The On-Chain Revolution of Traditional Finance: How BlackRock Is Reshaping the Future of $150 Billion in Assets?

TechFlow Selected TechFlow Selected

The On-Chain Revolution of Traditional Finance: How BlackRock Is Reshaping the Future of $150 Billion in Assets?

Public blockchains like Solana and Ethereum are gearing up to seize the benefits of this transformation.

By Oliver, Mars Finance

Yesterday, global asset management giant BlackRock dropped a bombshell: it plans to tokenize up to $150 billion of its money market fund through "DLT Shares" (Distributed Ledger Technology shares), using blockchain technology to record ownership. This announcement sent ripples across the financial world, stirring waves of convergence between traditional finance (TradFi) and Web3. With $11.6 trillion in assets under management, CEO Larry Fink once boldly declared, "Tokenization is the future of finance." Now, this Wall Street titan is turning words into action, bringing massive traditional financial assets onto the blockchain stage. Public blockchains like Solana and Ethereum are gearing up to capture the benefits of this transformation. But what kind of revolution is this? And how will it reshape the future of $150 billion in assets?

The Pain Points of Traditional Finance: Why Blockchain?

Money market funds are the bedrock of traditional finance—renowned for low risk and high liquidity. Yet their operational mechanics resemble an old steam engine: reliable, but inefficient. Redemptions and transfers must pass through multiple intermediaries, transactions are limited to business days, and record-keeping systems are cumbersome and lack transparency. Want to cash out quickly? Sorry—please wait for T+1 settlement. Want real-time portfolio visibility? That requires lengthy reconciliation processes.

Blockchain technology arrives as the perfect remedy. BlackRock’s DLT Shares leverages distributed ledger technology (DLT) to record fund ownership on-chain, enabling near-instant transaction settlement, 24/7 asset access, and immutable, transparent records. This not only boosts efficiency but also delivers unprecedented convenience to investors. Carlos Domingo, CEO of Securitize, BlackRock’s blockchain partner, stated plainly: “On-chain assets solve inefficiencies in traditional markets, offering 24/7 access to both institutional and retail investors.” Imagine being able to redeem your fund at 2 a.m. via your smartphone, without waiting for banks to open. This is the transformative promise of blockchain for traditional finance.

BlackRock’s Web3 Journey: From BUIDL to DLT Shares

BlackRock is no newcomer to blockchain. As early as 2023, its BUIDL Fund (BlackRock USD Institutional Digital Liquidity Fund) successfully piloted on Ethereum, focusing on tokenized U.S. Treasury assets. By March 2025, BUIDL had grown to $1.7 billion in assets and was on track to surpass $2 billion by early April. Even more notably, the fund has expanded to seven blockchains—including Solana, Polygon, Aptos, Arbitrum, Optimism, and Avalanche—revealing BlackRock’s ambitious multi-chain strategy.

Now, DLT Shares elevates this vision to new heights. Successfully tokenizing a $150 billion money market fund would mark a historic milestone in the fusion of TradFi and Web3. According to Bloomberg ETF analyst Henry Jim, DLT Shares, distributed through BNY Mellon, could pave the way for future digital currencies or on-chain derivatives. This is far more than a technical upgrade—it’s an experiment redefining how assets are traded, held, and made liquid. As one viral post on X put it: “BlackRock isn’t just testing blockchain—they’re rewriting the rules of the game!”

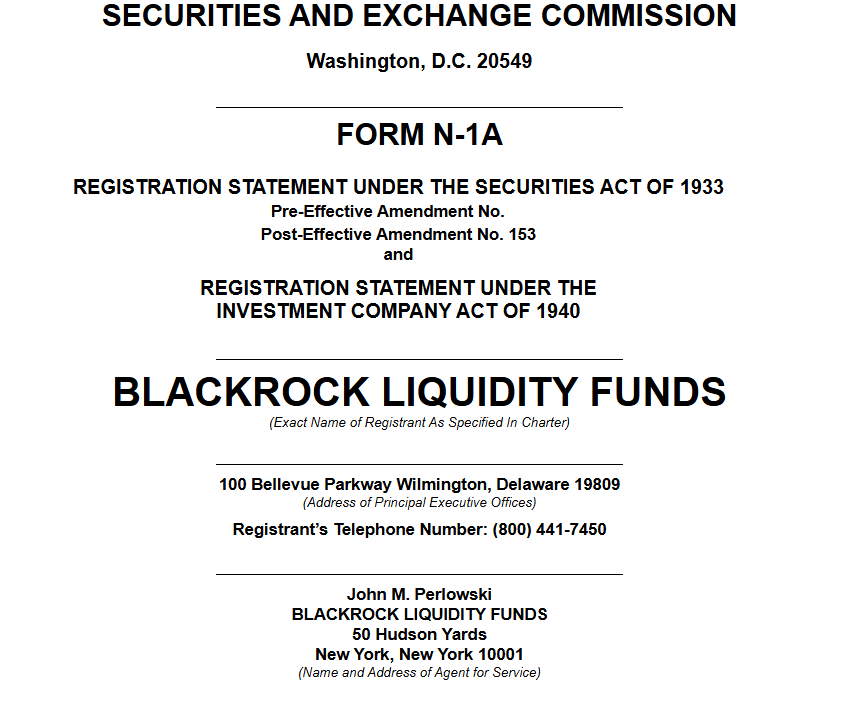

BlackRock’s filing for “DLT Shares” (Distributed Ledger Technology shares) aims to digitally transform its $150 billion money market fund by leveraging blockchain to record ownership via distributed ledger technology (DLT). This move signifies a deep integration between traditional finance and blockchain, revealing BlackRock’s strategic positioning amid the global wave of financial digitization.

1. What Are DLT Shares?

DLT Shares represent a new class of digital shares designed by BlackRock for its money market fund, utilizing blockchain to record holder information and ownership. Key features include:

-

Blockchain Recordation: Using distributed ledger technology, DLT Shares store share ownership on-chain, ensuring transparency, immutability, and real-time traceability.

-

Efficient Transactions: Unlike traditional T+1 settlement, DLT Shares enable near-instant redemption and transfer, with operations potentially available 24/7, breaking free from traditional banking hours.

-

Compliant Distribution: DLT Shares will be sold exclusively through BNY Mellon, emphasizing regulatory compliance and institutional trust. As custodian and distributor, BNY Mellon ensures seamless integration with the traditional financial system.

-

Potential Scalability: As noted by Bloomberg ETF analyst Henry Jim, DLT Shares may lay the groundwork for future digital currency or digital cash applications—suggesting potential beyond mere ownership tracking, possibly extending to on-chain payments or derivatives.

In short, DLT Shares bring traditional money market fund shares on-chain, enhancing efficiency, transparency, and accessibility while preserving traditional financial compliance frameworks.

2. The Significance of DLT Shares

The launch of DLT Shares is not merely a technological innovation for BlackRock—it carries profound implications for both traditional finance and the Web3 ecosystem:

-

Leap in Efficiency and Transparency: Traditional money market funds involve multiple intermediaries, long settlement cycles, and high costs. DLT Shares leverage blockchain’s decentralized nature to streamline processes and achieve instant settlement. As Securitize CEO Carlos Domingo notes, on-chain assets can “solve inefficiencies in traditional markets,” providing round-the-clock access for investors.

-

Digital Transformation of TradFi: With $11.6 trillion in AUM, BlackRock’s decision to bring $150 billion of its fund on-chain signals full-scale adoption of blockchain by traditional finance. This could inspire other asset managers—like Vanguard or State Street—to accelerate their own blockchain initiatives, driving a broader industry shift.

-

Boost to the Web3 Ecosystem: DLT Shares may deploy on public chains like Solana and Ethereum, increasing transaction volumes and demand for native tokens. Community discussions on X indicate Solana is favored for its high throughput (4,000+ TPS) and low fees, while Ethereum leads with 72% of the tokenized Treasuries market share.

-

Forward-Looking for Digital Currency: Henry Jim suggests DLT Shares could be a stepping stone toward central bank digital currencies (CBDCs) or stablecoins. This implies potential integration with USDC or CBDCs, laying the foundation for on-chain payments and financial derivatives.

3. BlackRock’s Strategic Intentions

Behind DLT Shares lies a multi-layered strategic agenda:

-

Seizing First-Mover Advantage in On-Chain Finance: BlackRock has been active in blockchain for years. Its BUIDL fund, launched on Ethereum in 2023, now manages $1.7 billion and expanded to seven blockchains including Solana by March 2025, with expectations to exceed $2 billion by April. DLT Shares further expands this footprint, cementing BlackRock’s leadership in tokenized finance.

-

Attracting Institutional Capital: Through high-compliance blockchain partnerships (e.g., with Securitize) and trusted custodians (BNY Mellon), DLT Shares lowers the barrier for institutional entry. Social media reflects community anticipation of an “institutional capital flood” that could drive up prices of assets like SOL and ETH.

-

Exploring Multi-Chain Ecosystems: BlackRock’s support for Solana, Ethereum, Polygon, and others shows reluctance to bet on a single chain. This diversified approach reduces technical risk and broadens user reach, potentially accelerating interoperability efforts such as cross-chain bridges or unified standards.

-

Paving the Way for Digital Currencies: The on-chain nature of DLT Shares opens doors for integration with digital currencies. BlackRock may use this to test blockchain applications in payments and clearing, building experience for future collaboration with CBDCs or stablecoins. As CNBC reports, CEO Larry Fink believes tokenization will “transform financial ownership,” and DLT Shares embodies that vision.

-

Reducing Operational Costs: Blockchain can cut intermediary layers and proxy voting expenses. At Davos, Fink noted tokenization allows “each owner to directly receive voting notices,” reducing operational burdens for BlackRock, especially in ESG-related controversies.

Solana vs. Ethereum: The On-Chain Battleground for Traditional Finance

BlackRock’s multi-chain strategy places Solana and Ethereum at the heart of this revolution. Their competition reflects not just technical differences, but divergent visions for Web3’s future.

Solana: King of Speed and Low Cost

Solana stands out with exceptional performance. Boasting over 4,000 transactions per second (TPS) and transaction fees as low as a few cents, Solana has become highly attractive to institutions. In March 2025, the expansion of the BUIDL fund to Solana triggered a significant rise in SOL’s price. As CoinDesk reported, Lily Liu, Chair of the Solana Foundation, said: “Solana’s speed, low cost, and vibrant developer community make it an ideal platform for tokenized assets.” More encouragingly, Solana’s DeFi ecosystem surpassed Ethereum in transaction volume in early 2025, signaling its growing strength in on-chain finance.

Community sentiment on X is bullish, with many users believing Solana’s low cost and high efficiency will draw more traditional financial institutions. One post boldly predicted: “If BlackRock launches a Solana ETF, SOL’s price will skyrocket!” Indeed, in April 2025, insiders hinted at possible ETF filings for Solana and XRP, further fueling market excitement.

Ethereum: The Sovereign of Security and Ecosystem

Despite Solana’s momentum, Ethereum remains dominant in tokenized assets. According to RWA.xyz data, the tokenized U.S. Treasury market reached $5 billion in March 2025, with 72% ($3.6 billion) built on Ethereum. Ninety-three percent of BUIDL’s assets remain on Ethereum, underscoring its unmatched security and liquidity. Moreover, Ethereum’s Layer 2 solutions (such as Arbitrum and Optimism) have significantly enhanced scalability, maintaining its lead in high-value asset tokenization.

Still, concerns linger. Some users on X warn that Ethereum’s validator concentration poses centralization risks—an issue particularly sensitive given institutional emphasis on compliance. Nevertheless, Ethereum’s mature ecosystem and vast developer base remain core strengths. As Fortune Crypto observes: “Ethereum’s stability and developer support keep it the top choice for high-value asset tokenization.”

The Future of Competition

The rivalry between Solana and Ethereum resembles a race between speed and stability. Solana’s low cost and high throughput make it appealing for institutional trading, while Ethereum’s ecosystem depth and Layer 2 scaling secure its leadership. If DLT Shares launches on either or both chains, demand for SOL and ETH will inevitably surge. More intriguingly, this competition may drive demand for interoperability—spurring development of cross-chain bridges or unified standards—and inject fresh energy into the Web3 ecosystem.

The RWA Tokenization Wave: Web3’s Golden Age

BlackRock’s DLT Shares is not just a milestone in its own transformation—it’s a catalyst for the broader RWA (Real World Assets) tokenization movement. According to RWA.xyz, the tokenized U.S. Treasury market has grown nearly sixfold in the past year, surging from $800 million to $5 billion. The total RWA market—including real estate, bonds, and more—is approaching $20 billion. BlackRock’s BUIDL fund leads with a 41.1% market share, followed by Franklin Templeton’s OnChain U.S. Government Money Fund (over $671 million in assets) and Fidelity Investments’ Ethereum-based tokenized fund (set to launch in May 2025).

This wave extends far beyond Treasuries. BlackRock’s success could inspire more traditional assets to go on-chain—stocks, real estate, even art. Imagine future investors buying a Manhattan apartment via blockchain, or owning tokenized shares of a Picasso masterpiece. DeFi protocols like Aave and Curve are already exploring integrations with tokenized assets, while stablecoins (like USDC) could serve as bridges for on-chain payments. Discussions on X are heating up—some hail “RWA as Web3’s killer app,” while others worry: “Will the influx of traditional finance erase Web3’s decentralized soul?”

Opportunities and Challenges in 2025

Looking ahead to 2025, BlackRock’s on-chain revolution unlocks boundless possibilities for Web3. Rapid growth in the RWA market will attract more institutions—Goldman Sachs and JPMorgan are already exploring tokenized bonds and credit products. On the policy front, Trump’s March 2025 announcement of a “Strategic Crypto Reserve” program—covering Bitcoin, Ethereum, and Solana—creates a more favorable environment for blockchain adoption, potentially accelerating RWA tokenization.

Yet challenges remain significant:

-

Regulatory Uncertainty: The SEC may intensify scrutiny of on-chain assets, especially those involving permissioned or semi-centralized chains. While BlackRock’s compliant approach with Securitize builds trust, tighter regulation could slow industry progress.

-

Technical Risks: Solana has faced network instability in the past, though it has improved markedly by 2025. Institutions will still need to verify its reliability. Ethereum’s Layer 2 solutions boost performance but add complexity, potentially raising development costs.

-

Community Divisions: Web3 communities are divided on traditional finance’s entry. On X, some welcome BlackRock’s capital and expertise, believing it will elevate on-chain asset values. Others fear institutional compliance demands may push Web3 toward centralization.

Conclusion: Dawn of an On-Chain Future

BlackRock’s $150 billion on-chain initiative is far more than a technical trial—it’s a paradigm shift in finance. By merging the scale of traditional finance with the innovative power of blockchain, it ushers in a new chapter for Web3. Whether through Solana’s speed or Ethereum’s resilience, this revolution will shine bright. The wave of RWA tokenization will fundamentally reshape how we perceive and interact with assets. From Wall Street to the blockchain, BlackRock is leading a journey across two worlds.

In 2025, the on-chain future is arriving faster than ever. Are you ready to get on board?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News