Daily Surge Over 10x: Analyzing the Driving Forces Behind the AI Meme ACT Frenzy

TechFlow Selected TechFlow Selected

Daily Surge Over 10x: Analyzing the Driving Forces Behind the AI Meme ACT Frenzy

The story of AI Meme may just be beginning, and for investors, the key to benefiting from the Meme supercycle lies in rationally assessing market sentiment and managing risk.

Today, Memes have become an emerging fuel pool in the crypto market. According to CoinGecko, the Meme sector's market cap surged by 18.8% within 24 hours and has now surpassed $95 billion. Among them, AI Memes represented by GOAT have emerged as the most imaginative new narrative in the Meme赛道 following the zoo-themed trend. Today, Binance announced the listing of ACT and PNUT, triggering a market frenzy. This not only reignited expectations for AI Memes but also injected strong momentum into the arrival of a Meme supercycle.

AI Meme Continues: ACT Leads Market Sentiment

Data from cryptocurrency exchange LBank shows that at the time of writing, ACT reached a maximum increase of 2,329%, currently priced at 0.31967 USDT with a market cap exceeding $300 million.

ACT initially rose due to speculation around a16z investment, but later plunged over 50% after being repeatedly sabotaged by developer @amplifiedamp, falling into a slump. Now, with its Binance listing, it has achieved the strongest reversal imaginable.

Research indicates that $ACT, as an infrastructure-type Meme coin, features unscripted and self-generated interactions, multi-agent dynamics, and continuous long-term observation—characteristics that give ACT strong competitiveness within the AI Meme narrative. Crypto KOL 0xWizard stated on Twitter:

"We can imagine a world where, in a few years, thousands of bots will appear on Twitter, speaking like humans, cracking jokes, making predictions, writing silly skits, talking like schizophrenics—that’s exactly what ACT is building.

$act is the core system enabling this future to happen."

In practice, ACT has already formed an invisible flywheel-driven economic effect, amplified by Binance’s top-tier platform influence, leveraging traffic and capital concentration.

Sentiment Driven: Tracking Its Secondary Trading Origins

We are increasingly realizing that sentiment best represents Meme market热度, including factors such as community activity, discussions on CT (Crypto Twitter), and promotion by KOLs. However, ordinary retail investors rarely possess the direct ability to identify potential value early. Therefore, secondary markets—especially CEX platforms—are more suitable hunting grounds for retail participants. Of course, Memes that pass exchange listing reviews gain a certain level of credibility.

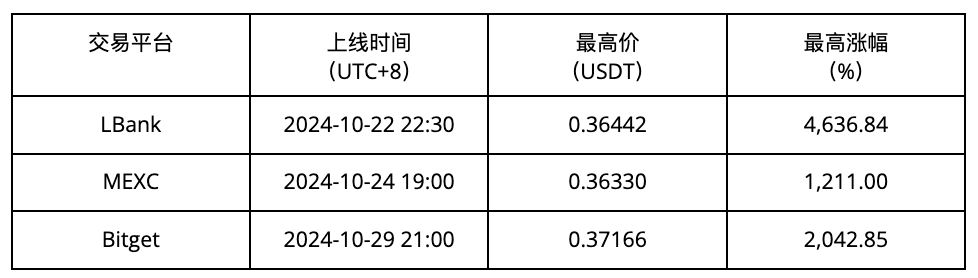

To investigate further, we tracked the market launch timeline of ACT and analyzed its performance across various platforms.

In terms of listing timing, LBank took the lead, giving crypto capital a crucial time advantage and maximizing both utilization and returns. In peak price surge, LBank again led with a staggering 4,636.84% increase, followed by Bitget at 2,042.85%.

Overall, LBank demonstrates stronger competitiveness in early project discovery and value tracking. This explains why, according to market data published by 0xScope, LBank ranks 12th globally with a spot trading market share of 3.04%.

How to Maximize Meme Potential?

The exploration of AI Memes continues to evolve—from AI bots issuing their own tokens, to AI agents training and interacting with each other—the market is still actively shaping AI Meme culture. For average investors, achieving maximum returns without being controlled by emotion remains a high-risk game suited only for the bold.

1: Follow CEX Trends to Capture Emerging Patterns

As the pyramid of the crypto market, CEXs hold unparalleled advantages. They not only list trending Memes first but also use indicators such as social media engagement, on-chain data, contract security, and trading volume fluctuations to screen projects and amplify market sentiment. LBank, in particular, holds a significant edge in the Meme赛道, offering retail investors both protective mechanisms and clear market direction.

2: Master the Rhythm and Leverage Arbitrage Tools

The爆发period of AI Memes brings extreme volatility; missing the optimal buy or sell moment can be costly. Hence, using arbitrage tools becomes essential. For instance, quantitative trading bots or manual price alerts help investors efficiently exploit price differences across CEX platforms. Especially powerful are tools integrating cross-market data, enabling investors to make instant decisions during peak market moments and maximize profits.

Perhaps the story of AI Memes has only just begun. For investors, the key to benefiting from the Meme supercycle lies in rationally assessing market sentiment and effectively managing risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News