WOO X Research: TVL increased by 130% in one month—what's new on Sonic?

TechFlow Selected TechFlow Selected

WOO X Research: TVL increased by 130% in one month—what's new on Sonic?

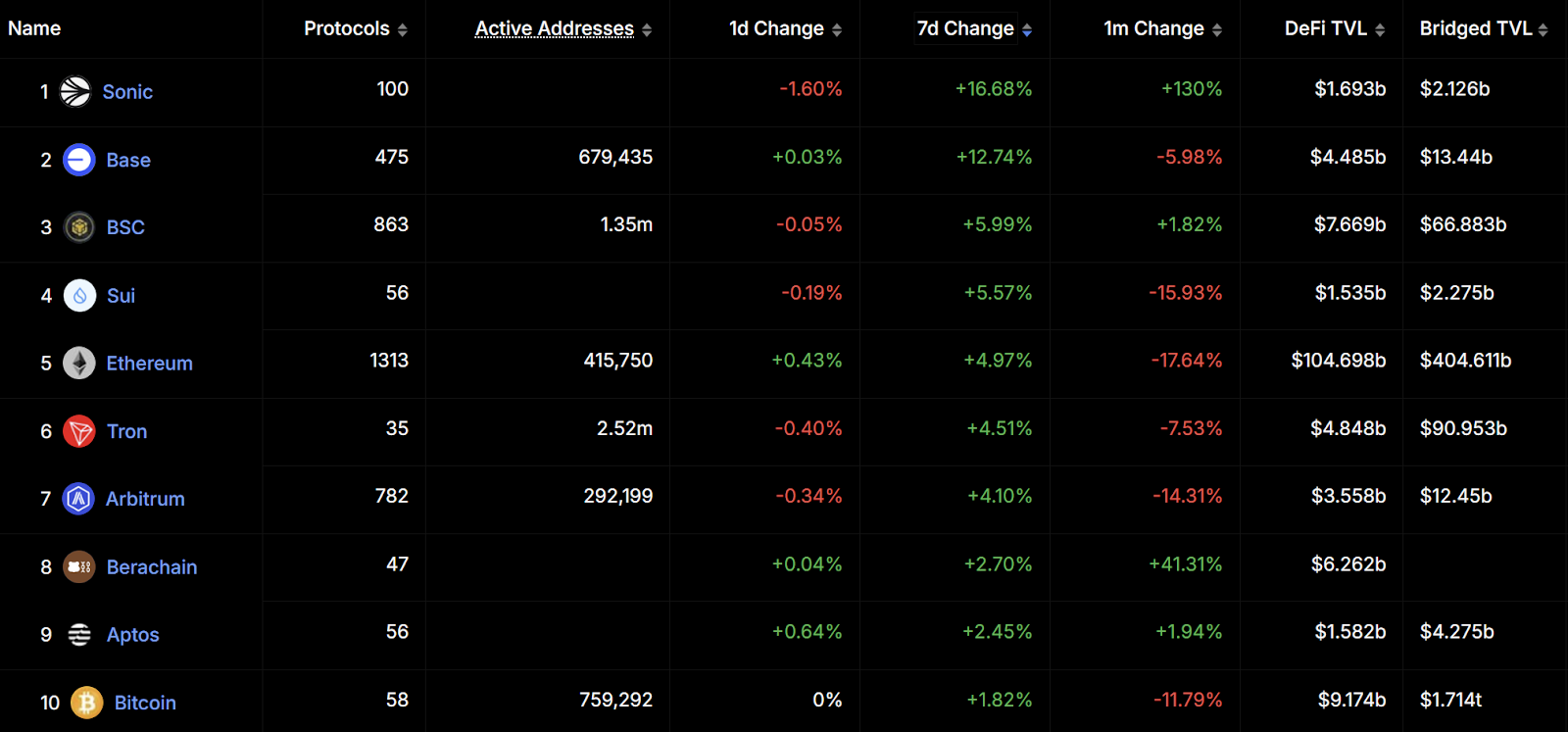

TVL growth rate data is impressive.

The current market is in a narrative vacuum, with memes cooling off and on-chain activity on Solana sharply declining. Most altcoins have plunged over 80% within three months. Yet one blockchain has seen its TVL grow by more than 130% in just one month—topping all other chains—and that’s Sonic.

What activities has Sonic recently launched? And which key projects are worth watching? Let WOO X Research guide you through it all!

Source: Defillama

What is Sonic? What's the latest airdrop event?

Sonic was formerly known as Fantom, a Layer 1 blockchain launched in 2019 focused on DeFi and dApps. It gained significant traction during 2021–2022, reaching a peak TVL of around $8 billion. In 2022, AC announced his temporary exit from the DeFi space, weakening market confidence in Fantom. Then in July 2023, its partnered cross-chain bridge Multichain suffered an exploit, causing stablecoins issued via the bridge on Fantom (such as USDC-MULTI and fUSDT-MULTI) to depeg significantly, undermining the ecosystem's stability and trust. Amid this backdrop, Fantom proposed its upgrade to Sonic.

Sonic has announced the issuance of 190.5 million S tokens, distributed through two mechanisms: 25% of the rewards can be claimed immediately, while the remaining 75% will be gradually released in tradable NFT form. Users can qualify for these rewards through two tracks:

-

Points (for network participants)

-

Gems (for developers). The return potential from these pathways may far exceed typical speculative airdrops.

Sonic Points are user-oriented airdrop points divided into passive points and active points. Holding whitelisted assets in a Web3 wallet earns passive points, while deploying whitelisted assets in applications earns active points. WETH, SolvBTC, and SolvBTC.BBN only earn active points. Active points yield twice the rewards of passive points.

Popular Projects on Sonic

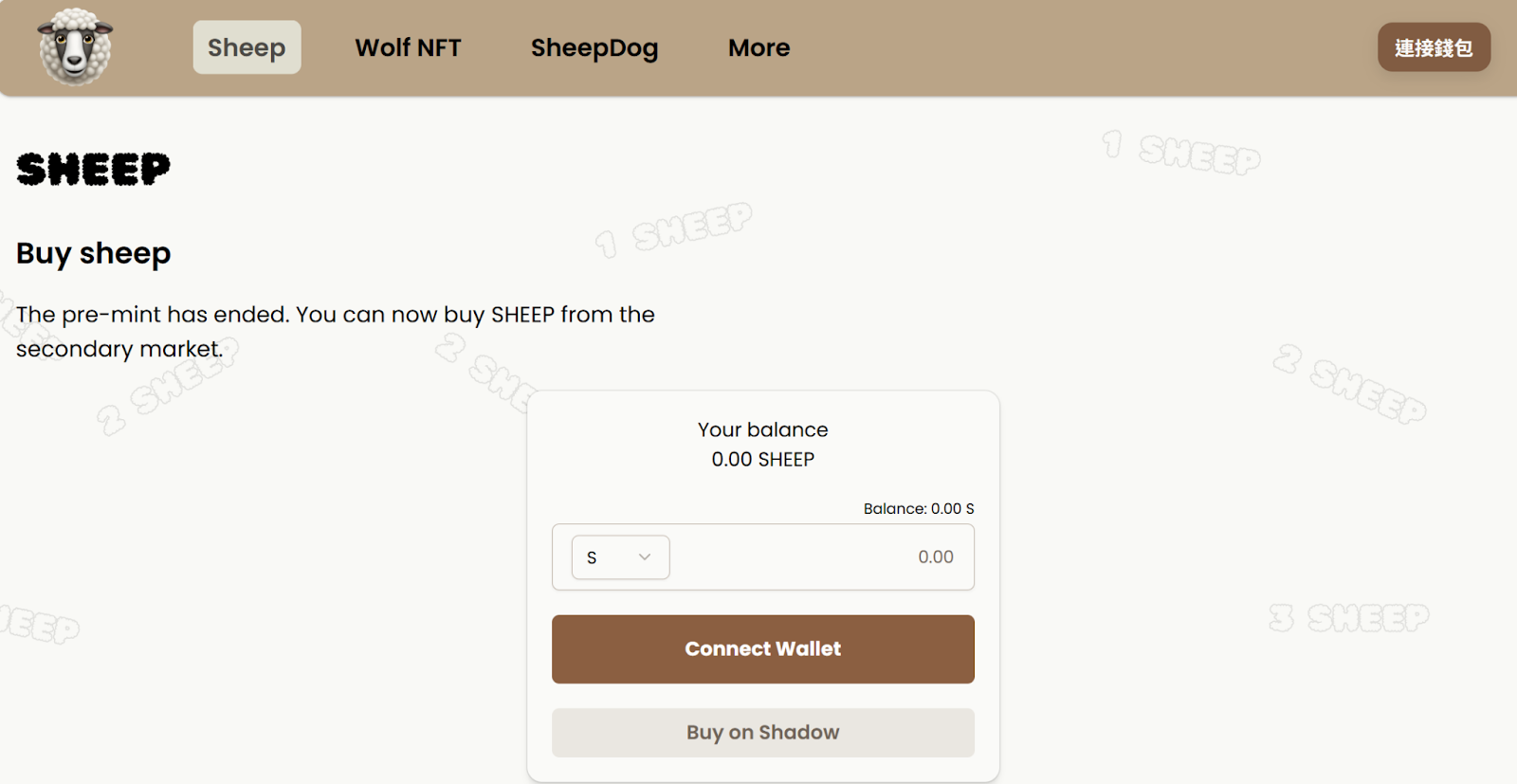

Sheep Coin (@SheepCoin69)

Source: @SheepCoin69

The Sonic Wolf & Sheep Game is a strategic gaming ecosystem combining blockchain asset management, NFT mechanics, and DeFi protocols. Players build advantages and generate returns by buying, minting, protecting, and attacking assets.

Buying Sheep Coin: Players can use $S to purchase Sheep Coin at a 1:1 ratio. During this process, 95% of the Sonic Tokens go toward providing liquidity for Sheep Coin. After launch, Sheep Coin becomes freely tradable.

Minting Wolf NFTs: Players can mint Wolf NFTs using Sheep Coin and $S. The cost increases incrementally with each mint (the first requires 1 Sheep Coin, the second 2, and so on), and all Sheep Coins used in minting are permanently burned. This means each mint reduces the total supply.

Wolf NFT Mechanics: Wolf NFTs are aggressive in-game assets with the following behavior patterns:

-

Each Wolf must consume Sheep daily, with consumption increasing per day (1 on Day 1, 2 on Day 2, etc.).

-

If a Wolf fails to eat Sheep for seven consecutive days, it becomes unusable (presumably unable to generate returns or participate further).

A Wolf can feed in two ways:

-

Liquidity Pool: Eating Sheep from the liquidity pool results in 100% destruction of those Sheep. Each Wolf can eat from the pool a maximum of three times.

-

Wallet (own or others): Eating Sheep from a wallet gives 25% of the Sheep to the Wolf owner, while 75% are destroyed.

Sheepdog Protection Mechanism: Players can deposit their Sheep into a Sheepdog for protection. To withdraw, players must activate "sleep mode," wait two days, and pay a fee.

Sheepdog Reward Mechanism: Sheep stored in a Sheepdog earn $S rewards through an annualized percentage yield (APR). Additionally, withdrawal fees paid by players contribute to these rewards.

Game Interpretation

Core Concept: Continuous deflation of Sheep caused by “Wolves eating Sheep” drives up the coin price.

-

Although the number of Sheep steadily decreases, the Sonic Tokens allocated in the liquidity pool remain unchanged, meaning the value of holding Sheep could rise steadily. However, players still face the risk of being attacked by Wolves.

About Wolves: High cost, high risk, but potentially high reward

-

The minting cost of Wolves increases depending on mint order, and profitability largely depends on whether they can successfully eat other players’ Sheep. If Wolves cannot feed regularly or starve to death, investments may fail.

-

If many Wolves appear simultaneously, competition for Sheep intensifies; but if Wolf numbers are limited, the rate of Sheep destruction may not be sufficient to allow quick returns.

Sheepdog: Pay daily rent for security and extra returns

-

A fixed rent of 10 $S per day is required, with 95% redistributed to users as APY. If a player holds too few Sheep, the rent may not be recoverable; however, with sufficient Sheep holdings, the appreciation over time makes protection more attractive.

-

The purpose of the Sheepdog is to prevent Sheep from being eaten while benefiting from their ongoing appreciation.

Strategic Dilemma 1: Is minting a Wolf worth it?

-

Wolf minting costs involve competition among players. Early mints offer advantage but come with higher costs and fiercer competition.

-

Feeding strategy is crucial: Rapid feeding accelerates breakeven but spikes demand for Sheep. Slow feeding extends survival but lengthens the payback period.

-

Since Sheep appreciate due to deflation, the profit from eating one later may not necessarily be worse than earlier—making timing a major strategic factor.

Strategic Dilemma 2: Should you rent a Sheepdog?

-

Rent is fixed regardless of how many Sheep a player owns. To recoup the rental cost via APY, a relatively large number of Sheep is needed.

-

The real function of the Sheepdog is to protect Sheep from being eaten while capitalizing on price appreciation.

Possible Scenarios and Corresponding Strategies

-

Due to high costs and uncertainty, few players may rush to mint Wolves. With fewer Wolves, Sheep destruction slows down, possibly delaying Wolf profitability.

-

If most players avoid using Sheepdogs, they might scatter Sheep across multiple wallets to reduce the risk of targeted attacks.

-

There is no fixed “optimal solution,” as market conditions and player behaviors constantly shift. Ultimately, success requires continuous monitoring of ecosystem dynamics and adaptive strategy adjustments.

Petroleum Finance (@Petroleum_Defi)

Petroleum City is a blockchain game themed around oil extraction. Players construct, upgrade, and manage Pumps to extract crude oil (cOIL), converting it into tradable $OIL to generate returns. Below are the core mechanics:

1. Buy a Plot

-

Each player can buy and customize their own plot to build an oil empire.

-

Plots can increase output by adding Pumps and decorations.

2. Buy Some Pumps

-

Pumps are the core production tools, each automatically generating cOIL continuously.

-

Pumps can be upgraded to boost output, but they degrade over time (Decay) and require repair using cOIL to maintain production.

3. Add Decorations

-

Players can decorate plots to enhance appearance and personal style.

-

New decoration suggestions can be submitted via the app or Discord.

4. Refine Your $cOIL

-

Produced cOIL must be refined at a “Refinery” before becoming tradable $OIL.

-

Withdrawal lock-up periods and taxes are as follows:

-

0–1 day: Cannot withdraw.

-

1–2 days: 10% tax upon withdrawal.

-

2–3 days: 5% tax upon withdrawal.

-

3+ days: No tax upon withdrawal.

-

-

The longer the refinement period, the higher the net return.

Strategies and Recommendations

-

Ensure continuous production: Keep enough cOIL reserved for pump repairs to avoid production interruptions.

-

Optimize refinement strategy: Aim to withdraw $OIL after 3 days to avoid high taxes.

-

Balanced upgrades and decoration: Simultaneously improve Pump output and decorative effects to maximize overall yield.

Petroleum City revolves around the core cycle: produce cOIL → repair Pumps → refine into $OIL → reinvest in upgrades. Players need to carefully plan production, refinement, and upgrade strategies to steadily generate returns and expand their assets.

Source: @Petroleum_Defi

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News