In a market without a main narrative, Alpha, as Binance's reservoir, has begun to show results in competing for market liquidity

TechFlow Selected TechFlow Selected

In a market without a main narrative, Alpha, as Binance's reservoir, has begun to show results in competing for market liquidity

The artificially inflated apparent trading volume is highly likely to experience a cliff-like drop once external stimuli are removed.

Author: Kevin, the Researcher at Movemaker

Binance Alpha1.0's Failure and Alpha2.0's Strategic Shift

Due to poor performance on the Binance Wallet, Binance Alpha1.0—the bridge connecting Binance to on-chain liquidity—has failed. Prior to its upgrade, both trading volume and user numbers dropped to historic lows. The daily trading volume of all tokens on Alpha totaled less than $10 million, with fewer than 10,000 transactions per day, a stark contrast to Binance’s main exchange volumes. It not only failed to attract on-chain users and corresponding liquidity to the exchange but also produced negative marketing effects.

As a result, Binance Alpha was upgraded to Binance Alpha2.0 by the end of March. Unlike version 1.0, which could only be accessed via the Binance Web3 wallet, Alpha2.0 is now directly integrated into the Binance app, allowing users to purchase Alpha tokens using funds from their exchange accounts.

The inability to grow wallet user numbers means Binance’s strategy of using Alpha as a bridge to capture on-chain liquidity has failed, undermining efforts to draw both liquidity and attention to BSC. In other words, when Binance cannot generate a natural positive cycle of growth on-chain, it must reverse course—redirecting traffic from its own exchange into Alpha. This injection aims to create quantitative changes that attract market attention, triggering qualitative transformation through sufficient wealth effects, ultimately turning Binance Alpha into a forward base for attracting on-chain liquidity and amplifying BSC’s visibility.

A Waiting Period Without Consensus: Alpha2.0's Trough Before the "Gunshot"

This concept is sound, but its success hinges on one critical precondition: in a liquidity-constrained market, there must be a shared consensus to mobilize观望 capital and ignite market interest in Binance Alpha2.0. Without such a catalyst, even after the upgrade, data from late March to mid-April shows that attempts to build order book depth or promote wealth effects could only briefly spark less than a week of market discussion before fading again—leading Alpha back into a trough by early April.

This does not indicate a failure of the Alpha2.0 upgrade or flawed strategy. To expand Alpha’s scale—specifically its total trading volume—Binance can either import liquidity from DEXs or inject liquidity from its own centralized exchange. Version 1.0 chose the former path because it mirrored established tactics used by secondary exchanges, making it easily acceptable to the market. Moreover, Binance, as the leading exchange, operates with far greater confidence than smaller players. For those exchanges, capturing on-chain liquidity is foundational; hence they can respond swiftly in UX and marketing. For Binance, however, on-chain expansion was more precautionary than urgent. Therefore, the combination of Binance Wallet’s poor user experience and the abrupt downturn in Q1 market conditions made it difficult for Binance to pivot quickly, leading to Alpha1.0’s collapse.

Thus, injecting liquidity from the exchange represents Binance’s final—and most powerful—upgrade move. However, data from March 20 to April 20 still paints a bleak picture for Alpha2.0. Why? Even though the pipeline for liquidity injection is now operational, synchronized inflows require a signal—a gunshot. Amid the current despair across crypto narratives, only Bitcoin can play this role.

Bitcoin Signals Ignition, Alpha2.0 Trading Ecosystem Finds Turning Point

Bitcoin’s price has become tightly linked to U.S. macroeconomic trends. For Bitcoin to initiate a new rally, it needs support from renewed macro-level market confidence. In the previous article, we noted that Bitcoin lingered around $85,000 for a week, awaiting confirmation of such confidence. When markets were gripped by fears of tariffs and recession, positive news—including a 90-day tariff cooling-off period, strong U.S. economic performance, and progress in China-U.S. talks—sparked a brief period of market easing. With no immediate risk of worsening tariffs and reduced fear of economic downturns, bearish pressures were contained. For dozens of days ahead, this provided Bitcoin with solid confidence confirmation. The rally began on April 21, and Ethereum’s strong breakout over three days signaled large capital moving in early, marking the start of phase two.

When Bitcoin sends a signal, hungry liquidity rushes first into high-risk assets, and the pipeline built by Alpha2.0 begins to function effectively.

Rewards Points and Token Bubbles: Alpha2.0's Dual-Engine Strategy

Returning to Alpha2.0 itself, beyond attracting on-chain liquidity, it also serves as a reservoir for Binance. To dilute the impact of new listings on Binance, liquidity for newly launched tokens must be pre-diverted while ensuring it remains within Binance rather than leaking to other exchanges. Thus, once Bitcoin provides a signal and short-term market consensus strengthens, Alpha2.0’s direction becomes clear: replicate how market makers have historically hyped narratives in each cycle—namely, creating bubbles within the reservoir. Alpha2.0 employs two methods to generate such bubbles:

-

Bottom-up points promotion

-

Alpha Points serve as direct incentives to boost trading volume and liquidity, calculated as the sum of balance points and trading volume points earned over 15 days.

-

Balance Points: Users earn daily points based on asset holdings in the exchange and wallet. For example: $10,000 to < $100,000 = 3 points/day.

-

Trading Volume Points: Scored based on purchases of Alpha tokens. Example: Every $2 purchased earns 1 point, with an extra point awarded whenever purchase amount doubles (e.g., $2 = 1 pt, $4 = 2 pts, $8 = 3 pts...).

-

Alpha Points determine eligibility for airdrop events. For instance, 142 Alpha Points grant qualification for an airdrop of 50 ZKJ tokens.

-

The difficulty of earning points increases with higher balances and trading volumes. Alpha2.0 aims to incentivize the broadest possible user base. Through carefully designed mechanics, it encourages users to maintain certain asset balances in the exchange and wallet and actively buy Alpha tokens, thereby enhancing market depth and activity. The double trading volume points campaign launched on April 30 boosted engagement among long-tail users—anyone placing orders or directly buying BSC tokens received double points. By expanding airdrop eligibility through doubled points, Binance generated market heat and activity, giving primary holders stronger motivation to pump Alpha tokens.

-

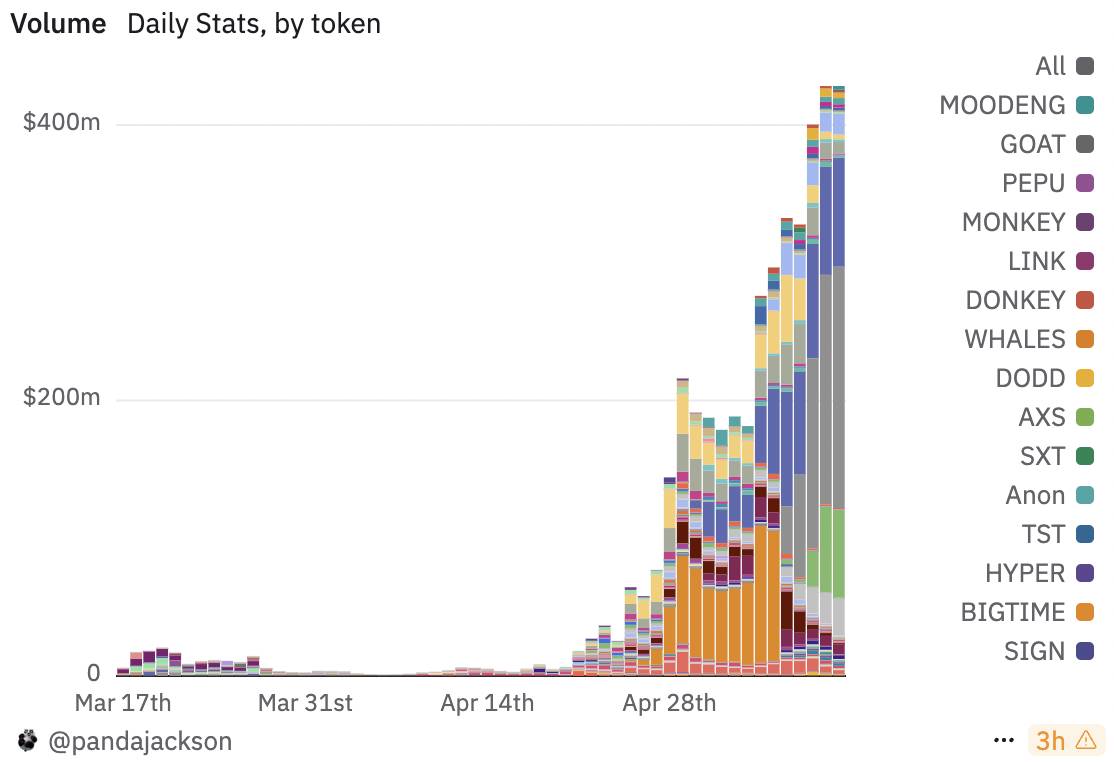

Since April 20, Alpha2.0’s trading volume shows Binance has successfully increased platform asset holdings and transaction activity, further boosting overall market vibrancy and depth. As more users participate, Alpha token liquidity will significantly strengthen. Sustaining this virtuous cycle will be key for Binance to stand out in future market competition.

-

Liquidity convergence driven by leader effects

Observing the post-transition daily trading volume trend of Alpha tokens under Alpha2.0, rule changes alone did not provide sufficient stimulus or attract significant capital interest. However, Bitcoin’s signal created a strong consensus. The main contributors to Alpha token daily volume are: $KMNO, $B2, and $ZKJ.

$KMNO: Kamino Finance, a DeFi protocol on Solana, entered Binance Alpha on February 13 and then declined steadily. From April 28 onward, trading volume surged—up 40x compared to two weeks prior—while price fluctuated narrowly between $0.065 and $0.085. Trading volume normalized after its spot listing on Binance on May 6.

$B2: A Bitcoin L2 protocol, launched and entered Binance Alpha on April 30. Its market cap peaked at just $30 million and currently stands at $27 million. Trading volume rose steadily post-launch, showing clear patterns—volume expands during Asian daytime hours and weakens at night.

$ZKJ: ZK protocol Polyhedra Network, launched and joined Binance Alpha on May 6, with a market cap of $130 million. Its volume pattern closely mirrors $B2, rising during Asian daytime and declining at night.

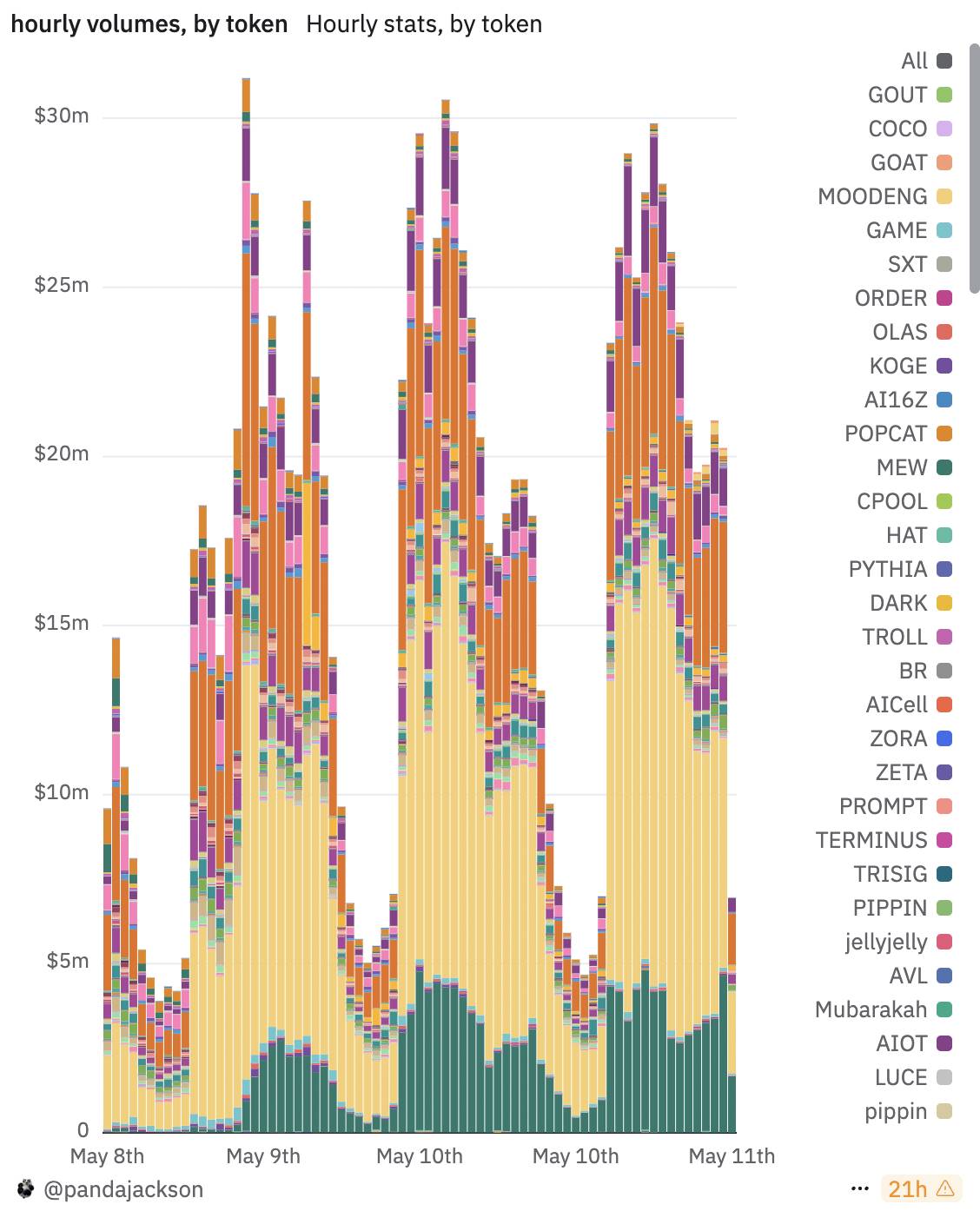

Asia-Day Driven Model: The Real Picture of Alpha Liquidity

Hourly volume charts clearly show that major contributing tokens to Alpha 2.0 exhibit strong intraday cyclical patterns. This behavior repeated consistently from May 8 to May 11, with significant volume spikes occurring from UTC midnight to noon (approximately 8:00–20:00 Beijing time), followed by sharp declines during UTC afternoon to late night (evening to early morning Beijing time). This rhythm perfectly aligns with Asian trading hours, indicating that Alpha 2.0’s current trading ecosystem heavily relies on liquidity from Asian markets. During peak Asian daytime hours, hourly total trading volume frequently exceeded $25 million, occasionally nearing $30 million, reflecting highly concentrated market-making and trading operations.

Additionally, examining the distribution of trading volumes across tokens reveals that ZKJ (yellow) dominates overwhelmingly, leading in most time periods. Its volume moves in sync with broader market rhythms, reinforcing the hypothesis of “systematic market making.” Beyond ZKJ, tokens like B2 and SKYAI also show notable activity during peak hours, forming a “market-making matrix” within the Alpha 2.0 ecosystem. Their volume movements are highly synchronized—not typical of organic retail trading—but resemble batch order placement and matching controlled by automated market-making systems or bots. Activated at fixed times and withdrawn at others, these behaviors likely stem from standardized, automated trading programs, possibly operated centrally during Asian business hours and scaled back or shut off at night.

Overall, Alpha 2.0’s current trading activity follows a clear “Asia-day market-driven model,” where market depth and liquidity depend largely on market-making activities of a few top-tier tokens rather than organic global retail participation. While this approach can sustain volume and activity in the short term, it exposes the platform’s reliance on a single time zone and limited market makers. Should these market-making accounts halt operations, trading volume could collapse abruptly. To build a more sustainable ecosystem, Alpha 2.0 must attract organic trading from diverse regions and participants, moving beyond its current rigid, visibly artificial rhythm.

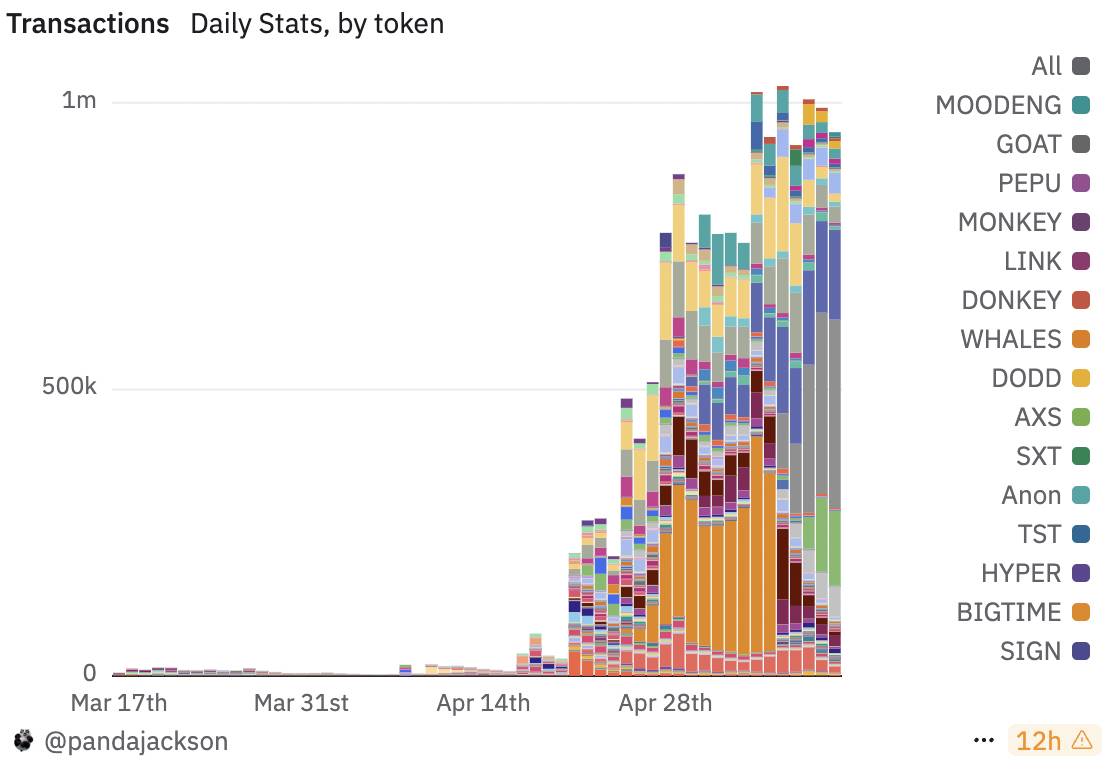

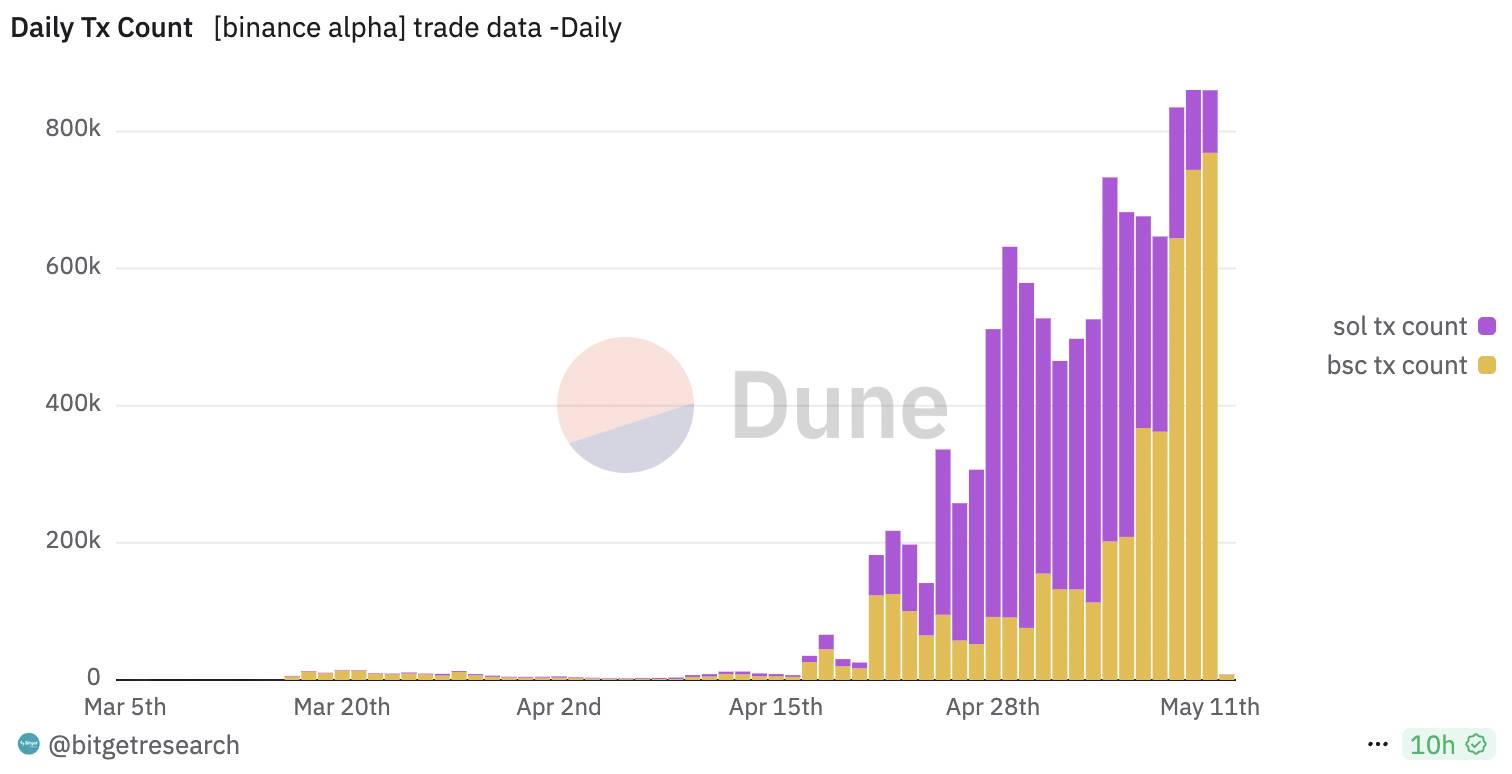

From the chart below, platform trading activity entered rapid growth after April 20, with transaction counts climbing from hundreds of thousands to nearly one million per day. However, starting around April 28, while trading volume remained high, daily transaction counts plateaued and recently showed slight decline. This divergence—“slowing transaction growth amid rising volume”—combined with the earlier “hourly volume distribution chart,” indicates a clear structural shift: Alpha 2.0’s trading behavior is transitioning from high-frequency, low-value “retail grinding” to low-frequency, high-value “market-maker-driven” activity.

The primary driver behind this shift is likely intensified market-making strategies for top tokens. As shown earlier, tokens like ZKJ and B2 see explosive volume surges during specific windows—especially daytime Asia hours—indicating they have become liquidity anchors. These trades are typically executed by a small number of market makers or automated bots whose strategies focus less on high-frequency execution and more on large-sized orders, matching, and arbitrage. As a result, even with limited transaction counts, average trade size increases significantly, driving overall volume upward. This structural “quality-over-quantity” shift, combined with incentives for order placement in the double-points campaign, suggests Alpha 2.0 has entered a new phase defined by optimized liquidity depth and concentrated core-token trading.

Further inference reveals this structural change reflects both development bottlenecks and strategic adjustments. Initially, growth relied on numerous minor tokens and retail participation to boost transaction counts, but diminishing returns have weakened this model. Now, the platform seeks to stabilize or increase total volume through reliable market-making mechanisms and flagship token ecosystems to attract more liquidity and attention. If this trend continues, Alpha 2.0 faces two strategic paths: either expand market maker participation to foster more “high-value, low-frequency” core pools, or improve UX and fee structures to re-energize retail traders and achieve a new peak of “high-frequency, high-value” trading.

Cross-Chain Switching and Market-Making Structure: Alpha2.0's Liquidity Migration Logic

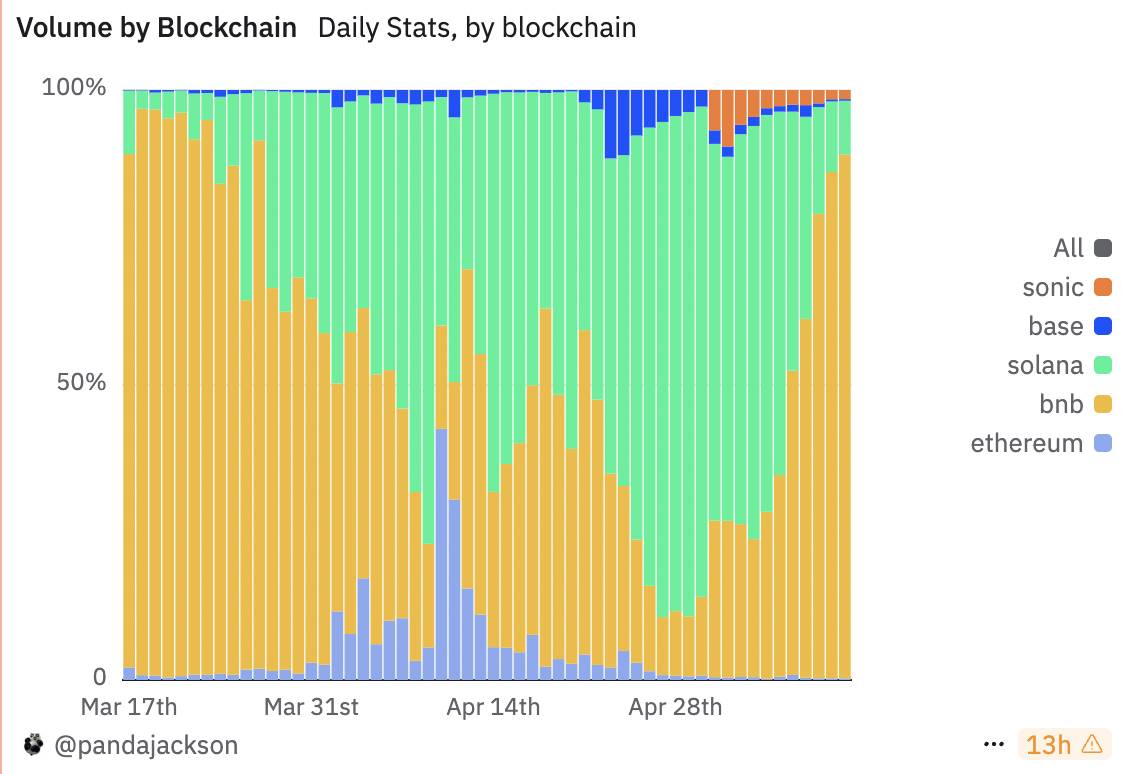

The chart below shows significant structural migration in daily trading volume of Alpha 2.0 tokens across different blockchains, with clear shifts in dominant chains over phases. From mid-March—shortly after Alpha 2.0’s rule changes—BNB Chain (orange) dominated, accounting for nearly 100% of trading volume. But by late March and early April, Solana (green) began rising, competing with BNB Chain and eventually surpassing it by mid-April, holding 60%-80% of daily volume share for about two weeks. During this period, Solana became Alpha 2.0’s primary liquidity hub—a quiet market phase that, in my view, reflects Alpha 2.0’s true organic traffic level.

Then, from late April to early May, BNB Chain reclaimed dominance, increasing its share to nearly 60%-70%, signaling a reversal in cross-chain liquidity flow.

This trend reveals several key insights: First, Alpha 2.0’s liquidity is highly mobile, highlighting BSC’s heavy dependence on market makers and bots. Second, Solana temporarily became the preferred chain for Alpha trading due to its high speed and low fees, but this leadership proved unstable. Once market sentiment shifted, massive volume could instantly return to BSC.

Overall, the shifting rhythm of trading volume across chains reflects a classic “liquidity arbitrage + incentive migration” driven model, rather than deep, long-term commitment to any single chain. This implies future traffic growth on Alpha will remain sensitive to inter-chain competition, cross-chain deployment costs, and incentive designs, leaving open the possibility of another chain switch in the near future.

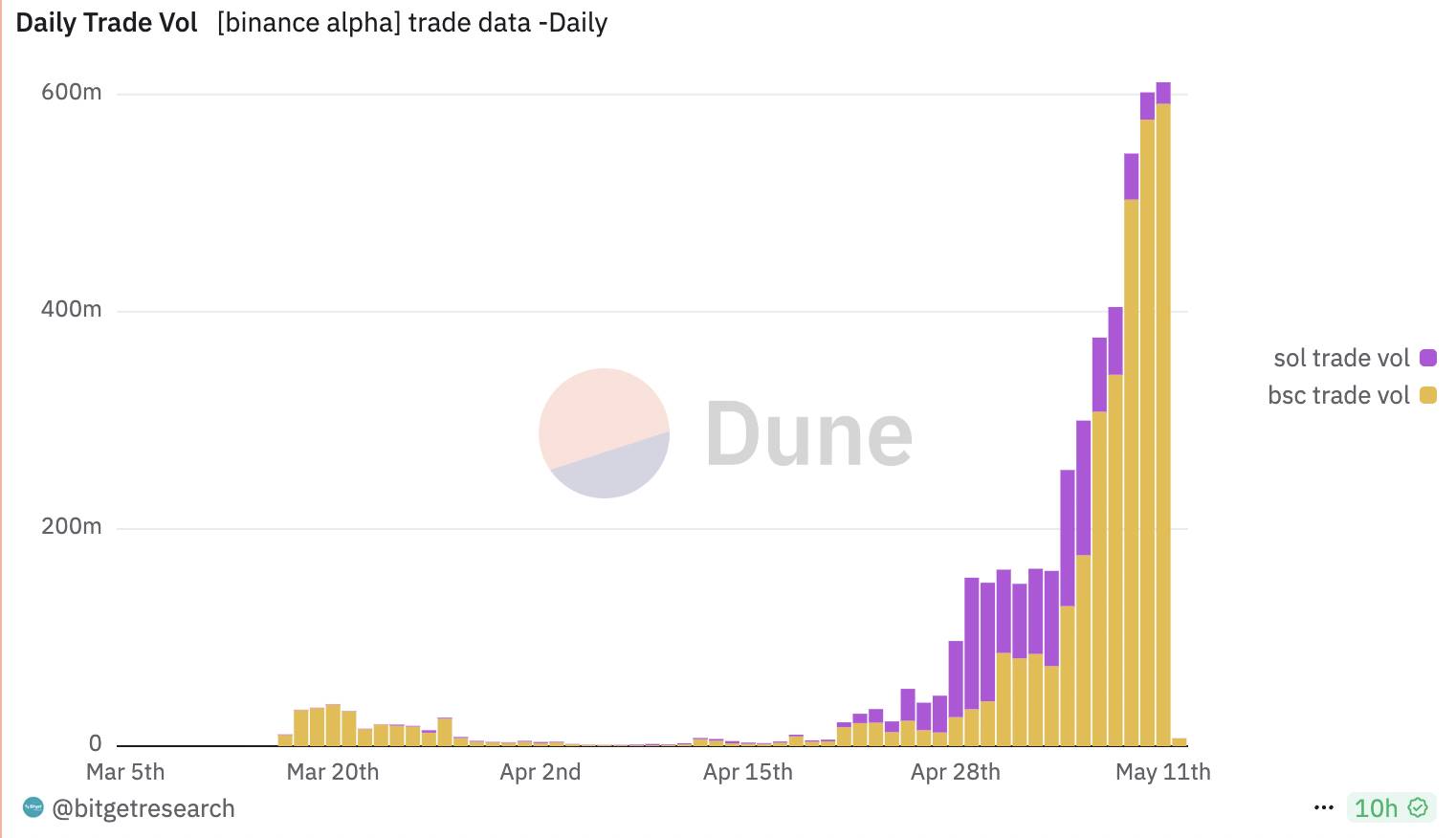

If we compare only the changes in trading volume and transaction count of Alpha 2.0 tokens on BSC versus SOL, we observe that Binance Alpha2.0 experienced explosive growth starting mid-April, a trend that continued through mid-May.

In terms of transaction count, Solana initially stood out—particularly in mid-to-late April—with significantly higher transaction volumes than BSC, indicating that Alpha2.0’s primary liquidity resided on Solana during this phase. However, by early May, BSC rapidly caught up and even surpassed Solana in transaction numbers, signaling a swift rise in BSC’s activity level, likely tied to adjustments in market-making strategies. While Solana maintained stable volume, its growth momentum slowed slightly.

Opportunities and Risks in the Sentiment Recovery Phase: Alpha2.0's Next Challenge

During the current recovery phase following recession and tariff shocks, the crypto market remains stuck in a narrative vacuum: without a new overarching story, market cohesion cannot form, traditional leader effects within narratives fail to emerge, and genuine wealth effects remain elusive. Although USDT supply remains ample, overall liquidity remains tight in relative terms. At present, no other narrative can shoulder the burden of driving the broader market—only Ethereum can temporarily fulfill the dual role of “narrative core” and “liquidity reservoir” amid fleeting market waves. Whether fueled by network upgrade expectations or actual ETF staking adoption may be debatable, but viewed differently, the market has deteriorated to a point where Ethereum must now carry the primary load of sentiment and capital flow. In past bull runs, this role was typically played by flagship projects.

When Ethereum, Memecoins, or other hot assets experience short-term explosive rallies, major whales and top exchanges like Binance must immediately ride the wave without hesitation. Because the current sentiment-driven mini-cycle may or may not evolve into a larger bull market, uncertainty looms. If major players fail to respond promptly—either through price action or trading volume—they risk being labeled “lacking energy” and subsequently abandoned by the market. Even if this mini-bull run ultimately fails to escalate, future potential catalysts (such as liquidity rebound) could still ignite the next leg. Under these circumstances, whales and exchanges should use every upward cycle to cultivate market confidence and reinforce wealth consensus: by continuously injecting liquidity and generating active trades before corrections hit, they establish a positive perception of “well-capitalized, market-savvy operations.” Conversely, choosing to “stand idle” at critical junctures risks being seen as lacking sustained momentum, making it harder to rally sufficient market force when larger opportunities arise.

For Alpha2.0, the current sentiment recovery brings both opportunity and hidden risks. Looking at real on-chain traffic, BSC’s activity is almost negligible—clearly not the ideal outcome Binance and its ecosystem hope for. The current buzz and noise around Alpha2.0 rely more on coordinated maneuvers by market makers and project teams than on spontaneous global retail participation. This artificially inflated volume could collapse sharply once external stimuli fade. How many more mini- or full-scale bull runs will it take to gradually cultivate a truly organic, self-reinforcing liquidity ecosystem? This remains the core variable we must closely monitor in Alpha2.0’s future development.

About Movemaker: Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, dedicated to advancing the construction and growth of the Aptos Chinese-speaking ecosystem. As Aptos’ official representative in the Chinese-speaking region, Movemaker strives to connect developers, users, capital, and various ecosystem partners to build a diverse, open, and thriving Aptos ecosystem.

Disclaimer: This article/blog is for informational purposes only and reflects the author’s personal views, not necessarily those of Movemaker. It does not constitute: (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, involves high risk, with significant price volatility and the potential for total loss. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific questions, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling such data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News