U.S. February PCE Higher Than Expected, Market Still Nervous; GME and Other Companies Issue Bonds to Buy BTC | Hotcoin Research Market Insights: March 24–28, 2025

TechFlow Selected TechFlow Selected

U.S. February PCE Higher Than Expected, Market Still Nervous; GME and Other Companies Issue Bonds to Buy BTC | Hotcoin Research Market Insights: March 24–28, 2025

Market Outlook: The market showed range-bound volatility this week, with sentiment remaining fearful. There was a slight increase in on-chain stablecoin issuance, while net inflows into U.S. spot Bitcoin ETFs slowed and net outflows from Ethereum ETFs also decelerated.

Author: Hotcoin Research

Cryptocurrency Market Performance

The current total market capitalization of cryptocurrencies stands at $2.84 trillion, with BTC accounting for 60.8%, or $1.73 trillion. Stablecoin market cap is $233.4 billion, up 0.98% over the past seven days, with USDT representing 61.88%.

This week, BTC's price showed range-bound volatility, currently trading at $84,094; ETH also experienced range-bound movement, now priced at $1,902.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: BERA gained 28.09% over 7 days, CRO increased by 27.92%, GRASS rose 27.74%, and SAFE was up 25.94%.

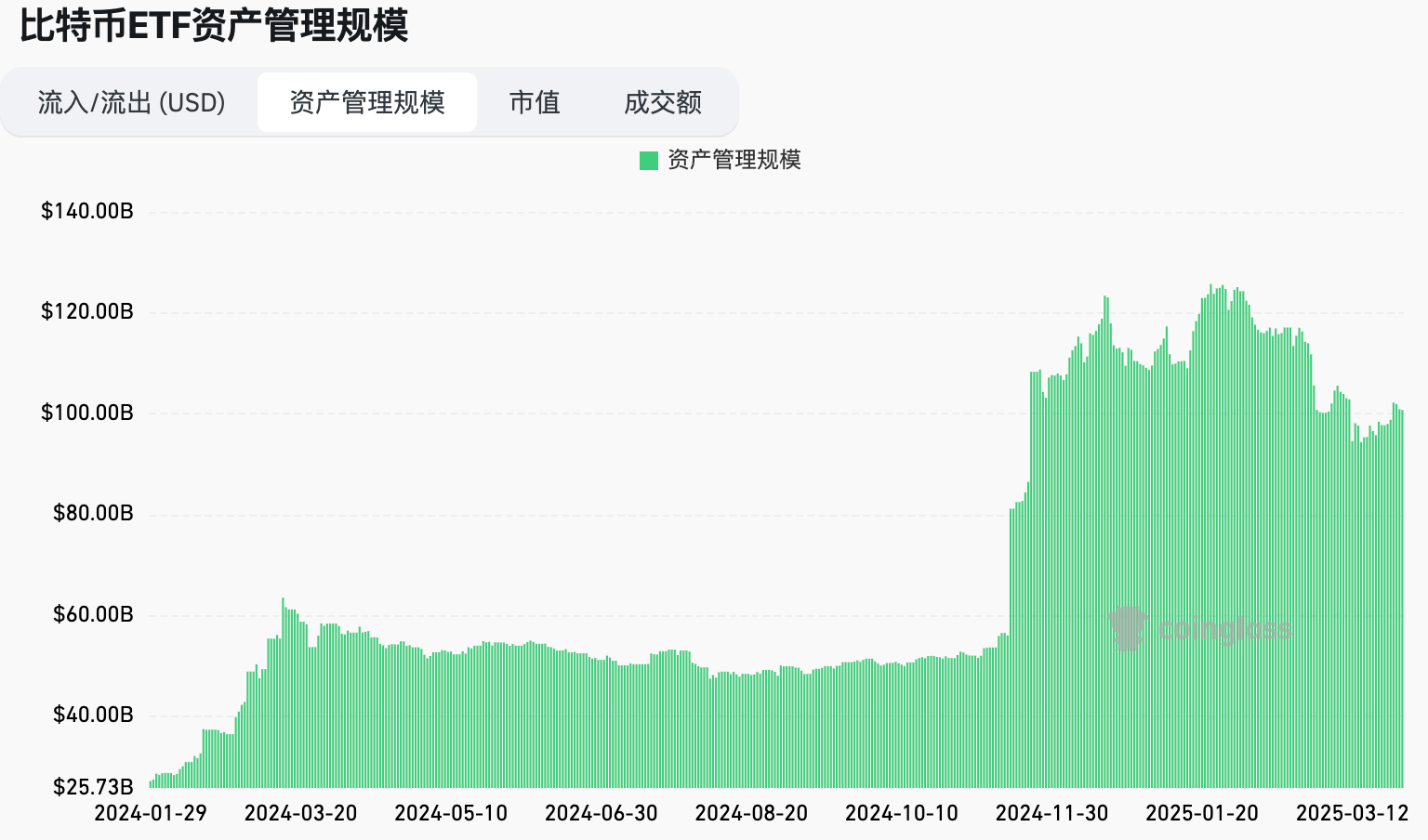

This week, net inflows into U.S. spot Bitcoin ETFs amounted to $196.4 million; meanwhile, U.S. spot Ethereum ETFs saw net outflows of $8.7 million.

The "Fear & Greed Index" on March 29 stood at 26 (lower than last week). Market sentiment this week: fearful for 3 days, neutral for 4 days.

Market outlook: The market remains in a consolidation phase, with persistent fear-driven sentiment. On-chain stablecoins saw slight issuance increases, while net inflow speeds for U.S. spot Bitcoin ETFs have slowed, as did outflows from Ethereum ETFs. Memes on the SOL chain are showing signs of resurgence, particularly GHIBLI with its Studio Ghibli theme. U.S. February PCE data came in above expectations. The Trump administration warned that if the EU and Canada collude to harm the U.S. economy, high tariffs would be imposed. The probability of the Fed holding rates steady in May is 87.8%. The broader market is expected to remain range-bound from April to June. For potential opportunities, monitor trending projects on BSC and SOL chains, and closely follow Hotcoin New Coin List to unlock more wealth opportunities.

Understanding the Present

Weekly Major Events Recap

1. On March 24, Japanese listed company Metaplanet Inc. announced it has purchased an additional 150 BTC, bringing its total holdings to 3,350 BTC;

2. On March 23, according to DeFiLlama data, Ethena’s TVL surpassed $6.5 billion, reaching a record high of $6.558 billion as of March 22. USDe supply reached 5.413 billion tokens, USDtb supply reached 1.142 billion;

3. On March 23, DefiLlama reported that PancakeSwap generated $3.45 million in revenue over the past 24 hours, ranking third on the crypto revenue leaderboard. Tether and Circle ranked first and second with $18.37 million and $6.25 million in 24-hour revenue respectively;

4. On March 25, prediction platform Polymarket officially launched on the Solana network, enabling users to deposit using SOL. Previously, the platform operated primarily on Polygon and only supported USDC deposits;

5. On March 25, the Dogecoin Foundation officially launched the “Official Dogecoin Reserve” through a newly established commercial entity and completed its first purchase of 10 million DOGE;

6. On March 25, Bloomberg reported that BlackRock, the world's largest asset manager, launched a Bitcoin exchange-traded product (ETP) in Europe, extending its success from the U.S. spot Bitcoin ETF (which has grown to $48 billion in size);

7. On March 25, CPIC Investment Management, a Hong Kong subsidiary of China Pacific Insurance (CPIC), announced the launch of a dollar-denominated money market fund (MMF) based on HashKey Chain. It received $100 million in subscriptions on its first day, available to professional and institutional investors;

8. On March 26, Lookonchain data showed that Hyperliquid liquidated 392 million JELLY tokens at $0.0095 each (worth ~$3.72 million) before delisting JELLY, suffering no losses and actually profiting $703,000;

9. On March 27, Elon Musk, Sam Altman, and other public figures posted AI-generated Studio Ghibli-themed images on X;

10. On March 27, GameStop announced plans to privately place $1.3 billion in 0.00% convertible preferred notes due 2030 to qualified institutional buyers. Depending on market conditions, initial purchasers may have the option to buy up to an additional $200 million within 13 days. Proceeds will be used for general corporate purposes, including purchasing Bitcoin per the company's investment policy;

11. On March 27, Taproot Wizards, an NFT project on the Bitcoin ecosystem, announced it will launch a Dutch auction tonight at 11 PM, starting at 0.42 BTC, decreasing by 0.01 BTC every three minutes. A total of 80 NFTs will be auctioned, accepting both Bitcoin and SOL;

12. On March 27, Corn, a yield network on the Bitcoin ecosystem, launched its airdrop query page;

13. On March 28, U.S. February core PCE price index YoY came in at 2.8%, higher than the expected 2.7%.

Macroeconomic Developments

1. On March 25, President Trump reiterated during a cabinet meeting his desire for the Federal Reserve to cut interest rates;

2. On March 27, Trump threatened that if the EU and Canada collude to damage the U.S. economy, the U.S. would impose high tariffs, stating on social media that these tariffs would be “far beyond current plans”;

3. On March 28, according to CME’s “FedWatch”: The probability of the Fed holding rates steady in May is 87.8%, and a 25-basis-point rate cut has a 12.2% chance;

4. On March 28, the SEC officially announced the withdrawal of lawsuits against Kraken, Consensys, and Cumberland, and has issued official notices;

5. On March 28, FOX Business journalist Eleanor Terrett reported that the U.S. Securities and Exchange Commission (SEC) has formally concluded its investigation into Crypto.com and will take no enforcement action against the platform.

ETFs

Data shows that from March 24 to March 28, net inflows into U.S. spot Bitcoin ETFs totaled $196.4 million. As of March 28, GBTC (Grayscale) has seen cumulative outflows of $22.48 billion, currently holding $16.2 billion in assets, while IBIT (BlackRock) holds $48.182 billion. Total market cap of U.S. spot Bitcoin ETFs is $96.526 billion.

Net outflows from U.S. spot Ethereum ETFs: $8.7 million.

Looking Ahead: Future Outlook

Event Announcements

1. Southeast Asia Blockchain Week 2025 will be held in Bangkok, Thailand from March 30 to April 5, 2025;

2. MEME.ing will host an offline event titled “Meme 2025 · PALAU” in Palau from April 2 to 3, 2025;

3. Foresight News will co-host the global cryptocurrency summit “BUIDL 2025” with The Block on April 5 at JW Marriott Hotel Hong Kong, aiming to build an efficient bridge for cooperation and exchange among global crypto practitioners through strong East-West media influence;

4. ETHGlobal Taipei 2025 will take place in Taiwan from April 4 to 6, 2025;

5. The 2025 Hong Kong Web3 Festival will be held at Hall 5BCDE, Hong Kong Convention and Exhibition Centre, from April 6 to 9, 2025.

Project Updates

1. Asset management firm VanEck will waive management fees for its spot Bitcoin ETF HODL from March 13 to March 31, 2025. If assets exceed $150 million by the deadline, the fee for the excess portion will be 0.2%. After March 31, 2025, the standard management fee of 0.2% will resume;

2. ZKsync Ignite Season 1 runs from January 6 to March 31, distributing 100 million ZK tokens to DeFi users providing liquidity on DEXs, lending, and Perps platforms, with rewards claimable weekly;

3. DAG-based orderbook DEX Vite Labs will shut down the Vite Gateway on April 4. Users can still use community-run gateways and must transfer funds to exchanges or community gateways.

Key Events

1. Binance will delist stablecoin trading pairs that do not comply with MiCA standards for European Economic Area (EEA) users on March 31, 2025, to meet regulatory requirements. Affected assets include USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG. MiCA-compliant stablecoin pairs (e.g., USDC and EURI) and fiat pairs (EUR) will remain available unchanged;

2. The Cayman Islands’ new licensing regulations will take effect on April 1, 2025. Under the 2025 Virtual Assets (Service Providers) (Amendment) Regulations, all entities offering virtual asset custody and trading services must obtain a license from the Cayman Islands Monetary Authority (CIMA). Existing Virtual Asset Service Providers (VASPs) must submit their license applications within 90 days of the effective date;

3. Japanese listed company Metaplanet will execute a 10-to-1 stock split on April 1. The company began purchasing Bitcoin in April 2024.

Token Unlocks

1. Hooked Protocol (HOOK) will unlock 8.33 million tokens worth approximately $1.14 million on April 1, representing 1.67% of circulating supply;

2. dYdX (ETHDYDX) will unlock 8.33 million tokens worth about $5.71 million on April 1, representing 1.13% of circulating supply;

3. Conflux (CFX) will unlock 87.5 million tokens worth around $7.46 million on April 1, representing 1.71% of circulating supply;

4. Gravity (G) will unlock 180 million tokens worth approximately $2.81 million on April 5, representing 1.5% of circulating supply.

About Us

Hotcoin Research, as the core research hub within the Hotcoin ecosystem, is dedicated to providing global cryptocurrency investors with professional, in-depth analysis and forward-looking insights. We offer a triple-service framework of “trend analysis + value discovery + real-time tracking,” delivering deep industry trend analysis, multi-dimensional evaluation of promising projects, and round-the-clock market monitoring. Through our bi-weekly strategy livestreams “Top Coins Selection” and daily news briefings “Blockchain Today,” we provide precise market interpretations and actionable strategies for investors at all levels. Leveraging cutting-edge data analytics models and an extensive industry network, we empower novice investors to build cognitive frameworks and help professional institutions capture alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate strictly within a sound risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News