Decrypting the Threefold Rashomon Behind ACT's Flash Crash: Did Exchange Risk Controls Become a "Nuclear Button"?

TechFlow Selected TechFlow Selected

Decrypting the Threefold Rashomon Behind ACT's Flash Crash: Did Exchange Risk Controls Become a "Nuclear Button"?

A routine adjustment of Binance's futures rules unexpectedly exposed the most vulnerable sore spot in the crypto market.

Author: Frank, PANews

A routine contract rule adjustment by Binance unexpectedly exposed the most vulnerable sore spot in the crypto market.

On April 1, a flash crash saw low-market-cap tokens such as ACT collectively plunge by half within 30 minutes, thrusting exchange risk controls, market maker algorithm strategies, and the fatal flaws of the MEME coin ecosystem into the spotlight.

Although Binance quickly attributed the crash to "whale selling," the cliff-like evaporation of 75% of open interest, the precisely synchronized price fluctuations across multiple coins, and Wintermute’s mysterious on-chain dumping after the crash reveal deeper industry vulnerabilities—under current weak liquidity conditions, exchanges attempting to patch systemic risks may instead become the final straw that breaks the market.

Multiple Tokens Halved Within Half an Hour

At 15:32 on April 1, Binance announced adjustments to leverage and margin tiers for several USDT-margined perpetual contracts, affecting trading pairs including 1000SATSUSDT, ACTUSDT, PNUTUSDT, NEOUSDT, and NEOUSDC. The change primarily reduced position size limits and adjusted margin requirements. For example, ACT’s maximum position limit was lowered from $4.5 million to $3.5 million. The official adjustment time was set for 18:30.

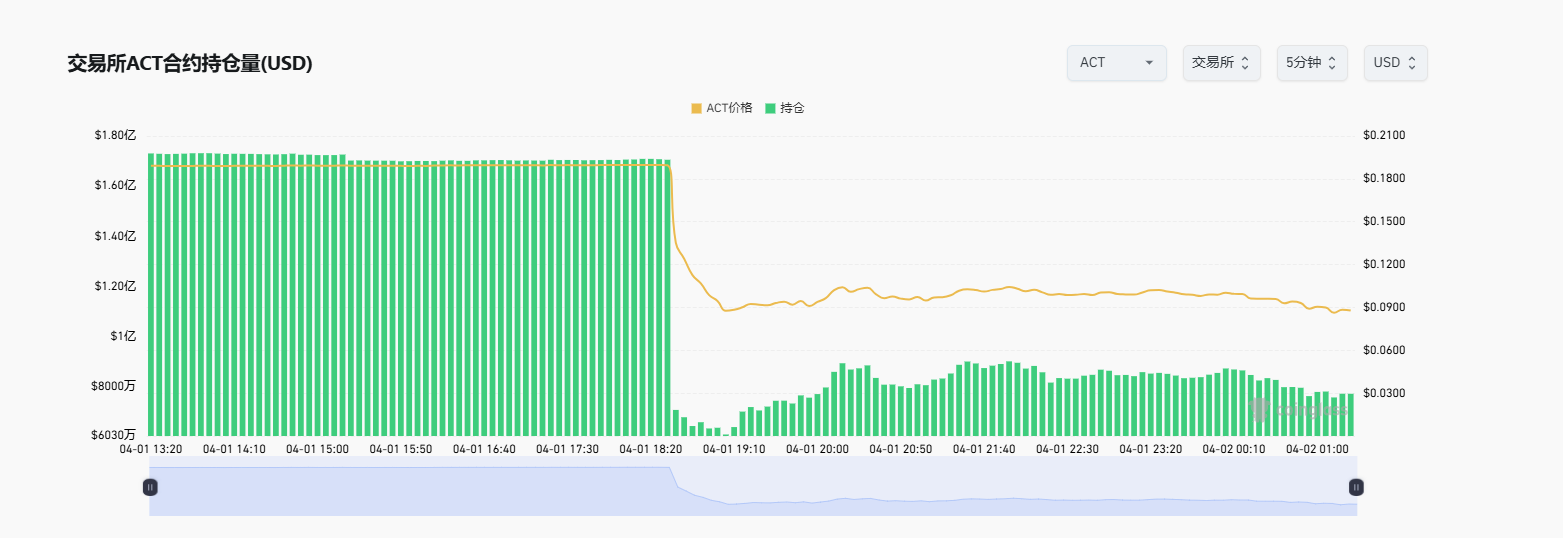

At 18:30, ACT dropped from $0.1899 to $0.0836 within 36 minutes—a 55% decline—sparking intense market debate.

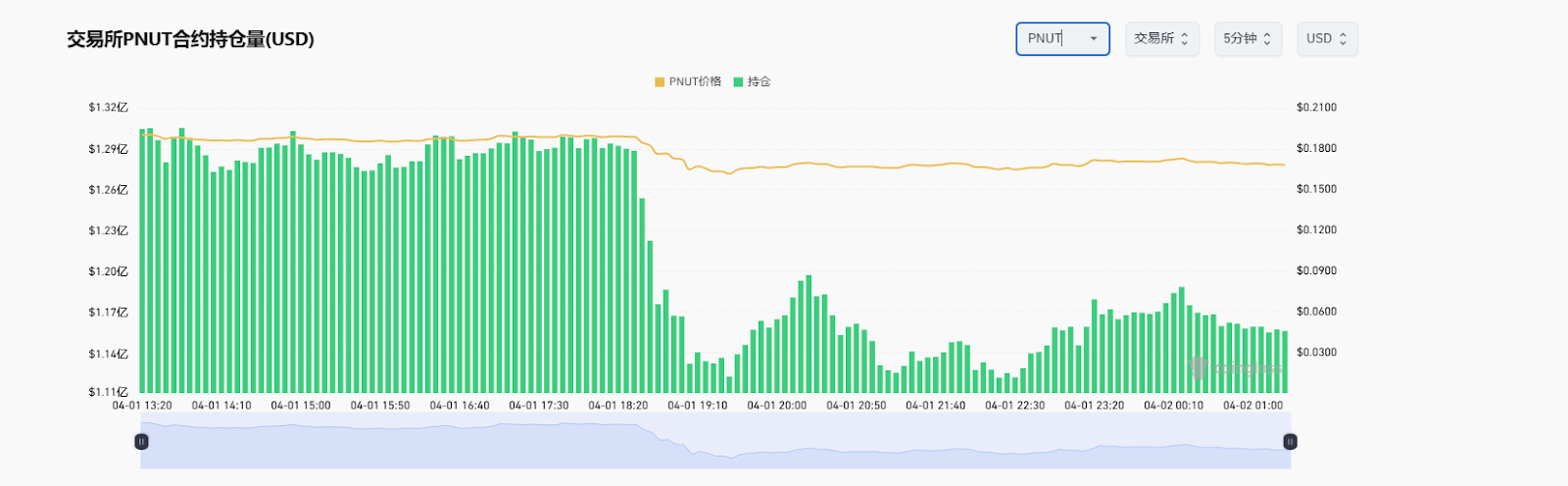

Almost simultaneously, other low-market-cap tokens on Binance—including TST, HIPPO, DEXE, and PNUT—also experienced flash crashes with declines ranging from 20% to 50%. Market data shows that 18:30 marked the starting point of a steep downturn across multiple tokens, far exceeding any single project, indicating clear synchronicity.

Specifically, the adjustment meant smaller maximum positions allowed at certain leverage levels. For instance, if previously you could hold $1 million worth of tokens at a given leverage, the new rules might cap it at $800,000. If users failed to manually close excess positions, the system would forcibly liquidate them at market price when the rule took effect. This led to sharp downward pressure on prices in a short period, triggering a stampede.

This sparked widespread discussion on social media. @terryroom2014 pointed out, “Binance futures open interest sharply dropped at 18:30; the exchange proactively cut large positions, causing a price collapse.” @yinshanguancha suggested, “Market makers were forcibly liquidated due to insufficient margin—the rule change was the trigger.” Most users blamed Binance’s rule adjustment, arguing that lowering position caps triggered forced liquidations, leading to panic selling and a cascading market crash.

Others speculated that ACT’s market maker intentionally dumped the token. @Web3Tinkle noted that ACT’s holdings on Binance dropped by $73 million in just 15 minutes, implying the project team or market maker executed a sudden sell-off to profit at the market’s expense.

In response, Binance co-founder He Yi commented on X (formerly Twitter), stating the team was “gathering details to prepare a reply” regarding whether the rule change caused ACT’s plunge.

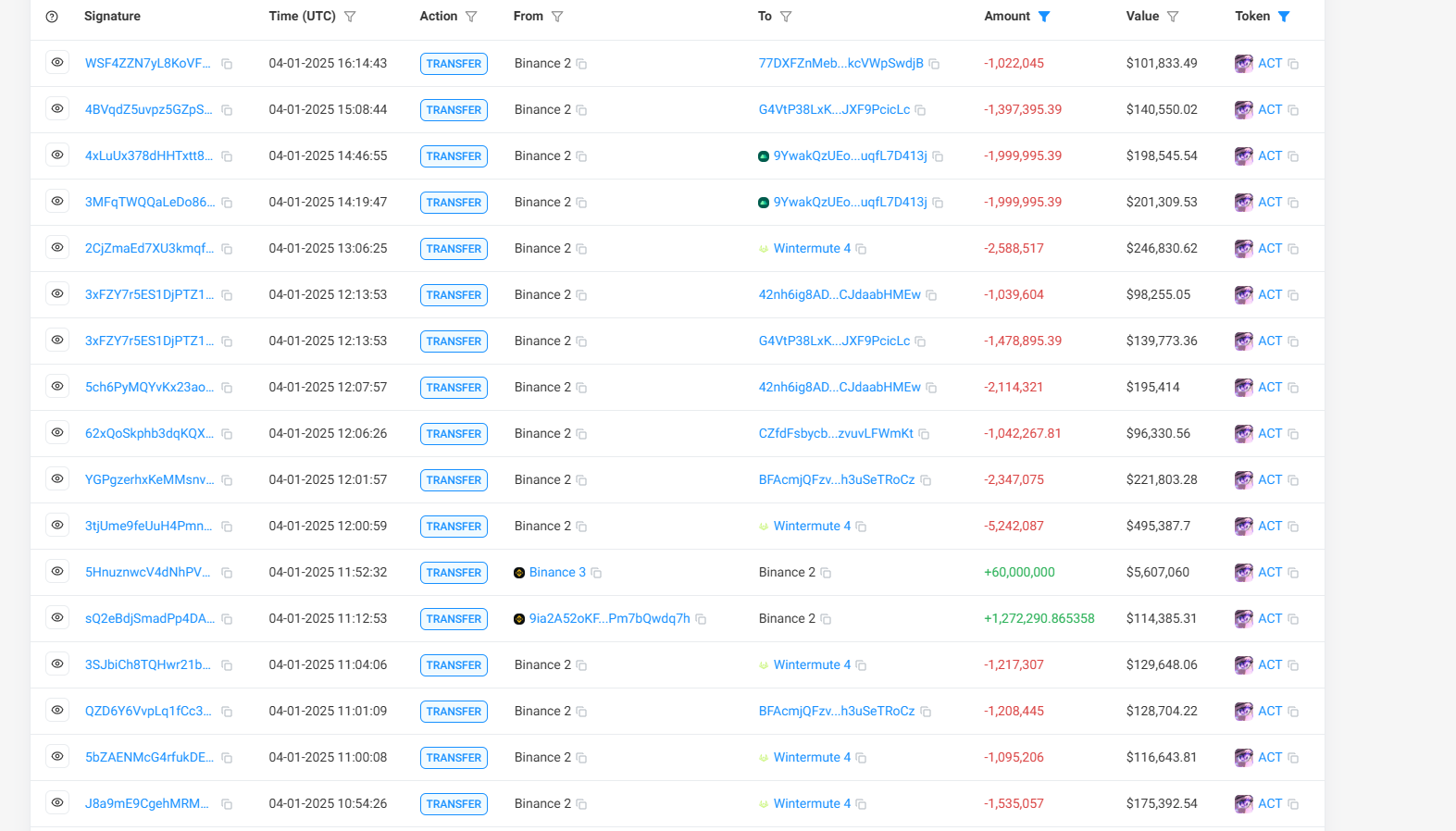

About two hours later, Binance released a preliminary investigation report, attributing ACT’s drop mainly to four users—three VIPs and one non-VIP—who sold approximately $1.05 million in spot tokens within a short timeframe, driving down prices and triggering broader declines. In summary, Binance claimed the sharp drop stemmed from whale selling, not its own rule changes.

Exchange Risk Control: Overcorrection or Market Maker Self-Preservation?

This flash crash recalls the recent Hyperliquid “lightning raid” incident. On March 26, the decentralized exchange Hyperliquid nearly suffered multi-million-dollar treasury losses after traders exploited a liquidity design flaw, offloading massive short positions onto the platform by withdrawing collateral.

Possibly warned by the Hyperliquid event, Binance attempted to reduce risks for low-market-cap tokens through tighter contract parameters—but inadvertently detonated a market landmine.

Beyond Binance’s rule change acting as a potential catalyst, market maker Wintermute also came under suspicion. The rule adjustment disproportionately affected market makers. As @CnmdRain analyzed, “Such adjustments hit market makers (MMs) especially hard, as they typically rely on high leverage and large positions to maintain liquidity and earn spread profits.”

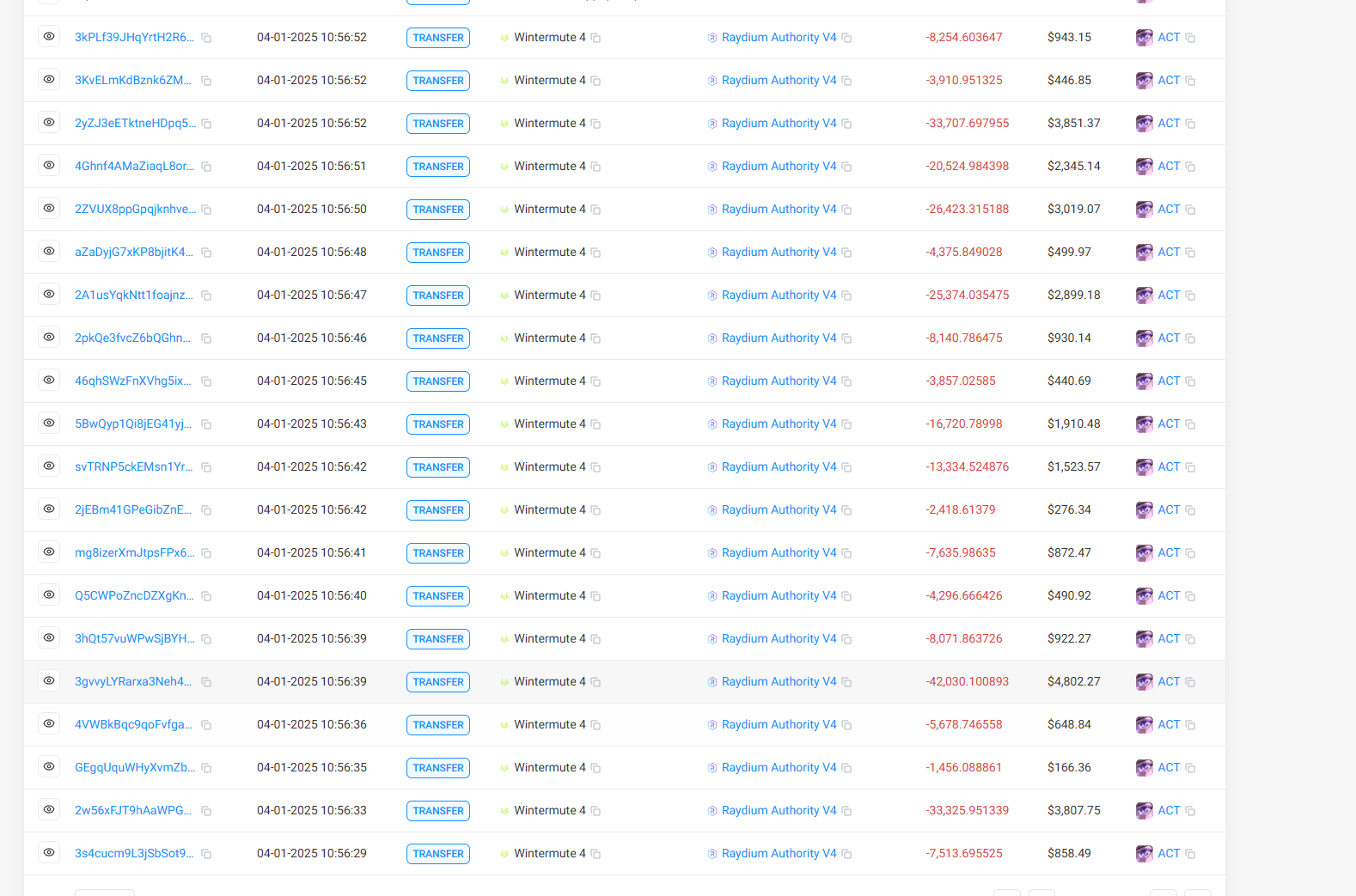

Previously, speculation by Yujin suggested Wintermute was ACT’s market maker (having received 9.482 million ACT tokens from the ACT community wallet in November 2024). After ACT’s plunge, Wintermute withdrew multiple batches of ACT from Binance and sold them on-chain.

In response, Wintermute founder Evgeny Gaevoy stated the firm did not orchestrate the MEME coin crash, only conducting arbitrage on AMM pools following extreme price volatility. He emphasized Wintermute was not responsible for initiating the market move and said the company is monitoring developments.

Amid the uproar, the ACT project team responded, saying it has launched an investigation, is collaborating with relevant parties, and working with trusted partners to develop a response plan.

Can a 75% Position Drop Be Explained by 'Whale Selling'?

So far, all parties involved have promptly distanced themselves from responsibility. Yet many questions remain.

First, Binance’s preliminary report lacks credibility. While it claims ACT’s decline resulted from four users dumping large amounts of spot tokens, this does not explain similar drops across other unrelated tokens. Whale selling may directly explain ACT’s fall, but the broader pattern suggests a stronger link to the rule adjustment itself.

CoinGlass data shows Binance’s ACT futures open interest plunged 75% at exactly 18:30, with similarly drastic drops seen in other affected tokens—an outcome difficult to attribute solely to isolated spot sales by individual whales.

Second, the crash wasn’t entirely due to the rule change. Among the adjusted tokens, ACT fell the hardest. Others like 1000SATS also declined but much less severely. Notably, DEXE—which wasn’t even on the adjustment list—also experienced a dramatic drop. Conversely, MEW, which was listed for adjustment, didn’t fall at all and instead rose in price.

Third, was Wintermute’s exit coincidence or intentional? As ACT crashed, Wintermute sold multiple MEME coins it held, each experiencing varying degrees of flash crash. Some social media users speculated the root cause was Wintermute’s algorithmic bots malfunctioning due to the rule changes.

Overall, the most comprehensive explanation appears to be: Binance’s adjustment of position limits for select tokens acted as the spark, causing algorithmic systems used by market makers like Wintermute to fail to adapt in time.

Yet regardless of the precise origin of this flash crash, it is always the market—and retail users—who end up paying the price.

According to Coinglass data, $8.71 million in ACT futures were liquidated post-crash, ranking third globally (behind only Bitcoin and Ethereum). Moreover, spot holders also suffered near-50% asset devaluation, with little hope of quick recovery.

In sum, the underlying causes of this crash include: First, following the Hyperliquid incident, exchanges grew concerned about whale manipulation and began tightening rules—a well-intentioned move that backfired, unintentionally triggering another stampede. Second, with the MEME market cooling, related tokens have become fragile and sensitive in both trading depth and sentiment. Thus, any abnormal trade exposes the fundamental lack of value backing behind MEME coins.

This multi-million-dollar "April Fools’ scare" ended temporarily with silent consensus among exchanges, market makers, and projects—all swiftly disclaiming responsibility. But the buried warnings run deeper than appearances suggest. Perhaps there was no true "culprit" in this crash, yet it ripped open the harshest truth of the crypto market: within the sophisticated systems built by institutions and whales, retail investors are often left as passive victims of systemic volatility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News