Can the race among各家 to offer gas-free transactions retain users?

TechFlow Selected TechFlow Selected

Can the race among各家 to offer gas-free transactions retain users?

Account abstraction and gas sponsorship can indeed boost transaction volume and user sign-ups, but the real test lies in users' repeated engagement.

Author: Stacy Muur

Translation: TechFlow

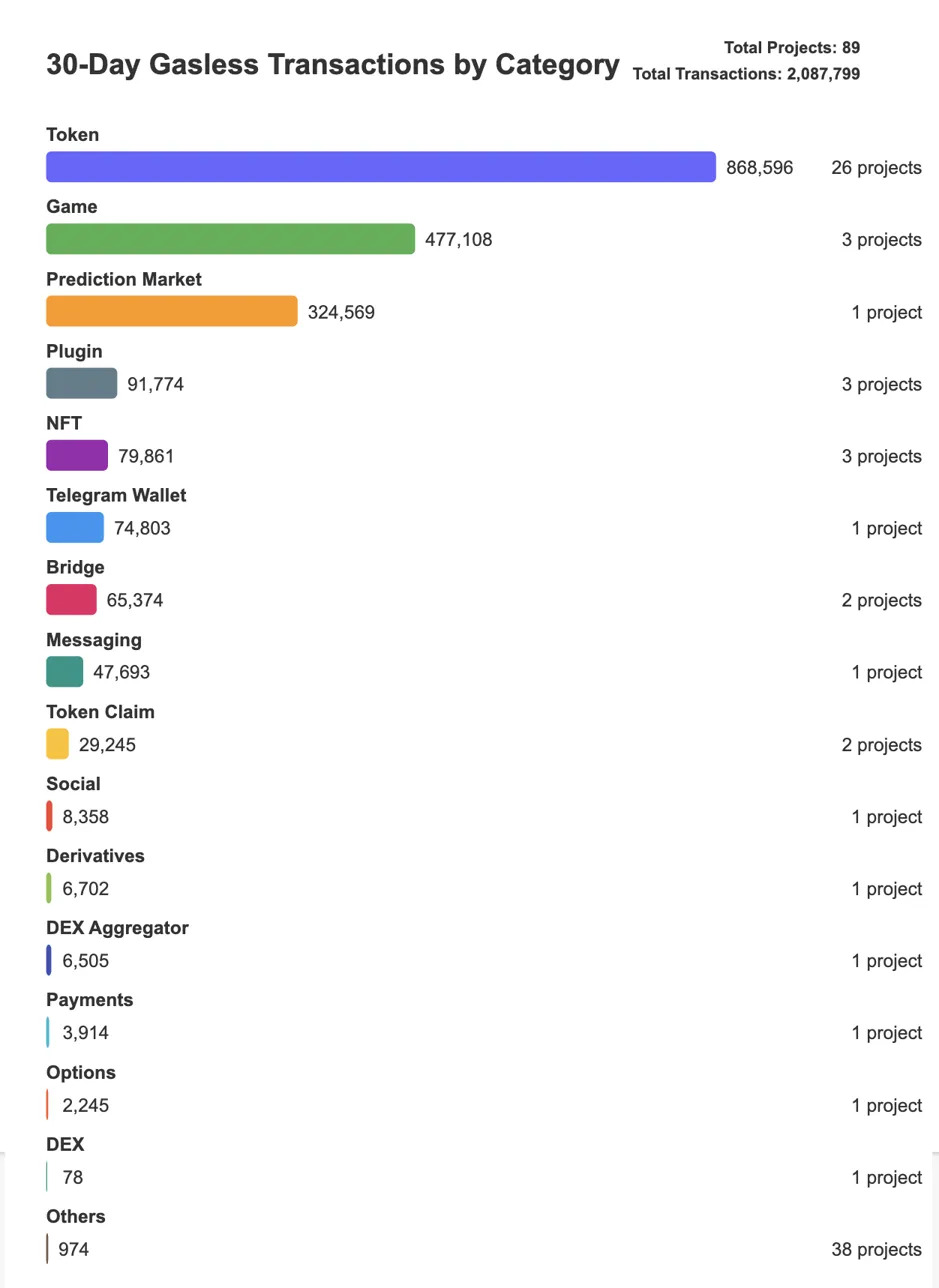

Within just 30 days, 89 projects across 9 blockchains completed over 2 million gasless transactions, saving up to $117,000 in gas fees.

This wave of gasless transactions shows that solutions like Paymasters in ERC-4337 smart wallets—where sponsors pay fees on behalf of users—can rapidly boost on-chain activity.

Usage Driven by Paymasters May Mask True User Demand

A surge in transaction volume does not necessarily reflect genuine user interest, especially when a small number of wallets (e.g., traders or bots) repeatedly call contracts.

For example, one-off events such as airdrops, free mints, or claim campaigns can cause a short-term spike in wallet numbers, but subsequent usage may be minimal.

Currently, NFTs, games, and token-related projects are indeed attracting many new wallets. However, many of these are used only for single operations (like minting or claiming rewards), without sustained user engagement.

On the other hand, some applications show deeper, repeated usage—typically driven by compelling gameplay loops, regular DeFi interactions, or infrastructure-level services.

These findings suggest that ERC-4337 smart wallets are reshaping on-chain activity: while sponsored gas effectively attracts users, only apps with strong value propositions that encourage repeat use can truly retain them.

@0xKofi created an authoritative dashboard tracking this growth, powered by @base:

https://www.gogasless.io/leaderboard/all

Key Statistics

-

89 independent apps/protocols

-

~724,000 active smart wallets

-

~$117,000 in gas fees abstracted

-

~2.08 million gasless transactions

The Bigger Picture: Evolution of ERC-4337

The rapid rise of gasless transactions is part of a broader trend. In 2024, over 103 million UserOps were executed via ERC-4337 accounts—more than tenfold growth from 2023 (8.3 million). Of these, 87% were paid by Paymasters, delivering a gasless experience.

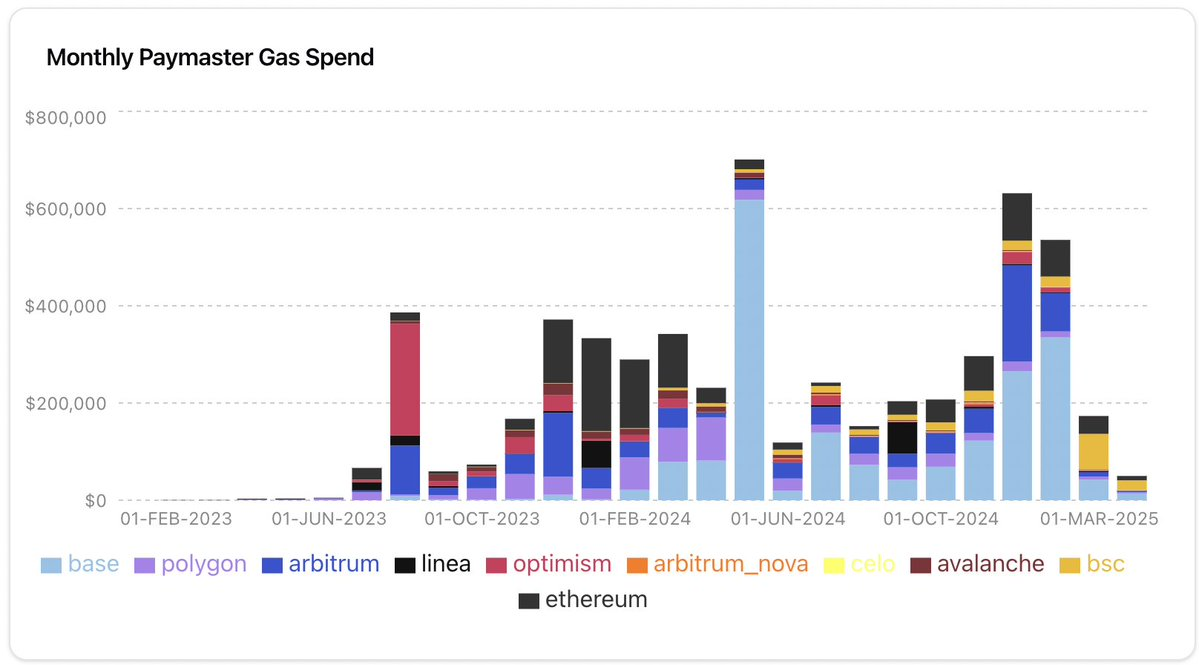

The monthly Paymaster gas expenditure chart reveals an interesting trajectory:

-

Early Adoption (2023): Minimal spending before mid-2023, with Optimism leading early adoption.

-

Growth Phase (Late 2023): Steady increase to ~$400,000 per month by October 2023.

-

Peak Activity (April 2024): Surge to ~$700,000, primarily driven by Base.

-

Recent Trends (Late 2024 – Early 2025): New highs in November–December 2024 (~$630,000), followed by a sharp decline to ~$150,000 in February 2025.

Total UserOp fees paid by apps and users through Paymasters have exceeded $3.4 million, with major providers including @biconomy, @pimlicoHQ, @coinbase, and @Alchemy. Despite market contraction and declining total spending in Q1 2025, @base ($391,000), @ethereum ($121,000), and @BNBCHAIN (~$112,000) remain dominant.

Data source: https://www.bundlebear.com/

Developer: @0xKofi

Chain Activity Rankings

-

Base (43.2%): Hub for entertainment and social, dominating gaming (76.8%).

-

Polygon (21.4%): Community interaction layer, focused on NFTs (50.7%) and Telegram wallets (42.3%).

-

Optimism (8.5%): Security-focused, emphasizing recovery infrastructure.

-

Celo (7.4%): Niche specialist, concentrating on prediction markets.

-

BSC (4.2%): Value transfer layer, highest gas cost, focused on token swaps.

Key Insights from the Data

Before diving into analysis, two key metrics must be understood:

1️⃣ Tx/Wallet – Measures average transactions per wallet. A low value (e.g., 1.0) suggests one-time actions like minting or claiming airdrops. A high value (e.g., 25) indicates repeated engagement such as active trading, gameplay, or bot operations.

2️⃣ Cost/Tx – Represents the average cost per transaction. In gasless systems, this reflects the fee abstracted per transaction, not what users actually pay.

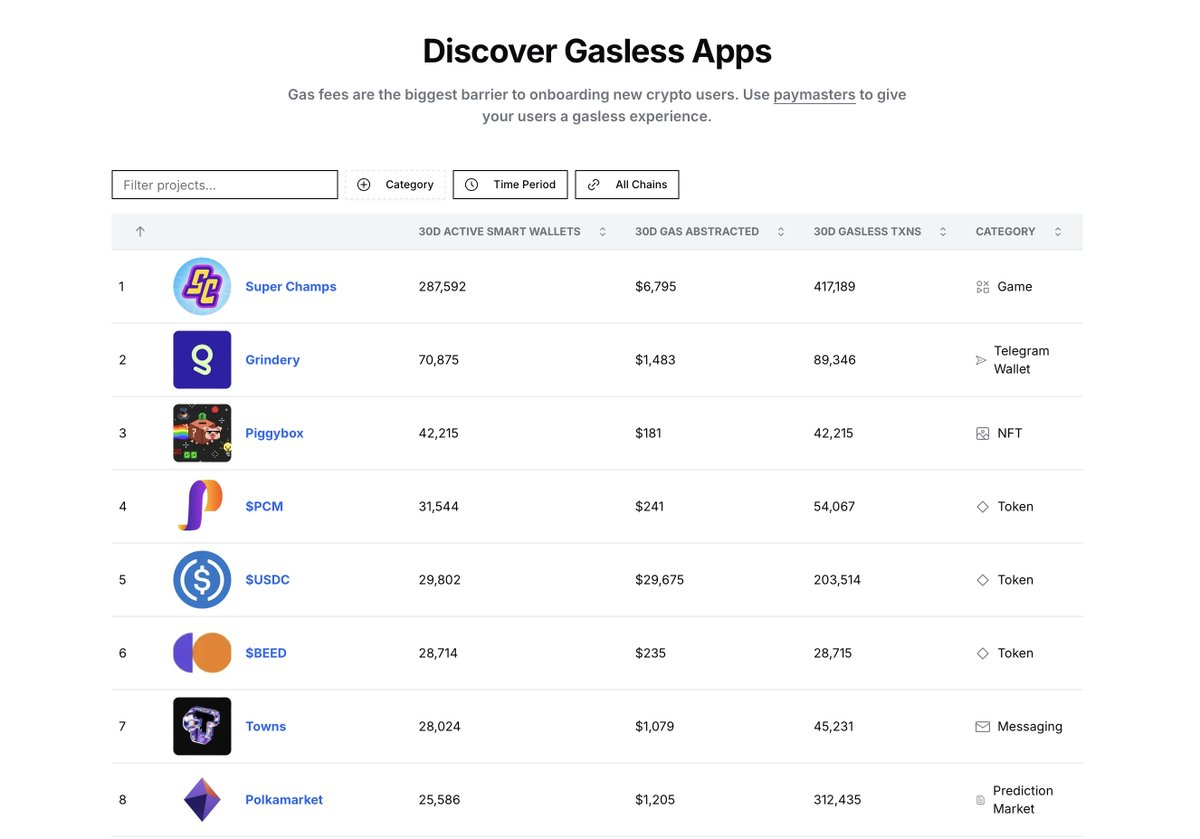

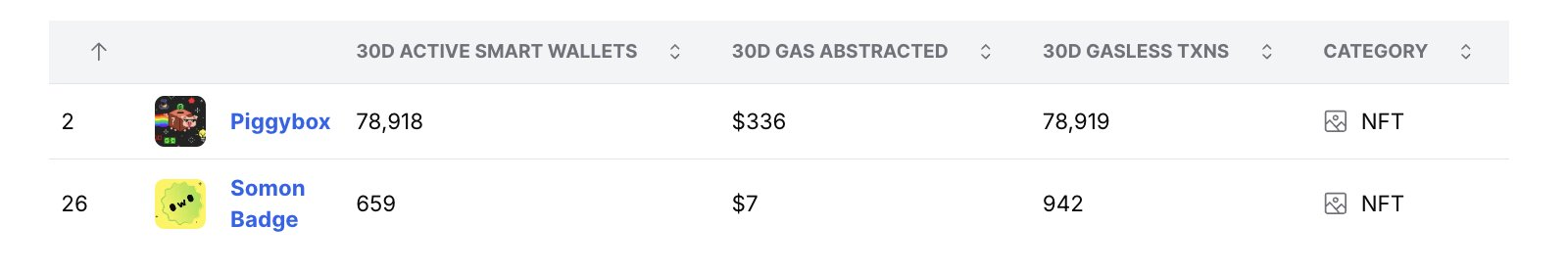

1.NFT Projects: Large Wallet Counts Often Mean One-Time Accounts

-

Piggybox: ~1 tx/wallet, ~$0.004/cost per tx.

-

Somon Badge: ~1.4 tx/wallet, ~$0.007/cost per tx.

Interpretation: Piggybox’s near 1:1 wallet-to-transaction ratio strongly suggests it's driven primarily by minting or claiming activity. Piggybox is an NFT users receive upon registering for EARN’M, which includes a prize box that may contain EARNM tokens.

One-Time Surge: Many wallets perform only one transaction (initial mint or claim) and then go inactive, resulting in an almost perfect 1:1 ratio.

Leaderboard Distortion: Due to a large influx of new wallets during minting, Piggybox ranks highly in wallet count and transaction volume. But if one-time wallets are filtered out, its ranking would likely drop out of the top five, and user retention is extremely low.

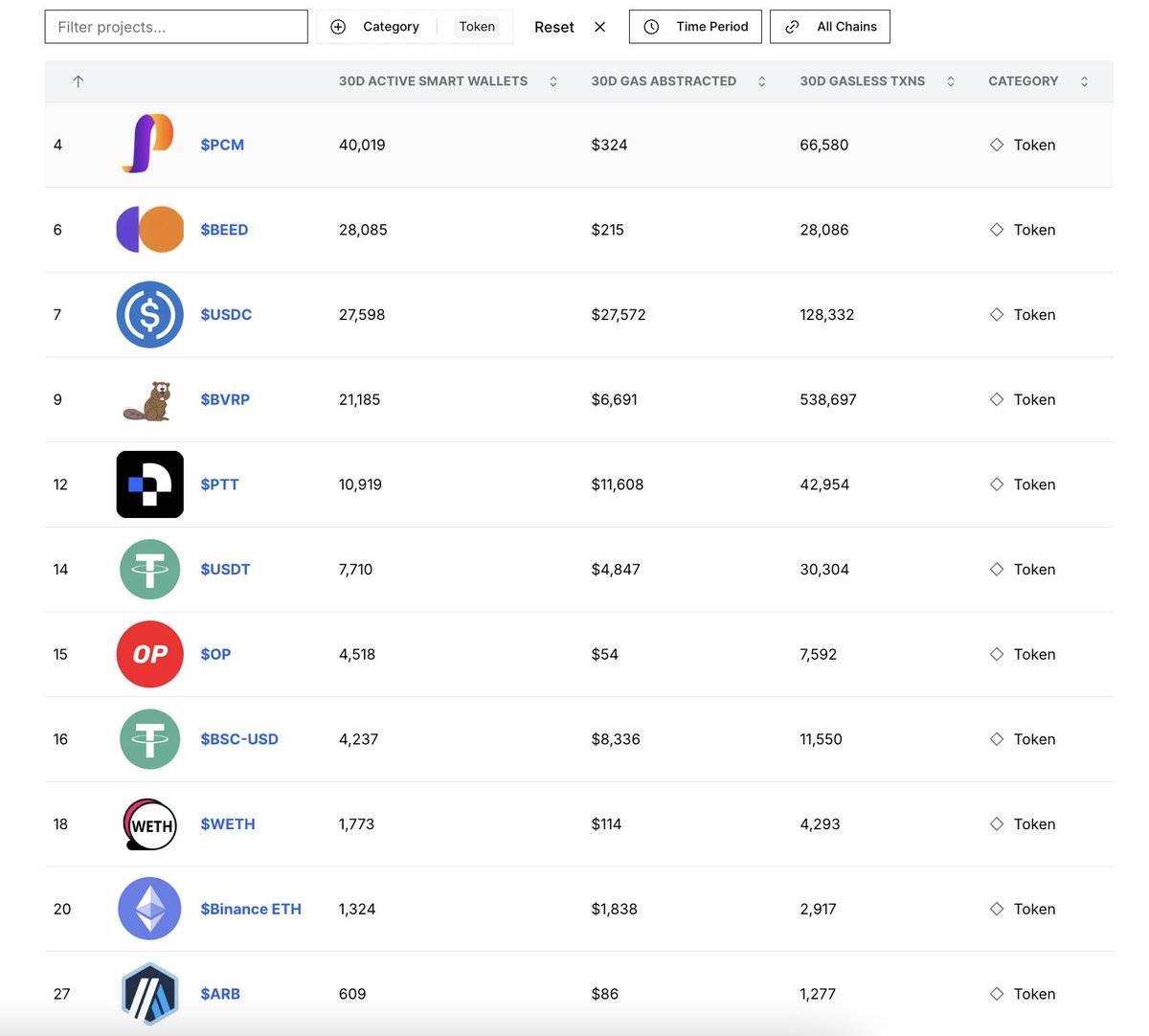

2. Token Swaps: Dominated by a Few Projects

-

Data Analysis: Token swap volume (868,000 transactions) appears dominant, with 26 token projects listed—far more than other categories. Yet, only two tokens ($BVRP and $USDC) account for over 667,000 transactions, representing the vast majority.

-

**$BVRP**: ~25 tx/wallet, ~$0.012/cost per tx.

-

**$USDC**: ~4.6 tx/wallet, ~$0.21/cost per tx.

-

-

Interpretation:

-

This concentration suggests not all token projects are equally active—most volume is driven by a few leading ones.

-

$BVRP shows exceptionally high transaction activity relative to wallet count, indicating high platform engagement, frequent trading, and possibly automated or repetitive behavior.

-

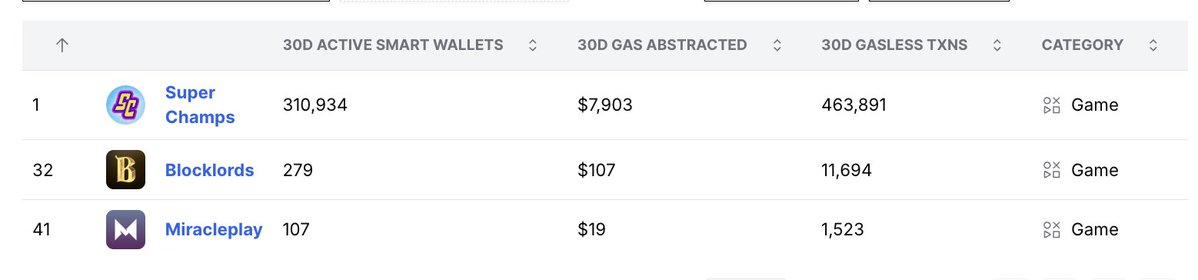

3. Gaming: One "Hit" and Divergent Wallet/Tx Ratios

-

Data Analysis:

-

@SuperChampsHQ: ~1.49 tx/wallet, ~$0.017/cost per tx.

-

@BLOCKLORDS: ~42 tx/wallet, ~$0.009/cost per tx.

-

@miracleplay_cn: ~14 tx/wallet, ~$0.012/cost per tx.

-

-

Interpretation:

-

Although Super Champs has far more total transactions (463,000) than other games combined (~13,000), each wallet performs only about 1–2 transactions, indicating low user engagement.

-

Blocklords has fewer wallets but extremely high transactions per wallet (~42), often associated with bot-driven repetitive actions. As Blocklords’ David Johansson said: “They’re fighting bots.”

-

https://www.blockchaingamer.biz/features/interviews/33860/blocklords-david-johansson-podcast/

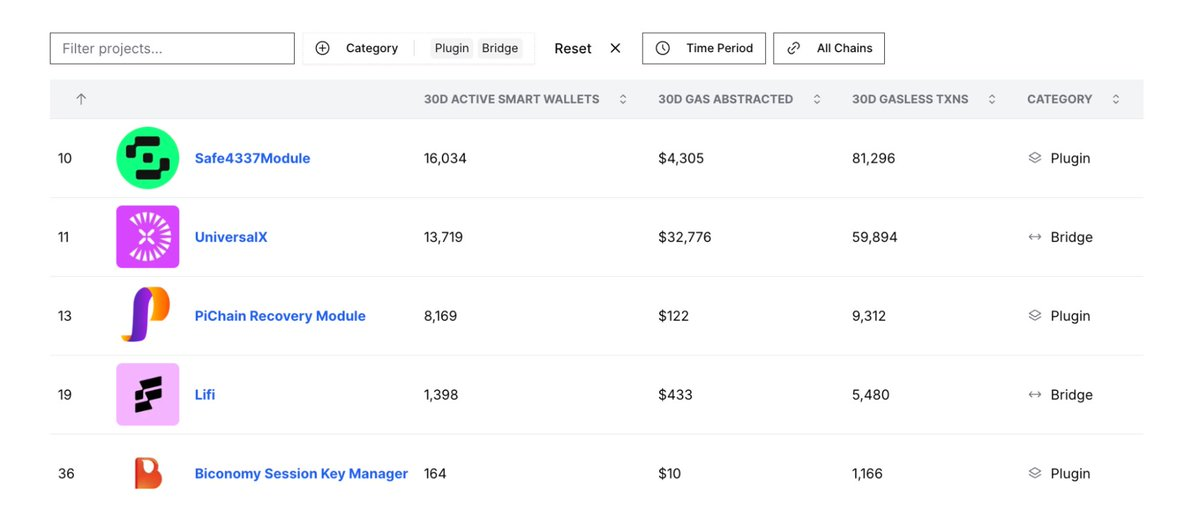

4. Cross-Chain Bridges & Plugins: Stable Usage with Higher Gas Costs

UniversalX: ~4.4 tx/wallet, ~$0.55/cost per tx.

Safe4337Module: ~5.1 tx/wallet, ~$0.053/cost per tx.

-

Interpretation:

-

Behind-the-Scenes Tools: Bridges and plugins aren't as flashy as tokens or games, but their usage remains steady because multiple dApps depend on them.

-

Health Indicator: Sustained moderate usage of infrastructure services indicates real utility rather than hype-driven spikes.

-

5. Specialization in On-Chain Activity

-

@base: 99.5% of game wallet activity (312,361 out of 310,934 wallets).

-

@0xPolygon: Dominates NFT and social activity, accounting for 87% of ecosystem NFT wallets.

-

@BNBCHAIN: Leads in high-value cross-chain bridge transactions, representing 23.2% of all gas-abstraction transactions.

-

@Celo: Strong in prediction markets (25,574 wallets, avg 12.7 tx/wallet).

6. Cost Differences Across Chains

Gasless transaction costs vary by up to 100x across chains, influencing which chains different app categories adopt:

-

Ethereum: $2.41 per gasless transaction (highest).

-

BSC: $0.50 per gasless transaction.

-

Base: $0.02 per gasless transaction (lowest among major chains).

-

Polygon: $0.03 per gasless transaction.

Conclusion: These stark cost differences will drive specific application types to choose certain blockchains, regardless of technical similarities. For instance, high-cost chains are unsuitable for economically sensitive applications like games and social dApps.

Overall Observations

-

NFT Adoption: While NFT activity may show tens of thousands of wallets minting once (e.g., Piggybox), follow-up usage is extremely low.

-

Infrastructure: Bridges and plugins see stable usage, with higher costs (bridges) or lower volatility as backend tools (plugins).

-

Divergent Transaction Patterns: Tx/wallet ratios vary significantly by category—some show highly repetitive actions, others are purely “one-and-done” behaviors.

-

Long Tail of Projects: Many projects have little to no user engagement, showing that free gas alone isn’t enough to generate demand; dApps need real value propositions to retain users.

Key Takeaways

Account abstraction and gas sponsorship do boost transaction volume and user sign-ups, but the real test is repeated engagement. Data combining wallet counts, gas abstraction, and gasless transaction volume shows that usage is often concentrated among a few star dApps or large one-off campaigns. Projects like Piggybox can quickly climb leaderboards due to nearly 1:1 wallet-to-transaction ratios, but their rankings plummet when one-time accounts are filtered out. In contrast, cross-chain bridges and plugin solutions show more stable, moderate usage, reflecting actual ecosystem needs rather than short-term hype.

The Role of ERC-4337 Smart Wallets

-

All these trends—gasless gaming, seamless DeFi, chain specialization—are powered by ERC-4337 smart wallets.

-

Unlike traditional externally owned accounts (EOAs), smart wallets significantly improve UX through automation, security, and flexibility.

What Are ERC-4337 Smart Wallets?

Smart contract wallets (or smart wallets) are programmable Ethereum accounts offering:

✅ Batch Transactions: Users can bundle multiple actions (e.g., DEX approval + trade) into a single transaction.

✅ Gas Fee Abstraction: Users don’t need ETH to pay gas; fees can be covered by sponsors or paid in other ERC-20 tokens.

✅ Seedless Security: Users authenticate via passkeys, social recovery, or multi-factor authentication instead of high-risk seed phrases.

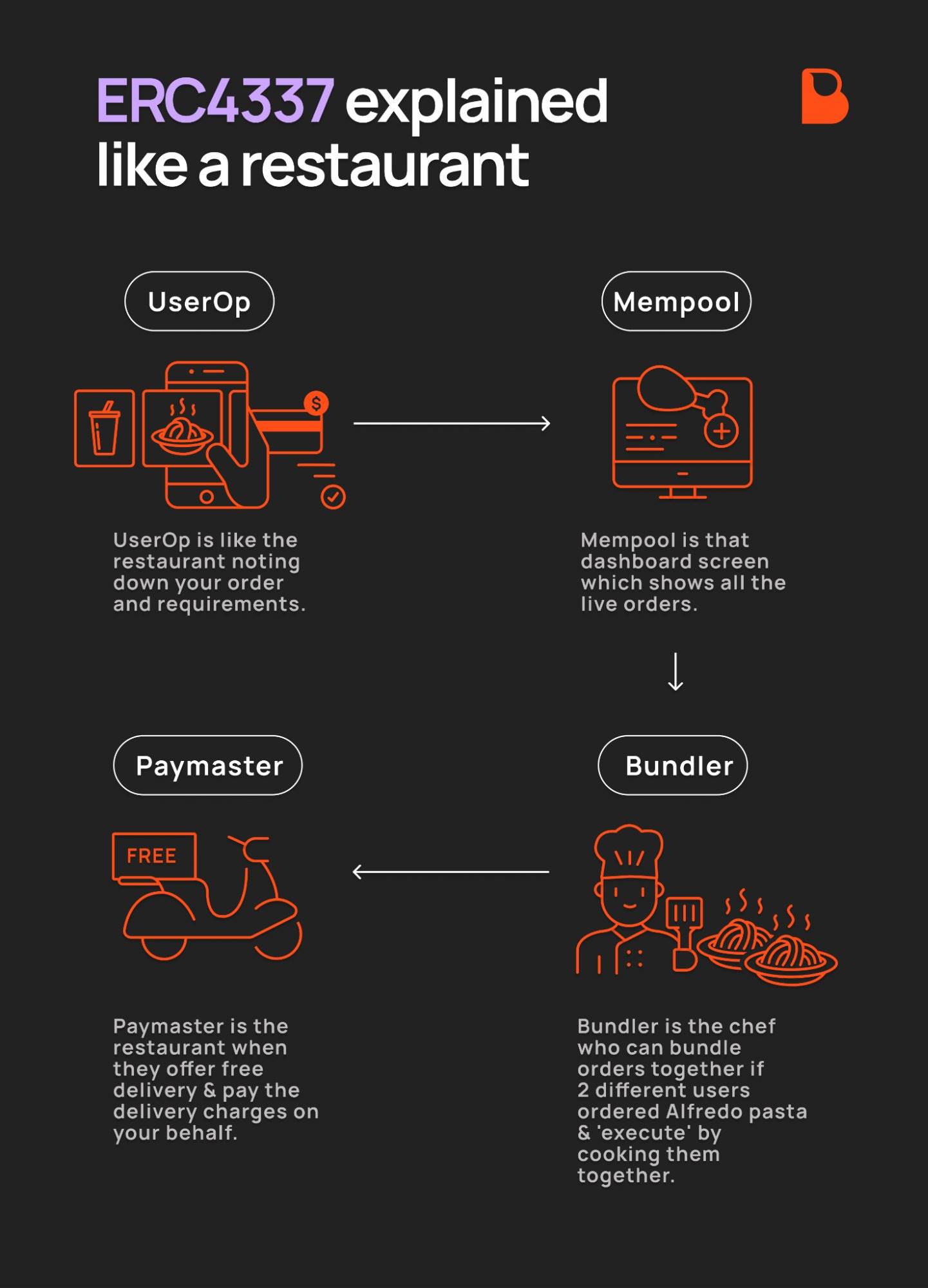

How Do Gasless Transactions Work?

When a user initiates a transaction, a Paymaster (a specialized smart contract) pays the gas fee on their behalf or allows payment in any ERC-20 token. This dramatically lowers the barrier for new users, making blockchain apps feel as smooth as Web2 experiences.

Challenges of ERC-4337 and How EIP-7702 Offers Solutions

Despite driving gasless transactions, ERC-4337 faces significant adoption hurdles that directly contribute to the retention issues mentioned above:

Technical Barriers: Complex components (e.g., UserOperations, Bundlers, EntryPoint contracts) create high entry barriers for average users and developers.

Cost Issues: While gasless transactions benefit users, implementing the full tech stack is expensive, and Bundler profitability suffers during gas volatility.

Reliability Concerns: Network congestion can delay transactions, and complex validation logic increases potential attack surfaces.

Poor UX: Fragmentation across chains leads to inconsistent wallet experiences, hindering seamless cross-chain management.

Summary

Account Abstraction and Gas Sponsorship do effectively boost transaction volume and new wallet registrations, but the true challenge lies in sustaining user engagement. Data shows:

-

Many dApps see usage spikes only during one-off events (e.g., NFT mints, airdrops), with poor long-term retention.

-

A few standout projects drive most on-chain activity, while the majority struggle with insufficient real user demand.

-

Cross-chain bridges and infrastructure solutions show more stable usage, indicating they deliver real utility beyond short-term hype.

While ERC-4337 has advanced gasless transactions and improved UX, its complexity and cost barriers limit mainstream adoption. EIP-7702 fills these gaps by:

-

Enabling EOAs to Support Account Abstraction

-

The core issue with ERC-4337 is that it excludes externally owned accounts (EOAs), requiring users to switch to smart contract wallets. EIP-7702 solves this by allowing EOAs to temporarily adopt smart contract code, enabling features like gas sponsorship (e.g., paying fees in ERC-20 tokens) and transaction batching (e.g., authorizing and using an ERC-20 token in one transaction). For example, users can now batch ERC-20 approvals and spends—a common flow on decentralized exchanges—without migrating to a smart wallet.

-

As noted in community discussions, this is particularly beneficial for users who prefer their existing EOAs and find migrating assets to new wallets cumbersome.

-

Simplifying Complexity & Reducing Costs

-

Allowing EOAs to temporarily use smart contract functionality reduces reliance on permanent wallet contracts, lowering gas costs and dependence on EntryPoints or Bundlers.

-

-

Improving Efficiency

-

Introducing transaction type 0x04 for batching EOA operations provides a leaner alternative to ERC-4337’s UserOps.

-

-

Optimizing Infrastructure

-

Limiting smart contract code to execution scope reduces reliance on alternative mempools (alt mempools) and Bundlers, simplifying the infrastructure.

-

-

Empowering Developers

-

Compatible with ERC-4337 while offering a flexible, low-barrier upgrade path, enabling developers to more easily provide enhanced features to users.

-

ERC-4337 laid the foundation, but EIP-7702 will make smart wallets cheaper, simpler, and easier to use—accelerating the next wave of Web3 adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News