The "digital gold" narrative underestimates Bitcoin's true value

TechFlow Selected TechFlow Selected

The "digital gold" narrative underestimates Bitcoin's true value

Equating it with gold is downplaying a monetary innovation that completely颠覆s the traditional financial system.

Written by:Isaiah Austin, Bitcoin Magazine

Translated by: Yuliya, PANews

Labeling Bitcoin as "digital gold" is a misunderstanding of this revolutionary form of money. This narrative reduces Bitcoin to merely a store-of-value asset, obscuring its deeper technological advantages and financial potential.

Analogy is a common human method for understanding new concepts. Faced with the unprecedented idea of Bitcoin, people naturally seek a familiar reference point. Before the general public fully grasps Bitcoin's underlying mechanisms, "digital gold" is undoubtedly an intuitive and easily digestible analogy. Bitcoin is scarce, globally accessible, and capable of storing value—so calling it "digital gold" seems perfectly reasonable.

This narrative has driven adoption at institutional and sovereign levels, even appearing in the opening line of President Trump’s executive order proposing a strategic Bitcoin reserve: "Due to its scarcity and security, Bitcoin is often referred to as 'digital gold.'"

This is an undeniable achievement. However, if Bitcoin is to realize its true potential, this narrative must evolve.

Bitcoin is not "digital gold."

Equating it with gold diminishes a monetary innovation that completely disrupts traditional financial systems. Bitcoin's fundamental properties render gold’s celebrated traits obsolete, while simultaneously making it faster, more secure, and more decentralized than fiat currency.

Scarcity and Finiteness

Gold’s enduring role as a store of value lies in its scarcity. Over the past century, annual gold production has grown by only about 1% to 2%. The difficulty of exploration, combined with high labor, equipment, and environmental costs, makes large-scale expansion economically unviable.

This naturally constrained supply has granted gold monetary status since 3000 BC. In ancient Rome, the amount of gold required to buy a fine robe is roughly equivalent to what’s needed today for a tailored suit—evidence of its long-term value stability.

Yet in the age of Bitcoin, using an asset with fluctuating supply as a unit of value appears outdated. Bitcoin isn't just scarce—it is finite. Its total supply is permanently capped at 21 million coins, immutable regardless of technological advances or space mining.

For the first time in history, humanity possesses a tradable currency with a fixed supply enforced by mathematics and technology—an achievement far beyond what "digital gold" can convey.

Fungibility

While gold can be physically divided, it cannot be considered highly fungible. Only with saws, lasers, and precision scales can division occur at all. Thus, gold works for large transactions but fails in everyday payments.

At current market prices, one gram of gold is worth approximately $108. Paying for a sandwich would require shaving off a tiny corner of that gram—an impractical scenario in real life.

Historically, humans mitigated this issue by minting standardized coins with defined metal content. Yet this opened the door to debasement.

For example, the stater gold coin minted around 600 BC in Lydia (modern-day Turkey) was originally made from electrum—a natural alloy of gold and silver—with about 55% gold content.

In 546 BC, after conquest by the Persian Empire, copper and other base metals were gradually added, reducing gold content. By the end of the 5th century BC, the coin’s gold purity had dropped to just 30%-40%.

Gold’s inability to achieve true divisibility led to systemic weaknesses throughout history. To conduct small transactions, citizens typically handed gold to governments in exchange for 1:1 coins. But this system often collapsed under elite manipulation, leading to currency dilution and erosion of public trust.

No gold-backed monetary system in history has ultimately avoided devaluation. The practical need for microtransactions forced the public to rely on state-issued paper money and small-denomination coins, surrendering control over their wealth.

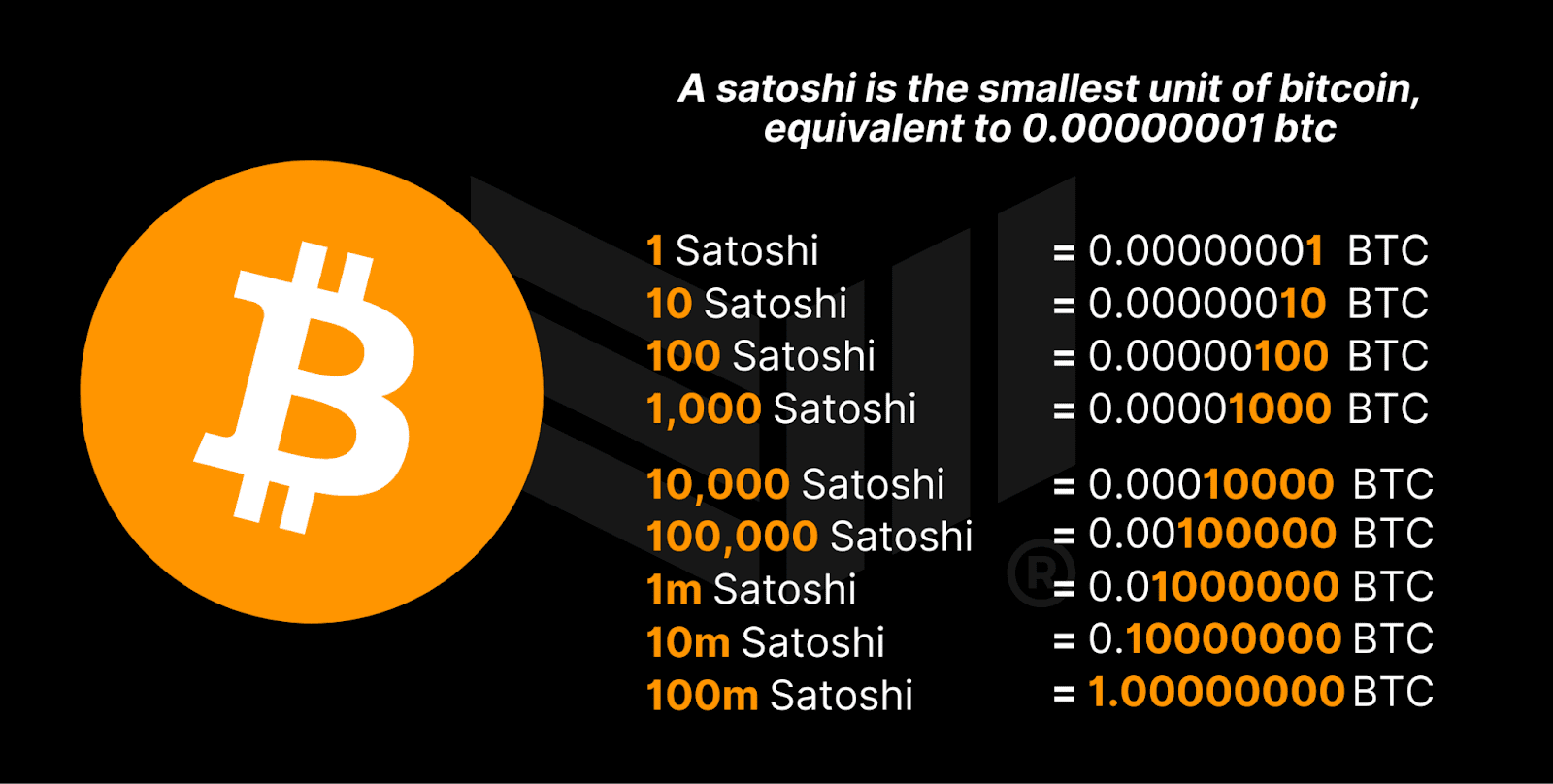

Bitcoin solves this problem fundamentally. Its smallest unit, the satoshi, equals one hundred millionth of a Bitcoin. At current prices, one satoshi is worth about $0.001—already surpassing the dollar in granularity. Bitcoin transactions require no institutional or governmental intermediaries; users can always transact directly using the smallest unit, making it a truly peer-to-peer monetary system.

Therefore, comparing gold and Bitcoin in terms of divisibility and unit precision is almost laughable.

Auditability

The last official U.S. audit of its gold reserves was in 1974. Then-President Ford allowed journalists into Fort Knox in Kentucky to view the vault, finding nothing amiss. But that was half a century ago.

To this day, speculation persists about whether the gold at Fort Knox remains intact. Recently, rumors circulated that Musk would livestream an audit—but that anticipated event quickly faded away.

Unlike gold, which undergoes rare and manual audits, Bitcoin verification is automatic. Through proof-of-work, a new block is added approximately every ten minutes, with the system continuously validating transaction legitimacy, total supply, and consensus rules.

Rather than relying on third-party trust like traditional audits, Bitcoin enables trustless, transparent on-chain verification. Anyone can independently verify blockchain data in real time. "Don’t trust, verify" is Bitcoin’s foundational principle.

Portability

Bitcoin’s portability needs no elaboration. Gold is bulky and heavy, requiring specialized ships or aircraft for cross-border transport. Bitcoin, stored in a wallet, has zero weight regardless of amount.

But Bitcoin’s real advantage isn’t just convenience—it’s that it doesn’t require physical movement at all. Receiving a gold payment in reality means bearing transportation costs and counterparty risk. International gold transfers involve multiple third parties: brokers, export logistics teams, carriers, recipients, and custodians—each link adding trust dependency.

Bitcoin requires no intermediaries. Users can send cross-border payments directly via the blockchain, with every transaction publicly verifiable and fraud-proof. For the first time in history, humanity has true "electronic cash."

Conor Mulcahy of Bitcoin Magazine noted: "Electronic cash refers to purely digital currency used for peer-to-peer transactions. Unlike electronic money that relies on banks and payment processors, e-cash mimics the anonymity and direct exchange features of physical cash."

Prior to Bitcoin, peer-to-peer non-face-to-face transactions remained theoretical. Critics who claim "if you can’t see or touch it, it’s not real" will inevitably fade away in our rapidly digitizing world.

Not All Bitcoin "Adoption" Should Be Celebrated

If the sole goal is driving up Bitcoin’s price, then the "digital gold" narrative works well—governments, institutions, and individuals will keep entering the market, pushing prices higher.

But if Bitcoin is viewed as a technological revolution reshaping the order of freedom, its messaging must be rethought. For Bitcoin to become central to global financial freedom, we must educate those unfamiliar with it—conveying its uniqueness rather than relying on oversimplified analogies.

Bitcoin deserves to be recognized as an entirely new form of money—not merely a digital substitute for gold.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News