IOSG Researcher: After Casinos, My "Bearish" Cryptocurrency Plan for 2025

TechFlow Selected TechFlow Selected

IOSG Researcher: After Casinos, My "Bearish" Cryptocurrency Plan for 2025

The growing stablecoin market will attract more developers and builders, potentially giving rise to new DeFi primitives from the ecosystem.

Author: Poopman, IOSG

Translation: TechFlow

The author of this article is a cryptocurrency enthusiast who got lucky with Memecoins and is now exploring legitimate investment opportunities for 2025—so I can explain to my dad that I'm working in a serious industry.

These are just my personal views on the market and do not represent the opinions of the team or IOSG as an entity.

Here’s what I’ll cover in this article:

The 2024 crypto market;

What comes after Memecoins;

What I’ll be watching if the market remains bearish;

2024: The Year of Bitcoin and Solana

2024 was brutal—unless you were a BTC maxi or trench warrior. Venture capital, liquidity providers, diamond hands, and true believers were all wiped out, and when AI hype collapsed, the future of crypto looked even bleaker.

BTC hit $100K, ETFs were approved, BTC dominance reached 60%, and TradFi adoption accelerated. 2024 was indeed the year of BTC.

Solana, the tokenization platform. At its peak, SOL had a daily trading volume of $36 billion—about 10% of Nasdaq’s average daily volume—which is massive for crypto. Memecoins / AI coins made this possible.

Hyperliquid emerged as a BBH (Big Black Horse) in this market. They rejected venture capital—a bold move—and their post-airdrop approach demonstrated strong demand for non-KYC perpetual trading and "thick" platform liquidity.

XRP, ADA, any Dino coin. Well, Uber drivers and the U.S. government seem to love them, so I’ll give them credit.

Other than that, I don’t recall any pump in this market lasting more than two weeks.

2025: From Casino to New DeFi + American Crypto

After TRUMP dropped, I noticed market profits weren't flowing back into AI tokens. So I converted everything—except part of my SOL position—into stable assets (which now seems a bit foolish).

It's becoming increasingly clear that after months of PVP (Pump and Volatility Play), people are tired of Memecoins and AI vaporware.

The entire AI sector has been destroyed, with most tokens down 70–80% from their peaks.

The $LIBRA event essentially sealed the fate of this narrative.

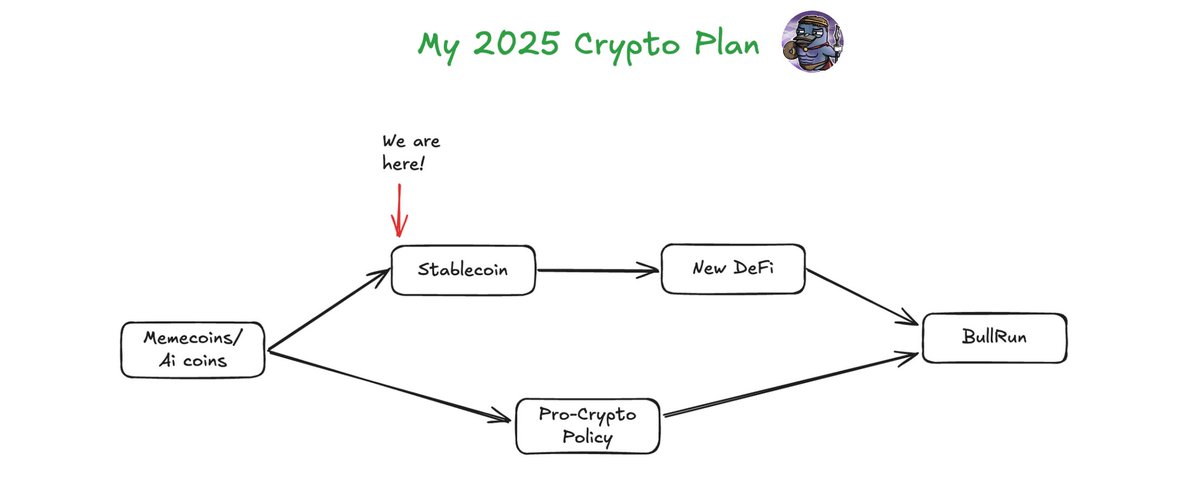

In short, Pumpfun is going to zero.

So where did all the Memecoin money go?

Due to a lack of foreseeable catalysts, the wealth effect of Memecoins is gradually fading, creating a vicious cycle that drives players away from Memecoins.

Meanwhile, in today’s crypto market:

-

Lack of breakthrough innovation in crypto

-

Existing altcoins continue to stagnate, ETH stuck in limbo

-

Fundamentals suddenly no longer matter

-

Legacy Memecoins have died

-

Newly launched tokens have low survival rates—only a few last beyond 2 weeks

This sounds extremely pessimistic, right?

In this calm environment, I believe investors will prefer “safe-haven” investments. That’s why I expect most capital to flow into fiat-backed stablecoins by 2025.

Some of these users want to put their assets to work and earn passive yield.

Therefore, yield-generating “stables” like USDe or USDS become highly attractive to them.

Stablecoins are the new oil.

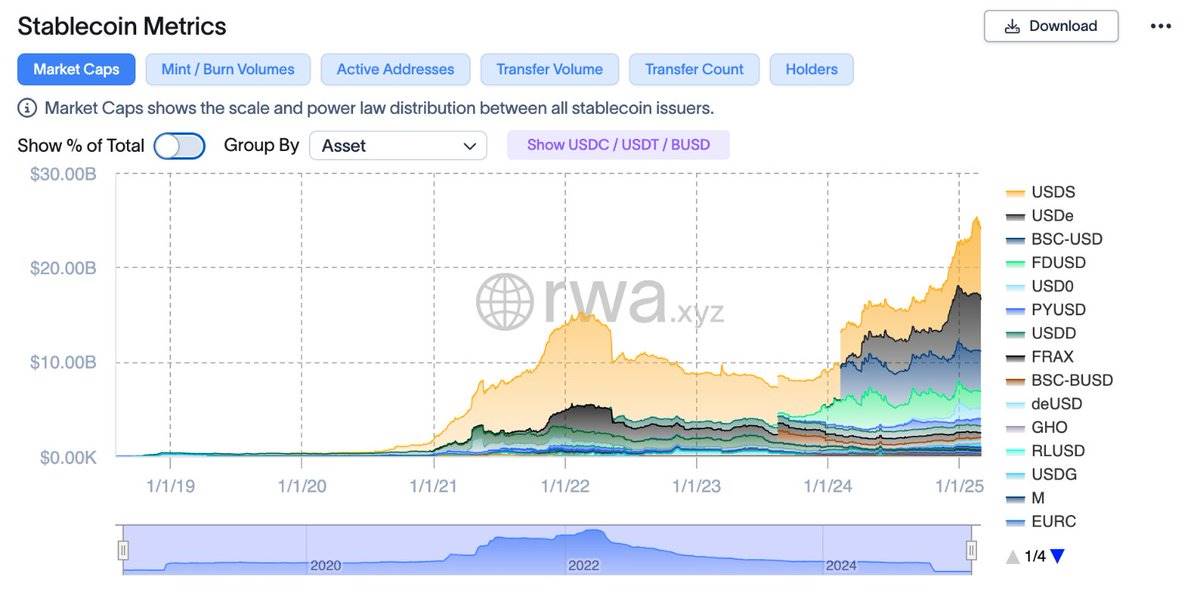

https://app.rwa.xyz/stablecoins

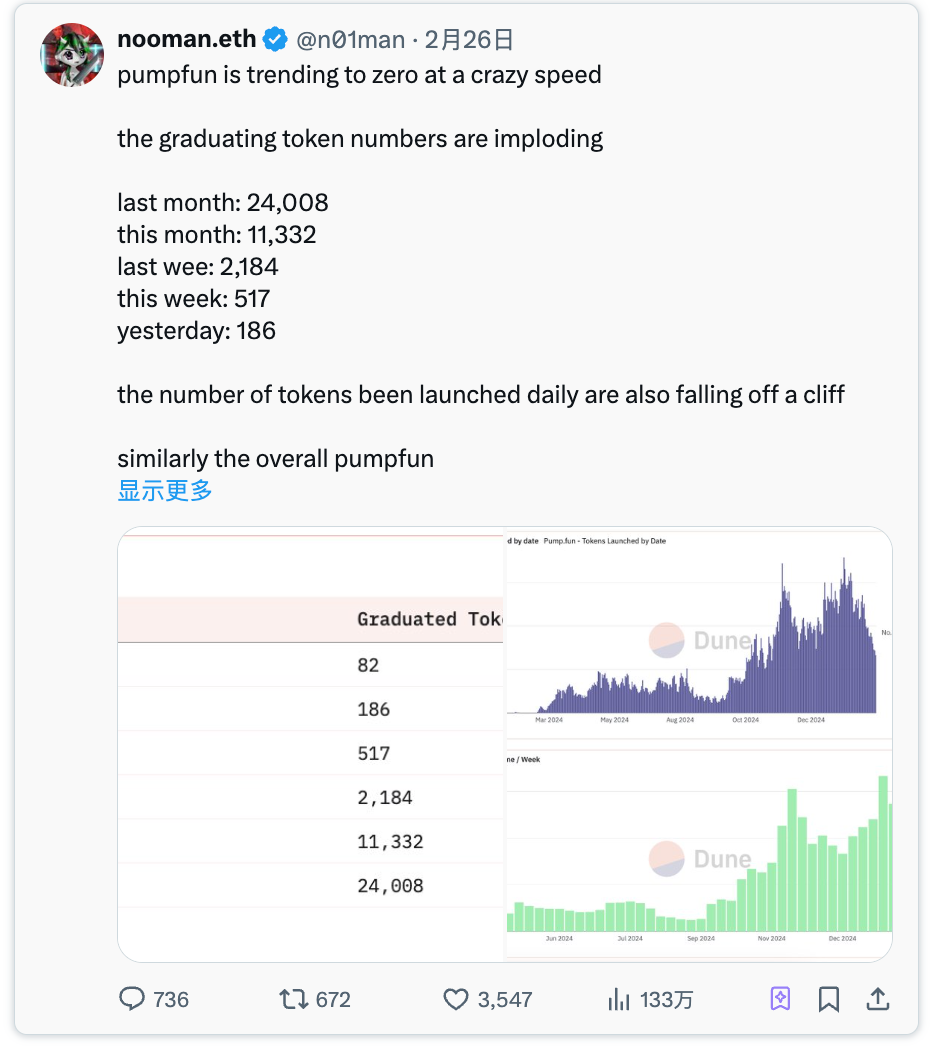

Despite heavy losses in AI and Meme markets, stablecoin TVL continues to grow steadily—up 3% MoM, surpassing $220 billion at the time of writing.

Those seeking safety and reliability choose fiat-backed stablecoins. USDT and USDC maintain ~90% market dominance, largely due to their widespread adoption across exchanges and payment platforms.

Users who want to actively use their stables opt for yield-generating or decentralized stablecoins—such as USDe, USDS, DAI, and USD0. So far, this segment holds only >10% share, but they’ve actually had an incredible year, with total TVL growing over 70%.

Alright, let’s cut to the chase. The current situation is:

90% fiat-backed stablecoins

10% yield-generating stablecoins

I believe there’s still room for growth in new (yield-bearing) stablecoins because:

1/ “Low-volatility yield options” are always appealing to crypto natives.

2/ Innovation in new stabilization mechanisms and capital efficiency strategies can boost yields.

3/ Stablecoins have found PMF (Product-Market Fit) in crypto—as both currency and investment instruments.

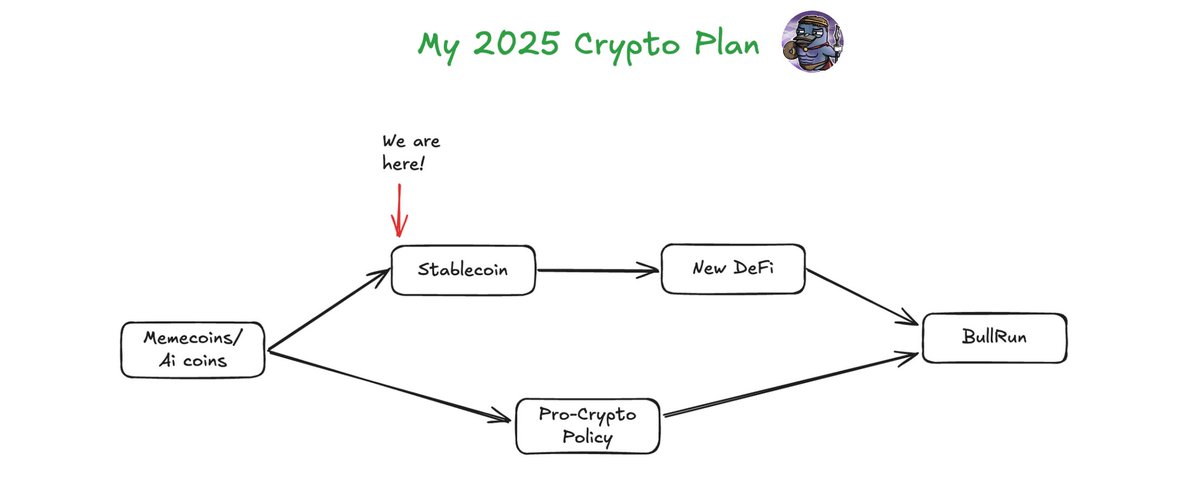

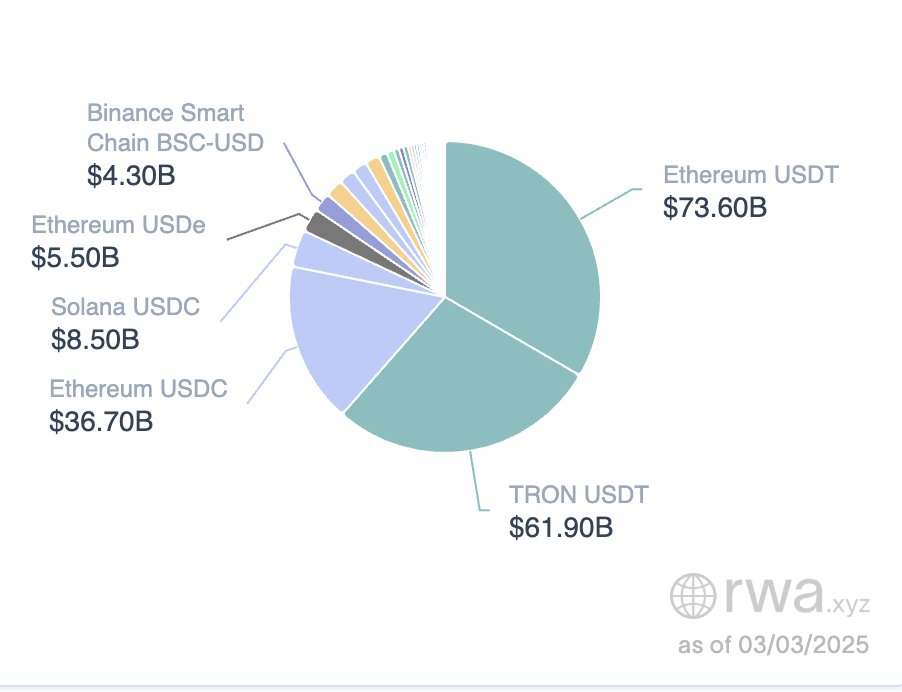

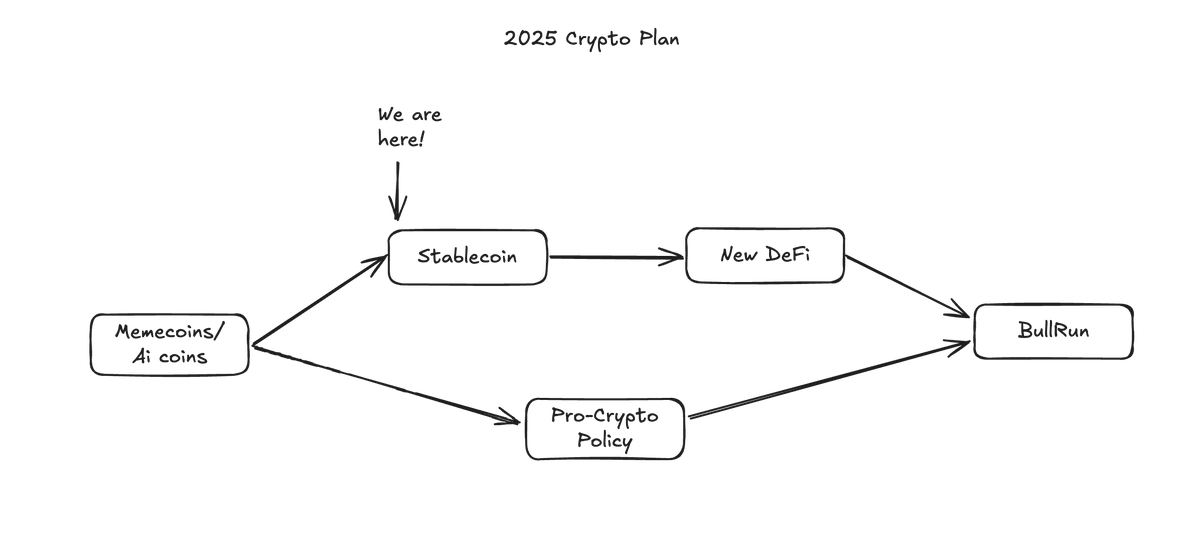

This is the rough outline of my 2025 crypto plan.

My 2025 “Bearish” Crypto Strategy

If there’s no innovation or narrative in 2025, I believe the market will trend in two directions:

-

Growing stablecoin markets driving DeFi innovation

-

Pro-crypto policies pushing forward “Made-in-America” crypto technology

1. Stablecoins and New DeFi Innovation

In the next 3–6 months, we’ll see more stablecoins emerge using dollar-based tokenization strategies, aiming to generate competitive yields through various collateral types or strategies.

Thanks to composability and stable “price stability,” they can easily integrate with different DeFi protocols and create synergies. Examples of existing DeFi integrations include:

-

Interest rate swap-related products like @pendle_fi, @spectra_finance—excellent designs allowing users to speculate on asset yields, effectively creating new markets for yield-generating (YG) assets including stablecoins.

-

Money markets like @MorphoLabs, @0xfluid that enable leveraged yield farming, significantly contributing to economic activity around stablecoins.

-

Dexes like @CurveFinance also provide excellent venues for bootstrapping stable liquidity.

Among these, my favorite innovations are those creating new asset classes—like Pendle’s YT-USDe—which builds a new market atop yield “Legos,” offering an additional yield layer for stable yielders.

Beyond yield optimization, I’d also like to see innovation in CDP design—especially ideas that reduce over-collateralization and minimize liquidation risks, making decentralization stable again.

Ultimately, I expect to see more innovation emerge within the growing stablecoin market, as it becomes the primary destination for incoming capital.

2. Pro-Crypto Policies Driving American Crypto Growth

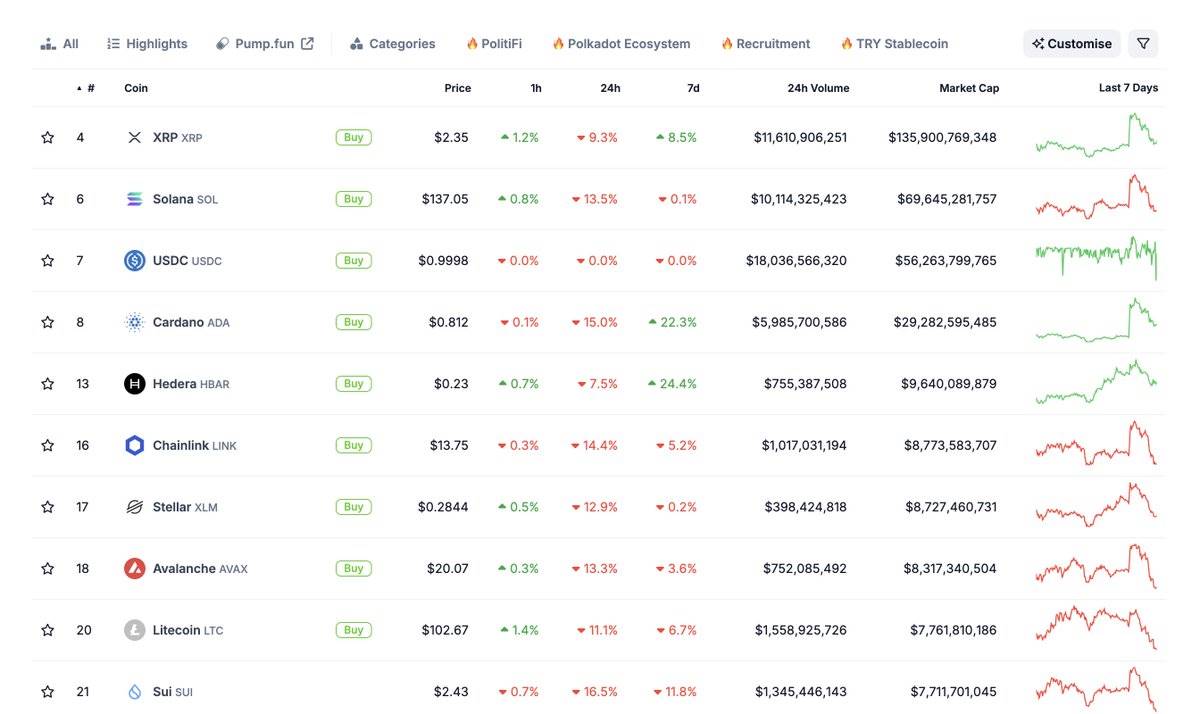

Recently, Trump announced plans to push a crypto strategic reserve program, including a basket of “Made-in-America” coins such as SOL, XRP, etc.

While it remains uncertain whether a government-backed crypto reserve will be approved, Trump’s influence on the crypto market cannot be ignored.

Examples of Trump’s pro-crypto stance include:

-

Firing Gary Gensler on Day One.

-

Retaining all BTC seized by the U.S. government to build a “National Strategic BTC Reserve” (e.g., Silk Road BTC being one example).

-

Launching the WiFi DeFi fund and launching TRUMP—very crypto-friendly moves.

-

SEC withdrawing charges against exchanges and crypto projects like Coinbase, Uniswap, Kraken.

Additionally, the Trump team may nurture the domestic crypto industry. Therefore, we can expect more favorable regulations targeting a U.S.-based basket of coins or consortiums.

NFA, but I’ll keep a close eye on these tokens—Trump’s influence is huge.

Summary

As mentioned, this is just brainstorming and intuitive thinking. None of these views are backed by statistics. So please don’t treat this as alpha.

Anyway, here’s a summary for those who don’t like reading:

-

Given the lack of crypto innovation and market enthusiasm, if the market remains “bearish” in 2025, I expect increased demand for stablecoins.

-

Assuming investors want to put their stables to work, I estimate that yield-generating stablecoin products could capture 20–30% of the overall stablecoin market in the long run (similar to stETH).

-

This growing stablecoin market will attract more developers and builders, potentially giving rise to new DeFi primitives from the ecosystem.

-

In the long term, Trump’s pro-crypto policies are positive for the crypto industry.

-

Moreover, his policies may benefit domestic U.S. crypto projects.

Therefore, monitoring American crypto tokens makes sense—because some “news” alone could send these tokens soaring.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News