3% of the market. In the consumer mobile payment space, Alipay and WeChat Pay dominate with a combined share exceeding 90%, making it unrealistic for JD to compete for significant domestic market share.

However, in the cross-border payments domain, Liu may yet find an opening through stablecoins. Although cross-border digital RMB and third-party cross-border payment systems are still developing, China’s cross-border payments remain primarily bank-based via the Cross-border Interbank Payment System (CIPS). In 2024, CIPS handled 8.2169 million transactions totaling ¥175.49 trillion. Meanwhile, despite the cross-border digital RMB pilot covering 129 countries and regions, its total transaction volume reached only ¥7.5 trillion that year. Third-party systems like Alipay and WeChat Pay’s cross-border services saw a combined market size of ¥1.534 trillion in 2024 across cross-border e-commerce and B2B foreign trade payments.

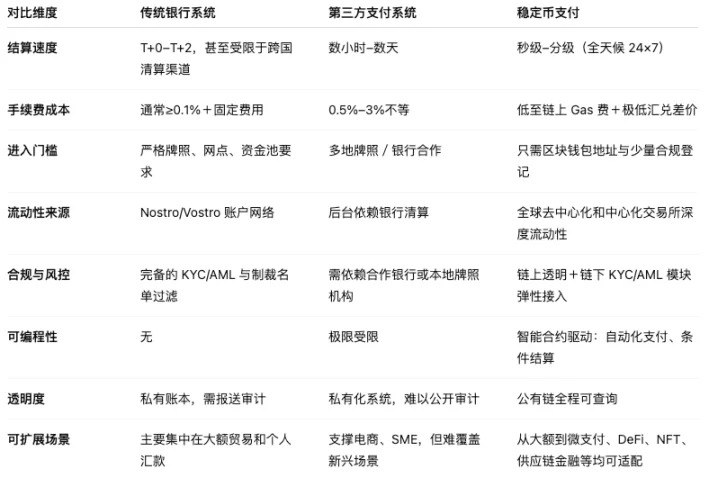

While traditional third-party cross-border payment platforms offer clear advantages over banks in cost, speed, and user experience, their clearing systems still rely heavily on banking networks. They also face challenges including difficult licensing processes, inability to handle large-scale settlements, and insufficient fund security—limiting their operations mostly to small- and medium-sized e-commerce transactions rather than competing directly with banks.

Stablecoins, however, are well-positioned to overcome many of these limitations. On one hand, although pegged to fiat currencies, stablecoins settle via blockchain networks rather than traditional banking systems, enabling real-time settlement. On the other, provided they obtain local regulatory approval, stablecoins can theoretically circulate globally—and with regulators worldwide increasingly embracing stablecoins, compliance pathways are becoming clearer and less burdensome.

Advantages of stablecoins over traditional banks and third-party payments in cross-border transactions

A true entrepreneur learns from past missteps: during the rise of third-party internet payments in 2007–2008, Liu failed to recognize the opportunity, missing the golden window to grow JD’s domestic payment business. Today, growing acceptance of stablecoins in the U.S. and beyond is driving global corporate and regulatory interest. This time, JD is not missing the boat.

Stablecoins as a Key Pillar of JD’s Internationalization Strategy

JD’s exploration of blockchain dates back to 2016, when it launched initiatives such as the consortium chain Jingzheng Chain, a blockchain-powered anti-counterfeiting traceability platform, and the NFT marketplace “Lingxi.” However, these remained experimental side projects, disconnected from JD’s core operations and overarching strategy.

In July 2024, JD Technology Group’s subsidiary, JD Blockchain Tech (Hong Kong), entered Hong Kong’s Stablecoin Issuer Sandbox and announced plans to issue a stablecoin pegged 1:1 to the Hong Kong dollar—marking the official beginning of JD’s stablecoin journey.

After a year of development, in May 2025, Liu Peng, CEO of JD Blockchain Tech, revealed progress: "The first phase of JD’s stablecoin will involve issuing HKD- and USD-pegged versions, with initial testing focused on cross-border payments, investment transactions, and retail payments."

It wasn’t until Richard Liu mentioned stablecoins in JD’s future strategy on June 17 that the business’s direction and strategic importance became fully clear. "The most important thing going forward is internationalization," Liu told reporters. "Our international strategy won’t follow the cross-border e-commerce model. Instead, we’re building local e-commerce platforms, local infrastructure, hiring local employees, sourcing locally, shipping locally, and selling only branded goods."

On June 18, Liu Peng added that JD’s Hong Kong and Macau self-operated e-commerce sites will soon support stablecoin payments. JD Blockchain Tech aims to receive its license and launch HKD-pegged and other fiat-pegged stablecoins in early Q4 2025.

This may explain why Liu wants to secure stablecoin licenses in all major currency countries—to use stablecoins as the settlement mechanism for its international operations. Doing so would eliminate complexities associated with multi-currency conversions and exchange rate fluctuations, while enabling JD to build a unified global settlement network.

"Frankly speaking, the past five years have brought no innovation from JD. It’s fair to say these were lost years—five years of decline. Without exaggeration, this period represents the least growth, progress, innovation, distinction, and value contribution in my entrepreneurial career," Liu remarked with regret.

JD’s bold moves into food delivery, stablecoins, and internationalization likely reflect Liu’s deep reflection on the company’s lackluster performance over the past half-decade. The next five years will determine whether JD can reclaim its momentum—not just reshaping China’s internet and finance landscape, but influencing the global stage as well.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News