Stay true to the Web 3.0 dream, don't become Fintech 2.0

TechFlow Selected TechFlow Selected

Stay true to the Web 3.0 dream, don't become Fintech 2.0

The path cannot become increasingly narrow.

Author: Zuoye

Crypto is doing payments; Fintech is building stablecoins.

Over the past year, the crypto industry has been rushing headlong into partnerships with traditional financial firms, Web 2.0 giants, and global politicians. Trump's meme coin marks the end of crypto liquidity—but the reconciliation has only just begun.

The advisor from Pakistan, Bhutan’s crypto mining farms, and Middle Eastern mega-funding rounds have all become the final straws crushing retail investors. Let them all crawl into wishing wells and turn into turtles—maybe they'll earn a bit of misplaced affection.

The Great Crypto Stagnation

Humans are strange creatures. When things were traditional, they craved freedom; now that everything is free, they crave tradition.

The only lesson humanity ever learns is that it learns no lessons.

I still remember when the Bitcoin Spot ETF was approved—everyone thought Bitcoin would change the world. Now, Bitcoin is widely seen as merely a proxy for M2. It neither hedges inflation nor acts as fuel for bull markets after being drained by ETFs. A one-track mind has turned into a dead-end trap.

The only lesson humanity ever learns is that it learns no lessons +1.

When Trump descended upon his loyal crypto followers clutching his meme coin, the post-pump silence was inevitable. PumpFun’s self-rescue, Binance Wallet’s offensive, or whether Boop is actually Binance’s CXO—all have become farces, the kind that don’t even make money.

Caption: Current crypto landscape, Image source: @zuoyeweb3

There's nothing new under the sun—crypto is in great stagnation.

First, Ethereum, once hailed as a civilizational-level innovation, couldn't withstand the drop from 4000 to 1500 and now seeks revival through Risc-V in the L1 race. If EVM can be reinvented, why not go all the way and switch PoS back to PoW? Can Ethereum really save itself by doubling down on L1 and adding Risc-V?

Being directed by your enemy is foolish—but this time, Solana is the director. Solana doubled down on L1 both before and after FTX.

In essence, SVM L2s or expansion layers are bloodsuckers on Solana—like remoras on a whale, not intentionally created but naturally attached. Meanwhile, ETH L2s are barnacles on Ethereum—yet ones that Ethereum itself invited.

The market paradigm we once knew is gone forever. ETH is not Money; Stablecoin is Money.

Second, useless information is infecting the entire market. KOL Summer will quickly become KOL Agency Summer, followed by CEX Summer. Don’t believe it? Just look at the spectacle of the Dubai Music Festival—projects, KOLs, and exchanges, all ultimately transaction-driven. Exchanges are the natural endpoint of transactions—a deadlock with no solution.

This isn’t a critique of KOLs, but recognition of market dynamics. From early WeChat group AMAs and community platforms like Bibao, to the media wars of the past, the peak of KOL popularity has always been their endpoint—the moment trust and influence are cashed out into transactions.

Yet this cycle shows new divergences. Though all noise, there are two main types:

1. Trash pump calls, targeting the下沉 market

2. Old money endorsements, asserting presence

Third, the collapse and persistence of VCs. Leveraging USD capital, Silicon Valley, Middle Eastern, and European VCs are positioning for the next phase. In contrast, isolated Chinese VCs are relentlessly pressured by LPs and ROI demands. Innovation is no longer the goal—they’re rapidly turning into market makers. Since everything leads to trading anyway, why not cut steps and do it themselves?

Real innovation used to emerge from Huaqing Jiayuan; now it’s Shenzhen Science Park. Chinese founders still need funding from Silicon Valley and Wall Street, but projects truly meeting next-phase market needs won’t be recognized under current investment frameworks.

Crypto doesn’t need financial advisors; Memes cannot be shorted.

The reason? Transaction paths are too short. Exchanges are watching closely, eyeing every flow of traffic. They’d rather waste resources casting wide nets than miss a trend. The sole beneficiaries are ex-big-tech employees fleeing into CEXs. It’s not just bytes that jump—it’s also the troughs where oxen and horses feed.

In 2018, the average tenure at ByteDance was just four months. By 2024, it had risen to seven or eight months. Still, more people keep getting pushed into society. In crypto’s big players, only top-tier CEXs matter.

Today’s hot take: VC beneficiaries are elite school grads; CEX beneficiaries are big-tech rejects. They bring more than expertise and impressive resumes—they bring deeper operational standards and, inevitably, declining capital efficiency due to increased intermediary costs.

The era of raw energy, explosive growth, and single-minded profit-seeking in crypto is gone, never to return.

Ongoing institutionalization has become crypto’s tightening curse. Crypto looks more like the internet; the internet looks more like XXX.

Invention Is the Mother of Necessity

I’m not spreading FUD about crypto. More accurately, I feel “confident in the industry, worried about my own future.” This is no longer a niche space full of get-rich-quick opportunities. Industry practitioners are being replaced by talent from the internet and finance sectors. Crypto OGs and grassroots promoters either go to jail, become subordinates, or—after jail—become subordinates to big shots. Baby, tonight we fight tigers.

Too much complaining harms your gut. We shouldn’t keep debating VCs and exchanges. Either rebuild from scratch like Ethereum did, or explore new ecosystems. In every crisis in crypto history, new asset issuance models emerged—ERC-20 powered DeFi, NFTs powered BAYC. Now we’ve reached the stablecoin phase.

Note: Last cycle’s core on-chain activity revolved around Ethereum and lending—“Lego-style” capital efficiency amplification. This cycle’s Ethereum and staking model haven’t repeated the miracle. In our timeline, Tencent didn’t invent WeChat—Xiaomi’s Mili rose instead.

Yield-bearing stablecoins (YBS) have become the new invention. They create new demand—not because existing stablecoin demand is unmet (USDT is doing fine)—but because YBS is now possible. That’s why Ethena was invented. Think of it as the end of dollar seigniorage, heralding a supercycle of stablecoins.

YBS will become a new form of asset issuance—an expectation. Borrowing psychohistory, I offer three predictions pointing to different futures:

-

YBS becomes the new asset issuance method, and Ethereum successfully reboots its chip. ETH replaces BTC as crypto’s new engine; Restaked ETH becomes real Money;

-

YBS becomes the new asset issuance method, but Ethereum fades into silence. YBS gets absorbed by US Treasury and other dollar assets. Fintech 2.0 becomes real; Web 3.0 remains a pipe dream;

-

YBS fails to become a new asset issuance method, and Ethereum collapses silently. Then blockchain becomes “chain without coin.” Fintech 1.0 was PayPal replacing banks; Stripe digitizing payment processing. Then coinless blockchain is at best Fintech 1.5.

In summary: Fintech 2.0 is financial blockchain; Fintech 1.5 is coinless blockchain technology.

Stablecoins are becoming a new asset issuance model—an outcome no VC research report ever predicted, not even Ethena itself. If we believe the market is inherently optimal, the biggest problem for VCs and exchanges isn’t learning from Vitalik’s obsession with tech narratives—it’s failing to respect market laws.

In today’s crypto landscape, exchanges, stablecoins, and public chains effectively form a triopoly. Binance, USDT, and Ethereum are the main cast; everyone else are suppliers and distributors orbiting them. Exchanges and public chains remain relatively stable. The current battlefield centers on stablecoins—not only USDC and BlackRock are entering, but on-chain developments point to YBS. This matters globally—responsibility cannot be shirked.

P.S.: Exchange stability means Binance’s dominance; public chain stability means Ethereum’s revival. Solana’s takeover is still underway.

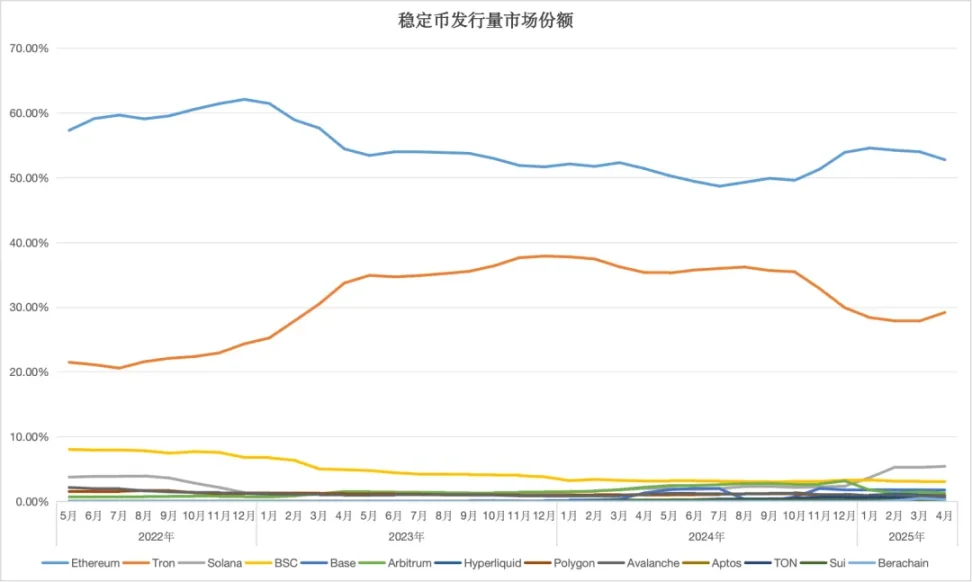

Caption: Stablecoin issuance volume, Image source: @zuoyeweb3

In today’s market structure, Ethereum and Tron dominate. Yet Solana hasn’t given up chasing. Especially since Ethereum hasn’t been fully defeated, we often hear claims that Solana DEX trading volume surpasses Ethereum’s ecosystem. But in terms of actual asset issuance volume, ETH + ERC-20 USDT still firmly lead.

This is the primary reason I believe Ethereum’s fundamentals remain sound. Market expectations price ETH at $10,000, while SOL is expected at $1,000—entirely different baselines.

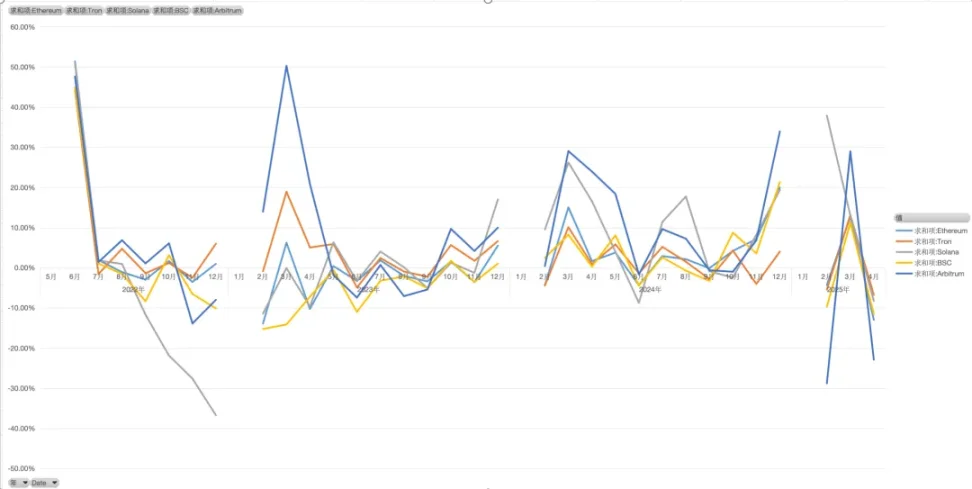

Caption: Stablecoin growth rate, Image source: @zuoyeweb3

Comparing growth rates across chains, we see near-synchronized movement. Except for Solana’s near-death experience in 2022, all other chains moved in step with Ethereum. Thus, in terms of correlation, no chain’s stablecoin has achieved independent momentum—it’s still Ethereum’s spillover.

Hence, this underscores the importance of pairing Ethereum with stablecoins. The significance of YBS lies in anchor-switching. With a $230 billion stablecoin market cap, USDe and other YBS variants remain mere “others.”

Once again: YBS must become the new asset issuance method to transmit ETH’s asset qualities to the monetary layer. Otherwise, RWA’s spring will be crypto’s winter.

Conclusion

Ethereum has only technical narratives; users embrace stablecoins.

We hope users embrace YBS, not USDT. This is the current reality—and where we diverge from the market.

Chasing niche appeal is now mainstream—look at贯穿 taillights and LABUBU’s global spread. Mention blockchain payments briefly—payments aren’t the issue. But until YBS backed by crypto-native assets goes mainstream, pushing blockchain payments is “result before cause.” Payments should be the outcome of YBS adoption.

Crypto must not become Fintech 2.0. The path must not narrow further.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News