New Hampshire enacts first-in-the-nation state Bitcoin reserve bill, more crypto legislation poised to follow

TechFlow Selected TechFlow Selected

New Hampshire enacts first-in-the-nation state Bitcoin reserve bill, more crypto legislation poised to follow

or trigger a wave of imitation across states.

Author: Weilin, PANews

New Hampshire, USA, is the birthplace of the "Bretton Woods" agreement. In July 1944, representatives from 44 nations convened at the Mount Washington Hotel in Bretton Woods, New Hampshire, for the United Nations Monetary and Financial Conference, establishing a fixed exchange rate system linking the U.S. dollar to gold and cementing the dollar’s status as the world's primary reserve currency.

More than 80 years later, on the evening of May 6, New Hampshire became the first state in the U.S. to include Bitcoin—the so-called "digital gold"—into its state treasury reserves, establishing a legal status and policy framework for Bitcoin. Governor Kelly Ayotte officially signed HB 302, announcing that the state will establish a "strategic Bitcoin reserve," allocating up to 5% of its state funds to hold precious metals, Bitcoin, and other digital assets with market capitalizations exceeding $50 billion (currently only Bitcoin meets this criterion).

New Hampshire Enacts HB 302: First State-Level Strategic Bitcoin Reserve Law in the U.S.

At the federal level, President Trump signed an executive order on March 6, 2025, formally creating a strategic Bitcoin reserve and reserves for other cryptocurrencies. While pro-crypto lawmakers across various states have drafted similar state-level strategic Bitcoin reserve bills, these efforts have recently encountered resistance.

However, on May 6, HB 302 in New Hampshire made history. The New Hampshire Treasury holds approximately $3.6 billion in funds according to its latest annual report, meaning the state could allocate up to about $181 million toward purchasing precious metals or Bitcoin.

The bill was initially proposed by several Republican lawmakers, including Representative Keith Ammon (the bill’s drafter), Calvin Beaulier, Mark Warden, Jason Osborne, and State Senators Daryl Abbas and Kevin Avard. Based on a version provided by advocacy group Satoshi Action, the bill was simplified to enhance clarity, acceptance, and practical implementation throughout the legislative process.

Under the bill, the New Hampshire Treasury is authorized to invest in Bitcoin and other digital assets with market capitalizations exceeding $50 billion. Currently, only Bitcoin meets this threshold. According to the bill’s sponsor, the core objective is to provide the state’s financial system with a tool for inflation hedging and portfolio diversification.

The law requires that any Bitcoin or digital assets held in the reserve must be custodied within the U.S. regulatory framework, including multi-signature wallets controlled by the state government, qualified custodians, or U.S.-listed exchange-traded products (ETPs). This measure aims to ensure the highest levels of security, long-term stability, fiscal responsibility, and transparency for taxpayers.

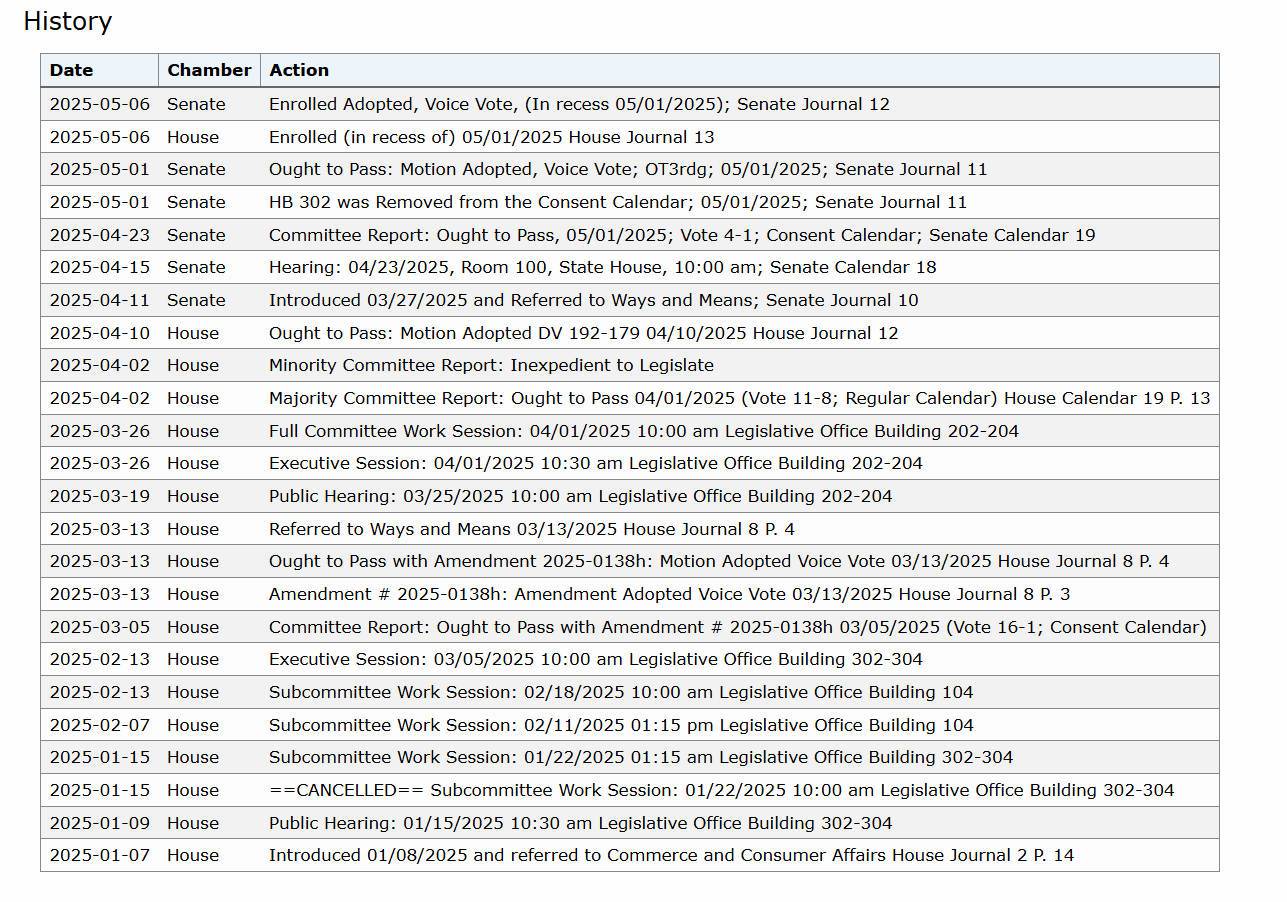

From Concept to Law: Review of HB 302’s Legislative Journey

HB 302 was introduced in the House in January. In New Hampshire, a bill must first be drafted. Drafts can be submitted by any of the 400 members of the General Court’s House of Representatives or 24 State Senators. Heads of state agencies, the governor, citizens, or interest groups who wish to propose legislation must find a legislator to sponsor the bill.

Next, the bill is submitted to the legislature: once drafted, it is delivered to the clerk of either the Senate or the House, depending on the sponsor’s chamber. When the House adopts a motion to consider the bill by number alone, it is formally introduced.

Following introduction, all bills referred to a committee—unless rules are suspended by a two-thirds majority vote—must undergo a public hearing. New Hampshire is one of the few states that require public hearings for all bills.

The next step is committee review: committee deliberations occur during executive sessions, where a majority of committee members must be present to take action. The public may observe the final vote. The committee then submits a report to the chamber clerk, which may conclude with one of the following recommendations: “Ought to pass,” “Ought to pass as amended,” “Inexpedient to legislate,” “Refer to interim study,” or “Re-refer to Committee.”

Afterward, the bill proceeds to floor debate: once the committee report is published in the House Calendar, the bill may be considered the following day. Major amendments recommended by the committee must be listed in the calendar. For a bill to be sent to the governor, identical versions must be passed by both the House and Senate. After passage, the bill goes to the Committee on Enrolled Bills for registration and formatting review.

Finally, the bill is either approved or rejected. If the legislature has not adjourned, the governor has five days to sign, veto, or take no action on the bill.

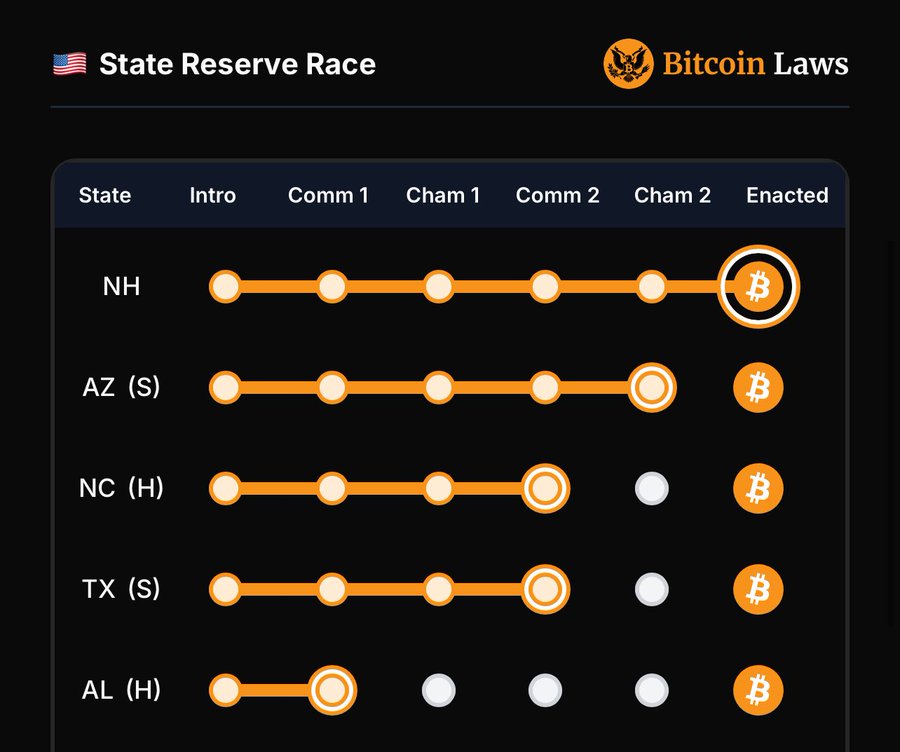

Prior to this, on May 4, according to official documents from Arizona, Governor Katie Hobbs vetoed Senate Bill 1025 (SB 1025), which would have allowed public funds to be invested in virtual currencies. In her veto statement, Hobbs noted that Arizona’s retirement system is among the strongest in the nation due to its prudent and sound investment strategies. She emphasized that public retirement funds should not be used to experiment with unproven investments like virtual currencies.

On May 6, Florida House Bill 487 and Senate Bill 550 were both “indefinitely postponed and withdrawn from consideration” as of May 3. These bills had aimed to allow up to 10% of state public funds to be invested in Bitcoin, establishing a state-level cryptocurrency reserve. However, the Florida legislature failed to pass the legislation before concluding its session on May 2, officially exiting the race to establish a state Bitcoin reserve. Similar bills have previously failed in South Dakota, Montana, and other states.

Potential Nationwide Ripple Effect: Key Proponent Rep. Keith Advances Two More Crypto Bills

HB 302 is not just a breakthrough in local fiscal strategy—it is seen as a new benchmark for digital asset policy across U.S. states. Dennis Porter, CEO and co-founder of Satoshi Action, celebrated the development: “Satoshi Action drafted the model, New Hampshire turned it into law, and now treasurers across the country can follow this roadmap. HB 302 proves you can diversify reserves while protecting taxpayer funds and securing the future of state finances—all while embracing the most secure monetary network on Earth. New Hampshire didn’t just pass a bill; it sparked a movement.”

Satoshi Action is a nonprofit policy organization dedicated to advancing Bitcoin-friendly legislation and contributed the model legislation upon which this bill was based. Nationally, the group has helped pass six pro-Bitcoin laws and facilitated the introduction of over twenty Bitcoin reserve proposals, consistently promoting stable, bipartisan policy development in the digital asset space.

Behind the success of HB 302 is a group of long-standing digital asset advocates. Among them, Representative Keith Ammon, representing Hillsborough District 40, served as the bill’s drafter and key driver throughout the legislative process. He also chairs the New Hampshire Blockchain Council and serves on the Commerce and Consumer Affairs Committee. Additionally, House Majority Leader Jason Osborne and Ian Huyett, a member of the New Hampshire Blockchain Council, played pivotal roles during the bill’s review.

Notably, HB 302 is just one of several pro-crypto bills championed by Keith. He currently has two additional Bitcoin- and blockchain-related bills under consideration, both of which have passed the House and are now in Senate review:

HB310 proposes forming a committee to study the feasibility of creating a regulatory framework in New Hampshire for stablecoins, tokenized real-world assets, and blockchain-based trusts. It is currently under Senate review; House status: passed / passed with amendments. The most recent hearing was held on April 29, 2025.

Keith stated that privacy concerns around stablecoins are particularly important to him and that he plans to engage in in-depth discussions with experts from Wyoming.

HB639 addresses the use of blockchain and digital currencies and related disputes. The bill adds a new chapter titled “Blockchain Foundation Law” to New Hampshire’s legal code, aiming to establish a new legal framework to protect blockchain technology and its users. It is currently under Senate review; the House has passed / adopted it. The most recent hearing was held on April 29, 2025.

Half of this bill is based on the model provided by Satoshi Action, while the other half draws from recommendations by other experts. The bill currently faces some resistance in the Senate, with certain environmental advocates expressing concerns about noise pollution and environmental impacts associated with cryptocurrency mining.

In summary, with the formal signing of HB 302, New Hampshire has taken a crucial step forward in fiscal policy and opened a new chapter for the legitimization of Bitcoin in public asset allocation. The enactment of this bill not only demonstrates the state’s forward-thinking stance in digital finance but may also inspire other states to follow suit, potentially marking a significant milestone in the era of digital currencies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News