2024 Cryptocurrency Crime Yearbook: Fraud Schemes Proliferate, Illicit Trading Volume Remains High

TechFlow Selected TechFlow Selected

2024 Cryptocurrency Crime Yearbook: Fraud Schemes Proliferate, Illicit Trading Volume Remains High

The scale of crypto fraud has sharply increased, while money laundering volumes have begun to contract.

2024 was a landmark year for the Web3 industry. The market capitalization of crypto and adoption of industry infrastructure reached unprecedented levels. At the same time, criminal industries have increasingly leveraged crypto infrastructure to optimize their operations or create new forms of illicit activity. This report analyzes and discloses the scale of major types of crypto-related crimes and highlights the impact of compliant infrastructure on the size of criminal enterprises, calling on both the industry and governments to recognize the harm caused by crypto-enabled crime.

Due to space limitations, this article presents only selected conclusions and data from the full report. For the complete version, please visit the Bitrace official website.

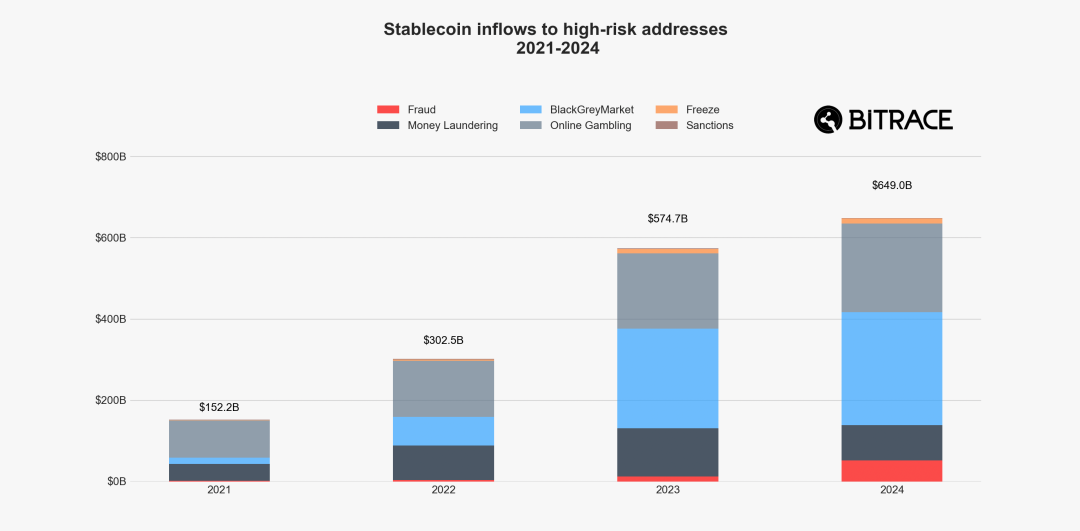

The situation regarding cryptocurrency crime remains severe

Volume of stablecoins received by high-risk addresses

Given that risky activities primarily occur on the Ethereum and Tron networks, Bitrace defines blockchain addresses used by illicit entities on these two networks to receive, transfer, or store stablecoins (erc20_usdt, erc20_usdc, trc20_usdt, trc20_usdc) as high-risk addresses. In 2024, the total volume of stablecoin receipts by such high-risk addresses reached $649 billion, slightly higher than the previous year.

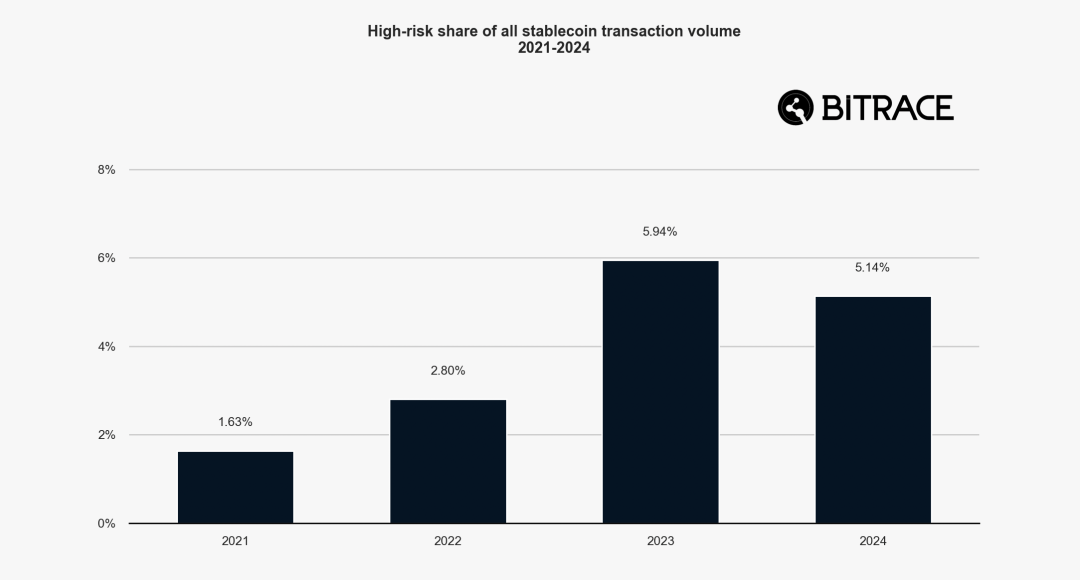

Proportion of high-risk activities in total stablecoin transaction volume

In terms of transaction volume, high-risk activities accounted for 5.14% of total stablecoin transactions in 2024, down 0.80% from 2023 but still significantly higher than in 2021 and 2022.

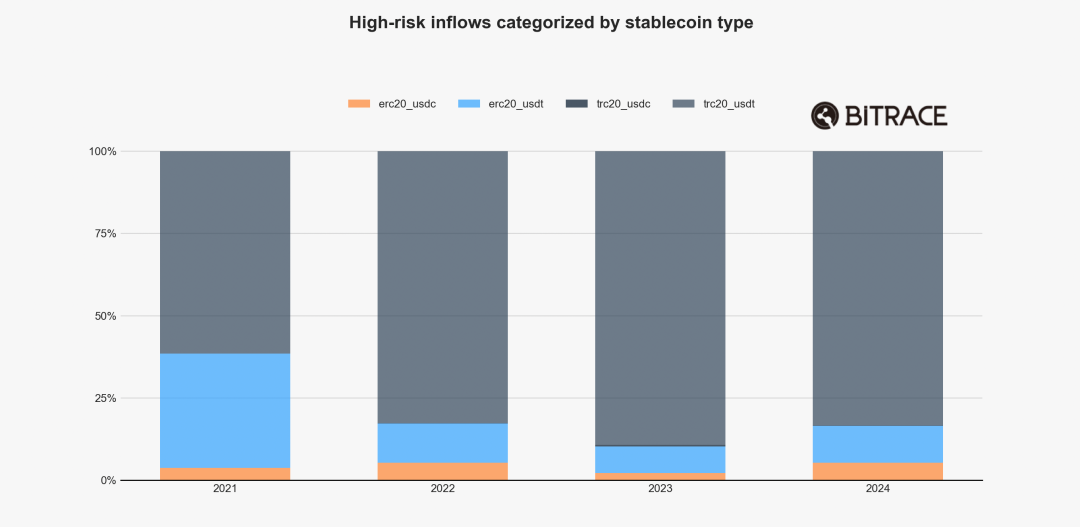

Breakdown of stablecoins received by high-risk addresses

In terms of stablecoin types, TRC20-USDT on the Tron network dominated from 2021 to 2024. However, in 2024, the share of USDT and USDC on the Ethereum network both increased.

Online gambling continues to grow

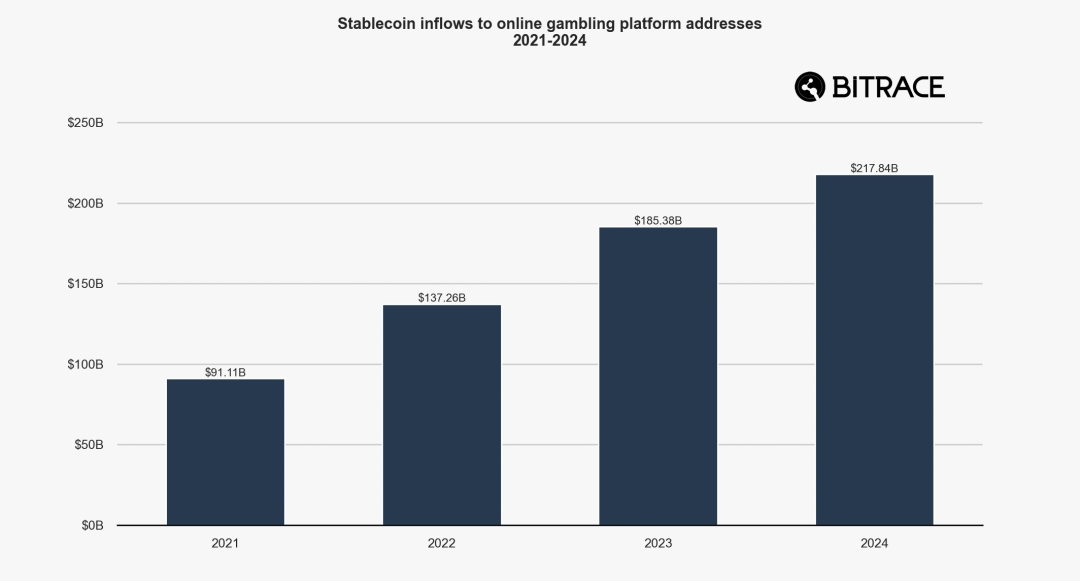

Stablecoin volume received by online gambling platforms

In 2024, the funding scale of online gambling platforms and their associated payment processors reached $217.8 billion, an increase of over 17.50% compared to 2023.

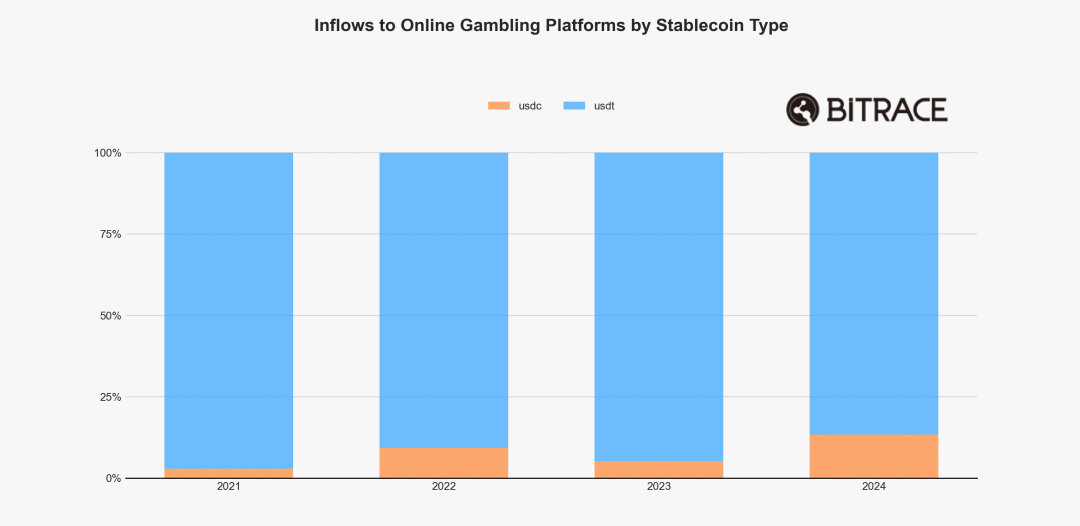

Breakdown of stablecoins received by online gambling platforms

Analysis of stablecoin usage by online gambling platforms shows that the share of USDC rose sharply in 2024 to 13.36%, far exceeding 5.22% in 2023. This indicates that despite being issued and regulated by compliant entities, USDC's adoption in online gambling has significantly increased alongside its growing market share.

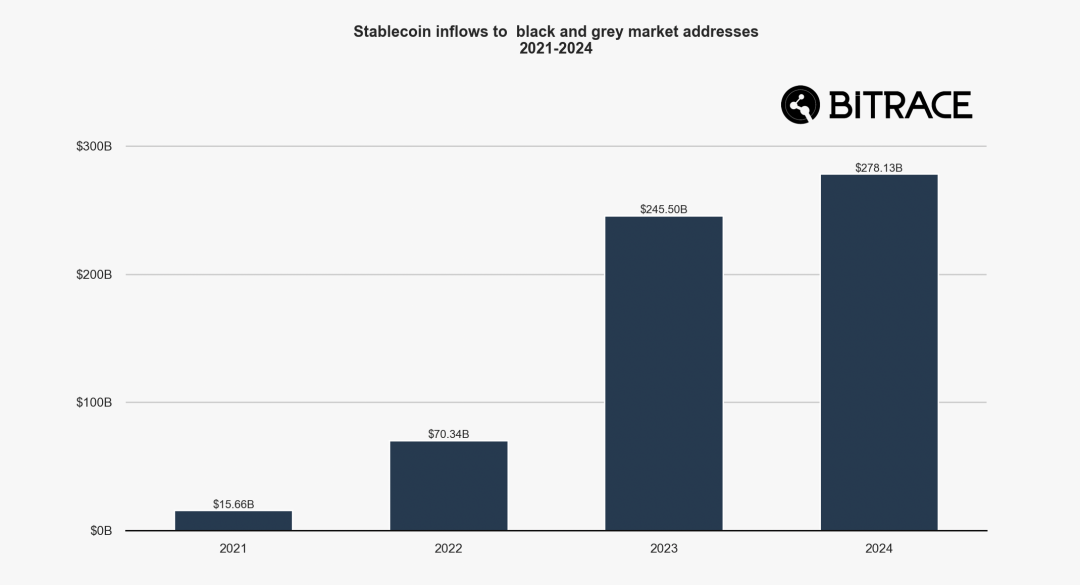

Black and gray market transaction volumes remain high

Stablecoin volume received by black and gray market transaction addresses

In 2024, business addresses related to black and gray market transactions on the Ethereum and Tron networks received over $278.1 billion in funds, slightly higher than in 2023, with transaction volumes in both years far exceeding those in 2021 and 2022.

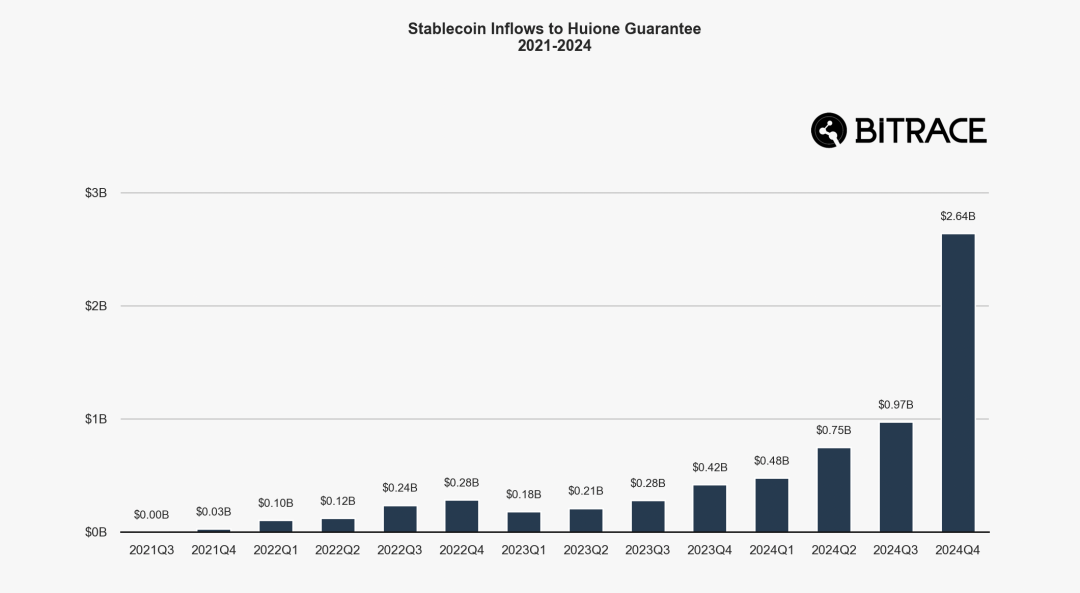

Closely tied to the development of black and gray markets are cryptocurrency escrow trading platforms. These platforms can provide escrow services for nearly all upstream and downstream segments of the illicit supply chain, establishing trust among criminals.

Stablecoin volume received by Haowang Escrow

The rise of Haowang Escrow and its competitors in Southeast Asia coincided with the gradual adoption of stablecoins in real-world economic activities in the region—a trend particularly evident in 2024. By the fourth quarter of that year, its business volume had expanded to $2.64 billion.

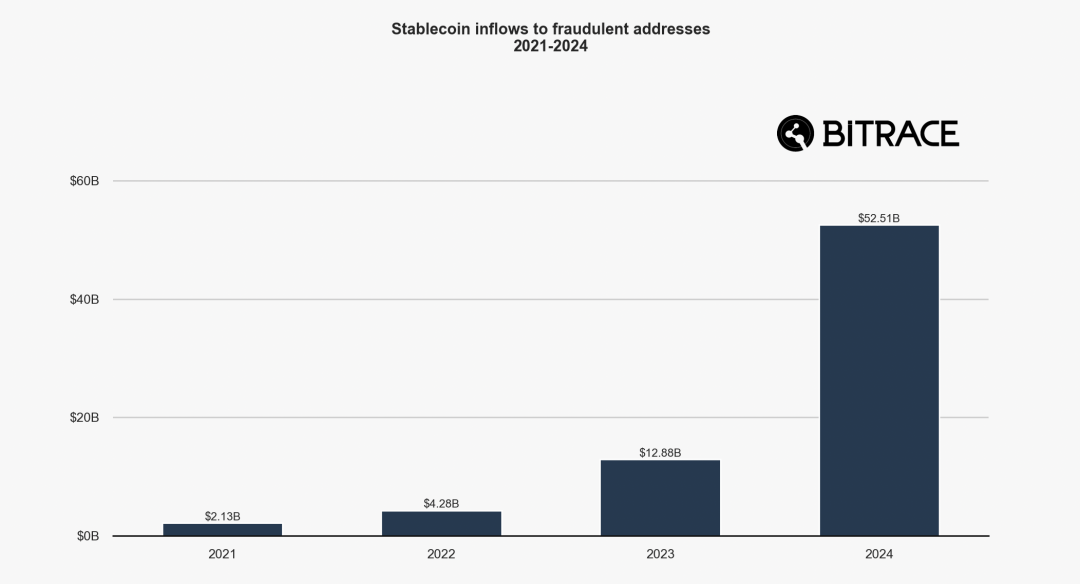

Scale of crypto fraud surges dramatically

Stablecoin volume received by fraudulent addresses

In 2024, blockchain addresses linked to fraudulent activities saw explosive growth in stablecoin receipts. With a total value of $52.5 billion, the volume surpassed the sum of all previous years combined (2021–2023).

However, this staggering growth may not be entirely accurate due to limitations in security vendors' detection methods and improvements in criminals’ sophistication. For example, as security firms expand support for newer public blockchains, more criminal incidents become visible—meaning past events may have gone undetected. Additionally, cases occurring within centralized institutions or not proactively disclosed by victims cannot be included in current statistics.

As detection methodologies improve and more cases are disclosed, this data is expected to grow further in next year’s report.

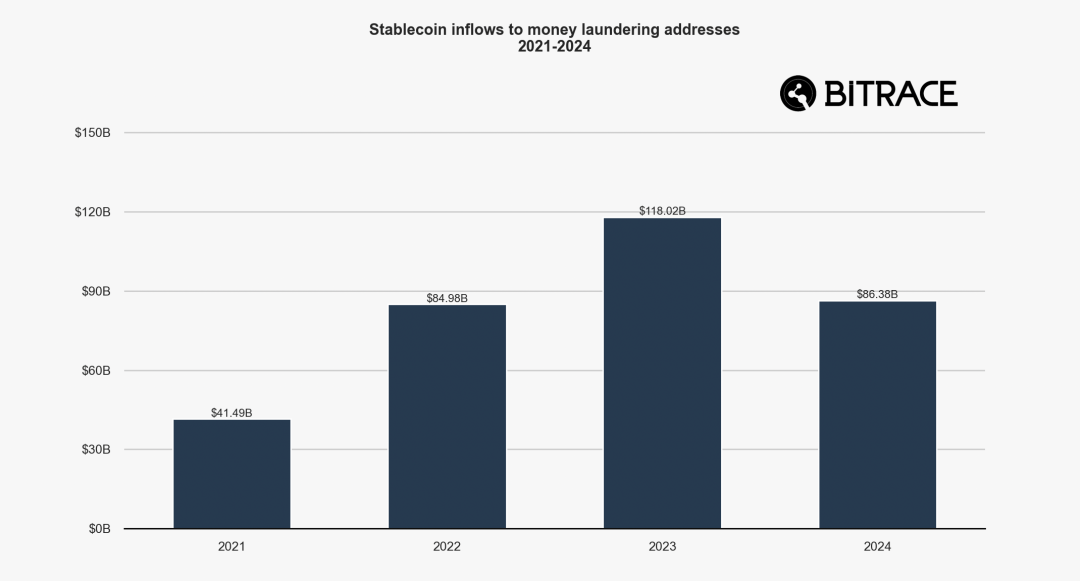

Money laundering begins to decline

Stablecoin volume received by money laundering addresses

In 2024, blockchain addresses associated with money laundering received $86.3 billion worth of stablecoins, slightly lower than in 2023 and on par with 2022. This figure suggests that major enforcement actions and regulatory legislation by key policy-makers over the past two years have effectively curbed money laundering in the crypto sector.

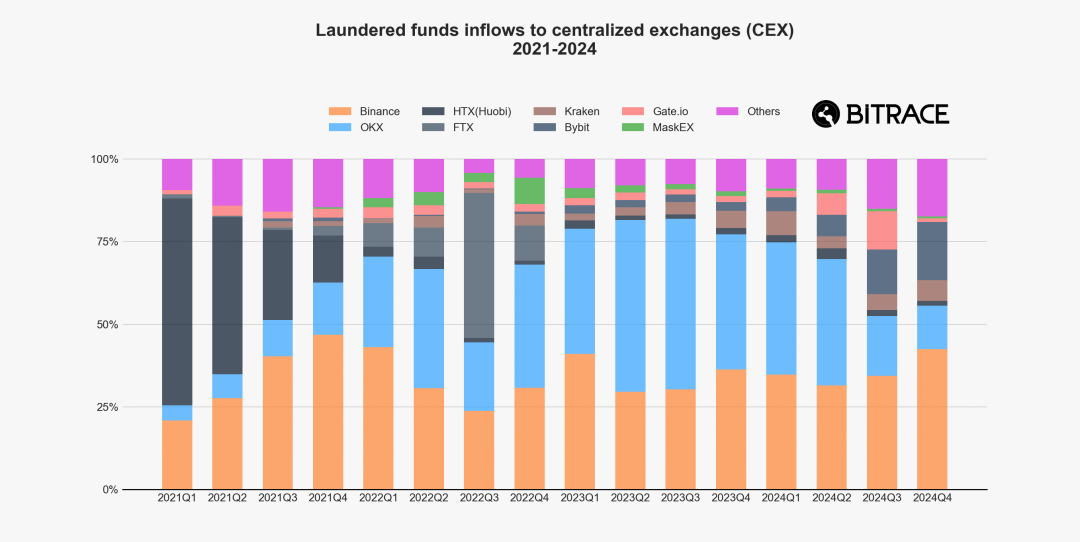

Proportion of laundered stablecoins received by major centralized exchanges

Given their unique advantages in cashing out funds, centralized exchanges are particularly attractive to money laundering groups. Bitrace conducted fund audits on hot wallet addresses of major centralized crypto exchanges.

Consistent with findings in the fraud section, the volume of laundered funds received by platforms is generally proportional to their overall business scale. However, OKX has seen a significant drop in its share in recent quarters, likely reflecting its strengthened compliance efforts.

On-chain stablecoin freezing activities surge

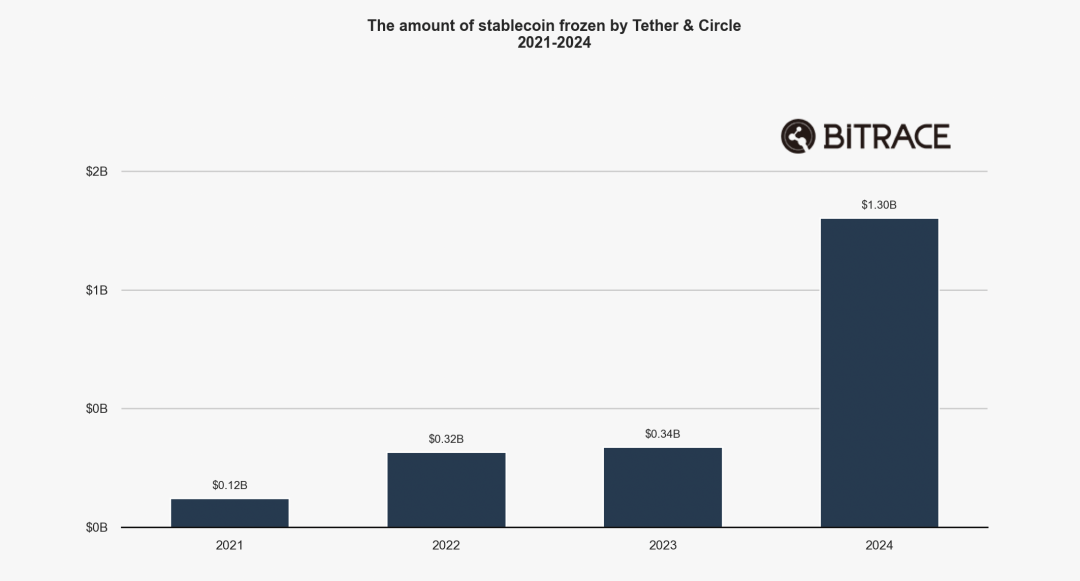

Stablecoins frozen by Tether and Circle

2024 marked a year of active cooperation between stablecoin issuers and law enforcement. Tether and Circle froze over $1.3 billion worth of stablecoins on the Ethereum and Tron networks—twice the total amount frozen in the previous three years combined.

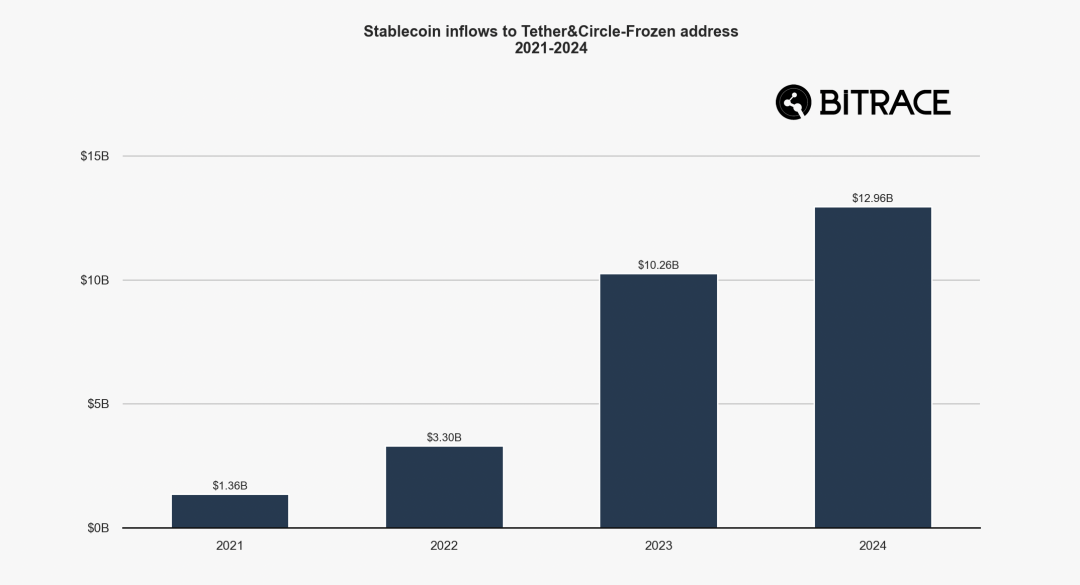

Transaction volume of frozen addresses in the reporting year

An analysis of fund transfers by frozen addresses shows that their transaction volume reached $12.9 billion in 2024, roughly on par with 2023. This indicates that on-chain crypto criminal activities were already active years ago but only began to be effectively targeted in 2024.

*It should be noted that not all frozen addresses were flagged due to involvement in criminal cases. Bitrace did not exclude such cases in this analysis, so the actual criminal volume may be slightly lower.

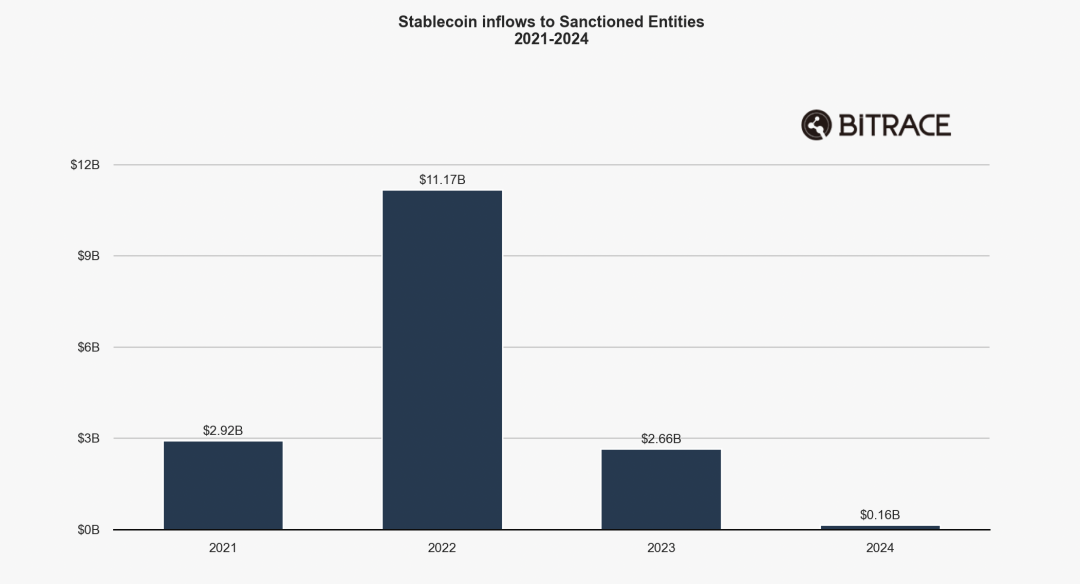

Sanctions trends from OFAC and NBCTF

Stablecoin volume received by blockchain addresses linked to OFAC- and NBCTF-sanctioned entities

The U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) and Israel’s National Bureau for Combating Terrorist Financing (NBCTF) are two agencies focused on sanctions and anti-terrorism financing, often collaborating to disrupt terrorist financing networks—including those linked to organizations like Hamas. An analysis of blockchain addresses associated with sanctioned entities disclosed by these two bodies shows that the total transaction volume peaked in 2022 and has declined annually since.

While government regulations significantly impact sanctioned entities, they have limited effect on criminal groups exploiting these infrastructures. The anonymity and permissionless nature of crypto make such entities difficult to sanction and highly replaceable. Regulators should conduct deeper investigations into crypto crimes and take targeted enforcement actions against criminal networks.

Regulation brings positive impacts to Hong Kong

2024 was a year of accelerated compliance across the crypto industry. Globally, major regulators shifted from观望to proactive engagement, driving the industry toward greater standardization and transparency. Hong Kong serves as a prime example—

Hong Kong’s compliance framework, built on clear legal requirements, customer fund protection, anti-illicit activity measures, institutional capital attraction, and alignment with international standards, has created a safer and more controllable crypto ecosystem. This has not only reduced direct financial losses from hacks, platform bankruptcies, or legal penalties but also lowered indirect risks by enhancing market trust and stability. While compliance increases costs in the short term, for crypto entities it significantly reduces long-term exposure to uncontrolled risks.

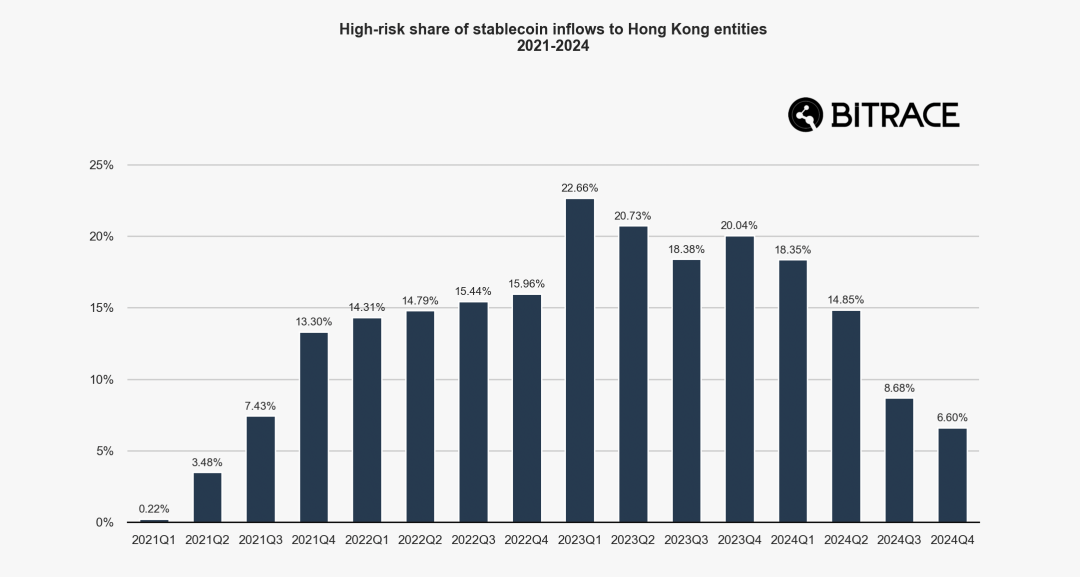

Proportion of high-risk funds in stablecoin inflows to Hong Kong-based Web3 entities

Financial analysis of addresses belonging to VATPs and VAOTCs serving Hong Kong clients shows that after Q3 2023, the proportion of high-risk stablecoins flowing into the region dropped sharply. This indicates that following the introduction of compliance policies and several high-profile crypto-related cases, stablecoin transactions linked to illicit activities in Hong Kong have been effectively suppressed.

Conclusion

2024 was a year of comprehensive revival for the industry and a pivotal moment when major economies began to seriously acknowledge its significance. Despite persistent crypto crime volumes, top-down regulatory compliance and bottom-up industry self-regulation have already brought positive changes to the crypto sector in certain countries and regions.

The industry is moving toward a safer and more trustworthy future—an outcome we believe is self-evident.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News