From Fort Knox's "black box" to on-chain transparency, will Bitcoin repeat gold's fate of being absorbed by the US dollar?

TechFlow Selected TechFlow Selected

From Fort Knox's "black box" to on-chain transparency, will Bitcoin repeat gold's fate of being absorbed by the US dollar?

This article will begin by comparing Bitcoin and gold to unpack the intriguing implications behind America's proposal.

By HedyBi

Curated by Lola Wang

Produced by OKGResearch

On March 24, Bo Hines, executive director of U.S. President Trump’s Digital Assets Advisory Committee, proposed a highly controversial idea: using proceeds from gold reserves to purchase Bitcoin in a “budget-neutral” manner, thereby increasing the nation's Bitcoin holdings. Just days earlier, the International Monetary Fund (IMF) officially incorporated Bitcoin into its global economic statistics framework. With Bitcoin now included in the *Balance of Payments and International Investment Position Manual* (BPM7), central banks and statistical agencies worldwide must record Bitcoin transactions and positions in their international investment reports. This move not only formally acknowledges Bitcoin’s growing influence within the global financial system but also signals its evolution from a speculative asset toward a more institutionalized financial instrument—making Bitcoin a viable foreign reserve option for nations starting March 20.

Yet what makes the U.S. proposal particularly intriguing is the suggestion to exchange gold—the asset long revered as the “ultimate safe-haven”—for Bitcoin. This raises a fundamental question: Is gold still unquestionably the premier safe-haven asset? If so, why—across centuries since the coinage eras of ancient Greece and Rome—has no corporation adopted a strategy akin to MicroStrategy’s aggressive, long-term Bitcoin accumulation? As policymakers globally reassess this emerging asset’s role in finance, the United States has taken a clear stance. Could Bitcoin be the first shot in a broader financial paradigm shift?

In 2025, OKG Research launched a special series titled "Trumponomics," tracking the impact of Trump 2.0 on the crypto industry and global markets. This article explores the deeper implications behind the U.S. proposal by comparing Bitcoin and gold.

Is America Selling Real Gold?

The United States holds an official gold reserve of 8,133.5 tons, ranking first globally for over 70 years. However, a key fact is that these gold reserves have long been out of circulation, stored instead in facilities such as the Kentucky Bullion Depository, Denver, and the Federal Reserve Bank of New York. Since the 1971 “Nixon Shock” ended the Bretton Woods system, U.S. gold reserves have no longer backed the dollar and are treated as strategic assets, rarely sold outright.

Therefore, if the U.S. intends to use “surplus from gold reserves” to buy Bitcoin, the most likely method involves leveraging gold-related financial instruments—not selling physical gold.

Historically, the U.S. Treasury can generate dollar liquidity without increasing actual gold holdings by adjusting the book value of gold. This is essentially an “asset revaluation” maneuver, which could also be seen as an alternative form of debt monetization.

Currently, the U.S. Treasury records gold at a fixed book value of $42.22 per ounce on its balance sheet—a figure far below the current market price of around $2,200 per ounce. If Congress approves an upward adjustment of this book value, the Treasury’s gold holdings would see a dramatic increase in nominal value. Based on this new valuation, the Treasury could request additional gold certificates from the Federal Reserve, which would then issue corresponding new dollars.

This means the U.S. could implement a form of “invisible dollar devaluation” unilaterally, generating massive fiscal revenue without needing international coordination. These newly created funds could then be used to purchase Bitcoin, further boosting national Bitcoin reserves. The fiscal gains from gold revaluation would not only fund Bitcoin acquisitions but might also drive broader demand for Bitcoin across financial markets. Stephen Ira Miran, an economic advisor in the Trump 2.0 administration, referenced the “Triffin Dilemma,” noting that the dollar’s status as the global reserve currency forces the U.S. into persistent trade deficits. Gold revaluation could help break this cycle and prevent sharp interest rate hikes. Without releasing excessive liquidity, Bitcoin stands to benefit from this structural shift.

While this approach may initially prompt other institutions and investors to follow suit—injecting more liquidity into the Bitcoin market—it cannot be ignored that if the market perceives a long-term erosion of dollar credibility, the global asset pricing system could shift, making Bitcoin’s price discovery mechanism increasingly uncertain.

The Gold Market Was Never Truly Free

If the U.S. Treasury uses gold revaluation to generate “book value surplus” and convert it into dollars for Bitcoin purchases, the Bitcoin market might experience short-term euphoria—but also face heightened regulatory scrutiny and liquidity controls. Much like how gold entered a “free pricing” era after the collapse of Bretton Woods—marked by both opportunity and volatility—Bitcoin could undergo a similar transformation.

But the gold market has never truly been free.

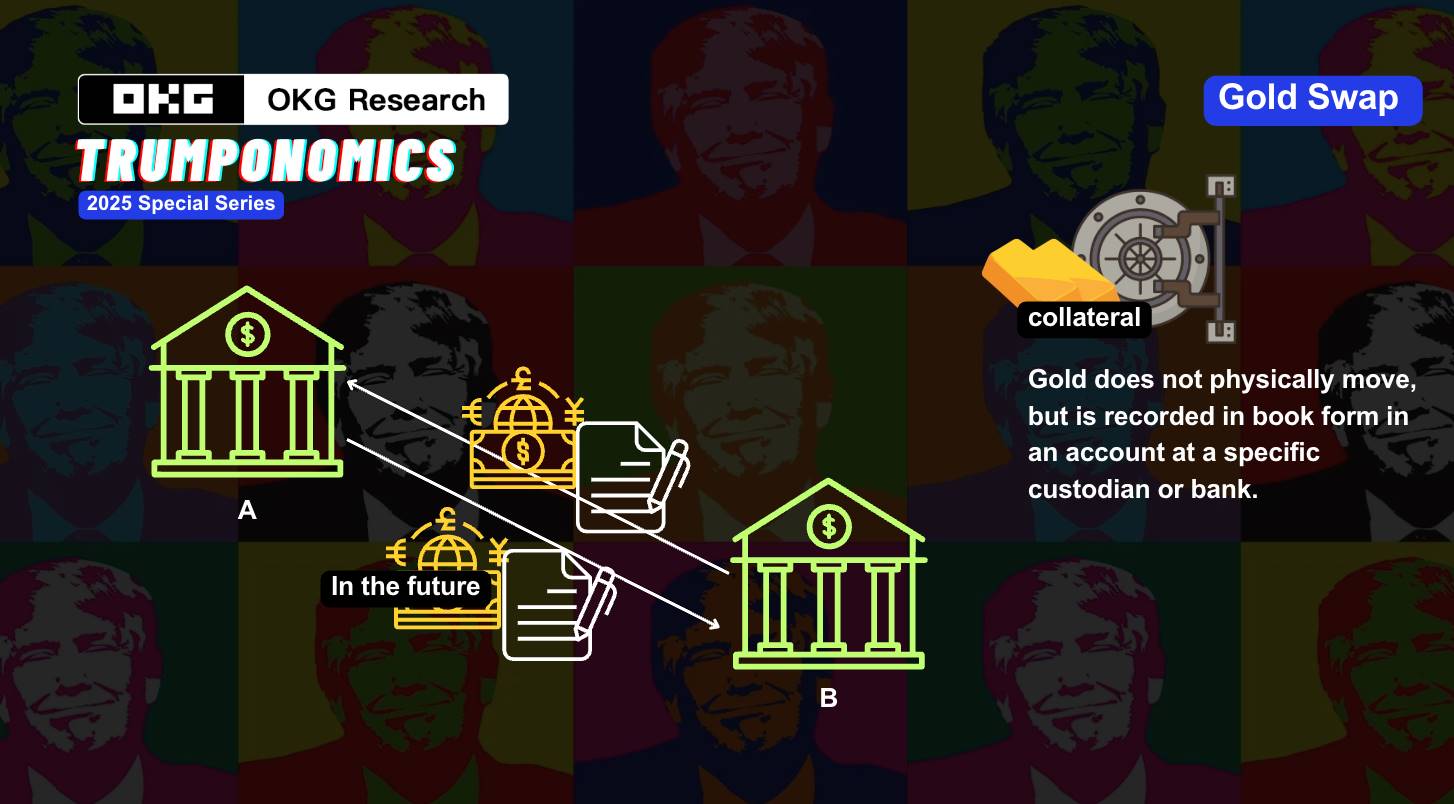

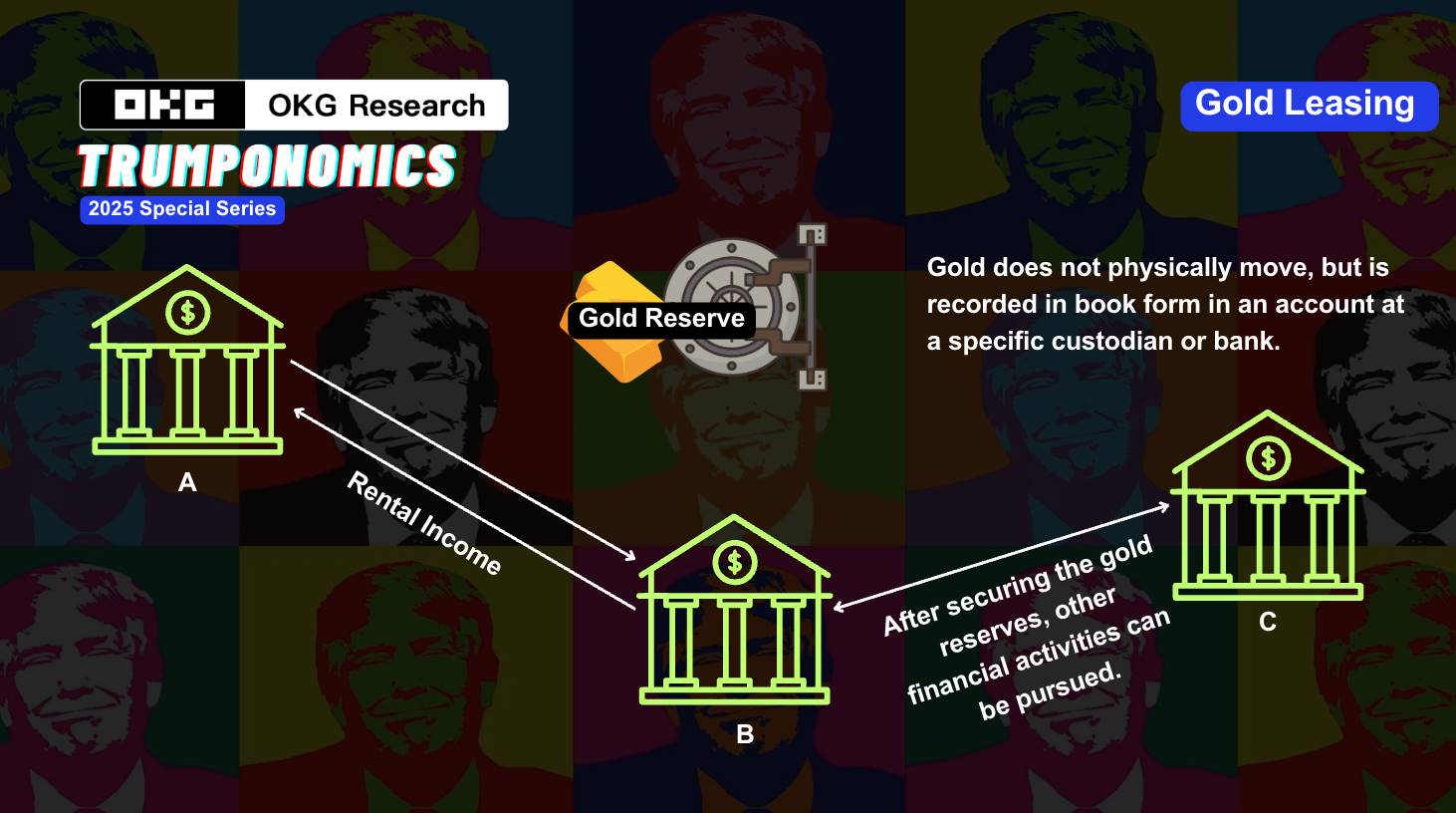

Historically, beyond being a safe-haven asset, gold has served as a “shadow leverage” tool within monetary systems, frequently leveraged for geopolitical maneuvering. A prime example is the 1970s “Gold Window” incident. At that time, the international credibility of the U.S. dollar was undermined by the Vietnam War and domestic pressures. To shore up global confidence in the dollar, the U.S. allowed the relative price of gold to rise. In the 1980s, the Reagan administration used “gold swaps” to indirectly manipulate prices; in the 2000s, the Federal Reserve released liquidity through the gold leasing market to maintain the dollar’s strength.

Moreover, gold’s credibility is not invincible. The figure of 8,133.5 tons has gone decades without independent audit. Whether the gold stored at Fort Knox (Kentucky) remains intact is a persistent “black box” issue debated in financial circles. More importantly, while the U.S. government does not directly sell gold, it may manipulate its value via financial derivatives—such as the aforementioned “book value adjustments”—to conduct shadow monetary operations.

A deeper concern emerges: If gold is revalued to release dollar liquidity while Bitcoin becomes a hedge against the dollar, how will the market redefine trust? Will Bitcoin truly become “digital gold,” or will it, like physical gold, be absorbed and controlled by the dollar-based financial system?

Could Bitcoin Become Part of America’s Shadow Monetary Play?

If Bitcoin is indeed heading toward a fate similar to gold—being co-opted and managed by the dollar system—as U.S. interest in holding Bitcoin grows, the market may enter a phase where “Bitcoin becomes a shadow asset”: officially recognized in value, yet constrained by policy and financial tools to limit its disruptive potential to the existing order.

Suppose the U.S. government classifies Bitcoin as a strategic asset and begins accumulating it. Unlike traditional gold, Bitcoin is decentralized—governments cannot directly control its supply or price. However, they could indirectly influence Bitcoin’s price and market sentiment through shadow institutions such as Bitcoin ETFs or Bitcoin trusts.

These entities could exploit Bitcoin’s liquidity and volatility, placing large quantities of Bitcoin into “strategic hoarding,” then releasing them at strategic moments to manipulate supply-demand dynamics and price trends. Such operations mirror historical practices in the gold market—“gold swaps” and “gold leasing”—achieving policy goals without direct physical transactions, using financial instruments and market strategies instead.

Not to mention the “bubble” in gold derivatives or questions about physical gold’s existence: In 2011, analysts estimated the ratio of paper gold to physical gold on COMEX could have reached as high as 100:1. Or the 2013 case of Germany requesting repatriation of its gold from the Fed—a process that took seven years—sparking speculation that the Fed may lack sufficient physical gold, or that some of it had already been leased or pledged.

Will Bitcoin follow the same path? Given current blockchain technology trends, the answer may be no.

1. Gold’s “Black Box” vs. Bitcoin’s Transparency

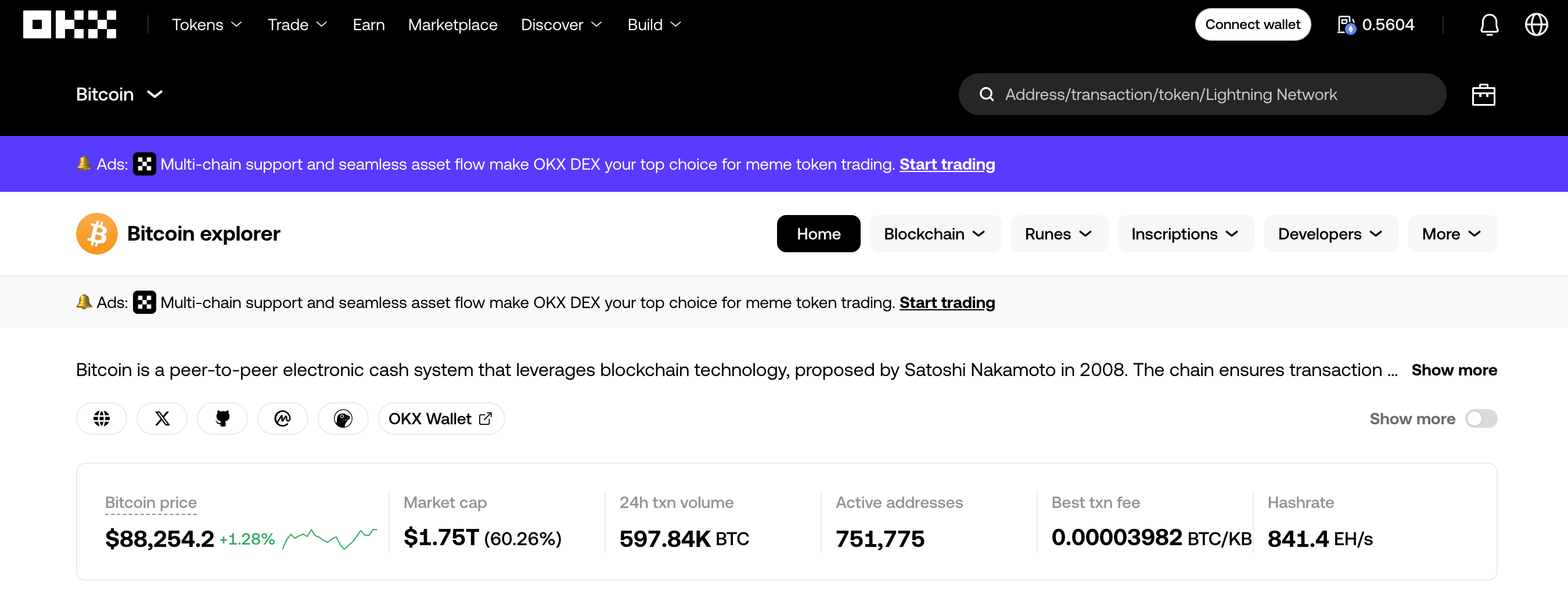

Bitcoin operates without “black box” manipulation—all transactions are traceable on-chain. Its decentralized nature gives Bitcoin superior transparency and auditability compared to gold. As a native blockchain asset, every Bitcoin transaction is publicly verifiable. Anyone can track Bitcoin flows using on-chain data tools such as OKX Explorer.

Additionally, Bitcoin’s network consists of decentralized, independent nodes, each maintaining a full copy of the ledger and collectively validating transactions. No single institution or nation can alter or manipulate transaction data. Bitcoin does not rely on third-party audits. According to on-chain data from OKX Explorer, whale wallets (holding 1,000+ BTC) collectively hold between 30%–35% of all Bitcoin—approximately 6 to 7 million BTC. This alone exceeds the amount held in hot wallets of centralized exchanges, institutional custodians, and ETFs. Funds stored in on-chain Bitcoin wallets are fully public and globally accessible.

The real-time efficiency surpasses most national gold reserve reports, which are updated quarterly or annually, and avoids incidents like the U.S. losing seven audit reports from Fort Knox. Due to reporting lags, market reactions to changes in gold reserves are often delayed.

2. Financial Run Risk vs. Bitcoin’s Resilience

One flaw in the traditional financial system is its centralized management model, which creates systemic risk. For instance, the 2008 collapse of Lehman Brothers triggered a chain reaction, and the 2023 bankruptcy of Silicon Valley Bank (SVB) once again exposed the fragility of the banking system. During liquidity panics, banks face mass withdrawals (“bank runs”), relying on government bailouts and Federal Reserve interventions to stabilize the system.

Even Bitcoin held at centralized exchanges can be verified technologically. On November 23, 2022, OKX officially launched its Proof of Reserves (PoR) program, making it a core tool for transparency and user protection. Excess PoR (i.e., PoR > 100%) means the exchange or custodian holds assets exceeding total user deposits, with an additional buffer reserve. This surplus acts as a safety net, ensuring institutions can meet all withdrawal demands even under extreme market volatility or partial asset loss. This eliminates the fractional-reserve model prevalent in traditional banking. By contrast, traditional banks typically maintain reserve ratios far below 100%, leaving them vulnerable to liquidity crises when trust evaporates.

The U.S. strategy of revaluing gold to create “new” dollars and using those funds to buy Bitcoin is not merely a shadow monetary operation—it also exposes the fragility of the global financial system. Whether Bitcoin can emerge as a truly independent and free “digital gold,” rather than just another appendage of the U.S. financial architecture, remains to be seen. But from a technological standpoint, both real-time on-chain visibility and institutional PoR mechanisms offer transformative solutions to the shortcomings of traditional finance. The proposal to exchange gold for Bitcoin has thus sparked a profound dialogue about the future of the global financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News