Binance employee caught red-handed in insider trading—why does it keep happening?

TechFlow Selected TechFlow Selected

Binance employee caught red-handed in insider trading—why does it keep happening?

When will the crypto rat-catching operation officially launch?

Author: ChandlerZ, Foresight News

On March 24, according to an official announcement from Binance, its internal audit team received a report on March 23, 2025, accusing an employee of using insider information to conduct front-running trades for improper gains. Binance has launched a comprehensive internal investigation.

At the time of the alleged incident, the individual was working within Binance's wallet team, which had no business relationship or collaboration with the project involved. However, he is suspected of abusing information obtained from a previous role for personal gain. Before joining the wallet team one month earlier, he served in a business development position at BNB Chain. Leveraging non-public knowledge and familiarity with on-chain projects gained from that prior role, he learned that the project was approaching its Token Generation Event (TGE) and used multiple linked wallet addresses to purchase large quantities of the project’s tokens before the public token listing announcement.

Shortly after the official announcement, the employee quickly sold part of his holdings, realizing significant profits, while retaining a substantial amount of unrealized gains from the remaining tokens. Based on confidential information obtained through his former position, this conduct constitutes front-running and clearly violates company policy.

The preliminary investigation has now concluded. The individual has been suspended and will face legal accountability. Additionally, Binance has completed verification and deduplication of the whistleblower reports and will distribute a $100,000 reward equally among the whistleblowers.

Chain Evidence Catches the "Rat's Tail"

According to X user @土澳大狮兄 BroLeon, Binance employee Freddie Ng is accused of engaging in illegal insider trading, participating in manipulative trading of the UUU token to illicitly profit approximately $110,000. After publicly disclosing on-chain evidence, BroLeon demanded Binance provide a reasonable explanation regarding the matter.

BroLeon stated, “The UUU token ‘rat warehouse’ has been confirmed! I’ve just verified this report—the entire act of cheating has been fully exposed on-chain. It remains to be seen how Binance will handle this wallet BD and growth team employee, Freddie Ng, caught red-handed.”

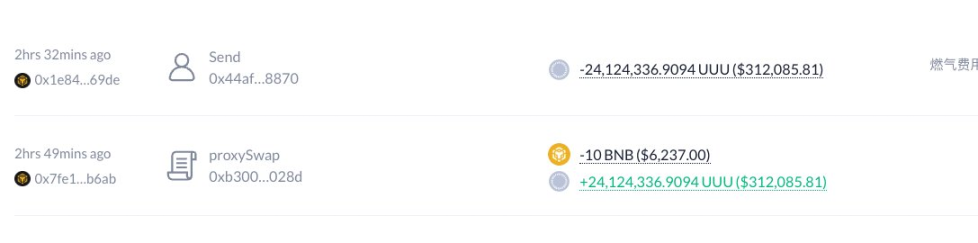

Based on the reconstructed sequence of events, Binance employee Freddie Ng clearly knew in advance that the UUU token would be pumped. Using a personal account starting with 0xEDb0, he spent 10 BNB at an average price of $0.00026 to buy 24.1 million UUU tokens worth $312,000, transferring all of them into a wallet starting with 0x44a.

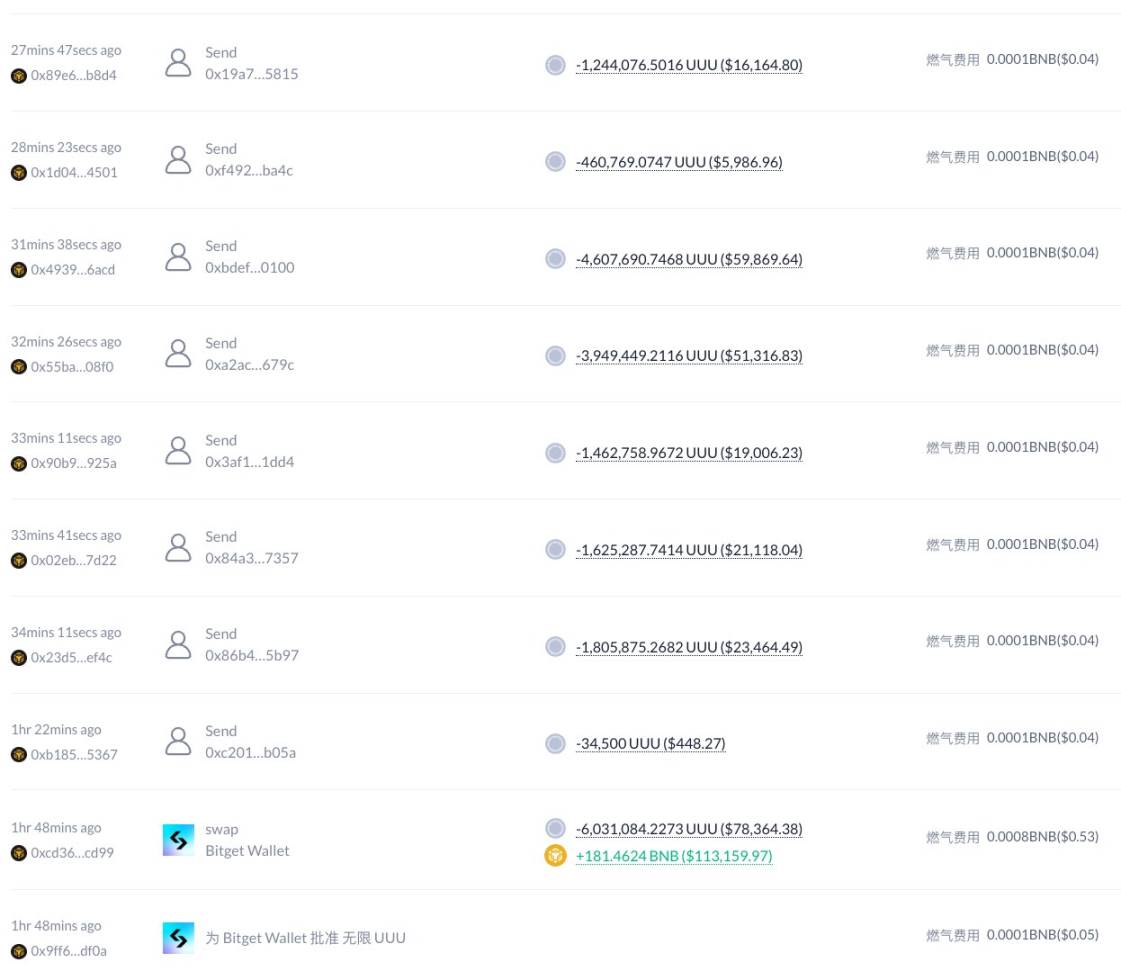

Subsequently, Freddie sold 6.02 million UUU tokens via a Bitget wallet at an average price of $0.0188, earning $113,600, and distributed the remaining UUU tokens across eight different addresses, each holding several tens of thousands of dollars' worth.

BroLeon noted, “The one mistake he made was that the funds used to buy the ‘rat warehouse’ came from his real-name wallet freddieng.bnb (starting with 0x77C), transferred into the trading wallet 121 days ago.”

On March 23, uDex, a BNB Chain-based exchange, officially launched its native token UUU on four.meme. As a member of BNB Chain’s MVB Season 8 program, uDEX provides users with on-chain data and enables direct trading from social networks. The token currently has a market capitalization of $8.22 million.

An Industry Illness Hard to Cure

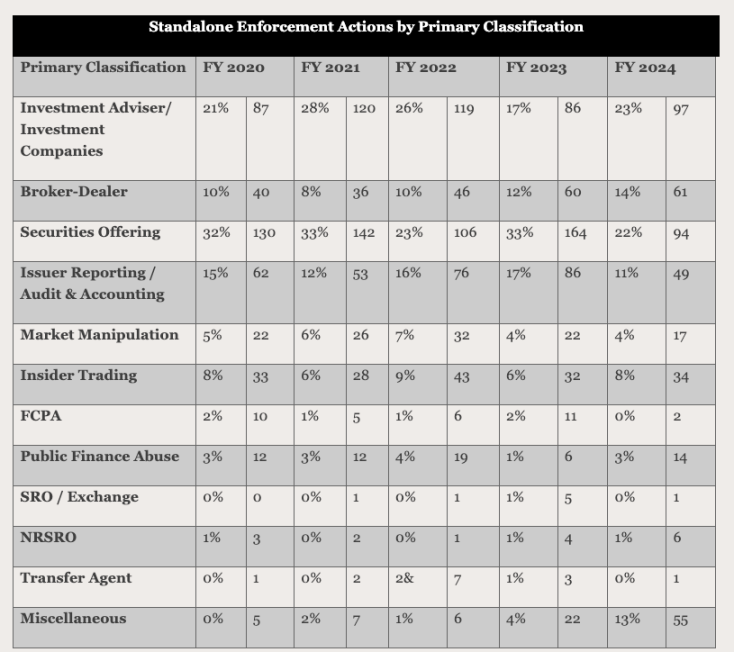

Insider trading is not unique to the cryptocurrency market. For example, based on historical data from the U.S. Securities and Exchange Commission (SEC), enforcement actions related to insider trading have consistently accounted for 8–9% of annual enforcement cases—a persistent issue even in traditional financial markets.

This is also not the first time Binance has faced allegations of insider trading, although previously few employees have been investigated or disciplined. Since 2018, the cryptocurrency industry has continuously raised systemic concerns about insider trading at exchanges. Multiple platforms across various periods have been accused of similar “rat warehouse” practices, making it a chronic problem across the sector.

The transparency and decentralized nature of the cryptocurrency market have not fully eliminated the risk of insider trading. On the contrary, due to the lack of unified regulation and inadequate internal controls, exchanges often become breeding grounds for such misconduct. Although major exchanges have strengthened compliance and risk control systems, the anonymity, technical complexity, and global operational model of cryptocurrencies pose significant challenges to the implementation of traditional regulatory methods.

Industry giants like Binance often demonstrate strong deterrent actions when confronting internal abuse, yet frequently fail to prevent recurring incidents due to insufficient preventive and monitoring mechanisms. Externally, Binance’s swift investigation and response in this case signal its determination to reform. However, whether it can truly eradicate the “rat warehouse” problem depends on the broader industry strengthening compliance management and transparency at the source.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News