Mikami Yua Launches Token: A Storm of Crypto Hype from a Top-Tier Influencer—Are Retail Investors Ready to Take the Loss?

TechFlow Selected TechFlow Selected

Mikami Yua Launches Token: A Storm of Crypto Hype from a Top-Tier Influencer—Are Retail Investors Ready to Take the Loss?

The dark goddess, who commands 17.5 million global followers in the adult entertainment industry, is redefining "fan economy" with blockchain technology.

Author: Lawrence, Mars Finance

Today we're diving into the surreal reality of Japan's former top-tier idol teacher, Mika Mikami, launching her "Mikami Coin" into the cryptocurrency market. When I heard the whitepaper aims to pack fan economies, AI agents, DAO governance, and Shinto shrine beliefs all into one blockchain project, I had to down three bowls of luosifen just to calm my shock—this isn't just a scam, it's the quantum superposition of internet scams.

1. From Photobook NFTs to Token Launches: The Wealth Code Evolution of a Superstar

Mikami’s foray into Web3 reads like a textbook case of how to farm crypto peasants. As early as 2021, she sold 28 “artistic photo NFTs,” with one piece fetching ¥170,000 RMB—a record set at the peak of the NFT bubble. Back then, degens paid real money to validate the ultimate truth of “LSP Economics”: as long as fans could store the teacher’s work on their hard drives, they’d happily pay for digital certificates in their wallets.

By February 2025, when she made a surprise appearance at a Lan Kwai Fong bar in Hong Kong for an exchange event, old-school crypto veterans already sensed the dark winds blowing. Sure enough, two months later, a token called Mikami Coin appeared on Solana, with a distribution plan more intense than the loot division scene in *Let the Bullets Fly*: 50% locked until 2069 (as if the private key were carved onto a Terracotta Warrior’s face), 20% allocated to presale “big brothers” so they could exit first, and 5% marketing budget that might as well be spent advertising on darknet resource sites.

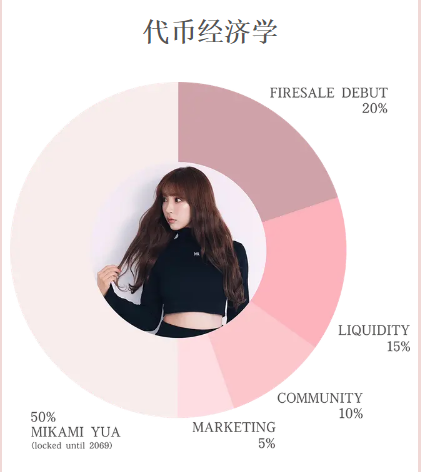

2. Token Distribution: A Carefully Crafted "Hunger Game"

Let’s dissect the whitepaper’s so-called “golden ratio”:

-

50% locked until 2069: This is “blockchain-style wishful thinking.” By the time it unlocks, Mikami will be 76 years old. At that point, there may be more virtual grannies dancing in元宇宙 square dances than actual token holders.

-

20% presale allocation: Clearly designed to let “crypto vultures” feast first. Recall how the whale behind a certain animal-themed coin pumped at 3 a.m. and dumped by 5 a.m.

-

15% liquidity pool: Based on current SOL prices, the market cap at launch equals about three years of Mikami’s salary (¥10 million RMB). But given meme coins average a 2000% turnover rate, this gives whales enough fuel to play ten rounds of “Russian roulette.”

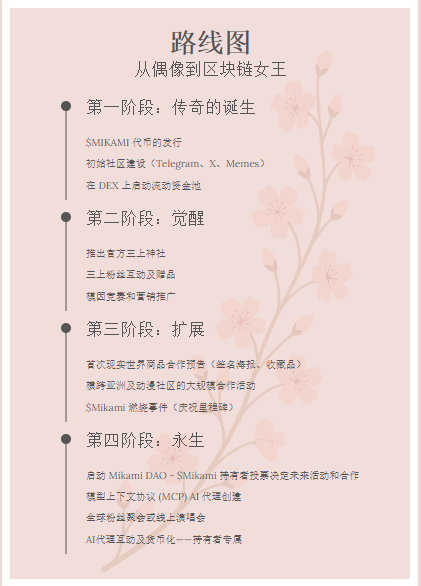

3. Roadmap Deconstruction: Traditional Scams Wearing a Web3 Skin

The project’s four-phase roadmap is the ultimate Frankenstein of blockchain buzzwords:

-

Shrine Economy: Tokenizing fan pilgrimages. Reminiscent of that Japanese temple that issued “merit NFTs,” only to see its monks go bankrupt from trading them.

-

AI Agent: Claims to build a virtual Mikami, but in reality, 99% of AI projects are just ChatGPT wrappers—about as effective as a ¥9.9 Taobao custom girlfriend service.

-

DAO Governance: Supposedly lets token holders vote, but with backdoor admin keys pre-reserved. Remember that famous DAO founder who ran off with $40 million and claimed his “private key was eaten by a cat”?

4. The Chemical Reaction Between Fan Economy and Crypto Ponzi

Is a fan worth $1 or $10? With Mikami currently boasting 8.23 million Twitter followers, the token’s market cap could fluctuate between $8.23 million and $82.3 million. This valuation model reminds me of Dongguan’s ISO service pricing tiers—basic, premium, and ultimate VIP packages.

But don’t forget the adult industry’s “silent fan” phenomenon: many hardcore fans would rather buy ten physical discs than leave a permanent on-chain transaction trail. This means real purchasing power may be only 20% of the surface numbers.

-

NFT purchasing power trap: 99% of the high-rollers who paid ¥170,000 for her photos are now stuck in the digital collectibles bear market.

-

Fandom voting logic fails: Idol voting is emotional spending; memecoin trading is zero-sum gambling. Recall how fans of a crashed idol token staged a protest art performance outside the exchange, holding up banners saying “Give us our wife-money back!”

-

Lifecycle mismatch: The average career span of a female performer is 5–8 years, while the median lifespan of a memecoin is just 27 days. This move is like using 3-day-expiry yogurt to brew a decade-aged liquor.

5. The Masterminds Behind the Curtain: A Professional Reaper Squad’s Downtime Strike

From the clues in the whitepaper, the team behind this is likely the “dark web Goldman Sachs”:

-

Tokenomics model: A perfect clone of the “four-stage harvesting method” used by a 2024 rug-pull project—only swapping anime avatars for photobook images.

-

Cross-chain deployment strategy: Choosing Solana over Ethereum clearly targets its “second-level confirmations + low gas fees,” ideal for high-frequency harvesting.

-

Burn mechanism design: Creates an illusion of deflation while enabling wash trading. See how one animal-themed coin used 200 burn events to hide its dumping activity on-chain.

6. Risk Alerts: 108 Ways for Peasants to Die

If you’re still tempted to “throw a few SOL in honor of youth,” memorize this survival guide first:

-

Audit report illusion: 98% of memecoin audit reports are worth about as much as the beef picture on a instant noodle package.

-

Liquidity trap: Initial trading depth may be thinner than a rural vegetable market—any large order could send prices into freefall.

-

Regulatory sword of Damocles: Japan’s Financial Services Agency just sued an artist-backed token project, levying fines big enough to buy out all of Akihabara.

-

Technical harvesting: From貔貅scams to flash loan attacks, whales have 100 ways to leave you broke down to your underwear.

7. Final Act: Predicting the Endgame of This Surreal Drama

The most likely outcome of this crypto circus:

-

Short-term: Price surges 300% on day one, with social media flooded with claims that “Mikami saved the Solana ecosystem.”

-

Mid-term: Whales cash out via the 20% presale allocation, price halves repeatedly, and complaint groups fill up with memes screaming “give me back my wife-money.”

-

Long-term: In 2069, when tokens unlock, a holder’s grandchild gasps during a 元宇宙 archaeology class: “Grandma actually bought this cyber antique?”

Conclusion: Staying Sane in a World of Madness

In this era of disruption, we must admit: from photobook DVDs to NFTs to memecoins, Mikami has always been at the forefront of tech revolutions. But as ordinary investors, remember two ironclad rules:

-

Treat memecoins like entertainment: Never invest more than you'd spend tipping a livestreamer.

-

Believe in market Darwinism: Any peasant who survives the reaper’s blade will eventually mutate and thrive in the bear market.

This dark goddess, worshipped by 17.5 million fans worldwide in the adult entertainment realm, is now redefining “fan economy” through blockchain. From DMM to DEX, from Blu-ray discs to token burns, Mikami proves one thing loud and clear: you don’t need clothes to harvest peasants.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News