Crypto AI Market Sentiment Survey: Clear Community Divide, Early Users Show Highest Bullishness

TechFlow Selected TechFlow Selected

Crypto AI Market Sentiment Survey: Clear Community Divide, Early Users Show Highest Bullishness

According to a recent survey by CoinGecko, nearly half of the respondents are bullish on crypto AI products and token prices for 2025, while at the same time, more than a quarter remain cautious or bearish.

Author: Yuqian Lim, CoinGecko

Translation: Zen, PANews

The convergence of cryptocurrency and AI is seen as a key driver of industry innovation. However, against a backdrop of prolonged market downturns and fading AI hype, market sentiment is showing clear signs of divergence.

Recently, CoinGecko surveyed 2,632 participants in the crypto market. The results show that nearly half of respondents are bullish on crypto AI products and token prices in 2025, while approximately one-quarter hold bearish views.

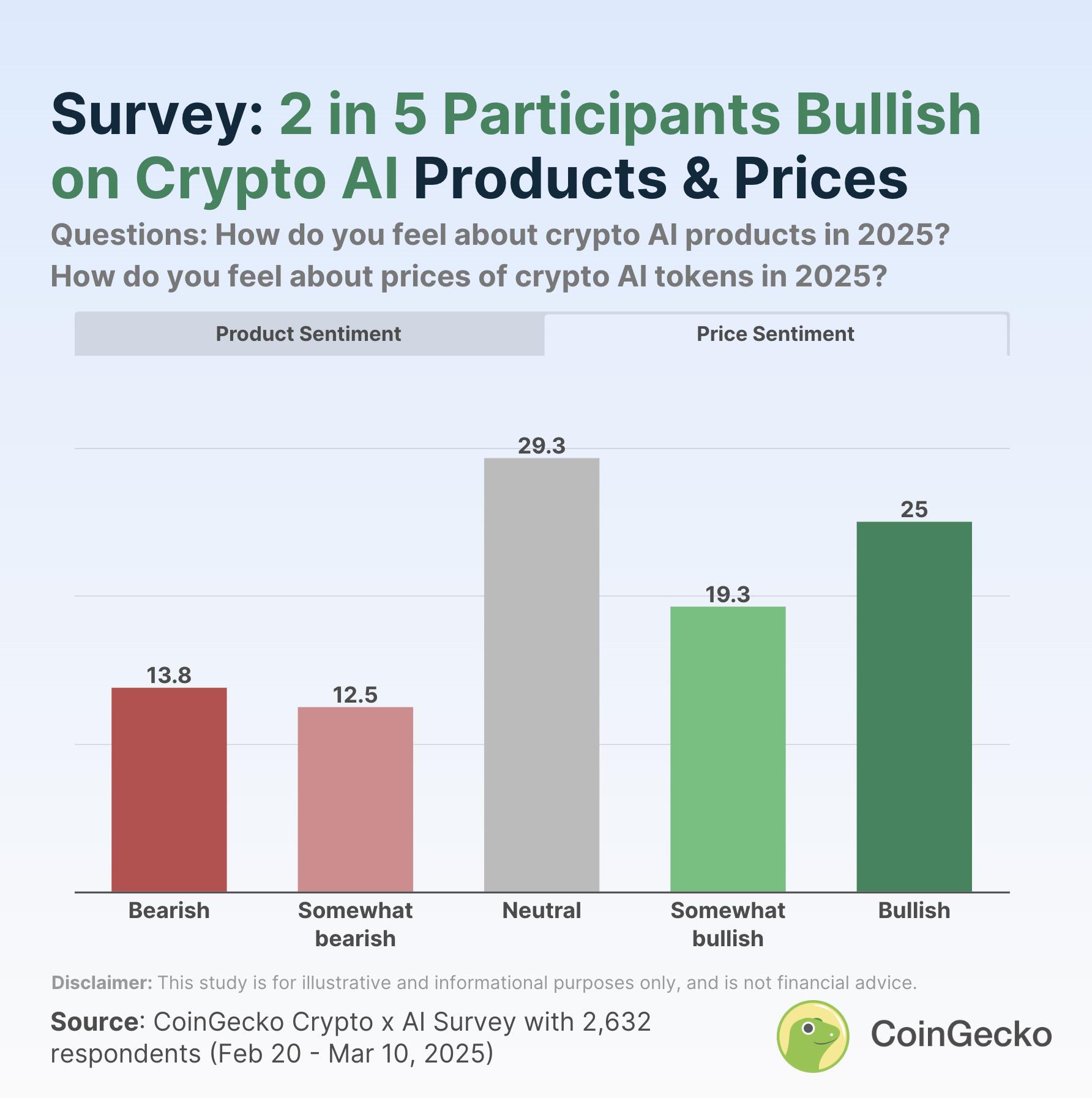

Nearly 30% remain neutral, 1/4 firmly bullish

In CoinGecko’s latest survey, 46.9% of crypto users expressed bullish sentiment toward crypto AI products in 2025. Of these, 19.9% said they were "somewhat bullish," while 27.0% were "fully bullish." As use cases combining crypto and AI continue to mature and gain broader adoption, market sentiment has shown some signs of recovery.

At the same time, 24.1% of crypto users hold "somewhat bearish" or "fully bearish" views toward crypto AI products in 2025. In other words, about one-quarter of respondents remain cautious or skeptical about crypto AI technology and its application prospects—at least in the short term.

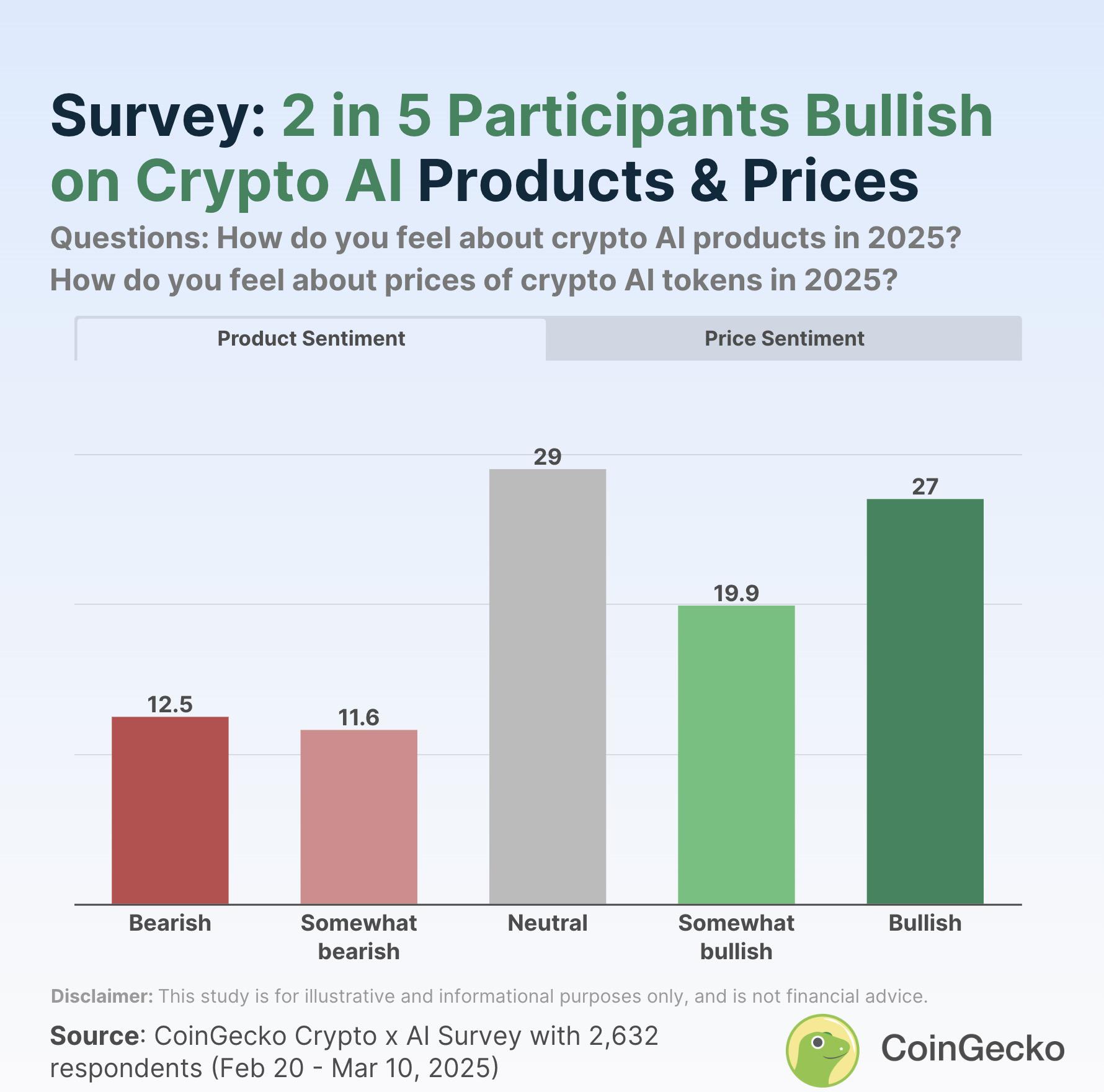

Sentiment regarding crypto AI token prices is similar. 44.3% of respondents are bullish, while 26.4% are bearish. This may indicate that the market has yet to clearly differentiate between the investment value, trading potential, and technological development of crypto AI. Such sentiment reflects market expectations for crypto AI to move beyond conceptual stages into maturity.

Almost one-third of respondents take a neutral stance on crypto AI products and token prices in 2025, at 29.0% and 29.3% respectively. In fact, across all options, "neutral" was the most selected response, followed by lower proportions choosing "bearish," "somewhat bearish," "somewhat bullish," and "bullish." This suggests a significant portion of respondents have not yet formed definitive opinions on the crypto AI narrative—or are still waiting and watching.

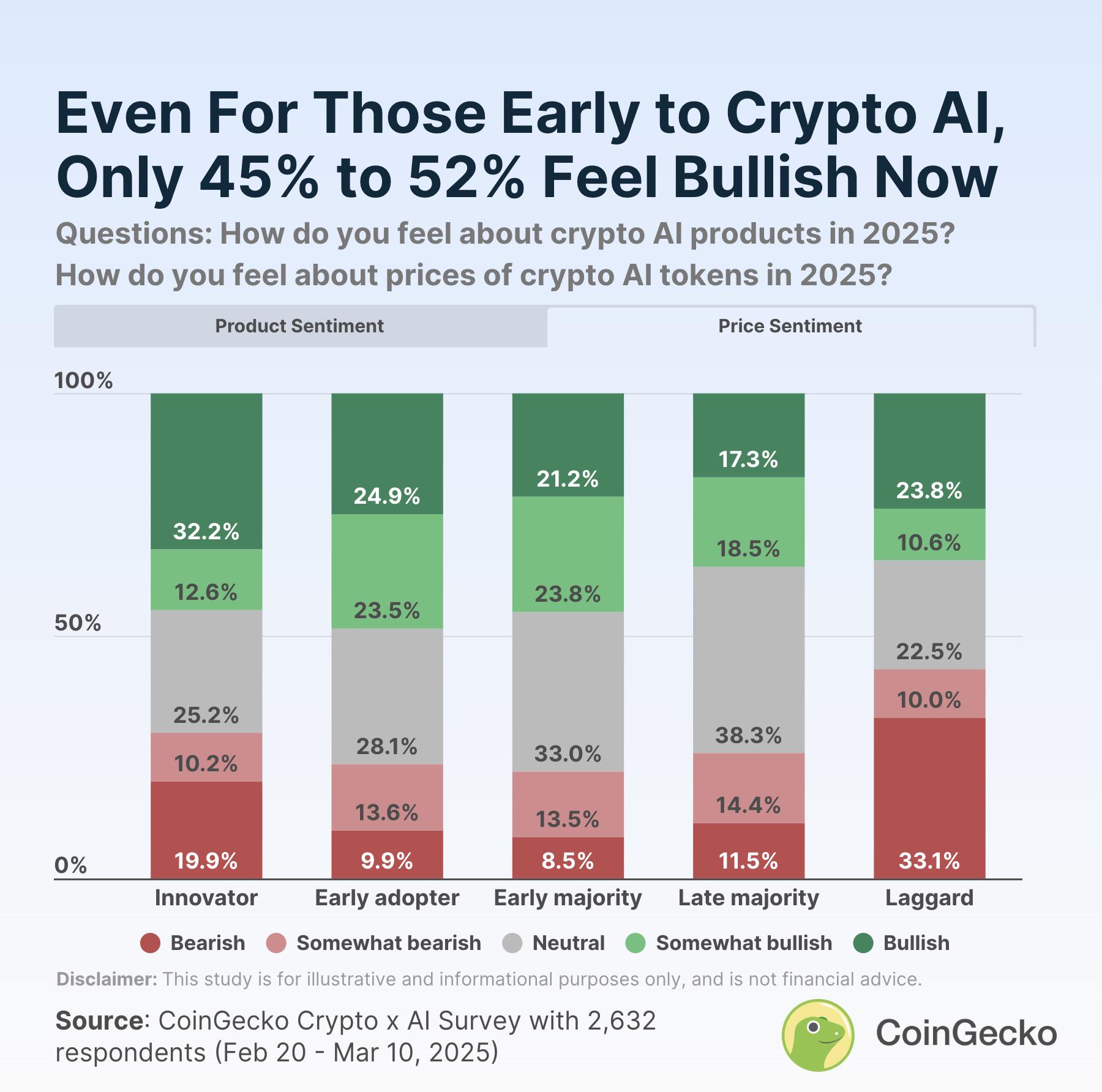

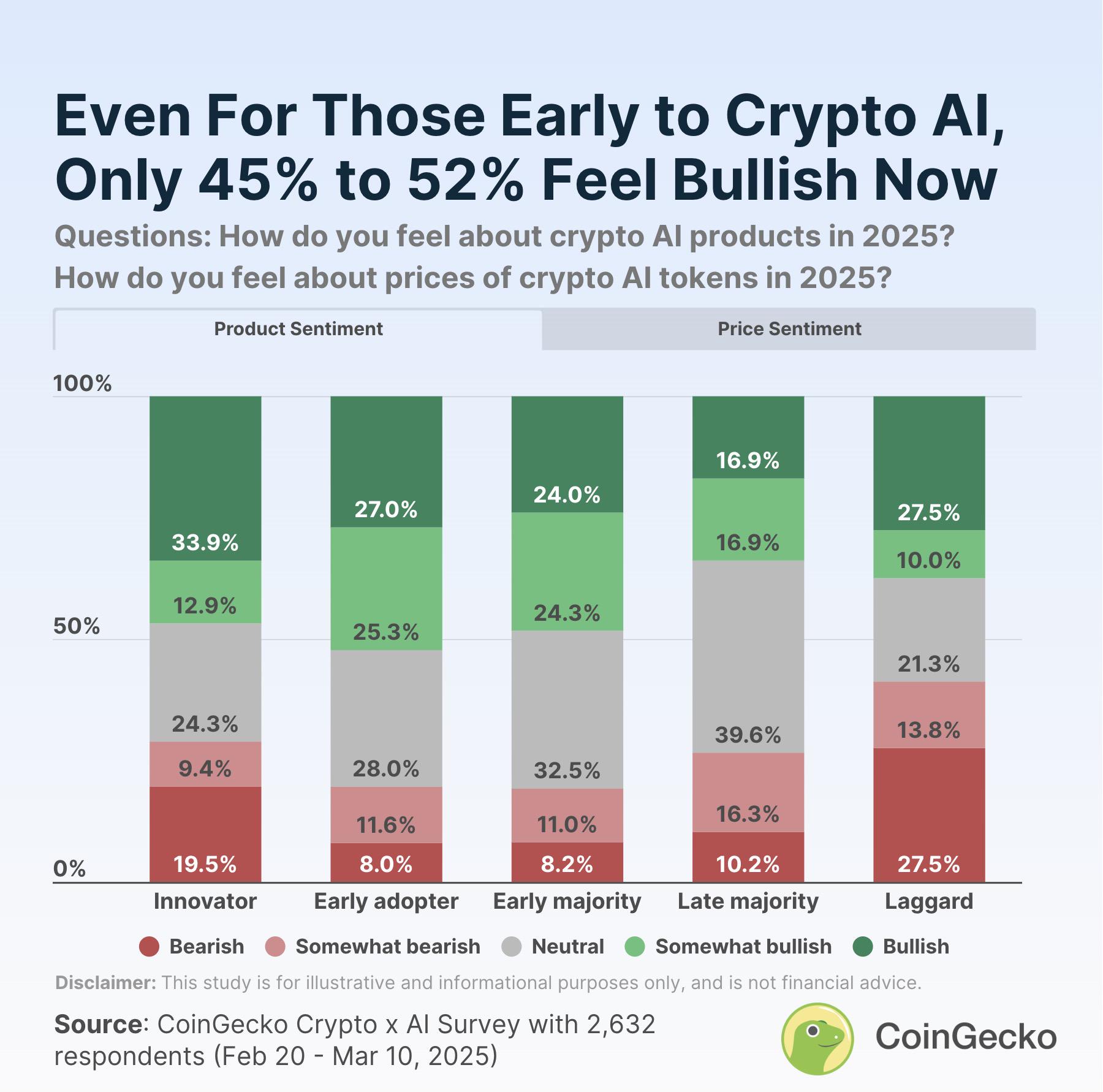

Bullish sentiment among early innovators and adopters only 45%-52%

Among self-identified "innovators" driving crypto AI applications, 46.8% of respondents are bullish on crypto AI products, while 28.9% are bearish. Similarly, only 44.8% of "innovators" are bullish on crypto AI token prices, with 30.0% bearish.

"Innovators" are typically the earliest group to engage with the crypto AI narrative. Yet in this survey, their bullish ratio is relatively low while bearish sentiment is comparatively high—indicating even early adopters remain cautious about the outlook for crypto AI.

In contrast, sentiment among the "early adopters," "early majority," "late majority," and "laggards" groups aligns more closely with market expectations. Among them, "early adopters" and "early majority" show the highest levels of bullishness—and the lowest bearish sentiment—toward both crypto AI products and token prices.

The "late majority" group holds the most conservative view toward crypto AI products, with only 33.9% expressing positive sentiment. The "laggards" are the most pessimistic overall, with 41.3% bearish on crypto AI products and 43.1% bearish on token prices. Notably, the "laggards" have the lowest proportion of neutral respondents, suggesting that despite entering the space later, their views are the most firmly held.

Methodology

This report analyzes responses from 2,632 crypto market participants in CoinGecko’s anonymous Crypto x AI survey conducted between February 20 and March 10, 2025. Findings are for reference only.

Among respondents:

-

51% identify as long-term holding-focused crypto investors;

-

26% identify as short-term trading-focused crypto traders;

-

10% identify as builders in the crypto AI space;

-

13% identify as observers remaining on the sidelines.

Regarding crypto experience:

-

53% are in their first crypto cycle (0–3 years of experience);

-

34% are in their second crypto cycle (4–7 years of experience);

-

The remainder are seasoned investors (8+ years of experience).

Geographically, 93% of respondents are from Europe, Asia, North America, and Africa, with the rest from Oceania or South America.

Note: This study is for informational purposes only and does not constitute financial advice. Please conduct thorough research and exercise caution before investing in any cryptocurrency or financial asset.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News