On Position Management for the End Times Amid Trump's Outbursts and the Looming Third World War

TechFlow Selected TechFlow Selected

On Position Management for the End Times Amid Trump's Outbursts and the Looming Third World War

Don't predict the future; instead, structurally prepare for the "worst."

Author: danny

"True safety is not about predicting the future, but designing a structure that survives no matter what the future holds." —— *Safe Haven: Investing for Financial Storms* by Mark Spitznagel

If you take too much risk, it will likely erode your wealth over time. And at the same time, if you don’t take enough risk, that too will likely cost you wealth in the long run.

Mark Spitznagel is one of Wall Street’s most renowned hedge fund managers and a partner of Nassim Taleb (author of *The Black Swan* and *Antifragile*). The firm he founded, Universa Investments, is among the very few globally that are truly dedicated to "tail risk hedging," profiting massively during crises such as 2008 and 2020. (He’s often called the King of the Black Swan.)

The core focus of this book is: how to build an investment portfolio that protects principal even during extreme events—the Safe Haven Portfolio.

Prelude: We Are Approaching the Next Great Rupture

History doesn't repeat itself, but it rhymes.

In 2025, we stand at a paradoxical moment: U.S. stocks keep hitting new highs, while long-term bond yields remain above 4.5%; the dollar is strong, yet consumption remains weak; AI fuels capital euphoria, while the world descends into fragmentation and rising war risks; pumpfun just got banned and silenced on X, while Tron rides the presidential wave straight onto Nasdaq…

Israel and Iran have just exchanged drone strikes; India and Pakistan are amassing troops along their border; Russia’s Black Sea fleet has been driven back, and Ukraine’s air force now has Western authorization to strike Russian territory directly; in the U.S., Trump’s “radical” agenda may be making a comeback, with tariffs and monetary easing potentially returning in tandem.

I. The Ultimate Truth of Wealth in Turbulent Times: It's Not About Winning Big—It's About Surviving Loss

Mark Spitznagel, author of *Safe Haven*, occupies a unique position in finance. He is neither a slow-compounding value investor like Buffett, nor a speculative trader like Soros.

He does only one thing: design investment portfolios capable of surviving “black swan” events.

This sounds mundane, but it represents an extremely rare form of wisdom—especially today, when everyone talks about “growth,” “innovation,” and “AI.” In his book, he presents a brutal yet undeniable truth:

His famous insight: "What ultimately determines your financial fate isn’t average return—it’s avoiding a single moment of ruin."

Using mathematics and historical analysis, he demonstrates that even if a portfolio earns 15% annually for years, one -80% black swan event can make recovery impossible. There are no inherently safe assets—only investment structures robust enough to survive loss.

It’s not about holding “gold” or “Bitcoin”—it’s about building a structural portfolio designed to endure storms.

Compounding doesn’t break during growth—it breaks during disaster.

II. Five Life-Saving Investment Principles from *Safe Haven*

In this book, Spitznagel not only critiques blind spots in traditional asset allocation but also proposes five hardcore strategies applicable in times of extreme crisis:

1. Safe Assets ≠ Low-Volatility Assets

Many people confuse “stability” with “safety.”

In 2008, both gold and bonds fell temporarily—the only asset that surged was long-dated deep out-of-the-money put options on the SPX (SPX PUTs).

Truly defensive assets are those that explode upward during systemic collapse. A real “safe haven” rises precisely when everything else is falling.

2. When Black Swans Hit, the Magic of Compounding Turns Against You

A -50% loss requires a +100% gain just to break even. But black swans often don’t stop at -50%—they lead to total wipeout.

His conclusion is simple: Don’t gamble on survival—engineer a structure that ensures it.

"The compounding effect is the most destructive force in the universe." (A different perspective from Buffett)

3. Don’t Predict the Future—Structure for the Worst

"You can't predict. You can only prepare."

"Prediction" is an illusion held by most investors; preparation is the real way to control risk.

You cannot foresee wars, financial crises, or regime changes—but you can allocate assets so that in any scenario, you won’t be wiped out.

4. Convex Payoff Structures Are the Real Safe Haven

A convex payoff structure means:

-

Small losses or breakeven under normal conditions

-

Multiples of gains—tenfold or more—during extreme events

Examples include: long VIX positions, deep SPX puts, long-dated gold call options, and hedges in USD/non-sovereign assets.

5. "Geographic Diversification + Custody Diversification" Is the Line Between Life and Death

Which country holds your assets, who custodies them, and whether you retain control—matters far more than most realize. Your physical location determines whether your assets remain yours when crisis hits.

Never custody solely in one country, never rely only on banks, and never go all-in on system-dependent assets (like local currency, domestic equities, or home-country real estate). Insurance becomes meaningless in true chaos.

Self-custodied crypto offers a compelling alternative due to its portability and accessibility.

III. What Does a "Safe Haven Portfolio" Look Like?

Spitznagel advocates the following structure:

-

90–95%: Low-risk, stable compounding assets (e.g., short-term Treasuries, cash, dividend-paying blue chips)

-

5–10%: High-leverage "tail hedge" positions (e.g., long VIX, long-dated SPX puts, gold/bitcoin backups)

Examples cited in the book:

-

80% in S&P 500 and 20% in gold

-

50% in S&P 500 and 50% in trend-following CTAs

-

66% in S&P 500 and 34% in long-term Treasuries

-

85% in S&P 500 and 15% in Swiss Franc

This type of portfolio delivers modest returns during calm periods but explodes during black swan events (for example, Universa gained 4,000% during the March 2020 pandemic crash).

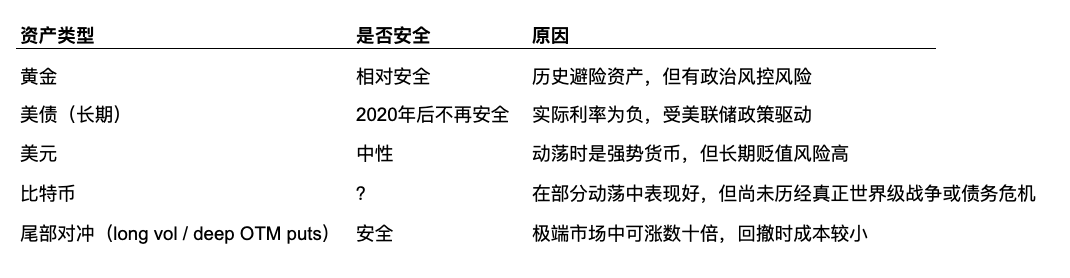

Based on his writings and interviews, here is his evaluation across asset classes:

"The net portfolio effect—or the cost-effectiveness of a safe haven—is thus driven by how little of that safe haven is needed for a given level of risk mitigation."

IV. A "Black Swan Survival Portfolio" for 2025: What Should You Do?

Given today’s risk landscape, here’s a possible layered asset framework:

Layer 0: Physical Health

No infectious or chronic diseases, maintain healthy body fat levels, develop consistent exercise habits, cultivate physical mobility; ability to operate various vehicles, know how to cook.

Layer 1: Systemic-Risk-Resistant Assets (Self-Custodied)

To survive complete systemic collapse

| Type | Allocation Suggestion | Characteristics |

|---|---|---|

| Physical Gold (coins preferred) | 5–10% | Does not depend on state recognition; usable for escape/emergency relocation |

| BTC (stored in cold wallet) | 5–10% | Digital gold, globally portable, though subject to regulatory risks |

| Overseas land / second passport | 5–10% | Enables relocation and rebuilding identity when necessary |

Layer 2: Tail Risk Hedge Positions (High-Leverage Hedging Assets)

To surge during black swan events and replenish portfolio value

| Type | Allocation Suggestion | Characteristics |

|---|---|---|

| Deep SPX Puts | 1–2% | Long-dated options, primary source of maximum alpha |

| Long VIX | 1–3% | Explodes when market volatility spikes |

| Gold Call Options | 1–2% | Rises sharply during high inflation or war scenarios |

Layer 3: Liquidity + Growth Assets (Normal Market Return Sources)

To support stable living standards and cash flow when the economy remains intact

| Type | Allocation Suggestion | Characteristics |

|---|---|---|

| Short-Term Treasury ETFs / Money Market Funds | 20–30% | Safe and stable, ensures liquidity |

| Global diversified high-dividend stocks | 20–30% | Income-generating, reduces exposure to single-country collapse |

| Emerging market real estate + USD-denominated REITs | 5–10% | Diversified income streams |

"In investing, good defense leads to good offense."

V. Conclusion: Everything Can Collapse—But You Don’t Have To

What *Safe Haven* ultimately teaches us is this:

You cannot prevent wars, crashes, or revolutions—but you can proactively design an asset structure that won’t go to zero, no matter what happens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News