Decoding "Twenty One": With $4 billion in Bitcoin reserves, are SoftBank and Tether teaming up to create another MicroStrategy?

TechFlow Selected TechFlow Selected

Decoding "Twenty One": With $4 billion in Bitcoin reserves, are SoftBank and Tether teaming up to create another MicroStrategy?

In-depth analysis of Twenty One's investment opportunities.

Author: Jack Inabinet

Translation: TechFlow

The convergence of traditional finance and cryptocurrency is accelerating, and this trend is particularly evident in the emergence of Twenty One. Twenty One, a new entity focused on Bitcoin, is preparing to go public via a SPAC (Special Purpose Acquisition Company) backed by Cantor Fitzgerald.

With notable participation from major firms such as Japan’s SoftBank and plans to hold over $4 billion worth of Bitcoin on its balance sheet, Twenty One positions itself as the next evolution of MicroStrategy’s Bitcoin accumulation strategy. But can it live up to expectations and sustain a high premium?

Some view this as a breakthrough moment for Bitcoin adoption on corporate balance sheets, with public markets already valuing this opportunity at three times the value of the Bitcoin it intends to hold. Meanwhile, others express concerns about complex capital structures, asymmetric incentives, and significant implications for retail investors.

Today, we’ll dive deep into the investment opportunity presented by Twenty One.

What Is Twenty One?

Publicly led by CEO Jack Mallers, who founded the Bitcoin payments app Strike in 2017, Twenty One brands itself as a “unique vehicle dedicated to Bitcoin,” engaging in “Bitcoin advocacy initiatives” and exploring “future expansion into Bitcoin-native financial products.”

While Twenty One’s mission statement may initially seem ambiguous, the company closely resembles Michael Saylor’s MicroStrategy—a vehicle designed to accumulate Bitcoin and increase Bitcoin exposure for individual shareholders.

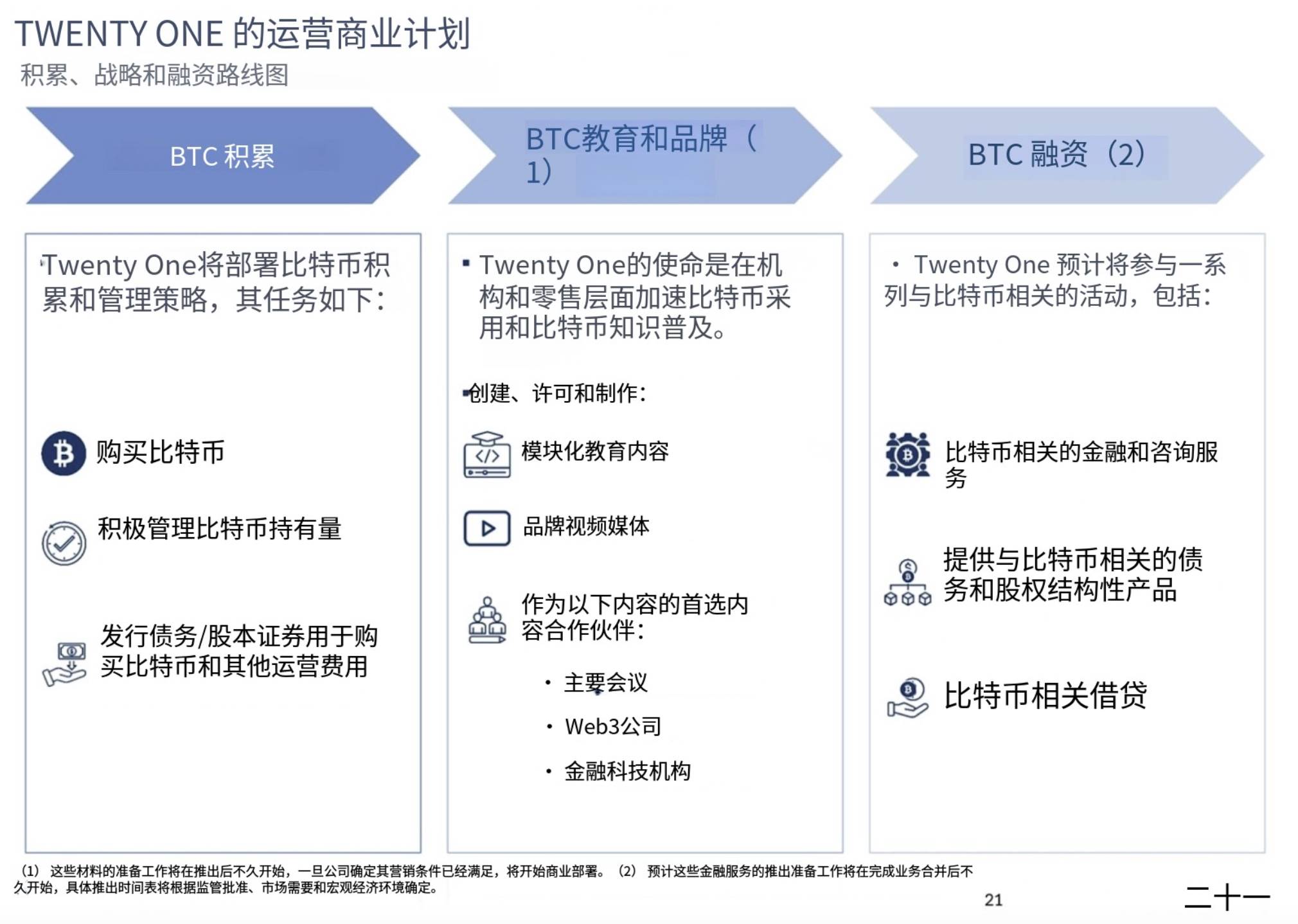

According to an investor presentation filed with the U.S. Securities and Exchange Commission (SEC), like MicroStrategy, Twenty One will acquire Bitcoin through debt and equity issuance. With a slight twist, Twenty One also plans to produce Bitcoin educational content (e.g., YouTube videos) and participate in “various Bitcoin-related activities,” including Bitcoin-focused financial advisory services and lending out its Bitcoin holdings.

Source: SEC

Translation: TechFlow

Based on Twenty One's projected assumptions, it will launch with a treasury holding 42,000 Bitcoins—worth slightly over $4 billion at current market prices. While Mallers is the public face of the company, he is far from going it alone…

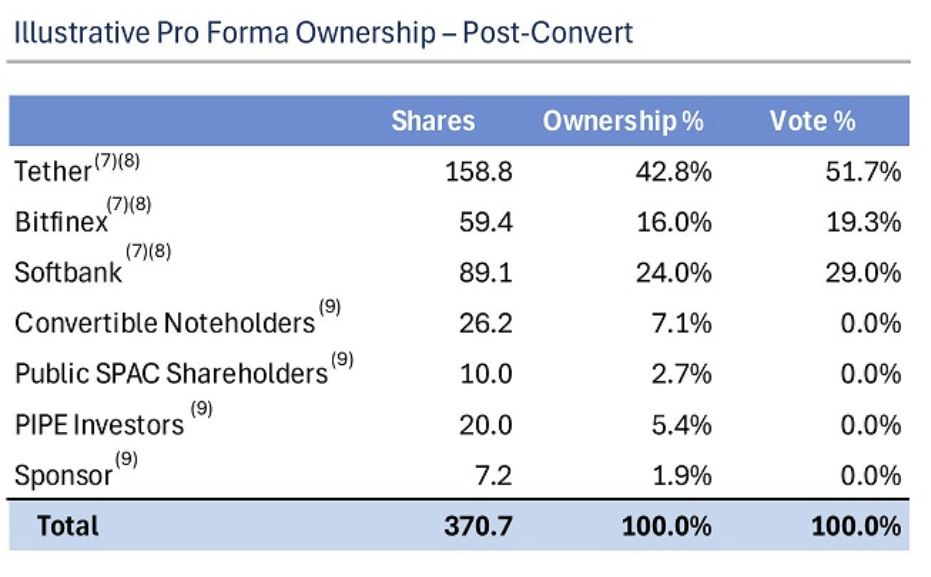

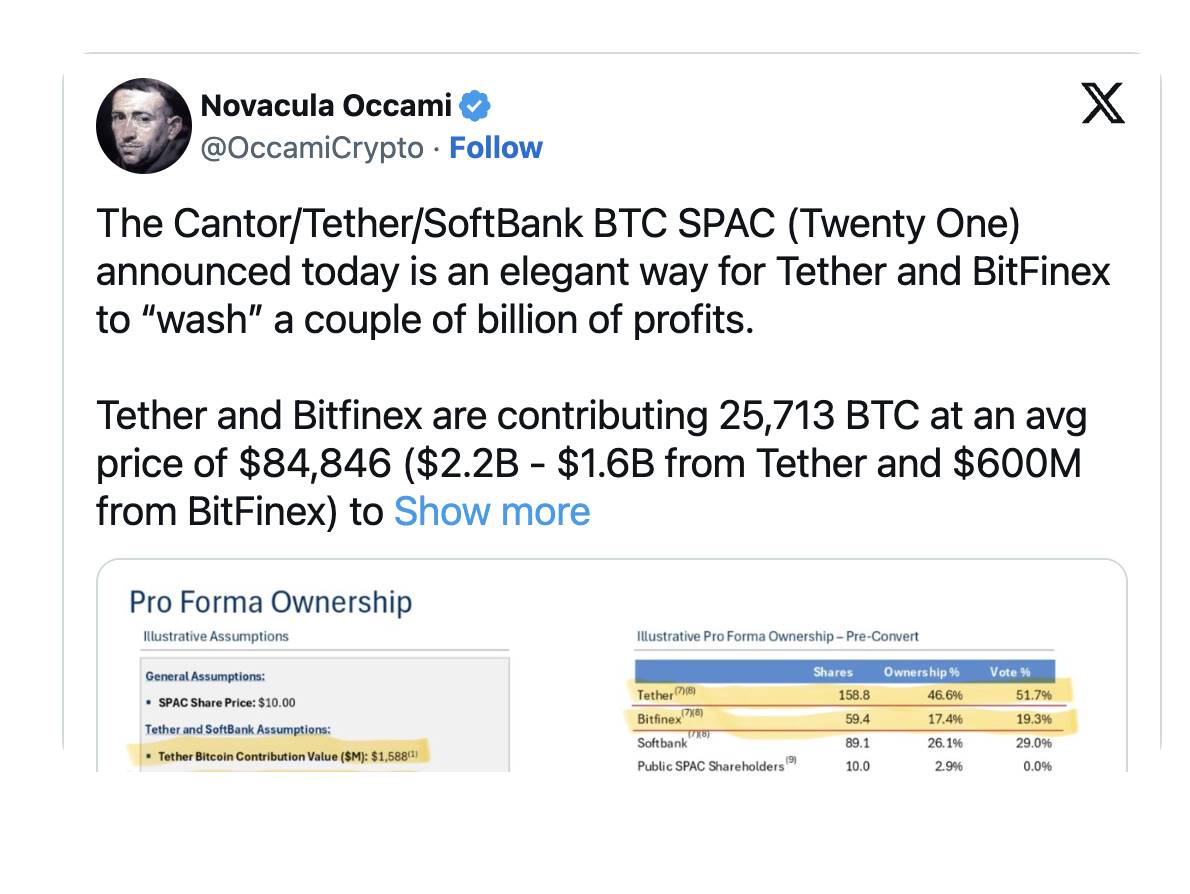

Tether, the stablecoin issuer, and cryptocurrency exchange Bitfinex (both subsidiaries of iFinex, a British Virgin Islands–registered holding company), will contribute 36,213 Bitcoins to Twenty One. In exchange, the two entities will collectively receive 58.8% ownership and 71% of voting rights in Twenty One; Tether alone will hold 51.7% of voting power.

Nearly one-third of the Bitcoin contributed by Tether and Bitfinex is reportedly provided on behalf of Japan-based technology investor SoftBank Group. According to reports, SoftBank will pay Tether $462 million to indirectly own a 24% stake in Twenty One. This amount reflects the market value of the Bitcoin that SoftBank indirectly contributes and could generate an immediate paper profit for SoftBank if Twenty One’s shares trade at a premium to net asset value, as expected.

The transaction has not yet officially closed, but it is anticipated that Twenty One will be acquired by Cantor Equity Partners. Cantor Equity Partners is a Special Purpose Acquisition Company (SPAC) that has been trading on Nasdaq under the ticker “CEP” since mid-August 2024 and is affiliated with Howard Lutnick’s financial services firm, Cantor Fitzgerald (which holds a 5% stake in Tether via convertible bonds).

The SPAC structure allows Twenty One to reduce SEC regulatory hurdles typically associated with going public by merging with an already-listed shell company. In return, Cantor Equity Partners will inject $100 million in cash into the combined balance sheet, while CEP shareholders will receive 2.7% of Twenty One’s equity without voting rights.

In addition, investors participating in the initial convertible bond offering will receive 7.1% of Twenty One’s equity in exchange for contributing $340 million; meanwhile, PIPE (Private Investment in Public Equity) investors will receive 5.4% of equity under preferential terms—for example, they can purchase shares at Bitcoin’s net asset value, whereas public SPAC shareholders must buy CEP shares at market price. These two rounds are expected to raise approximately $500 million in cash, which will be paid to Tether to compensate for the Bitcoin it contributed on behalf of investors.

As the deal’s “sponsor,” Cantor Fitzgerald will receive $45 million in convertible notes and 3.8 million shares of Twenty One stock, representing a combined 1.9% equity stake in the company.

Source: SEC

So What’s the Bottom Line?

Many in the Bitcoin community see the launch of Twenty One as a pivotal moment, potentially marking the beginning of widespread Bitcoin adoption on corporate balance sheets—especially given SoftBank’s involvement, a globally recognized venture capital firm known for identifying transformative trends (such as artificial intelligence) ahead of broader investor enthusiasm.

In its filings with the U.S. Securities and Exchange Commission (SEC), Twenty One positions itself as a superior Bitcoin accumulation vehicle compared to MicroStrategy. For investors seeking simple, passive Bitcoin exposure, the smaller scale of Twenty One may make it easier to raise funds to buy Bitcoin—these arguments are directly laid out in Twenty One’s investor materials.

As of Thursday, April 24, Cantor Equity Partners (CEP) had a market capitalization of $317 million and a cash balance of $100 million. While increased Bitcoin adoption among large financial institutions may seem encouraging, the preferential terms allowing institutional investors to participate at cost have raised skepticism among critics.

In the end, Tether appears to be the biggest winner in this arrangement. By injecting Bitcoin into the SPAC, the stablecoin issuer stands to gain nearly $1 billion in cash and billions of dollars’ worth of Twenty One equity. In doing so, Tether effectively extracts value from institutional players eager to distribute Bitcoin-backed shares at a premium to retail investors—without having to sell tokens on the open market.

SPACs have gained a poor reputation in recent years, often regarded as among the worst stock market investments of the past decade. While taking a concept public via SPAC can be highly profitable for insiders and sponsors, the math rarely favors retail investors in the secondary market. Since 2009, such investments have consistently delivered poor returns across industries. For retail investors planning long-term holdings in Twenty One, their returns may ultimately be shaped by majority shareholders looking to exit their positions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News