Virtuals leads, CreatorBid lurks—who will dominate the AI Agent赛道?

TechFlow Selected TechFlow Selected

Virtuals leads, CreatorBid lurks—who will dominate the AI Agent赛道?

Speculative interest may shift from individual Agent tokens to the core infrastructure building open AI systems.

Author: 0xJeff

Translation: zhouzhou, BlockBeats

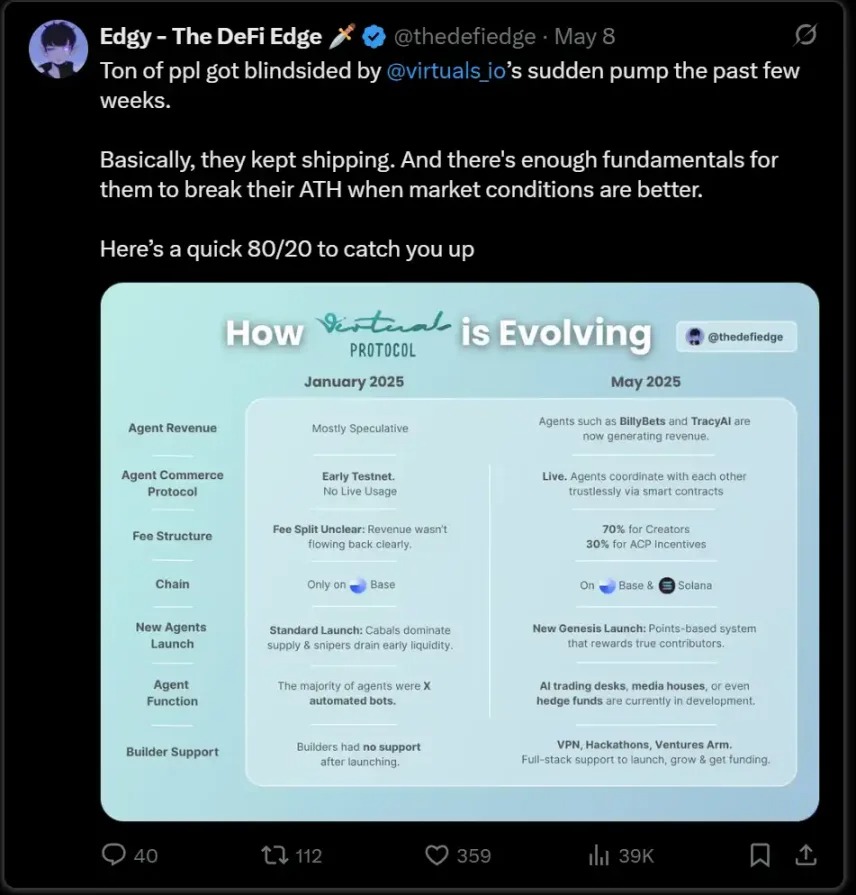

Editor's Note: This article evaluates multiple crypto AI projects on ecosystem development, product iteration, community distribution, and token value, concluding that Virtuals leads in speed and sustained momentum, while CreatorBid—though slower in execution—has a clear vision focused on the Bittensor agent ecosystem and holds promising long-term potential. The AI agent sector remains in its early stages overall, with future focus likely shifting toward infrastructure and real-world consumer applications.

The following is the original content (slightly edited for readability):

About 7 months have passed since the AI Agent boom began. This wave started with the emergence of @truth_terminal ➙ @pmarca investing in it ➙ someone launching a token for it ➙ it promoting that token ➙ @virtuals_io launching an agent tokenization platform ➙ the rise of AIDOL and conversational agents ➙ the alpha agent phase, with @aixbt_Agent rising to prominence ➙ the framework phase, with @elizaOS (formerly ai16z) launching an open AI developer movement ➙ small-scale AI x gaming experiments (but none survived) ➙ the DeFAI phase (still strong in vision, but lacking execution).

This roughly summarizes the key phases of the AI Agent landscape so far.

Out of these phases emerged a few credible AI agent teams—still active today, consistently releasing new products and features (though largely sustained by early trading fee revenues).

More importantly, several ecosystems remain strong, offering developer support, helping ideas go from zero to product, and driving AI products and tokens from concept to successful launch.

The Role of Ecosystem Leaders

These ecosystem leaders provide invaluable support:

-

Strong distribution networks that bring attention to your token and project;

-

Integration of your product/service with the core ecosystem (i.e., access to potential users);

-

Guidance and incubation from 0 to 1 to 10;

-

Funding and investment backing for your idea.

In the Web3 AI space, ecosystem leaders remain central pillars. Community is a core component of crypto—community determines whether a token can achieve network effects (unlike traditional SaaS models that rely on subscriptions, Web3 projects depend on tokens to incentivize participation, accelerate growth, and drive user adoption).

Over the past 7 months, we've seen various ecosystem leaders rise and fall. But those still active stand out in the following ways:

-

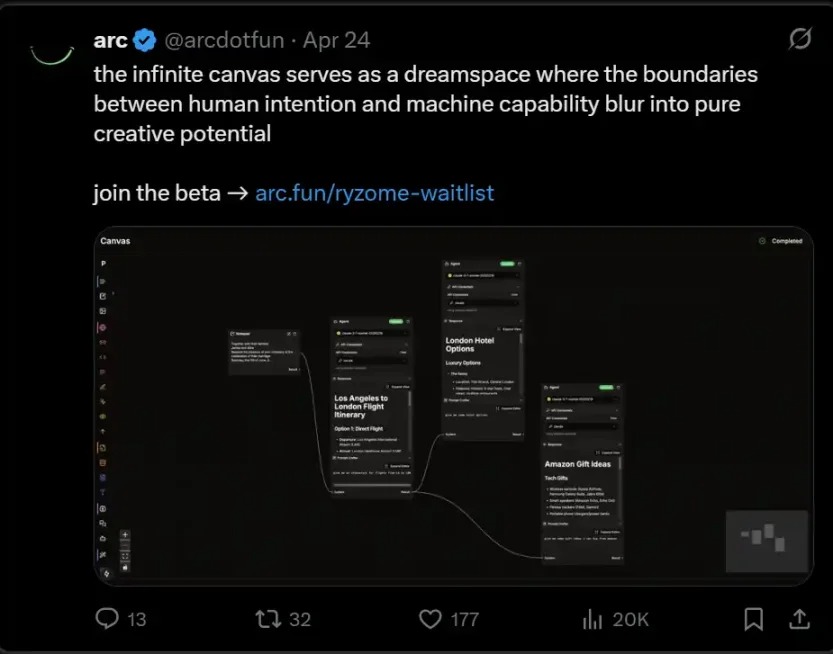

Positioning as an app store for AI Agents, where developers/users can access Web2 and Web3 services to enhance or automate workflows—@arcdotfun

-

Building an economy where autonomous agents (and humans) transact with each other—@virtuals_io

-

Leading the largest open AI movement in Web3—@elizaOS

-

Integrating Bittensor subnet intelligence with AI Agent workflows to attract more participants into the @opentensor (Bittensor) ecosystem—@creatorbid

This article will objectively analyze how each ecosystem performs—highlighting who’s leading, who’s lagging, etc.

We’ll assess them across the following dimensions:

-

Product & Distribution

-

AI / Intelligence Level

-

Pace of Development

-

Token Value Capture

Without further delay, let’s begin with the first aspect:

Product & Distribution

In Web3, the token itself is often treated as a product. However, in this article, we define “product” as a good or service that meets real user needs.

In the Web3 AI space, most products revolve around “financialization”—tools and intelligent services designed to help people make money—such as alpha terminals, conversational agents expressing sentiment about projects, trading or prediction agents aiming to outperform the market, etc.

A product’s success heavily depends on “distribution.” Typically, this space is 90% distribution + 10% technical architecture. Few insiders care about which model your AI Agent uses; what matters more is whether its output is consistent and whether the insights and alpha it shares are genuinely useful.

Virtuals

@virtuals_io offers the most diverse product suite within the ecosystem—including alpha signals, terminals, on-chain/off-chain data, agent workflows for audits and security analysis, bots, investment DAOs, trading agents, prediction agents, sports analytics, music, DeFi, and more.

Virtuals excels at storytelling and narrative-building, and is arguably the most responsive team when it comes to community feedback and rapid iteration (you could call them the “strongest survivors”).

However, despite the wide range of offerings, only a few teams are building products that deliver real utility beyond entertainment.

Virtuals was the first to pioneer an AI Agent launch platform, enabling anyone to publish conversational agents tied to a token. This mechanism is a double-edged sword—Virtuals initially captured value through launch fees, but because anyone can publish, it attracted many short-term speculators and value extractors who may repeatedly launch tokens or even rug after listing.

(That said, Virtuals is developing ACP, and we hope to see some flagship agent products and services soon.)

Arc

Players like @arcdotfun have taken a completely different path.

Instead of building a “launchpad” encouraging mass project listings, they’re focusing on creating the AI Agent marketplace “Ryzome,” partnering with a select number of high-quality projects to integrate their products and services onto Arc’s MCP infrastructure.

In addition, they’re launching “Ryzome Canvas,” a no-code/node-based agent builder allowing users to plug into general MCP server resources and services/use cases provided by Arc partners to customize agent workflows (similar to Rayon Labs’ Squad tool).

Users can sell these workflows or tokenize them and launch via Arc’s Forge (its launch platform).

(In short, Arc follows a “polish the product first, then distribute” strategy. Ryzome will open for testing soon.)

Eliza

Among all frameworks, @elizaOS stands out as the most flexible and versatile.

Eliza supports various integrations, such as secure execution via TEE, trading, real-time on-chain data analysis, smart contract execution, wallet management, and more.

The framework supports multi-agent systems, enabling developers to create groups of agents with distinct personalities, goals, and KPIs that collaborate on tasks (e.g., trading, social media automation, business process automation).

As a result, Eliza’s user base continues to grow, now boasting around 16,000 GitHub stars and 5,100 forks.

However, despite high framework adoption, Eliza initially lacked distribution channels. Unlike Virtuals, Eliza failed to capture early momentum and traffic during the initial AI Agent surge at the end of last year.

This changed a few weeks ago—Eliza launched @autodotfun, a SOL-denominated launch platform (with $ai16z liquidity pools coming next), pledging to use part of transaction fees to repurchase $ai16z tokens.

So far, however, autodotfun hasn’t demonstrated clear differentiation among similar launch platforms, nor has any truly interesting or unique project launched, which is somewhat disappointing.

(Eliza’s greatest strength and weakness both lie in @shawmakesmagic: without Shaw’s relentless effort, this framework wouldn’t exist; yet he frequently burns out and makes questionable decisions that trigger market FUD, something that’s happened multiple times.)

AI / Intelligence Capability

As noted earlier, markets usually prioritize “product” and “distribution” over underlying architecture or AI models.

But if you possess a powerful and continuously evolving intelligence system, you can still build more user-centric products.

For example: a model trained specifically on on-chain data will outperform general-purpose models in analyzing blockchain information; a model trained on sports data, crowd wisdom, and real-time inputs will have an edge in predicting game outcomes.

Bittensor remains the largest ecosystem with the most diverse intelligent models. The only team truly committed to integrating Bittensor subnet intelligence with AI Agent/agentic workflows is @CreatorBid.

This team underperforms in distribution (slower agent rollouts, slower iteration pace), but is laser-focused on supporting Bittensor. (They haven't announced it yet, but may launch a subnet called SN98 Creator to further incentivize building agentic workflows on Creatorbid.)

Development Speed / User Growth / Project Launch Cadence

In Web3, if you're building long-term products, you must consider: how to keep the community engaged in the short-to-medium term.

If you can’t “entertain” the community, token prices tend to decline over time as holders lose interest. In contrast, the market favors projects that consistently generate buzz and build transparently.

Virtuals leads in this area—developing publicly, quickly fixing issues, actively listening to community feedback, regularly launching new features or narratives to sustain user interest, while also building their ACP. They also frequently host Genesis Launches for new users.

Eliza ranks second in distribution, thanks to its developer network and partnerships with multiple L1/L2 chains. Eliza is also the preferred framework for deploying agents on non-Solana chains. autodotfun further eases project launches.

Arc’s Ryzome and Ryzome Canvas are underway—once launched, they could reignite ecosystem momentum and potentially drive more Forge project releases.

On the Creatorbid front, top agents recently rolled out new features (though valuation ranges haven’t shifted much). CB may be preparing to launch Bittensor subnet-powered agents and its own subnet. The pace remains slow—hopefully it accelerates soon.

Token Value Capture

$VIRTUAL currently captures the most value—it’s the primary currency for LP creation in the Virtuals ecosystem and required for launching agents on Virtuals. Recent Genesis Launches introduced Virgen Points, which flow to $VIRTUAL and other ecosystem tokens, further enhancing $VIRTUAL’s holding value.

$ai16z may rank second. autodotfun sees daily trading volume of $2M–$3M (still far below Virtuals and other platforms), with part of fees used to repurchase $ai16z. But Eliza needs to launch high-quality projects soon—especially those with multi-million dollar valuations—or attention will remain focused on Virtuals.

$arc captures value through LP trading fees and future revenue streams from developers on Ryzome. However, this path is still early and will take time to materialize.

$BID has the most unique tokenomics—low circulating supply allows token releases to incentivize platform activity. But so far, these releases haven’t been well utilized, and trading volume remains low ($100K–$500K daily).

Summary

Each of the above projects has its strengths, but in the short-to-medium term, “distribution capability” + “ability to attract speculative capital” (i.e., trading volume) are the most critical moats.

The key to system sustainability is whether you can continuously generate hype and get players to keep betting in your “casino.” On this front, Virtuals is currently the strongest performer.

Whether they can sustain this momentum long-term and convert it into real product strength remains to be seen.

Although @CreatorBid’s execution still needs improvement, I personally believe in them the most—their vision aligns with mine: bringing high-quality AI to the masses and truly commercializing agentic workflows.

Imagine: a continuously evolving trading signal system that consistently beats the market, transformed into a fully autonomous trading agent—that’s the vision behind SN8 Proprietary Trading Network.

We’re still in the early market stage, and it’s unclear who will ultimately win. More complex use cases are being handled by large teams outside the current ecosystem, such as:

-

@vana—focused on data ownership

-

@NousResearch—reinforcement learning

-

@TheoriqAI—building liquidity provision systems

-

@gizatechxyz—specializing in financial/stablecoin-related agents

How the leading AI Agent ecosystems position themselves going forward will determine whether they can capture the next cycle’s growth. We may see more DeAI infrastructure emerge, deeper decentralization of agent systems, and entrepreneurial opportunities across different layers of the tech stack.

Ultimately, speculative hype may shift from individual agent tokens to core infrastructure powering open AI systems. Perhaps we’ll finally see AI products that serve real consumers and generate genuine revenue—not just short-term speculative bubbles driven purely by “degens flipping tokens.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News