Tiger Research: From Community to Product, How Did Sign Rise?

TechFlow Selected TechFlow Selected

Tiger Research: From Community to Product, How Did Sign Rise?

Sign is not merely a verification tool—it is laying the foundation for the trust architecture of the future, with a vision to "define trust and make it programmable."

Translation: TechFlow

This report was written by Tiger Research, analyzing Sign's success in building the "Orange Dynasty" community, developing a profitable TokenTable infrastructure, and advancing its vision for the trust-based Sign Protocol within the Web3 ecosystem.

Executive Summary

Community: Sign successfully built a thriving "Orange Dynasty" community through cultural symbols (orange color and "SignGlasses"), a fair incentive mechanism based on soulbound tokens (SBTs), and continuous engagement. This community of over 50,000 members provides strong support for Sign.

Fundamentals: In 2024, Sign generated $15 million in revenue through its token distribution platform, TokenTable, which has processed over $4 billion in token airdrop transactions. To date, the company has raised $28 million from investors including YZi Labs and Sequoia Capital, demonstrating its strong market position.

Vision: Sign is expanding beyond TokenTable to the Sign Protocol—a blockchain-based attestation identity system designed to address issues like Sybil attacks while building a programmable trust infrastructure with practical applications in real-world assets (RWA), central bank digital currencies (CBDC), and government collaborations.

The Role of Community in the Web3 Industry

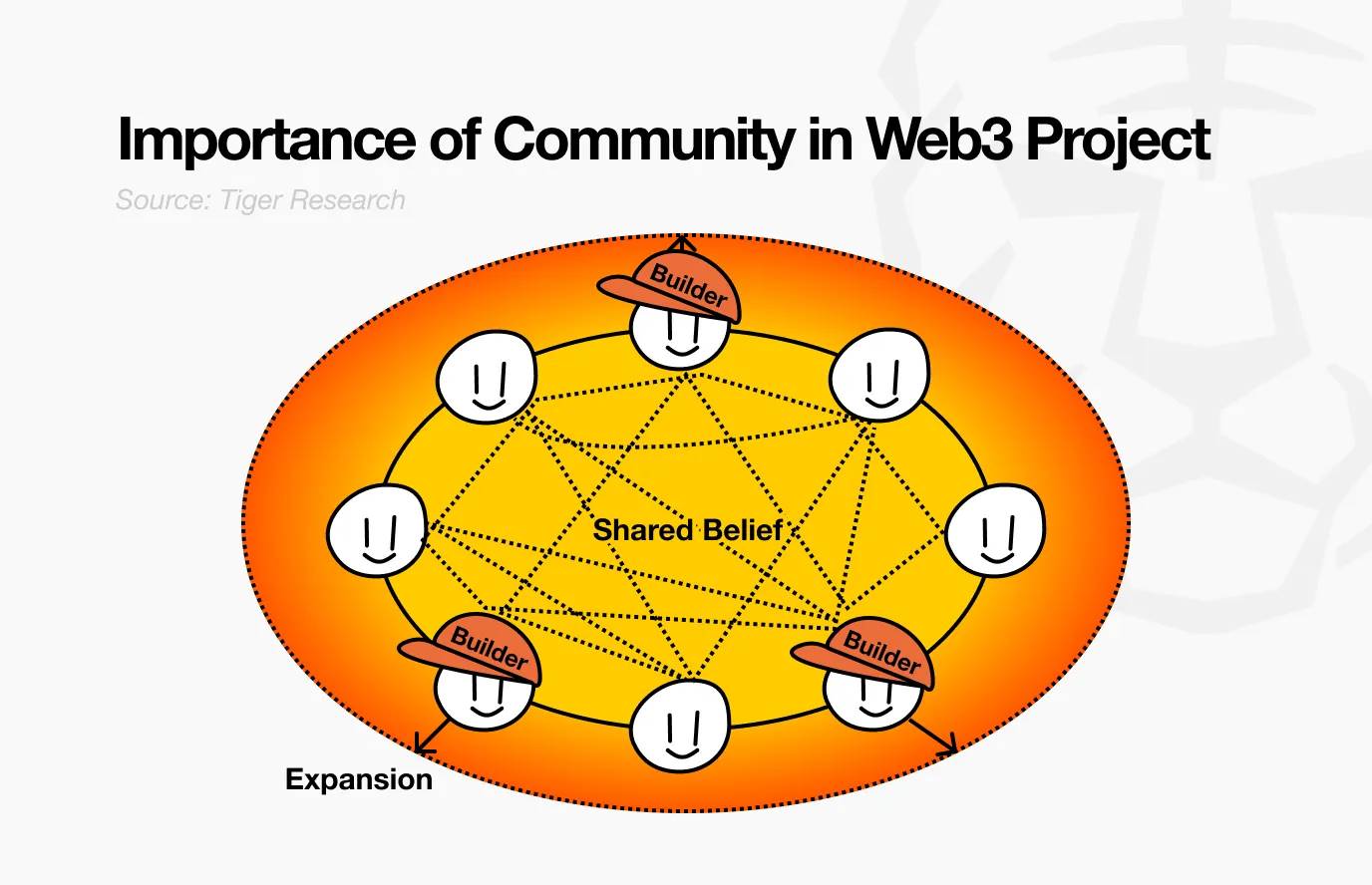

Community plays a crucial role in brand development. It provides members with a sense of identity and belonging, creating emotional bonds that enhance loyalty. These connections drive organic growth and strengthen resilience during crises.

Community-building is not a new concept—it has long played an important role in traditional industries. For example, Lululemon achieved global expansion by building a fitness community of 13 million members, where users actively spread brand value in the market. Similarly, Harley-Davidson faced intense competition from Japanese motorcycle brands in the 1980s but successfully navigated a major business crisis by forming the Harley Owners Group (H.O.G.), rebuilding its brand strength.

In the Web3 industry, the role of community is even more critical. Web3 operates on a culture-centered collaborative foundation. In decentralized environments, participants unite around shared beliefs and values rather than relying on centralized authority. Community members are not just consumers—they often act as volunteer contributors and builders, further amplifying the importance of community in project success.

Academic research also supports this view. Gartner and Moro (2024) analyzed data from 3,644 initial coin offering (ICO) projects and found a strong correlation between the number of followers on social media platforms (such as Twitter and Telegram) and the likelihood of reaching funding goals.

In contrast, traditional professional indicators—such as the educational background and experience of management teams—have minimal impact on success. This suggests that in the Web3 ecosystem, community support and participation are stronger predictors of success than conventional credentials. Projects with high online visibility and active communities are more likely to achieve investment targets and sustain long-term growth.

Community: How Was the Orange Dynasty Built?

While many Web3 projects theoretically emphasize the importance of community, few succeed in practice. Most focus only on initial incentives or large-scale external events, failing to create a culture that participants can genuinely resonate with.

Three key elements are essential for building sustainable Web3 communities:

-

Establishing identity and belonging through cultural symbols;

-

Encouraging participation via fair incentive mechanisms;

-

Maintaining member activity through ongoing events and communication channels.

When these elements are integrated and reinforce each other, authentic communities emerge.

Sign exemplifies this approach. Its community, the "Orange Dynasty" (Orange Dynasty), has cultivated a distinct identity through consistent use of color and language.

2.1. Building Strong Identity and Belonging Through Cultural Symbols

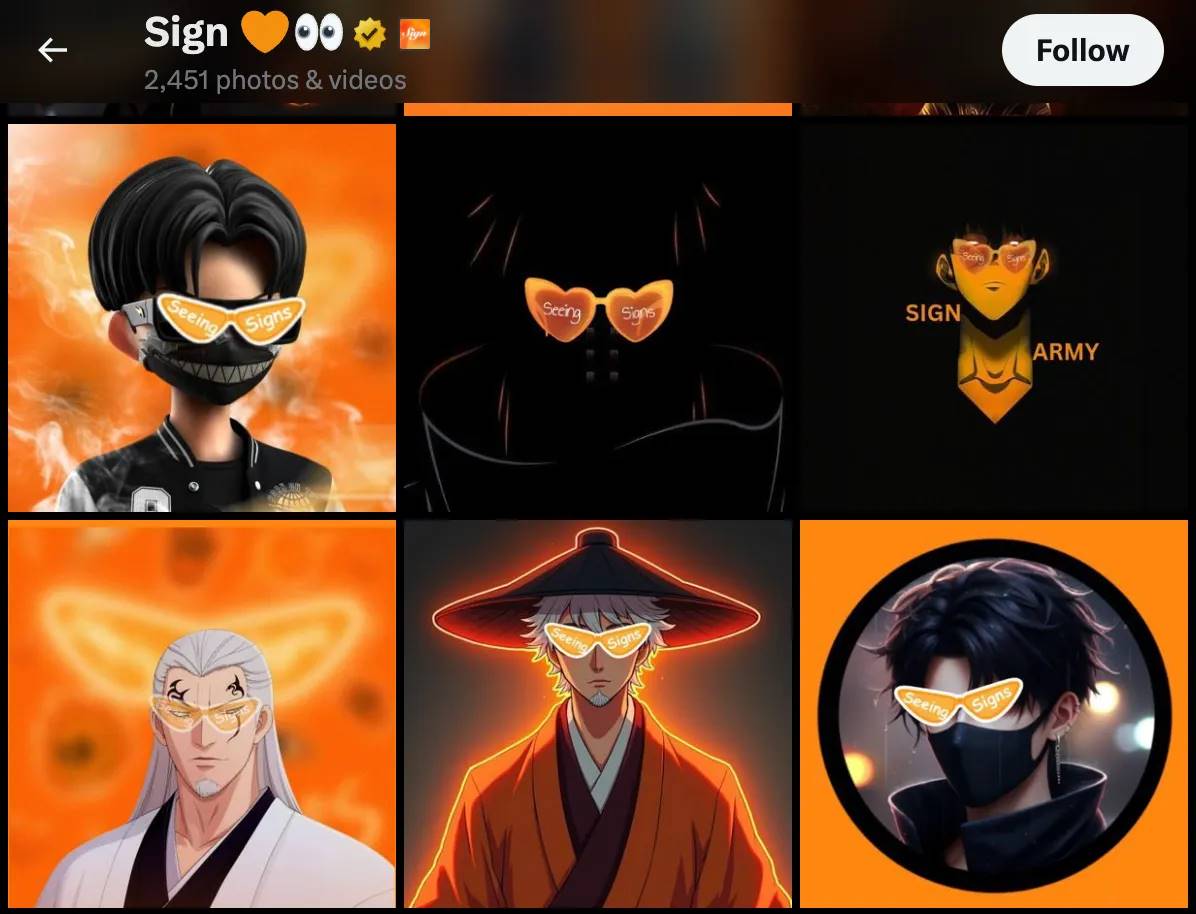

Source: X

Orange, adopted as the community’s iconic color, transcends branding to become a cultural symbol. Psychologically associated with energy and passion, it infuses vitality into the community and has evolved into a unique emblem—the “SignGlasses,” a stylized pair of sunglasses representing community identity.

On X (formerly Twitter), users can easily join the community through simple visual modifications—such as adding an orange background to their profile or incorporating sunglasses into their avatar—without fully altering their personal brand. This low-barrier participation encourages voluntary engagement, strengthens cohesion among members, and drives organic growth.

2.2. Fair Incentive Mechanisms to Encourage Participation

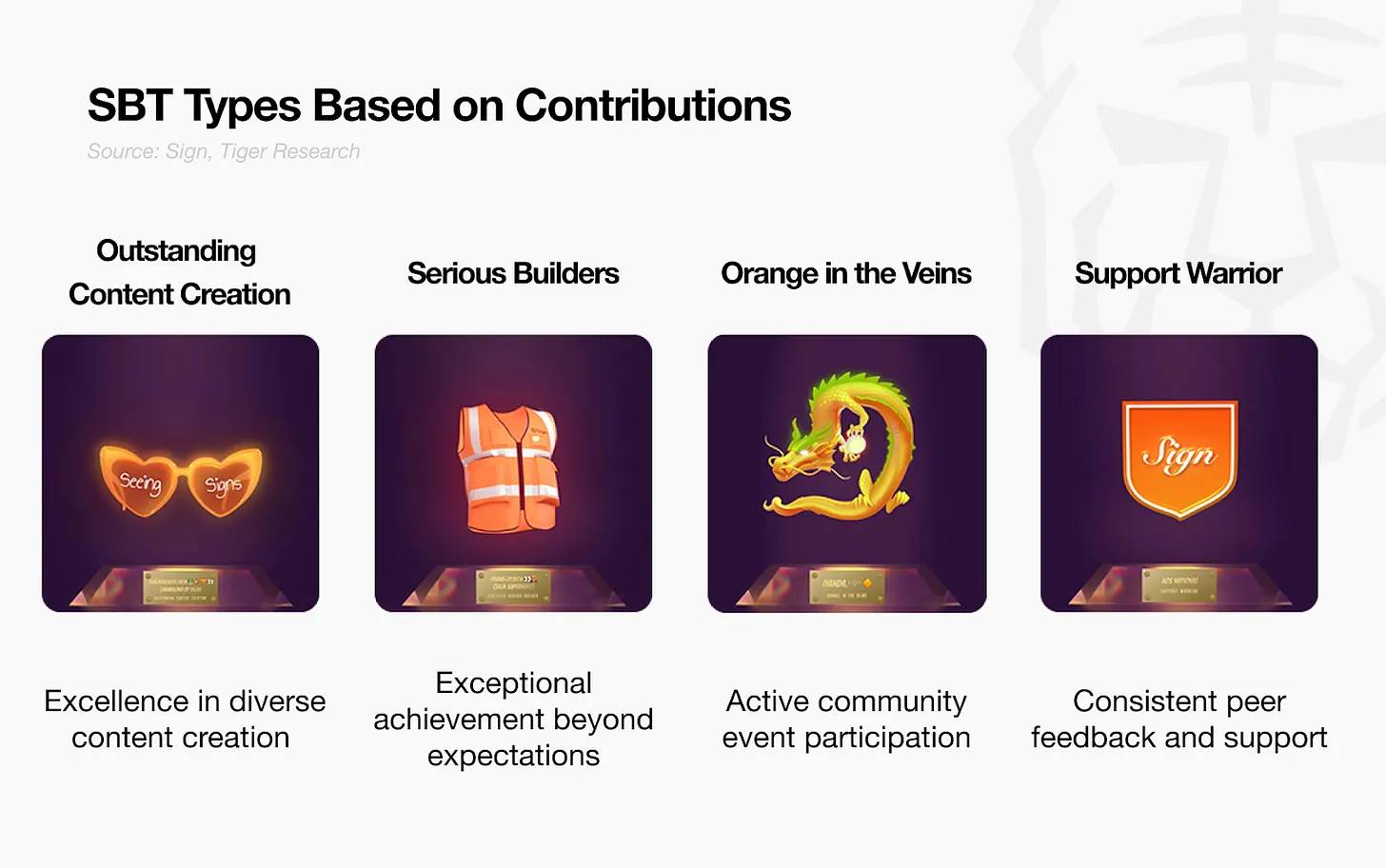

Sign’s second strength lies in its unique incentive model, using a non-transferable token system—Soulbound Tokens (SBT)—to assign value to meaningful contributions.

The uniqueness of this system lies in its emphasis on quality ("qual"), not just quantitative metrics. Sign does not reward surface-level actions such as post counts or likes, but instead recognizes genuine participation and value creation. SBTs are divided into four categories and are non-tradable, effectively preventing manipulation and ensuring that individual recognition is earned through effort, not purchased.

2.3. Ongoing Activities and Communication Channels to Maintain Engagement

Source: Sign

Sustained communication and activities are the final key to success. Sign has demonstrated passion and commitment through over 14,500 posts and more than 560 hours of X Spaces (formerly Twitter Spaces) operation.

The ultimate success factor is continuous communication and interaction. Sign proves its dedication through over 14,500 posts and more than 560 hours of X Space sessions.

Notably, Sign’s official presence on X is not centralized under a single @sign account but driven by community accounts. This structure allows new users to encounter the project through community-generated content, experiencing Sign’s culture and values before delving into its core mechanisms.

Source: X

Through these engagement strategies, Sign has successfully nurtured a self-sustaining community of over 50,000 members. The depth of belonging is evident—some members have even tattooed the Sign logo onto their bodies, a striking display of loyalty that underscores the project’s cultural impact.

Fundamentals: TokenTable’s Substantive Achievements

A strong community alone is insufficient—long-term sustainability requires tangible products and a clear vision. In 2024, Sign generated over $15 million in revenue through its token distribution platform, TokenTable. This level of revenue is extremely rare in the Web3 space, providing solid foundational support for the community and further amplifying its influence.

Source: Sign

These achievements have attracted significant investor attention. To date, Sign has raised a total of $28 million. This includes $12 million raised during the seed round, followed by an additional $16 million in a Series A round led by CZ’s YZi Labs (formerly Binance Labs) in January 2025.

Notably, all three regional divisions of Sequoia Capital—United States, China, and India/Southeast Asia—participated in the seed round. Given that Sequoia typically invests through a single regional fund, Sign stands out as a rare exception. This cross-regional involvement reflects strong investor confidence in Sign’s global potential.

3.1. The Current State of TokenTable

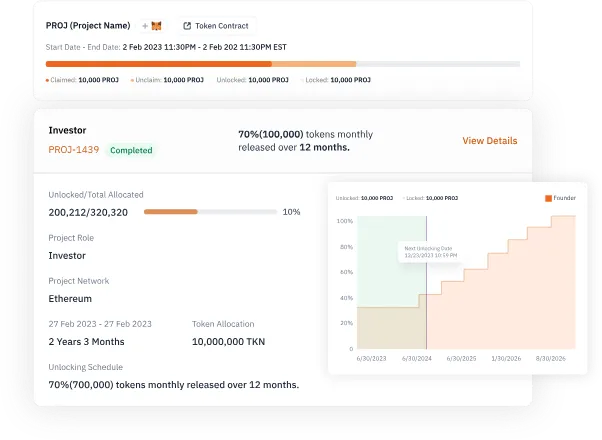

TokenTable has positioned itself as the "Goldman Sachs" of the Web3 world. Just as Goldman Sachs handles stock issuance, investor onboarding, and market making in traditional finance, TokenTable serves as core infrastructure in the blockchain ecosystem, focusing on token issuance, distribution, and liquidity management.

The complexity and risk involved in token operations explain the importance of such services in the Web3 ecosystem. Token issuance involves writing and auditing smart contract code, requiring highly specialized technical expertise. Distributing tokens to tens of thousands—or even millions—of users is a technically challenging task, where even minor errors can lead to significant losses. Additionally, managing vesting schedules for investors and team members demands high transparency and precision, as manual handling increases the risk of errors or misconduct.

TokenTable solves these challenges by providing standardized infrastructure, streamlining the entire process. This allows project teams to focus on tokenomics and product development instead of operational risk management.

Source: Sign

-

Airdrop Management: Enables automated token distribution to community users. For instance, Kaito used the platform to distribute tokens to over 100,000 users.

-

Token Unlock Management: Uses smart contracts to schedule token unlocks for investors or team members. Multiple projects, including Starknet, Dogs, and Zetachain, have utilized TokenTable’s Unlocker tool to manage this process transparently and securely.

-

Over-the-Counter (OTC) Brokerage Services: Facilitates large-volume token trades by transferring withdrawal rights for locked tokens. This is analogous to selling an apartment directly—enabling bulk token transfers without impacting prices on centralized exchanges.

TokenTable’s client portfolio includes several notable projects such as Starknet, ZetaChain, DOGS, Mocaverse, and TON (Telegram Open Network)-based projects like Notcoin and GAMEE. Within the TON ecosystem alone, TokenTable has distributed over $2 billion in assets to 40 million users.

3.2. TokenTable in 2025

TokenTable’s primary revenue comes from airdrop claiming fees and OTC service fees. To date, the platform has processed over $4 billion in token airdrops and unlocks, connecting more than 40 million users and investors.

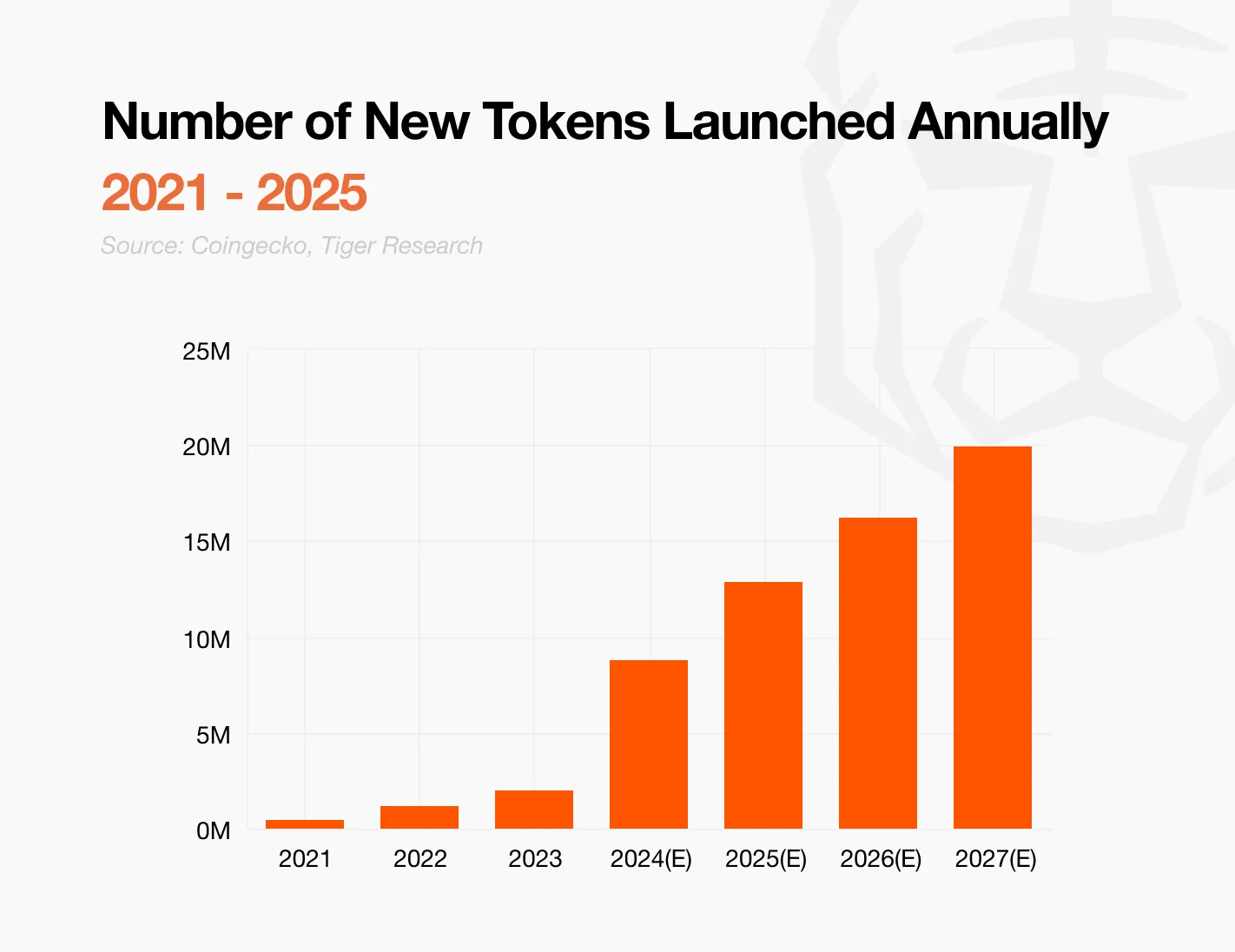

Demand for TokenTable’s services is not limited to large projects. With the rise of token launch platforms, the number of small Web3 projects is rapidly increasing. By 2027, approximately 1.9 million projects are expected to enter the market, many of which will conduct airdrops or require structured token management. Therefore, TokenTable’s potential customer base is poised for significant expansion in the coming years.

TokenTable Lite: A simplified version designed for smaller projects with fewer than 100,000 users. Requiring no approval, it features an intuitive interface and streamlined setup, enabling anyone wishing to create and distribute memecoins, fan tokens, or AI agent tokens to get started easily.

TokenTable Dashboard: A transparency tool for investors, providing real-time data on on-chain token allocation and distribution plans. It displays token distribution across stakeholders, exchanges, and wallets, going beyond disclosures typically found in project whitepapers.

FutureToken Technology: A next-generation derivative designed to revolutionize OTC trading. Rather than simply transferring withdrawal rights, it creates standardized financial instruments based on locked tokens that can be freely traded in secondary markets. This is akin to converting apartment lease rights into securities tradable on stock exchanges—enhancing investor protection, reducing information asymmetry, and increasing secondary market liquidity.

These product expansions aim to support broader adoption, lower entry barriers for new projects, and unlock additional revenue streams. Backed by a loyal community and a scalable revenue model, Sign is well-prepared for long-term growth.

Vision: The Trust-Based Sign Protocol

Sign is expanding its scope beyond TokenTable toward a broader authentication system. While TokenTable effectively connects token distribution with investors, it faces a key limitation: it cannot link digital wallet addresses to real user identities.

This gap makes it difficult to address issues such as Sybil attacks. If wallets could be reliably tied to individual users, systems could detect and prevent users from claiming multiple airdrops via multiple accounts. Currently, such detection relies on analyzing wallet interactions to infer suspicious behavior. Although blockchain systems are designed to operate trustlessly, in certain contexts—especially airdrop distribution or governance—knowing the real identity behind an address becomes essential.

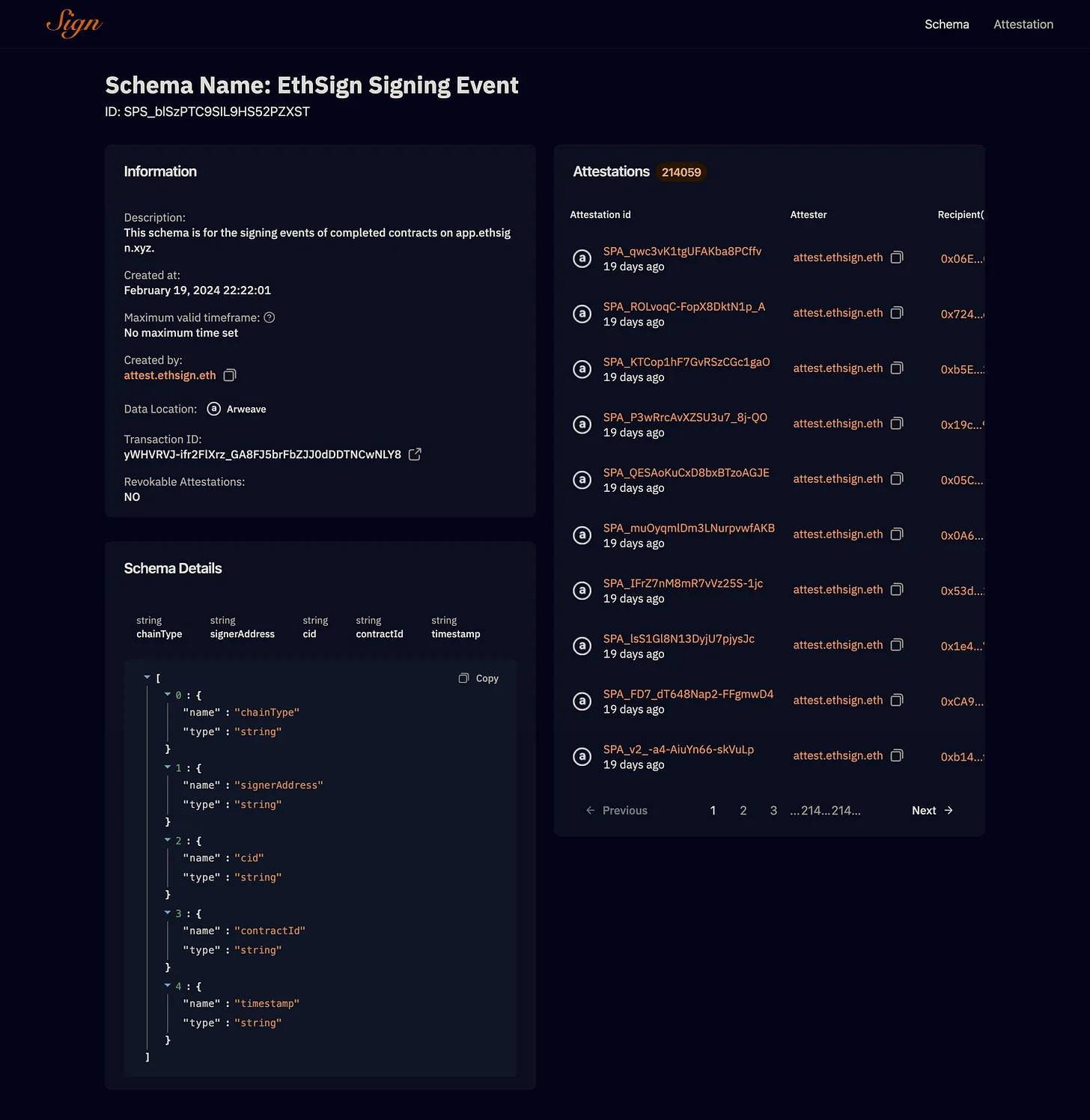

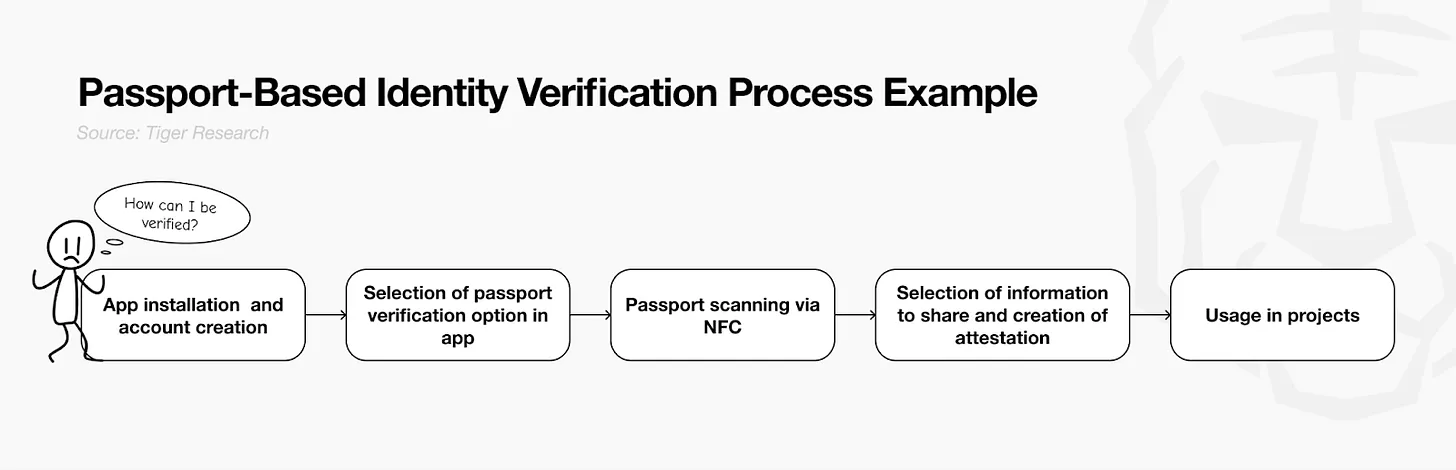

To address this challenge, Sign developed the Sign Protocol, a trust system designed to enable easy and reliable identity verification across physical and digital spaces. At its core is the concept of “attestation”—digitally verifying and recording the truth of a specific piece of information or claim so others can validate its authenticity at any time.

For example, when a government confirms that “this person is a citizen of a particular country,” that information can be digitally signed and recorded on-chain. Once stored this way, other institutions and services can easily verify its authenticity. Sign Protocol organizes these attestations using standardized templates called “Schemas,” similar to how passports or ID cards follow consistent formats to manage identity data.

This system significantly improves user experience. Instead of repeating KYC (Know Your Customer) procedures across multiple platforms, users can reuse a single attestation created via the Sign Protocol. While initial use cases focus on airdrop eligibility and Sybil attack prevention, this framework shows broader potential in areas requiring identity or qualification verification, particularly in real-world assets (RWA) and central bank digital currencies (CBDC).

Real-world assets (RWA) refer to the concept of converting physical assets such as real estate or stocks into digital tokens that can be traded on blockchains. Compliance is critical in this domain. Managing verified investor qualifications via the Sign Protocol can streamline investment processes. As RWAs move on-chain, corresponding decentralized finance (DeFi) applications are expected to grow naturally.

Meanwhile, CBDC (central bank digital currency) distribution represents another key application. When governments seek to distribute digital currency at scale, combining TokenTable’s mass distribution capabilities with Sign Protocol’s identity verification infrastructure enables efficient and secure deployment.

However, for Sign’s attestations to evolve into true trust infrastructure, they must gain recognition beyond simple on-chain statements—from real-world institutions and systems. To this end, Sign has already achieved notable milestones:

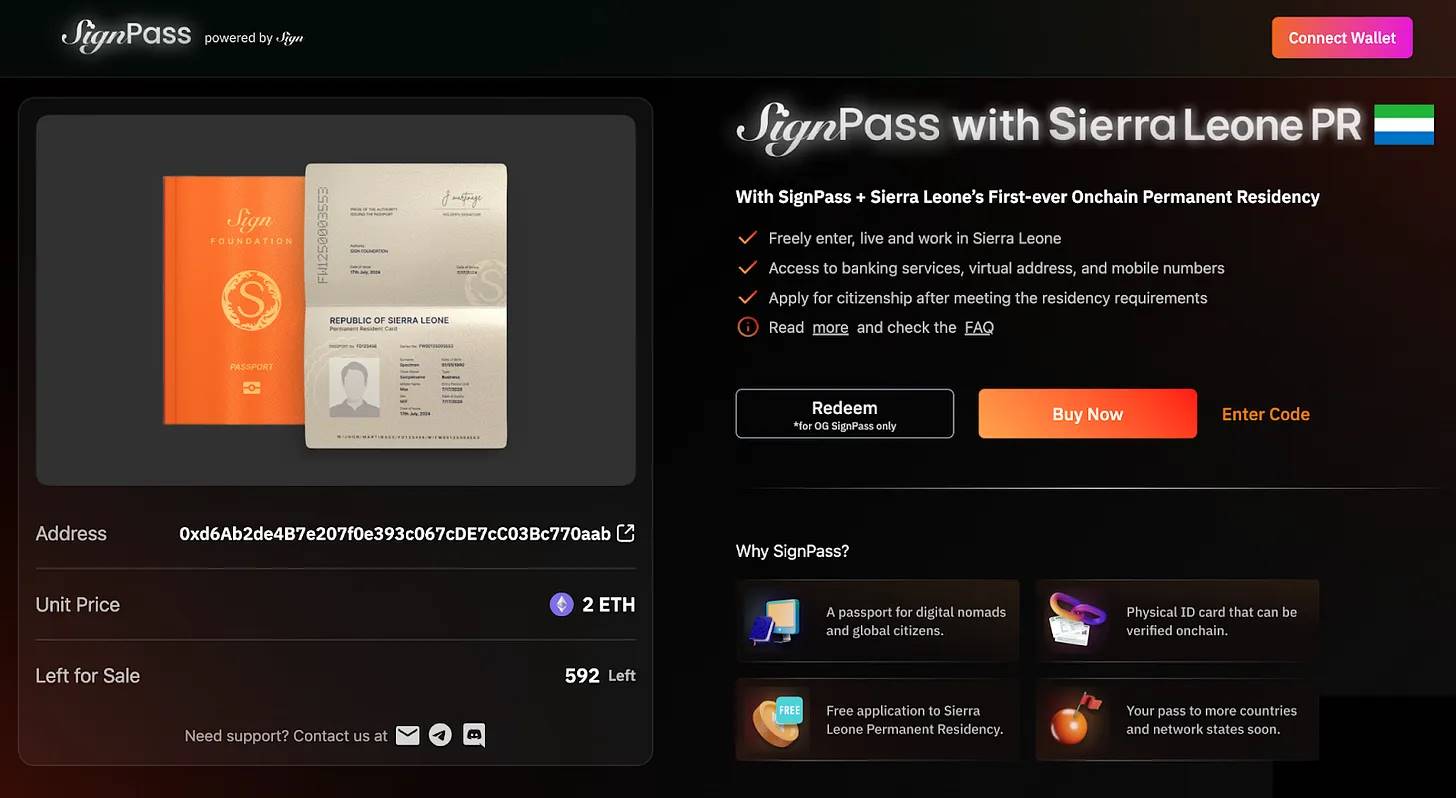

In Sierra Leone, the team built a blockchain-based digital ID, issuing the world’s first verifiable physical identity credential on-chain.

In the UAE, they partnered with the Ras Al Khaimah government to automate public administrative processes using blockchain.

Through collaboration with Cypher Capital and RAK DAO, they launched a 10-year residency visa program for Web3 entrepreneurs.

These milestones show that Sign is not merely building technological infrastructure but actively establishing trust in the real world.

In the end, Sign is more than just a verification tool—it is laying the foundation for future trust architectures, with a vision to “define trust and make it programmable.” As the Web3 ecosystem matures, this foundational capability will become increasingly indispensable.

Sign: Community, Fundamentals, and Vision

Sign is a model project in the Web3 ecosystem, successfully achieving parallel growth in community building and commercial fundamentals. Unlike many projects that rely on token-driven fundraising before product launches, Sign has expanded its ecosystem around TokenTable—a mature revenue-generating product—demonstrating an execution-first strategy.

Although the Sign Protocol remains in early stages, the team has demonstrated strong execution through government partnerships, including developing IDs and crypto cards. These achievements serve as powerful proof of feasibility and long-term sustainability, going beyond abstract vision statements.

At the same time, Sign faces challenges in expanding its ecosystem using only internal resources. To convert current community enthusiasm into sustained growth, the project needs to cultivate external builders aligned with its mission. This requires strategic planning around its strong cultural foundation, enabling third-party services to build atop the Sign Protocol.

Despite these challenges, Sign is widely regarded as a project with immense long-term potential, backed by both commercial achievements and a dedicated community. If the team can successfully expand the Sign Protocol into a broader ecosystem, building upon the proven success of TokenTable, it may provide a new blueprint for sustainable Web3 growth.

Disclaimer

This report was partially funded by Sign but independently produced by our researchers using reliable sources. The findings, recommendations, and opinions expressed herein are based on information available at the time of publication and may change without notice. We assume no liability for any losses arising from the use of this report or its contents and make no guarantee regarding its accuracy or completeness. Information in this report may differ from other viewpoints. This report is for informational purposes only and does not constitute legal, business, investment, or tax advice. References to securities or digital assets are for illustrative purposes only and do not constitute investment advice or an offer. This material is not directed at investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News