Tether CEO Interview: Investing in Agriculture, Dairy, and Also AI and Brain-Computer Interfaces

TechFlow Selected TechFlow Selected

Tether CEO Interview: Investing in Agriculture, Dairy, and Also AI and Brain-Computer Interfaces

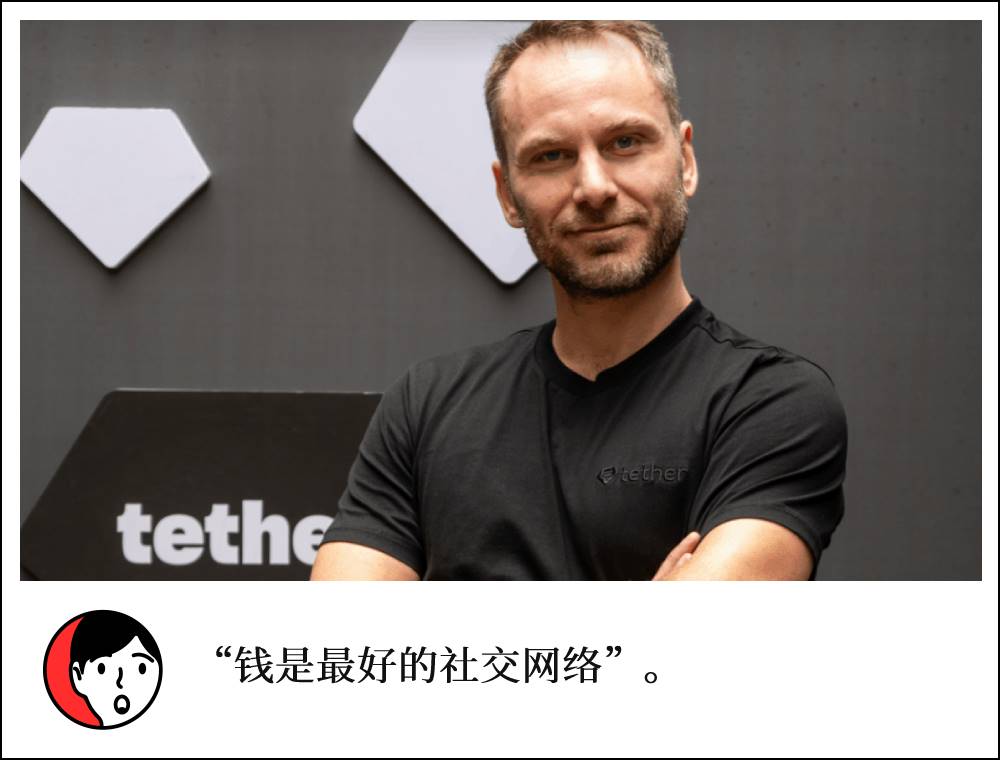

"Money is the best social network."

By MD

Produced by Bright Company

During the Global Bitcoin Conference at the end of May, Paolo Ardoino, CEO of Tether—the world's largest issuer of the stablecoin USDT—gave an interview to CNBC.

In his speech at the Bitcoin conference, Paolo Ardoino said that USDT has approximately 420 million users in emerging markets and developing countries, accounting for 62% of decentralized trading volume. "More significantly, about 35% of USDT users treat it as a savings account—because they live in countries like Turkey, Argentina, and Vietnam where local currencies are rapidly depreciating, they have no choice but to save in U.S. dollars, and USDT is their most practical option."

Data from Coingecko on June 18 shows that USDT’s total market cap is approximately $155 billion, with around $27.7 billion traded in the past 24 hours, making Tether the world’s largest stablecoin issuer. Circle,recently listed as the "first stablecoin stock" (CRCL.US),has issued USDC with a total market cap of about $61.5 billion and a 24-hour trading volume of roughly $9.2 billion.

However, some market analysts believe that under the framework of the "Genius Act" (officially the Guidance and Establishment of American Stablecoin National Innovation Act), which was passed by the U.S. Senate on June 17 and now awaits review by the House of Representatives, Tether is less compliant than Circle—partly explaining why Circle went public before Tether. In the interview, Paolo Ardoino also addressed concerns regarding Tether’s “offshore structure” and auditing, stating that the company has had productive discussions with the Big Four accounting firms, though he acknowledged, “This will be a long journey.”

Notably, Paolo Ardoino shared Tether’s rationale for investing in agriculture, dairy, video platforms, brain-computer interface technologies, and other tech ventures.

According to Tether’s official website, on April 30, Tether announced the acquisition of Adecoagro, a Latin American agricultural enterprise. The company operates primarily in sugar, ethanol, dairy, and crop production across Argentina, Brazil, and Uruguay, and owns 210,400 hectares of farmland and multiple industrial facilities in these countries.

Regarding this, Paolo Ardoino explained in the interview: “We’re exploring how to show agricultural enterprises and commodity producers (such as wheat, rice, milk) how to use stablecoins for international trade. For example, Adecoagro sells its products to Asia and the U.S., and to make those transactions more efficient, they’ve started considering using stablecoins.”

Tether’s latest disclosed investment was its announcement on June 12 of acquiring a 31.9% stake in Canadian gold royalty company Elemental Altus Royalties. Tether stated this move supports its goal of integrating long-term stable assets such as gold and Bitcoin into its ecosystem—both as a hedging strategy and as part of its commitment to building resilient digital economic infrastructure.

Below is Bright Company’s translated and edited transcript of the interview (abridged):

Host: Tether is one of the most profitable companies per employee in the world. Before diving into your stablecoin strategy and broader work, I’m curious about your recent investments—including in a Brazilian dairy company. Could you talk about your investments in AI and neuroscience, and why you’re bullish on dairy and milk in the long term?

Paolo: First, thank you for having me. From the outside, it might look like we’re doing random things, but that’s not the case.

Host: When you have massive capital, you need to invest wisely—that’s exactly why I want to understand what you’re doing.

Paolo: Over the past two and a half years, we’ve generated $20 million in profit. You have to think carefully and plan precisely. We receive hundreds of investment proposals every day, so we must be extremely selective. Part of our investments—by the way, these are separate from our stablecoin reserves—are long-term, secure investments such as land and agriculture. Tether is known for creating and maintaining the world’s largest stablecoin, USDT—a tool that brings stability to people, communities, and nations. We provide stability to countries whose local currencies are extremely fragile, like the Argentine peso or Turkish lira, so stability is at our core. And for long-term human stability, nothing is more fundamental and essential than land and agriculture.

We invested in Adecoagro—one of the largest publicly traded landowners in Argentina, Uruguay, and Brazil—because we want our portfolio to include “real Bitcoin”: land. Land is scarce; you can’t create more of it. Sure, you could go to Mars, but realistically, humanity will always need land and good agriculture to survive and thrive. That’s why we allocate part of our portfolio to land-based businesses. Additionally, we’re exploring how to demonstrate to agribusinesses and commodity producers (like wheat, rice, milk) how to use stablecoins for international trade. Since Adecoagro exports to Asia and the U.S., they’re starting to consider using stablecoins to make these sales more efficient. This is a highly attractive path, as we believe commodity trading firms will become the biggest drivers of stablecoin adoption over the next five years.

Of course, we also make investments in cutting-edge technologies like artificial intelligence and biotechnology. I love these fields—I’m essentially a geek at heart—so we’ve invested in NorthernData. We’re a major shareholder in NorthernData, which may be the world’s largest independent AI infrastructure provider—not Google, Microsoft, or Amazon. They own 24,000 GPUs, and we plan to leverage these resources within Tether to build our own AI models. We’re currently building our own AI platform at Tether. We’ve also invested in biotech and neurotech, particularly in a company I really admire, Blackrock Neurotech, which is arguably a competitor to Neuralink—though in reality, Neuralink is the one competing with them. We’re helping develop one of the world’s most advanced brain-computer interfaces capable of reading 90 words per minute from the human brain. If you consider normal speaking speed, that’s nearly equivalent. I believe this will be one of the most critical technologies for human survival, because as AI and robots advance, I believe humans will need a mathematical co-processor in their brains to stay relevant and competitive. We’ve also invested in other companies like Rumble, an excellent video platform that rivals YouTube and now boasts 60 to 70 million users.

Host: Your investment portfolio is incredibly strong. But your core business controls over 60% of the stablecoin market. We’ve seen progress on the Genius Act on Capitol Hill, though it faces resistance from Senate Democrats. David Sacks at the White House remains optimistic it will pass (it was approved by the Senate on June 17). My question is, once clear regulations are in place, what will the competitive landscape look like, especially if many new stablecoins enter the market? Over the past few years, we’ve seen attempts like PayPal launching their own stablecoin, yet its market cap remains below $1 billion—many find it hard to compete with Tether. USDC is currently second, but still lags behind. How do you see policy changes affecting competition?

Paolo: I welcome competition. But I believe the real competition will be between us and our second-largest rival, Circle, not others. Why? Because all companies announcing stablecoin projects come from traditional finance. USDT succeeded because we understood that 3 billion people in the world are unbanked. These aren’t bad people—they’re great—but they’re poor and ignored by banks. To attract a bank’s attention, you need to generate at least $150 annually in fees and commissions. But if you live in a country where the average daily income is $1.34, or earn only $80 monthly in Africa, you’ll never reach that threshold. So every stablecoin created by traditional financial institutions will serve only their existing customers. We serve 3 billion people—people whom the banking system labels a “niche market.” Many competitors say Tether serves a “niche,” but half the world’s population shouldn’t be called a niche. We built ourselves through grassroots efforts. We’ve set up numerous kiosks across Africa and aim to have 100,000 by 2030, providing electricity via solar panels to small villages. We already have hundreds of thousands of touchpoints across Latin America, offering education on stablecoins and Bitcoin.

Host: I’ve always been curious because Tether emphasizes offline payments—you can use a crypto wallet on your phone to pay with stablecoins. Yet much of the world remains cash-based. So stablecoins are clearly important for unbanked populations needing remittances and secure value storage, especially in high-inflation economies. But are people really willing to spend cryptocurrency at physical stores?

Paolo: Increasingly, yes. We now have about 420 million users, adding around 30 million new wallets each quarter—growth similar to Facebook in its early days. This proves that money is the best social network. Even in the poorest countries, more people can now afford low-cost smartphones capable of running wallets. Through word-of-mouth, our user base is growing rapidly. All our competitors focus on institutional clients, while we’ve built millions of real-world access points. We started on the streets, not in ivory towers.

Host: On that note, I met a brilliant developer in South Africa, Kgothatso Ngako, who integrated Lightning into mobile payments—people can send Bitcoin via SMS without data. Is that similar to what you’re doing—enabling usage without internet access?

Paolo: We support many such terminals that accept Bitcoin Lightning and USDT payments. That’s one of our exploratory directions. Also, by setting up service kiosks in Africa, we directly engage villagers receiving remittances (from Europe or the U.S.) and teach them to store funds on smartphones—then they spread the knowledge throughout their communities. We grow through word-of-mouth and real-world validation in the smallest, most remote African villages. If it works there, it’ll work anywhere.

Host: You welcome competition and aren’t worried about new entrants. I recall a Wall Street Journal report saying major Wall Street banks like JPMorgan and Citi are considering a unified digital dollar. But they’d likely compete with Circle, since Tether focuses on emerging markets.

Paolo: We work on the ground every day, with full teams dedicated to education and local partnerships. JPMorgan will never go to a small African village to teach people how to use their stablecoin. That’s our daily reality. JPMorgan and similar firms will only sell stablecoins to wealthy, already-banked individuals. That’s why I believe stablecoins are a “nice-to-have” in the U.S.—not a necessity. In the U.S., you have over a dozen payment options, the networks are top-tier, and the dollar itself is the best payment rail. Outside the U.S., everything is less developed. People desire the dollar, but physical USD is increasingly hard to obtain. So the best way for them to hold dollars is via USDT. But nobody else cares about this market—only we do.

Host: Given Tether’s scale today, have you considered moving out of the Cayman Islands?

Paolo: Actually, we’ve already moved from the British Virgin Islands (BVI) to El Salvador—we’re now registered there. El Salvador is currently the only country with comprehensive, intelligent stablecoin regulation. European stablecoin rules (MiCA) are terrible. They require stablecoin issuers to keep 60% of reserves in uninsured cash deposits. Look at what happened to our main competitor in 2023 with Silicon Valley Bank—they had $3 billion in uninsured deposits there, and when the bank collapsed, our competitor nearly died—only saved later by FDIC intervention. So the stablecoin survived. But you should buy Treasuries, not hold uninsured cash. MiCA requires you to hold uninsured cash—that’s why we decided not to apply. It’s a flawed framework. El Salvador now has the most robust and secure regulatory system. The U.S. will soon catch up with solid regulations. Until then, we play the hand we’re dealt.

Host: I previously spoke with Bo Hines, head of the White House Presidential Council of Advisers for Digital Assets. He mentioned Tether is the seventh-largest buyer of U.S. Treasuries and among the highest historical holders. Once the Genius Act or other stablecoin legislation passes, demand for U.S. Treasuries could surge overnight.

……

Do you have any concerns about the Genius Act? Do you support other legislative initiatives underway?

Paolo: I think the Genius Act is reasonable and comprehensive. Establishing proper rules for stablecoins is crucial because stablecoins represent blockchain technology’s most powerful application.

Host: Tether currently releases self-attested reports on financial transparency. Will you disclose more in the future? After all, there have been controversies and settlements in the past.

Paolo: Let me clarify: No meaningful stablecoin issuer has ever undergone a full audit—all major stablecoin issuers, including our biggest competitor, only issue self-attestations. The media often singles out Tether, but this isn’t a Tether-specific issue—none of the major stablecoin companies have full audits, only self-attestations. Let me explain: In 2022, Senator Warren sent an open letter to all audit firms saying not to touch cryptocurrency. At the time, the OCC also tried to suppress crypto. Back then, the Big Four audit firms simply wouldn’t sit down with stablecoin companies—not just us, but everyone. Now the situation has changed—governments are embracing crypto.

In the past six weeks, we’ve begun very positive conversations with some of the Big Four firms. It will be a long process, but the fact that dialogue has started is encouraging. We’re having open discussions. I’m confident we will achieve full audits. I love transparency—I’m the strongest advocate for it within the company. If you examine our self-attestation reports, they’re more detailed than our competitors’, disclosing all investment categories, including how much gold, Bitcoin, other assets, and Treasuries we hold. Last year, after more than two years of due diligence, a U.S. institution conducted the largest-ever reserve audit on us, scrutinizing every detail. The results were published in early 2024, confirming the accuracy of our reserves. They conducted checks in both January and May. I also disclosed two years’ worth of processes and reserves to the New York Attorney General as part of our settlement. We’re among the most scrutinized companies globally. I know we’re transparent and are setting standards for the entire industry. I’m also correcting many external misconceptions about us.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News