Go to Hong Kong, seize the new era

TechFlow Selected TechFlow Selected

Go to Hong Kong, seize the new era

Adults don't make choices—they seize the policy红利 period and go for both A+H.

Author: Xie Zhaoqing, Tencent News "Qianwang"

"Busy" has become the norm for Hong Kong investment bankers over the past period.

"We travel to mainland China several days every week—to follow projects and compete for new ones," said a sponsor at a top Chinese-headquartered investment bank in Hong Kong.

He currently handles eight Hong Kong IPO projects—two have already filed listing applications, two more will file soon, and the rest have been on-site for some time. In addition, he is negotiating several other deals, competing with peers for final sponsorship contracts, including A-share companies seeking dual listings in Hong Kong.

"Back in Hong Kong just long enough to attend meetings, stay one day, then off again on another business trip," said another banker. "Catching flights or high-speed trains has become routine. The market is heating up, and our pace feels like it did before the pandemic in 2018 and 2019."

Data from the Hong Kong Stock Exchange (HKEX) confirms this surge. As of June 15, 30 companies had gone public on HKEX. Four more—including Haichuang Flavor & Food (an A-share food and soy sauce company), Sanhua Intelligent Controls (industrial), and two healthcare firms—were in the subscription phase. Including these four, total fundraising would reach HK$100 billion, more than five times higher than the same period last year. This marks the first time in six years that HKEX has reclaimed the top spot globally in IPO fundraising volume.

Bian Jing, Head of Capital Markets at ABC International Holdings, said this current wave represents the best window for Hong Kong IPOs since the second half of 2021.

He noted that many of the companies going public are strong players, including industry leaders such as Contemporary Amperex Technology Co. Limited (CATL), Hengrui Medicine, and Haichuang Flavor & Food. Sovereign wealth funds and leading overseas long-only investors he has engaged with are returning to Hong Kong and becoming active again. Meanwhile, regulatory support from both sides of the border—including faster备案 approvals for mainland companies listing in Hong Kong—has helped revitalize the market.

Mainland Companies Accelerate Hong Kong IPOs: Raising HK$52.2 Billion in One Week, Over 200 Queued

"Overall, the Hong Kong market is indeed very active now," said Zhu Zhengqin, China Head of Global Investment Banking at UBS. During the third week of May alone, her team completed four deals—including CATL—raising over US$8 billion (approximately HK$62.7 billion). Three were Hong Kong capital market transactions: CATL and Hengrui Medicine’s IPOs, and Bilibili’s secondary offering, which raised US$690 million.

That week marked a mini peak for Hong Kong IPOs. Public data shows three mainland companies listed in Hong Kong that week: CATL raised over HK$41 billion, Hengrui Medicine raised HK$9.89 billion, and Mirxes raised US$167 million. Total proceeds reached US$6.657 billion (HK$52.25 billion).

In just seven days during the third week of May, Hong Kong IPOs raised 63% of the entire 2024 annual total of HK$82.9 billion.

Zhu believes the market is significantly livelier compared to the previous two years. She observed a brief revival in Hong Kong’s capital markets after September last year, followed by stagnation. But starting January this year, sentiment began rising steadily—driven partly by DeepSeek's breakthrough—and despite short-term setbacks due to U.S.-China trade tensions, the market quickly recovered.

The Hang Seng Index tells a similar story: It climbed from 18,800 points on January 13 to a near two-year high of 24,770 on March 19, dipped below 20,000 by April 7, then resumed its upward trend, closing above 24,000 on June 11.

Multiple Central-based bankers, including Bian Jing and Zhu Zhengqin, believe this boom could last for some time. Many mainland enterprises have noticed the trend and are accelerating their Hong Kong listing plans.

Dr. Lam Tsz-lung, Global Head of Capital Markets at Eden Financial, said issuers are now seeing clear signs of full recovery in the Hong Kong market and have become more positive in mindset.

Previously, most IPOs required proactive push from investment banks. “Now, many issuers are driving the process themselves,” he said, noting that mainland companies increasingly see feasibility in listing in Hong Kong amid improving market conditions.

HKEX data reflects this shift: 37 and 42 companies submitted listing applications in April and May respectively, up from 29, 11, and 13 in January through March. Even within the first 11 days of June, 14 companies had already filed applications.

As of June 13, HKEX’s official website showed 211 companies waiting to list, while 30 had already gone public.

Typically, HKEX lists around 100+ companies annually—even during the 2018 peak, only 218 listed. This suggests a potential IPO backlog in 2025—"a traffic jam"—depending on how fast regulators approve filings.

Adults Don’t Choose: Seizing Policy Benefits, They Want Both A-Share and H-Share Listings

"For issuers today, listing in Hong Kong is no longer an either/or decision," said Zhu Zhengqin. Years ago, mainland firms debated between domestic, U.S., or Hong Kong listings. Now, they seriously consider Hong Kong as part of their strategy.

This is because Hong Kong offers advantages such as easier follow-on financing and flexible equity incentive arrangements for executives, making it more attractive to issuers.

Bian Jing added that this round of activity represents not only the best market window since late 2021 but also a golden policy window.

Last year, China’s Securities Regulatory Commission (CSRC) announced five cooperation initiatives with Hong Kong, explicitly stating support for leading mainland firms to list in Hong Kong and encouraging A-share companies to pursue dual listings.

Lam Tsz-lung felt the change deeply. His team had started preparing A-share-to-Hong Kong projects two years ago. Back then, discussions about dual listings with A-share company management yielded little interest due to market uncertainty.

A banker working on IPOs recalled being dismissed as a "scammer" when discussing Hong Kong listings with A-share company executives last year—reflecting historical concerns over Hong Kong’s liquidity and valuations compared to A-shares.

Moreover, prior to recent changes, timing and costs for A-share companies listing in Hong Kong were unpredictable—a major headache for both issuers and bankers. Normally, if everything goes smoothly, an H-share IPO takes 6–9 months, sometimes extending to 12 months from filing to listing.

All this changed after the “September 26 policy” announcement (referring to the Politburo meeting emphasizing efforts to boost capital markets). Both A-share and H-share markets surged. Most notably, Midea Group successfully listed in Hong Kong on September 17, raising over HK$30 billion with strong aftermarket performance—up nearly 17% in two days.

Lam said mainland A-share issuers are particularly sensitive to policy signals. After seeing Midea’s successful debut, they recognized the clear intent behind new policies supporting dual listings. Feasibility was confirmed; the remaining discussion became solely about valuation.

Subsequent acceleration in approval processes—such as for CATL—further reinforced confidence among mainland issuers regarding policy direction.

Multiple bankers agree that for the foreseeable future, Hong Kong’s IPO momentum will center on A-share companies listing in Hong Kong, with these deals dominating fundraising volumes.

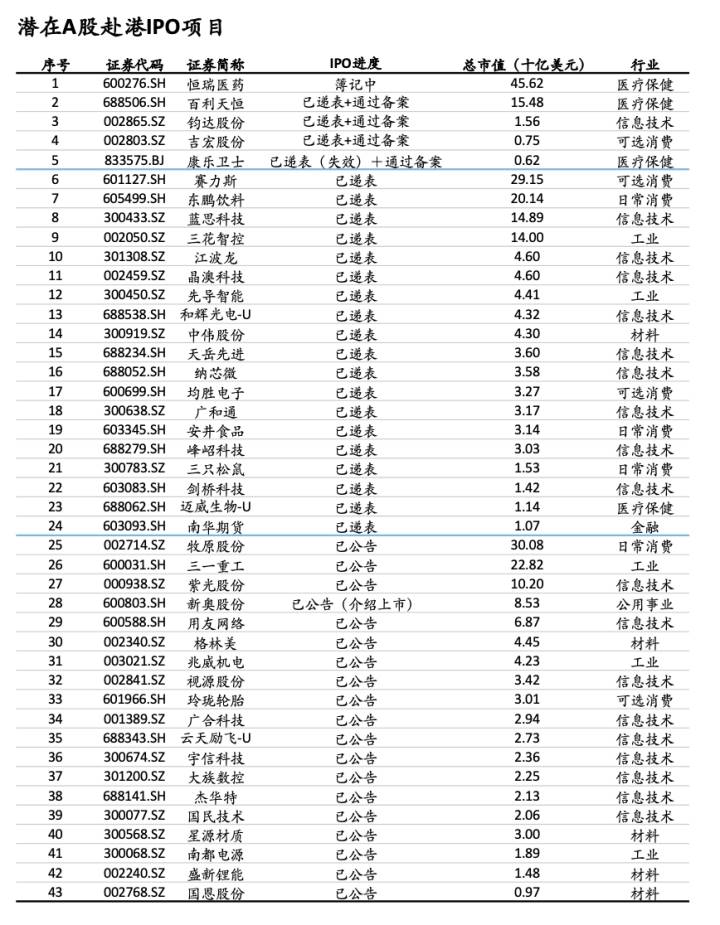

This makes sense—the current batch of A-share firms heading to Hong Kong are high-quality, mostly valued above US$1 billion, some nearing US$5 billion. As of May 20, publicly announced A-share companies planning Hong Kong listings are shown in the chart below (source: UBS).

"They all want to seize this policy window," Lam said, describing the prevailing mindset among mainland issuers he meets. Their attitude has shifted dramatically—they’re now highly motivated. These companies believe they should move forward during this favorable period, raise capital early, and use the proceeds for share buybacks or expanding overseas operations.

Bian Jing added that this wave also aligns with the broader trend of Chinese companies "going global." Many of the firms pursuing Hong Kong listings have strong international expansion or global industrial layout ambitions.

A mid-tier brokerage executive noted that A-share companies’ applications for Hong Kong listings are indeed being processed faster than those for new IPOs in Hong Kong or the U.S. He attributed this to the fact that these applicants are often established industry leaders already listed in mainland China, so documentation and review processes are smoother.

Of course, improving liquidity in Hong Kong is another key factor attracting issuers. Public data shows HKEX averaged HK$242.3 billion daily trading volume in the first five months of 2025—up 120% from HK$110.2 billion in the same period last year.

Beyond liquidity, valuations in Hong Kong are also shifting. With the Hang Seng Index climbing past 24,000, the valuation gap between A-shares and H-shares is narrowing—and in some cases, reversing into a rare "H-share premium" scenario.

CATL exemplifies this: Listed at HK$263 per share on May 20—about 7% discount to its A-share price—it opened over 12% higher, briefly surging more than 18%, and closed at HK$306.20—slightly above its A-share price of RMB263. This phenomenon remains uncommon among the more than 100 existing A+H listed companies. Previously, only a few like BYD and China Merchants Bank saw temporary H-share premiums.

Some Central fund managers suggest that beyond the stock’s scarcity value, CATL’s limited free float in Hong Kong (1.56 billion H-shares vs. 3.9 billion A-shares) contributed to upward price pressure.

Wang Shuguang, a member of the Management Committee at CICC, said when quality Chinese companies list in Hong Kong and command premiums over their A-share prices, it signals international investor recognition. This could eventually feed back into the A-share market, drawing greater attention to undervalued quality stocks.

A mid-sized broker noted that with A-share IPO approvals still constrained, Hong Kong remains the primary viable option for Chinese asset listings in the foreseeable future. Geopolitical risks make U.S. or European listings less appealing.

Failing to act decisively may mean missing optimal opportunities—as seen with e-commerce leader Shein.

Shein once considered listings in the U.S., UK, and even Singapore, but recently filed its application in Hong Kong. During its indecision, its valuation reportedly halved—from a peak of $100 billion to under $300 million.

CATL Set a 'Bad' Precedent: Investment Banks Are Now Competing Fiercely, Even Losing Money

Wang Shuguang believes the trend of A-share companies listing in Hong Kong will persist for a long time.

Public data indicates nearly 50 A-share firms have clearly signaled intentions to list in Hong Kong this year. As of June 13, five A-share companies—including CATL, Hengrui Medicine, and Jihong Shares—have already listed, while two others, Haichuang Flavor & Food and Sanhua Intelligent, are in the subscription phase.

Zhu Zhengqin added that the pool of A-share companies is large enough that even with current interest levels, the pipeline can sustain activity for years.

She also emphasized that this IPO boom isn't entirely driven by A-share southbound listings. Examples include makeup brand MG Ping, listed at the end of last year, and earlier this year, Mixue Ice Cream & Tea and Brucke—new IPOs unrelated to A-share dual listings—that also generated strong market responses.

Bian Jing echoed this view, expecting the momentum to continue. There is ample project backlog. At ABC International, nine of his team’s projects have already filed applications, over ten are preparing to file, and another ten-plus are in preliminary talks.

Meanwhile, Bian noted increasing returns from foreign long-term funds and sovereign wealth funds to Hong Kong.

In recent IPOs, names like Temasek, GIC (Singapore), Canadian Pension Plan Investment Board, Malaysian funds, and Middle Eastern sovereign funds from Abu Dhabi, Kuwait, and Saudi Arabia have appeared on cornerstone investor lists. Many others participated via institutional book-building—non-disclosed portions not widely known. "As long as these IPOs generate solid returns, they’ll keep investing in Hong Kong," he said.

TechFlow learned that these sovereign funds aim to capture the current "China renaissance" and don’t want to miss out.

Most of these overseas funds profited. According to EY, about 70% of Hong Kong IPOs in the past six months were profitable on their first trading day.

International funds pay close attention to high-quality, undervalued A-share companies listing in Hong Kong. Going forward, over 90% of these dual-listed firms are expected to have market caps exceeding US$1 billion. Currently, most filings are led by top-tier Hong Kong-based investment banks.

Lam believes the current wave of A-share companies valued above US$1 billion may continue into next year, after which smaller A-share firms below US$1 billion might begin entering the market—precisely where his firm, Eden Financial, and other mid-tier brokers are focusing. Most of his team’s A+H projects now target companies valued under US$1 billion.

"It looks bustling, but really, it’s all big banks benefiting. Small and medium-sized investment banks aren’t involved much," lamented a head of a small-to-mid-sized investment bank. Most of his IPO projects haven’t received approval, and major A-share-to-Hong Kong deals are inaccessible to smaller firms. In his view, large projects absorb most market capital, leaving smaller offerings struggling to launch.

Yet even big banks aren’t doing as well as outsiders think. Multiple bankers admit that while deal volume has increased, IPO profit margins haven’t risen as expected—in fact, some have declined, with even large banks losing money on certain IPOs.

"Fees for A-share-to-Hong Kong listings are extremely competitive now," multiple sources said. Despite razor-thin pricing, investment banks still fiercely bid for mandates because IPOs serve as "customer acquisition tools." Winning an IPO allows banks to build relationships that could lead to future follow-on financings, family office services, or other lucrative corporate finance work. Skipping IPO participation risks losing out on downstream business.

No case illustrates this better than CATL, whose fixed underwriting fee was just 0.2%. Many bankers believe CATL set a "bad" precedent in Hong Kong, creating a benchmark that most subsequent A-share companies now reference when negotiating fees.

Currently, most A-share-to-Hong Kong IPOs charge fixed underwriting fees below 1%, with some foreign banks quoting as low as 0.4%—far below the traditional 3%-5% standard. Chinese broker-affiliated investment banks, especially bank-backed ones, tend to win bids by offering lower fixed fees.

For investment banks, the workload and complexity of A+H listings haven’t decreased, yet fees have dropped sharply. Many bankers complain that A+H projects are now more exhausting than ever, yet pay less. Several Chinese investment banks have seen significant drops in revenue and bonuses over recent years. Still, junior bankers hesitate to jump to foreign firms—despite higher pay—because foreign institutions often downsize rapidly during downturns, creating job insecurity. In contrast, Chinese banks, particularly those affiliated with financial groups, offer greater stability.

Bian Jing said that as market conditions improved and deal flow picked up, staffing shortages forced investment banks to adjust their pricing strategies. According to him, fees for some IPOs—including sponsorship fees—have begun to rise slightly from earlier lows.

During the market slump, when IPOs were scarce, some Chinese investment banks competed so hard on signature fees that sponsors accepted around HK$3 million. The most extreme case was CATL, where all sponsors—including foreign banks—agreed to a uniform fee of US$300,000 (HK$2.35 million). The sponsors included JPMorgan Chase, Bank of America, and CITIC Construction International, among others.

Bian also learned that at least five Chinese investment banks in Hong Kong have launched new hiring initiatives due to increased IPO activity. "With the market recovering, things are gradually improving—not just revenues, but recruitment too."

For the foreseeable future, life will be considerably better for Hong Kong investment bankers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News