A Comprehensive Analysis of TRON's DeFi Ecosystem

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of TRON's DeFi Ecosystem

TRON has established a pivotal position in the public blockchain sector, with its ecosystem data demonstrating a strong trend of continuous growth.

TRON has firmly established its core position among mainstream public blockchains, thanks to its comprehensive ecosystem, active user base, and massive asset scale.

Particularly in this current crypto bull market, TRON's achievements have been remarkable: it leads all blockchain networks in USDT issuance volume and serves as the preferred settlement layer for stablecoins, handling approximately 60% of global stablecoin transaction traffic. In May alone, its monthly revenue surpassed $350 million, making it the second most profitable product in the cryptocurrency market.

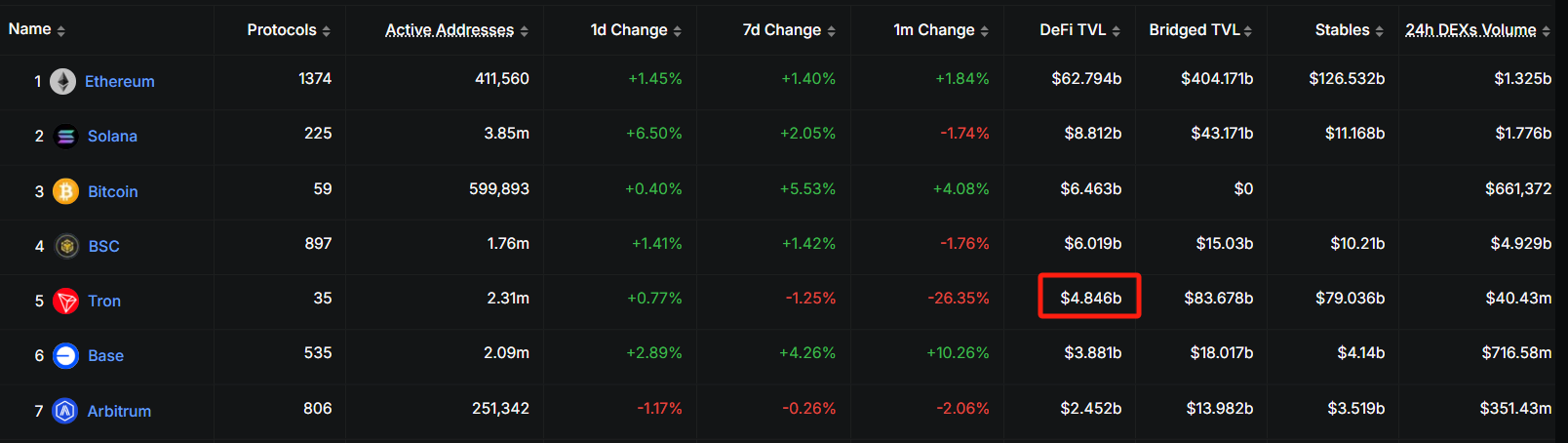

According to DeFiLlama data, on June 16, the total value locked (TVL) in TRON’s DeFi applications reached $4.84 billion, with over 2.3 million active addresses and nearly $80 billion in stablecoin assets. Its TVL has consistently ranked within the top five across all public blockchains.

These impressive figures not only reflect TRON’s solid user foundation and substantial asset strength but also serve as strong evidence of its thriving ecosystem.

The "Three Engines" Driving Data Growth: ~200K+ Daily New Addresses, Assets Exceeding Quadrillions, Diverse Ecosystem Protocols

Over the past year, TRON’s on-chain metrics have experienced explosive growth, with ecosystem vitality reaching unprecedented levels. The “daily addition of over 200,000 new addresses, circulating asset value exceeding quadrillions of dollars, and a rich diversity of ecosystem protocols” represent the three key drivers behind TRON’s data surge—showcasing its robust development potential and leading market competitiveness.

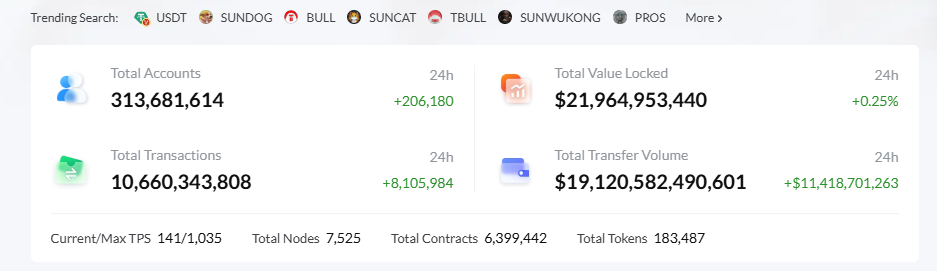

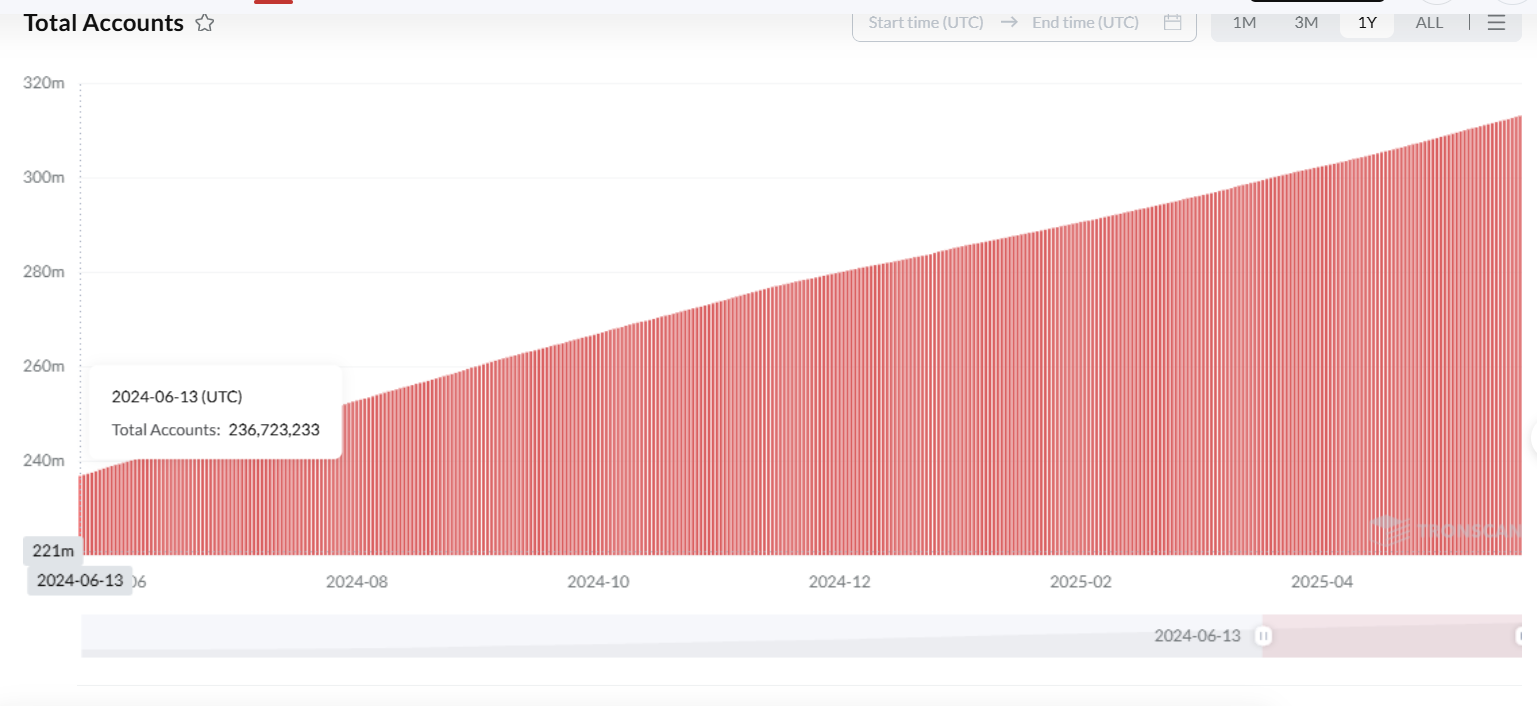

In terms of user scale and growth, TRON continues to expand steadily, with both total on-chain accounts and daily new address registrations showing strong momentum. According to TRONScan browser data, as of June 13, the total number of on-chain accounts exceeded 313 million, with more than 200,000 new addresses added daily. The network processes over 8.67 million transactions per day, with a daily transferred asset value reaching up to $25 billion.

Notably, TRON’s address growth follows a stable linear trajectory. A year ago on the same date, the total number of on-chain accounts was approximately 237 million; today, it has grown by over 32%, averaging around 210,000 new accounts per day. This data powerfully demonstrates the continuous expansion of TRON’s user base and highlights its widespread global appeal and strong market penetration, successfully attracting vast numbers of users worldwide and laying a solid foundation for sustained ecosystem prosperity.

In transaction processing performance, TRON also excels, with extremely high on-chain activity—daily transaction counts frequently ranging from millions to tens of millions. Over the past 30 days, the average daily on-chain transfer value has remained above $23 billion. Such large-scale, high-frequency transaction volumes not only demonstrate TRON’s powerful capability in fund circulation but also indicate the network’s stability and security.

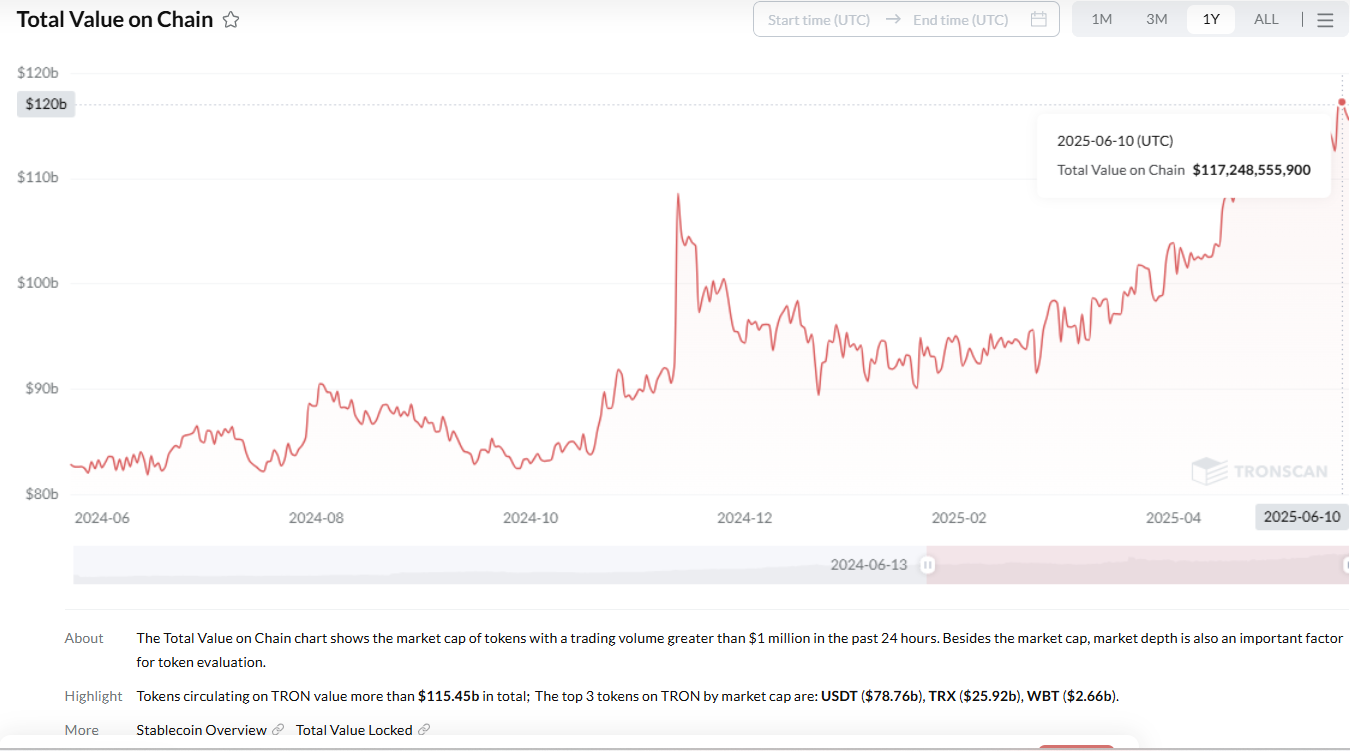

On the asset front, TRON has shown strong growth momentum. From the perspective of Total Value Circulating (TVC) on the TRON chain, assets have increased by over 40% year-to-date, forming a diversified ecosystem.

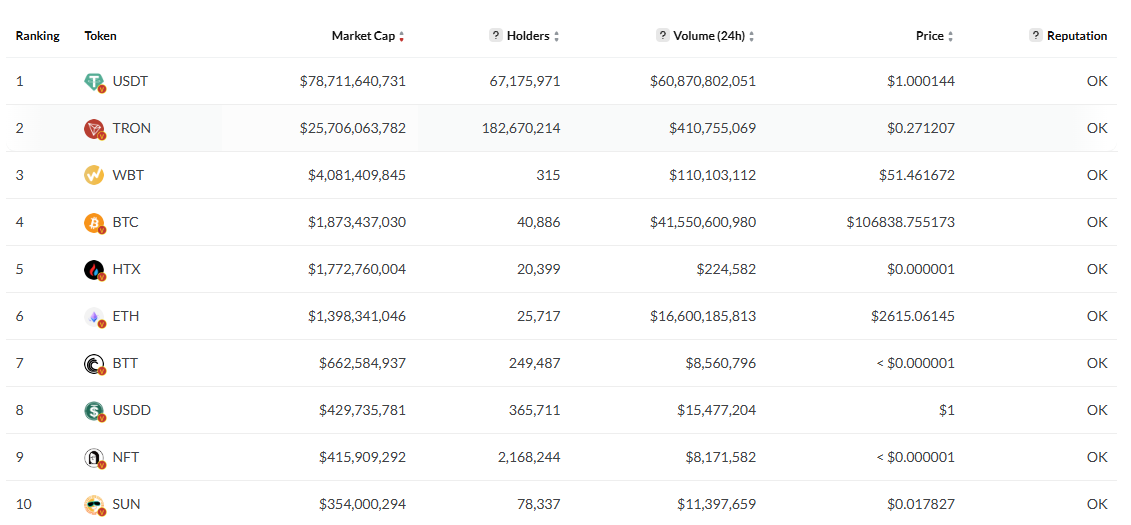

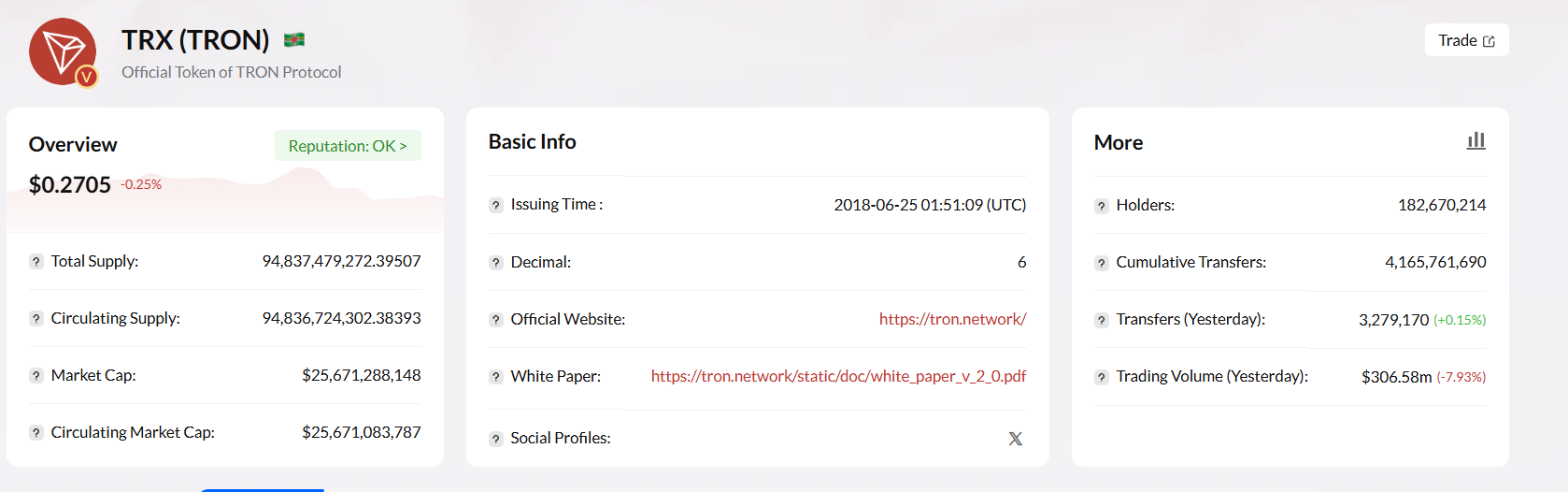

According to TRONScan, as of June 13, the total circulating asset value (TVC) on the TRON network reached approximately $1.155 quadrillion, a significant 40% increase compared to $820 billion during the same period last year. The top three assets by circulating value on TRON are USDT (~$78.8 billion), TRX (~$25.9 billion), and WBT (~$2.66 billion), followed closely by BTC and ETH. Additionally, other TRON-native assets such as WBT, HTX, USDD, BTT, NFTs, and TUSD span various domains, collectively building a rich, multi-layered value system that enhances overall diversification.

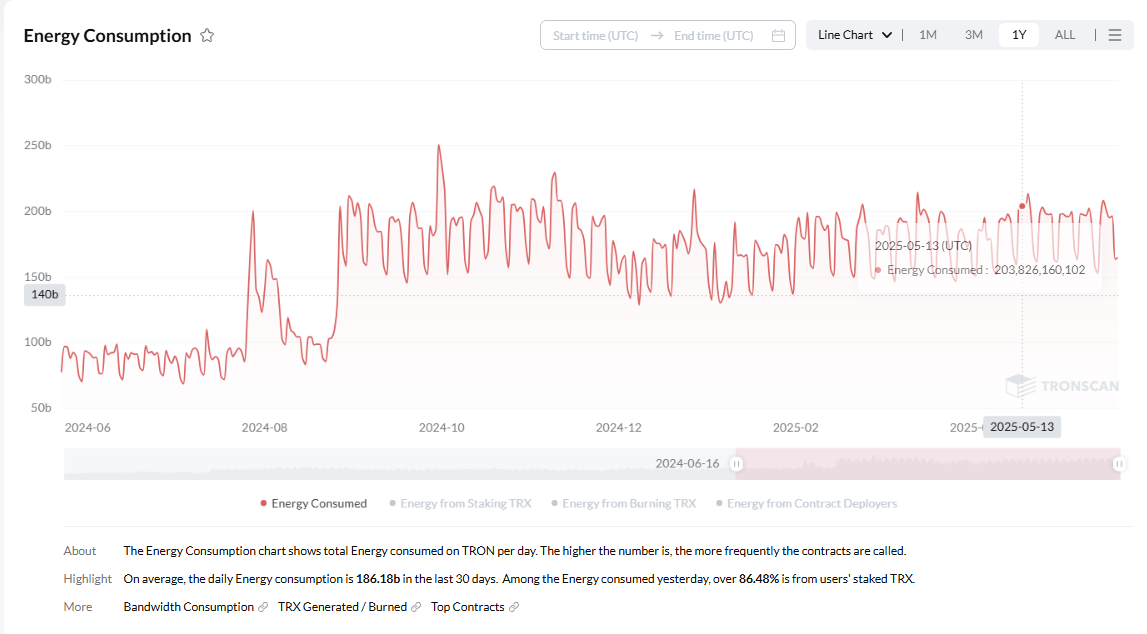

Network activity can also be gauged through Gas fee consumption. On the TRON network, the Gas fee mechanism operates via a combination of Energy and Bandwidth. Users must consume Gas fees when performing actions like transfers or withdrawals.

Official browser data shows that over the past year, Energy consumption surged from an initial 80 billion to 190 billion—an increase of 240%. This sharp rise directly reflects the explosive growth in on-chain transaction activity and further confirms a strong positive correlation between Energy consumption and real user transaction demand. Higher Energy demand indicates more frequent on-chain activities such as token transfers and smart contract calls, highlighting the depth and breadth of user participation and the vibrancy of TRON’s ecosystem.

In terms of Energy-consuming account distribution, major cryptocurrency exchanges including OKX, Bybit, and Binance occupy the top 10 spots. Their high-frequency Energy usage clearly illustrates their deep reliance on and substantial demand for the TRON network, underscoring TRON’s superior performance in supporting large-scale commercial applications and its strategic role as critical infrastructure for leading exchanges—bridging digital asset trading and Web3 technologies.

From an ecosystem development standpoint, TRON hosts a wide range of applications—from the transaction hub SUN.io and the meme asset issuance platform SunPump, to JUST’s one-stop DeFi solutions such as JustLend DAO, Staked TRX liquidity staking protocol, Energy Rental platform, and the stablecoin USDD. These core protocols and products collectively enrich TRON’s DeFi ecosystem, offering users diverse financial options.

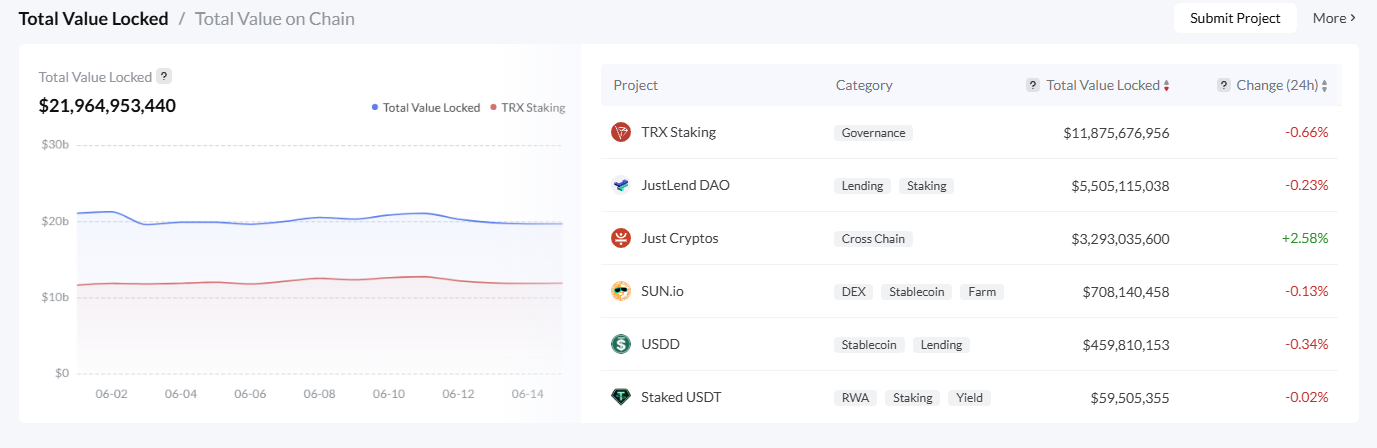

As of June 16, TRON’s on-chain TVL exceeded $22 billion, maintaining a relatively stable level around $20 billion over the past year. Among them, TRX staking accounted for the largest share with over $11.8 billion in TVL; JustLend DAO lending recorded about $5.5 billion, ranking second; Just Cryptos cross-chain had $3.3 billion; SUN.io exchange platform held $700 million; and USDD stablecoin reached $458 million. These figures fully demonstrate the prosperity and dynamism of the TRON ecosystem, signaling broad prospects for future growth.

A Closer Look at Mainstream DApps Within the TRON Ecosystem

1. JUST – One-Stop DeFi Solution

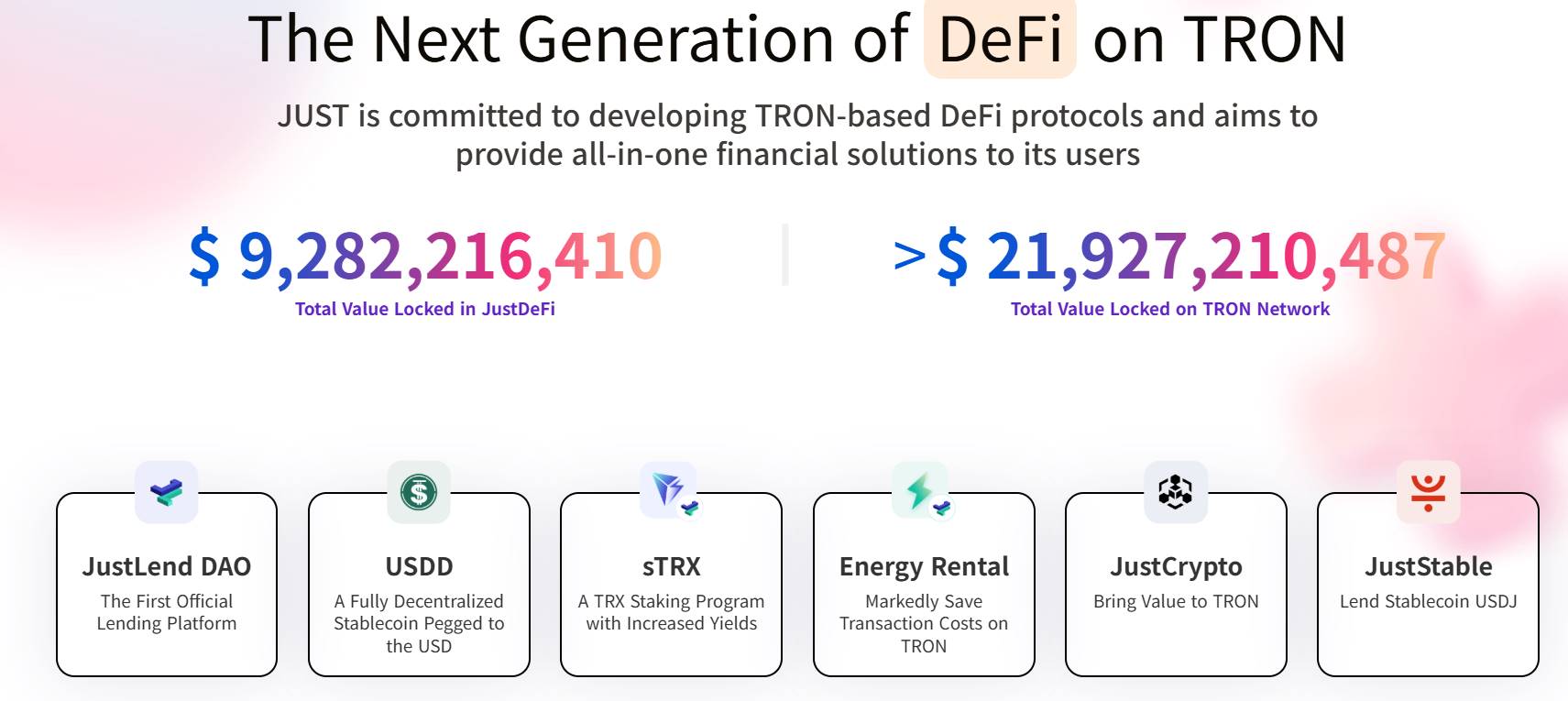

JUST focuses on developing DeFi protocols based on the TRON blockchain, aiming to provide users with an integrated financial solution. Its product suite includes JustLendDAO, USDD, sTRX, Energy Rental, JustCrypto, JustStable, and others, delivering a diversified financial experience that meets various user needs within the DeFi space.

According to official data, as of June 16, the total TVL of the JUST protocol approached $9.3 billion.

● JustLendDAO: The first official lending platform on TRON, allowing users to collateralize assets for loans or deposit idle funds to earn stable interest, enabling flexible asset appreciation.

● USDD: A fully decentralized stablecoin pegged 1:1 to the US dollar, supported by over-collateralization using high-quality crypto assets such as TRX, sTRX, and USDT.

● sTRX (Staked TRX): A liquid staking product on TRON that offers higher returns and more flexible unstaking options, allowing users to enjoy staking rewards while retaining flexibility in asset allocation.

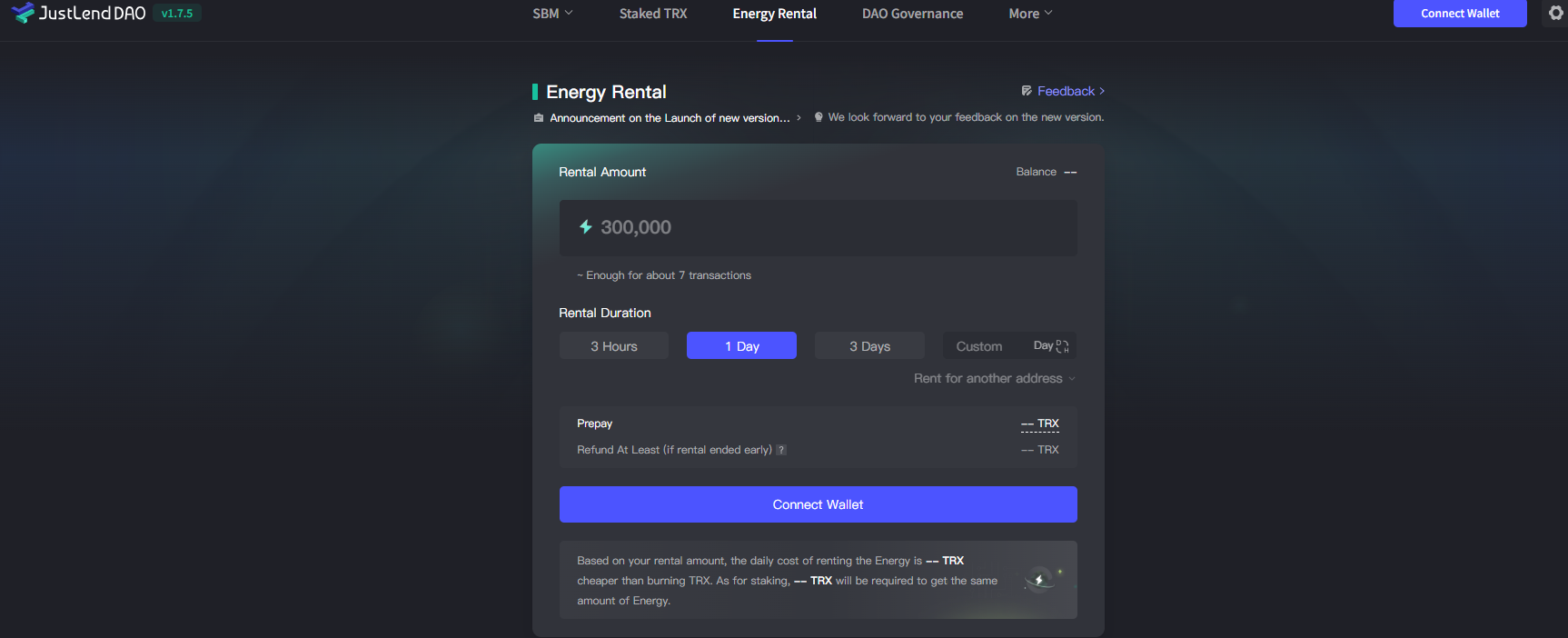

● Energy Rental: A unique energy leasing service within the TRON ecosystem. Users can lease Energy instead of burning TRX to cover transaction costs—functioning like an “energy coupon”—significantly reducing Gas fees and improving capital efficiency for more economical transactions.

● JustCrypto: A cross-chain token backed by the JUST ecosystem, designed to maintain price stability for assets like BTC, ETH, DOGE, and LTC across different networks. Its cross-chain mechanism is supported by reputable platforms such as Poloniex and BitTorrent Chain.

2. Lending Ecosystem – JustLendDAO

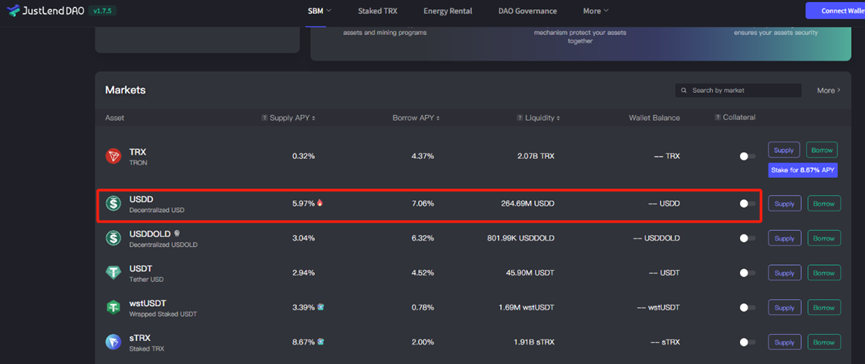

JustLend DAO is an efficient and flexible lending platform built on the TRON blockchain. Users can deposit idle funds to earn interest or borrow other crypto assets to leverage investments. Borrowing and lending operations are automated via smart contracts, with floating interest rates algorithmically adjusted based on supply and demand for specific assets on JustLend DAO, ensuring dynamic balance and fairness.

Currently, JustLend supports lending markets for TRX, USDT, USDD, SUN, JST, BTC, ETH, TUSD, BTT, and others.

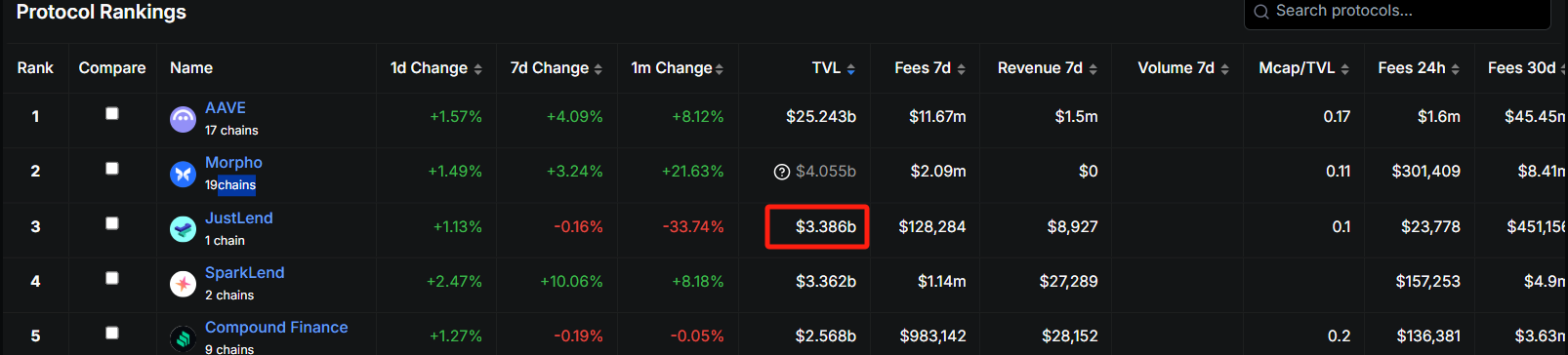

According to DefiLlama data, on June 16, JustLend’s TVL reached approximately $3.4 billion, placing it among the top three in the global lending sector.

Beyond lending, JustLend DAO also provides Staked TRX and Energy Rental services.

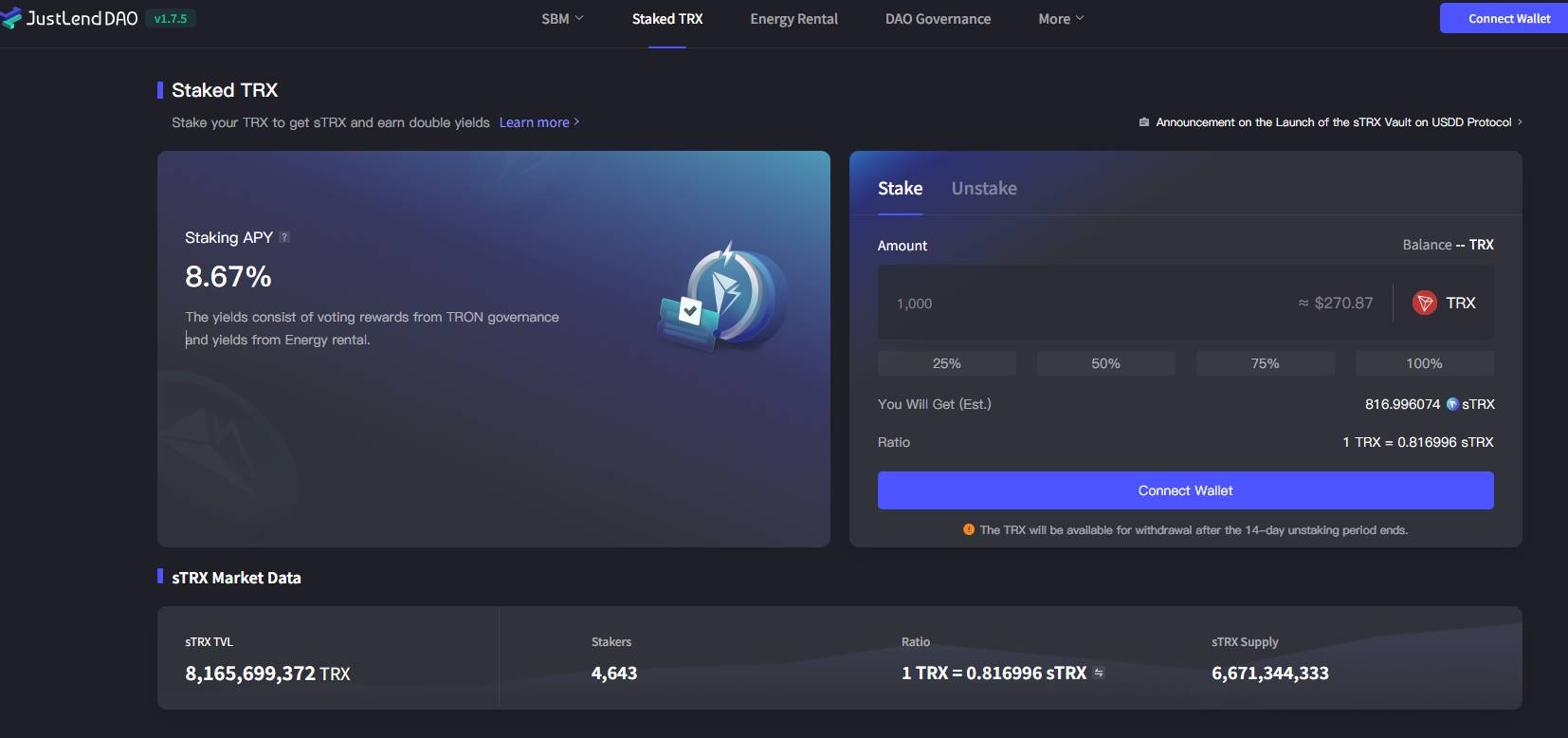

Staked TRX offers users a convenient staking option. With a single click, users can stake TRX and receive sTRX in return. The staked TRX is used for voting governance and energy leasing, and users earn passive income simply by holding sTRX. As of June 16, over 8.166 billion TRX were staked, with participation from more than 4,600 addresses, offering an annualized yield of 8.67%.

However, according to TRONScan data, as of June 16, there were over 182 million TRX holder addresses, with a market cap exceeding $25.6 billion—indicating a vast and highly distributed user base. Yet, the current staking penetration rate stands at just 8.6%, suggesting significant room for future growth in staking participation.

Energy Rental is another user-friendly feature offered by JustLend DAO, enabling users to directly rent Energy to offset Gas fees without burning TRX. This function helps reduce on-chain transaction costs. Given the steady rise in TRON’s holder count and transaction frequency, Energy Rental better serves the ecosystem. On June 16, JustLendDAO offered 37 billion units of Energy for rental, with over 65,000 addresses having utilized the service—a clear sign of its popularity.

In addition to earning interest from deposits, users on JustLend DAO can now earn extra rewards by storing USDD. USDD is a decentralized stablecoin initiated jointly by GrantsDAO (a sub-DAO under JustLend DAO) and the TRON DAO Reserve. In January, USDD upgraded to version 2.0, and shortly after, JustLendDAO launched USDD lending functionality. Users who store USDD currently earn around 6% annualized returns. As of June 16, the pool holds as much as 264 million USDD.

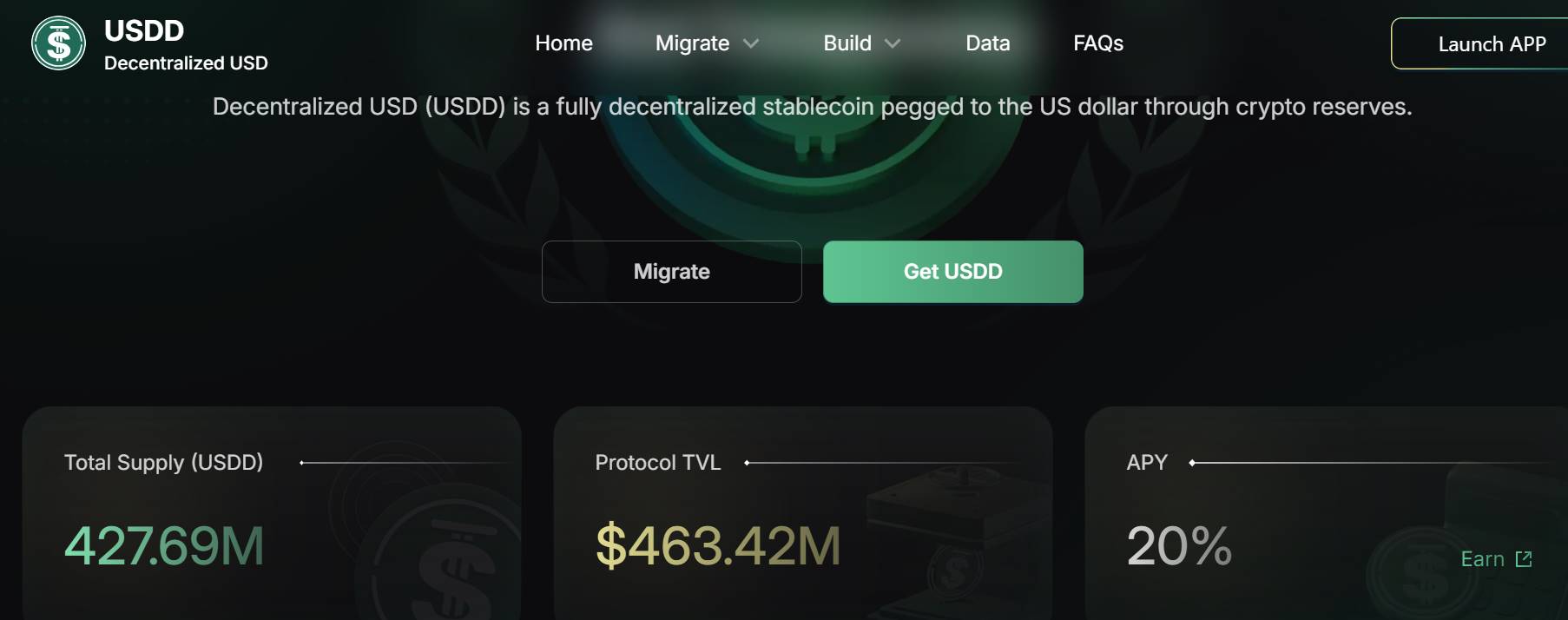

3. Decentralized Stablecoin – USDD

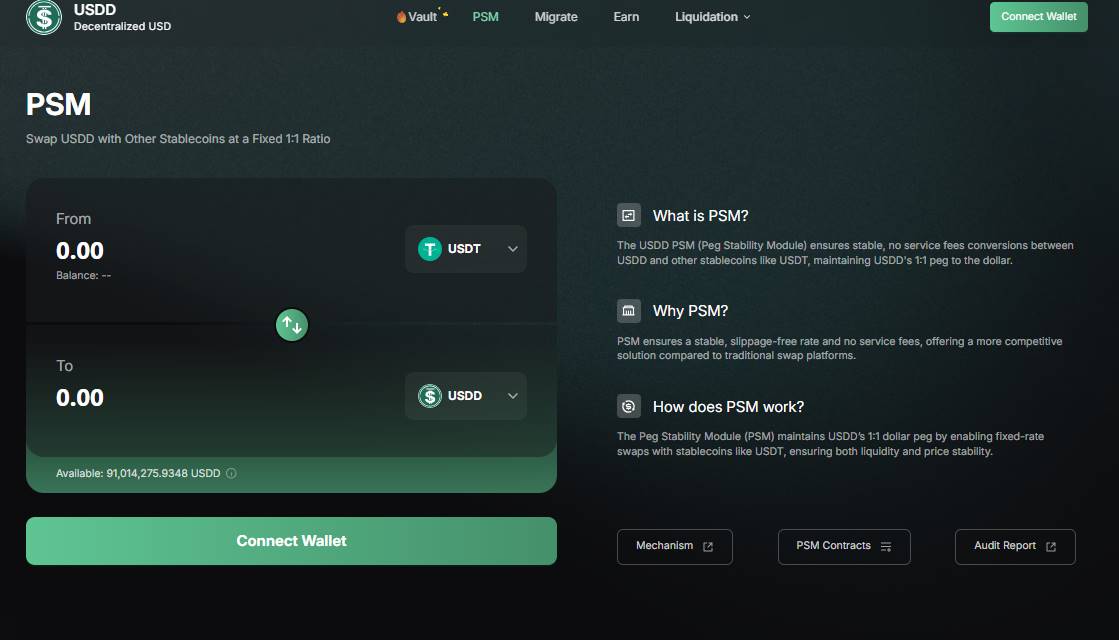

USDD is a decentralized stablecoin issued on the TRON blockchain. Currently, users can obtain USDD in two ways: First, by over-collateralizing high-quality assets such as TRX, sTRX, or USDT to mint USDD; Second, via the PSM stablecoin swap tool, which allows direct 1:1 conversion between USDT and USDD with zero Gas fees and no transaction charges.

Official data shows that as of June 16, the total supply of USDD is approximately 430 million.

Today, USDD seamlessly integrates with major DeFi platforms such as JustLend DAO and SUN.io. It also maintains close partnerships with compliant exchanges including Kraken, HTX, Bybit, Gate.io, and Poloniex. On these platforms, users can stake USDD to earn high yields. This extensive ecosystem integration provides ample space for USDD’s circulation and application, allowing it to deeply embed into every corner of the crypto market and deliver greater value and convenience to users.

4. All-in-One Trading Platform – SUN.io

SUN.io is an integrated trading platform built on the TRON blockchain, combining functionalities such as asset swapping, meme coin issuance, liquidity mining, and DAO governance, aiming to provide efficient and secure trading services for the TRON ecosystem.

The current product matrix of SUN.io includes the following main components:

● SunSwap (Core Trading Engine): An AMM-based decentralized exchange that has evolved through V1, V2, and V3 iterations, with most current trading activity occurring on V3.

● SunCurve and PSM: Focus on stablecoin trading. PSM is a dedicated swap tool for USDD, enabling fixed 1:1 ratio exchanges between USDD and USDT/USDC/TUSD with zero slippage and zero fees.

● SunPump: The latest product launched by Sun.io, positioned as the first fair-launch meme coin platform within the TRON ecosystem.

● SunBoost (Liquidity Incentive Center): The LP staking module where users can stake their SunSwap LP tokens to earn reward tokens—the core mechanism driving liquidity incentives.

● DAO Governance System: Empowers users to participate in platform governance and incentive distribution decisions through the veSUN model, establishing a community-driven governance structure.

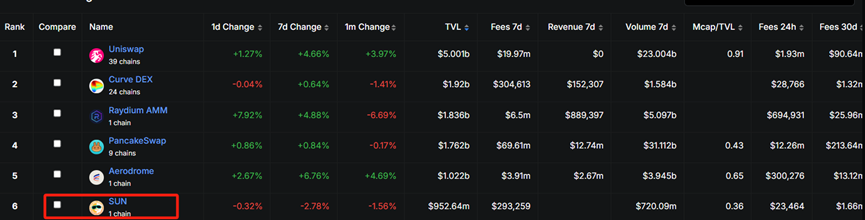

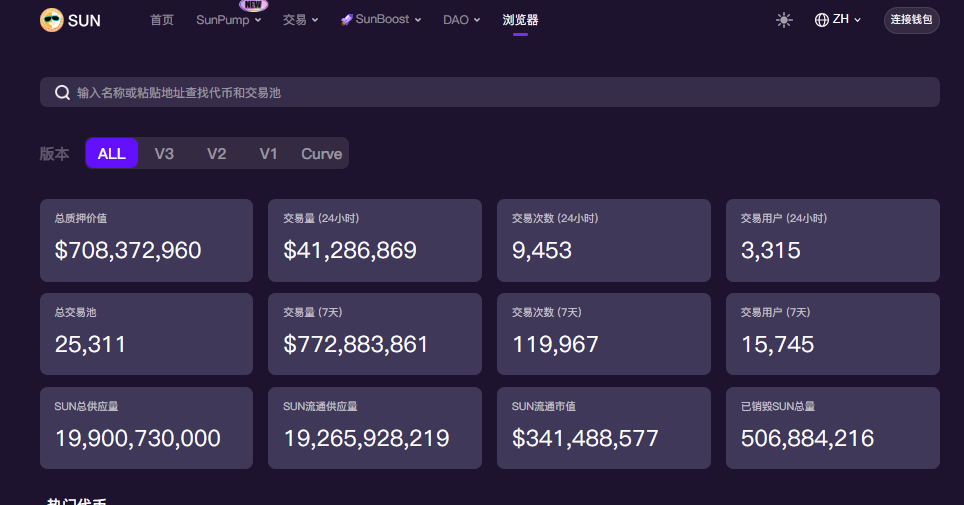

Data-wise, SUN.io performs exceptionally well. According to DefiLlama, on June 16, SUN.io’s TVL exceeded $952 million, consistently ranking among the top three on the TRON network and within the top six across all DEXs globally.

Additionally, according to official SunScan browser data, SUN.io’s trading activity remains strong. In the past seven days, SunSwap processed nearly 120,000 transactions totaling over $770 million. The number of active trading addresses exceeded 15,000 in the past week, with more than 25,000 cumulative trading pools covering a wide range of assets—from stablecoins and major cryptocurrencies to long-tail meme assets—forming a diverse and inclusive financial ecosystem.

Moreover, the SUN platform token has shown healthy growth. With a circulating market cap of approximately $341 million and over 500 million tokens already burned, its deflationary path is clear. The token model is tightly linked to platform value growth, and as the platform expands, the value of SUN tokens is expected to continue rising, delivering increasing returns to users.

5. Fair Meme Asset Launchpad – SunPump

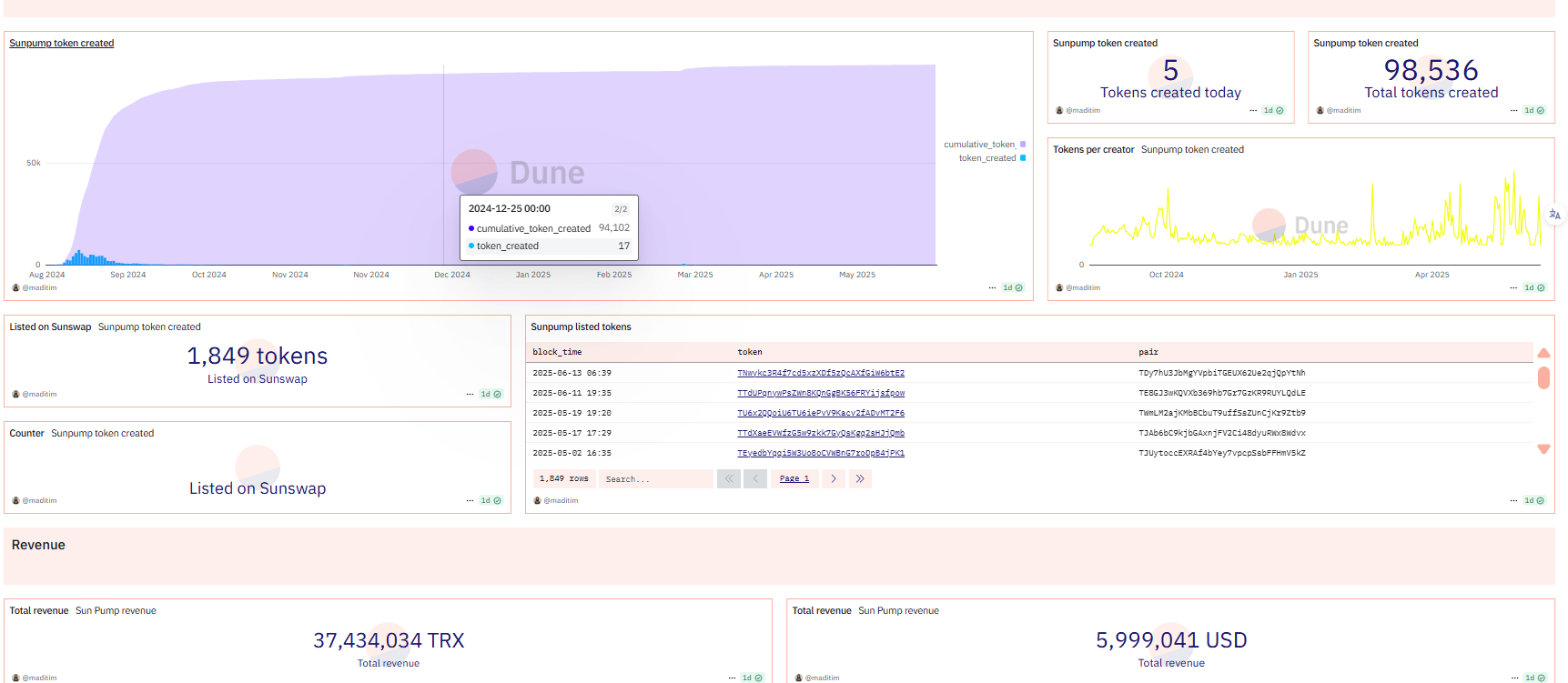

SunPump, developed by Sun.io, is a fair-launch platform for meme assets. Leveraging TRON’s robust technical infrastructure and vast user base, SunPump quickly gained popularity after its launch in August 2024, consistently ranking among the top three in the competitive meme coin launch space.

In its first month, SunPump demonstrated astonishing momentum, setting a record of launching 7,351 meme coins in a single day and generating up to $560,000 in daily revenue—once outperforming industry leader PumpFun.

According to Dune analytics, as of June 16, SunPump has created over 98,000 tokens, with around 1,850 listed on SunSwap. Since launch, the protocol has cumulatively generated over $10 million in revenue—a testament to SunPump’s vibrant growth.

On the ecosystem front, four meme tokens have achieved market caps exceeding $10 million, including SUNdog and PePe.

Product-wise, SunPump continuously iterates around three core pillars: token creation, trading growth, and community engagement. It has introduced several new features such as Sunflare (helping users discover promising projects early), a Ranking System (real-time ranking of tokens based on trading volume and holder count, providing clear investment insights), and CEX Listing Apply (enabling projects to directly apply for centralized exchange listings via SunPump, expanding growth channels). These innovations greatly enhance user experience and extend the platform’s ecosystem boundaries, transforming SunPump into a more complete and diverse meme asset launch and trading environment.

In terms of innovation, SunPump continues to push boundaries. Last year, it launched Sun Agent, an AI-powered assistant that optimizes content generation and management tools for creators and traders. In March this year, the platform introduced the innovative AI Agent @SunGenX, enabling a lightweight “tweet-to-token” launch feature. Users can now issue a meme coin simply by posting a tweet—dramatically simplifying the token creation process.

Conclusion

Today, TRON occupies a pivotal position in the public blockchain landscape, with ecosystem metrics showing sustained and robust growth—a result of multiple synergistic factors working in tandem.

TRON’s outstanding achievements in user scale, asset volume, and ecosystem protocol development constitute the “three engines” driving its rapid expansion, propelling it forward on the crypto赛道 with unstoppable momentum.

Core protocols such as SUN.io, SunPump, JustLend DAO, and USDD offer users a wide array of financial products and services, meeting diverse investment and trading needs. These foundational modules are not only the bedrock of the TRON ecosystem but also the key force enabling TRON to maintain leadership in the DeFi space. They continuously drive the entire ecosystem toward greater prosperity, diversity, and innovation.

Looking ahead, TRON is poised to build on its deep technological expertise, massive user base, and powerful ecosystem synergy to continue writing a brilliant chapter in the cryptocurrency market—building a more open, efficient, transparent, and inclusive financial ecosystem for global users, truly becoming a key infrastructure illuminating the future of decentralized finance across the world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News