Glider: DeFi Enters the Era of Simple Investing

TechFlow Selected TechFlow Selected

Glider: DeFi Enters the Era of Simple Investing

Everything old faces the historical opportunity to be reshaped, and new opportunities have already emerged.

By: Zuoye

-

Complex on-chain activities are being simplified, and the technical infrastructure has matured;

-

Everything old faces a historic opportunity to be reshaped—new opportunities have already emerged;

-

Intent, TG/Onchain Bot, and AI Agent all need to solve the authorization problem.

On April 16, Glider secured $4 million in funding led by a16z’s CSX (startup accelerator). Its positioning in the seemingly simple but actually complex field of on-chain investing benefits from technological trends like Intent and LLM. However, DeFi as a whole indeed needs reconfiguration to lower investment barriers.

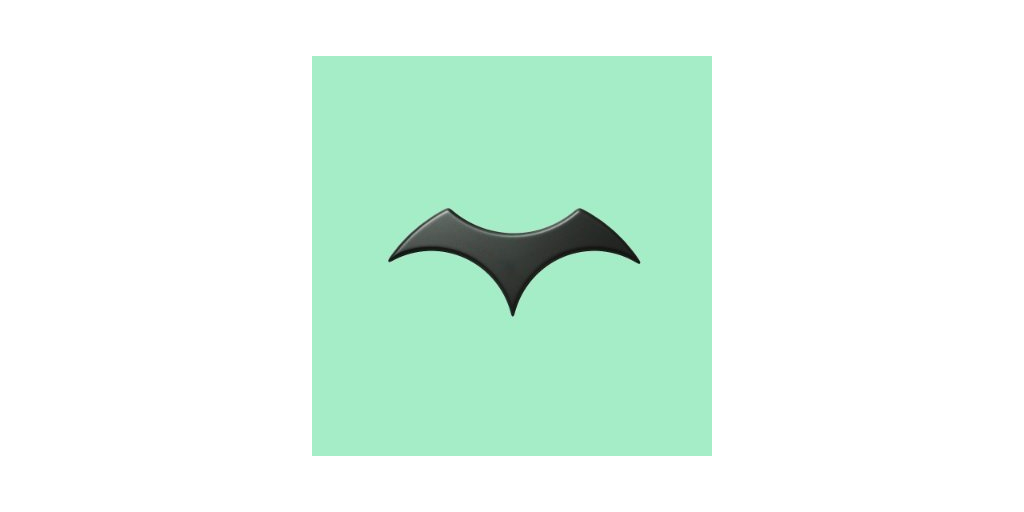

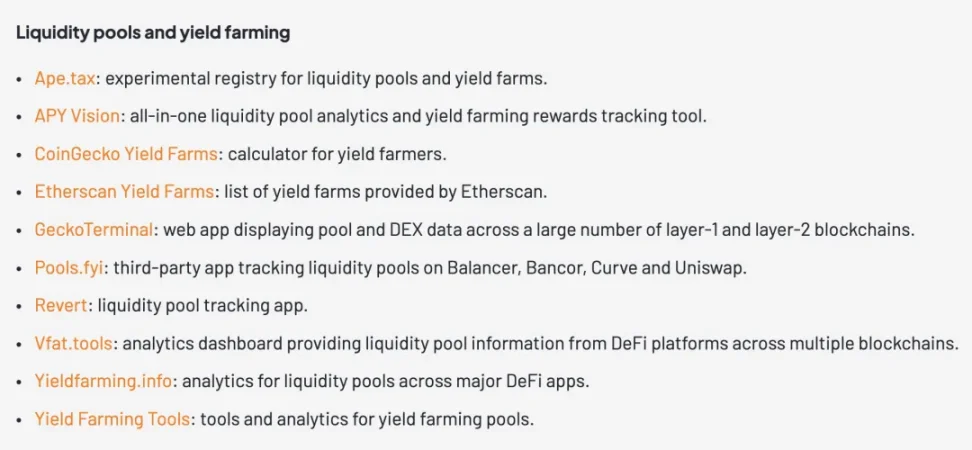

Image caption: The evolution of DeFi tools, image source: @zuoyeweb3

The era of DeFi Lego is over; an era of secure, coupled wealth management has arrived.

Past: Furucombo, Doomed Before It Began

Glider began as an internal startup within Anagram at the end of 2023, initially taking the form of Onchain Bots—combining different operational steps to facilitate user investment and usage.

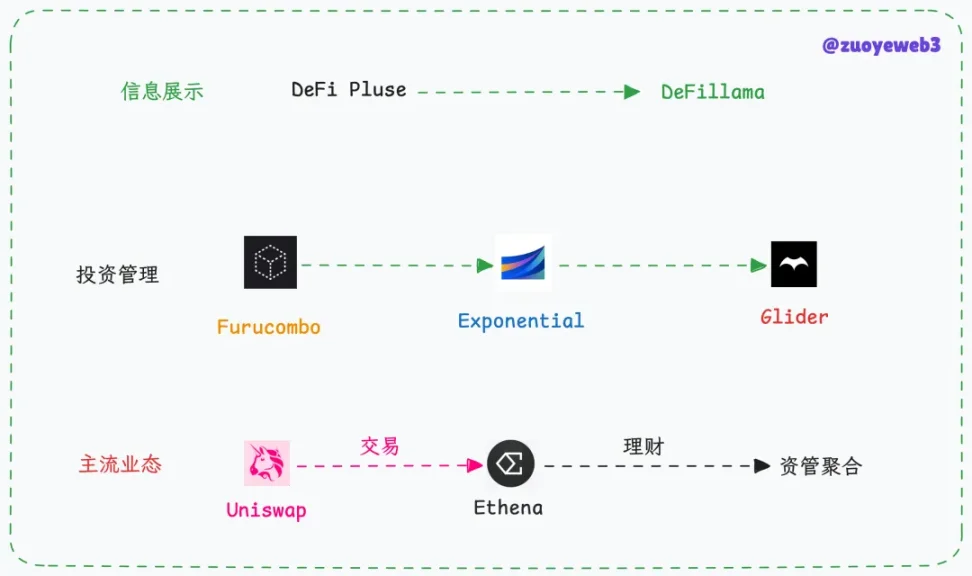

Image caption: Glider feature preview, image source: businesswire

But this isn't a new model. Wealth management for users has always been a long-standing business—true in TradFi, true during DeFi Summer. Currently, Glider remains in internal development; based solely on PR materials, we can outline its general approach:

-

Integrate existing DeFi tools—including sector leaders and emerging protocols—using API connections to build a B2B2C customer acquisition logic;

-

Allow users to create investment strategies and support sharing, enabling copy trading, follow-on investments, or collective investing to achieve higher returns.

With the combined power of AI Agents, LLMs, intent-based systems, and chain abstraction, building such a stack isn't technically difficult. The real challenges lie in traffic operations and trust mechanisms.

Fund flows involving user assets are always sensitive—this is also the main reason on-chain products haven't overtaken CEXs. Most users accept decentralization as long as it doesn't compromise fund security, but they fundamentally reject decentralization increasing security risks.

In 2020, Furucombo received investment from institutions like 1kx, aiming to help users reduce confusion when facing DeFi strategies. If one must draw a parallel, it's most similar today to Meme coin tools like GMGN—except that during the DeFi era, it was about combining yield-generating strategies, while GMGN focuses on discovering high-potential, low-value Memes.

However, most users didn’t stay with Furucombo. On-chain yield strategies operate in an open market where retail investors cannot compete with whales in server capacity or capital size, meaning most yield opportunities remain inaccessible to average users.

Compared to unsustainable yields, security issues and strategy optimization become secondary—during high-return eras, there’s no room for stable wealth management.

Present: The Democratization of Asset Management

ETFs for the rich, ETS for the masses.

ETF tools aren’t limited to stock markets; exchanges like Binance experimented with them as early as 2021. From the perspective of technical asset tokenization, this eventually gave rise to the RWA paradigm.

Image caption: Exponential interface, image source: Exponential

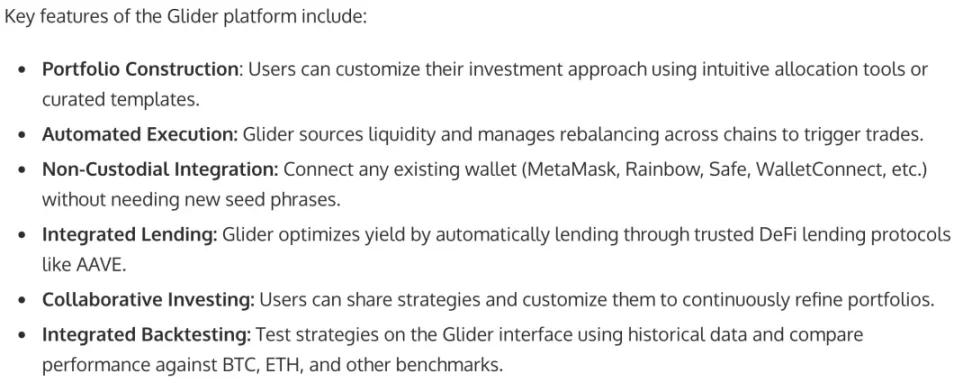

Further still, how to fully on-board ETF tools onto the blockchain has become a focal point for startups. From DeFillama’s APY calculation and display to Exponential’s continuous operation, demand clearly exists.

Strictly speaking, Exponential is a marketplace for strategy selling and showcasing—countless experts, precise calculations, human and AI-assisted decision-making. But blockchain transparency means no one can truly hide efficient strategies from being copied and improved upon, triggering an arms race that ultimately flattens yields across the board.

In the end, it becomes another round of boring big-fish-eat-small-fish games.

Yet standardization remains elusive—no project has yet evolved into a market-redefining force like Uniswap, Hyperliquid, or Polymarket.

Lately, I’ve been pondering: after the Meme Supercycle ends, will the old forms of DeFi be able to revive? Is the industry’s peak temporary or permanent?

This matters because it determines whether Web3 is the next stage of the internet or merely FinTech 2.0. If the former, then the ways humans manage information and capital will be fundamentally reshaped. If the latter, then Stripe plus Futu NiuNiu represent the ultimate endpoint.

From Glider’s strategy, we can infer that on-chain yields are transitioning into a democratized era of asset management. Just as index funds and 401(k)s together fueled the long bull run of U.S. equities, sheer capital volume and massive retail participation will drive enormous demand for stable income.

This is the next significance of DeFi. Beyond Ethereum, there’s Solana—blockchains still carry the innovation of Internet 3.0, and DeFi should rightfully be FinTech 2.0.

Glider incorporates AI assistance, but tracing back from DeFi Pulse’s data presentation, through Furucombo’s initial attempt, to Exponential’s stable operation, even a steady ~5% on-chain return continues to attract users beyond CEXs.

Future: Yield-Bearing Assets Go On-Chain

After years of development, only a few crypto products have truly gained market acceptance:

-

Exchanges

-

Stablecoins

-

DeFi

-

Blockchains

All other product types—including NFTs and Meme coins—are merely阶段性 asset issuance models without sustainable self-maintenance capabilities.

However, RWA has been steadily growing since 2022, especially after the collapse of FTX and UST-Luna. As AC noted, people don’t truly care about decentralization—they care more about yield and stability.

Even without the Trump administration actively embracing Bitcoin and blockchain, the productization and practical application of RWA are accelerating. If traditional finance can embrace digitization and informatization, there’s no reason to resist blockchain integration.

In this cycle, both complex asset types and sources, as well as overwhelming numbers of on-chain DeFi strategies, severely hinder the migration of CEX users to on-chain platforms. Regardless of whether mass adoption is real or not, the vast liquidity from centralized exchanges can certainly be drawn away:

-

Ethena converts fee revenue into on-chain yields via incentive alliances;

-

Hyperliquid pumps exchange perpetual contracts onto-chain via LP Tokens.

These two cases prove that liquidity migration onto chains is feasible. RWA proves that asset onboarding is also viable. This is a remarkable moment for the industry: ETH may seem inactive, yet everyone is clearly going on-chain. In a way, fat protocols inhibit fat applications—but perhaps this is also the final night before blockchains return to their role as infrastructure and application scenarios begin to shine. Dawn is breaking.

Image caption: Yield calculation tool, image source: @cshift_io

Beyond these products, vfat Tools—an open-source APY calculator—has operated for several years. Projects like De.Fi, Beefy, and RWA.xyz each have their own focus, displaying project-specific APYs. Over time, yield tools have increasingly centered around YBS and other yield-bearing assets.

Currently, enhancing AI trustworthiness raises questions about accountability, while increasing manual intervention reduces user experience—a tough dilemma.

Possibly, separating information flow from capital flow, creating a UGC strategy community, letting projects compete fiercely, and allowing retail users to benefit could be a promising path forward.

Conclusion

Glider has gained market attention due to a16z backing, but long-term issues in the sector persist—authorization and risk. Here, “authorization” does not refer to wallets or funds, but whether AI can satisfy humans. If AI-driven investments suffer heavy losses, how should responsibility be assigned?

The world is still worth exploring the unknown. Crypto, as a public space amid a fractured world, will continue to thrive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News