From $30 to Financial Freedom: A Gen Z On-Chain Trader's Journey of Mental Evolution

TechFlow Selected TechFlow Selected

From $30 to Financial Freedom: A Gen Z On-Chain Trader's Journey of Mental Evolution

Obsession is the first essential element of success.

Written by: jack

Translated by: Luffy, Foresight News

In early 2021, while everyone was obsessed with perpetual contracts and NFTs, I stumbled upon a post from a now-deleted user named "CLs intern." That was my first real exposure to the world of on-chain trading.

Before that, I only knew three ways to make money in crypto: perps, spot trading, and NFTs. In this obscure post, he bragged about scoring his tenth 500x this week by sniping a mutated Shiba Inu coin, mocked people for going crazy over 25x leverage trades, and explained that for those with limited capital, on-chain trading offered the greatest opportunity.

"Scan every transaction, track every wallet, scrutinize every Etherscan page." Beyond the profit screenshots, this sentence stuck with me most.

It electrified me as a teenager. As schoolwork grew harder, my interest in studying faded fast, so I set my sights on on-chain trading as my life's mission. With zero guidance, I spent three or four months figuring out where to start, making some trades on FTM and ETH chains—but gained nothing.

By then, BTC had already fallen from its all-time high. The dark age of crypto followed—inevitable crashes and collapses came one after another. With the previous cycle ending and real-world financial struggles mounting, I gradually lost my initial passion.

Time flew. One evening during the spring-summer transition of 2022, I randomly came across a YouTube video titled “BSC Trading Guide,” which included a Discord server link in the description. I joined and found myself in a BSC meme coin on-chain trading community of several hundred people. My passion reignited instantly. My life began revolving around camping Poocoin for newly deployed contracts and filtering projects.

I stared at Telegram channels and new contract deployments for 18 hours a day, like a madman, for weeks straight. Eventually, I learned how to distinguish scam coins from genuine ones. The next stage was predicting which tokens would actually gain user traction—and I discovered I had an uncanny intuition for it.

"Holy shit, did I finally find what I'm good at?" When I started real trading with $30 saved up, the Discord admin noticed my skills and "hired" me to analyze market trends daily—for a salary of 1 BNB per month. For me at the time, it couldn’t have been better.

Within three months, $30 turned into $10,000; within another month, $10,000 became $100,000. In the first six months, I paid off my family’s massive debts and gave them a fresh start.

Once financial pressure no longer hung over me like a sword, I reinvested $5,000–$6,000 and grew it back to six-figure net worth within a year. But misfortune struck again—just as I planned to take profits and withdraw most of my holdings, the FTX collapse hit, wiping out 95% of my portfolio value that same week.

So I had to restart—again—from scratch. No complaints. I accepted reality and focused solely on successful trading. By mid-2023, I’d recovered triple the amount I lost from FTX. By year-end, I achieved lifelong financial freedom—all thanks to on-chain trading.

In 2023, I created this Twitter account intending to share content about on-chain trading, to guide newcomers. Because my hardest, most frustrating times were when I wandered aimlessly, learning everything alone.

But this article isn’t just about my plain story—it’s merely necessary self-introduction for the final post on this account. The real purpose is to summarize my trading philosophy: To keep up with this ever-changing, labyrinthine market, you must reshape your thinking. So this isn't a technical guide, but rather an attempt to shift your perspective on on-chain trading and the market as a whole.

Obsession: The First Ingredient of Success

Obsession — noun, the state of being controlled by persistent and intense thoughts or feelings

Every genius you’ve met, every reliable trader you know—they often share similar beginnings. They may differ in personality, but at their peak, they all share one trait: obsession.

We see someone staring at charts and clicking screens for 20 straight hours and think, “How do they do it?” But if you've ever been truly obsessed, the answer is obvious.

Like when Fortnite first launched—you were willing to spend 12 hours immersed, chasing every Victory Royale, craving constant wins. That’s obsession.

To invest enough time and energy into on-chain trading, you must reach this state. If your brain doesn’t enjoy it, you’ll never sustain 10+ hours a day doing the same thing repeatedly.

This is the first filter separating those truly capable: either you’re deeply engaged and obsessed, or you quit. It can't be switched on by sheer willpower.

A person logging 3 hours a day just to earn $500 before logging off will always be left far behind by the obsessed—the ones spending 20 hours daily, month after month.

“I don’t get it—what’s the point? What are you trying to tell me?”

I’m telling you: change your mindset. Make trading the center of your life. What’s the first thing you think of when you wake up? Is the first thing you do helping you understand the market better, bringing you closer to victory?

Are you truly giving everything to win this game?

If obsession hasn’t arrived yet, move toward it: use every waking free moment to monitor new contract deployments, study charts, identify patterns.

No matter how tired, boring, or seemingly “useless” it feels now, stick with it for a few weeks. Soon, you’ll find yourself thinking about trading nonstop—even seeing new contracts flash in your mind while watching movies.

Congratulations—you’ve entered the state of obsession.

“I’ve been online 12 hours a day for months and I’m still terrible! This doesn’t work! Stop misleading people—it’s all gambling and luck!”

You’re utterly clueless.

For months, you scanned every new deployment, watched every rising token, yet your average brain failed to notice any exploitable patterns?

Again: change your thinking. How? Start by clearing your mind.

Throw out all your previous stupid assumptions about on-chain trading. Discard your fixed ideas about “money.”

(“Memescope is just gambling! Pure luck! A loser’s game!” These are garbage beliefs—discard them.)

On-chain trading is a game. Dollars are your points.

It’s a business model where you earn points in two ways: either by spotting market asymmetries and inefficiencies before competitors, or by providing services in high-demand niches.

Your core objective should always be: find and target market inefficiencies.

Think! Think! Think! Most people never think before trading—they blindly follow wallet movements, rely on signal groups, acting like helpless losers. Eliminate dependence on anything external. Trust only yourself.

Ask yourself: “What am I seeing that most others haven’t noticed?” “What trends can I foresee that others haven’t spotted?” “Is there such an opportunity in what I’m currently watching?”—If not, walk away immediately.

Eventually, among hundreds of tokens, you’ll spot opportunities most haven’t seen. If you’re wrong, reframe your thinking: you must have misread the information or overestimated the project’s potential. Correct the error, move forward.

Repeat this process until you master identifying lagging pumps perfectly. The easiest, most common opportunities aren’t Musk or Trump tweets—they’re lagging moves you catch earlier than others.

In short, this mindset is the core weapon for recognizing narratives. No matter how long it takes, you must master it.

Obsession is beneficial—at least until it fades. During that time, your inner drive sustains months of brutal screen time.

The only reason obsession fades: lack of results. If someone pours themselves in for months and gains nothing, passion naturally dies.

How to avoid this?

You’ve completed step one: preparing to spend 10+ hours daily in front of a screen for months. Now, how do you ensure actual returns?

The answer lies in how you truly focus.

Under ideal conditions, humans enter a “trance” state: the mind immerses deeply in the current task, begins noticing subtle patterns previously ignored, achieving absolute focus.

Don’t just be “online”—immerse yourself in what you’re observing. Staring at the screen isn’t enough. You need to understand it.

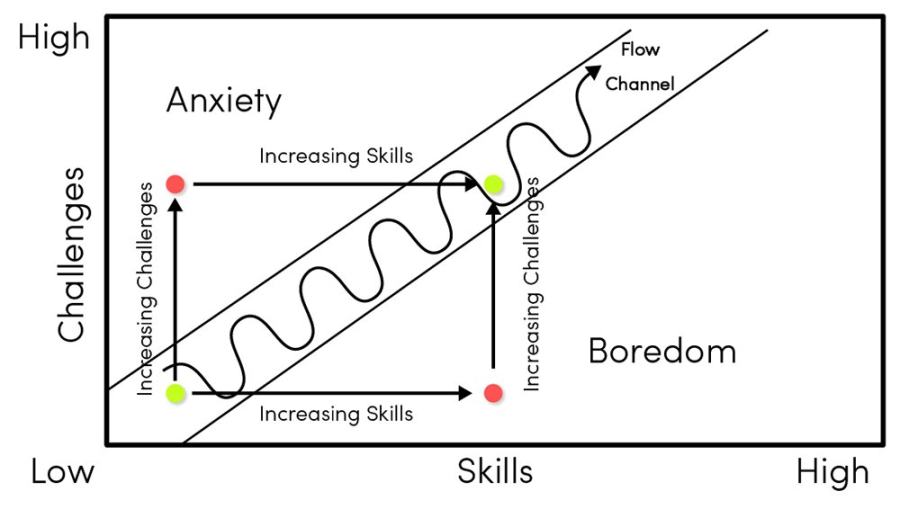

In basic psychology, this is called “flow state.”

Famous F1 driver Ayrton Senna once described his racing focus:

“I no longer consciously drove the car. I operated purely on instinct, as if entering another dimension. I was far beyond my limits, yet kept pushing further. It frightened me, because I realized my state had surpassed rational understanding.”

The first time I experienced flow, I was confused—10 hours felt like 30 minutes. I rapidly scanned all available data, processed information, and instantly thought through the most probable outcomes.

How do you enter flow state?

Set challenges based on your current skill and talent level to maximize concentration:

-

Challenge too easy: you’ll quickly grow bored and lose focus (e.g., a trader averaging $15K–$20K monthly setting a $5K profit goal);

-

Challenge too hard: unrealistic goals cause anxiety, preventing focus (e.g., a $10K-account trader aiming to make $500K in one month).

The right approach is setting realistic goals. For example, a trader with 100 SOL sets a daily target of earning 2.5 SOL—a likely achievable goal. With this target, he focuses on the market with absolute precision because it’s feasible.

In this state, you won’t drift through chaotic markets half-asleep. Instead, you push yourself forward, grasp market essence, and perform beyond normal capacity.

Summary: strive to master the ability to achieve absolute focus. In this state, you’ll detect the most patterns, make the best split-second decisions, and genuinely grow as a trader.

Current Market Landscape and Strategies

Undeniably, on-chain trading is getting harder. Four years ago, simply buying into liquidity-locked tokens could make you money.

But as the market matures, technical indicators are becoming less relevant. Simply put: the more you focus on token metrics (holder count, liquidity, volume, charts), the more misled you’ll be, and the market will seem increasingly chaotic.

The only thing worth consistently monitoring is: how participants react to a token. This has remained unchanged over the past four years. Human emotions stay consistent—and we must exploit that.

Today, the starting point and core of trading is undoubtedly Memescope/Pulse.

People constantly ask about my trading style. Throughout my session, I manually scan every single graduated token, looking for narrative or technical outliers. Any project that seems unique and interesting, I buy a 1–2% position below $200K market cap, then wait and observe.

“Why not trade pre-graduation?” Uncertain. Nowadays, the streaming trend of “buying 5 SOL at $5K MC, selling 12 SOL at $12K MC” is growing popular—it reflects the public’s primitive understanding of on-chain trading.

But I’m certain that sticking exclusively to this style long-term is harmful. You must remain flexible, adapting to both PVE and PVP markets. When top cycles extend from hours to weeks, traders stuck in old habits will struggle, underperforming those who can still spot clear anomalies in PVP environments.

PVP markets don’t last forever, nor do they depend solely on BTC price. The market shifts when capital flows from inexperienced players to skilled ones and harvesters.

“Are volume tools useful? What about wallet tracking?”

I never use volume tools or related “alerts.” Tracking wallets helps understand on-chain activity and trending tokens, but I’ve never blindly copied any trade.

Information overload—using too many tools, tracking too many wallets—is only beneficial for those who can extract valuable signals from noise.

I know traders who track thousands of wallets simultaneously and achieve strong returns because they’ve internalized the behavioral patterns of these wallets.

Regardless, your lifelong task is to root yourself in these platforms, screening every post-graduation pair until you understand what goes up and why. I guarantee that even starting from zero, if you camp and filter tokens daily for two consecutive months, you’ll make massive progress—not necessarily in P&L, but in understanding.

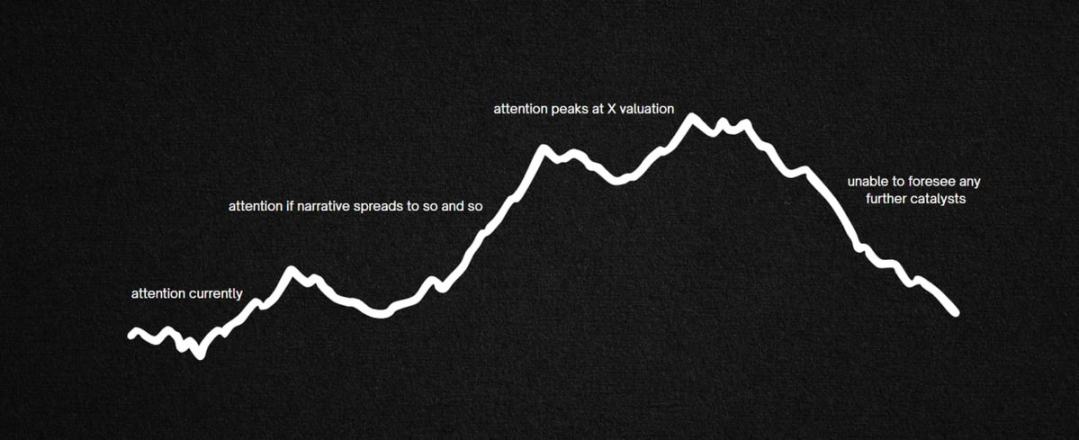

When you suspect a token might pump beyond 5 minutes, conduct a brief but deep analysis: anticipate how others will perceive it, assess how much attention it could attract from this point onward.

I mentally draw an “attention chart”—it doesn’t exist in reality, but you can imagine it.

After formulating a sound strategy, determine your position size (simple rule: the size should make profits feel rewarding and losses survivable), then patiently await results.

If wrong, reassess and exit. If right, congratulations—you saw further than the average participant!

Mastering the ability to discern and interpret market attention—linking attention to price—is how you evaluate value before narrative repricing. I always say: entry, sizing, and exit are technical aspects that can be refined over time. But independently assessing narrative/technical value is critical.

The same applies to tech-based trading. When AI hype exploded, hundreds of projects lingered below $1M market cap for hours or even days before surging to tens of millions. Those who understood their technical value before others captured inevitable repricing early.

A project might sit at $100K market cap for hours while its fair valuation should be at least $5M (based on comparison with established high-market-cap tokens’ metrics/charts)—this is a practical lagging anomaly opportunity.

Sometimes, a token appears promising amid low information but sudden volume spike. I’ll open 1/3 of a normal position first and keep evaluating: if mediocre, exit immediately; if truly strong and not near expected ceiling, add more.

Key takeaway: the core of catching narrative and technical repricing early lies in your ability to read attention inflows and outflows.

“Is news trading worthwhile? What about Musk’s tweets?”

Of course. But many lose money blindly chasing sharp volume spikes and steep price curves.

They won’t even spend 10 seconds thinking: has this news-driven trade already peaked? An old news item from a month ago lacks attention-catalyzing power, whereas Musk’s newly launched pet coin could attract massive attention. I hope you see the difference.

If you want to participate in such trades, you must make rational decisions within 10 seconds: assess value, plan optimal position size and exit point. This is exactly why I emphasize increasing screen time—it’s the only way to sharpen this skill.

The top traders I know build their entire systems around “pre-evaluating narrative value.”

High Engagement Yet Stagnation—Why?

Among experienced traders, the most common reason is lack of accountability. They miss trades they shouldn’t have due to inexperience, yet blame external factors instead of seriously analyzing failures.

Missing obvious opportunities equals losing money—and should be treated as such. Humans naturally excuse their incompetence: “So what if I missed X coin? There’s always next time!” This repeats hundreds of times, each time cushioned by self-comfort. But when you miss something you shouldn’t have, you must be harsh on yourself. Truly feel the loss, understand the flaw, grow from it—don’t ignore it.

I saw this clearly after the Trump trade. Among those who missed it, two reactions emerged: one group completely ignored the failure, stagnant and unmotivated; the other fell into deep despair, unable to focus for long periods. Those who reflected deeply after missing it are now performing the best.

Feeling devastated by failure is a necessary path to growth. You can’t keep saying ignorantly, “There’s always next time.” You must change, so “next time” doesn’t happen again. Yes, excuses bring temporary relief, but without real change, what awaits you months later? Standing still, exhausted.

Is Devoting Part of My Life to This Really Worth It?

I’ll believe until my death: yes, it’s worth it. If you have the ability to adapt your trading strategies multiple times according to market demand, then it’s absolutely worthwhile. For those with small capital but ambition, on-chain trading offers the best opportunity.

I wish I could give you a simple blueprint for success, but no such formula exists. It’s like asking a successful footballer how he scores so many goals. His most detailed answer might simply be: “By kicking the ball near the goal.”

Some people are inherently clueless, never realizing on-chain trading is a mental battle, never understanding they’re competing against thousands of similar minds, needing to learn how others think.

But many of you have potential—you just replace action and commitment with doubt. Don’t waste your ability on an ordinary life.

Dedicate yourself to solving this puzzle. Follow your trading process. Rebuild it multiple times when needed—to win.

Conclusion and Personal Reflection

These are the complete insights into my trading style—I’ve tried my best to precisely describe my mindset in words. It may sound simple, but this is exactly the core behind my extraordinary profits.

I’ve published dozens of technical guides on on-chain trading, but I’ve never truly discussed the psychological aspect—because it’s hard to express in language. Here, I’ve attempted to convey how to achieve focus, and pointed toward where that focus should go.

Undoubtedly, this game is extremely difficult. But don’t be intimidated. Don’t fear the market. Face the challenge head-on. Embrace the puzzle. Enjoy the process.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News