Hotcoin Research | On-Chain Fund Flow Analysis: Whales Keep Accumulating BTC in April—Has BTC Completed Its Bottoming Phase This Cycle?

TechFlow Selected TechFlow Selected

Hotcoin Research | On-Chain Fund Flow Analysis: Whales Keep Accumulating BTC in April—Has BTC Completed Its Bottoming Phase This Cycle?

This article will analyze the trend of large on-chain addresses and traditional financial institutions increasing their BTC holdings, examine the correlation between on-chain capital flows and BTC price movements to assess whether the current market has bottomed out, and conduct an in-depth analysis of multiple on-chain indicators by evaluating the impact of macroeconomic conditions and policies on market sentiment and capital flows.

Author: Hotcoin Research

1. Introduction

In April 2025, the Bitcoin market experienced significant volatility. After a sharp pullback from its Q1 highs, BTC price briefly dropped below $75,000 due to U.S. tariff policy developments, triggering market panic. However, notably, whales continued aggressively buying the dip without showing signs of large-scale sell-offs typically seen during bear markets. Meanwhile, traditional financial institutions accelerated their adoption of Bitcoin, with multiple entities either increasing or initiating BTC allocations.

This report analyzes whale and institutional accumulation patterns, examines the interplay between on-chain capital flows and BTC price movements to assess whether the market has bottomed out, and evaluates how macroeconomic conditions and policies influence market sentiment and capital allocation—offering an in-depth interpretation of key on-chain metrics to forecast market trends.

2. Whale Address Capital Flows

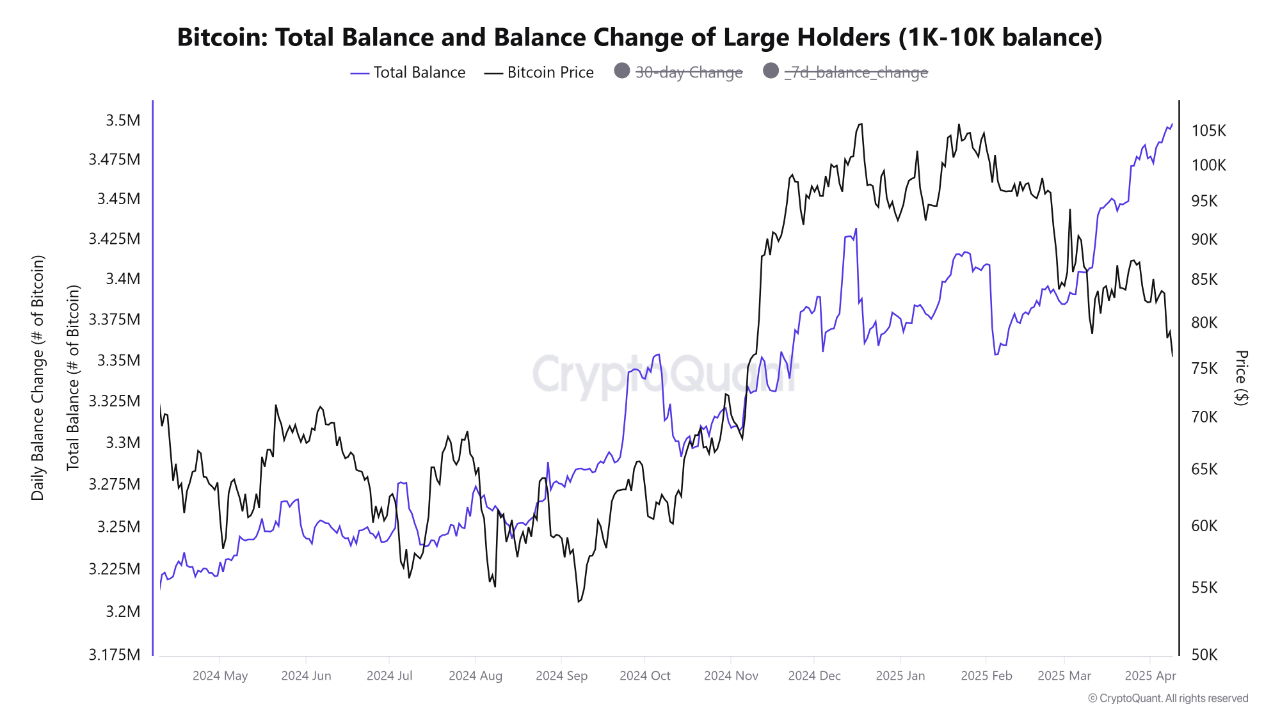

Since March, Bitcoin whale addresses have exhibited clear "buy-the-dip" behavior, seizing this correction to accumulate significantly. BTC is shifting from exchanges and retail investors into whale wallets. The chart below compares the total balance of large holders (1,000–10,000 BTC, purple line) with BTC price (black line) from 2024 to 2025. It shows that as prices declined in March–April, whale balances rose markedly, indicating active accumulation.

Source: https://www.mitrade.com/

Data provided by CryptoQuant analyst caueconomy indicates that whale wallets accumulated over 100,000 BTC during this period. Despite relatively low network activity and cautious retail participation, whales continued systematic buying. This trend pushed the total holdings of large addresses (1,000–10,000 BTC) above 3.35 million BTC, reaching a new interim high. Whales’ counter-trend accumulation is often viewed as a potential signal of market bottoming.

On-chain tracking accounts such as Whale Alert and Lookonchain have repeatedly detected major whale transfers and balance changes in April. On April 11, more than $2.4 billion worth of BTC was withdrawn from U.S. exchange Kraken, suggesting large investors are consolidating exchange-held tokens for long-term self-custody. Another notable whale pattern is “large new wallet accumulation.” In late March, a billionaire-level Bitcoin whale bought 3,238 BTC (~$280 million) within 24 hours at an average price of $86,500. Over the past month, numerous massive BTC inflows into cold wallets have occurred, totaling over 50,000 BTC moved offline by large investors—evidence of strategic accumulation during the downturn.

Overall, whale capital flows in April followed a “net inflow and hoarding” pattern: substantial BTC outflows from exchanges into long-term holding wallets; rising aggregate whale holdings with no signs of panic selling. Instead of reducing positions amid a ~30% price correction, whales increased their BTC exposure—reflecting confidence that the current move is a temporary retracement rather than a structural reversal.

3. Institutional Capital Movements

As Bitcoin gains recognition as digital gold and an inflation hedge, more traditional institutions are joining the ranks of holders. According to data from BitcoinTreasuries, over 80 companies currently hold Bitcoin, based on incomplete statistics.

Source: https://treasuries.bitbo.io/

3.1 Asset Management Funds

In early 2025, several Wall Street giants launched or expanded their Bitcoin-related products. BlackRock, the world’s largest asset manager, saw strong market response to its spot Bitcoin ETF launched in late 2024. In 2025, the fund continued recording net inflows. Reports indicate that BlackRock is not only expanding its Bitcoin position but also entering other assets: on April 10, it purchased 4,126 ETH (~$6.4 million) through its spot Ethereum ETF. On April 15, BlackRock added 431.823 BTC (~$37.07 million) via its Bitcoin ETF IBIT, bringing its total BTC holdings to 571,869.

Beyond BlackRock, financial titans like Fidelity Investments and JPMorgan Chase are also reported to be increasing Bitcoin or derivative exposures. Fidelity launched spot Bitcoin trading and custody services in 2024, and client funds showed new BTC allocations in Q1 2025. Additionally, institutional investors like Grayscale continue holding large volumes of BTC through trust products. The discount rate of its flagship product GBTC narrowed significantly in April, reflecting rising institutional demand.

3.2 Public Companies and Corporations

Strategy remains the publicly traded company with the largest BTC holdings, continuing to raise capital via stock and bond issuance to purchase Bitcoin. According to recent disclosures, Strategy acquired 3,459 BTC between April 7 and April 13 at an average price of $82,618, totaling $285.8 million. As of April 17, Strategy held 531,644 BTC with an average cost basis of approximately $67,556 per BTC.

Moreover, corporate treasury reserves are increasingly allocating to Bitcoin. Consulting reports suggest growing numbers of firms view Bitcoin as a balance sheet reserve asset to hedge against economic uncertainty. Companies like Tesla and Block (formerly Square) have already adopted BTC. While Tesla hasn’t added to its holdings since 2022, it still holds around 10,000 BTC and has not further sold down. Traditional industry players such as Norwegian energy firm Aker have also allocated part of their reserves to Bitcoin, signaling broader acceptance across non-crypto sectors.

Overall, traditional institutional capital is making or has already made significant moves into the Bitcoin market—from Wall Street asset managers to public companies and investment funds. Whether driven by hedging, speculation, or strategic reserve motives, BTC is being integrated into more institutional portfolios. This force provides solid buying support and serves as a key driver behind the ongoing whale accumulation wave.

4. BTC Price Movement and On-Chain Capital Flow Correlation

In recent weeks, Bitcoin prices underwent sharp fluctuations: after hitting an all-time high of $109,000 in January, profit-taking and U.S. tariff policy concerns triggered a ~30% correction, briefly dropping below $75,000. By April 17, prices recovered and stabilized in the $83,000–$85,000 range.

-

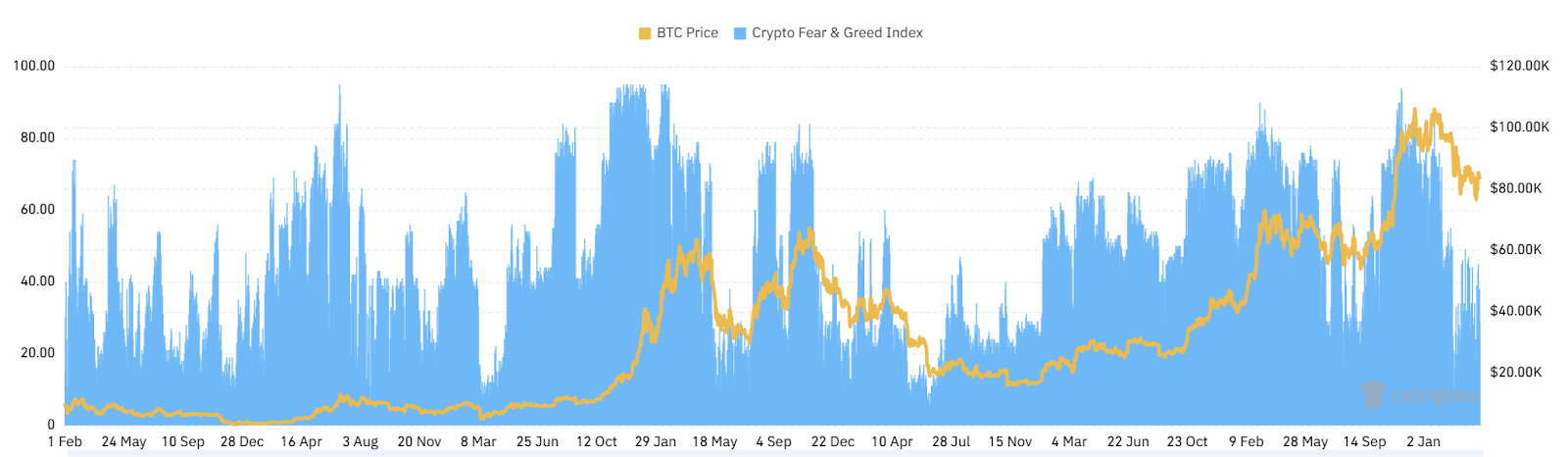

Downtrend Phase (January peak to March trough): BTC fell from $109K to ~$75K by end-Q1, a decline of about 30%. On-chain data revealed net BTC inflows into exchanges during the rapid sell-off (indicating retail panic selling), while whale wallet balances increased as they bought and withdrew BTC from exchanges. Specifically, starting mid-March, exchange BTC balances began declining—signaling net outflows—while stablecoins flowed into exchanges, showing capital exiting falling BTC positions and moving into stablecoins for preservation. Overall, fear dominated sentiment; the Crypto Fear & Greed Index dipped to just 19 (“Extreme Fear”) in early April. Such extreme fear often signals exhaustion of selling pressure.

Source: https://www.coinglass.com/pro/i/FearGreedIndex

-

Bottoming and Rebound Phase (Early April to Present): After breaking below $75K, BTC quickly rebounded above $80K and entered consolidation. During this phase, on-chain flows showed net BTC outflows from exchanges (investors withdrawing coins), while stablecoins surged into exchanges—indicating incoming capital preparing to buy. CryptoQuant data showed that in early April, net stablecoin inflows across global exchanges reached tens of billions of dollars, peaking since July 2023. This means substantial capital entered the market, converted into USDT and other stables, and deposited into exchanges ready to accumulate crypto assets. Indeed, total stablecoin supply grew by ~$30 billion in Q1 2025, surpassing $230 billion again. Tether conducted multiple issuances in April, providing fresh “ammunition” to the market. With capital returning, BTC prices stabilized above $80K, testing support and resistance zones.

The interplay between on-chain data and price further confirms accumulation at the bottom. Approximately 63% of all Bitcoin has remained unmoved on-chain for over a year, one of the highest levels ever recorded—demonstrating strong conviction among long-term holders. Whale accumulation, centralization of supply, reduced exchange liquidity, and capitulation of weak hands align closely with historical cycle bottoms. Unless unexpected macro shocks occur, BTC is well-positioned to resume an upward trajectory and enter a new bull phase.

5. Impact of Macro Environment and Policy

The correlation between crypto markets and macroeconomic conditions continues to strengthen. Whale and institutional capital flows in April were influenced not only by technical price action but also by macro policies and sentiment shifts.

5.1 Fed Interest Rate Policy and Liquidity Expectations

Federal Reserve monetary policy directly affects global liquidity, indirectly shaping capital flows into risk assets like Bitcoin. The aggressive rate hikes and balance sheet contraction from 2022–2023 pressured crypto markets. However, a shift began in late 2024: the Fed initiated rate cuts at its final 2024 meeting, then held steady twice in early 2025, maintaining the federal funds rate at 4.25%–4.50%. At the March 19 FOMC meeting, Powell signaled no rate hikes, lowered growth forecasts, raised inflation expectations, and expressed concern over rising economic uncertainty. The dot plot suggests two rate cuts expected in 2025, bringing year-end rates down to ~3.9%. Additionally, the Fed announced a slower pace of quantitative tightening (QT) starting in April—sending a dovish signal to markets.

These policy shifts are bullish for crypto: peak interest rates and anticipated easing improve liquidity conditions and boost investor risk appetite. Market focus is now on a potential rate-cutting cycle—some institutions (e.g., JPMorgan) speculate the Fed might deliver “aggressive cuts” in H2 2025 if economic weakness intensifies. Such expectations fuel optimism for liquidity-driven rallies, with some analysts drawing parallels to the post-2020 stimulus bull run. Overall, the Fed's pivot provides favorable macro tailwinds for bottom formation, though short-term noise may cause temporary disruptions.

5.2 Global Economic and Geopolitical Factors: Trade Policies, Recession Outlook

Another key macro factor is evolving trade dynamics. Following Trump’s return to the White House, his administration adopted a hardline stance on tariffs. In early April, surprise announcements of sweeping new tariffs spiked global risk-off sentiment and rattled financial markets. However, days later, a 90-day tariff pause was introduced, allowing room for negotiations. This erratic policy caused turbulence in traditional markets, affecting crypto as well. Yet Bitcoin demonstrated some safe-haven characteristics: amid rising trade tensions and equity market declines, whales treated BTC as a store of value and accelerated purchases. This “risk hedging” behavior reflects a mindset shift—increasingly viewing BTC as a macro hedge rather than pure speculative risk asset.

Recession outlooks remain central to macro discourse. The IMF recently downgraded global growth projections, with many economies slowing under high-rate environments. In the U.S., persistent yield curve inversion adds to concerns of a 2025–2026 recession. For crypto, a mild recession isn't necessarily negative—central banks would likely respond with rate cuts or renewed QE, benefiting liquidity-sensitive assets like Bitcoin. However, a severe crisis or systemic financial event could trigger short-term liquidity crunches, prompting broad asset sell-offs including crypto. A repeat of early 2023’s Silicon Valley Bank collapse or European banking stress could undermine confidence and lead to large-scale on-chain dumping.

5.3 Regulatory Landscape

In the first half of 2025, crypto regulation evolved with mixed outcomes: while the U.S. SEC maintained strict scrutiny over altcoins and exchanges, policies around Bitcoin ETFs and institutional reporting became increasingly favorable. For example, following the SEC’s approval of the first spot Bitcoin ETF in late 2024, multiple similar products queued for launch in 2025—facilitating easier entry for traditional capital. This boosted institutional interest in BTC, with ETF inflows effectively increasing indirect on-chain holdings. Europe implemented MiCA regulations, creating clarity that enabled compliant asset managers to begin allocating to Bitcoin.

At the national level, on March 7, 2025, President Trump signed an executive order establishing a “Strategic Bitcoin Reserve,” designating ~200,000 seized BTC as strategic assets and authorizing the Treasury and Commerce Departments to develop budget-neutral strategies to acquire more. El Salvador, the first country to adopt Bitcoin as legal tender since September 2021, continues actively purchasing under President Nayib Bukele’s leadership. Its “Buy 1 BTC Daily” program persists regardless of price. As of March 2025, El Salvador holds approximately 5,800 BTC. Bhutan, through its government-owned Druk Holding & Investments fund, held about 13,029 BTC as of February 2025.

Overall, the current regulatory climate leans mildly positive. Central bank digital currency progress, eased institutional access, and supportive national policies reinforce Bitcoin’s long-term value proposition.

6. Conclusion and Outlook

First, on-chain capital flows—from whales, large institutions, and even smaller investors—display classic bottoming traits: transfer of supply from short-term speculators to long-term value holders. Traditional financial institutions are strategically positioning themselves during the correction, integrating Bitcoin into broader portfolios. Sustained accumulation by BlackRock, Strategy, and others underscores institutional and corporate confidence in BTC’s long-term value.

Second, the alignment between price action and on-chain indicators supports a bottoming thesis: BTC found strong support around $74K–$75K, where a meaningful “value consensus” emerged. Subsequent recovery above $80K and consolidation reflect a process of digesting prior selling pressure and solidifying the base. On-chain activity has moderately increased without overheating, indicating gradual yet rational re-engagement. Over time, this sideways consolidation may complete energy buildup, setting the stage for a new upward leg.

The macro backdrop provides a favorable “tailwind” for bottom formation. The Fed’s pause on rate hikes and expectation of future cuts, along with the Trump administration’s tariff moratorium, have eased systemic risks. Global liquidity appears poised to loosen again, and market sentiment has improved from “extreme fear” to neutral-to-cautious. Historical patterns show that turning points often emerge after periods of deep pessimism.

Still, several variables warrant monitoring. First, new macro shocks—such as escalating geopolitical conflicts or financial crises in major economies—could disrupt the bottoming process and trigger further downside. Second, technical confirmation is needed: only when BTC sustains above the 200-day moving average and clears key resistance levels can the bottom be fully confirmed. Until then, range-bound volatility remains possible. Third, ongoing tracking of on-chain metrics is essential—if whales start offloading or exchange BTC balances surge unexpectedly, caution should prevail.

In summary, multiple signals suggest Bitcoin has largely completed its bottoming phase in April 2025. The market is transitioning from fear toward rebuilding confidence, supported by improving internal and external conditions. With favorable momentum building, BTC is poised to resume its uptrend and reach new highs in the near future.

About Us

Hotcoin Research, the core investment research hub of the Hotcoin ecosystem, is dedicated to delivering professional, in-depth analysis and forward-looking insights for global crypto investors. We offer a triple-layered service framework of “trend analysis + value discovery + real-time monitoring,” providing precise market interpretations and actionable strategies through deep dives into industry trends, multi-dimensional project evaluations, and round-the-clock market surveillance. Backed by our weekly “Top Coin Selection” strategy livestreams and daily “Blockchain Headlines” briefings, we empower investors at all levels. Leveraging advanced data analytics models and extensive industry networks, we help novice investors build cognitive frameworks and enable professional institutions to capture alpha returns—jointly unlocking value growth opportunities in the Web3 era.

Risk Disclaimer

Cryptocurrency markets are highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a rigorous risk management framework to safeguard capital.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News