Binance and OpenAI's Mysterious Benefactor: UAE's Second-in-Command Betting Trillions on AI

TechFlow Selected TechFlow Selected

Binance and OpenAI's Mysterious Benefactor: UAE's Second-in-Command Betting Trillions on AI

In the tide of the times, one is compelled to take sides in the China-U.S. rivalry.

Author: TechFlow

In February, Binance founder CZ and OpenAI founder Sam appeared together at a private event in Abu Dhabi.

A mysterious force connects the two—they share a common investor: Abu Dhabi’s sovereign wealth fund MGX.

On March 12, Binance announced it had secured a $2 billion investment from MGX.

The mastermind behind this deal is Sheikh Tahnoon bin Zayed Al Nahyan (referred to as Tahnoon), chairman of MGX's board.

Tahnoon holds a "Mother of Dragons"-level list of titles: son of the UAE’s founding father, National Security Advisor of the UAE, Deputy Ruler of Abu Dhabi, brother of the UAE President, Chairman of the Abu Dhabi Investment Authority (ADIA), Chairman of Royal Group, Chairman of First Abu Dhabi Bank (the UAE’s largest bank), Chairman of Abu Dhabi Development Holding Company (ADQ), Chairman of International Holding Company (IHC), and Chairman of G42—the Middle East’s largest AI company.

At 56 years old, he controls the UAE’s financial purse strings, overseeing assets totaling an estimated $2 trillion.

This isn’t the first time Tahnoon has invested in crypto-related ventures.

His IHC group previously invested in Phoenix, a cryptocurrency group listed in Abu Dhabi. Its core business operates Phoenix Miner, the world’s largest Bitcoin mining operation, controlling 7% of global Bitcoin network hash power. It also runs a $650 million joint-venture mining facility with ADQ, Abu Dhabi’s sovereign wealth fund.

In addition, Phoenix owns exchange M2.com and crypto investment firm Cypher Capital. Notably, Bill Qian, executive of Phoenix Group and chairman of Cypher Capital, was formerly head of Binance Labs.

Tahnoon is now not only the financial backer of the world’s largest cryptocurrency exchange and Bitcoin mining operation, but also of the largest AI companies globally—his portfolio includes OpenAI, xAI, and Anthropic.

A long-time Middle Eastern businessman told TechFlow that identifying Tahnoon is simple: he wears sunglasses at all times, indoors and outdoors, due to light sensitivity.

Gaining access to Tahnoon requires either entering his trusted inner circle or engaging with his personal passions: Brazilian jiu-jitsu, cycling, video games, chess, and longevity (he claims he intends to live to 150).

A few lucky individuals have been invited aboard his superyacht Maryah to play chess under the Persian Gulf sun.

Cryptocurrency may be just an appetizer. Tahnoon is now a fervent believer in AI, pouring billions into the sector. Yet he finds himself deeply entangled in the U.S.-China tech rivalry. Even someone of Tahnoon’s stature must ultimately choose sides.

Gamer: From Chess to AI

Born in 1968, Tahnoon came three years after his father, Zayed, helped establish the UAE. As one of six sons born to Zayed’s favorite wife, Fatima, Tahnoon was favored from birth and seen as a primary successor.

In the mid-1990s, Tahnoon traveled to Southern California, where he studied Brazilian jiu-jitsu under the name “ben” at a San Diego training center. According to reports from a European jiu-jitsu website, he was humble, often arriving early to help set up the mats. Only later did he reveal his true identity as a prince from Abu Dhabi.

Jiu-jitsu became a lifelong passion. In 1998, he co-founded the ADCC Submission Fighting World Championship with Brazilian coach Nelson. Filmmaker Bobby Razak, currently producing a documentary on Tahnoon, calls him “one of the founders of mixed martial arts,” adding, “Without him, the sport wouldn’t be where it is today.”

Tahnoon is also passionate about cycling.

He converted a palace within his royal estate into a gym, sponsors the top-tier cycling team UAE Team Emirates, and transformed an island near the presidential palace into a cyclist’s paradise.

He has a particular fondness for ultra-light Colnago bikes—so much so that in 2020, a company under his control acquired a majority stake in the Italian brand, showcasing the sheer power of capital.

But perhaps his greatest passion lies in chess.

In the mid-2000s, a small supercomputer named Hydra, based in Abu Dhabi, earned the title of world’s best chess-playing machine. Equipped with a 3.06GHz Intel Xeon processor, this 64-bit system could calculate 200 million moves per second and think 40 moves ahead.

Chrilly, Hydra’s chief designer, described their patron as an ardent computer chess enthusiast, noting: “This sponsor liked to play games against Hydra day and night.”

The anonymous player used the alias zor_champ in online chess matches, forming a human-machine team that consistently crushed opponents.

This mysterious figure was none other than Tahnoon.

In late 2017, Google’s AlphaZero defeated the world’s strongest chess programs after just four hours of self-training—far surpassing Hydra’s capabilities. Tahnoon was stunned by this breakthrough and began to grasp the transformative potential of AI.

The following year (2018), he appointed Peng Xiao, former CTO of MicroStrategy, as CEO to launch AI company G42.

If you’re a sci-fi fan, the significance won’t be lost on you: 42 is the answer to life, the universe, and everything in *The Hitchhiker’s Guide to the Galaxy*. Here’s a fun Easter egg—if you search “the answer to life, the universe, and everything” on Google, the result is 42.

G42 has been dubbed “the Alibaba and Tencent of the Middle East,” leading AI development across the UAE and the broader region. The company now encompasses AI firms Core42, AIQ, and Presight; healthcare companies M42 and Hayat Biotech; data center provider Khazna; and geospatial intelligence firm Bayanat.

Chinese executives are well represented in G42’s leadership, including CEO Peng Xiao and Hayat Biotech CEO Hongbin Cong. Its expansion fund, G42 Expansion Fund (42X), maintains an office in Shanghai and recruited Ningfeng Hu, former JD.com corporate vice president and head of strategic investments, who joined 42X in 2023 as its China lead.

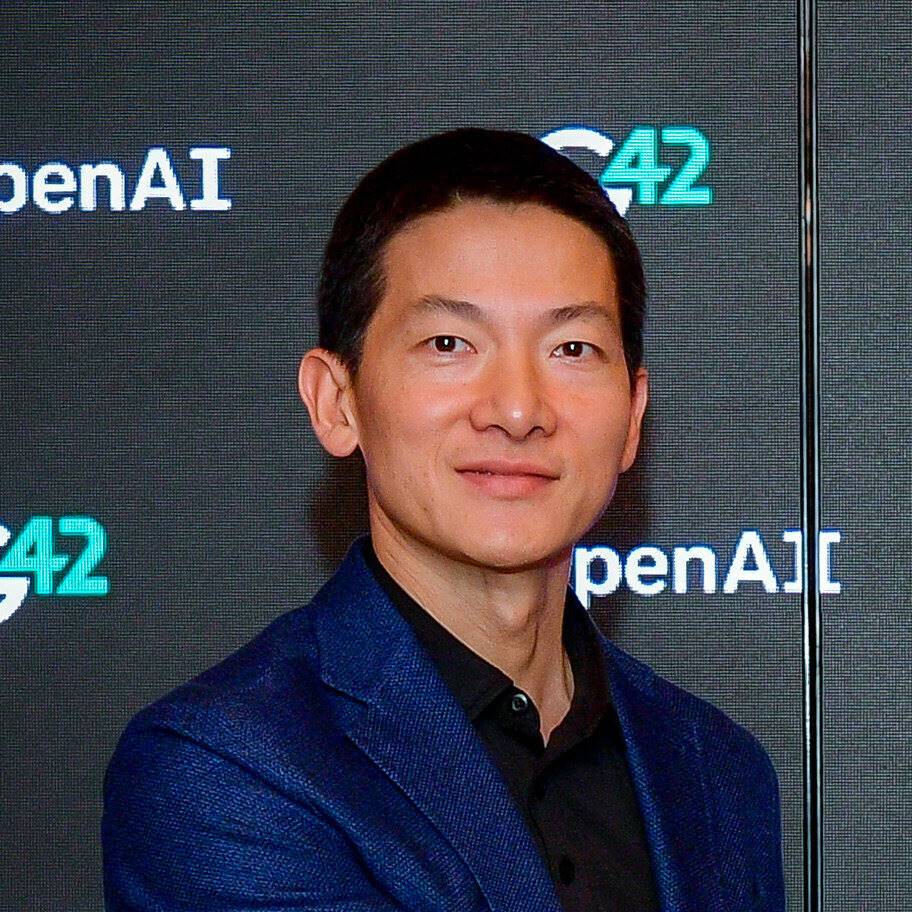

Photo: Peng Xiao

Power Struggles and Deals

Despite being a winner of the “womb lottery,” admired by millions worldwide, Tahnoon has faced significant challenges throughout his life.

The UAE’s founding father, Zayed, had around twenty sons. Among them, Tahnoon and his elder brother Mohamed belong to the “Bani Fatima” group—six sons born to Zayed’s most beloved wife, Fatima.

After Zayed’s death in 2004, another brother, Khalifa, became President of the UAE, while Mohamed, the eldest of the Bani Fatima brothers, was named Crown Prince.

In 2014, President Khalifa suffered a severe stroke, and Mohamed took over state affairs, triggering a succession battle.

Tahnoon insisted on preserving tradition—Zayed’s sons should retain power as long as they remained physically healthy and mentally sharp—making him a strong contender.

Mohamed, however, pushed for his own son, Khalid, to be named Crown Prince.

Tahnoon even presented evidence suggesting Mohamed’s plan violated their father’s intended succession, echoing historical tales of uncles and nephews vying for imperial power in Chinese history.

The conflict ended in negotiation and compromise: Tahnoon relinquished his claim to the crown in exchange for substantial control over national economic assets.

In 2023, Tahnoon was appointed Chairman of the Abu Dhabi Investment Authority (ADIA), the country’s largest sovereign wealth fund. Weeks later, Khalid was named Crown Prince.

Thus, Tahnoon became the de facto “CFO of the UAE,” overseeing the two largest sovereign funds—ADIA and ADQ—as well as the UAE’s biggest bank, First Abu Dhabi Bank, and a vast business empire spanning real estate, agriculture, healthcare, energy, industry, shipping, food, and retail.

According to the latest data from Global SWF, Tahnoon commands over $2 trillion in assets.

Yet, as U.S. media report, those who’ve interacted with Abu Dhabi in recent years agree that Tahnoon’s influence has grown significantly beyond finance—he now leads diplomatic outreach to Iran, Qatar, and Israel, and has built ties with figures in Trump’s inner circle.

MGX participated in Elon Musk’s xAI $6 billion funding round, while its asset management arm Lunate added $1.5 billion to Affinity, managed by Trump’s son-in-law Jared Kushner.

Tahnoon’s power extends beyond wealth—it reaches into intelligence and technology. As National Security Advisor, he oversees the UAE’s intelligence apparatus and leveraged it to build G42 into a powerhouse in AI and biotechnology.

After resolving internal power struggles, Tahnoon now faces a new challenge: geopolitical conflict.

AI and Geopolitics

Prior to 2023, G42 maintained close ties with Chinese tech giant Huawei, and employed numerous Chinese executives—a situation that drew criticism from U.S. hawks.

“You have to pick a side,” former U.S. Secretary of Commerce Gina Raimondo bluntly told Tahnoon during a 2023 meeting in Washington: “Investment is welcome—but you can’t straddle both China and the U.S.”

In August 2023, the U.S. imposed major restrictions, blocking Nvidia GPU exports to the Middle East. Any company using Huawei technology was barred from receiving these chips.

Faced with this ultimatum, Tahnoon had no choice but to decide.

In early 2024, G42 announced it would sever ties with China, removing all Chinese-made technology—including Huawei routers from its offices—and sold its stake in ByteDance.

In April 2024, Microsoft announced a $1.5 billion investment in G42 for a minority stake, with Microsoft President Brad Smith joining G42’s board.

That summer, Tahnoon embarked on a diplomatic tour of the U.S., meeting tech titans including Musk, Zuckerberg, Bill Gates, Satya Nadella (Microsoft CEO), and Jeff Bezos (Amazon founder). He also held discussions at the White House with National Security Advisor Jake Sullivan, Secretary of Commerce Gina Raimondo, and even President Biden.

Meanwhile, in March 2024, Tahnoon established MGX, partnering with BlackRock and Microsoft to invest in the AI sector—specifically, American AI.

MGX CEO Ahmed Yahia stated that 70% to 80% of the fund’s capital will be directed toward the United States. MGX made major investments in OpenAI, Musk’s xAI, and Anthropic (backed by Amazon), and is one of the few supporters of SoftBank’s “Project Gulfstar.”

These efforts quickly paid off. The U.S. granted Nvidia permission to sell GPUs to G42, including large quantities of H100 chips, now deployed in Abu Dhabi.

In this global AI race, Tahnoon’s strategic pivot is more than a business move—it’s a high-stakes bet on national destiny.

As we observe this U.S.-China tech rivalry, it becomes clear that whether tech giants, national leaders, or trillion-dollar royals, all are merely participants in history’s current, each placing their bets on an uncertain future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News