BlackRock 20-year veteran all in on Ethereum, Joseph Chalom joins SharpLink to become the MicroStrategy of Ethereum

TechFlow Selected TechFlow Selected

BlackRock 20-year veteran all in on Ethereum, Joseph Chalom joins SharpLink to become the MicroStrategy of Ethereum

SharpLink spends millions to poach Joseph Chalom, BlackRock's cryptocurrency head, joining the race for the "microStrategy of ETH."

Author: Zen, PANews

Ethereum, as a yield-generating asset, continues to attract institutional capital through mechanisms such as staking and restaking. Recently, Joseph Chalom, who served for two decades as an executive at BlackRock, the world's largest asset management firm, announced he is joining publicly listed Ethereum treasury company SharpLink Gaming (ticker: SBET) as co-CEO, marking a new chapter in his career.

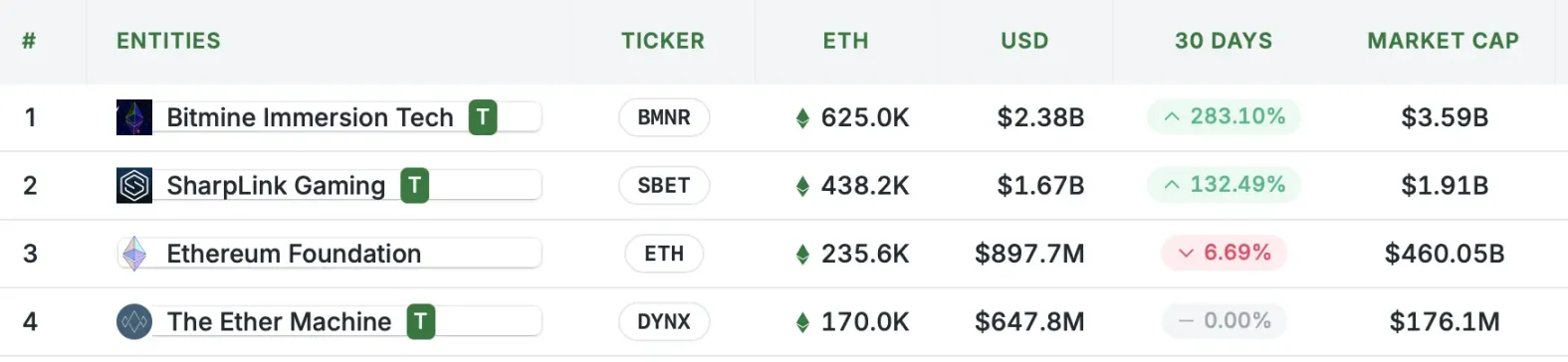

Following Chalom’s announcement, SharpLink Gaming made a major purchase over the weekend of more than 77,000 ETH, all of which were deposited into staking. SharpLink now holds approximately 438,000 ETH, trailing closely behind another ETH treasury strategy firm, Bitmine. The two companies are now competing for the title of "the MicroStrategy of ETH," aggressively buying up ETH. Bitmine, under the leadership of board chairman Tom Lee—renowned as the "Wall Street oracle"—has drawn significant investment from Cathie Wood's Ark Invest. In contrast, SharpLink’s support team is primarily rooted in the crypto industry and urgently needs a leader with traditional financial connections to attract Wall Street capital. Chalom is the ideal candidate.

Listed Companies by Ethereum Holdings

From Law Firm to Crypto: SBET Spends $12.5 Million to Recruit Talent

Joseph Chalom earned his Bachelor of Arts in International Affairs from Johns Hopkins University and later obtained a Juris Doctor from Columbia Law School. He began his career as a corporate and regulatory legal counsel, serving as a senior attorney at law firms Arnold & Porter and Skadden, Arps LLP, providing legal services to multiple investment banks and large enterprises.

In 2005, Chalom joined BlackRock, transitioning into the fintech sector. He served as Chief Operating Officer of BlackRock Solutions, leading the productization and external expansion of Aladdin—the global institutional risk management and investment platform—transforming it from an internal tool into a core fintech hub managing over $10 trillion in assets worldwide.

In early 2020, Chalom was promoted to Managing Director and Head of Strategic Ecosystem Partnerships, overseeing BlackRock’s strategic planning and execution in data and indices, digital assets, and technology ecosystems. He led partnerships with leading digital asset infrastructure firms including Coinbase Prime, Securitize, BNY Mellon, and Circle, bridging traditional asset management platforms with the blockchain ecosystem through joint ventures, technical integrations, and product rollouts.

"After 20 years at BlackRock, I am beginning a new chapter by joining SharpLink Gaming as co-CEO," Chalom announced in late July this year, signaling his professional focus shifting toward cryptocurrency and Ethereum treasuries. Rob Phythian, founder and CEO of SharpLink Gaming, will gradually transition to President while remaining on the board, working alongside Chalom to lead the company forward.

Joseph Lubin, founder of Consensys and Chairman of SharpLink, stated that Chalom has exceptional influence in advancing institutional adoption of digital assets, and his appointment strongly validates SharpLink’s Ethereum treasury strategy and its vision that “Ethereum will become the global financial infrastructure.”

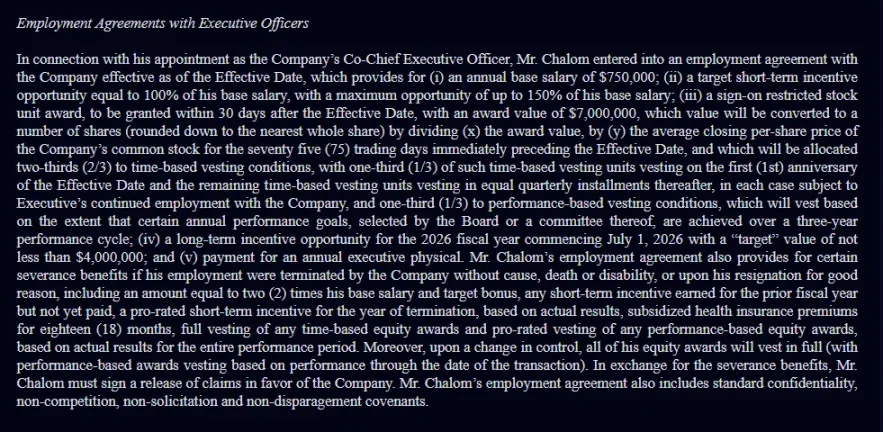

According to SharpLink Gaming’s Form 8-K filing with the U.S. Securities and Exchange Commission (SEC), the total cost of hiring Chalom reaches $12.5 million. This includes an annual base salary of $750,000 and an annual performance bonus target equal to 100% of base salary, with a maximum payout of 150% for overperformance. Additionally, Chalom received a one-time sign-on award of restricted stock units (RSUs) valued at $7 million, with two-thirds (approximately $4.66 million) vesting annually over time and the remaining one-third (approximately $2.33 million) tied to three-year performance goals. Furthermore, under the long-term incentive plan (LTIP), SharpLink has set a minimum incentive amount of no less than $4 million for Chalom in fiscal year 2026.

Leader Behind BlackRock’s Digital Asset ETFs

Joseph Chalom was one of the key figures driving BlackRock’s digital asset strategy.

Under his leadership, BlackRock launched the world’s largest Bitcoin ETF, iShares Bitcoin Trust (IBIT), in January 2024—now managing over $80 billion in assets, significantly ahead of Fidelity’s FBTC and Grayscale’s GBTC, each holding around $20–24 billion in Bitcoin ETFs. Earlier this month, IBIT surpassed 700,000 BTC in holdings, accounting for 55% of all Bitcoin held by U.S. spot Bitcoin ETFs. Moreover, the annual fee revenue generated by IBIT is nearly equivalent to that of BlackRock’s flagship product, the iShares Core S&P 500 ETF, despite the latter having almost nine times the asset size.

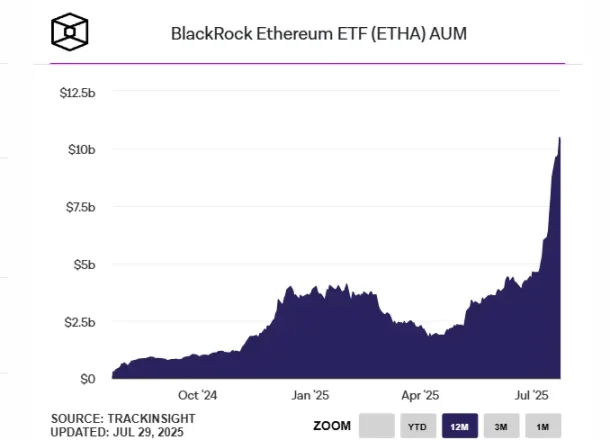

On July 23, 2024, after more than half a year of application and preparation, BlackRock launched the iShares Ethereum Trust (ETHA), offering traditional investors a regulated and direct way to access the cryptocurrency market.

As of July 25, one year after launch, ETHA reached $10 billion in assets under management, representing about half of the total AUM across all Ethereum ETFs. According to Eric Balchunas, Senior ETF Analyst at Bloomberg, this milestone makes ETHA the third-fastest ETF in history to reach this level, following only BlackRock’s IBIT and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

Additionally, Chalom launched BUIDL, the first Treasury tokenization product based on Ethereum, which brings traditional Treasury yields onto the blockchain, offering institutional clients an innovative solution combining compliance with liquidity. He also initiated and led BlackRock’s strategic collaborations with digital asset infrastructure providers such as Coinbase Prime, Securitize, BNY Mellon, and Circle, deeply integrating traditional asset management platforms with the blockchain ecosystem through cross-sector joint ventures, technical integration, and product promotion.

Connections and History with the Ethereum Ecosystem

BlackRock’s initial foray into cryptocurrency dates back a decade, driven by Mary-Catherine Lader, former President and COO of Uniswap, who recently departed from the role.

In 2015, Lader led BlackRock’s blockchain task force, organizing employees from various teams to conduct months-long research on cryptocurrencies and engaging in discussions with industry experts such as Joseph Lubin, co-founder of Ethereum. They explored potential investment opportunities, applications of blockchain technology, and possible partnerships in the space. At the time, Joseph Lubin was already CEO of Consensys and would later become Chairman of SharpLink, potentially marking the earliest point of connection between him and Chalom.

Joseph Chalom’s direct involvement and leadership in digital asset initiatives began in early 2020, when Robert Mitchnick, BlackRock’s Head of Digital Assets, and his team started reporting directly to Chalom. At the time, Chalom served as Chief Operating Officer of BlackRock Solutions, where the Aladdin system—a unified fintech platform—was originally developed for internal risk control and investment management at BlackRock before evolving into a core platform for global institutional clients.

Notably, Mitchnick joined BlackRock in 2018 as the firm’s first full-time employee dedicated exclusively to cryptocurrency, marking the beginning of BlackRock’s systematic research into the crypto market. During his first two years, Mitchnick reported to Lader, who left BlackRock in 2021 to join Uniswap.

In August 2022, under Chalom’s leadership, BlackRock partnered with Coinbase—Coinbase Prime would provide Aladdin’s institutional clients with cryptocurrency trading, custody, prime brokerage, and reporting capabilities. Chalom noted that institutional clients were increasingly interested in entering the digital asset market and focused on efficiently managing the operational lifecycle of these assets.

Throughout the advancement of its crypto initiatives, Chalom became a steadfast advocate for cryptocurrency and blockchain. Amid the crypto bear market in the second half of 2022, Chalom stated in an interview with Business Insider: “Despite the winter in crypto, its market cap remains in the trillions of dollars. We see the accelerated development of these technologies creating both opportunities and greater efficiency.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News