From Incentivizing Innovation to KOL Marketing: A Moonshot User Growth Case Study

TechFlow Selected TechFlow Selected

From Incentivizing Innovation to KOL Marketing: A Moonshot User Growth Case Study

This article explores the pivotal role of cryptocurrency payment solutions in driving the growth and broader adoption of the crypto ecosystem, fundamentally revolutionizing user experience and lowering the barriers to blockchain technology.

Author: Oak Grove Ventures Research Team

Introduction

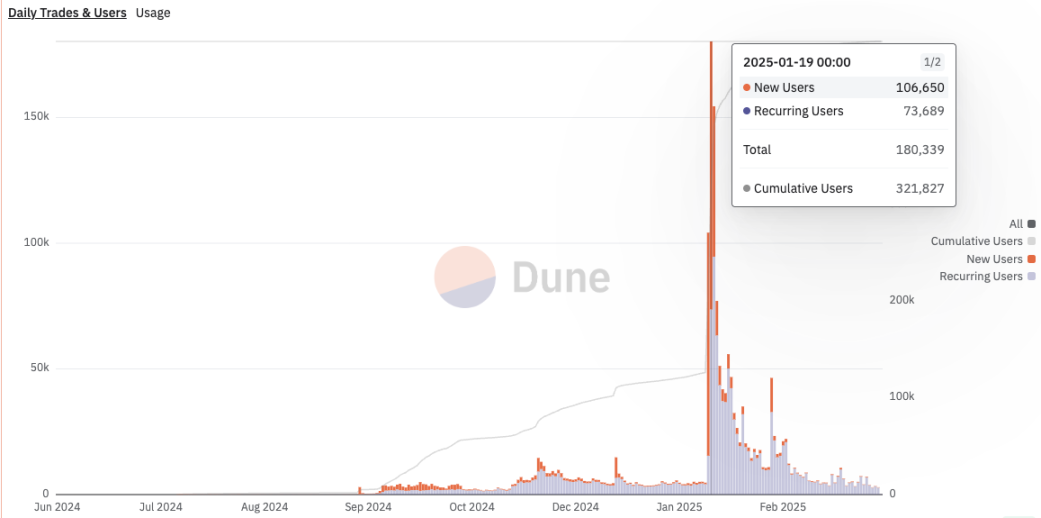

This report analyzes the growth strategies and mechanisms behind Moonshot, a cryptocurrency platform that achieved rapid user growth within its niche and gained strong market traction. By examining how each platform succeeded—from leveraging KOL influence and focusing on product innovation to designing incentive-based ecosystems—we gain insights into building sustainable growth models in Web3 and the memecoin space, ultimately paving the way for continuous innovation and user-centric economic systems.

The Relationship Between Crypto Payments and User Acquisition

Crypto payments are particularly effective in driving user adoption because they simplify traditionally complex blockchain interactions such as wallet setup, private key management, and cumbersome transaction processes. Additionally, convenient fiat deposit features enable a seamless transition from traditional finance to crypto, significantly lowering entry barriers and making it easier for new users—especially those unfamiliar with crypto technology—to actively participate in blockchain platforms.

Kaito is an excellent example of using payment functionality for user acquisition. Serving hedge funds, traders, researchers, and developers globally, Kaito demonstrates how seamless crypto payments can drive growth. To find a scalable recurring payment solution, Kaito adopted Loop to eliminate manual billing, saving time and reducing operational costs. By integrating Loop with Stripe, Kaito now supports both fiat and crypto subscriptions—covering Ethereum, Polygon, BNB Smart Chain, Optimism, Arbitrum, and Base—allowing users to choose their preferred payment method while helping Kaito expand its global reach.

Protocols like AEON further enhance the accessibility and utility of crypto payments. AEON allows payers to use crypto assets from any blockchain or trading account to settle transactions in the recipient’s preferred chain or fiat currency, streamlining the user experience and broadening digital asset applications. Since its launch last year, AEON has integrated with nearly 100 partners, including 4meme, Bitget Wallet, and TON, and currently enables payments to over one million offline merchants across Southeast Asia. Its widespread integration shows that effective crypto payment solutions can significantly boost user adoption by enabling seamless transactions across diverse ecosystems.

Moreover, the protocol’s current integration with AI agents opens new possibilities for automated financial interactions. This includes empowering autonomous agents to complete real-world payment tasks such as booking hotels, buying groceries, ordering coffee, and arranging deliveries. These developments align with the trend of AI-driven financial agents. Platforms like Coinbase’s AgentKit, integrated with OpenAI’s Agents SDK, equip AI agents with on-chain wallets, enabling them to conduct secure, internet-native financial transactions. This integration allows AI agents to autonomously manage service payments, access premium data sources, and interact with decentralized finance (DeFi) protocols, improving operational efficiency and user experience. Similarly, in the decentralized physical infrastructure network (DePIN) space, projects like Helium Mobile have partnered with Sphere to offer users the option to pay for mobile plans using various cryptocurrencies. By linking supported wallets such as Phantom, Coinbase, and Solflare, users can prepay for a full year of service, increasing the flexibility and practicality of using crypto for essential services. The convergence of AI-powered payment agents with simplified crypto payment protocols like AEON highlights the growing synergy between emerging technologies, creating more efficient and user-friendly crypto payment systems for global users.

Growth Case: Moonshot

Moonshot is a Solana-based application designed to simplify memecoin trading and lower the barrier to entry for mainstream users into the crypto market. Moonshot’s core competitive advantage lies in its deep understanding and precise targeting of the memecoin market, along with its convenient fiat on-ramps via Apple Pay, credit cards, and PayPal—making it easy for users to convert fiat into crypto.

1. Early Influence from KOLs

Prominent KOL Murad (MustStopMurad) was instrumental in driving organic traffic during Moonshot’s early stages:

Murad’s Endorsement: In July, Murad expressed strong bullish sentiment toward Moonshot on Twitter, sparking a surge in attention. His influence grew further in September after delivering a keynote titled “Memecoin Supercycle” at the Token2049 summit in Singapore.

Riding the Memecoin Wave: Around the same time, Murad promoted "SPX 6900," whose market cap surged from under $9 million to $900 million. Moonshot had already listed the token ahead of this rally, establishing its reputation as a platform capable of identifying high-potential tokens early.

By aligning with top-tier KOLs and listing promising tokens in advance, Moonshot positioned itself as the go-to platform for high-growth memecoins.

2. Growth Through Popular Memecoin Projects

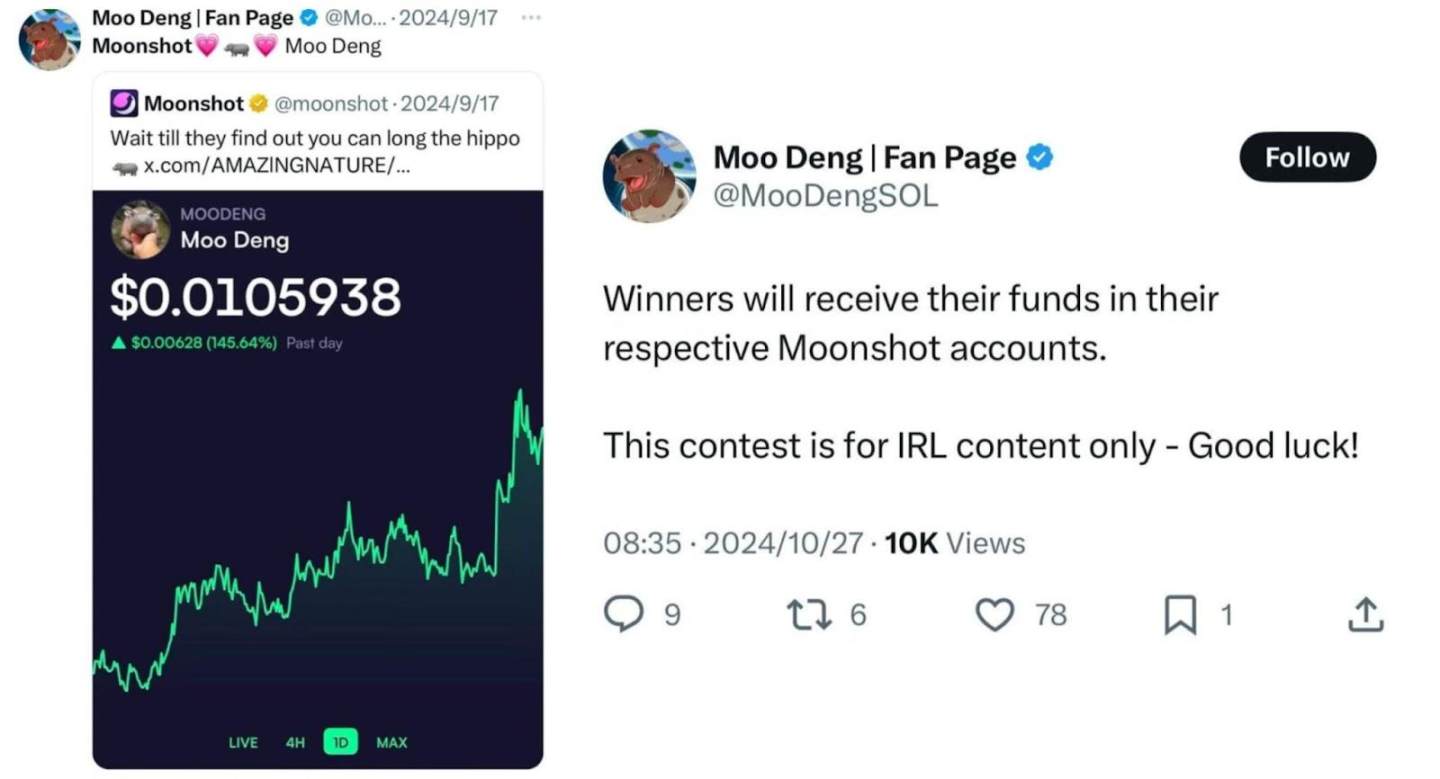

Moonshot broke through its initial user base following the price surge of $MOODENG:

-

Listing Effect: After $MOODENG’s price began rising sharply, Moonshot actively promoted the success across its official social channels, highlighting record-breaking trading volumes and surging token prices.

-

Community Co-Marketing: The official $MOODENG Twitter account responded in kind, frequently recommending Moonshot as the preferred platform to buy the token. This organic co-marketing further boosted Moonshot’s visibility and credibility.

By consistently listing “breakout” memecoins ahead of their rise, Moonshot became known as an early discovery platform, attracting new projects seeking listings and encouraging communities to trade on Moonshot.

3. Official Interaction with KOLs

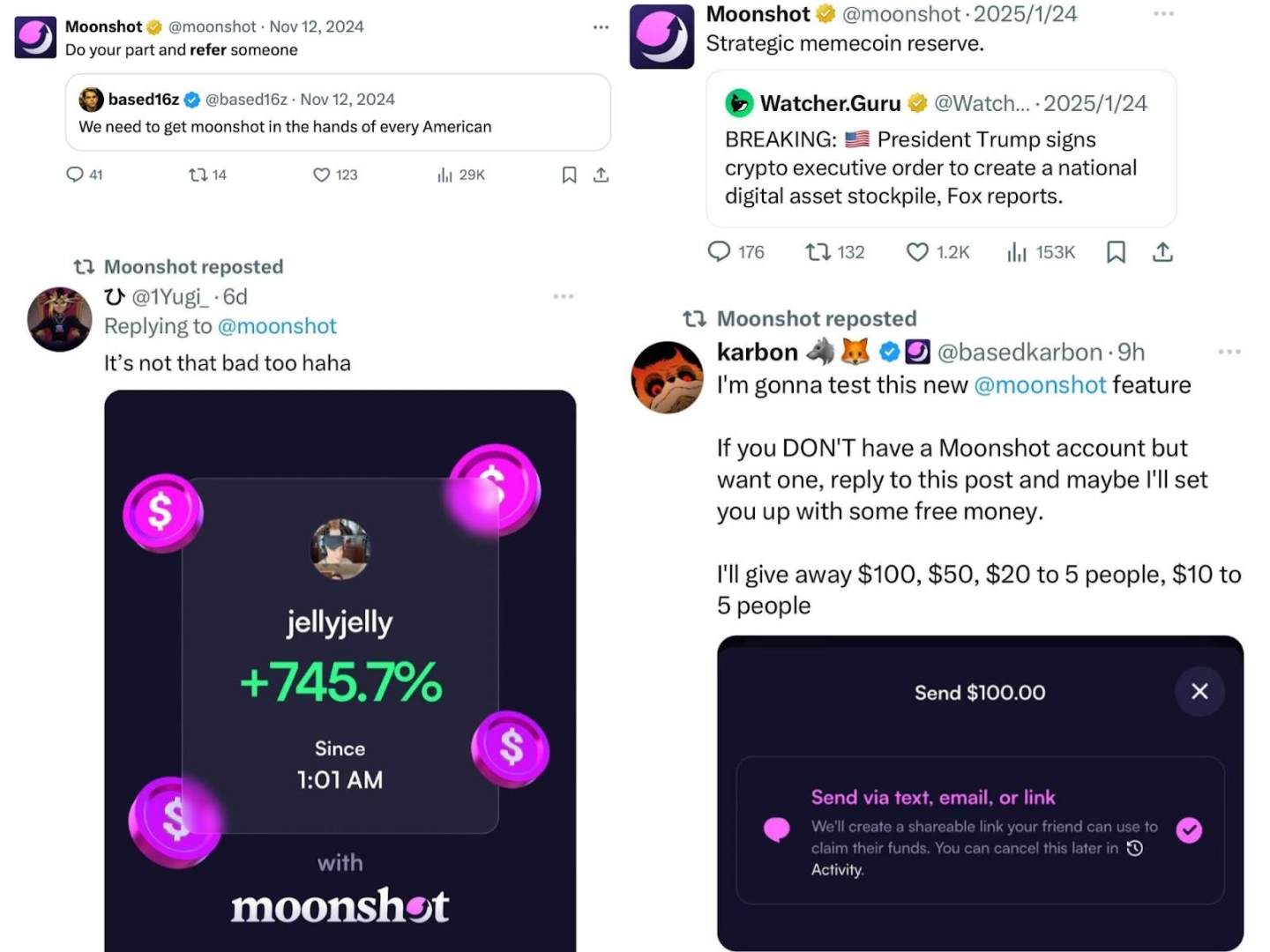

Moonshot’s Twitter strategy focuses on amplifying community and KOL content:

-

Sharing KOL Posts: Frequently retweeting and commenting on discussions about Moonshot by influencers.

-

Giveaway Campaigns: Running giveaways to attract new users.

-

Showcasing Profits: Highlighting screenshots of large user gains to emphasize success stories.

-

Engaging Trends & Community Support: Participating in trending market conversations and fostering a supportive environment for newcomers.

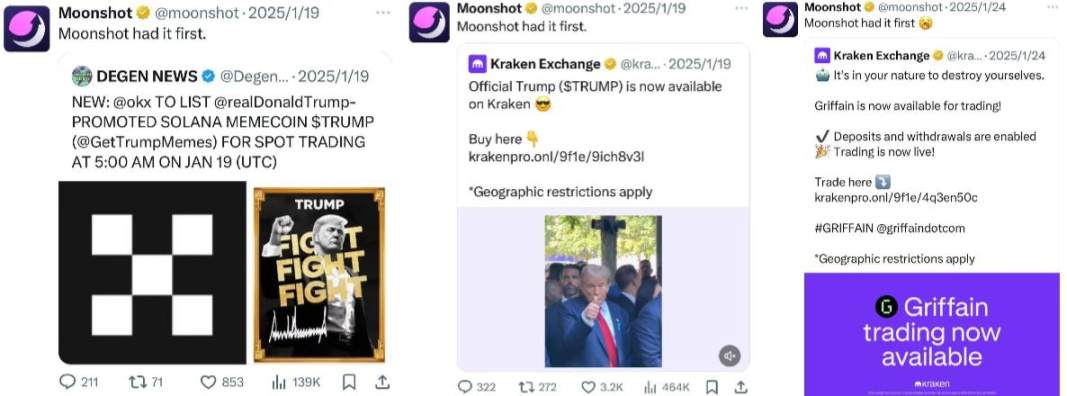

4. “Moonshot Had It First”

A simple yet clever strategy: Moonshot often retweets announcements from competitors or partners with the tagline “Moonshot Had It First.” This subtle messaging positions Moonshot as a pioneer, effectively highlighting its track record of early innovation and first-mover advantage, reinforcing its image as the original leader in the space.

5. User Acquisition Tactics

5.1. App Referral Rewards

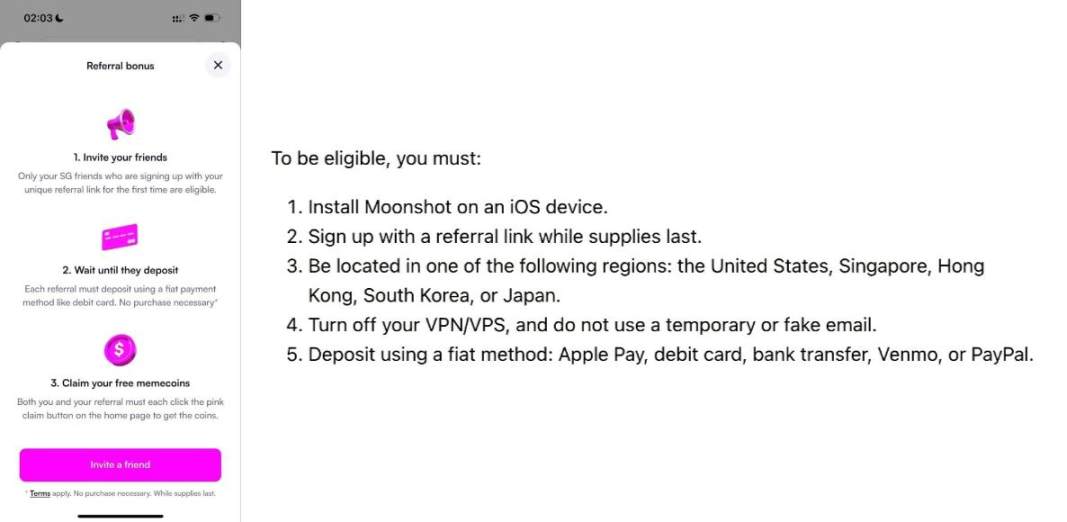

Moonshot offers referral rewards of up to $100, subject to the following conditions:

-

Geographic Restrictions: Available to users in the U.S., Singapore, Hong Kong, South Korea, and Japan.

-

Deposit Requirement: Users must make a minimum fiat deposit of $20 to qualify for the reward.

-

Claim Process: Both referrer and referee must click the “Claim” button to receive free memecoins.

While the referral program appears straightforward, the $20 deposit requirement ensures only genuinely engaged users claim rewards, filtering out low-intent sign-ups.

5.2. Social Media Referral Incentives

Moonshot encourages users to share referral links on Twitter, offering a 50% share of the referee’s trading fees as a reward. This campaign also attracted support and amplification from KOLs.

5.3. Reddit Rumors

Some Reddit discussions claimed users could receive $3–$100 without depositing, just by registering. Though unverified, these rumors increased platform awareness and curiosity. However, official documentation later confirmed the $20 deposit requirement.

Key Takeaway: By combining high-value incentives with a deposit threshold, Moonshot ensures high-quality user growth and filters for genuine traders.

6. Partnership with MoonPay – Third-Party Payment Integration

6.1. Removing Technical Barriers: Simplifying Fiat-to-Crypto Conversion

Moonshot’s integration with MoonPay enables seamless fiat deposits via Apple Pay, credit cards, and PayPal, effectively bridging Web2 and Web3 ecosystems. This eliminates friction associated with complex blockchain processes such as wallet setup, gas fee management, and private key storage.

According to Gate.io Learn analysis: “User growth structure: Of 204,000 new users, 83% completed their first deposit via Apple Pay/PayPal, with an average deposit amount of $420.” This data underscores the dominance of Web2-friendly payment methods in attracting non-crypto-native retail investors—particularly those interested in memecoin speculation but deterred by traditional blockchain complexity.

MoonPay’s integration allows Moonshot to onboard users unfamiliar with blockchain, mirroring the simplicity of traditional payment apps like PayPal. This is crucial for attracting retail investors seeking low-barrier access to memecoins.

6.2. Fiat Dominance in Trading Volume

Fiat transactions form the backbone of Moonshot’s trading activity, especially during high-profile memecoin launches:

Example of $TRUMP:

Within 12 hours of $TRUMP’s launch, Moonshot saw a surge in new users, with $400 million in fiat deposits flowing through MoonPay—an all-time platform record. This accounted for approximately 65% of Moonshot’s historical trading volume during the event.

At the peak of $TRUMP activity, weekly trading volume reached $1.73 billion, with fiat transactions representing over 80% of total inflows.

Overall Trend:

On average, 60–70% of Moonshot’s daily trading volume comes from fiat purchases, particularly evident with popular memecoins like SPX6900 and GOAT.

6.3. Liquidity Assurance During Demand Spikes

Demand surges highlighted MoonPay’s critical role in maintaining liquidity on Moonshot. When $TRUMP purchases depleted crypto reserves on the platform, MoonPay secured an emergency loan of $160 million ($100 million from Galaxy Digital, $60 million from Ripple) to prevent transaction failures during the explosive launch of $THUMP on Solana.

MoonPay initially estimated demand at $50 million but doubled its request to $100 million after trading volume spiked unexpectedly, ensuring uninterrupted transactions for 750,000 new users. Once traditional banking operations resumed, MoonPay repaid the loan, solidifying Moonshot’s reputation as a reliable, retail-friendly platform capable of seamless fiat-to-crypto conversion even during high-volatility events.

Summary and Conclusion

Moonshot leveraged KOL-driven marketing and community-centric strategies to fuel rapid growth. However, its core approach stands out:

Growth Insights:

-

KOL-Community Synergy: Strategic partnerships with influential KOLs or reciprocal promotions with trending projects can accelerate brand visibility.

-

Incentivizing Quality Users: Setting meaningful thresholds—whether through deposits or content quality—or offering targeted rewards ensures higher user engagement.

-

Showcasing Success Stories: Highlighting real user wins builds trust and attracts media attention.

-

Scaling Through Ecosystem Tools: Features like voting platforms, referral systems, and OTC markets foster deeper engagement and self-sustaining user adoption cycles.

-

Integrating Fiat Payments: Simple fiat on-ramps (e.g., Apple Pay, credit cards, PayPal) drastically lower entry barriers for users unfamiliar with blockchain, accelerating broader adoption.

-

Enhancing Convenience with Automated Crypto Payments: Crypto-based subscriptions and automated transactions improve UX and appeal to crypto-native users who prefer direct on-chain payments.

-

Token Incentives: Offering token rewards and crypto-based participation incentives increases user retention, engagement, and long-term loyalty.

In conclusion, Moonshot’s success underscores the importance of innovative incentive design, strong influencer (KOL) backing, seamless crypto payment solutions, and authentic community engagement in driving sustainable growth. By combining these strategies, emerging projects can replicate—and potentially surpass—the rapid expansion seen in this case study, further enriching the broader Web3 landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News