The Power of Channels: Unveiling the Key to Stablecoin's Global Expansion

TechFlow Selected TechFlow Selected

The Power of Channels: Unveiling the Key to Stablecoin's Global Expansion

In this war without smoke, whoever can expand the broader channels will become the true king.

By TechFlow

Recent events in the crypto market have once again thrust stablecoins into the spotlight.

On the evening of April 2, a revelation by Justin Sun regarding Hong Kong-based trust company First Digital Labs sparked controversy, causing its issued stablecoin FDUSD to instantly lose its peg, dropping as low as $0.87 and igniting heated discussion across the community.

Binance, the primary trading platform for FDUSD, quickly responded, affirming that FDUSD remained fully redeemable at a 1:1 ratio, which gradually restored confidence and brought the token back to its dollar peg.

Almost simultaneously, Circle—the powerhouse behind stablecoin USDC—filed an IPO application with the U.S. Securities and Exchange Commission (SEC), aiming to expand globally through public listing and regulatory compliance.

While these two incidents may seem unrelated, they both point to a core truth:

Today’s stablecoin success is not driven by technology, but by channels.

FDUSD faced the risk of being abandoned at a critical moment—if not for Binance's strong endorsement, it might have already faded into obscurity, becoming a "priced but unusable" orphaned coin.

Behind Circle’s IPO push, what many may not realize is revealed in its S-1 filing: exchanges earn significant interest revenue sharing by holding USDC. In plain terms, Circle pays for channel access, incentivizing major exchanges to hold USDC on their platforms.

This is the power of channels: they determine not only a stablecoin’s visibility and liquidity, but also directly shape user trust and adoption.

The Two Ends of Stablecoins: Reserves and Distribution

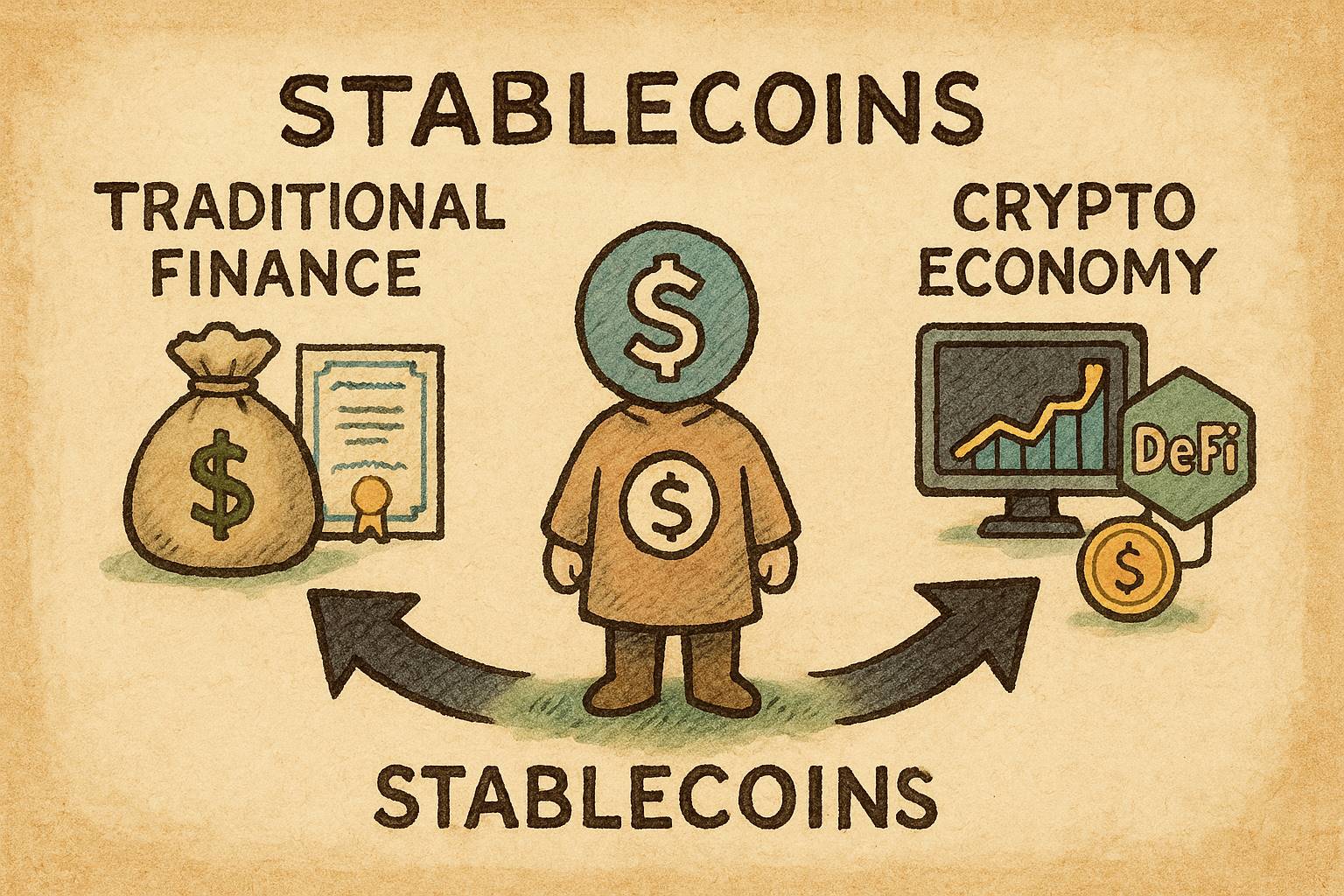

In a world where stablecoins, traditional finance, and crypto economies increasingly converge, the survival logic of a stablecoin can be broken down into two key aspects:

One end is sufficient asset reserves, addressing the issue of trust—"you can use it with confidence." For example, both USDC and USDT are backed by short-term U.S. Treasuries or dollar-denominated assets. Massive reserve holdings assure users they’re not transacting with "air coins."

The other end is distribution, solving the problem of usability—"you have somewhere to use it." In the crypto world, distribution means exchange endorsements, integration into DeFi protocols, and coverage in payment scenarios. Without inclusion in major exchange trading pairs, DeFi liquidity pools, or over-the-counter (OTC) markets, a stablecoin cannot achieve real-world utility.

By analogy with traditional industries, distribution is like a brand fighting for exposure and traffic. A stablecoin must maintain constant presence in the most active user environments to stand out among competitors.

Data previously showed that in April 2024, monthly trading volume for stablecoins on centralized exchanges (CEXs) reached $2.18 trillion—up significantly from $995 billion in December 2023—highlighting their central role in the crypto ecosystem.

Industry trends suggest that if growth continues, stablecoin monthly trading volume could reach $1.2 trillion by February 2025, with active addresses potentially rising from 27.5 million in May 2024 to 30 million.

Additionally, data from September 2024 indicates that approximately 90% of stablecoin trading volume is concentrated on top-tier exchanges and DeFi protocols. This means the breadth and depth of distribution directly determine adoption rates.

While asset reserves and distribution appear equally important, in practice, distribution often proves more decisive.

The reason is simple: user trust in a stablecoin stems not just from reserve transparency, but more importantly from its market visibility and liquidity.

No matter how robust a stablecoin’s reserves, without channel support, users cannot easily trade or spend it—rendering it a "visible but unusable dead coin."

After all, for most people, Tether and Circle’s financial reserves remain distant audit reports; whether USDC and USDT can actually be bought and used is something anyone can see immediately.

Exchanges Are the Channel

Returning to the earlier examples.

When Justin Sun alleged that First Digital Trust (FDT), issuer of FDUSD, was unable to meet redemption requests, FDUSD rapidly lost its peg, falling to $0.87.

FDUSD’s reserve transparency has always been questionable—its custodian banks and asset composition have never been publicly disclosed. The sole factor possibly sustaining its stability might be Binance’s endorsement.

According to CoinMarketCap data, Binance remains the largest liquidity provider for FDUSD.

When Binance officially confirmed that FDUSD remained fully redeemable at par, market confidence rebounded and the price gradually recovered.

This incident effectively demonstrates that when a stablecoin lacks transparent reserves, channel endorsement can serve as its "lifeline." Without Binance’s strong backing, it would be uncertain whether FDUSD could have recovered amid the storm of negative sentiment.

To put it bluntly, this was a stablecoin surviving a FUD attack passively saved by its distribution channel.

Of course, some stablecoins actively court channels.

Public data shows USDT dominates the stablecoin market, holding over 60% share, while USDC accounts for about 25%.

To secure USDC’s market position, Circle—the issuer—has extended incentives to major exchanges, encouraging them to hold larger amounts of USDC.

For instance, Circle’s recent SEC IPO filing reveals it paid Binance a one-time upfront fee of $60.25 million and agreed to ongoing monthly incentive payments based on the amount of USDC held by Binance.

"Binance must promote USDC on its platform and hold USDC in its treasury reserves. Monthly incentives are only paid if Binance holds at least 1.5 billion USDC, and Binance has committed to holding 3 billion USDC."

Similarly, Circle has offered comparable terms to U.S.-based exchange Coinbase, granting it 50% of the residual income generated from USDC reserves.

In detail, the revenue-sharing percentage from Circle’s reserves is directly tied to the quantity of USDC held on Coinbase’s platform.

The more USDC stored on Coinbase, the higher the revenue share the exchange receives; conversely, if users hold USDC directly through Circle or other platforms, Coinbase’s revenue share decreases.

In essence, Circle is paying for channel access, incentivizing exchanges to stockpile and promote its USDC.

Any Cat That Catches Mice Is a Good Cat

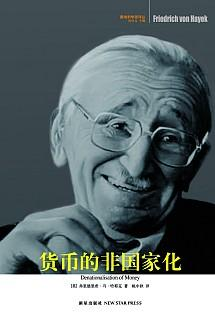

Austrian School economist Friedrich Hayek once proposed a radical idea in his book *The Denationalisation of Money*:

"Let the market compete freely, allow natural selection to occur, and ultimately the best currency will emerge."

Hayek argued that money should not be monopolized by governments, but rather multiple currencies should coexist and compete, allowing the market to select the most stable and trustworthy form. The rise of stablecoins appears to be a practical test of this theory: USDT and USDC are vying to become the preferred "digital dollar" in users’ minds.

But in reality, market choice is profoundly shaped by distribution channels.

Stablecoin competition isn’t purely based on reserve transparency or technological superiority—it hinges more on who controls the most channel resources.

Why is USDT so dominant?

Certainly, large reserves are part of its strong fundamentals. But more importantly, USDT has secured unique footholds in certain "specialized channels."

Illicit activities such as money laundering, fraud referral schemes, pump-and-dump operations, and telecom scams—within these shadowy sectors, USDT has become an unspoken underground hard currency. Rarely do people actually redeem USDT 1:1 for USD; yet it has widely become the default settlement asset for these "special operations."

In internet jargon, it found its vertical niche.

Even USDC, despite lacking similar underground dominance, owes its prime placement on Binance and Coinbase not to organic market selection, but—as shown in Circle’s IPO filing—to paid arrangements.

Two stablecoins, two adoption strategies—neither ordained by law nor chosen by fate, but forged through the crypto industry’s journey from the fringes to mainstream relevance.

In this gray-zone-filled crypto world, USDT and USDC prove one thing: whether underground hard currency or purchased shelf space, any cat that catches mice is a good cat.

The Key to Global Expansion

In the end, the survival logic of stablecoins boils down to a game of trust and usage scenarios.

Distribution is not just a lifeline—it’s the winning edge.

As Hayek envisioned free market competition, perhaps one day the market will crown the ultimate "best digital dollar."

But in this war, whoever secures more exchange trading pairs, DeFi liquidity pools, and payment integrations will win user trust and market dominance.

USDT thrives in gray channels, USDC buys legitimacy, and emerging stablecoin challengers struggle to survive under the support of various DeFi protocols, exchanges, and blockchain ecosystems—different paths, same truth: channel supremacy reigns.

Looking ahead, tighter regulations, the rise of DeFi, and competition from central bank digital currencies (CBDCs) will make the global expansion of stablecoins even more complex.

Yet no matter how rules evolve, the logic of channels remains unchanged.

In this silent war, whoever builds the broadest distribution network will emerge as the true king.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News