Coinbase Ventures: The Rise of On-Chain AI – A Comprehensive Overview of the Landscape and Business Models

TechFlow Selected TechFlow Selected

Coinbase Ventures: The Rise of On-Chain AI – A Comprehensive Overview of the Landscape and Business Models

On-chain AI expands the crypto space to potentially billions of AI-driven participants.

Author: Jonathan King

Translation: TechFlow

Summary

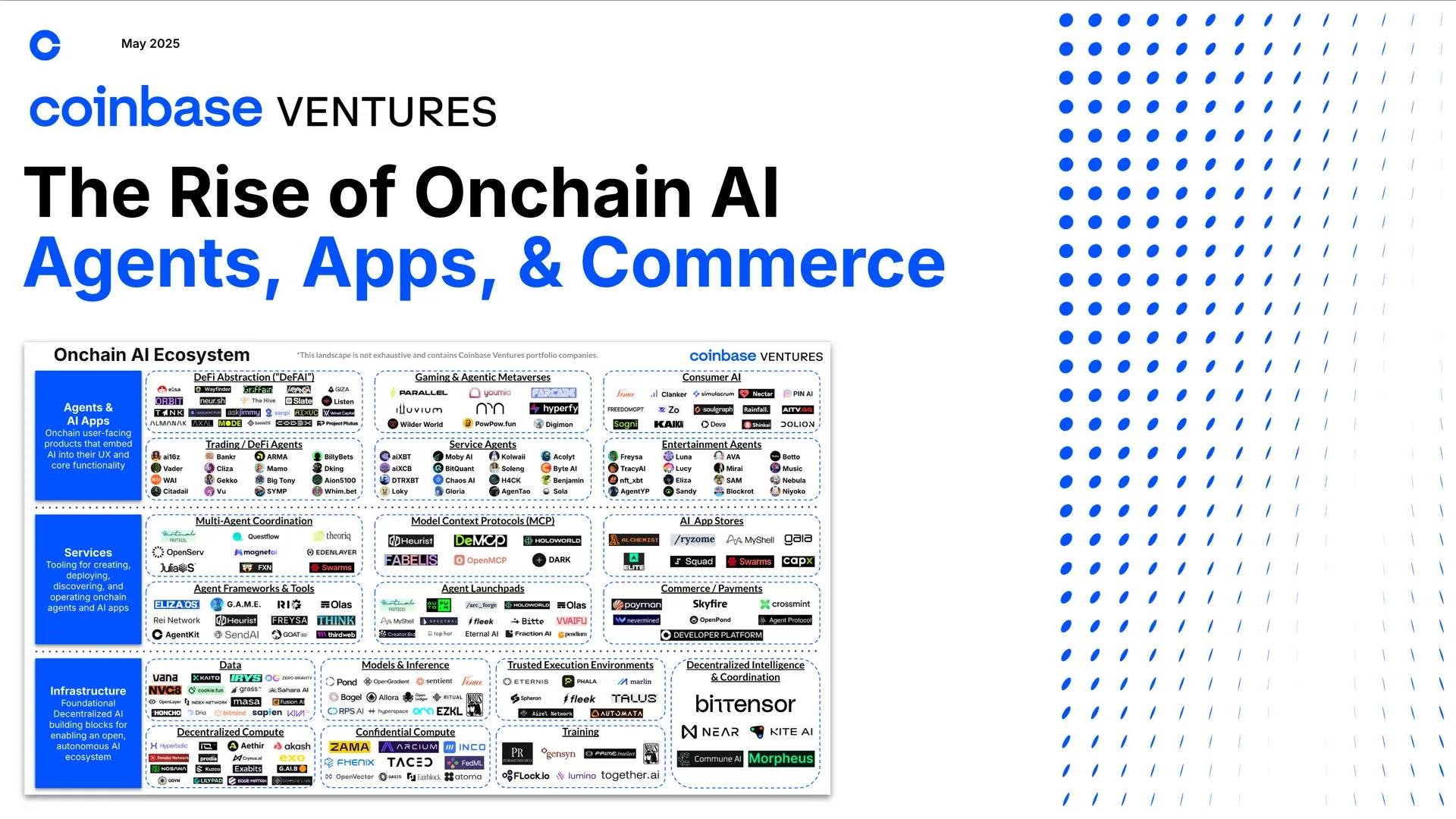

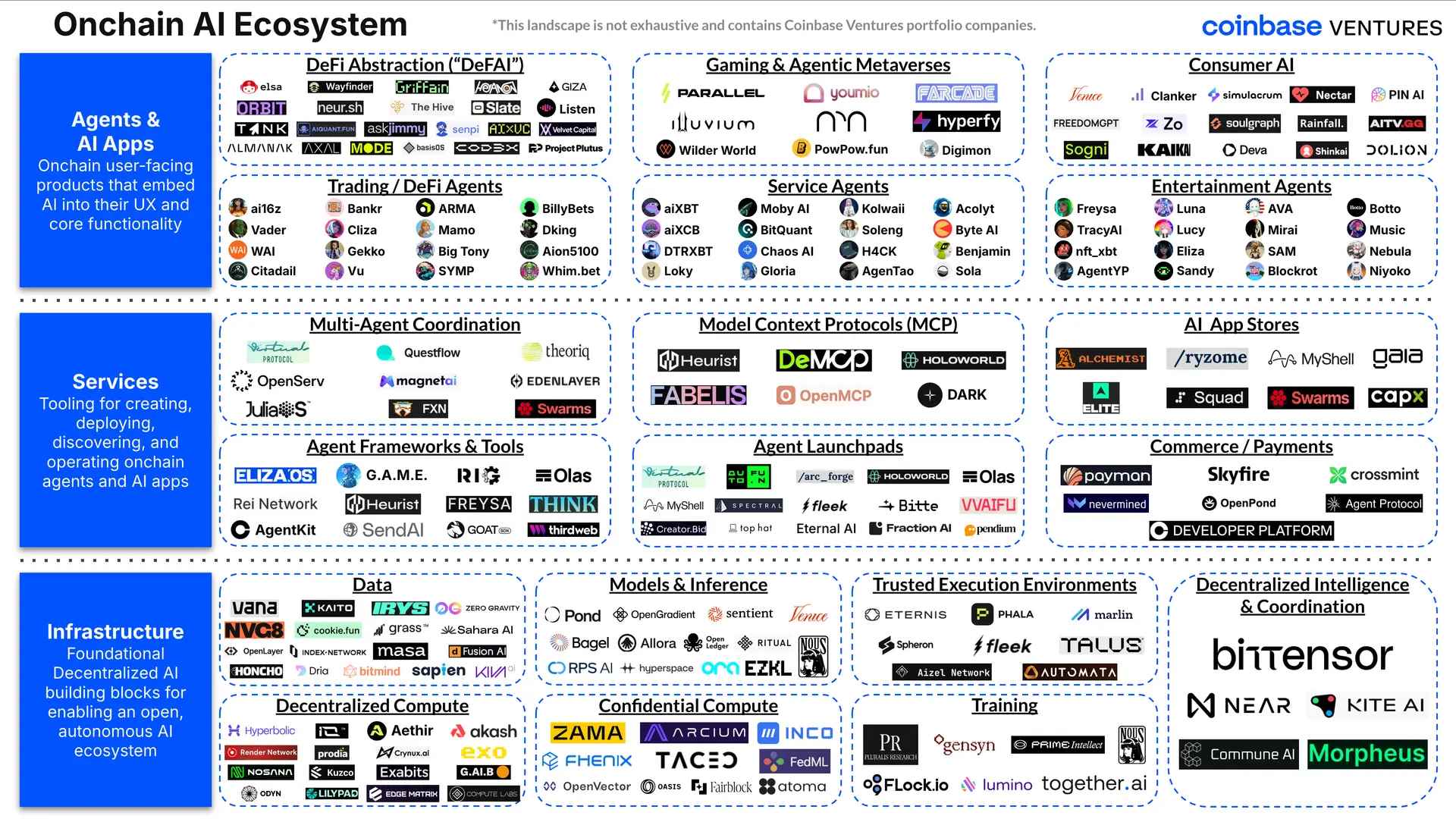

The convergence of cryptography and artificial intelligence is giving rise to a thriving on-chain AI economy—an ecosystem of blockchain applications and services driven by autonomous AI agents. Over the past 18 months, decentralized AI projects have attracted significant funding and rapid growth, but we believe on-chain AI is now rapidly emerging, marking the next wave of innovation in this cross-sector space. The significance of on-chain AI lies in its expansion of the crypto domain to potentially billions of AI-driven participants. Each autonomous AI agent acts as a new "user" on the blockchain, capable of operating 24/7 and making complex decisions, significantly driving on-chain activity and growth.

By investing in on-chain AI, Coinbase Ventures supports builders shaping this future agent-based economy, paving the way toward a new "Agentic Web."

Coinbase Ventures portfolio companies mentioned for the first time in the article below are marked with an asterisk (*).

In October 2024, Coinbase Ventures published a framework outlining its thesis on the convergence of crypto and AI, highlighting the complementary strengths of blockchain and AI—blockchain offering decentralization, censorship resistance, verifiability, and user ownership, while AI brings powerful data processing, reasoning, and automation capabilities. We believe this synergy could transform how humans and machines interact in the digital economy, ultimately fostering an "Agentic Web," where AI agents operate on cryptographic infrastructure, driving substantial economic activity and growth.

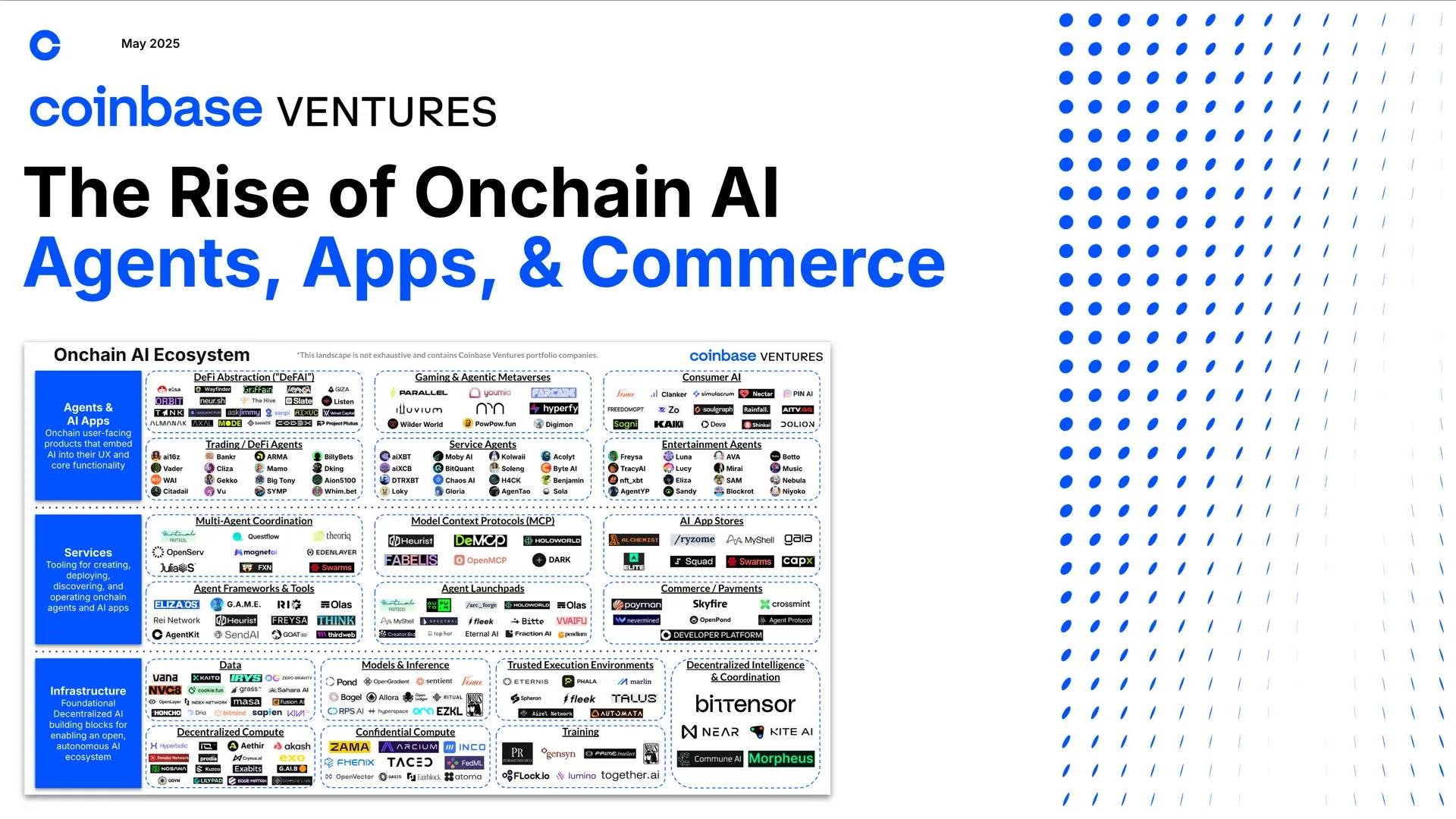

A key distinction is between decentralized AI and on-chain AI. Decentralized AI ("Crypto → AI") refers to building general-purpose AI infrastructure that inherits the openness and peer-to-peer nature of blockchain networks. This includes efforts to democratize access to compute resources, data, models, and training, preventing AI development from being monopolized by a few large corporations. These decentralized AI resources also support on-chain AI ("AI → Crypto")—an ecosystem of applications and services embedding AI into both new and existing blockchain use cases (e.g., trading agents, on-chain portfolio managers, DeFi abstraction). While decentralized AI projects have seen substantial funding and growth over the past 18 months, we believe on-chain AI is now rapidly rising, signaling the next phase of innovation in this intersection.

Introduction to On-Chain AI

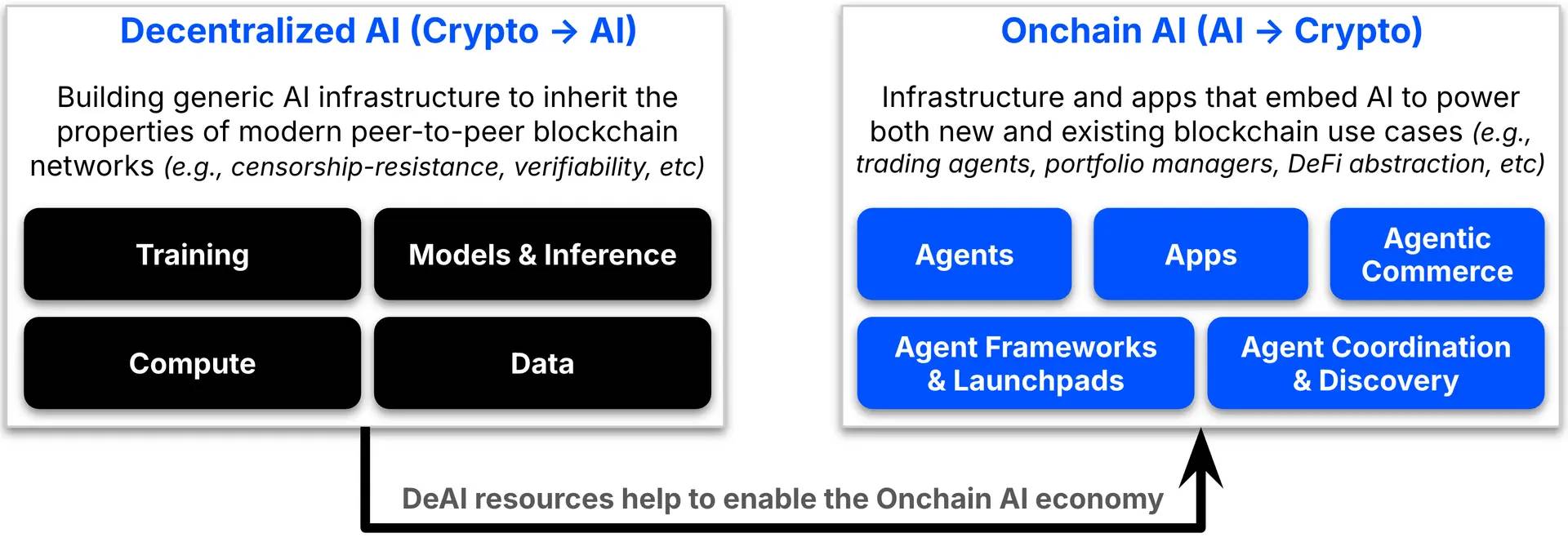

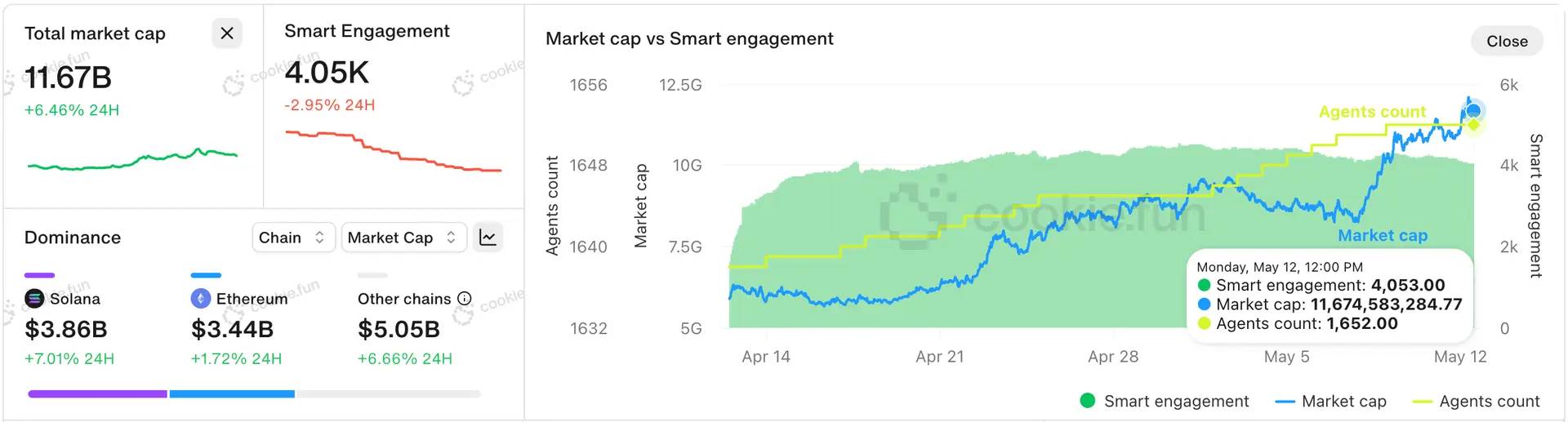

Over the past year, we’ve seen an AI agent like Truth Terminal, equipped with a self-custodied wallet, create an internet-native religion and launch a meme coin with a market cap exceeding $950 million, becoming the first AI agent “millionaire.” According to data from cookie.fun, there are currently around 1,600 AI agents with a combined market cap exceeding $11 billion. Overall, we observe AI agents (and related "agent tokens") quickly dominating social channels, some delivering real utility, turning on-chain AI from concept into a thriving reality. In particular, three interconnected concepts are gaining increasing attention: on-chain AI agents, on-chain AI applications, and agentic commerce.

-

On-chain AI agents are autonomous programs (powered by AI models) capable of performing on-chain operations. Think of an AI agent as an intelligent software bot with a crypto wallet—it can hold tokens, interact with smart contracts, trade assets, and even vote in DAOs, all based on its programming and objectives. Unlike the isolated AI chatbots common on social platforms today, these agents can learn, reason, and act within on-chain economies.

-

On-chain AI applications are blockchain applications that integrate AI into their core functionality. For example, AI can be embedded into DeFi protocols to optimize yields, into games to control NPC behavior, or into decentralized social networks or consumer apps to enable highly personalized user content. While we’ll explore these examples later, the key point is that these applications aim to seamlessly blur the boundary between blockchain and AI-driven logic.

-

Agentic commerce is an emerging business model where AI agents conduct transactions over blockchains (including with humans). It represents a paradigm shift from manual, search-based transactions to more automated, intent-driven, and personalized transaction experiences. Agents will become shoppers, negotiators, and service providers, completing transactions at software speed while aligning with human intent. Blockchains provide these agents with identity, wallets, stablecoins as payment currency, and a programmable smart contract framework for transactions.

The importance of on-chain AI lies in expanding the crypto domain to potentially billions of AI-driven participants. Each autonomous AI agent functions as a new "user" on the blockchain, capable of running 24/7 and making complex decisions, laying the foundation for significant on-chain activity and growth. Next, let’s dive deeper into the flourishing on-chain AI ecosystem, exploring its building blocks (new infrastructure services and types of on-chain agents), emerging on-chain AI applications, and how commerce itself might be reshaped.

Agents

On-chain AI agents are the core of the "Agentic Web." These are AI-driven entities capable of perceiving, deciding, and acting within on-chain economies. To understand their rise, we need to break down the infrastructure required to enable on-chain agents and explore the types of agents currently emerging.

Agent Infrastructure & Services

Building a powerful on-chain AI agent is highly complex—it requires a new suite of services and tools built atop decentralized AI (DeAI) infrastructure resources (e.g., compute, data, models, intelligence) to support an open, autonomous agent ecosystem. These services make it easier to create, deploy, discover, and operate autonomous on-chain agents by abstracting complexity and providing reusable components. Below are key emerging categories within agent infrastructure and their roles in the on-chain AI tech stack.

-

Trusted Execution Environments (TEEs)

To achieve true autonomy and secure operation, on-chain AI agents require a tamper-proof, verifiable execution environment independent of any centralized party. Trusted Execution Environments (such as Intel SGX or decentralized alternatives like Eternis*, Fleek*, or Phala Network) provide a hardware-secured "enclave" where an agent’s code and data can be processed confidentially—even from the agent’s creator. Agents running in TEEs are protected from external interference and can generate cryptographic proofs verifying their actions comply with programmed instructions. As the agent economy scales, embedding sovereignty at the infrastructure layer will be crucial for earning user trust and enabling fully autonomous agent ecosystems.

-

Agent Frameworks & Tools

Agent frameworks (like ElizaOS, G.A.M.E. by Virtuals, RIG, Heurist, REI) are development environments and libraries for building AI agents, allowing developers to avoid starting from scratch. These frameworks provide the architecture for an agent’s "core brain"—responsible for memory, decision-making, responding to prompts, and executing tasks. On-chain agent toolkits (like Coinbase AgentKit, SendAI) pre-package these frameworks for specific use cases and connect agents to smart contracts, wallets, payment channels, and on-chain data. Using these frameworks and tools, developers can quickly build powerful agents with built-in support for advanced multi-platform interactions, long-term memory, and on-chain connectivity.

-

Agent Launchpads

Platforms in this category help creators build, launch, manage, and/or monetize AI agents by packaging them as on-chain entities (often with their own tokens). For example, agent launchpads (like Virtuals, auto.fun, ARC) allow creators to deploy new agent instances and build communities or financial backing around them. Through token or fee-based incentive alignment, these launchpads enable agent developers to sustain and scale their on-chain agents as standalone projects or businesses.

-

Multi-agent Coordination

Not all problems are best solved by a single agent. Multi-agent coordination protocols (like Virtuals ACP, Questflow, Theoriq) coordinate multiple AI agents (i.e., "agent swarms") to work together on complex tasks. For instance, one agent may handle data collection while another evaluates results, all overseen by a coordinating on-chain agent. This "swarm" approach leverages specialization and parallel processing to exceed the capabilities of individual agents. By enabling collaboration among agents, multi-agent coordination platforms expand the scope of on-chain AI automation—from multi-step workflows to entire autonomous organizations.

-

Model Context Protocols (MCP)

Model Context Protocols sit at the intersection of AI agents and external data, initially introduced by Anthropic as a critical service. These protocols help standardize how on-chain agents retrieve relevant context, knowledge, or tools from external sources. Instead of custom integrations for every data source or smart contract, MCP-integrated agents can access any compatible context provider (whether on-chain data, off-chain databases, or web services) to fetch needed information or tools. Decentralized MCPs (like Heurist and DeMCP) offer agent developers open-source, self-hosted MCP services, enabling one-stop access to mainstream large language models and enhancing the adaptability and capability of on-chain agents in practice.

-

AI App Stores

AI app stores (like Alchemist AI, ARC Ryzome) serve as marketplaces and discovery layers for on-chain agents, tools, and experiences. These platforms allow developers to easily publish, monetize, and distribute agents or AI modules, while enabling users to browse, summon, or customize agents through familiar interfaces. Beyond distribution hubs, these app stores act as coordination interfaces for the broader on-chain AI economy, promoting interoperability among agents, tools, and protocols. As the number of on-chain agents and AI-native apps grows, these platforms could become major ecosystems—curating experiences, guiding users, and capturing value flowing through agent interactions.

Types of Agents

With rapid development in the agent infrastructure and services layer, we categorize current on-chain AI agents into the following broad types:

-

Trading / DeFi Agents

These agents focus on financial operations such as executing trades (like Bankr*, Cliza), providing liquidity (like BasisOS), optimizing yields (like ARMA*, Mamo*), or arbitrage in DeFi. They may also participate in prediction markets (like Billy Bets*), or even manage entire investment funds or portfolios (like ai16z, aiXCB). Trading agents can react faster than humans, operate 24/7, and potentially make more informed decisions based on data, improving market efficiency (or possibly outperforming human traders in certain aspects).

-

Service Agents

Service agents provide practical utilities for users or protocols. For example, an agent might deliver market analysis, research, and insights (like aiXBT, BitQuant*, Chaos AI*). Some agents may handle DAO governance tasks—reading proposals, summarizing content, or even voting based on preset logic. Others may audit smart contracts for vulnerabilities or automatically generate new smart contract code from natural language inputs (like AgenTao, Kolwaii). Additionally, commerce-related service agents (like Byte AI) may negotiate deals or pay for goods on behalf of users. These agents are essentially autonomous workers in crypto, automating on-chain tasks that typically require human labor or attention.

-

Entertainment Agents

These agents focus on user interaction. In gaming, AI agents can serve as NPCs (non-player characters) interacting naturally with players. Unlike scripted game bots, these AI NPCs can learn and evolve, making games more immersive. Beyond gaming, there are social agents—AI influencers (like Luna) on platforms such as X or Farcaster* that post content and engage with users, or AI agents creating art and IP based on community input (like Botto). In the future, you might follow an AI influencer on-chain who manages its own treasury (possibly earning cryptocurrency by creating content on Zora or completing tasks for fans). There are also AI companion agents offering highly personalized interactions, some featuring nuanced multimodal expressions and behaviors (like Nectar AI).

Though still early, these categories showcase the vast potential of on-chain AI agents. From AI fund managers to AI virtual friends, on-chain agents can occupy multiple niches. What unites them is their foundation in crypto, leveraging cryptographic primitives as a "playground" and toolkit—holding assets, executing smart contract code, and fully utilizing the transparency and composability of decentralized networks.

Applications

Alongside the rise of autonomous agents, we’re also witnessing a surge in AI-powered on-chain applications. These apps and platforms embed AI into user experience or core functionality. Here are areas where on-chain AI applications are taking shape:

-

DeFi (“DeFAI”)

AI is entering DeFi in multiple ways. A notable trend is AI-assisted trading and portfolio management. Instead of manually navigating complex DeFi protocols, users can delegate tasks to AI interfaces. For example, HeyElsa is an AI-powered crypto assistant where users issue task commands (e.g., “swap X for Y”) and the agent executes operations across protocols. Protocols like Giza offer non-custodial agents that monitor DeFi markets, identify yield optimization opportunities, and dynamically manage positions using real-time market awareness. We see this AI-driven UX as a “Wealthfront moment for crypto”—where on-chain AI agents act as robo-advisors designed specifically for DeFi, effectively becoming personal crypto portfolio managers accessible to everyone.

-

Gaming & Agentic Metaverses

Gaming is a natural testing ground for AI agents, and when combined with real asset ownership on-chain, it gives rise to the concept of agentic metaverses. These are game worlds or virtual environments populated by AI agents alongside other agents or human players, generating richer, more dynamic content. Agents can be friendly NPCs, autonomous opponents, or AI avatars controlled by other players. For instance, Youmio is building an autonomous world where AI agents learn, play, and entertain in real time, creating perpetual on-chain simulations. Companies like Farcade* are developing AI-powered on-chain game studios where anyone can “jam-code” and distribute on-chain games using natural language prompts.

-

Consumer AI

AI is transforming consumer experiences by making apps more personalized, interactive, and intelligent. ChatGPT alternatives like Venice and FreedomGPT let users access powerful models in private, censorship-resistant environments. In on-chain social networks, AI agents can act as influencers, curators, or creators—managing content feeds, generating posts, joining conversations, and even performing on-chain actions (like Clanker). In on-chain consumer apps (like Zo), AI can streamline user onboarding, recommend actions based on on-chain behavior, or negotiate on behalf of users in P2P markets. Finally, AI companion agents (like Nectar) allow users to create and interact with agents capable of nuanced multimodal expression and action—all verifiable on-chain. These agent-driven experiences promise to greatly enhance the crypto user experience, bringing it closer to mainstream consumer expectations.

-

Commerce

One of the most profound impacts of on-chain AI is how it enables a new form of digital commerce—what Coinbase Ventures calls “agentic commerce.” This business model is driven by transactions between AI agents and humans or other agents. In such an economy, cryptocurrency becomes the preferred payment method for both machines and humans. The logic is simple: autonomous AI agents running globally cannot access banks, but they can send and receive cryptocurrency trustlessly on public blockchains. Cryptocurrency’s borderless, programmable nature makes it ideal for machine-to-machine payments, microtransactions, and automated contracts. For example, Coinbase’s developer platform team recently launched x402, a new open-source payment protocol allowing AI agents and apps to use crypto to pay for GPU compute, API access, digital content, etc. Startups like Payman* and Skyfire* are building infrastructure services that use stablecoins like USDC to coordinate payments between agents and humans or between agents.

Though still in early stages, we believe agentic commerce has the potential to automate and accelerate commercial transactions in unprecedented ways. Commerce could become as efficient and always-on as machines, with agents negotiating deals, executing contracts, and exchanging value in seconds. Crucially, humans set goals and parameters, while agents handle the rest. The role of blockchain is to provide a secure, interoperable “playground” for these agent transactions—with clear rules (smart contracts) and reliable currency (stablecoins).

Outlook

Looking ahead, the potential of on-chain AI is immense, but its evolution will unfold in stages. In the near term, we expect continued experimentation with on-chain AI agents and AI-driven applications. In the long run, we believe cryptocurrency will become the de facto economic layer for AI, meaning any advanced AI agent will use crypto to store value and settle transactions. As AI becomes increasingly capable of writing software and smart contract code, the pace of innovation in on-chain economies could accelerate rapidly, ushering in a flood of new applications and users.

However, realizing this vision requires overcoming several challenges. Agent technology remains early, and some expectations may already outpace reality. Current AI agents are still limited in reliability and functional scope, and it may take time before they can safely handle open-ended tasks. Meanwhile, blockchain scalability will be tested if massive numbers of agents transact simultaneously. Additionally, new trust and governance frameworks are urgently needed. While AI agents can greatly enhance on-chain systems, poor governance could amplify security and trust issues.

From a value capture perspective, unlocking the potential of the on-chain AI economy will require support in several areas: robust infrastructure to boost agent intelligence (e.g., data networks and post-trained models tailored for on-chain agent use cases); services and tools to coordinate agent behavior (e.g., multi-agent coordination, decentralized MCP, agent identity/payment rails); and channels to distribute agents to mainstream consumers (e.g., agent launchpads, AI app stores, consumer AI).

In conclusion, the rise of on-chain AI represents a new frontier in machine-driven intelligence. From autonomous agents executing smart contracts to on-chain applications adapting in real time to user needs, this movement could redefine human-machine interaction. It’s an exciting era—Coinbase Ventures and many in the crypto community believe this could lead to the next major leap in internet evolution: the arrival of the "Agentic Web," ushering in a more autonomous and intelligent digital economy.

Special thanks to Hoolie (Coinbase Ventures), Luca (Base), Lincoln (Coinbase), Vik (Coinbase), Daniel (Variant), Josh (Contango Digital), Anand (Canonical), Teng (Chain of Thought), and EtherMage (Virtuals) for their insightful feedback and discussions on this piece.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News