Comparing zk-Rollup and OP-Rollup: Analyzing Why zkSync Gas Fees Are Currently High from a Validation Perspective

TechFlow Selected TechFlow Selected

Comparing zk-Rollup and OP-Rollup: Analyzing Why zkSync Gas Fees Are Currently High from a Validation Perspective

What are the differences between zk-rollup and op-rollup, and why is zkSync gas currently high?

Author: Village Chief of Crypto

Perhaps everyone has grown accustomed to the outrageously high gas fees on ARB and OP—around $0.7 per transaction—hardly resembling the low-cost promise of an L2. In the spirit of hardcore technical education, let’s examine the differences between zk-rollups and op-rollups, and analyze why zkSync currently has relatively high gas fees.

When it comes to the ZK space, many immediately think of zero-knowledge proofs, often associating them with privacy protection.

However, mainstream discussions around zk-rollups are actually focused on scalability. They leverage SNARKs and STARKs proof technologies to achieve what's known as "validator proof"—a cryptographic verification mechanism.

The privacy-preserving aspect of zero-knowledge is relatively weak in zk-rollups. For now, set aside the concept of privacy and instead consider the underlying technology from the perspective of “validator proof.”

In simple terms, all transactions in a zk-rollup occur off-chain (on a sidechain). Using zk algorithms, these transactions are batched together and a SNARKs proof is generated, which is then submitted to the mainnet. A smart contract on the mainnet uses zk algorithms to verify whether all transactions in the batch comply with protocol rules before finalizing them on-chain.

This significantly increases the mainnet’s transaction capacity and speed, while reducing gas consumption compared to transacting directly on Layer 1.

The logic behind op-rollups is easier to grasp: numerous transactions are processed, computed, and recorded on a sidechain. The resulting ledger summary is then aggregated into a block and synchronized with a smart contract on the mainnet.

To prevent malicious behavior by validators, op-rollups employ fraud proofs: if within a 7-day challenge period a validator submits evidence of a suspicious transaction that gets verified, the entire block will be rolled back—ensuring transaction security and integrity.

At their core, zk-rollups and op-rollups differ primarily in their validation mechanisms: validator proof versus fraud proof.

-

Validator proof verifies transactions through cryptographic proofs. While this consumes more computational power and resources, it ensures result correctness within each block cycle, thereby accelerating transaction processing.

-

Op-rollups use fraud proofs, which save on resource costs but require users to wait during the challenge period.

Notably, op-rollups trade time for lower resource consumption. However, their sidechain infrastructure carries certain centralization risks—for example, reliance on centralized sequencers.

In contrast, zk-rollups sacrifice short-term computational resources to achieve faster security finality. Combined with account abstraction and distributed validation, they mitigate centralization risks.

Therefore, the higher gas fees on zk-rollups are justified—they are simply not comparable to those on op-rollups.

Currently, zkSync transaction fees depend on three factors:

(1) Resource costs incurred by validators when generating and verifying SNARK proofs—such as storage and computation; this fixed cost component is relatively high;

(2) The gas fee paid when validators submit SNARK proofs to the Ethereum mainnet; this fluctuates based on mainnet congestion.

(3) Service fees paid by users to validators, covering transaction confirmation, message broadcasting, etc.—these must cover the above costs.

In summary, L2 user gas fee = zk system computation & storage costs + per-batch mainnet submission gas + validator node incentives + others?

The mainnet gas fee and validator incentives need no further explanation. Since computational resource costs are relatively fixed and can be diluted as usage grows, this means that as zkSync achieves broader mass adoption, gas fees will decrease. Yes, current high fees aren’t due to being too competitive—they’re due to *not* being competitive enough!

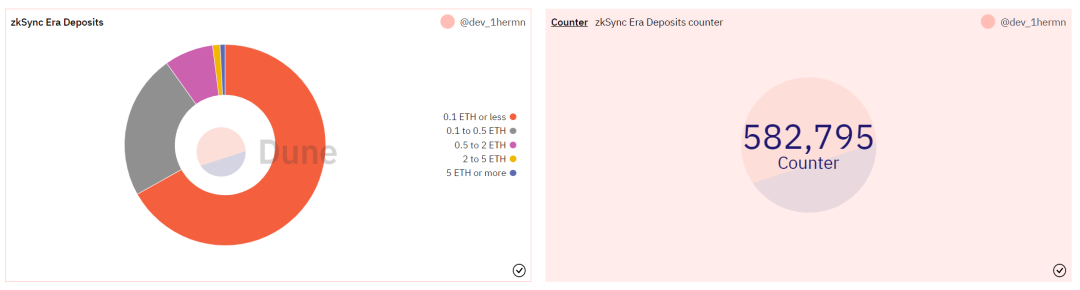

According to data from @DuneAnalytics, zkSync currently averages between 100,000 and 400,000 daily transactions. While active users continue engaging enthusiastically, compared to the vast potential of zk-rollups, zkSync’s ecosystem remains an alpha baby. Instead of complaining about high gas, let’s stop whining and keep building.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News