Decrypting Moonshot's listing data: 50% doomed to zero, TRUMP token emerges as top moneymaker

TechFlow Selected TechFlow Selected

Decrypting Moonshot's listing data: 50% doomed to zero, TRUMP token emerges as top moneymaker

116 tokens listed in the past three months, 68 nearly down to zero, one-third peaked at launch.

Author: ChandlerZ, Foresight News

Since its launch, Moonshot has quickly risen to prominence by focusing on the Meme coin ecosystem, even being hailed by some industry insiders as the "Binance of the Meme world." Amid an overall relatively sluggish trading sentiment, the data from Moonshot's listings—reflecting price movements, market cap trends, and development status of various projects—still provides crucial insights into understanding the Meme ecosystem.

In short, Moonshot is a Meme trading platform built on the Solana blockchain, lowering the barrier for ordinary users to enter the crypto market through a highly simplified registration and trading process. The platform supports multiple fiat on-ramp methods such as Apple Pay, credit cards, and PayPal, and also enables fast and convenient asset withdrawals. During the Meme coin craze in the second half of 2024, Moonshot successfully attracted users by swiftly identifying and listing popular tokens.

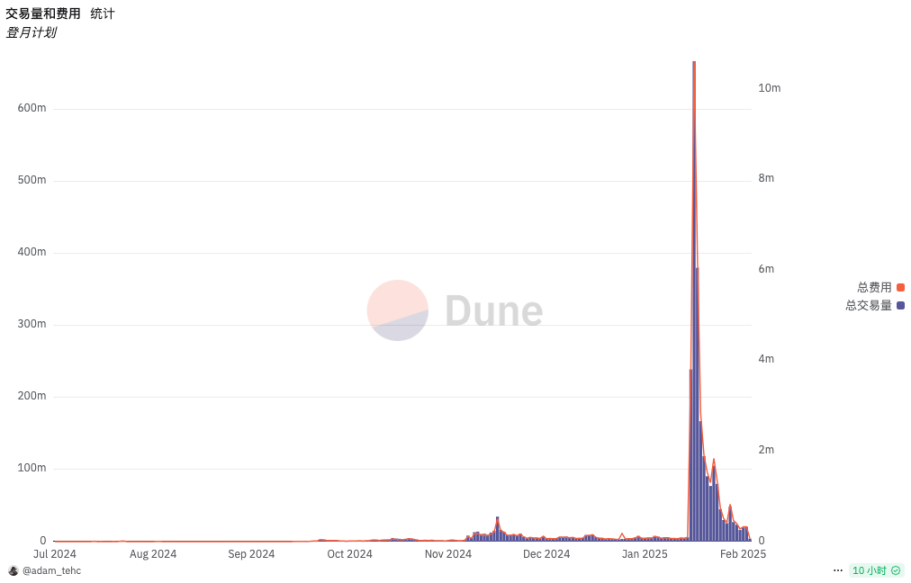

Dune data shows that throughout 2024, Moonshot’s trading volume and transaction fees exhibited steady growth, with daily trading volumes hovering around tens of millions of dollars and an average of 3,500 to 4,900 daily unique traders. This trend shifted dramatically when former U.S. President Trump launched his personal Meme coin TRUMP on January 18, 2025. After Moonshot listed TRUMP and Trump officially promoted the token via Twitter, enthusiasm surged.

According to official figures, within 12 hours of being recommended as a purchase method on TRUMP’s official website, Moonshot processed nearly $400 million in trading volume, breaking records for fiat onboarding and attracting over 200,000 new users.

As TRUMP and the broader market cooled down, Meme coins experienced widespread corrections and price volatility. How real was Moonshot’s wealth-generation effect? We attempt to answer this by deeply analyzing the actual performance of tokens listed on Moonshot over the past three months, examining the state of this emerging trading platform and the underlying market conditions behind this phenomenon.

116 Tokens Listed in March, 68 “Nearly Zeroed,” One-Third Peaked at Launch

In this article, we selected tokens listed on Moonshot between November 2024 and January 2025 as our research sample, with data sourced from the “Moonshot Listings” account’s record of listing times.

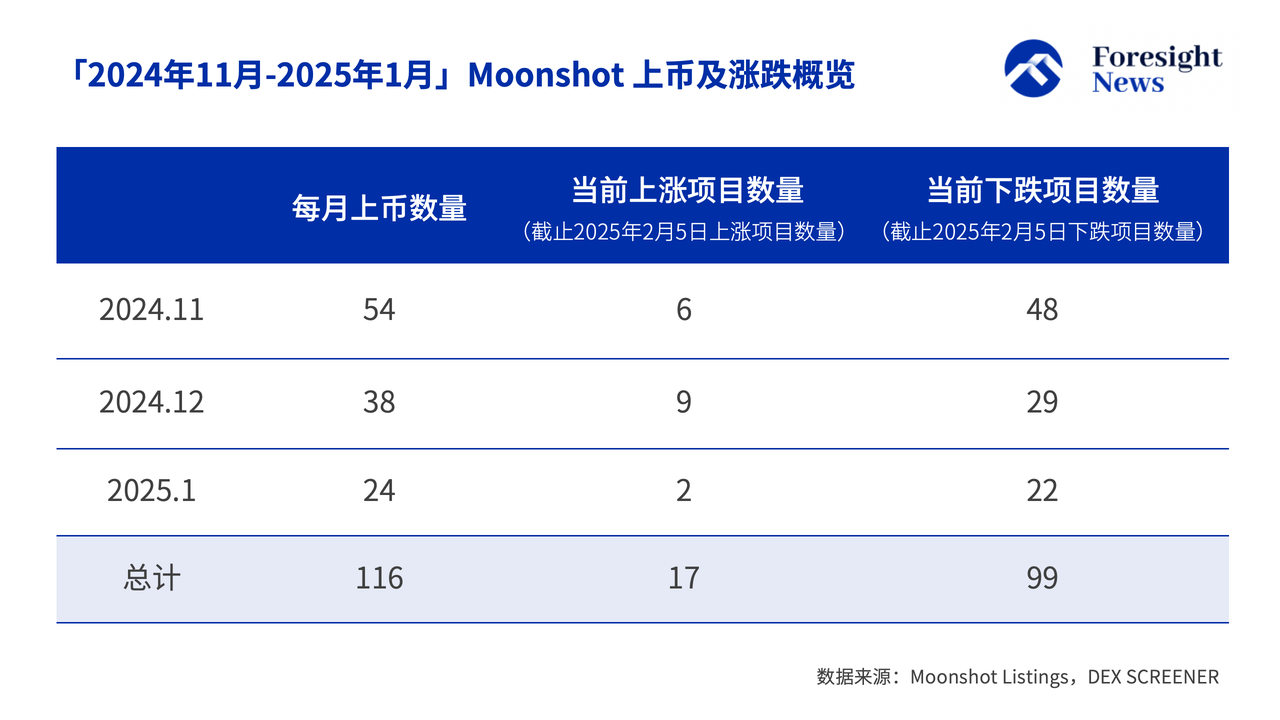

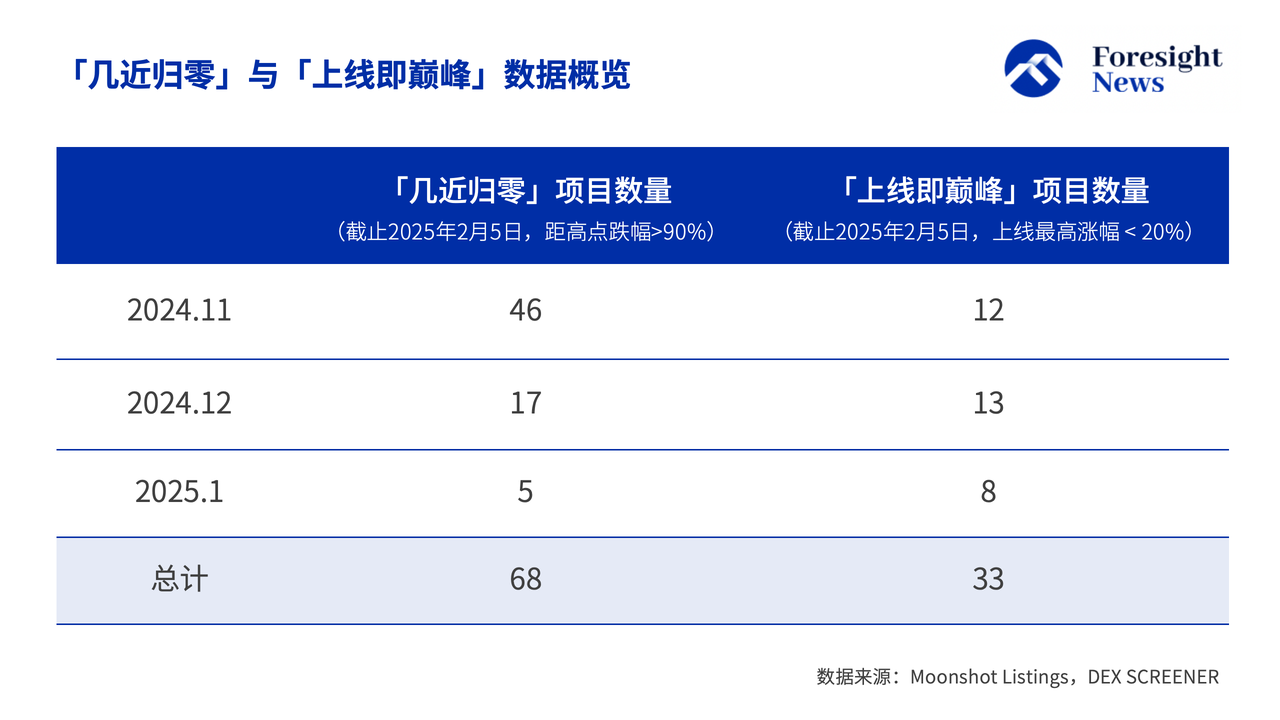

The overall data is shown in the chart below:

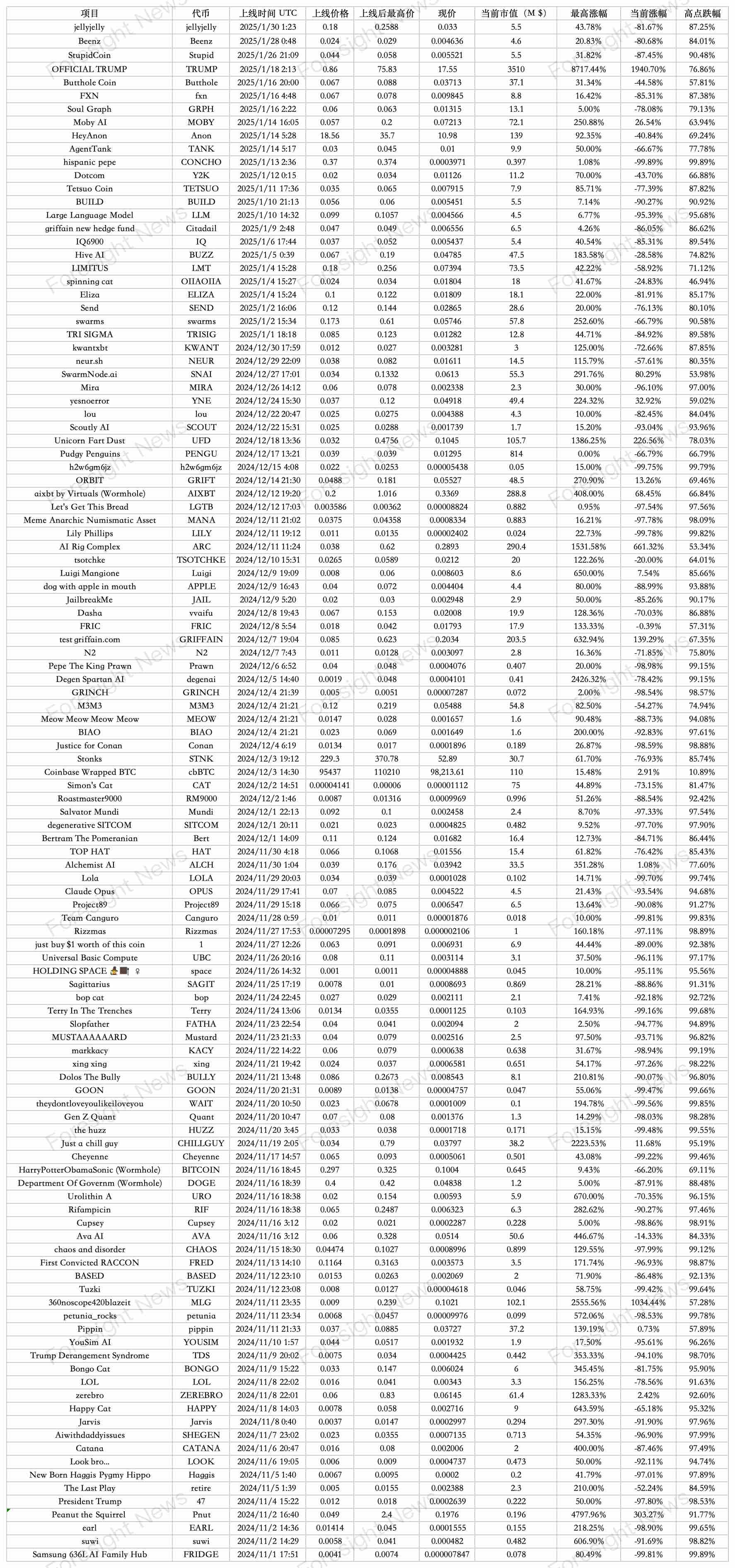

Data from “Moonshot Listings” indicates that during these three months, Moonshot listed 116 tokens: 54 in November 2024, 38 in December, and 24 in January 2025.

Further analysis reveals that under current market conditions, only 17 out of the 116 listed tokens are trading above their listing prices—a ratio of less than 15%. The vast majority of projects are now in a downtrend, with over 85% experiencing price declines.

Given that most Meme coins eventually go to zero, we attempted an objective calculation. Projects defined as “nearly zeroed” are those whose current price has dropped more than 90% from their all-time high after listing. According to this standard, 46 projects met the criteria in November, 17 in December, and 5 in January 2025, totaling 68 projects—or over 58.6% of the total. This number vividly reflects how most tokens rapidly lose market support after initial hype.

Meanwhile, we found that projects categorized as “peaked at launch”—those whose highest post-listing gain was less than 20%—numbered 12, 13, and 8 across the three periods, totaling 33 projects, or nearly one-third of the total. This suggests that close to a third of the projects had already reached near their historical highs upon debut on Moonshot, then quickly lost upside potential due to lack of sustained fundamentals or weakening market confidence.

40% of Tokens Doubled Post-Listing, TRUMP Dominates Capital Inflows

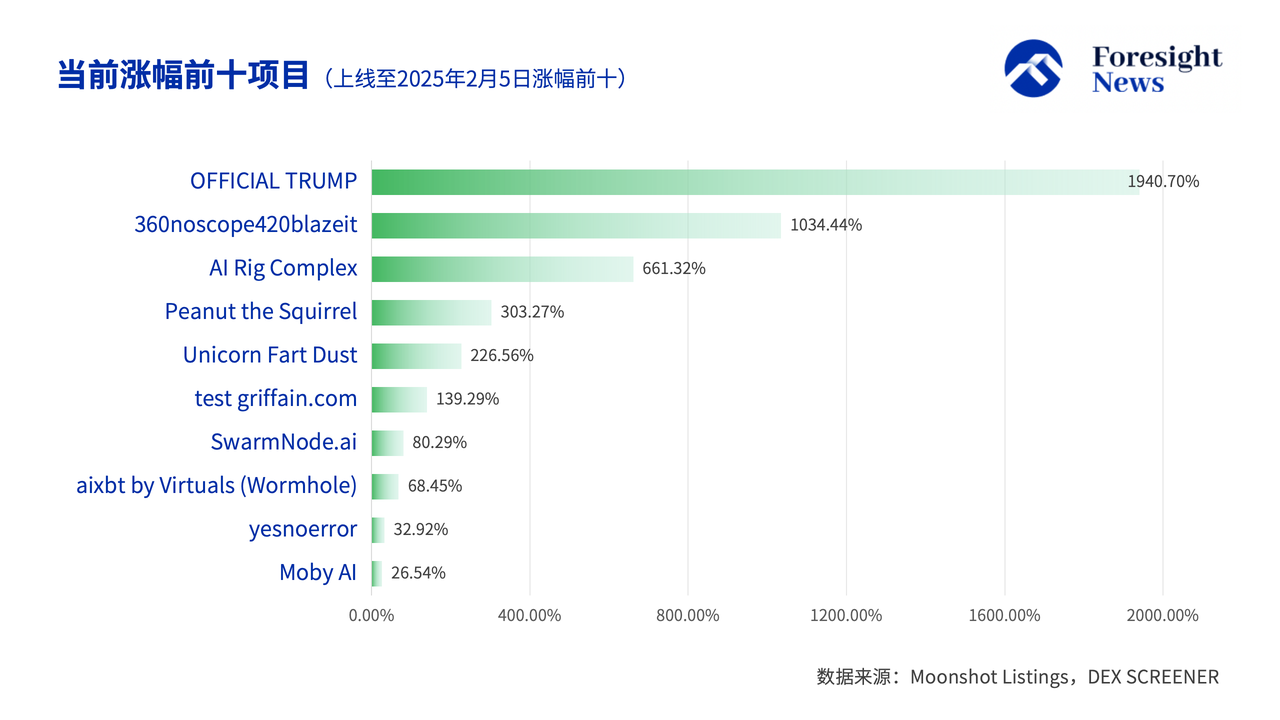

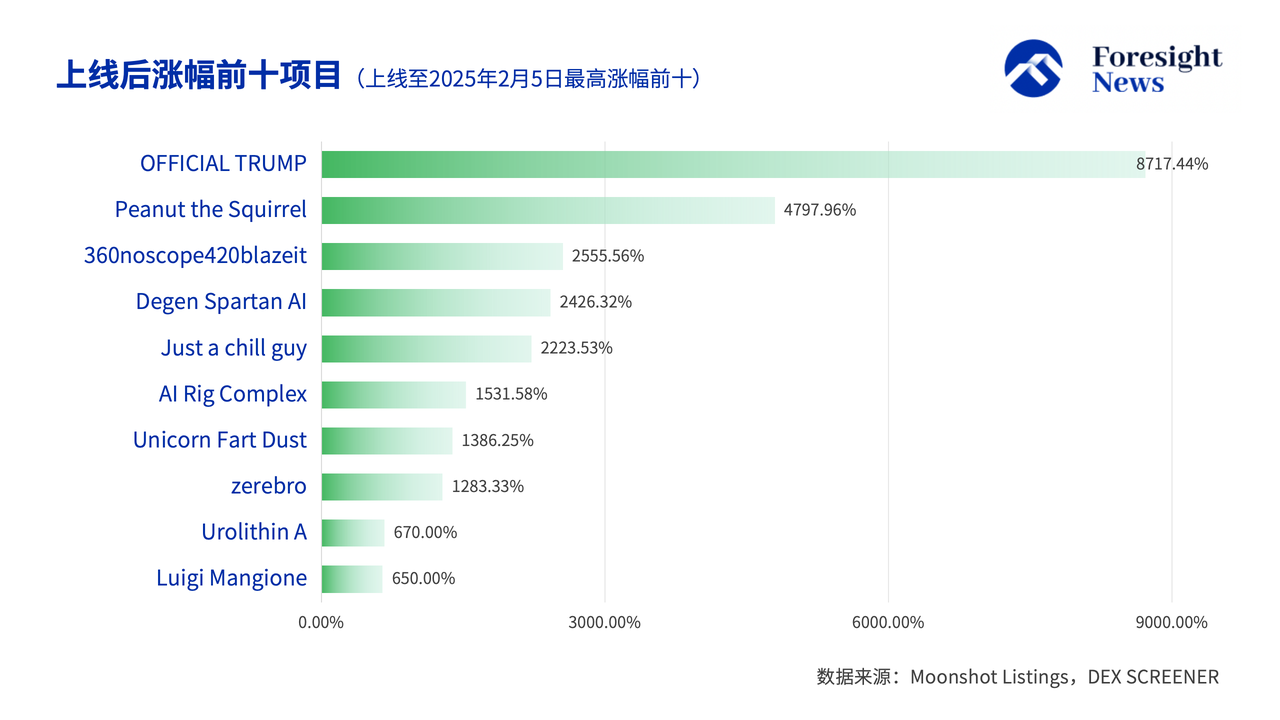

Approximately 40% of the tokens at least doubled in price after listing, indicating strong initial market enthusiasm and speculation. Data-wise, the top performers both in terms of peak gains and current gains show some overlap, with certain tokens leading in both historical highs and current valuations. Due to its unique political context, TRUMP stands clearly dominant.

PNUT and 360noscope420blazeit (MLG) achieved gains of 4797.96% and 2555.56% respectively, while degenai, CHILLGUY, and several others surpassed the 20x threshold. These figures indicate that under extreme market sentiment and short-term speculation, some tokens received extraordinary attention and speculative capital, creating sharp price spikes.

However, compared to their historical peaks, the current gains of the top-performing tokens appear relatively modest. Currently, TRUMP’s gain stands at 1940.70%, far below its peak; similarly, MLG and AI Rig Complex (ARC) are at 1034.44% and 661.32% respectively—both significantly off their highs—while Moby AI, ranked tenth in current gains, has only risen 26.54%. This gap illustrates that although some projects experienced explosive growth, as market sentiment normalized and profit-taking became widespread, the vast majority saw their gains sharply erode.

These two datasets complement each other, painting a clear picture: in the short term, some projects surged due to market hype, but as enthusiasm faded and profit-taking emerged, very few managed to sustain growth. This highlights the highly speculative nature and extreme price volatility in today’s Meme coin market, while also exposing the harsh reality most projects face—value correction and risk reassessment—after the initial frenzy subsides.

"Halving from Peak" Is Actually Resilient

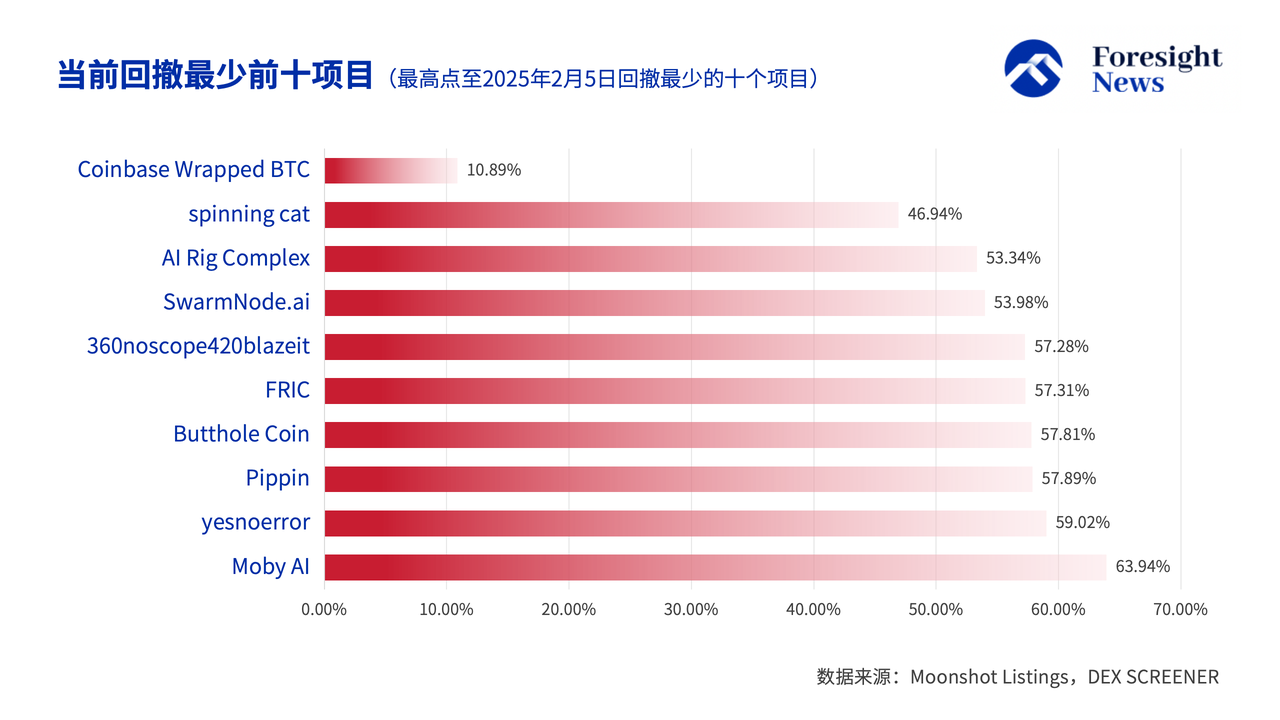

Looking at pullback data, excluding the special case of Coinbase Wrapped BTC, projects with drawdowns around 50% have actually held up relatively well.

For example, spinning cat (OIIAOIIA) saw a pullback of approximately 46.94%, making it one of the milder corrections from its peak. Subsequent projects like ARC, SNAI, MLG, FRIC, Butthole, and Pippin all experienced drawdowns approaching or exceeding 50%. This shows that within the sample, only a small minority with drawdowns around 50% could be considered relatively resilient, while most suffered much steeper price collapses.

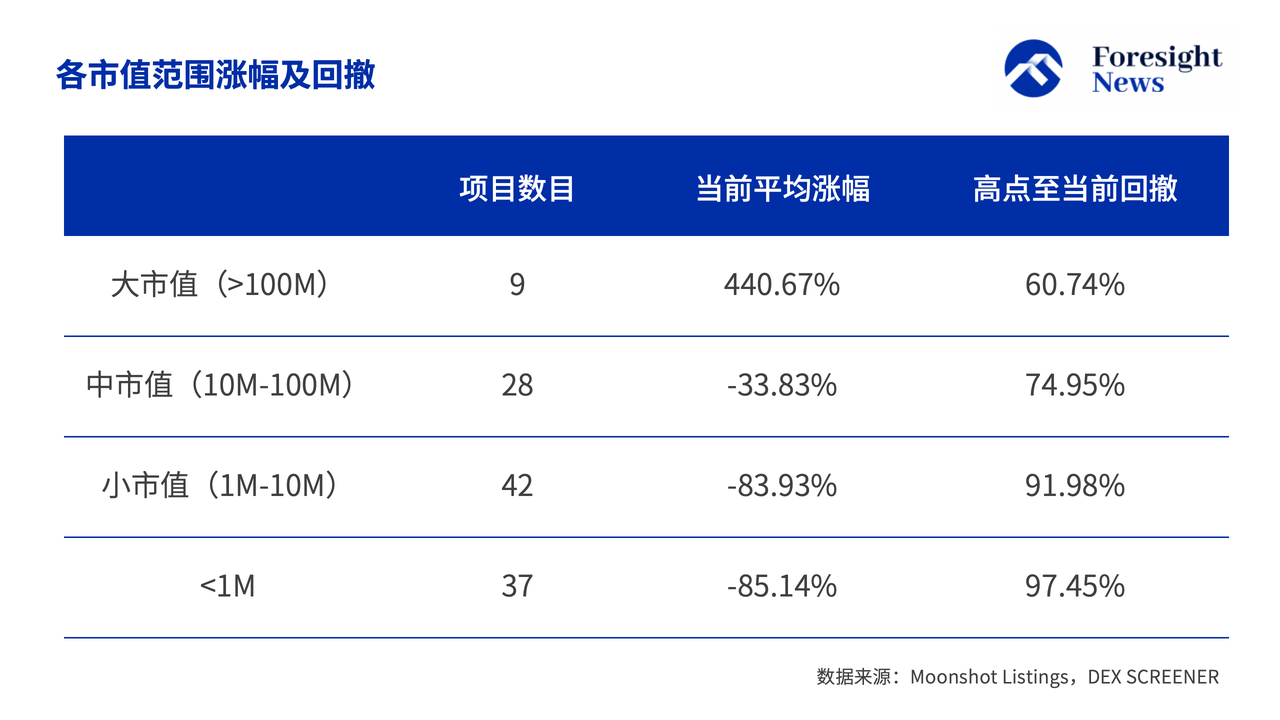

If we segment by market cap, there are currently only nine large-cap Meme coins, averaging a 440.67% gain and an average peak-to-current drawdown of 60.74%. In contrast, mid-cap (28 projects), small-cap (42 projects), and sub-$1M market cap projects (37 projects) present a starkly different picture. Low-market-cap projects, heavily influenced by speculation and volatility, are mostly already in a “zeroed” state.

In summary, we can see that the wealth-generation effect demonstrated by this platform in the Meme space is both dramatic and inherently high-risk. As an emerging Meme-focused trading platform, Moonshot’s listing effect did enable exceptional short-term returns for select projects (such as TRUMP), drawing massive speculative inflows during extreme market conditions. However, overall data shows that among the 116 listed projects, over 85% experienced significant declines, with low-market-cap and sub-$1M tokens commonly facing near-total wipeouts. Thus, under current market conditions, Moonshot’s listing effect has failed to provide broad or lasting value support.

Meme coins, driven primarily by entertainment and virality, exhibit extreme and rapid price fluctuations—trends emerge and vanish quickly, and the speed at which they collapse to zero is staggering. This extreme volatility and fragility are core characteristics of the Meme asset market. Market sentiment can easily be pushed to euphoric highs by short-lived hype, but once the spotlight fades, capital rapidly exits, leading to sharper-than-expected corrections or complete collapses.

In conclusion, while Moonshot’s listing effect has delivered substantial returns to a “select few” investors, it also serves as a warning to market participants. In a market defined by speed and short-term gains, speculative fervor is often fleeting. Risk management and rational investing remain the only viable path forward in navigating this high-risk landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News