Deep Dive into Keeta, the "New Billionaire" of 11 Billion: A "Super High-Speed Rail" in the RWA Sector or Just Another "PPT Myth"?

TechFlow Selected TechFlow Selected

Deep Dive into Keeta, the "New Billionaire" of 11 Billion: A "Super High-Speed Rail" in the RWA Sector or Just Another "PPT Myth"?

Keeta Network has heavyweight backing from investors such as former Google CEO Eric Schmidt, but its technical performance, transparency, and market acceptance still face skepticism.

By Luke, Mars Finance

The cryptocurrency market never lacks surprises. When a previously obscure name—Keeta—suddenly emerges as a dark horse, with its KTA token surging in price and briefly surpassing an $11 billion market cap to reach new highs, it's hard not to wonder: what exactly is going on? Is this just another fleeting capital frenzy, or could this be a genuinely disruptive force quietly knocking at the door of a new era? The intrigue deepens when Keeta’s name becomes closely tied to the currently red-hot RWA (Real-World Assets) narrative. After all, RWA is widely seen as the next industry breakthrough capable of unlocking trillions of dollars in traditional assets, making any "emerging contender" at this moment subject to intense scrutiny. Could Keeta be the answer we’ve been waiting for?

Discussions around Keeta extend beyond its technology alone. Backing from heavyweight figures such as former Google CEO Eric Schmidt has bestowed upon it significant visibility and investor interest. Its bold performance claims—such as a processing capacity of up to 10 million transactions per second (TPS) and settlement times of 400 milliseconds—have sparked widespread attention, while also drawing cautious skepticism from technical communities and market observers. Keeta’s sudden rise appears to be the result of a confluence of factors: the growing momentum behind RWA, celebrity endorsement, ambitious technological storytelling, and the crypto market’s ongoing search for high-growth Layer-1 alternatives. This “perfect storm” of hype has driven rapid valuation growth but also placed Keeta under intense public scrutiny, exposing it to increasingly rigorous real-world tests. This article will delve into the technical features, market positioning, challenges, and future prospects of Keeta Network within the RWA space.

RWA Wave: The Next Trillion-Dollar Frontier?

Before diving deeper into Keeta, it's essential to understand its core battleground—the tokenization of real-world assets (RWA). In blockchain terminology, RWA refers to digital tokens representing tangible or intangible assets that exist in the physical world. These can include real estate, commodities, art, bonds, carbon credits, and more. The fundamental idea is to use blockchain technology to digitize these traditional or physical assets, thereby bridging the gap between the physical world, legacy finance, and the digital economy.

The market potential for RWA tokenization is enormous. Industry analyses estimate that the total addressable market for RWA tokenization could reach several trillion dollars. As of December 2024, the tokenized RWA market excluding stablecoins had reached $15.2 billion, while including stablecoins, the total tokenized asset market stood at $217.26 billion. Some forecasts even project that by 2034, the RWA tokenization market could grow to $30.1 trillion. Behind this trend lie several key advantages offered by RWA tokenization:

-

Enhanced Liquidity: Converting traditionally illiquid assets like real estate or private equity into tokens tradable on secondary markets unlocks their intrinsic value.

-

Improved Accessibility and Fractional Ownership: Tokenization allows high-value assets to be divided into smaller units, lowering investment barriers and enabling broader participation.

-

Greater Transparency and Security: The distributed ledger nature of blockchain ensures transaction records are immutable and traceable, enhancing transparency and security regarding ownership and transaction history.

-

Increased Efficiency and Lower Costs: Smart contracts automate complex processes such as asset transfers and dividend distributions, reducing reliance on intermediaries and cutting operational costs.

Despite its promising outlook, RWA tokenization faces numerous hurdles. Regulatory uncertainty and compliance complexity remain top challenges, with differing legal frameworks across jurisdictions hindering global adoption. Additionally, ensuring accurate on-chain-to-off-chain asset value anchoring, reliable and secure oracle data feeds, smart contract vulnerabilities, and the legal enforceability of tokenized ownership rights are critical issues yet to be fully resolved.

Nonetheless, there have already been successful implementations of RWA tokenization. For example, tokenized U.S. Treasury products have attracted substantial institutional interest, including BlackRock’s BUIDL fund and Franklin Templeton’s money market fund issued on Avalanche. Dubai-based developer DAMAC partnered with MANTRA to tokenize $1 billion worth of assets, including real estate and data centers. Tether’s gold-backed stablecoin XAUT provides a convenient channel for digitizing physical gold trading. These cases demonstrate that RWA is not merely theoretical—it is gradually being implemented and showing transformative potential. The reason the RWA narrative resonates so strongly lies in its role as a bridge connecting the vast world of traditional finance (TradFi) with the emerging crypto ecosystem. Projects focused on RWA—especially those emphasizing compliance, like Keeta—aim to pave the way for institutional capital and mainstream users to enter the digital asset space. The active involvement of financial giants like BlackRock in tokenized Treasuries serves as strong validation of this trend. Success in the RWA sector would significantly enhance the legitimacy and scale of the entire digital asset ecosystem, shifting it from one dominated by speculative native crypto assets to one encompassing broad real-world value. Consequently, Layer-1 blockchains capable of securely and compliantly handling RWAs occupy a strategic vantage point.

Keeta Network: A Challenger Born with a "Golden Spoon"

Keeta Network emerged precisely within this context. Officially, its mission is to unify global payment networks, enable efficient and compliant movement of RWAs, and serve as a universal foundational infrastructure for all forms of asset transfer. Keeta aims to overcome bottlenecks in traditional finance (TradFi) by offering near-instant, low-cost cross-border payment solutions.

What sets Keeta apart from other emerging L1 projects is largely due to its powerful “halo effect.” Most notably, the backing of former Google CEO Eric Schmidt stands out. In 2023, Schmidt led a $17 million seed round for Keeta through his venture firm Steel Perlot and personally joined as an advisor. He publicly stated: "Keeta’s technology exceeds existing solutions by orders of magnitude in scalability and efficiency." Such high-profile support has injected significant market confidence and media attention into Keeta. When Schmidt followed Keeta’s official account on X (formerly Twitter), the KTA token surged immediately—a clear testament to his influence.

In terms of team composition, Keeta has assembled experienced individuals. Co-founder and CEO Ty Schenk is a software engineer who previously worked in crypto payments, was a partner at Steel Perlot, and served as CEO of LFG Payments. Chief Technology Officer Roy Keene was a core developer of Nano (formerly RaiBlocks) and left to launch a new project after advocating for changes to Nano’s incentive model and greater institutional adoption.

This impressive pedigree functions like a “golden spoon,” granting Keeta far greater visibility and resources than typical startups during its early stages. However, it’s also a double-edged sword. While elite affiliations bring advantages, they also raise sky-high expectations. Any technical flaws, roadmap delays, or gaps between promises and reality will be magnified and may invite harsh criticism. If the “Google光环” isn’t consistently backed by tangible results, its shine could quickly fade. Keeta’s journey forward will serve as a case study in how well a startup manages market expectations and delivers on grand visions under the spotlight of influential endorsements.

Under the Hood: Keeta’s Technical Arsenal and Compliance Design

Keeta Network claims its high performance and compliance capabilities stem from a unique technical architecture and design philosophy. Understanding these core components is crucial to evaluating its true potential.

Mixed-Power Engine: Decoding dPoS and the "Virtual DAG" Architecture

At its heart, Keeta reportedly employs a hybrid consensus mechanism combining Delegated Proof-of-Stake (dPoS) with a “virtual Directed Acyclic Graph” (vDAG). dPoS is known for high efficiency, achieving consensus through a limited number of block producers, though it carries inherent centralization risks. DAG structures theoretically allow for high-concurrency transaction processing, overcoming the linear confirmation bottleneck of traditional blockchains, but face challenges such as high computational overhead, complex confirmation logic, and vulnerability to specific attacks.

Keeta claims its “virtual DAG” represents an innovative design. According to analysis by Delphi Digital, each account in Keeta maintains its own transaction chain (forming an independent DAG), while cross-account interactions are handled via “virtual links”—metadata references that logically connect a transaction on one account’s chain to a corresponding transaction on another. This enables massive parallel processing. However, Keeta’s whitepaper and available technical documentation primarily outline conceptual designs and goals, lacking detailed implementation specifics or widely verified results on how it overcomes DAG’s inherent limitations to achieve its claimed multi-million TPS throughput.

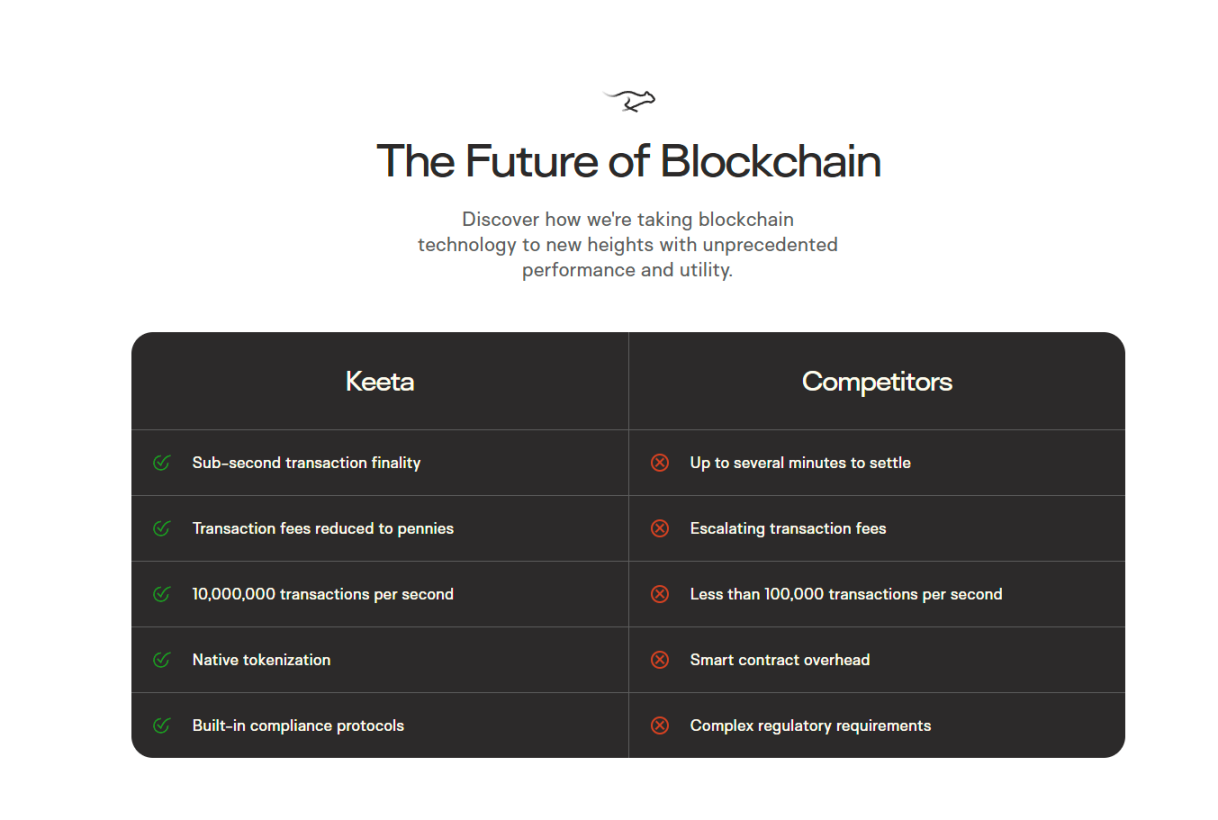

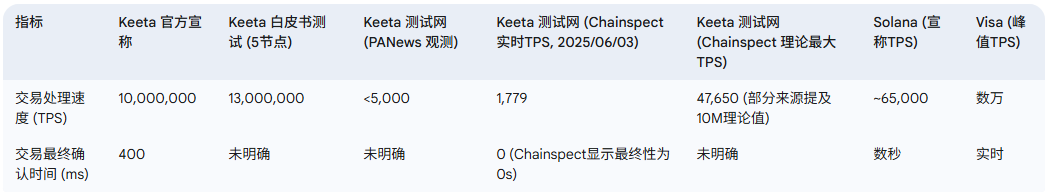

Keeta asserts its network can handle 10 million TPS with final transaction confirmation in 400 milliseconds. This figure dwarfs even centralized payment giants like Alipay (peak ~544k TPS) and vastly outpaces other high-performance blockchains like Solana (~65k TPS). Naturally, such extraordinary claims have drawn widespread skepticism. According to test results cited in its whitepaper, Keeta achieved up to 13 million TPS in a test environment with only five nodes—a setup whose real-world relevance remains questionable. Observations by PANews indicate that Keeta’s testnet currently sustains TPS below 5,000. Third-party platform Chainspect reports a theoretical maximum TPS of 47,000 and real-time TPS fluctuating between 1,210 and 1,779. Keeta explains that the testnet intentionally limits scalability because transactions are feeless; a dedicated benchmarking testnet will be established later. In its whitepaper, Keeta attributes its high performance to a no-mempool design, client-driven validation skipping queues, two-phase voting for speed and security, and leveraging cloud infrastructure (e.g., Google Cloud or AWS).

Comparison of Keeta’s Performance Claims vs Observed Data

This table clearly contrasts Keeta’s core performance claims with observed data from multiple sources, highlighting the gap between ambition and current reality, and situating Keeta within the broader industry landscape.

KeetaScript and KeetaVM: Foundations for Verifiable Computing and Custom Rules

To support its compliance and RWA strategy, Keeta introduces a new programming paradigm centered on KeetaScript and KeetaVM. KeetaScript is a domain-specific language (DSL) designed specifically for verifiable computation. Its primary goal is to let developers define strict logical constraints, validation rules, and compliance conditions directly at execution time, rather than treating them as optional add-ons.

Paired with KeetaVM (Keeta Virtual Machine), KeetaScript forms a tech stack optimized for formal verification. This makes Keeta theoretically well-suited for applications requiring deterministic guarantees, such as zero-knowledge rollups, trustless cross-chain bridges, and programmable RWA tools. The whitepaper also mentions a scalable permission system and native token functionality, allowing issuers to control interactions with their tokens.

Built for Compliance: Rule Engine, Digital Identity (X.509 Certificates), and KYC/AML

Compliance is embedded at the architectural core of Keeta. Its native token and rule engine allow participants to create and manage digital or real-world assets while integrating comprehensive controls and compliance mechanisms directly into the protocol layer. This rule engine enables developers and enterprises to enforce asset-level compliance requirements, transfer conditions, and behavioral logic at the protocol level. Asset issuers can set rules such as whitelisting, transaction limits, and certification requirements.

For digital identity and KYC/AML (Know Your Customer / Anti-Money Laundering), Keeta claims its design meets the stringent regulatory and operational standards of financial institutions. The whitepaper explicitly states the use of X.509 digital certificates to implement a digital identity and KYC/AML compliance framework. This mechanism allows trusted KYC providers to issue secure digital certificates for user accounts, which can be instantly verified on the network while aiming to protect user privacy and maintain high security standards.

Asset Tokenization on Keeta: Enabling RWA

Keeta natively supports asset tokenization. Users can create tokens representing any asset, trade them, and unlock new liquidity. While public documentation does not detail step-by-step RWA tokenization workflows on Keeta, the core logic relies on its “built-in tokenization” feature and “rule engine.” This means KeetaScript and the rule engine will be used to define the properties and compliance logic of these RWA tokens.

Keeta is considered an ideal platform for stablecoins and real-world asset transfers. Specific RWA use cases remain largely conceptual—for instance, “tokenized real estate, securities, or commodities,” or “on-chain credit and lending” mentioned on its official social media.

Keeta’s approach to RWA compliance attempts to balance regulatory demands, user privacy, and system openness—an apparent “compliance trilemma.” By using X.509 certificates and a network of trusted KYC providers, Keeta seeks to verify identities while minimizing data exposure to preserve privacy. However, the “trusted provider” model inherently introduces some degree of centralization or permissioned access, which may be acceptable for institutional-grade RWA but diverges from the fully permissionless ethos of DeFi. The purpose of KeetaScript and the rule engine is to embed compliance directly into the asset itself, enhancing robustness. Whether Keeta’s compliance framework succeeds will depend on its ability to strike a balance between satisfying regulators and users, and whether its ecosystem of “trusted KYC providers” can scale effectively while maintaining credibility. This reflects an evolving understanding of “decentralization” when interfacing with highly regulated legacy systems.

KTA Token: Fueling the Keeta Ecosystem

The KTA token is Keeta Network’s native utility and governance token, playing a central role in the ecosystem by paying transaction fees, participating in network consensus (via staking), and enabling governance voting.

Tokenomics and Distribution Mechanism

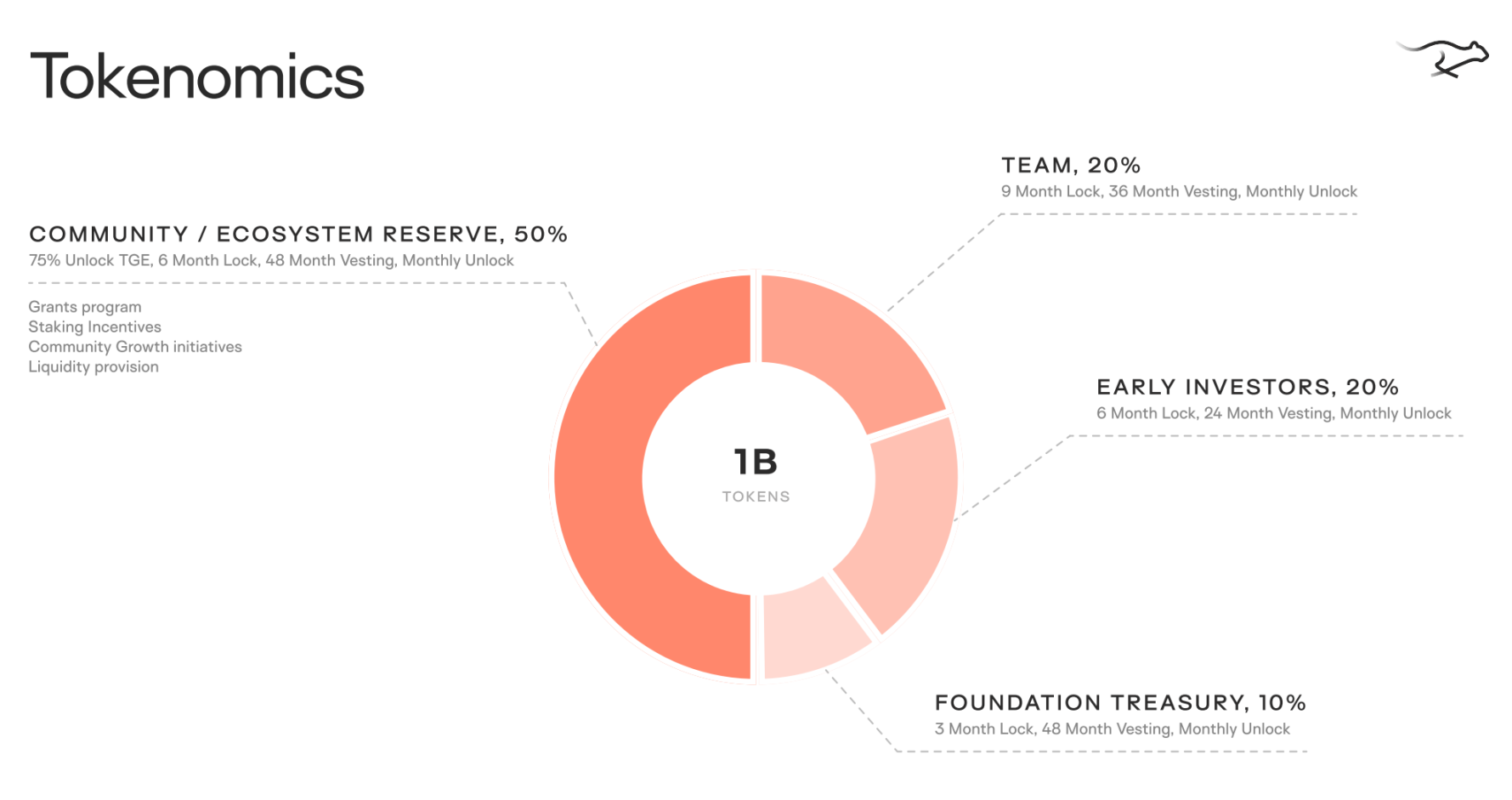

KTA has a total supply of 1 billion tokens. As of early June 2025, the circulating supply was approximately 400 million.

Based on consistent and detailed sources, the initial allocation and vesting/release schedule for KTA is as follows:

Notably, the KTA governance token launched “stealthily” in March 2025 on Base, an Ethereum Layer-2 network, without prior marketing or announcements. This triggered panic, uncertainty, and doubt (FUD) within the community, with speculation ranging from compromised accounts to outright fraud. Founder Ty Schenk explained the team hadn’t prioritized marketing, wanted to avoid confusion with Ethereum meme coins, and chose Base for its low gas fees and existing user base. The KTA token will eventually migrate to become the native L1 token upon Keeta mainnet launch. This unconventional token launch strategy undoubtedly added drama to its early market performance.

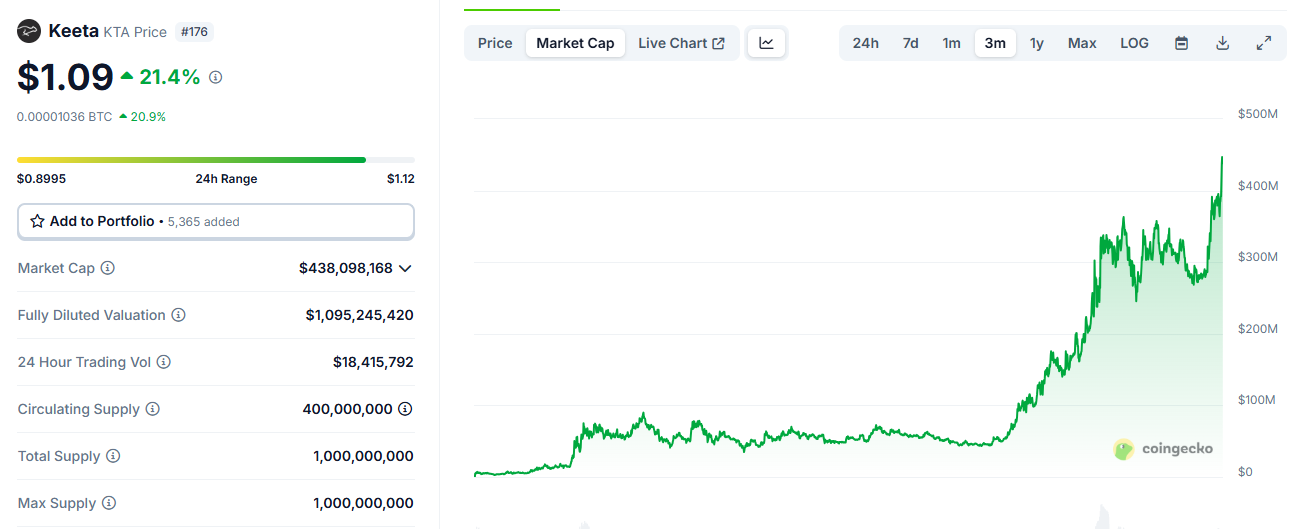

Market Performance and Investor Sentiment

Since its debut—and especially after gaining attention from notable figures—KTA has seen dramatic price increases and market cap growth. For example, since launching in March 2025, KTA’s price rose over 74x, increasing by 600% within two weeks in May. This strong performance was driven by multiple factors: Eric Schmidt’s endorsement, expectations around its million-TSP performance claims, the popularity of the RWA narrative, and the perception of being an “early-stage” opportunity given that most tokens remain locked.

Currently, KTA trades primarily on decentralized exchanges (DEXs) and a few centralized exchanges (CEXs) such as BitMart, LBank, and BingX. Market sentiment suggests that listing on additional major exchanges could further catalyze price appreciation.

The sharp rise in KTA’s price before full mainnet launch and unproven technology exemplifies the “pre-mainnet premium” phenomenon—investors speculating based on future potential. This often comes with information asymmetry: project teams and early investors typically possess more knowledge about actual technical capabilities and development progress, while the general public relies heavily on whitepapers, marketing materials, and limited testnet data. Keeta’s stealth launch, intentional or not, exacerbated this asymmetry and fueled FOMO once Schmidt’s involvement became known. This pattern is common in crypto and highlights the risks retail investors face when trading based on incomplete information or market hype. Furthermore, despite the community allocation accounting for 50%, the incentives and distribution criteria were unclear prior to TGE, making it difficult to assess who actually controls this portion and who benefited most from the early price surge.

The Long Road Ahead: Promises, Challenges, and the Path to Mainnet

Keeta Network has painted an ambitious picture, but the path from concept to reality is fraught with challenges. The successful launch and subsequent performance of its mainnet will be the ultimate test of its true value.

Mainnet Launch and Future Vision

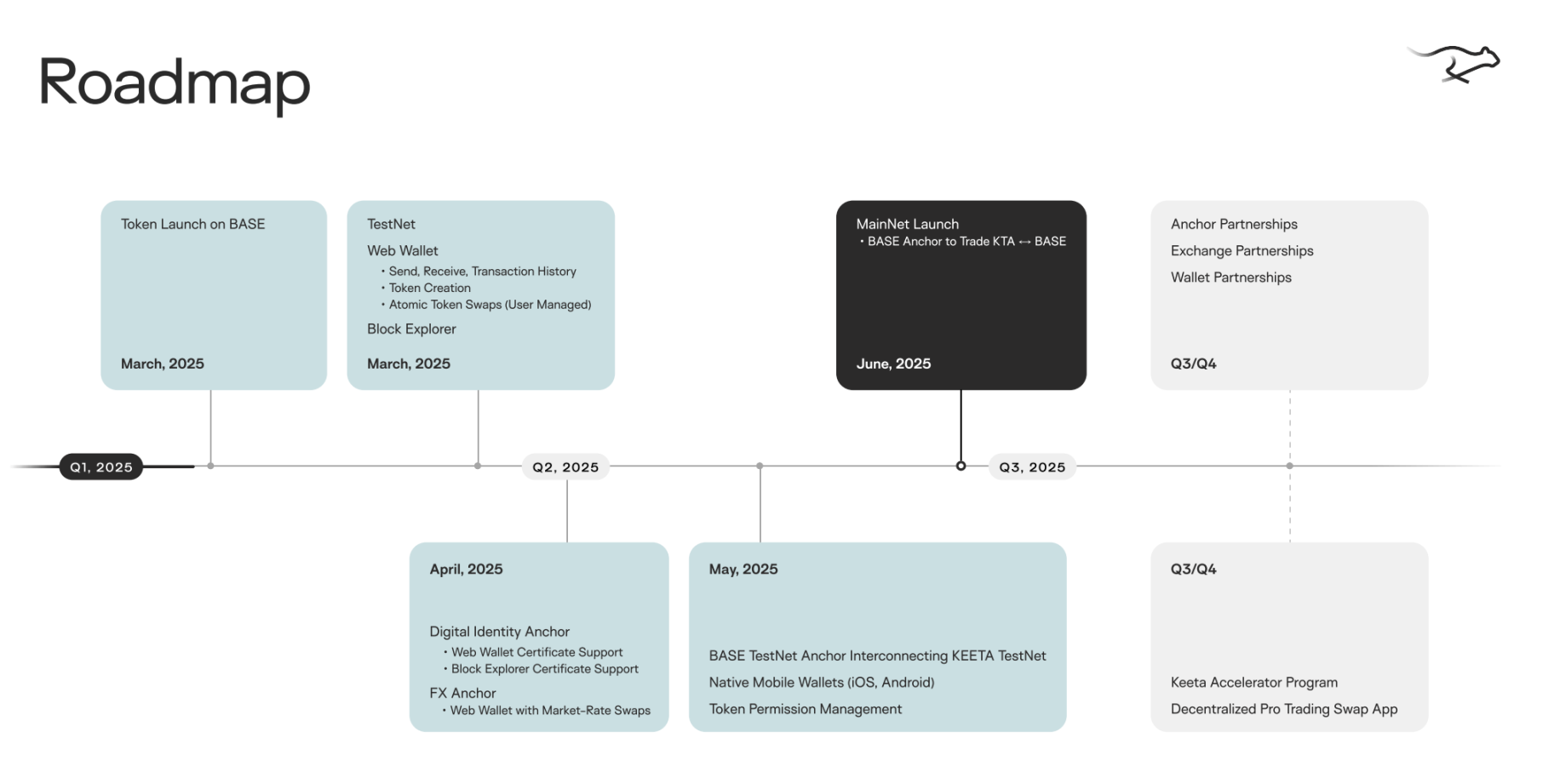

According to public information, Keeta’s testnet launched at the end of March 2025, accompanied by a web wallet and block explorer. The much-anticipated mainnet is scheduled to go live in June 2025 or during the summer—a pivotal milestone for Keeta.

Prior to mainnet launch, Keeta plans to progressively enhance its testnet:

-

April 2025: Integrate digital identity verification and certificate support into the web wallet and block explorer.

-

May 2025: Add FX anchors for market-rate token swaps within the web wallet; deploy a Base testnet anchor for cross-chain interoperability; release a native mobile wallet (iOS and Android); launch advanced token permission management.

-

Post-June 2025: The Keeta Wallet, expected shortly after mainnet launch, will aim to unify management of fiat, cryptocurrencies, stocks, digital identities, and other tokenized assets.

In addition, Keeta released its official SDK documentation on May 16, 2025. Its developer portal (developers.mykeeta.com) and GitHub repositories are now live and actively maintained. Future plans include Layer-2 scaling solutions, enhanced interoperability, and expanded DeFi capabilities.

Facing Skepticism: The Gap Between TPS "Vision and Reality," Transparency, and Community Growth

Despite its optimistic vision, persistent questions surround Keeta’s core technical metrics. As previously noted, there remains a vast chasm between its claimed 10 million TPS and current testnet observations (below 5,000 TPS, or Chainspect’s reported range of 1,210–1,779 TPS). Keeta attributes the limited testnet performance to the absence of transaction fees and promises a dedicated benchmarking network in the future. Yet, the market awaits definitive proof from the mainnet.

Transparency is another major challenge. Public details on how vDAG overcomes inherent technical obstacles to achieve ultra-high TPS remain scarce. Moreover, ambiguity surrounding the pre-TGE community incentive program and the opaque control over large token allocations—particularly the community share—has raised concerns.

Regarding community and ecosystem development, although Keeta has established official social channels and engages with users via X Spaces and Discord, some analysts argue that its community activity and developer engagement do not yet match its market热度. As of May 20, 2025, its official Twitter account had around 12,000 followers, though other sources claim it reached 75,000.

For any Layer-1 blockchain—especially one making bold claims like Keeta—the mainnet launch is a decisive “moment of truth.” Architectural designs and lab-based performance tests must be validated in a real, decentralized production environment. Even with the team’s explanation of “intentional limitations,” current testnet results fall far short of targets. To earn lasting trust beyond speculative hype, the mainnet must deliver sustained TPS far exceeding testnet levels, robust security, and effective operation of its compliance framework and RWA functionalities. The crypto industry is littered with projects boasting strong narratives and funding but failing to deliver technically sound mainnets. Keeta’s mainnet performance will be the key indicator of its long-term viability and potential impact on the RWA and cross-border payments sectors. Failure to meet expectations at this critical juncture could lead to a swift repricing of its current high valuation.

Keeta’s Competitive Position in the RWA Landscape

With its dual emphasis on compliance and scalability, Keeta Network aims to carve out a niche in the increasingly competitive RWA space. Its core differentiation lies in deeply integrating compliance—through KYC/AML, rule engines, and X.509 digital identity—into the protocol layer, combined with promises of extremely high transaction throughput, targeting traditional financial institutions with strict regulatory requirements for RWA tokenization and transfer.

Across the broader RWA landscape, Keeta faces competition. Ethereum holds a dominant position (about 57% market share) thanks to first-mover advantage and a vast ecosystem, supporting RWA token standards like ERC-3643 and ERC-1400, though it still struggles with scalability and high gas fees on mainnet. Polygon, as an Ethereum Layer-2 solution, offers low cost and fast speeds with EVM compatibility, appealing to retail-focused RWA projects. Avalanche leverages its Subnet architecture to allow developers to build custom blockchains with tailored compliance rules, coupled with high throughput and fast finality, making it ideal for regulation-sensitive projects—Franklin Templeton’s tokenized money market fund runs on an Avalanche Subnet. Algorand simplifies RWA issuance and management via Algorand Standard Assets (ASA), includes built-in compliance tools, and offers high performance. Other chains like Stellar, Tezos, XDC Network, and Solana are also actively pursuing RWA initiatives with varying focuses.

Among these players, Keeta aims to differentiate by targeting a niche it calls “compliant scalability.” While many L1s claim high scalability (e.g., Solana) and others focus on RWA (e.g., Algorand’s ASA or Avalanche’s Subnets), Keeta’s unique selling proposition is combining extreme scalability with a deeply integrated, protocol-level compliance framework designed specifically for traditional finance. If Keeta can deliver on both fronts, it could indeed open a lucrative niche. Its rule engine and KeetaScript are central to this vision, enabling RWA assets to be programmed with compliance logic from inception. This reflects a broader trend in blockchain—from purely permissionless systems toward solutions that interface effectively with regulated traditional finance. Keeta is betting that institutions choosing RWA platforms will prioritize “compliant scalability” and may accept reduced decentralization in exchange for reliability and regulatory alignment.

Conclusion: Keeta’s Potential and the Future of RWA—Opportunity Meets Risk

Keeta Network has rapidly captured market attention with its grand vision of building a high-speed, compliant infrastructure for RWA and payments, amplified by endorsements from prominent figures and an attractive—if not yet proven at scale—technical narrative. Should Keeta successfully fulfill its technological promises, particularly in scalably and compliantly managing RWA, it could profoundly transform how traditional assets are managed, traded, and accessed.

However, the challenges facing Keeta are equally formidable. First is the urgency of technical validation: the market demands real-world proof of its claimed TPS and vDAG efficiency on a live, decentralized mainnet. Second is building market acceptance and trust: Keeta must move beyond speculative hype to gain genuine adoption from financial institutions and RWA issuers, which requires time and demonstrable reliability. Third is transparency and community development: the project must address concerns over opacity and actively cultivate a vibrant, engaged ecosystem of developers and users. Lastly, execution risk looms large: Keeta must not only deliver its ambitious roadmap on time but also navigate the complex and evolving regulatory landscape surrounding RWA.

In summary, Keeta possesses many traits of a potential “high-flyer,” yet harbors significant underlying risks. Its future hinges entirely on its ability to steadily turn lofty ambitions into tangible realities. It could emerge as an industry-disrupting dark horse—or fade into obscurity if it fails to deliver or cannot stand out in the fiercely competitive L1 arena.

Keeta’s current high market valuation is largely based on expectations of its potential—a classic “pre-mainnet premium.” But sustainable value stems from an “execution premium”: successfully launching a robust mainnet, attracting significant RWA projects and partners (for which there is currently little public evidence), demonstrating the effectiveness of its compliance framework through real institutional collaborations, and nurturing a thriving developer ecosystem. Today’s market performance reflects hope; the “execution premium” must be earned through proven utility and widespread adoption.

Regardless of Keeta’s ultimate success or failure, its exploration within the RWA space will offer valuable lessons for the entire industry—especially on balancing technological innovation, market expectations, compliance demands, and the relentless effort required to build truly transformative technologies. As a key trend driving the convergence of blockchain and the real economy, RWA is still in its early days, and Keeta stands as a compelling case worthy of close observation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News