USD1 Ignites Binance Summer: A Crypto Feast Endorsed by Trump

TechFlow Selected TechFlow Selected

USD1 Ignites Binance Summer: A Crypto Feast Endorsed by Trump

USD1 has rapidly risen thanks to its dollar-pegged mechanism, strong political support, and ecosystem expansion, reaching a market cap of $2.1 billion.

Author: Oliver, Mars Finance

On May 22, 2025, Bitcoin surged past $110,000, hitting a new all-time high and sending shockwaves through the crypto market. Yet Bitcoin's rally was merely the opening act of this wave—center stage was quietly seized by a stablecoin named USD1. As the dollar-pegged stablecoin launched by World Liberty Financial (WLFI), a DeFi project backed by the Trump family, USD1 ignited a frenzy among ecosystem tokens after Binance announced support for its trading pair. Within just one day, BUILDon, a token linked to USD1, soared 480%, while usd1doge skyrocketed tenfold, fully igniting market sentiment.

Binance Lights the Fuse: USD1 Trading Pair Ignites Market

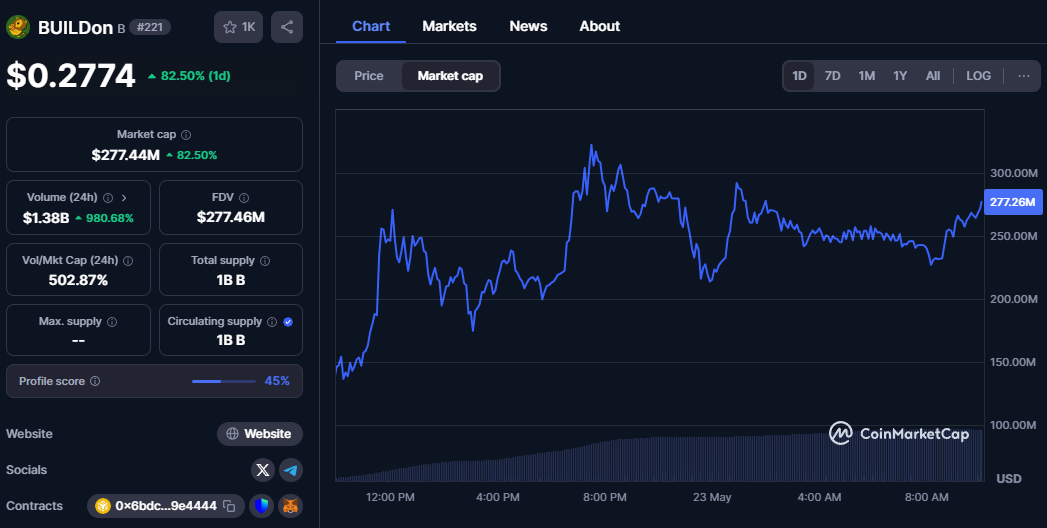

At 8 p.m. on May 22, Binance officially launched the USD1 trading pair, becoming the third major exchange after HTX and MEXC to support USD1. The news acted like a bomb dropped into the market, rapidly triggering a surge in USD1-related tokens. BUILDon (token B) on Binance Alpha was hit first, spiking 480% within six hours and gaining as much as 192% in a single day, with its market cap surpassing $220 million and reaching an all-time high. In community forums, investors excitedly speculated: "Is USD1 about to replace FDUSD as Binance’s new favorite?"

BUILDon wasn't alone. The meme coin usd1doge, pegged to USD1, achieved a stunning tenfold increase within 24 hours, briefly surging from a $130,000 market cap to $2 million before pulling back to $730,000—a performance that still left observers stunned. Another token, EAGLE, also made waves. As the first Ethereum-based project tied to USD1, it saw an intraday peak gain of 1,067%, briefly touching a $3.74 million market cap. On Binance’s gainers list, tokens such as LISTA and STO also performed strongly, rising 46.62% and 20% respectively, pushing investor confidence in “WLFI-themed” and “Binance-affiliated” projects to new highs.

The immediate catalyst for this surge was Binance’s support for USD1. Launched by WLFI in March 2025, USD1 is positioned as a 1:1 USD-pegged stablecoin, fully backed by short-term U.S. Treasuries and U.S. dollar deposits, with custody provided by BitGo Trust Company. Backed prominently by the Trump family—with Eric Trump as co-founder—USD1 enjoyed instant visibility. Within two months, its market cap surged from $128 million to $2.1 billion, placing it among the world’s top seven stablecoins. More importantly, 90% of USD1’s circulation occurs on the BNB Chain, and Binance’s listing of the trading pair has injected fresh momentum into this ecosystem.

Hot Money Moves: The Catalyzing Power of the Trump Label

USD1’s rise was no accident—it rides on the dual momentum of “U.S. hot money” and the “Trump label.” In early May, Abu Dhabi-based investment firm MGX used USD1 to inject $2 billion into Binance. This event not only boosted USD1’s market cap but also demonstrated its strong ability to mobilize resources. On May 16, Binance founder Changpeng Zhao publicly stated that the investment was completed entirely via USD1 and had no connection to the TRUMP meme coins circulating in the market. This clarification further legitimized USD1 and heightened expectations around Binance’s deepening ties with the asset.

More strikingly, USD1 also appears tied to deeper geopolitical maneuvering. On May 23, The Wall Street Journal cited sources revealing that Steve Witkoff, Trump’s Middle East envoy, traveled to the UAE a month before Trump’s inauguration to discuss regional issues and attend a crypto-focused conference. His son Zach Witkoff, founder of WLFI, referred to Trump as the “Godfather” when pitching to crypto firms, claiming WLFI would leverage America’s increasingly favorable crypto regulatory environment. Moreover, Zach Witkoff visited Pakistan and met with senior government officials, proposing to tokenize the country’s rare earth mineral trade. Weeks later, these same officials entered negotiations with the Trump administration over a ceasefire between India and Pakistan. CZ (Changpeng Zhao), Binance’s founder, reportedly helped facilitate some of WLFI’s overseas trips, though a WLFI spokesperson clarified that CZ was merely a friend of Zach’s, not a formal intermediary. Additionally, WLFI has held talks with Gulf region firms about token purchases, suggesting such deals could aid their expansion into the U.S.—a claim denied by the company’s spokesperson. These moves indicate USD1’s ambitions extend far beyond the stablecoin market, aiming to merge cryptocurrency technology with geopolitical strategy to open new frontiers.

In online communities, speculation grows that Binance is using its Alpha platform to test USD1’s potential, possibly aiming to establish it as the core stablecoin of the BNB Chain. After all, USD1 has already achieved multi-chain deployment via Chainlink’s CCIP protocol, spanning Ethereum, BNB Chain, and Tron, with an expansion speed that has stunned observers. On May 1, WLFI co-founder Zack Witkoff revealed that USD1 would be natively deployed on the Tron chain—a move closely tied to investments from Tron founder Justin Sun. As WLFI’s largest individual investor, Sun contributed $75 million, and his influence undoubtedly accelerated USD1’s multi-chain strategy.

A Frenzy of Ecosystem Tokens: Opportunity Meets Bubble

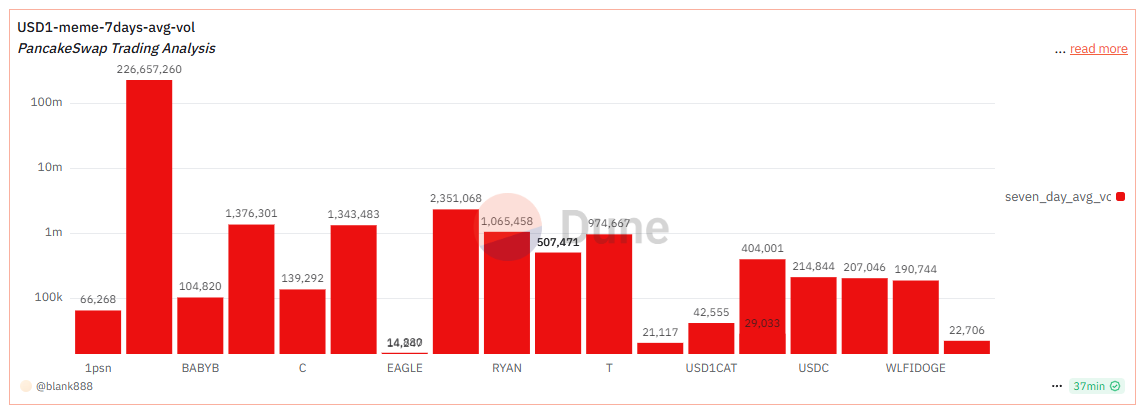

The launch of the USD1 trading pair didn’t just trigger a surge in Binance-affiliated tokens—it also signaled alpha opportunities for investors. Take BUILDon, for example. Originally just a mascot promoting BSC development culture, fairly launched via Four.meme, it became a market darling due to WLFI’s endorsement and the USD1 hype. PancakeSwap data shows BUILDon’s 7-day trading volume reached $220 million, vastly outpacing other tokens, with an average of 27,487.9 trades per day over the period—clear evidence of intense market interest. When WLFI officially announced purchases of token B and launched its USD1 Build initiative, it sent a strong signal about the growth of the USD1 ecosystem, instantly fueling investor enthusiasm.

Meanwhile, tokens from protocols partnering with WLFI also attracted attention. LISTA, the token of Lista DAO, rose 46.62% on May 22, driven by the launch of USD1Vault on its lending product, Lista Lending—the first real-world application of USD1 on BNB Chain. STO, the token of StakeStone, gained 20% on news of integration plans with USD1, offering cross-chain yield products that enhance capital efficiency for USD1 holders. These collaborations not only improved USD1’s utility but also brought traffic and capital inflows to partner projects.

Yet beneath the euphoria, signs of a bubble loom. Prices of usd1doge and EAGLE sharply retreated after their spikes, revealing heavy speculative sentiment. In online forums, some users enthusiastically debate “the next 10x coin,” while others caution: “These rallies are often short-lived; chasing highs carries significant risk.” Indeed, while the USD1 ecosystem offers opportunities, its sustainability remains uncertain.

USD1’s Ambition: From Payment Tool to Ecosystem Core

USD1’s success goes beyond trading pair mania—it lies in the broad expansion of its ecosystem. It has integrated with over ten DeFi protocols, including Venus Protocol, Meson Finance, and Pyth Network, spanning lending, cross-chain swaps, and oracle services. In consumer use cases, USD1 has shown strong adoption potential. Decentralized wallets TokenPocket and HOT Wallet, along with Web3 travel platform Umy, now support USD1, enabling users to book over a million hotels worldwide. Payment infrastructure provider Pundi X has also fully integrated USD1, laying the groundwork for retail applications.

Zach Witkoff, co-founder of WLFI, stated that USD1 aims to provide institutions with secure and efficient cross-border payment tools, with future plans to integrate with traditional retail POS systems. This vision echoes the paths taken by USDT and USDC. However, USD1 still faces a long road ahead if it hopes to challenge the two dominant stablecoins. Its reserve transparency and peg stability must withstand market scrutiny, and the political risks tied to the Trump association cannot be ignored.

Summary

USD1’s emergence has given the Binance ecosystem a powerful boost and introduced a fresh narrative to the crypto market. From BUILDon’s explosive gains to the coordinated rises of LISTA and STO, investor excitement around the “Trump theme” is driving a new wave. For investors, alpha opportunities may lie hidden within the USD1 ecosystem—but high returns come with high risks. Amid this crypto feast, staying calm and rational is crucial. Can USD1 secure a lasting position in the stablecoin market, or even challenge USDT and USDC? The current surge, fueled by Trump family backing, might just be the beginning of a much longer story.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News