Highlights and Shadows in a Downtrend

TechFlow Selected TechFlow Selected

Highlights and Shadows in a Downtrend

Market stability and the emergence of new projects will be key factors.

Author: Frontier Lab

Market Overview

Overall Market Conditions

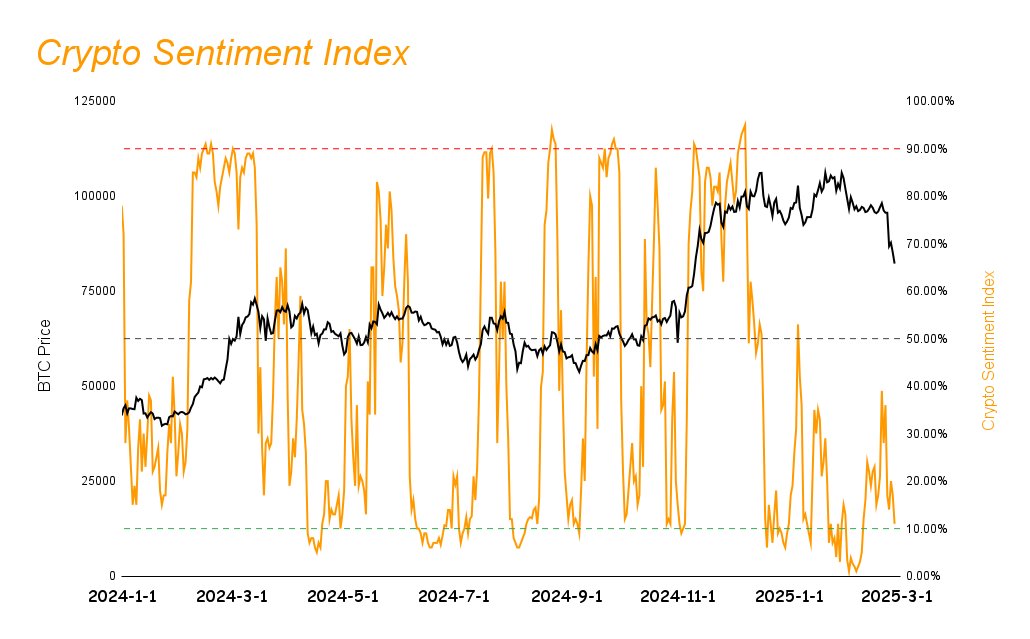

This week, the cryptocurrency market experienced a sharp downward trend, with the market sentiment index falling from 33% to 11%. Stablecoin market capitalization has largely stopped growing (USDT at $142 billion, USDC at $55.9 billion, with changes of +0.02% and -0.53% respectively), indicating that institutional capital inflows have halted and capital outflows have begun amid the volatile downturn. The panic in market sentiment was primarily triggered by the Bybit exchange hack involving $1.5 billion in stolen assets and Trump’s aggressive tariff policies, which intensified inflation concerns, reduced expectations for Fed rate cuts, and heightened fears of an economic recession in the U.S., severely impacting overall market sentiment. As a result, the market has entered a state of extreme fear, with altcoins generally underperforming the benchmark indices.

Next Week's Predicted Assets

Bullish assets: LTC, S, SOSO, BERA

LTC: This week, LTC rose against the broader market decline, demonstrating strong performance. This is mainly due to increased market expectations for approval of a spot LTC ETF. Canary Capital’s proposed spot LTC ETF has already been listed on the Depository Trust & Clearing Corporation (DTCC) system, and betting markets such as Polymarket show an 87% probability of approval. With high market anticipation for the approval of a spot LTC ETF, the event will likely be repeatedly hyped before any official decision, driving continued interest in LTC.

S: Sonic has recently expanded into the DeFi sector, attracting significant on-chain users and capital through high APYs offered by its DeFi projects. On Sonic, major liquid staking protocols Beets and Origin offer maximum APYs of 32.22% and 123% respectively based on S tokens. Additionally, the average borrowing rate for S tokens on Sonic’s lending protocol is 10.21%, allowing users to earn over 20% yields. Recently, rising demand for S tokens driven by the popularity of Sonic’s ecosystem has led to price increases, further boosting user returns. In this current bear market, the ability to earn over 20% risk-free yield continues to attract users who borrow tokens to participate, increasing demand for S tokens and fueling a spiral upward price trend.

SOSO: SoSoValue has consistently adapted its development direction according to market trends. Initially positioning itself as an AI-enhanced all-in-one investment platform aligned with the AI Agent trend, it shifted focus back to DeFi when market attention and capital returned to high-APY projects after the AI Agent hype faded. While still incorporating AI technology within its products, SoSoValue now emphasizes high-yield offerings. Its recently launched second mining season allows users to mine SOSO tokens by holding or staking the SSI wrapped index token. Combined staking rewards and SOSO airdrops can achieve up to 42% APY, attracting more participants and strengthening bullish expectations for the SOSO token.

BERA: Amid a broadly declining market this week, BERA initially fell but quickly reversed course. The Berachain team swiftly adjusted staking yields on its LSD projects—Infrared Finance boosted WBERA’s APY to as high as 123%, while lending rates for BERA reached 23.68%. This enabled arbitrageurs to earn up to 100% risk-free annualized returns, effectively halting the downtrend and turning it into an uptrend. Berachain’s strategy mirrors Sonic’s: using high APYs to attract users and capital to drive the cycle of “staking lock-up → liquidity release → DeFi empowerment → token appreciation.” By increasing demand for the native BERA token, the project aims to push its price higher.

Bearish assets: ETH, SOL, ADA, AI, TKO, RUNE

ETH: This week, Bybit lost 491,000 ETH in a hack. Although Bybit has fully replenished these funds through purchases and swaps, the buying pressure hasn't translated into price support, reflecting persistent FUD among investors about potential ongoing sell-offs by the hacker. Bybit’s investigation report confirmed the breach originated from a vulnerability in Safe, not their own infrastructure, raising serious doubts about Safe technology—widely used across Ethereum-based projects—and posing a latent security threat to much of the Ethereum ecosystem. Additionally, Ethereum’s Pectra upgrade is set to launch on testnet this weekend. Historically, price pumps precede technical upgrades, followed by pullbacks once the news is priced in. Since Pectra offers limited fundamental upside for ETH, a post-launch price decline is likely.

SOL: SOL dropped sharply this week along with the broader market, primarily due to the fading meme coin wave. As the leading blockchain for meme coin gains, Solana has faced growing FUD, prompting capital flight from its ecosystem. TVL fell from $12.1 billion to $7.3 billion—a 39.66% drop. Liquid staking yields on Solana declined from 10.29% to 7.26%, and on-chain transaction volume plunged from $35.5 billion to $2.4 billion, a staggering 93.23% decrease, indicating near-collapse of Solana’s on-chain activity. Moreover, 11.2 million SOL are scheduled to unlock on March 1, all held by institutions, potentially adding sustained selling pressure and worsening investor anxiety.

ADA: This week, Cardano’s on-chain TVL dropped significantly by 26.88%, now standing at $308 million—down 56.06% from its peak of $701 million. All ecosystem projects saw TVL declines exceeding 10%, signaling rapid capital outflows and widespread FUD toward the Cardano ecosystem. DEX trading volume has fallen over 68%, and the current borrowing rate for ADA is only 3.29%, far below levels seen on other major chains, indicating minimal participation in lending activities. If capital outflows continue, ADA is expected to decline further next week.

AI: Sleepless AI is a GameFi project built on AI technology. The AI and GameFi sectors have suffered the deepest corrections in this downturn, as investors have lost interest in the Play-to-Earn model, user numbers dwindle, and new capital inflows are nearly absent. Moreover, AI projects are widely perceived as overvalued, resulting in prolonged and substantial drawdowns across the sector. Adding to the pressure, 17.27 million AI tokens—representing 1.73% of the current circulating supply—are set to unlock next week. Given the large unlock size and weak sector performance, a short-term price drop is expected post-unlock.

TKO: Tokocrypto is Southeast Asia’s largest cryptocurrency exchange. Recent negative sentiment following the Bybit hack has affected all centralized exchanges, leading to poor performance of exchange tokens. Additionally, 100 million TKO tokens—2.02% of the current circulating supply—are即将 unlocked, a relatively large amount that is likely to trigger a price decline after unlocking.

RUNE: THORChain is a decentralized cross-chain AMM trading protocol. It saw a strong counter-trend rally from Monday to Wednesday this week, primarily because the hacker who stole ETH from Bybit continuously routed the stolen funds through THORChain for money laundering, drastically increasing transaction volume and fees. However, after public exposure of THORChain’s involvement in these illicit transactions, developer Pluto announced his resignation. With declining transaction volumes and ongoing FUD around money laundering, RUNE is expected to face continued downward pressure next week.

Market Sentiment Index Analysis

The market sentiment index dropped from 33% last week to 11%, nearing the "extreme fear" zone.

Hot Sectors

Sonic

Current Status

Over recent weeks, Sonic’s chain has maintained rapid TVL growth. While most blockchains saw declining TVL this week, Sonic was the only one exceeding $50 million in TVL to grow by over 10%. Its weekly growth rate reached 10.32%, pushing TVL to $683 million. This shows that even during extreme market panic, Sonic’s ecosystem continues to attract capital inflows. Sonic’s native token S also rose 7.63% this week—modest in absolute terms, but notable given the broader market collapse, reflecting market confidence in the project.

Reasons for Popularity

Sonic has recently shifted its strategic focus from GameFi to DeFi, adopting a high-APY model to attract users. Its top liquidity projects offer APYs as high as 123%, while lending platforms provide borrowing rates around 10%, enabling users to earn over 100% arbitrage APY. In the current bear market, such high yields are extremely attractive, prompting users to buy or borrow tokens to participate, thereby increasing demand for the S token and contributing to its relative strength compared to other altcoins.

Outlook

The main driver behind Sonic’s recent success is the high yields provided by its LSD projects, which have drawn users into arbitrage activities. This highlights a viable path for rapid ecosystem growth: efficiently driving an economic flywheel by focusing on DeFi and maximizing asset utility. To empower assets within DeFi, protocols must incentivize staking and liquidity provision so that capital generates compounding returns across DEXs, lending, and asset management. A sustainable on-chain economy requires a positive feedback loop: staking → liquidity release → DeFi empowerment → token appreciation → user retention → restaking → developer attraction. The core engine lies in dual drivers—native token staking and liquidity release—enabling “staking as productivity” across DEX, lending, and wealth management use cases. Once users are attracted by high APYs, the ecosystem must maintain this loop. Otherwise, if incoming capital fails to offset arbitrage-driven sell-offs, the S token price will fall, reducing yields across projects and triggering user departures—an existential threat. Going forward, monitoring Sonic’s DeFi project APYs will be key to assessing whether the ecosystem retains growth momentum.

However, despite being the fastest-growing chain among those with over $100 million in TVL, Sonic’s TVL did not rise steadily this week but instead showed signs of a pullback after an initial spike.

Berachain

Status

During a week of steep market declines, all top-10 TVL projects except Berachain saw losses. Though Berachain’s TVL grew only 4.66%, maintaining positive growth under current conditions is impressive. Its TVL reached $3.194 billion, ranking sixth among all layer-1 blockchains, surpassing Base. The BERA token also rose 7.26% this week, showing strength among altcoins.

Reasons for Popularity

This week, TVL growth slowed across Berachain’s leading DEX, lending, and LSD projects. TVL initially declined mid-week but recovered after Infrared Finance, a major LSD protocol, raised WBERA’s APY to 121%, and emerging LSD project Stride pushed yields to 190.12%. Meanwhile, the lending rate for BERA stood at 23.68%, enabling arbitrageurs to earn over 100% risk-free annualized returns. This quickly reversed the downtrend and reignited growth.

Outlook

Berachain remains hot this week due to elevated APYs that continue to attract users and capital. Its development path closely resembles Sonic’s, meaning it faces similar risks. Currently, Berachain has achieved the cycle of “staking → liquidity release → DeFi empowerment → token appreciation,” but has yet to establish strong follow-through in “user retention → restaking → developer attraction.” While the high-yield model enables rapid short-term growth and boosts BERA’s price, it inevitably leads to mounting sell pressure. When new capital inflows fail to offset arbitrage-driven selling, BERA’s price will drop, reducing yields across projects and prompting user exits. Therefore, future monitoring should focus on whether new flagship projects emerge on Berachain and whether LSD project yields experience significant declines.

Overall Market Theme Performance

Data source: SoSoValue

Based on weekly returns, the Sociafi sector performed best, while PayFi performed worst.

-

Sociafi sector: Dominated by TON and CHZ, which together account for 95.17% of the sector. Their weekly declines were -4.86% and -4.79% respectively—still better than most other altcoins, making the overall Sociafi index the top performer.

-

PayFi sector: Led by XRP, LTC, and XLM, collectively representing 94.62% of the sector. Their weekly drops were -19.23%, -1.21%, and -16.96% respectively, resulting in the worst-performing sector.

Upcoming Crypto Events Next Week

-

Monday (March 3): U.S. February ISM Manufacturing PMI

-

Wednesday (March 5): U.S. February ADP Employment Change; Pectra network upgrade scheduled to launch on Ethereum testnet

-

Friday (March 7): U.S. February Non-Farm Payrolls; U.S. February Unemployment Rate

Summary

This week, the cryptocurrency market saw significant declines, with the sentiment index plunging, reflecting widespread investor concern. Despite this, certain projects like LTC, Sonic, SoSoValue, and Berachain attracted users through high-APY strategies. However, long-term sustainability will depend on ecosystem stability and the emergence of new standout projects. Investors are advised to closely monitor market developments and proceed with caution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News