Not Just BTC: The Battle for Crypto Treasuries Begins, Tracing Reserves of 28 Public Companies

TechFlow Selected TechFlow Selected

Not Just BTC: The Battle for Crypto Treasuries Begins, Tracing Reserves of 28 Public Companies

20 focused on BTC, 4 on SOL, 2 on ETH, and 2 on XRP.

Source: Galaxy Research

Compilation: BitpushNews

Crypto Treasury Trends

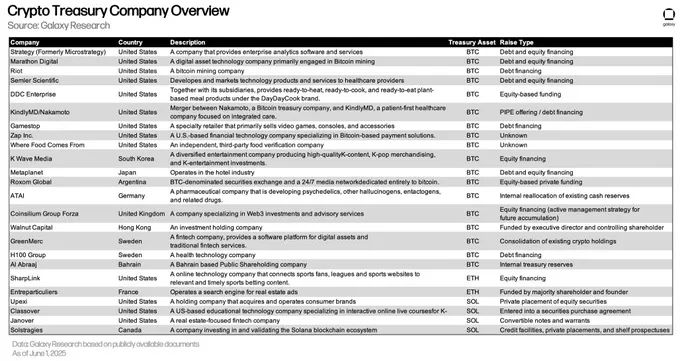

The trend of public companies establishing crypto treasuries is expanding beyond Bitcoin to include a broader range of crypto tokens, with increasing allocation sizes.

Just last week, two publicly traded companies announced plans to purchase XRP for their treasuries, while another revealed it is acquiring ETH as reserves.

Bitcoin treasury companies have dominated headlines for much of this year, led by Strategy (formerly MicroStrategy). VivoPower and Nasdaq-listed Webus separately announced intentions to launch $100 million and $300 million XRP treasuries, respectively, while SharpLink announced the establishment of a $425 million ETH treasury.

Including these firms, Galaxy Research has compiled a list of 28 crypto treasury companies:

20 focused on BTC, 4 on SOL, 2 on ETH, and 2 on XRP.

Overview of Crypto Treasury Companies

Our View

Given the momentum among existing companies and strong market interest in funding such firms at significant scale and across multiple assets, the crypto treasury trend is expected to continue evolving.

However, as more crypto treasury companies emerge, skepticism continues to grow.

The primary concern centers on the funding source for some of these purchases: debt.

Some companies rely on borrowed funds—mainly zero-interest or low-interest convertible notes—to acquire treasury assets.

At maturity, these notes can be converted into company equity at the investor’s discretion, provided they are “in-the-money” (i.e., when the company's stock price exceeds the conversion price, making equity conversion economically favorable). However, if the notes are “out-of-the-money” at maturity, additional capital will be needed to cover the liability—this is where concerns about the sustainability of the treasury company model arise.

In addition, though less frequently discussed, there is also a risk that these companies may lack sufficient cash flow to service interest payments on their debts.

In either case, treasury companies face four main options. They can:

-

Sell their crypto reserves to replenish cash, which could pressure asset prices and negatively impact other treasury holders of the same assets.

-

Issue new debt to cover maturing obligations—effectively refinancing their debt.

-

Issue new shares to cover liabilities, a method similar in nature to how they currently use equity financing to fund asset purchases.

Or, if the value of their crypto holdings fails to fully cover liabilities, default.

In worst-case scenarios, each company’s chosen path will depend on specific circumstances and prevailing market conditions; for example, treasury companies can only refinance when market conditions permit.

In contrast to debt financing is equity issuance, where treasury companies issue shares to fund asset acquisitions. Equity-funded purchases raise fewer concerns in the broader context, as this method does not create default obligations or liabilities tied to asset purchases.

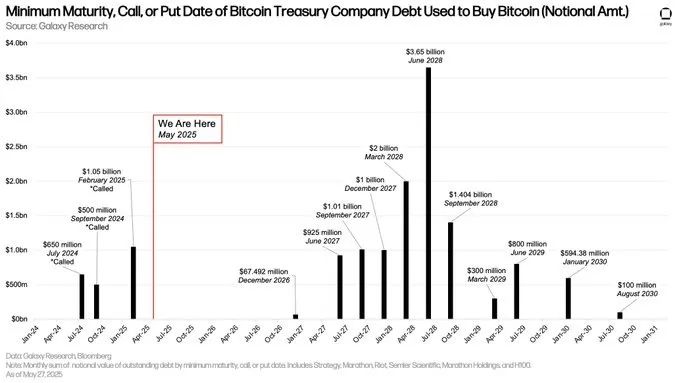

In our recent report on the crypto leverage landscape, we examined the size and maturity schedules of debt issued by several Bitcoin treasury companies.

Based on our findings, we believe there is currently no imminent threat—as commonly perceived—since the majority of the debt matures between June 2027 and September 2028 (as shown in the chart below).

The above chart summarizes debt issued by Bitcoin treasury companies specifically for Bitcoin purchases, listing the earliest dates when such debt may be required to be repaid (maturity/redemption/exercise dates), along with the corresponding nominal amounts.

Considering the industry’s historical issues related to leverage, concerns over debt-driven treasury strategies are not unfounded. However, at present, we do not see material risks associated with this approach.

That said, as debt maturities approach and more companies adopt this strategy—potentially employing higher-risk methods such as issuing shorter-dated debt—the situation may not remain unchanged.

Even in worst-case scenarios, these companies would still have access to a range of conventional financial tools to navigate difficulties, which may not necessarily result in treasury asset sales.

– Galaxy On-Chain Analyst @ZackPokorny_

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News