10 Projects' Real Data: Binance Wallet IDO Project Survival Report

TechFlow Selected TechFlow Selected

10 Projects' Real Data: Binance Wallet IDO Project Survival Report

Binance Wallet IDO is a "value filter," and even more so, a narrative validation.

Author: Klein Labs

As Web3 enters a new phase of adjustment, token generation events (TGEs) are no longer just simple fundraising tools—they have become arenas where projects engage in strategic博弈 with the market. Especially amid tightening liquidity and weakened investor confidence, how and whether to launch has become a critical decision for project teams.

IDO (Initial DEX Offering) is a common TGE model. In the early days, platforms like CoinList helped spawn several blue-chip projects through IDOs. However, as the number of projects surged, the wealth effect of IDOs diminished. Meanwhile, every move by Binance continues to shake market sentiment. Since 2025, Binance Wallet IDO has emerged as a preferred launchpad for many new projects. Its characteristics of “low barrier, high热度, strong流量” quickly captured market attention, drawing numerous startups and community interest. Yet this model has also revealed fundamental shifts in new token market structures, valuation systems, and project logic.

But is this model truly suitable for every project? Which types can leverage it to amplify narratives and achieve successful cold starts, while others might face the trap of “high opening, low follow-through” after initial hype?

The Klein Labs Research team conducted a systematic data analysis and structural breakdown of 10 Binance Wallet IDO projects that have already launched, aiming to help project teams make smarter strategic decisions.

1. Context: What Market Cycle Are We In?

Over recent months, we can clearly observe the evolution of market investment preferences:

-

Early preference: High valuations + low circulating supply models (VC-driven, short-term speculation)

-

Mid-cycle frenzy: Fully diluted Meme coin models (zero-barrier炒作)

-

Current turning point: The market is shifting back toward focus on fundamentals and sustainable projects

Meanwhile, TGE structures themselves have undergone three evolutionary phases:

-

Early model: Low-valuation issuance + market-driven price discovery (narrative-led)

-

Mid-cycle model: High-valuation issuance + insider profit-taking (via OTC or immediate selling post-release)

-

Current state: Return to low-valuation openings (lack of buy-side demand, no one willing to "catch the falling knife")

This market condition is most directly reflected in the low-valuation listings seen in Binance Wallet IDO projects. Project teams must now offer extremely low valuations and minimal token releases to gain even a sliver of market attention. Underlying this trend is a crucial insight:

TGE valuations do not reflect a project’s “future value,” but rather represent an aggregate snapshot of current market liquidity, exchange listing expectations, narrative strength, and market-making capabilities.

2. Binance Wallet IDO Still Delivers Strong Traffic—But Timing Is Key

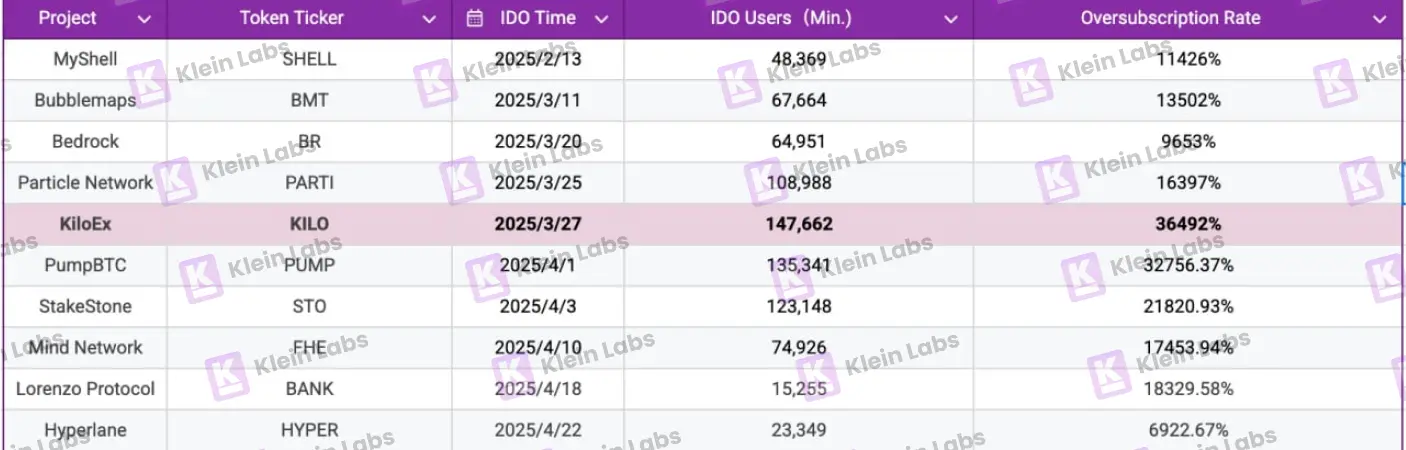

Data shows that Binance Wallet IDO brings significant market attention and brand exposure to projects:

-

Average participation: 80,965 users per event;

-

Fundraising range: 60,000 – 443,000 BNB per round;

-

Over-subscription rates between 6,900% and 36,500%.

KiloEx achieved an over-subscription rate as high as 36,492%.

Binance Wallet IDO easily draws user attention at the ten-thousand level—even in a cooling market, it still channels tens of millions of dollars worth of assets into projects.

Although participation thresholds have increased due to mechanism improvements, these changes effectively filter for higher-quality, more engaged users with greater long-term potential, leading to healthier community structures and better foundations for future engagement and conversion.

With Binance Wallet's lightweight outreach mechanism, projects still gain strong momentum for cold starts, significantly shortening user acquisition paths and reducing startup costs.

3. TGE Models Are De-Leveraging: Binance Wallet IDO Projects Launch at Low Valuations

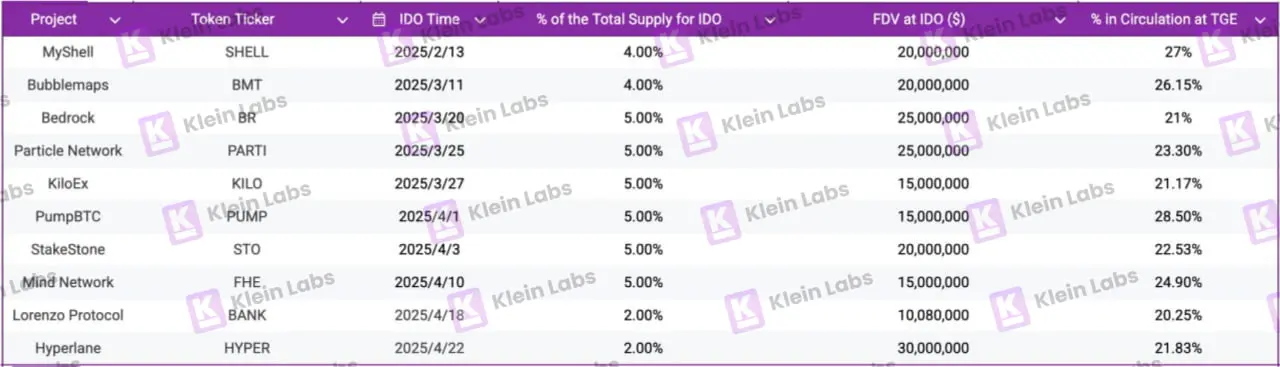

Data analysis reveals clear commonalities in the tokenomics of Binance Wallet IDO projects:

-

Token release ratio during the IDO stage is generally low, ranging from 2% to 5% of total supply, averaging 4.44%;

-

Circulating supply at TGE typically falls between 20% and 30%, ensuring initial market liquidity isn’t excessively diluted;

-

Full Diluted Valuation (FDV) at IDO ranges from $10 million to $30 million—relatively reasonable, even slightly conservative.

Project teams choose Binance Wallet IDO for several key reasons:

-

The product is mature and requires a token for utility, incentive systems, or settlement;

-

They need cost-effective ways to gain community visibility and trading support—an effective large-scale market launch that establishes initial liquidity;

-

They embrace a long-term philosophy, accepting low valuations, limited releases, and gradual growth.

Current Binance Wallet IDO projects must endure downward pressure on valuations due to weak market confidence. However, this also leaves room for strong projects to grow their market cap over time.

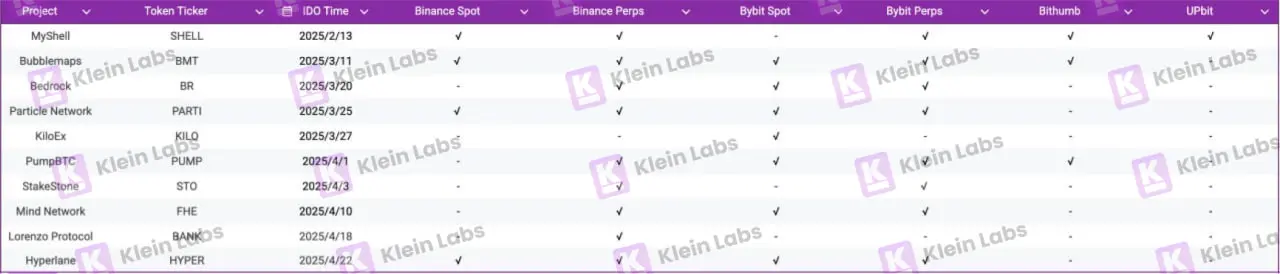

4. Exchange Listings: Binance Wallet IDO Is a Gateway to Binance, Not the Final Destination

Many teams assume that a Wallet IDO equals “listing on Binance.” Reality tells a different story:

-

Spot listing rate on Binance: 40% (SHELL, BMT, PARTI, HYPER);

-

About 90% of projects listed on Binance Futures;

-

70% listed on Bybit spot, 80% on Bybit futures;

-

South Korean exchange listings remain low and non-standardized.

A Binance Wallet IDO does not guarantee a spot listing on Binance. Instead, it functions more like a trial pass into Binance’s traffic ecosystem. Whether a project gets “graduated” to the main spot market depends on post-launch performance metrics, user feedback, and internal evaluations by Binance’s listing team. Teams should treat it as a “dress rehearsal” before the main stage and prepare thoroughly for subsequent listings and secondary market liquidity support.

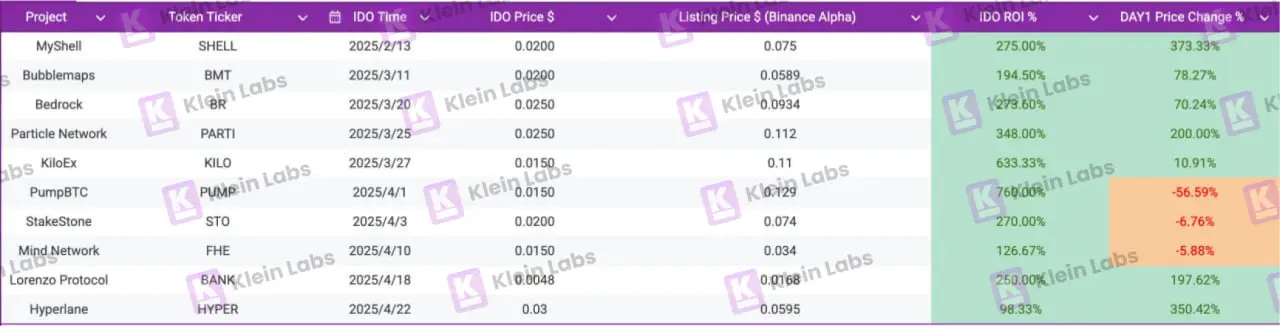

5. Price Trends: Strong Start, Long-Term Performance Hinges on Execution and Strategy

Current data indicates most Binance Wallet IDO projects deliver strong first-day performances with impressive ROI:

-

PumpBTC surged 760% on day one; KiloEx also delivered outstanding returns.

-

Despite high initial volatility, medium- to long-term performance relies heavily on sustained operational capability, market management strategy, and clear long-term planning.

-

Notably, some projects (e.g., MyShell, Bubblemaps, PumpBTC) actively expanded into the South Korean market post-IDO to drive further growth.

While Binance Wallet IDO projects often enjoy explosive initial热度, those lacking long-term vision struggle against today’s market challenges—including weak buying pressure, investor reluctance to chase tokens with high short-term float, insufficient fundamental backing, and prematurely exhausted narrative value. As a result, project performances are increasingly diverging.

Short-term热度 is easy to generate, but what ultimately determines longevity is consistent execution and strategic market management. Teams must plan ahead for secondary market control, investor relations, and price stability to avoid rapid drawdowns and enable steady realization of long-term value.

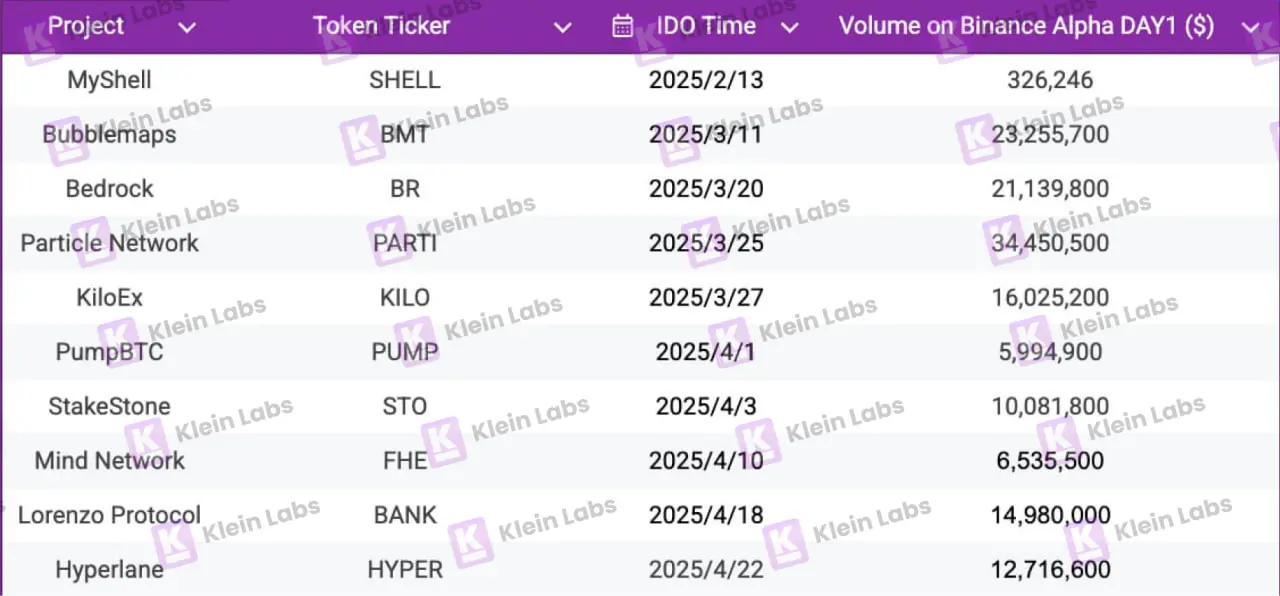

6. Trading Activity: Real Indicators of Market Interest and Capital Momentum

Market performance varies across Binance Wallet IDO projects, but overall trading热度 remains high:

PARTI, BMT, and BR stood out, each exceeding $20 million in first-day trading volume.

High trading volumes stem not only from initial流量 but also from narrative strength, tokenomic design, and effective market expectation management.

IDO serves only as the ignition point. Sustaining热度 and catalyzing secondary markets depend entirely on a project’s execution quality and operational rhythm. Many underperforming projects fade quickly after TGE—either due to lack of ongoing content and engagement or loss of market confidence caused by poor management.

Conclusion: Binance Wallet IDO Is a "Value Filter"—And a Narrative Stress Test

Binance Wallet IDO is a structured, high-leverage method for Web3 projects to launch narratives, build consensus, and amplify visibility. It offers teams a low-cost “opening script” to generate outsized attention—but demands exceptional execution, operational foresight, and market discipline.

The performance data from Binance Wallet IDOs reflects deep transformations in market valuation logic and launch methodologies. It is neither an endpoint nor a guaranteed ticket, but rather a low-cost window to validate product vision, test market mechanisms, and demonstrate capability.

Because the market is currently in a late-stage cycle marked by low confidence, tight liquidity, and high skepticism, it’s all the more important for genuinely committed, long-term builders to step forward and use Binance Wallet IDO to showcase their product value, narrative pacing, and operational strength.

It’s not for everyone. But for teams with a clear story, disciplined节奏, and genuine commitment to long-term development, it serves as a vital springboard into Binance’s ecosystem and mainstream visibility. In this post-bubble phase, the market is returning to fundamentals—a positive signal for builders who aim to create real value.

Like all platform-based IDOs, the question remains: After the initial celebration, how do you sustain the feast? This is also a challenge Binance Wallet itself must confront. Put simply, if Binance Wallet IDO can consistently become the go-to launchpad for high-quality assets, its lifecycle will be extended. And at the heart of this lies a deeper question: What defines a “high-quality asset”? What kind of projects does the industry truly need? And which ones are best suited to thrive in this environment? These are questions each of us must deeply consider.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News