WOO X Research: On-chain hype revival: Comparing three LaunchPads and their popular tokens

TechFlow Selected TechFlow Selected

WOO X Research: On-chain hype revival: Comparing three LaunchPads and their popular tokens

LaunchPad market buzzing with activity, driving market热度.

Author: WOO X Research

Launchpad is a decentralized platform, typically operated by blockchain projects or decentralized exchanges (DEX), used to help emerging blockchain projects issue tokens to the public via IDO. These platforms provide fundraising channels for project teams while offering investors early access to high-potential projects.

The Launchpad discussed in this article primarily refers to meme launch platforms. Compared to traditional Launchpads, these platforms feature lower market cap tokens upon listing, nearly 100% circulating supply, mostly meme-based tokens, low barriers for users to create tokens, and higher potential wealth effects.

Functions:

1. Project Fundraising: Provides new blockchain projects with funding channels by selling tokens to the community to raise capital for development and marketing.

2. Token Distribution: Helps project teams distribute tokens to early investors, usually at a low initial market cap to attract participation.

3. Traffic Acquisition: Popular events or IPs are currently key methods for Launchpad platforms to gain visibility and attract significant attention.

4. Wealth Effect: Tokens on-chain start with low market caps; if they gain market recognition, FOMO buying or future listing on major CEXs could bring substantial profits to early buyers, leading to rapid community spread.

Since Pump Fun achieved massive success last year, the LaunchPad sector has become a top entrepreneurial choice for many development teams and even public chains—though most attempts have failed to gain traction. Currently, market consensus around meme coins remains concentrated on Pump Fun.

Besides Pump Fun, BONK, a veteran Solana meme coin, recently launched its own LaunchPad—Letsbonk.fun. Several of its meme coins have reached market caps exceeding $10 million, marking a strong start.

Virtuals Protocol, the leading AI Agent LaunchPad, recently introduced new participation methods and campaigns. Regardless of its token performance, the parent token $VIRTUAL doubled in price within a week, suggesting the new initiatives are having some effect.

So while Pump Fun, LetsBonk, and Virtuals Protocol are all LaunchPads, how do they differ functionally? And what tokens on these three platforms deserve attention recently? Let WOO X Research break it down.

Pump Fun

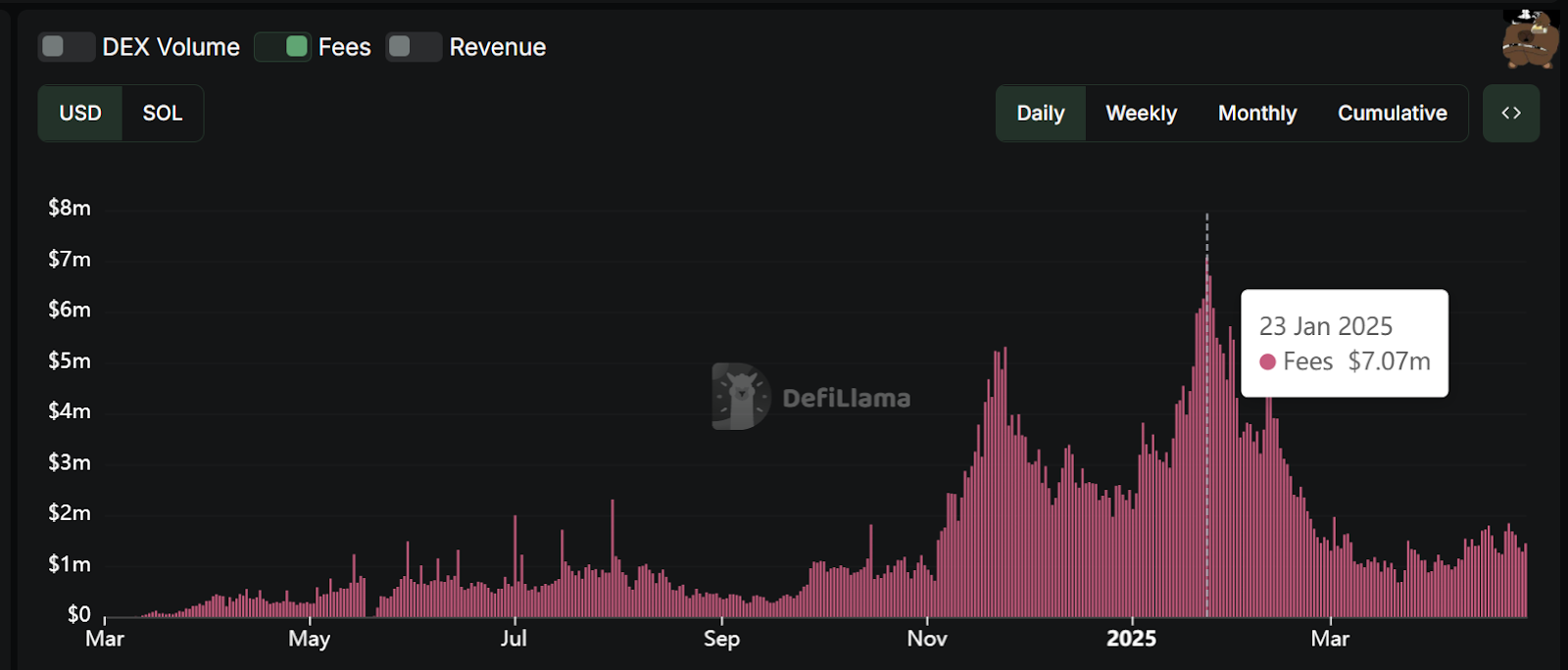

You're likely already familiar with Pump Fun—the meme frenzy of late 2024 began here. At its peak, it earned over $7 million per day. Even now, amid cooling meme enthusiasm, it still averages around $1.5 million daily. Since launch, it has generated over $600 million in revenue, making it a true money printer in the crypto space.

All of Pump Fun's revenue is denominated in SOL. Native Solana projects commonly stake their earned SOL or run their own nodes to avoid being perceived as "exit scams" and to align more closely with the Solana Foundation. Pump Fun does the opposite—constantly dumping its SOL holdings into USDC.

Since 2025, they've sold $317 million worth of SOL, a staggering amount.

This approach not only looks bad but, combined with past controversies like live streams and lawsuits, means that despite its profitability, Pump Fun is not favored by the Solana Foundation.

In terms of meme coins, Pump Fun has become the go-to launch platform—the main traffic gateway rather than a niche player. As such, it hosts all kinds of themes: animals, puns, news events, AI, etc. Almost any concept can become a meme coin here. Therefore, the platform doesn't emphasize any specific characteristics for its tokens, and Pump Fun remains the top choice for token launches.

Source: DefiLlama

LetsBonk

Compared to Pump Fun, LetsBonk is clearly more politically orthodox. The main reason is that BONK is Solana's most iconic meme coin—the original meme coin with proven wealth effects—and a project deeply rooted in the Solana ecosystem for over four years. Beyond recent endorsements from Toly, BONK has long been visible at various Solana offline events. Its relationship with the ecosystem is far more favorable than Pump Fun’s constant token dumping.

In terms of platform mechanics, LetsBonk also appears more altruistic than Pump Fun. It charges a 1% transaction fee, which goes toward:

-

Platform operations and growth

-

Rewards for BONKsol validators to support DeFi growth and network security

-

BONK buybacks and burns (a dashboard for this is即将推出)

Additionally, through its partnership with Raydium's LaunchLab, LetsBonk demonstrates genuine goodwill toward the Solana ecosystem.

The highest market cap token on Letsbonk is Hosico, reaching $38 million. It's inspired by a Scottish Straight-eared cat named "Hosico," born on August 4, 2014. This golden shorthair cat, known for its round face, big eyes, and adorable look, has nearly 2 million followers on social media (like Instagram) and is a globally recognized internet celebrity cat.

Other notable tokens include the namesake Letsbonk and Grassiot.

Letsbonk was initially seen as the official platform token. On its first day, it reached a market cap of $30 million. However, due to an influx of new tokens splitting user attention, it gradually declined and now sits at just $4 million.

Grassiot surged after BONK founder TOM bought, burned, and then re-bought the token—essentially gaining value through founder attention. Later, TOM clarified he purchased it solely as support, with no insider knowledge or developer involvement, and publicly disclosed he also holds Hosico and Letsbonk, along with the amounts. As a result, Grassiot’s market cap dropped from a high of $13 million to about $4.3 million at the time of writing.

Virtuals Protocol

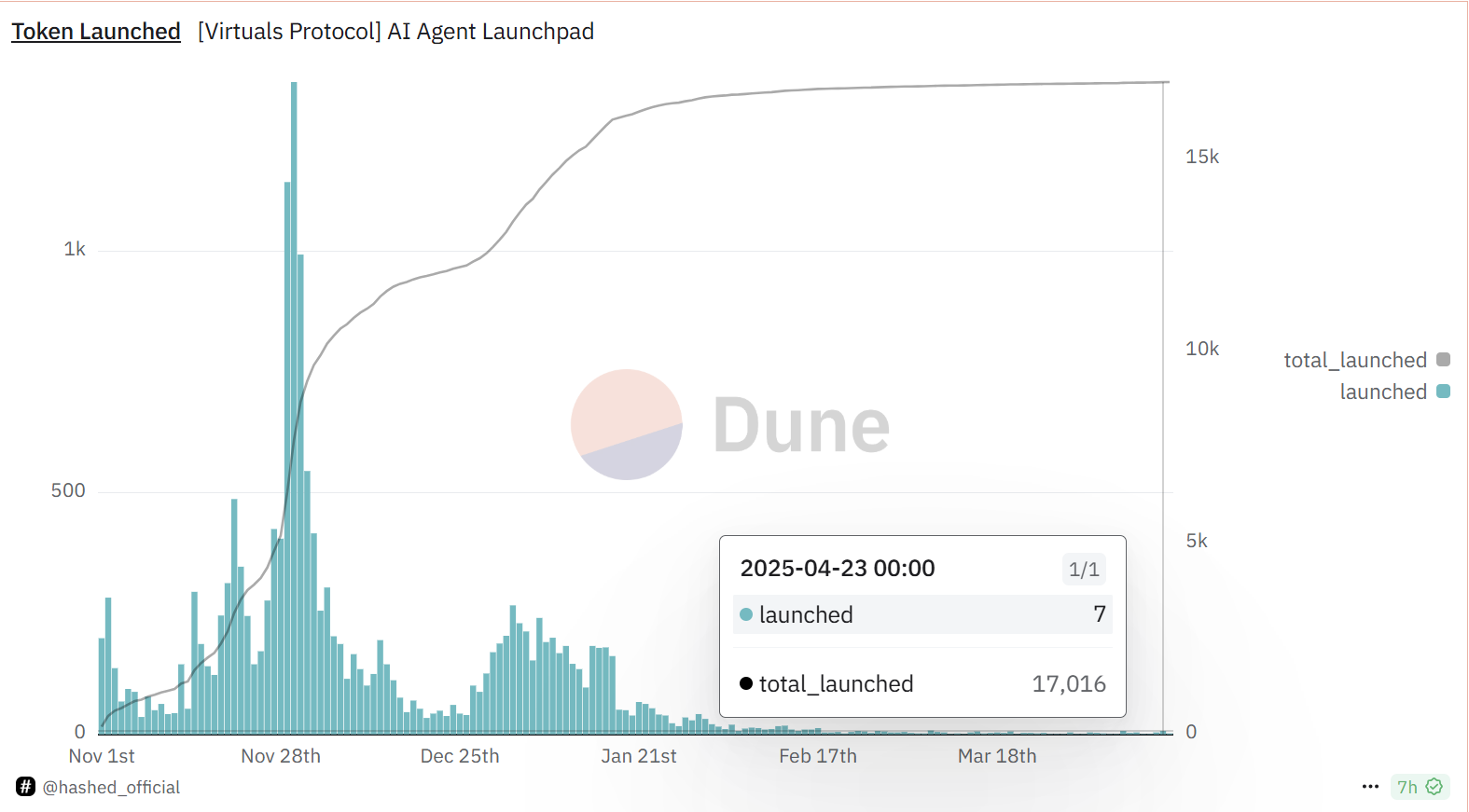

An AI Agent LaunchPad originally built on Base, later expanded to Solana. The business model is straightforward: users must spend VIRTUAL to create and trade tokens on the platform. However, with the AI hype fading, fewer than 10 tokens are successfully launched per day now—down sharply from over 100 previously.

Source: Dune

Recent Major Updates

Virgen Points: This system is a key mechanism by which Virtuals Protocol incentivizes user participation, granting access to pre-TGE token allocations—especially for "giga AI Agent launches." These points directly affect users' eligibility and rights on the launch platform.

AI agents launch with a fixed fully diluted valuation of 336,000 $VIRTUAL (approx. $232,580 USD). All Virgens receive equal early access through Virgen Points commitments. Allocation is determined after a 24-hour points bidding period. If the funding goal isn’t met, no tokens are minted, and all $VIRTUAL and points are fully refunded.

Earning Methods:

-

Trenchor Points: Earned by trading Sentient and Prototype Agent tokens.

-

$VIRTUAL Points: Earned by holding $VIRTUAL tokens.

-

Yap for Points: Earn points by creating content related to Virtuals Protocol (e.g., X posts). According to an X post on April 23, 2025, the campaign encourages users to "Yap" (participate in discussion or content creation), with submission details available via a provided link. The post mentions "Stronger signal. Higher rewards," implying higher-impact content earns more points.

-

$VADER Stakers: Earn by staking $VADER tokens.

How to Participate?

-

Staking Requirements:

-

Commit Virgen Points to participate, eligible for up to 0.5% of total token supply allocation.

-

Final allocation depends on your committed points relative to total committed points.

-

Over-committing increases chances of receiving maximum allocation.

-

If Genesis Launch succeeds, only points used for allocation are burned; remaining points are refunded.

-

Invest $VIRTUAL Tokens:

-

Invest up to 566 $VIRTUAL to secure maximum allocation.

-

If participation exceeds expectations, allocations will be diluted, and excess $VIRTUAL returned.

-

Claim Tokens:

-

After a successful Genesis Launch, claim your purchased tokens on the Agent page.

-

If the launch fails, all points and $VIRTUAL are fully refunded.

In summary, Virtuals Protocol is building a smaller, more loyal LaunchPad—similar in spirit to Binance Wallet’s recent points-based IEO program—aiming to boost user engagement across its ecosystem. If you believe Virtual’s system will succeed going forward, there are three ways to get involved:

-

Buy $VIRTUAL tokens directly

-

Buy $VADER tokens directly

-

Participate in activities

The first two are straightforward, and both $VIRTUAL and $VADER have shown remarkable gains recently, making them the biggest beneficiaries of the campaign. To participate in activities, you must first accumulate points—this can be done by holding $VIRTUAL in your wallet. If you're concerned about potential downside risk in $VIRTUAL, you can short an equivalent amount on a centralized exchange. This way, you protect your activity gains from price drops. The design ensures you won't lose money—only potentially earn less than expected. The downside is that opening a short requires additional capital, significantly reducing overall capital efficiency.

Conclusion

Overall, Pump Fun, LetsBonk, and Virtuals Protocol each have strengths and concerns: Pump Fun dominates as a traffic gateway through aggressive selling and high-profit models, yet faces criticism for constant "cashing out" and negative incidents; LetsBonk wins goodwill through deep community integration and low-fee revenue sharing, but struggles with fragmented attention across its platform and sub-tokens, leaving long-term engagement uncertain; Virtuals Protocol introduces innovative point mechanisms and AI Agent access to carve out a new niche, though it hasn’t yet demonstrated consistent launch volume—whether user enthusiasm lasts remains to be seen.

Looking ahead, the next wave of momentum in the LaunchPad space hinges on "value realization" and "community resilience": Can platforms balance short-term buzz with long-term ecosystem building through smart design? Can projects deliver real utility beyond flashy narratives? When speculative capital retreats, sustainability will become the key metric. For researchers and participants alike, beyond tracking platform traffic and token volatility, it's crucial to deeply evaluate each platform’s core risks and upgrade potential—to identify the truly viable long-term bets amid the competition.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News