Solana's crash: the end or a new beginning?

TechFlow Selected TechFlow Selected

Solana's crash: the end or a new beginning?

We continue to uphold the same view—that SOL through ETFs is not a question of yes or no, but when.

This research will be divided into several parts:

(1) Was Solana's recent crash an end or a new beginning?

(2) The New Chain War is beginning

(3) The direction of the primary market going forward

01.Was Solana's recent crash an end or a new beginning?

1.1 Value assets on Solana

SOL ETF approval is only a matter of time, likely between May and June.

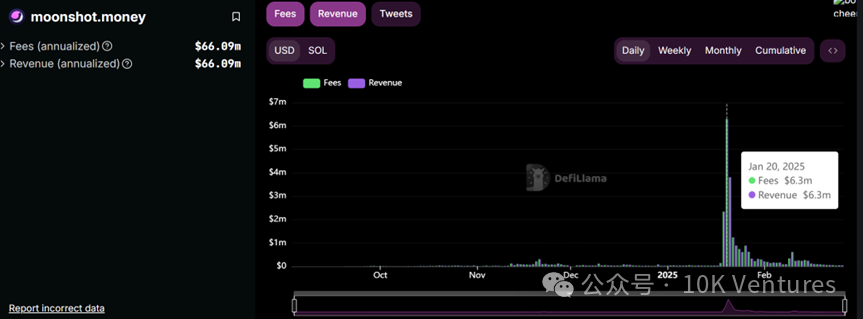

Accompanied by Trump launching a token on Solana, its circulating market cap briefly reached $14 billion, and Solana/TRUMP began to gain mainstream attention. When Trump was approaching its all-time high (ATH), friends outside the crypto circle may have started asking how to buy Trump and Solana. On that day, Moonshot, a highly web2 user-friendly crypto brokerage, achieved its historical revenue ATH, with single-day income reaching $6.3 million.

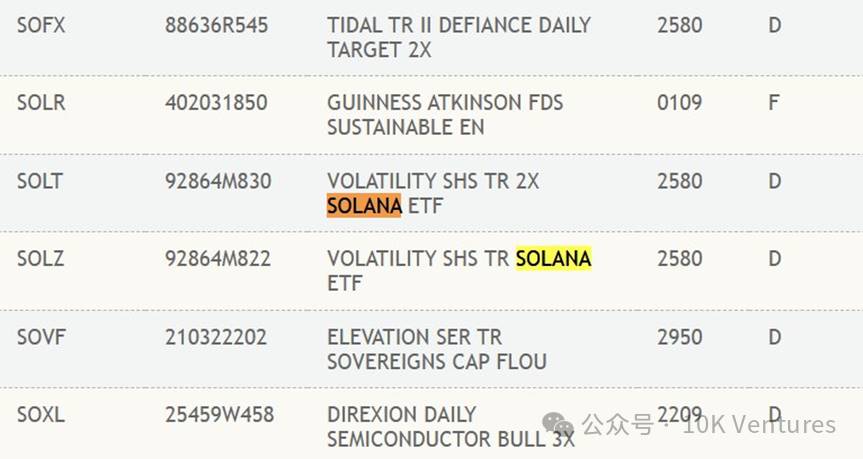

As Trump/Solana gained traction among retail investors, the rollout of SOL ETFs accelerated. As of February 27, 2025, the latest update on the SOL ETF is that it has been listed on DTCC (news broke just as I was writing this article). DTCC (Depository Trust & Clearing Corporation) is the largest financial transaction back-office service provider in the U.S., responsible for centralized custody and settlement of securities such as stocks and bonds, serving major exchanges including NYSE and Nasdaq. When a product or security is listed on DTCC, it means it has entered DTCC’s centralized custody and settlement system. However, this does not directly imply it will be listed on Nasdaq.

Notably, the first BTC ETF was listed on DTCC on October 23, 2023, followed by its Nasdaq listing on January 11, 2024 (a gap of two and a half months); the first ETH ETF was listed on DTCC on April 26, 2024, with its Nasdaq listing on July 23, 2024 (a three-month gap).

Therefore, we maintain our consistent view—SOL ETF approval isn’t a question of yes or no, but when. Based on precedent, timing should be 2–3 months from now, i.e., mid-May to June.

Pump.fun remains one of the best cash-flow-generating decentralized companies in crypto.

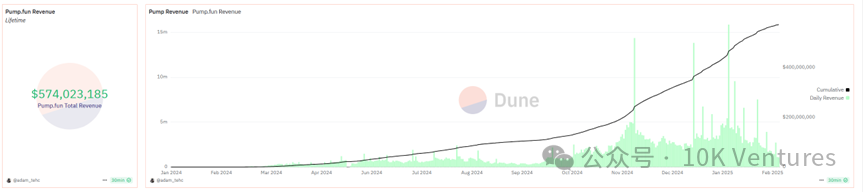

Pump.fun launched in early 2024, gained moderate trading volume by mid-2024, and exploded in popularity after October 2024. Pump.fun is an all-in-one meme coin launch platform. After creating a token, users pay only 0.02 SOL to mint it and immediately list it on Pump.fun’s market. Pump.fun uses a bonding curve to define pricing: the more tokens are bought, the higher the price climbs along a predefined curve. 100% of tokens are sold through the curve, ensuring no unfair advantages. This model eliminates the need for creators to provide initial liquidity, lowering financial barriers. Meme coins on Pump.fun can be traded within the platform, where users can buy or sell tokens anytime based on the bonding curve model. Once a token’s market cap reaches $100k, it automatically migrates to Raydium (though recently Pump.fun has begun deploying its own liquidity pools, encroaching on Raydium’s market). Liquidity is then deposited into Raydium, and 17% of the liquidity tokens are burned.

As of February 27, 2025, priced at $140 per SOL, Pump.fun generated approximately $574 million in first-year revenue—one of the most successful products in the crypto industry to date.

Before 2021, the growth path for VC-backed tokens typically involved raising funds from VCs, launching mainnets alongside exchange listings, and gradually building business operations after token issuance. After 2021, the model shifted to simultaneous fundraising and development, followed by airdrops, exchange listings, and continued operations. The problem emerged after FTX’s collapse, leaving Binance as the sole dominant player, which completely eroded project teams’ listing negotiation power—after all, without listing on Binance, there would be no strong liquidity. Project teams were thus forced to allocate large portions of their tokens to Binance/BNB holders. This led to massive sell-side pressure upon listing on Binance, stemming from airdrops, team allocations, and market makers, making it impossible for retail investors to profit in the secondary market. To counteract this, project teams had to inflate valuations in the primary market, so they could afford to give Binance only 2%-5% of tokens.

In the past, what attracted retail investors most to the crypto market was the wealth effect in the secondary market—during 2021, buying anything on Binance was profitable, and VC-backed tokens surged multiple times. But once primary market valuations became too high, retail investors could no longer earn desired profits in the secondary market, leading them to disengage entirely (although shorting high-valued projects could still generate profits).

Thus, meme coin popularity began rising steadily after late 2023 and peaked in early 2025. Beyond cultural, cult-like, or sociological angles, from a retail investor perspective, meme coins offer several advantages: 1. 100% fully liquid supply with no apparent VC-related sell pressure; 2. low market cap at early participation, offering extremely high return potential; 3. life-changing gains—this is about transformation, not just doubling money; 4. if it’s all gambling anyway, why invest in your overpriced VC project at launch?

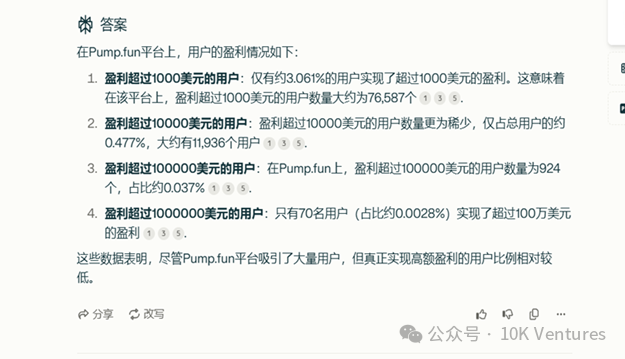

On Pump.fun, investing 1 SOL in a sub-$100k market cap token yields 100x returns ($100 SOL) if it trades at $10M, or 500x returns at $50M. Not to mention legendary tokens like ACT/PHAT that further cemented Solana’s meme-driven wealth creation myth. Playing small-cap games on Pump.fun mirrors how VCs invest in early-stage startups.

Pump.fun is a product that maximizes human gambling instincts. Especially amid collective frenzy, when KOLs promote a token, users blindly buy without considering the token’s meaning or underlying token distribution. Against the backdrop of fees charged by Raydium and Pump.fun, the negative-sum game ensures only a tiny fraction of users profit. Yet, a casino doesn’t need half or even 80% of players to win. It only needs a few individuals to achieve extraordinary wealth effects. A casino only needs retail investors to believe they can make money and have a chance at getting rich. In these low-stakes trial-and-error gambling environments, retail investors rarely lose all their money. After losses, they keep gambling repeatedly. Under a negative-sum game, the real winners are always the exchanges and token issuers.

With Pump.fun entering DEX operations, Raydium’s market share may gradually decline

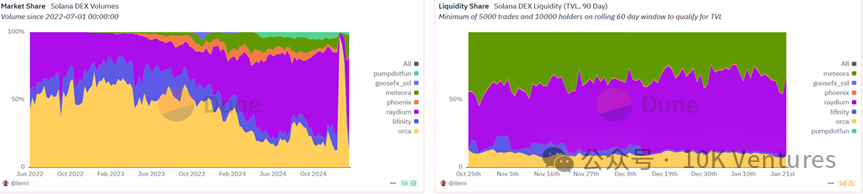

Previously, Orca was the leading DEX on Solana, primarily handling mainstream Solana tokens like SOL/BONK. However, after Pump.fun integrated with Raydium, Raydium became the main battlefield for memes. Additionally, Solana’s liquidity is primarily concentrated in Raydium, Orca, and Meteora.

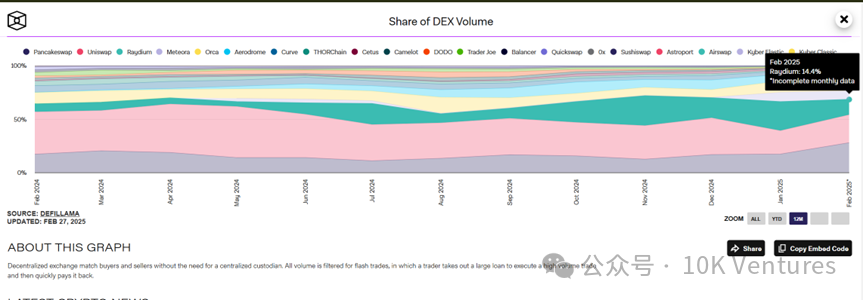

After concluding internal trading on Pump.fun, meme coins migrate to Raydium for broader trading. In January 2025, the DEX-to-CEX trading volume ratio reached nearly 20%, breaking past expectations of a 15% ceiling. According to our annual report, meme coins are primarily taking market share from mid-to-lower-tier VC-backed projects. Especially after the Trump couple launched meme coins on Solana, Solana-based DEXs saw further market share gains. In December 2024, Raydium (Solana) vs Uniswap (Ethereum) market share stood at 19% vs 34%. But by January 20, Raydium caught up to Uniswap, both at 25%. During recent TRUMP trading surges, Raydium’s market share even temporarily surpassed Uniswap.

Raydium charges 0.25% per trade, with 0.22% going to LPs and 0.03% used to repurchase RAY. RAY offers stronger utility than UNI. Due to regulatory constraints, UNI only serves governance purposes, whereas RAY can also be used to pay trading fees, participate in IDOs, and receives 12% of Raydium’s trading fees for buybacks.

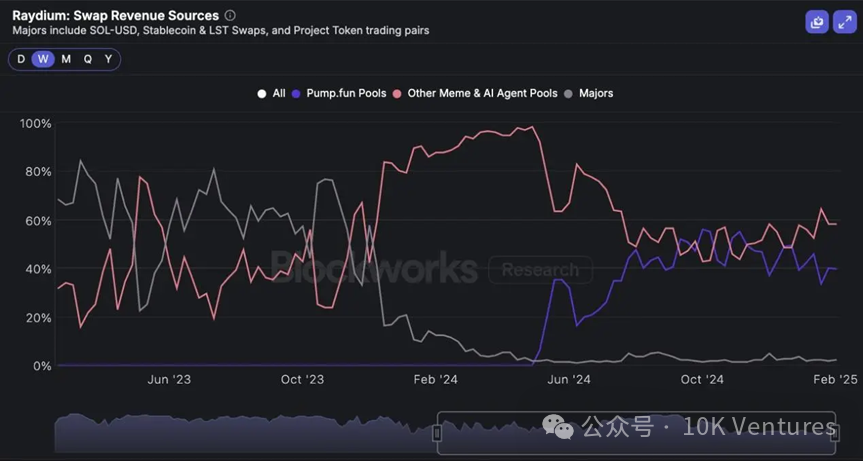

Since April 1 last year, tokens launched via Pump.fun have contributed $346 billion in trading volume to Raydium—half of the DEX’s total traffic—and generated $104 million out of Raydium’s cumulative $197 million in fees.

Now, Pump.fun may be internally testing AMM functionality, meaning Raydium’s uniqueness could vanish. We’ve always found it strange that such a profitable business wouldn’t be vertically integrated by Pump.fun itself—why share the most lucrative profits with Raydium? It simply doesn’t make sense.

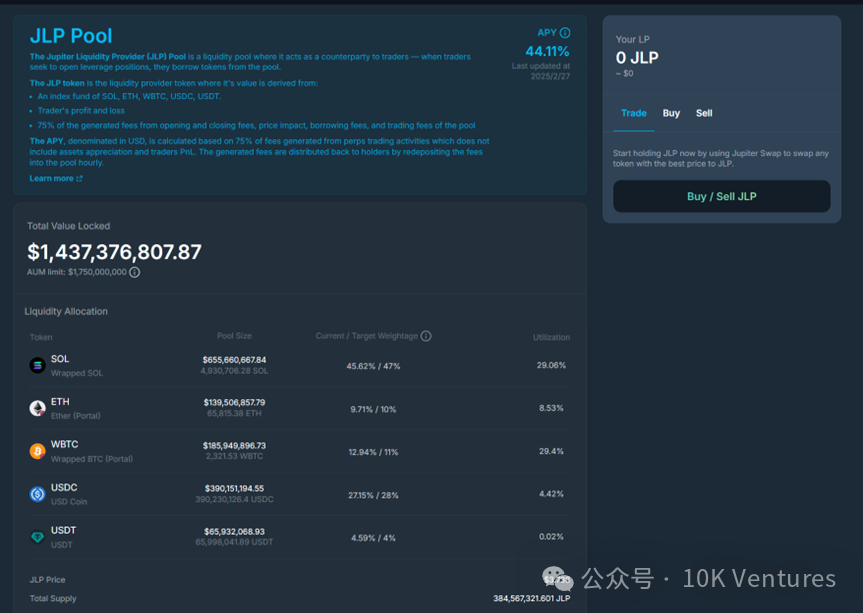

JUP+JLP token utility is excellent—recommended for close monitoring

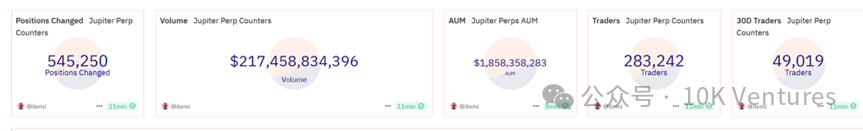

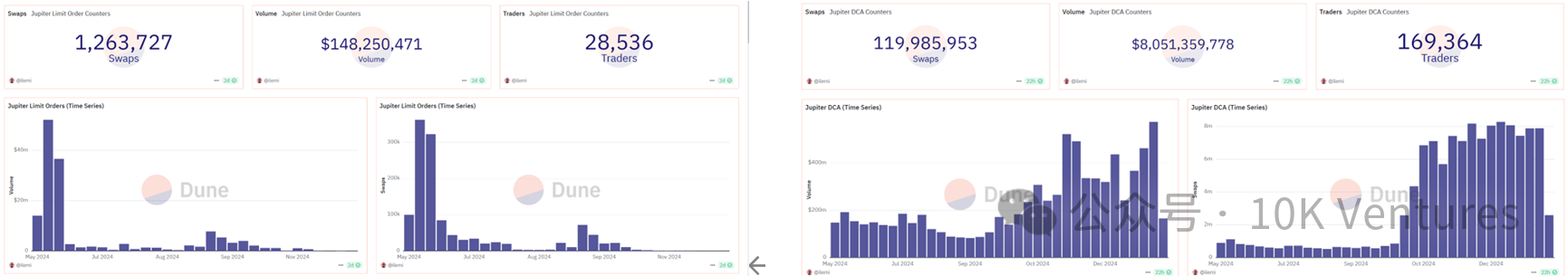

Jupiter is Solana’s largest perp DEX and spot aggregator. Jupiter’s core businesses include: 1. DEX aggregation; 2. Perp DEX; 3. DCA (Dollar-Cost Averaging); 4. Limit orders. Jupiter charges no fees on spot aggregation trades, but takes a 0.1% platform fee on Limit and DCA services. As shown in the chart below, perpetual DEX trading volume is the primary revenue driver. In perpetual contracts, Jupiter earns 0.06% of users’ position open/close AUM, plus liquidation fees. Additionally, Jupiter launched the JLP pool, allowing users to deposit liquidity and effectively bet against retail traders. A portion of Jupiter’s trading fees and liquidation payouts flow into the JLP pool, causing its value to continuously grow. JUP token utility is also improving—currently, 50% of protocol fees are used to buy back JUP, providing price support.

JLP can be seen as betting against retail traders in derivatives, earning fees and profiting from user losses. According to the law of large numbers, a negative-sum game ensures that, over time, a contract exchange that includes liquidations will always profit. JLP decentralizes the traditional CEX futures model, allowing retail users to add liquidity and bet against other retail traders playing futures. Over the long term, this is guaranteed to be profitable—although in the short term, black swan events could cause LPs to lose money. JLP is essentially a strong yield-generating use case. Beyond asset appreciation from underlying holdings (SOL, ETH, BTC annual gains), the pool’s fee income, funding rates, and net user losses have delivered an annualized return of 44.11%.

1.2 Can the meme coin crash spark a VC-backed token comeback?

Since late January 2025, BTC has declined from its peak near $110,000, dropping over 6% in a single day on February 26 to $88,189. SOL prices fell in tandem, dragging Solana-based meme coins (e.g., BONK, WIF) down more than 30% in a day.

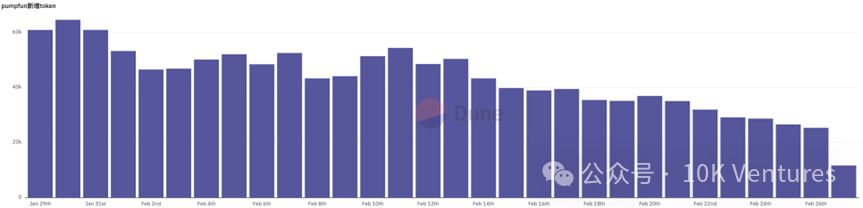

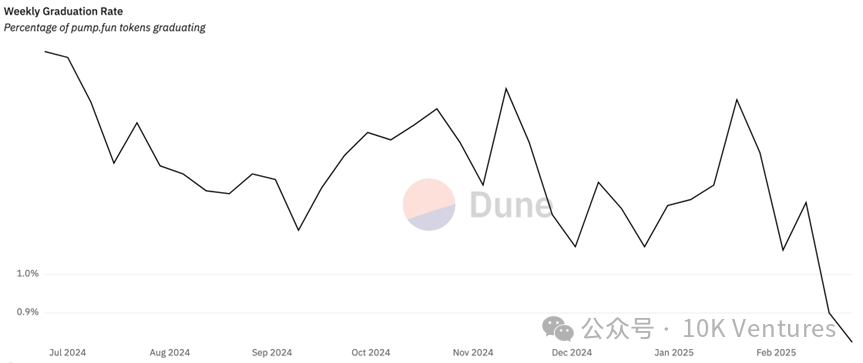

The number of new tokens created daily on pump.fun dropped from 60,000 to under 30,000, partly due to market fatigue with the “one-click launch” model. The success rate of new tokens “graduating” (reaching liquidity thresholds) fell from 1.5% to 0.8%, reflecting faster淘汰 of low-quality projects. After speculative capital exits, only a few projects survive.

On January 18, the Trump family launched tokens (TRUMP, MELANIA), triggering market euphoria and controversy. TRUMP opened at $0.1824 and surged over 43,860% to $80 within 48 hours. Celebrity endorsement became the key catalyst for short-term meme coin rallies.

On February 15, Argentine President Javier Milei publicly endorsed a meme coin called $LIBRA, claiming it supports small businesses and economic development in Argentina, and shared the token contract address. The token price spiked to $4.96 within half an hour, briefly nearing a $5 billion market cap. However, it plunged 85% shortly after due to massive insider selling (~$107 million), falling below $0.60 and causing severe investor losses. The incident triggered global skepticism toward "political meme coins," raising concerns about celebrities exploiting influence to exploit retail investors in unregulated environments.

Multiple once-popular flagship meme coins have sharply pulled back from all-time highs, with typical declines exceeding 80%.

AI16Z (AI Agent leader): crashed from $2.49 to $0.34 (-86%), mainly due to fading interest in AI Agent narratives.

AIXBT (crypto intelligence platform): fell from $1.06 to $0.21 (-80%), despite whale accumulation—the sector correction combined with shrinking liquidity pressured prices.

SWARMS (decentralized AI network): down 90% ($0.63 → $0.06), reflecting market rejection of AI concept tokens lacking real use cases.

Trump family tokens (TRUMP, MELANIA): TRUMP dropped from $85 to $13 (-85%); Melania coin collapsed 95% ($18 → $0.86), primarily due to regulatory scrutiny and bubble deflation after traffic dissipated.

Earlier hotspots like AI Agents have entered a "deep squat" phase—most top tokens relied purely on hype without technical substance, making them vulnerable to collapse once community interest fades. This downturn confirms the volatile nature of meme coins—“they rise fast, fall faster.” Investors must beware of narrative-driven tokens with no intrinsic value. Cash out early, play new, not old; never get emotionally attached—that’s the essence of on-chain meme coins.

There’s a viewpoint: since Pump.fun rose to fame, there’s been little innovation in new sectors in this industry. Fewer founders today claim they’re using blockchain to change the world. More openly admit this space is just a big casino. Perhaps inventing a new sector or launching a new CA leads to the same outcome—drawing a Christmas tree—but new sectors produce smoother trees, while CAs result in sharp pumps followed by dumps. Three years ago, teams invented new sectors and told new stories. Now, all you need is a new CA.

But now, Pump.fun’s traffic and hype seem to be fading. Could this create a window of opportunity for truly builder-focused teams? Let’s wait and see.

02 The New Chain War is beginning

2.1 Berachain

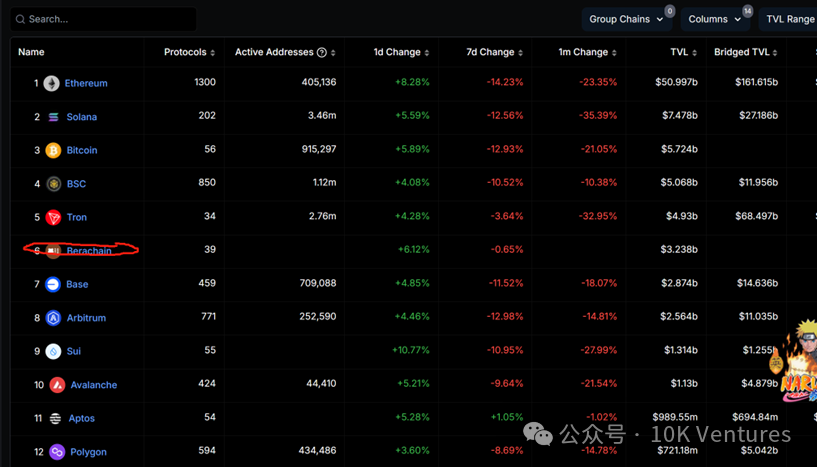

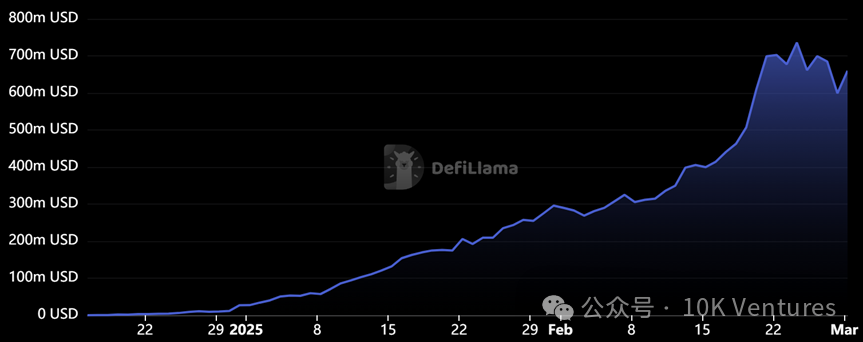

Berachain is the fastest-growing public chain in terms of TVL recently, increasing from an initial $500 million to $3.2 billion today, thanks to its unique POL (Proof of Liquidity) consensus mechanism.

POL involves three tokens:

1. BERA: native gas token, used for gas fees and staking

2. BGT: governance token, a one-way convertible SBT + reward token (BERA cannot be converted to BGT). Users receive BGT rewards after participating in Berachain DeFi and can choose whether to convert them to BERA.

3. HONEY: stablecoin. Users can mint HONEY by depositing collateral, with BGT holders governing vaults.

Unlike POW/POS/POH, POL exclusively rewards contributions to DeFi liquidity providers, incentivizing deeper system participation. POL drives exceptionally strong early ecosystem growth. But it’s a double-edged sword: BGT’s first-year inflation is 10% of total supply, introducing 50 million BGT to the market. Considering all BGT eventually enters circulation, combined with the current 107 million circulating BERA, this could increase market supply by up to 50%. Since BGT is concentrated among large DeFi participants (e.g., early teams, key partners), retail holders have minimal BGT, creating potential heavy sell-side pressure—a concern validated by Berachain co-founder DevBear selling tokens from a doxxed address. He received around 200,000 BERA from the airdrop (already questionable, given they designed the rules) and swapped portions into WBTC, ETH, BYUSD, etc.

Therefore, we remain cautious on BERA’s price outlook, though optimistic about POL’s ability to accelerate ecosystem growth.

If BERA gains momentum from KOLs and whales, it may become another classic “Christmas tree” scenario—winner takes all, fastest hands win.

2.2 Sonic

Another notable public chain ecosystem is Sonic. Sonic’s TVL surged eightfold within a month, rising逆势 during a bearish macro environment. APRs across various DeFi mining pools remain high, creating a dual positive feedback loop between token price and yield.

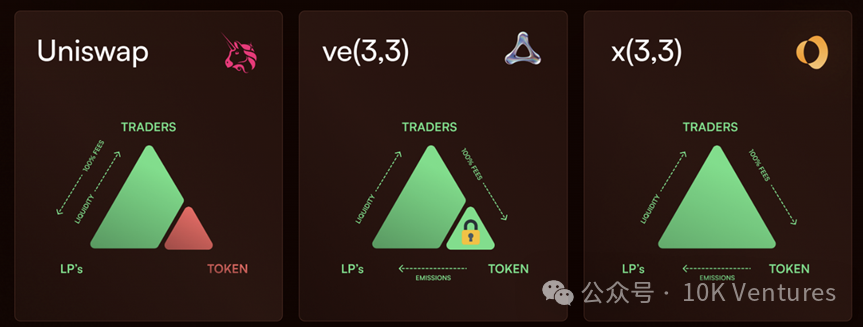

Sonic was formerly Fantom. In the previous cycle, Fantom captured market attention through Andre Cronje’s DeFi projects like SpookySwap, Beefy Finance, and Scream. Andre Cronje himself became Fantom’s public IP and face. Now, with AC returning to Sonic, he brings a new twist: x(3,3).

x(3,3) is best illustrated in ShadowExchange: users stake SHADOW to receive xSHADOW. However, redemption amounts vary over time—early withdrawals within 15 days incur discounts, with full 1:1 conversion only possible after 60 days, and the discount linearly decreases during this period.

Because immediate exit incurs a 50% penalty, with the forfeited amount distributed among remaining stakers. This mechanism allows long-term stakers to earn: 100% of protocol fees, voting rewards, and exit penalties. The x(3,3) model not only attracts deep capital commitment but also solves ve(3,3)'s exit dilemma.

After DeFi drew capital back, Sonic launched meme marketing. Though AC personally dislikes memes, the team hosted a meme contest anyway. Community mascots like GOGLZ, TinHatCat, and AC’s cat all saw explosive price increases amid Sonic’s boom. However, unlike meme coins on Solana or Base, Sonic’s memecoins rely more on ecosystem subsidies and contest-driven marketing, lacking broad market consensus. We consider Sonic memes short-term speculative plays.

Meanwhile, NFTs in the Sonic ecosystem have also delivered significant wealth effects. Derp is the core NFT in Sonic, enjoying strong community consensus. AC even changed his FateAdventure avatar to Derp. Those who bought Derp at a floor of 600S in early January saw prices surge to 2300S by February 28.

Additionally, gaming is a key focus area in the Sonic ecosystem. Key projects include FateAdventure, Sacra, and EstforKingdom. Related tokens $FA, $SACRA, and $BRUSH all saw significant price increases.

Sonic leverages DeFi to attract TVL and boasts a well-developed application ecosystem. Token S is a solid beta play. After market corrections, its market cap settled around $2.3 billion, making it a compelling entry point. Alpha assets in the Sonic ecosystem include: DeFi—Shadow, NFT—Derp, Meme—GOGLZ, and Gaming—FA.

2.3 Sahara

Sahara AI is an AI x crypto project we invested in during its first round in 2023. Sahara is building a platform where anyone can monetize AI models, datasets, and applications within collaborative spaces. Users can manually permissionlessly train models, contribute training data, and build custom AI models using no-code tools.

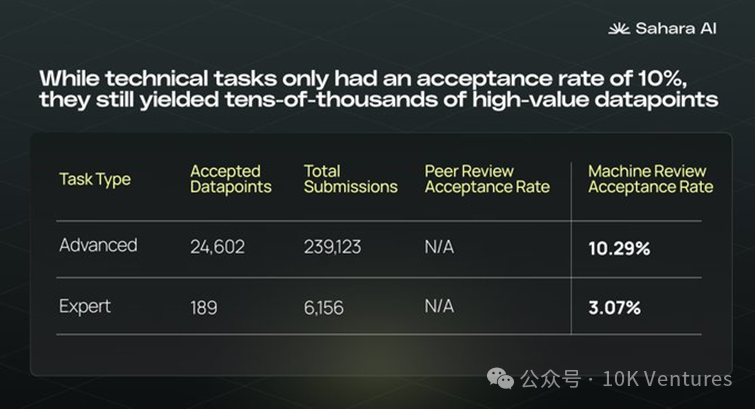

Recently, Sahara shared some interesting operational data. Previously, there were concerns about whether decentralized data labeling could meet large model data quality requirements. From Season 1 test results, although acceptance rates for advanced tasks were only 10%, they still produced over 24,000 high-value data points critical for testing AI model safety and robustness. The low acceptance rate indicates the difficulty of curating high-quality, domain-specific datasets. These tasks required contributors to generate edge-case adversarial inputs designed to test LLM boundaries. Overall, Sahara improves data quality through automated filtering of low-quality submissions, decentralized peer review, machine verification of complex binary tasks, and final human QA review. Sahara will soon launch Test Season 2, expanding data labeling efforts.

Additionally, Sahara has launched the Sahara Incubator Program. This initiative aims to identify and support the world’s most promising AI x Web3 innovation projects, offering selected teams comprehensive resources including deep technical mentorship, ecosystem integration, and fundraising acceleration to foster long-term development of AI-native projects. As a pioneer at the intersection of Web3 and AI, Sahara AI is committed to building a collaborative economic AI blockchain platform, focusing long-term on AI infrastructure and intelligent application R&D, driving decentralized AI innovation through blockchain technology.

The incubator program will focus on two key tracks: AI Infrastructure and AI Applications. Teams with MVP-level maturity or above are encouraged to apply. Successful applicants will gain full access to the Sahara AI ecosystem, receiving exclusive technical support, market expansion resources, investment opportunities, and connections to investor networks—jointly building the next generation of AI x Web3 products.

03 Primary Market Outlook

-

The only consensus at Hong Kong Consensus Conference was the need to invest in projects with viable business models. What distinguishes this cycle is the emergence of projects with stable business models beyond simple token sales. So far, sectors related to trading (CEX/DEX, lending, perps, brokers, wallets), asset management (profiting from volatility), stablecoins (trading instruments + cross-border payments), and new blockchains (new casinos, also trading-related) have proven resilient. All these sectors demonstrated strong revenue growth in 2024. We won’t reiterate revenue figures for emerging stars like Pump.fun or Ethena, but non-giant startups like Solv (Bitcoin asset management), Particle (DEX), and Moonshot (brokerage)—each operating for about a year in new directions—have already achieved over $10 million in annual revenue, proving crypto companies can generate real income.

-

With the competitive cycle in "crypto" lengthening, founder requirements are rising. Vision alone is no longer enough—leadership is essential. Founders must consistently make correct decisions over extended periods and build efficient organizations.

-

Return to "People game, people first"—elevate the importance of individuals, focusing on three key aspects: whether correct decisions at critical moments stem from luck or sound judgment, ability to build efficient organizations, and resilience to recover from setbacks.

-

Make counter-consensus decisions, seek exceptional founders who challenge norms, avoid "groupthink" projects—market volatility is fatal for unstable teams.

-

Prioritize product experience first, then consider which sectors and products will be needed in the blockchain industry five years from now.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News