Coingecko Survey: Who Are the People Hypeing Crypto AI?

TechFlow Selected TechFlow Selected

Coingecko Survey: Who Are the People Hypeing Crypto AI?

Compared to the typical bell curve distribution seen in technology adoption, the proportion of "pioneering adopters" in crypto AI is unusually high.

Author: Yuqian Lim

Translation: TechFlow

How Mainstream Are Crypto AI Applications in 2025?

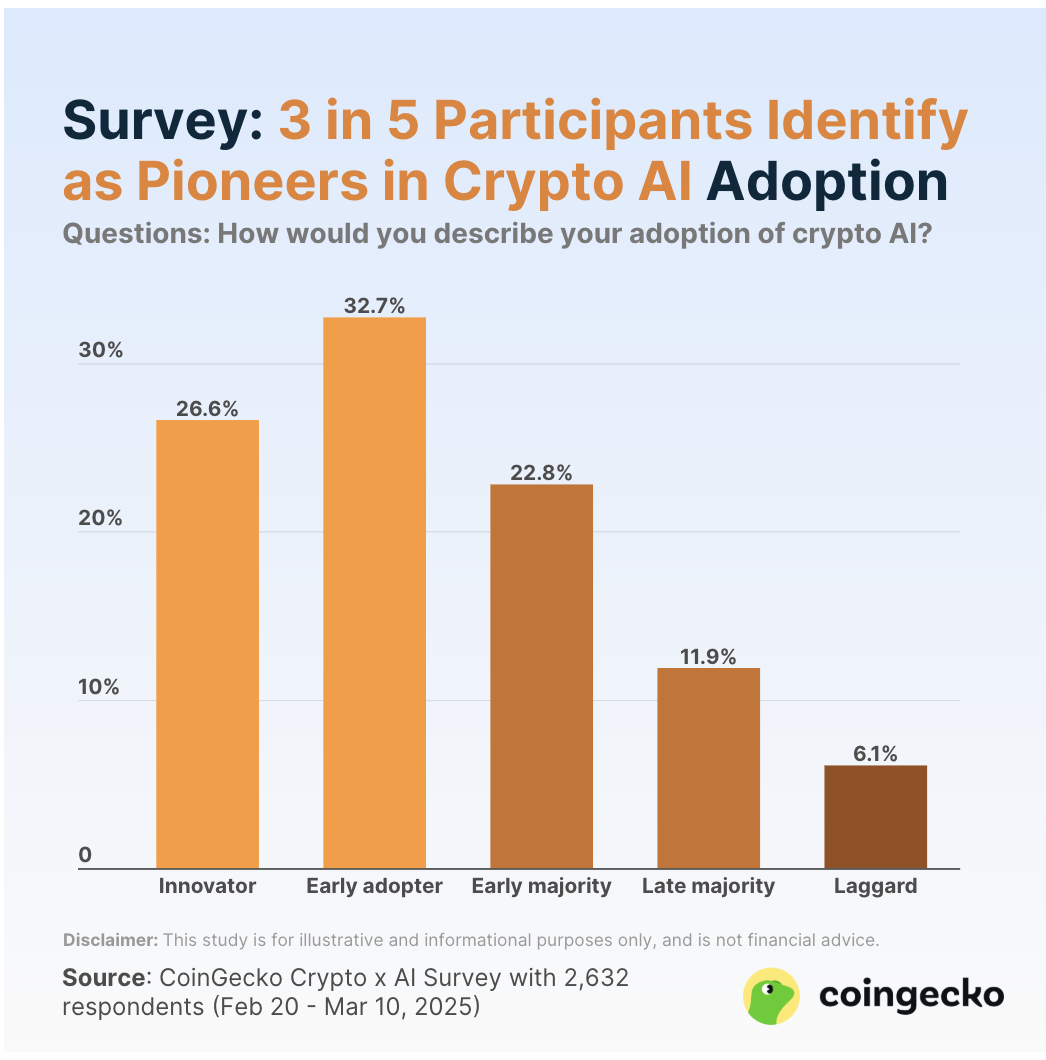

In a survey conducted this year, 59.3% of cryptocurrency industry participants (nearly three out of five) identified themselves as "early adopters" of crypto AI. Another 34.7% categorized themselves as "mainstream users" of crypto AI applications, while the remaining 6.1% were "skeptics" with the lowest willingness to adopt crypto AI.

Compared to the typical bell-curve distribution seen in technology adoption, the proportion of "early adopters" in crypto AI is unusually high. This phenomenon may be influenced by self-selection bias—those who already have an interest in crypto AI are more likely to participate—but it also reflects that current adoption of crypto AI remains largely limited to tech enthusiasts and has not yet achieved true mainstream status within the crypto industry.

Among these "early adopters," 26.6% of respondents defined themselves as "innovators" (tech enthusiasts passionate about chasing new technological narratives), while 32.7% identified as "early adopters" sensitive to emerging trends. The higher proportion of "early adopters" may reflect a shift in industry perception—crypto AI is increasingly being viewed as a key area with real potential, rather than just another hype cycle.

Meanwhile, 22.8% of cryptocurrency industry participants classified themselves as part of the "early majority" for crypto AI applications, nearly double the 11.9% who identified as part of the "late majority."

This suggests that the primary challenge for crypto AI today lies in driving adoption among pragmatic, risk-averse mainstream users. To attract the "early majority," crypto AI projects may need to clearly demonstrate their ability to solve real-world problems or deliver tangible value to users.

Ultimately, only 6.1% of respondents categorized themselves as skeptical and resistant to change—the so-called "laggards"—a proportion consistent with the tail end of a typical bell curve. These "laggards" may include realists solely interested in profiting from crypto AI, critics of AI, and cautious users waiting for the technology to mature further.

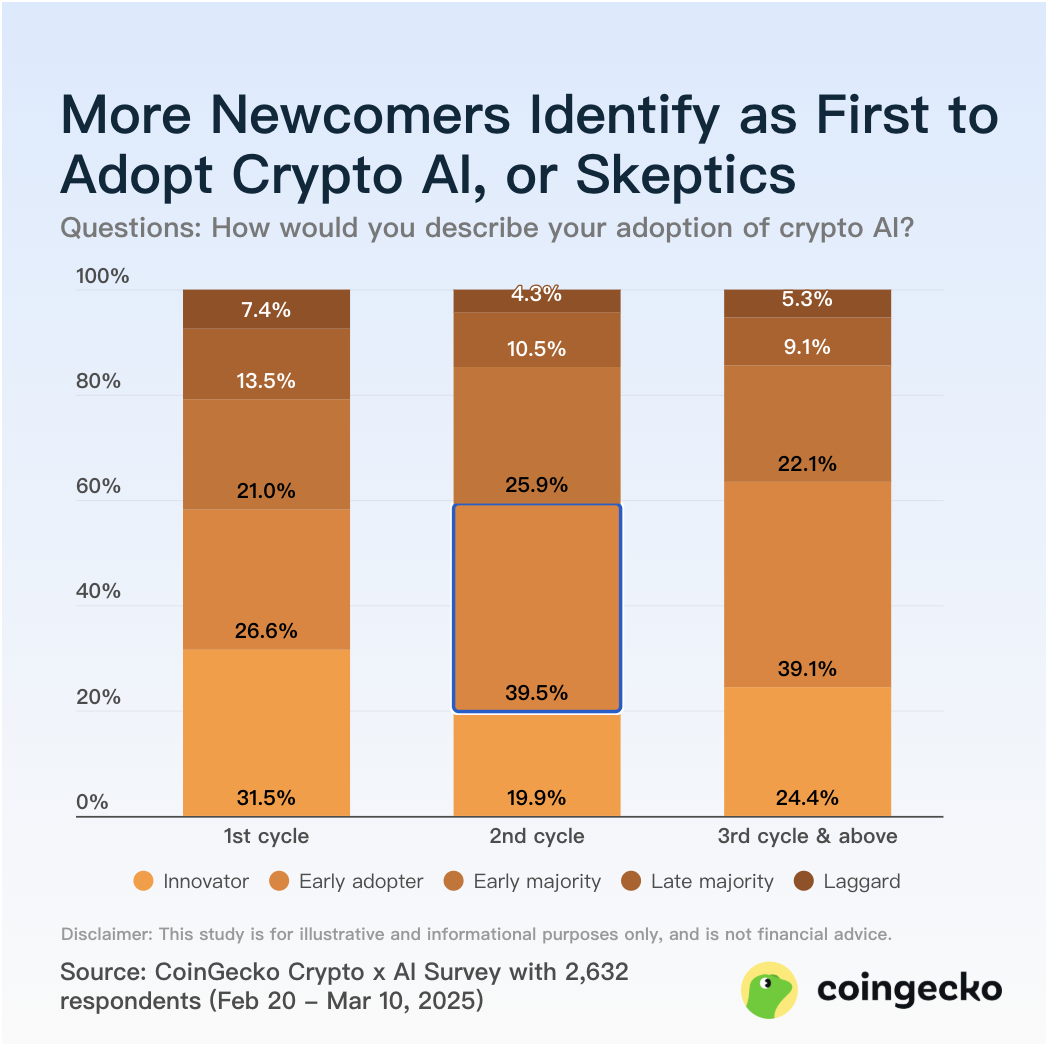

Newer Crypto Users Show More Polarized Views Toward Crypto AI Applications

Notably, among participants experiencing their first market cycle, 31.5% defined themselves as "innovators" in crypto AI applications, while 7.4% considered themselves "laggards."

Both figures are higher than those among participants in their second market cycle (19.9% "innovators," 4.3% "laggards") and experienced users (those in their third or later market cycle, 24.4% "innovators," 5.3% "laggards").

This indicates that newer crypto users may hold stronger and more polarized views toward the crypto AI narrative—partly because some may have entered the crypto space recently, drawn specifically by the surge in interest around crypto AI.

On the other hand, participants in their second market cycle and seasoned veterans show similar distributions in their attitudes toward crypto AI adoption. The only notable difference is that second-cycle participants have a slightly higher share in the "early majority," while veteran users show a relatively higher proportion among "innovators."

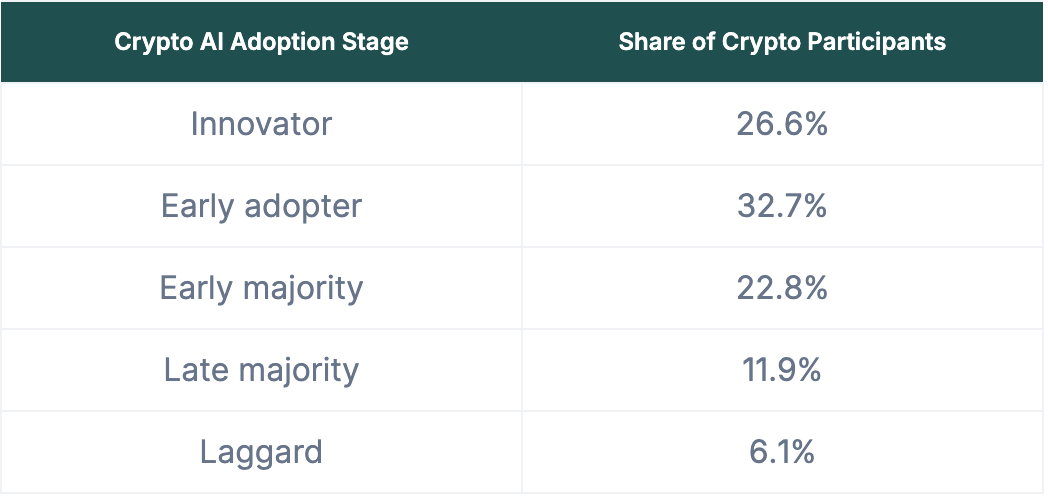

Crypto AI Adoption Curve in 2025

The cryptocurrency market's interest in or attitude toward crypto AI adoption is distributed as follows:

Methodology

This study is based on an anonymous CoinGecko Crypto x AI survey conducted between February 20 and March 10, 2025, collecting feedback from 2,632 cryptocurrency industry participants. Survey results are for reference only.

Among respondents, 51% identified as crypto investors primarily holding long-term assets, 26% as traders focusing on short-term holdings, 10% as developers engaged in building, and 13% as passive observers. In terms of experience in the crypto space, 53% were newcomers experiencing their first market cycle (0–3 years), 34% were in their second cycle (4–7 years), and the remainder had eight years or more of experience. Geographically, 93% of respondents were from Europe, Asia, North America, and Africa, with the rest located in Oceania or South America.

This research is intended for informational purposes only and does not constitute any financial advice. Please conduct your own research and exercise caution when investing in any cryptocurrency or financial asset.

If you reference insights from this study, we kindly ask that you link back to this article on CoinGecko, which helps us continue delivering valuable, data-driven content to you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News