After the financial markets were battered, how do Wall Street titans view Trump's tariff policy?

TechFlow Selected TechFlow Selected

After the financial markets were battered, how do Wall Street titans view Trump's tariff policy?

This tariff turmoil has exposed how policy uncertainty undermines market confidence, prompting a rare "collective outcry" on Wall Street.

By: zhouzhou

Bill Ackman, billionaire founder of Pershing Square, has issued a warning to global leaders: "Don't wait for war to start negotiations—call your president now."

Ackman’s warning is not just hyperbole—it reads more like an appeal.

Just days ago, President Trump's tariff plan hit financial markets like a bombshell. U.S. equities lost $6 trillion in market value within a week, and the Dow Jones recorded its largest intraday swing in history at 2,595 points on Monday. Oil prices fell, interest rates declined, yet inflation concerns lingered. While Trump confidently declared on Truth Social that “tariffs are beautiful,” Wall Street heavyweights grew uneasy, speaking out in unison—a symphony of resistance against tariffs.

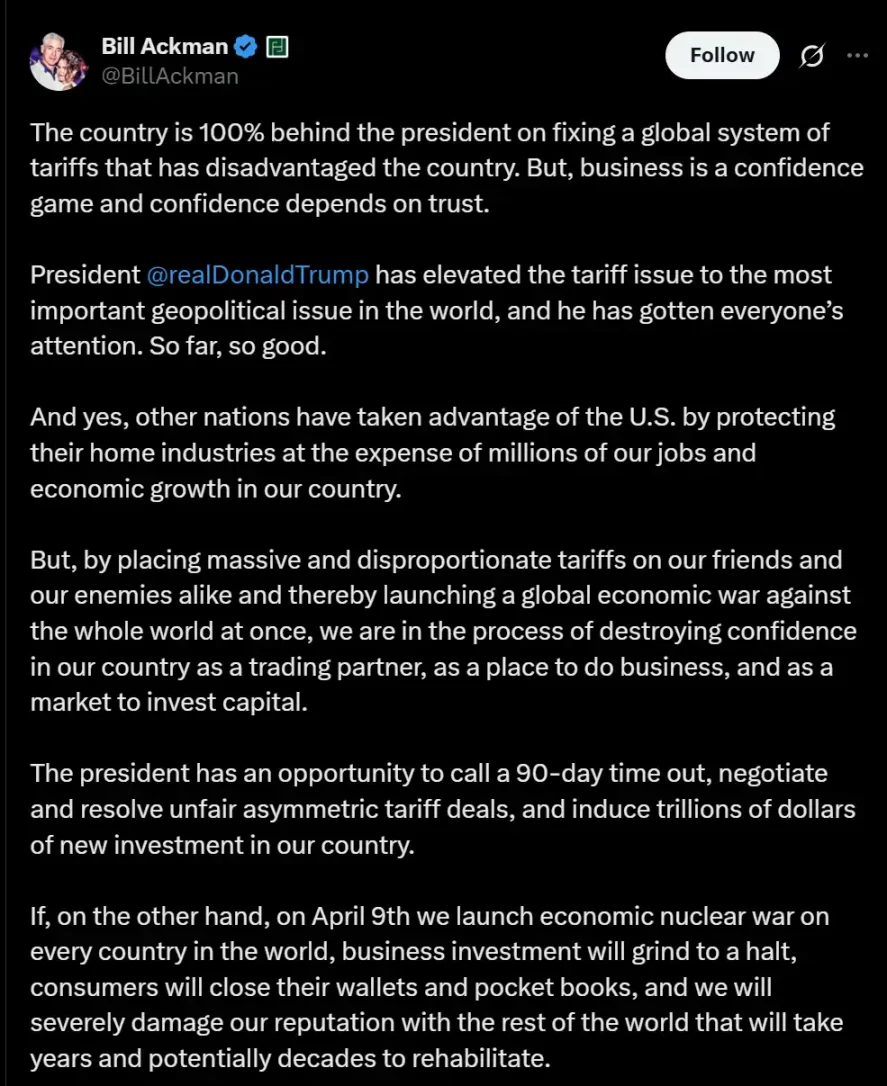

On April 6, 2025, Ackman posted on X: "By imposing massive and disproportionate tariffs on both our friends and enemies, we are waging an economic war against the entire world. We are headed toward a self-induced economic nuclear winter."

Ackman isn’t alone in sounding the alarm. Facing the escalating tariff policies of the Trump administration, numerous Wall Street figures have publicly opposed the expansion of tariffs—even those who previously supported him or hoped his administration would bring deregulation and economic growth.

Lloyd Blankfein, former CEO of Goldman Sachs, questioned: "Why not give them a chance?" suggesting that Trump should allow countries to negotiate reciprocal tariff rates.

Others joining the chorus include Boaz Weinstein, Ross Gerber (CEO and President of Gerber Kawasaki), and Jamie Dimon, CEO of JPMorgan Chase.

Boaz Weinstein predicted that "the avalanche has only just begun." Dimon stated bluntly: "The sooner this gets resolved, the better, because some negative effects accumulate over time and become difficult to reverse," warning of potentially catastrophic fractures in America’s long-term economic alliances. Gerber described President Donald Trump’s tariff policy as “destructive,” saying it could trigger a recession.

It’s clear that even financial giants accustomed to market volatility—and some who once backed Trump—are now concerned about uncontrollable chain reactions from this tariff war.

The growing criticism comes as Trump shows no sign of backing down from his punitive trade overhaul set to begin on April 9. Markets can tolerate uncertainty—but not policy speculation backed by raw power. The rare collective outcry from Wall Street reveals that capital is unwilling to pay for political gambles.

Howard Marks, Co-Chairman of Oaktree Capital, noted in a Bloomberg interview that tariff policies have disrupted established models of global trade and economics, making the environment far more complex. Investors must now factor in a host of unknowns—such as inflation triggered by tariffs, supply chain disruptions, retaliatory measures from trading partners, and the potential impact of these factors on economic growth and asset prices.

Marks’ caution reflects the broader anxiety across the professional investment community. When policy overrides market rules, traditional analytical frameworks break down. Even the most seasoned fund managers must relearn how to place bets in a new era of global economic博弈.

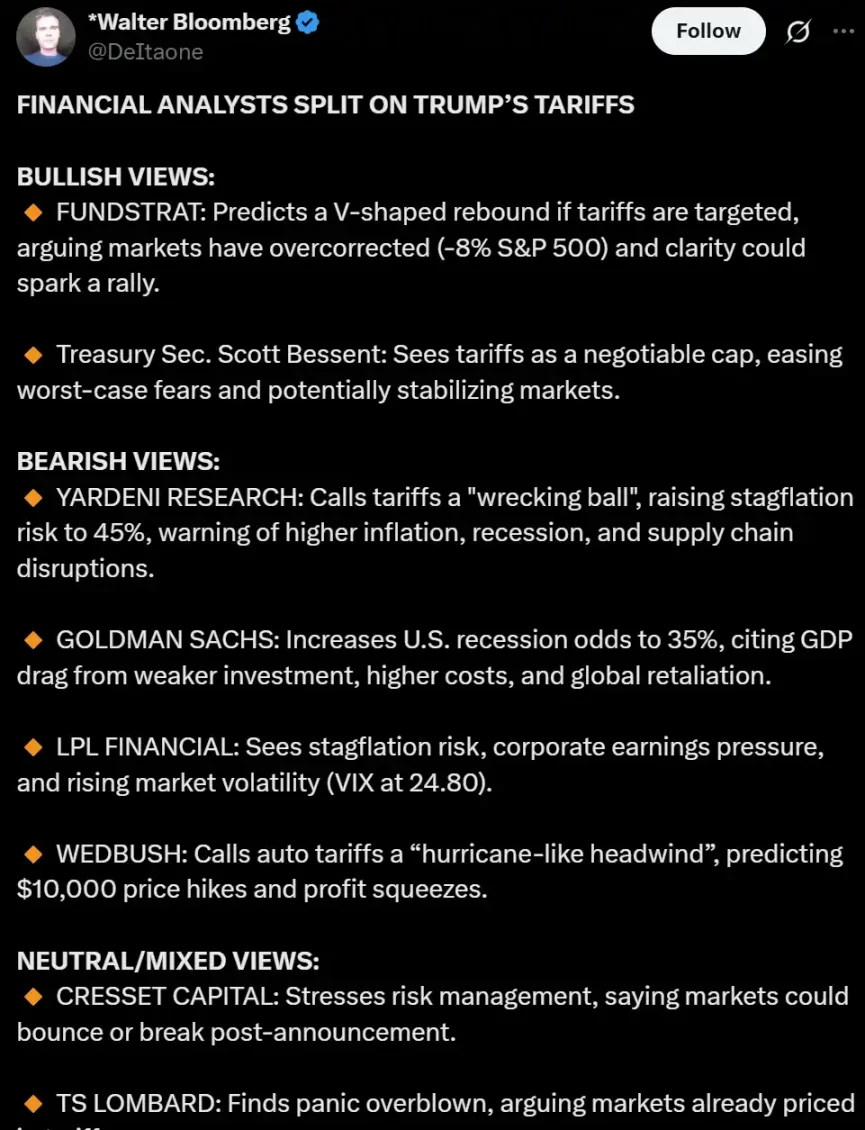

As recently as April 3, 2025, Wall Street remained divided on Trump’s tariff policy. Bulls like Fundstrat and Treasury Secretary Scott Bessent argued that earlier market declines were overdone, and clarity in policy could spark a “V-shaped recovery.” Bears, however, warned of mounting risks. Yardeni Research likened tariffs to a “wrecking ball,” Goldman Sachs raised the probability of a U.S. recession to 35%, while LPL and Wedbush expressed concern over stagflation, corporate earnings pressure, and severe damage to the auto industry.

In the meantime, neutral voices emphasized risk management, noting that some downside had already been priced in. Future performance, they argued, would hinge on the enforcement intensity of tariffs and the real resilience of manufacturing. Yet as market turmoil intensified and panic rose, even cautious observers began shifting their stance, with skepticism toward Trump’s tariff policy growing markedly louder.

While Ken Fisher harshly criticized Trump’s early-April tariff plan as “stupid, wrong, and extremely arrogant,” he maintained his usual optimism. He argued that “fear is often worse than reality,” viewing the turmoil as perhaps akin to a 1998-style market correction—one that might ultimately deliver annualized returns as high as 26%.

Steve Eisman, the famed “Big Short” investor known for predicting the subprime crisis, cautioned that markets haven’t yet priced in the worst-case scenario of Trump’s tariff policies, advising against heroics. He said Wall Street remains overly reliant on the old paradigm that “free trade is good,” and is thus caught off guard by a president who defies tradition.

Eisman admitted suffering heavy losses from being long the market, noting the current atmosphere is filled with “the bitterness of losers.” He also stressed that current policies aim to address groups overlooked under free trade—and Wall Street shouldn’t be surprised, since Trump “said he’d do this long ago; people just didn’t believe him.”

Amid the cacophony, U.S. Treasury Secretary Scott Bessent insisted that tariffs are fundamentally a tool to “maximize leverage” in negotiations—not permanent economic barriers. He countered: "If tariffs are so bad, why are our trading partners using them too? And if they only hurt American consumers, why are they so nervous?" In his view, this is a pushback against China’s system of “low costs, forced labor, and subsidies.”

In reality, however, Bessent appears to play little decisive role in policymaking—more of a spokesperson tasked with calming markets. The extreme volatility caused by tariffs has, in fact, already raised alarms within the White House itself.

This tariff storm has exposed how policy uncertainty can shatter market confidence, prompting a rare wave of collective criticism from Wall Street. Regardless of stance, most voices are questioning—or outright attacking—the recklessness and haste of the policy. Beneath the surface disagreements lies widespread frustration over the logic and pace of implementation. But the deeper question that demands attention is: how can confidence be restored amid chaos?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News