Amid Tariff Turmoil, Wallet Savings Outperforms BTC HODL Strategy by 16% Despite Market Dip

TechFlow Selected TechFlow Selected

Amid Tariff Turmoil, Wallet Savings Outperforms BTC HODL Strategy by 16% Despite Market Dip

They don't chase excessive profits or promise miracles, but they can give you a sense of rhythm amid turbulence, helping you stay steadily in the game.

The recent crypto market has been a bit unpredictable.

Trump’s tariff threats have turned the market upside down. One day BTC was steady at $85,000, the next it dropped $8,000 overnight, then swung wildly alongside U.S. equities. From its pre-tariff peak of 88,500, it suffered a maximum drawdown of 16%—hardly the behavior expected of a safe-haven asset.

Ethereum hasn’t fared much better, sliding from $2,000 down to $1,500. At this point, anyone running into Vitalik Buterin might ask: when are you guys going to do something?

With prolonged market volatility expected, many investors find themselves stuck in the same dilemma: should they continue HODLing? Watching their portfolio value yo-yo is nerve-wracking. But cashing out entirely risks missing the next bull run if a sudden rally takes off.

Yet between HODLing and exiting, there's a less stressful alternative: participating in low-risk, predictable-yield on-chain financial products—keeping assets productive while earning some yield along the way.

On-Chain Finance Overview

When people hear “on-chain finance,” their first thought is often: open an app, pick a pool, deposit stablecoins, and collect APY rewards?

In reality, different types of on-chain financial products vary significantly in structure and suit different users. For example:

Protocol-interactive products require active user engagement. While highly flexible and decentralized, they’re best suited for experienced DeFi users skilled in strategy composition. Strategy-managed products, on the other hand, cater to those who “understand a bit but don’t want to monitor the market constantly.” Most automated vaults follow predefined algorithms or protocol combinations—offering a “semi-managed, semi-autonomous” middle ground.

But most crypto users lack deep strategic knowledge or the time and energy to actively manage positions. That’s where platform-packaged products come in.

These are essentially “one-click” solutions, with platforms abstracting away complex underlying details. Users don’t need to understand the mechanics—they only need to know “what asset to invest,” “what return to expect,” and “when funds can be withdrawn.” Their key advantage lies in low barriers to entry, short user paths, and ease of use.

However, the most beginner-friendly and “lazy investor”-oriented gateway to such finance may actually lie within crypto wallets themselves.

Wallet-Based Finance Overview

Today, many mainstream wallets have integrated on-chain financial features directly into their interfaces. There’s no need to jump to dApps or verify contract addresses—users can participate with just one click. That said, different wallets offer varying functionalities.

Below are four popular wallets and their financial offerings.

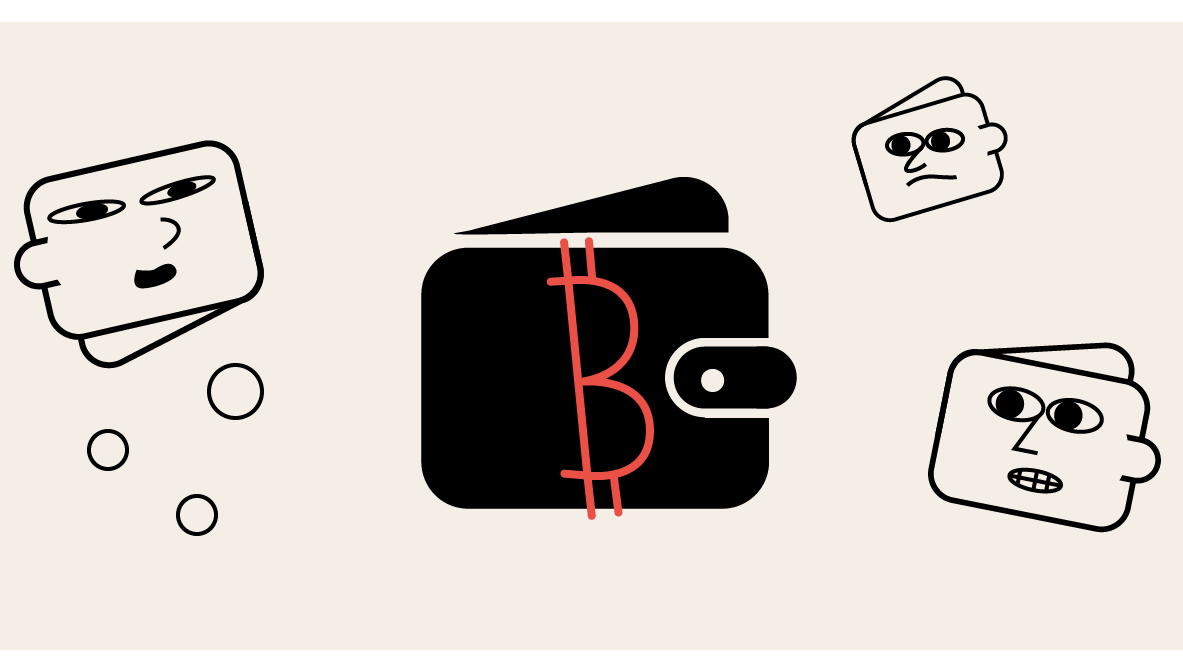

MetaMask

MetaMask functions more like an “on-chain finance connector.”

As the most widely used Ethereum wallet, MetaMask does not natively include a traditional “finance module.” Its only built-in feature is access to ETH staking.

Beyond that, users can visit the MetaMask Portfolio page to interact with major protocols like Lido, Aave, Yearn, and Compound. These remain direct on-chain interactions—MetaMask merely provides a unified interface for display and redirection, handling connection and signature prompts, without encapsulating strategies or designing yield mechanisms.

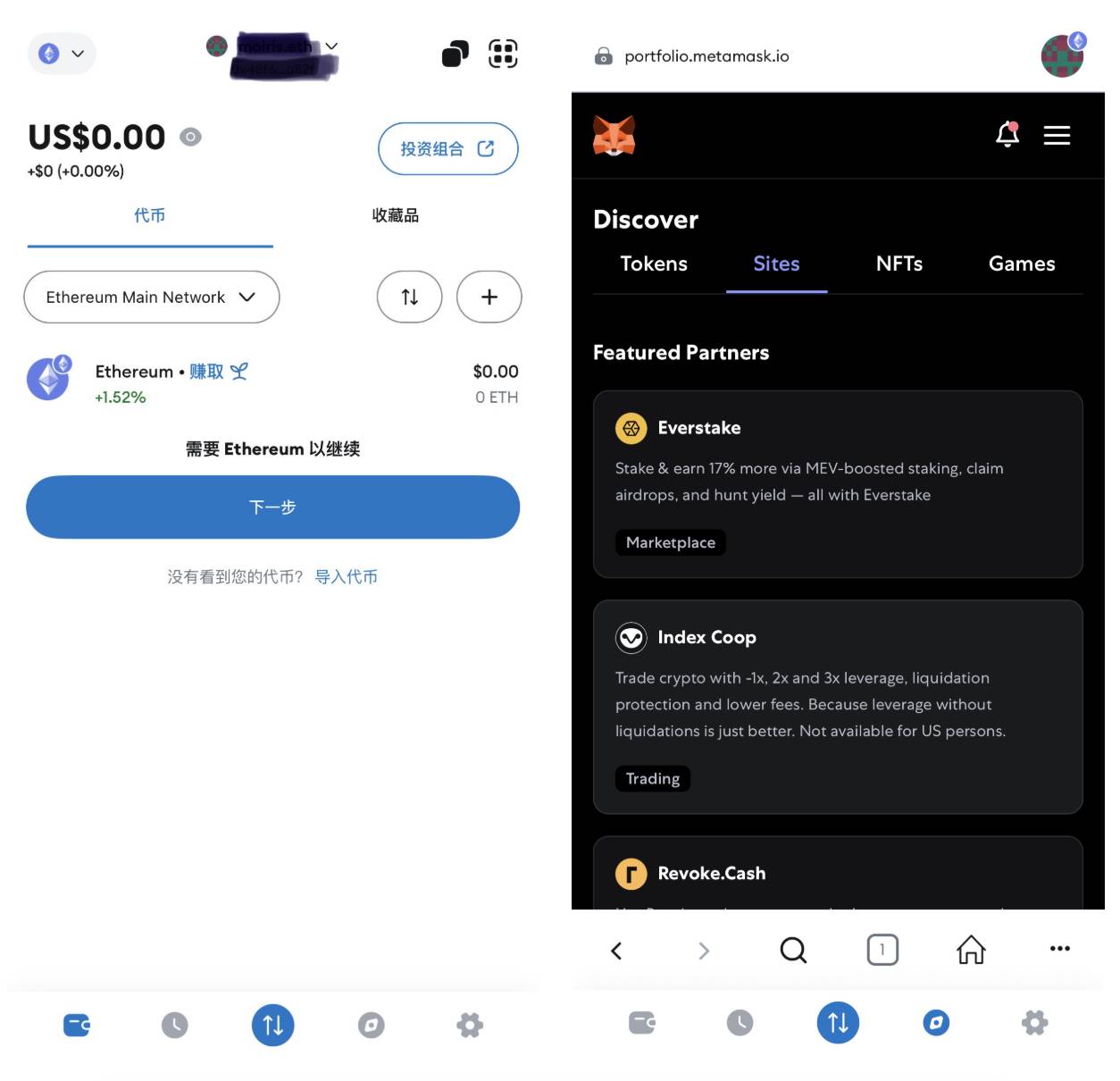

Bitget Wallet

Bitget Wallet is one of the few wallets that has comprehensively packaged the on-chain finance experience.

By navigating to "More Features" on the wallet homepage, users will find a “Finance” section under “Earn,” offering various options from stable returns to project participation. These features are natively integrated by Bitget Wallet—no dApp switching or manual address lookup required. The process is streamlined and intuitive, ideal for users who want their assets working without the hassle.

In terms of financial products, Bitget Wallet currently focuses on stablecoin-based offerings, including flexible savings that allow instant redemption. APY rates dynamically adjust with market conditions, reaching up to 50%. This represents a “low-risk, steady-return” strategy, suitable for allocating part of a portfolio during volatile periods to mitigate frequent price swings. Of course, Bitget Wallet also supports non-stablecoin financial products, covering major assets like BGB, ETH, SOL, BNB, stETH, and TON.

Additionally, Bitget Wallet recently launched its “Hold2Earn” feature—perfect for beginners and passive investors. Simply holding any of 12 supported tokens such as JitoSOL, mSOL, bnsSOL, or weETH in the wallet generates interest income—more convenient and flexible than traditional staking.

Meanwhile, Bitget Wallet regularly launches special on-chain incentive campaigns on its Earn page. Amid the recent tariff turmoil, it quickly introduced a PAXG on-chain gold trading event to meet users’ demand for gold as a hedge—allowing them to purchase blockchain-tracked gold assets while earning additional rewards.

Other examples include the month-long Super DEX “Recovery Program” and Morph Platinum NFT events launched during recent market downturns. These let users earn extra yields through everyday interactions, further lowering the barrier to entry in terms of both learning and participation.

For users seeking broader DeFi exposure, Bitget Wallet also offers API integration. Through the Discover page, users can locate preferred third-party products and access them via the in-app dApp browser.

OKX Wallet

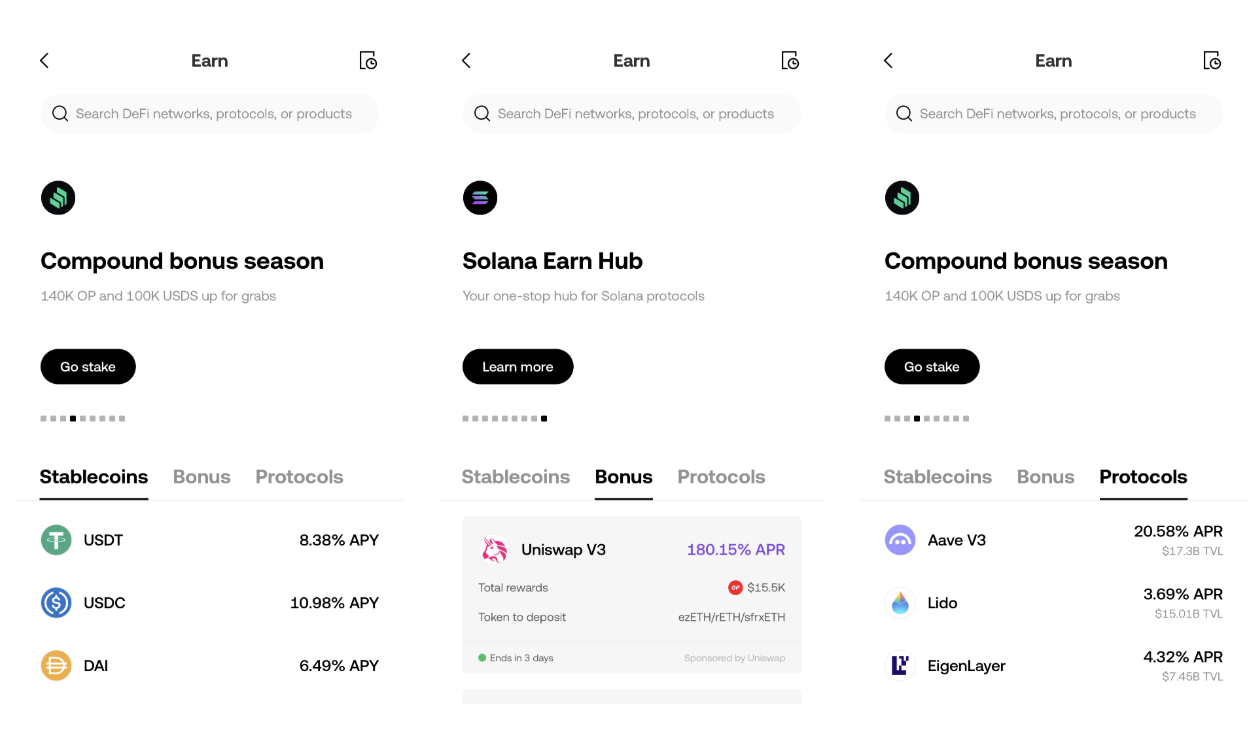

Like Bitget Wallet, OKX Wallet offers well-packaged financial products.

However, unlike Bitget Wallet, OKX Wallet categorizes its financial offerings into three types—stablecoin products, incentivized activities, and DeFi protocols—rather than organizing them by target asset. This means users must explore each category to determine eligibility, making the experience more akin to a “financial supermarket.”

Although most products are provided by third-party protocols, OKX Wallet presents them clearly and streamlines navigation—making it accessible even for users unfamiliar with on-chain mechanics.

Additionally, OKX Wallet includes a Discover page featuring various dApps, serving as gateways for users to access external services.

Trust Wallet

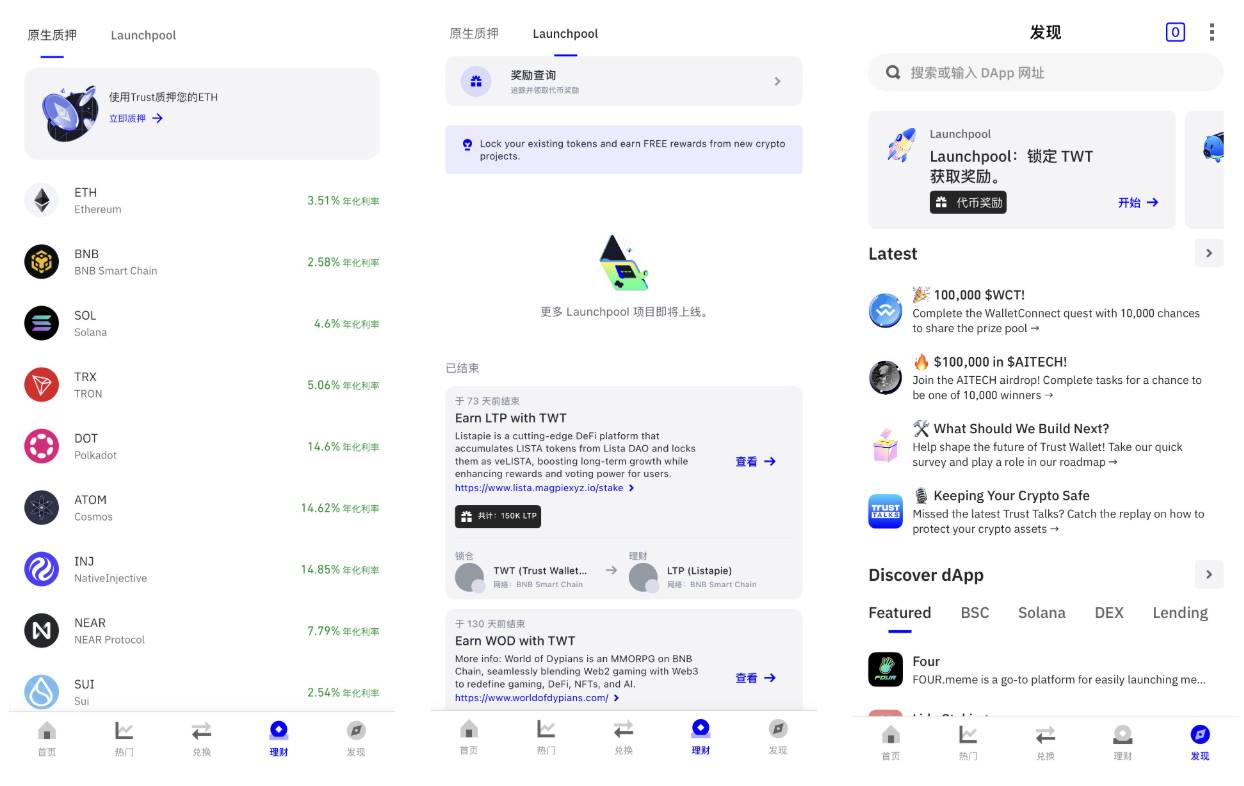

Trust Wallet emphasizes “native staking + on-chain access.”

Navigating to the “Earn” tab in the bottom menu, users see a list of supported staking assets, including major tokens like ETH, BNB, SOL, TRX, and DOT. The staking process is simple, APYs are clearly displayed, and transactions are completed via on-chain signatures—resulting in a lightweight experience without needing to switch to dApps or configure complex settings. Occasionally, Trust Wallet also hosts Launchpool events, allowing users to participate in early project airdrops, though these opportunities are time-limited and competitive.

Through its built-in dApp browser, Trust Wallet also enables access to external DeFi protocols for more advanced strategies such as lending, liquidity provision, and yield farming. However, these are merely API integrations—Trust Wallet acts solely as an “entry provider,” without further abstraction or packaging.

In summary, earning and staking features have become standard in mainstream wallets, yet differences in positioning and functionality remain. For most users, a wallet with comprehensive features, simple operations, diverse options, and regular incentive campaigns—such as Bitget Wallet—may be the ideal choice.

Conclusion

Sometimes, the market isn't simply about rising or falling, and your choices don’t have to be all-in or all-out.

The real challenge lies in finding a comfortable middle ground amid uncertainty—a way to keep your assets active without being driven by emotion.

On-chain finance, especially these wallet-integrated financial products, might just offer that balance. Platforms like Bitget Wallet and OKX Wallet, with higher levels of product integration and richer functionality, align perfectly with current user needs. They don’t chase excessive gains or promise miracles, but instead provide a sense of rhythm during turbulence—helping you stay steadily in the game.

No one knows when the next cycle in crypto will arrive. But what determines whether you’ll be around to catch it isn’t market timing—it’s whether you’ve found a way to keep participating, consistently.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News