Cryptocurrency Contract Trading Tutorial: Mastering Strategies and Avoiding Common Mistakes

TechFlow Selected TechFlow Selected

Cryptocurrency Contract Trading Tutorial: Mastering Strategies and Avoiding Common Mistakes

The market changes quickly; staying informed, optimizing strategies, and managing emotions are key to long-term consistent profitability.

Key Takeaways

-

– Crypto futures allow traders to speculate or hedge without holding the actual asset, offering flexibility and amplified profit potential through leverage, but also increasing risk.

-

– Risk management is crucial——use stop-loss orders wisely, control position size, and apply leverage cautiously to avoid liquidation and protect capital.

-

– Strategies vary by experience level——beginners should start with trend trading and breakout strategies, while advanced traders can explore scalping, arbitrage, and funding rate trading.

-

– Continuous learning and discipline——rapid market changes require staying informed, refining strategies, and managing emotions for long-term profitability.

Futures trading has long played a key role in traditional financial markets, helping investors speculate, hedge risks, and manage capital. In the crypto market, futures trading has rapidly gained popularity, allowing traders to profit from the high volatility of digital assets such as Bitcoin (BTC) and Ethereum (ETH).

However, how exactly do crypto futures work? What strategies suit beginners, and which ones are better for experienced traders? In this article, we’ll start from the basics, dive into practical trading strategies, and share essential risk management principles to help you navigate this high-risk, high-opportunity market.

Table of Contents

Introduction to Crypto Futures Trading

Beginner-Friendly Trading Strategies

-

– Trend Trading

-

– Breakout Trading

-

– Moving Average (MA) Crossover Strategy

-

– Scalping

-

– Arbitrage Trading

-

– Hedging Strategies

-

– Funding Rate Trading

-

– RSI (Relative Strength Index)

-

– MACD (Moving Average Convergence Divergence)

-

– Bollinger Bands

-

– Fibonacci Retracement

-

– Volume Analysis

-

– Market News and Events

-

– On-Chain Data Analysis

-

– Macroeconomic Factors

-

– Market Sentiment Analysis

Risk Management and Leverage Control

-

– Key Risk Management Strategies

-

– Common Trading Mistakes and How to Avoid Them

Introduction to Crypto Futures Trading

What Are Crypto Futures?

Crypto futures are derivatives that allow traders to buy or sell based on price movements without owning the underlying asset. These contracts specify buying or selling a cryptocurrency at a predetermined price on a specific date. However, the most popular type today is Perpetual Futures, which have no expiration date. Instead, they use a funding rate mechanism to keep prices aligned with the spot market.

The biggest advantage of futures trading is flexibility——traders can go long (betting on price increases) or short (betting on price declines), creating opportunities in both bull and bear markets. Unlike spot trading, futures don’t require holding actual crypto. Instead, they use leverage to amplify trade size for speculation or hedging.

Why Choose Futures Over Spot Trading?

The main appeal of futures is leverage, which magnifies profits but also increases risk. For example, with 5x leverage, a 2% price increase yields a 10% return, but a 2% drop results in a 10% loss. Therefore, leveraging must be carefully managed.

Another key benefit is hedging. If you hold crypto spot positions but fear a short-term price drop, you can open a short futures position to offset losses. Even if the market falls, your futures gains can balance out spot losses. This strategy is commonly used by long-term investors, miners, and traders aiming to reduce exposure to market volatility.

Risks to Be Aware Of

High Volatility + Leverage = Rapid Losses

The crypto market is highly volatile, with sharp price swings possible in minutes. When combined with high leverage, even small price moves can lead to large losses—or immediate liquidation. Liquidation occurs when margin falls below required levels, prompting exchanges to automatically close positions to prevent further losses. Thus, strict risk control is essential when using leverage.

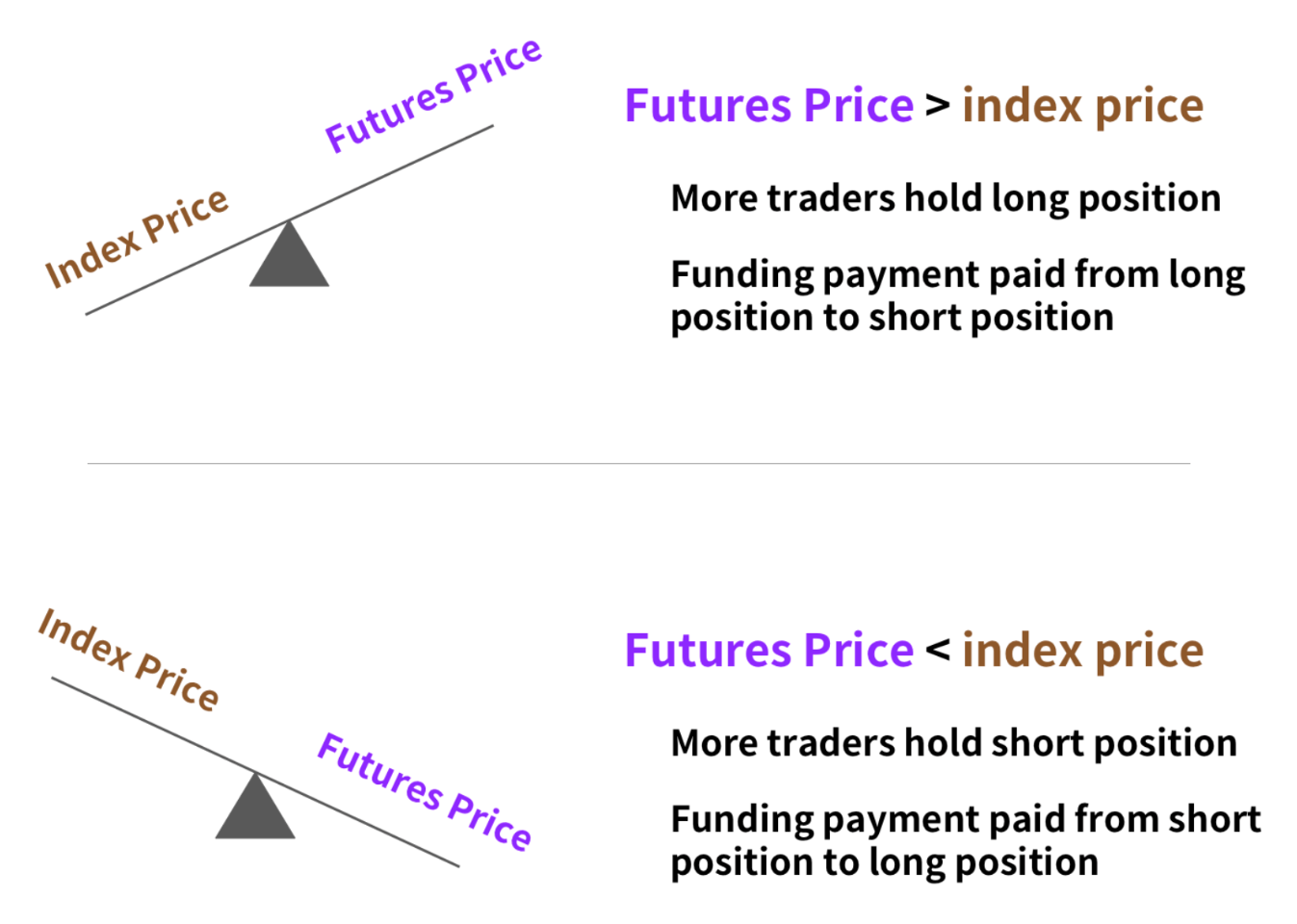

Basis Risk and Funding Rate Risk

Futures prices don't always match spot prices exactly. The difference is known as basis risk. During periods of high volatility or low liquidity, futures prices may deviate significantly from spot prices, affecting expected returns.

Additionally, perpetual futures use a funding rate mechanism where long and short holders periodically pay each other to keep contract prices close to spot prices. If market sentiment strongly favors one side (e.g., excessive long positions), funding rates can spike, reducing your profits.

Counterparty and Exchange Risk

Not all crypto futures exchanges are strictly regulated. Many operate in jurisdictions with weak oversight and may face hacking, fund misappropriation, or even bankruptcy. If an exchange collapses financially, your funds might become inaccessible.

To mitigate these risks, choose high-volume, reputable exchanges and avoid keeping all your funds on a single platform.

Regulatory Risk

The U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) classify crypto futures as high-risk speculative instruments and have increased scrutiny. Some exchanges may restrict deposits or withdrawals due to regulations, or exit certain markets altogether. Always understand local laws before trading to avoid regulatory disruptions.

Beginner-Friendly Trading Strategies

If you're new to crypto futures trading, start with simple, stable strategies focused on risk control and learning. Here are four beginner-friendly approaches:

Trend Trading

"The trend is your friend." The core idea of trend trading is to follow the prevailing market direction—upward, downward, or sideways—and trade accordingly.

How to Identify Trends?

-

– Use moving averages (e.g., 50-day and 200-day): If the short-term MA is above the long-term MA and prices keep making higher highs, the market is likely in an uptrend.

-

– Conversely, if the short-term MA crosses below the long-term MA and prices make lower lows, the market may be in a downtrend.

Entry Timing

-

– Confirm trend direction: Rising prices accompanied by increasing volume often signal a reliable trend, suggesting a good entry point.

Exit Timing

-

– Trend weakening: If price breaks below key MAs or forms lower lows, consider exiting via stop-loss to limit losses.

Avoid for Beginners: Counter-Trend Trading

-

– New traders should avoid counter-trend trades (e.g., shorting during strong uptrends), as they require precise timing and carry high risk.

Image Credit: Pinterest

Breakout Trading

This strategy aims to enter when price breaks through key support or resistance levels, capturing strong momentum.

How to Identify Breakouts?

-

– Look for trading ranges: Observe whether the market oscillates between clear support and resistance levels, e.g., ETH stuck between $1,500 and $1,600.

-

– Wait for volume confirmation: A real breakout usually comes with a surge in volume, signaling active market participation.

How to Avoid False Breakouts?

-

– A false breakout occurs when price briefly breaches a key level then quickly reverses, trapping traders.

-

– Set stop-losses: After buying on a breakout above resistance, place a stop-loss below the former resistance (now support) to minimize damage from fakeouts.

Image Credit: Pinterest

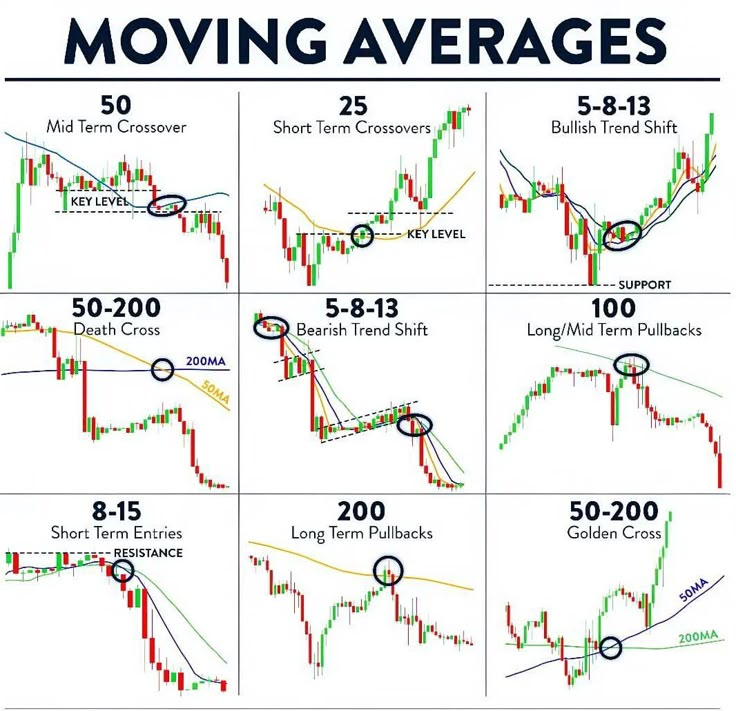

Moving Average Crossover

Moving averages smooth out price fluctuations, helping identify trend shifts.

Golden Cross

-

– When a short-term MA (e.g., 50-day) crosses above a long-term MA (e.g., 200-day), it signals a potential strong uptrend, favoring long positions.

Death Cross

-

– When a short-term MA drops below a long-term MA, it suggests a downtrend, favoring short positions or reduced exposure.

Best Market Conditions

-

– This strategy works well in trending markets but generates many false signals (whipsaws) during choppy, sideways movement, reducing accuracy.

Image Credit: Pinterest

Advanced Trading Strategies

Experienced traders can explore more sophisticated strategies requiring faster decision-making, larger capital, and deeper analysis. These aim to exploit market inefficiencies, lock in arbitrage opportunities, or reduce risk via hedging.

Scalping

Scalping is an ultra-short-term strategy aiming to capture small profits from tiny price movements, with holding times ranging from seconds to minutes.

Execution Speed

-

– Scalpers typically use 1-minute or shorter charts and require ultra-low latency execution to enter and exit instantly.

Risk Control

-

– One large loss can wipe out dozens of small gains, so strict stop-loss enforcement is critical.

Transaction Cost Management

-

– Due to extremely high frequency, fees can severely erode profits. Scalpers often choose platforms with low fees or rebate programs.

Image Credit: Pinterest

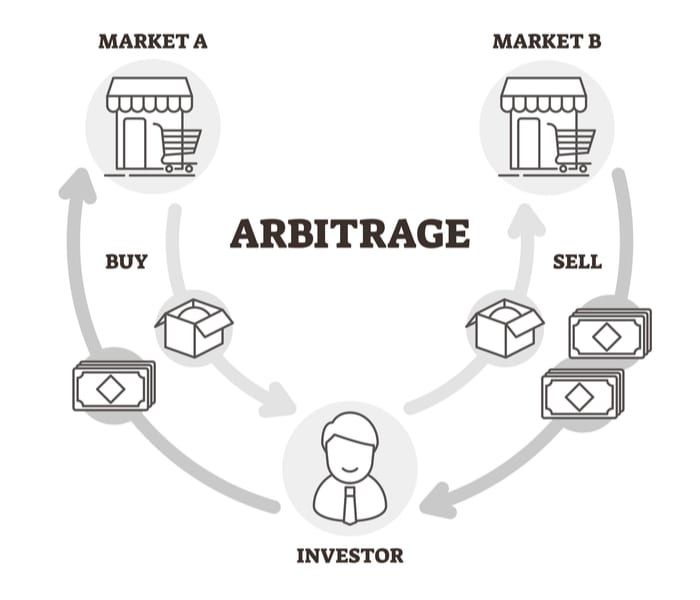

Arbitrage Trading

Arbitrage exploits price differences across markets or contract types to earn low-risk profits.

Spot vs. Futures Arbitrage

-

– Buy an asset in the spot market and simultaneously short its futures contract. If futures trade at a premium, arbitrageurs profit when prices converge.

Cross-Exchange Arbitrage

-

– Same assets may trade at different prices on different exchanges. Buy low on one exchange, sell high on another, and pocket the spread.

Key Considerations

-

– Low risk, low reward: Arbitrage is relatively safe but offers small margins, requiring large capital for meaningful returns.

-

– Speed is critical: Price gaps last only seconds. Execution speed and transaction costs determine feasibility.

Image Credit: Pinterest

Hedging

Hedging isn’t about direct profit—it’s about reducing exposure to market volatility and avoiding one-sided risk.

Long-Term Position Hedging

-

– If holding ETH long-term but worried about short-term downside, short the ETH/USDT futures to offset potential losses.

-

– If ETH drops, futures gains can offset spot losses.

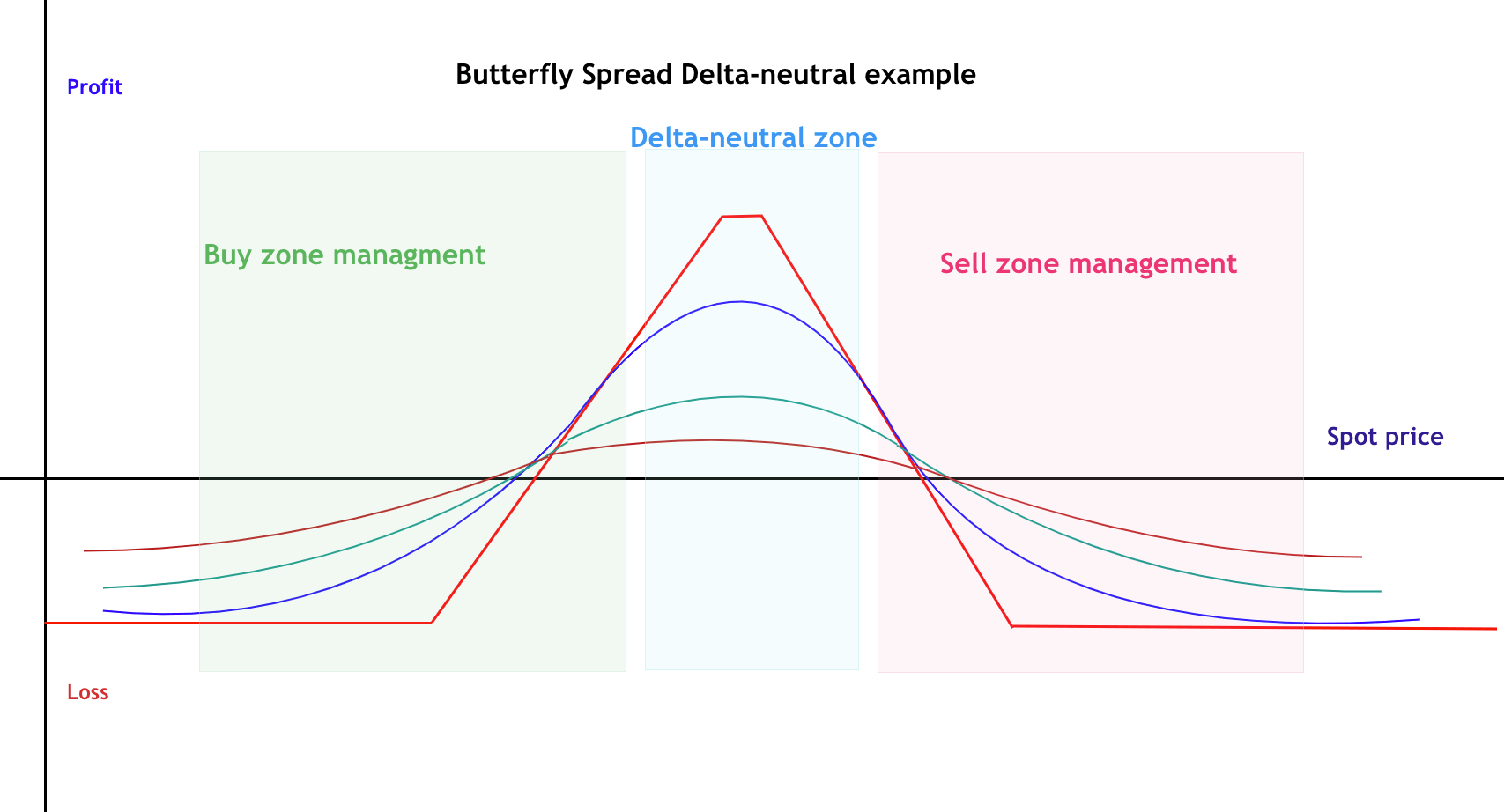

Delta-Neutral Strategy

-

– Professional traders or miners may adopt delta-neutral positions—holding equal long and short exposures—to minimize market impact.

Hedging Costs

-

– Hedging often incurs funding rates, and some contracts may carry premiums. While not free, it reduces portfolio volatility during extreme market swings.

Image Credit: Forex Academy

Funding Rate Trading

In Perpetual Futures, exchanges use funding rates to align contract prices with spot prices. It's a periodic payment between longs and shorts: when perpetual prices exceed spot, longs pay shorts, and vice versa.

Profiting from Funding Rates

-

– When funding rates are extremely high, traders can short perpetuals and go long on spot or quarterly contracts to collect payments, minimizing directional risk.

Funding Rate as a Sentiment Indicator

-

– Extreme funding rates signal overcrowded positions. High rates suggest excessive bullishness, potentially indicating a reversal.

-

– Many advanced traders use extreme funding data to spot contrarian opportunities.

Image Credit: Biqutex

Technical Analysis Methods

In crypto trading, technical analysis (TA) is a vital tool. By studying price charts and indicators, traders can better assess trends and shape their strategies.

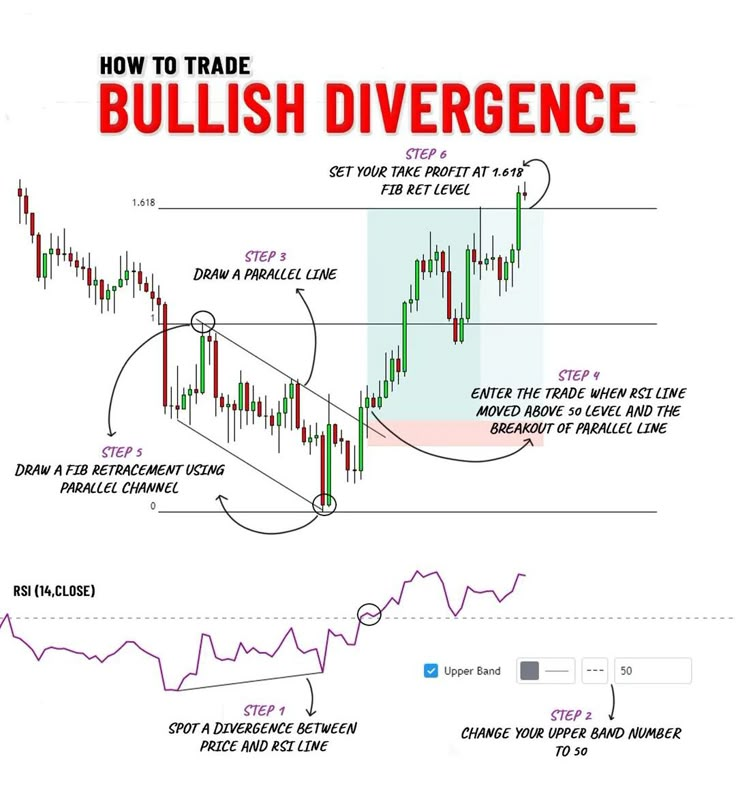

Relative Strength Index (RSI)

-

– RSI measures market momentum on a 0–100 scale. Above 70 indicates overbought conditions; below 30 suggests oversold.

-

– If price makes new highs but RSI fails to, it may signal weakening momentum—caution advised.

Image Credit: Pinterest

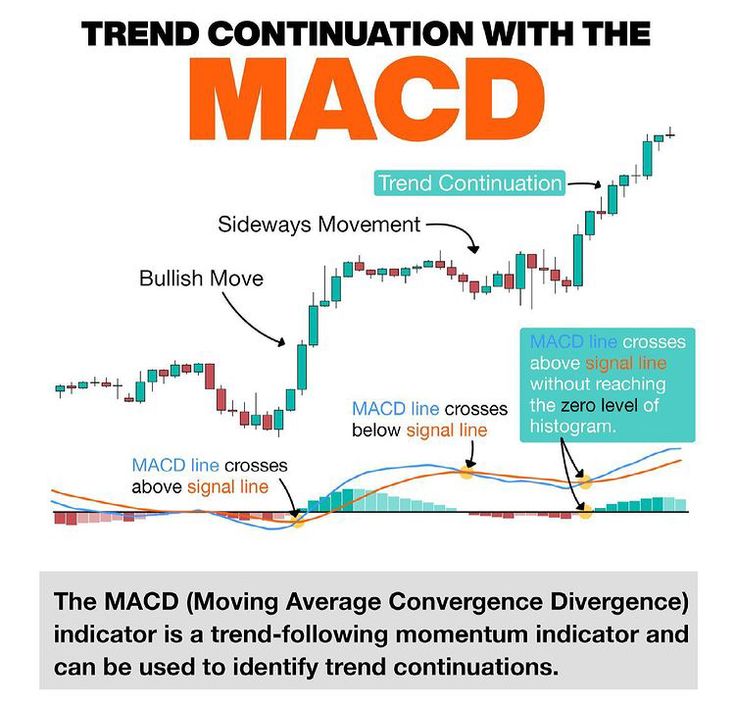

Moving Average Convergence Divergence (MACD)

-

– A momentum-based trend-following indicator composed of two moving averages.

-

– When the MACD line crosses above the signal line, it often signals strengthening momentum—a potential buy signal. But in ranging markets, MACD can give false signals; best used with other tools.

Image Credit: Pinterest

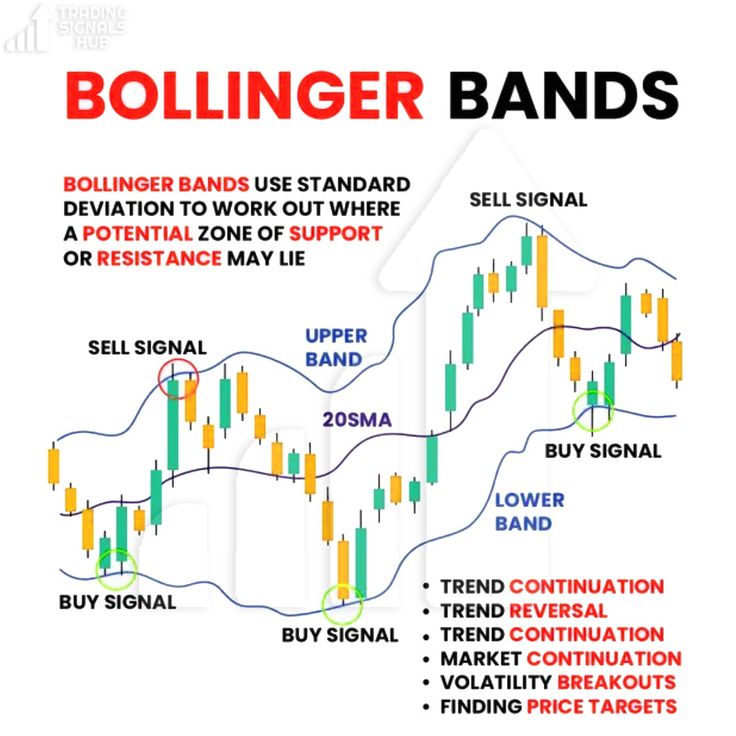

Bollinger Bands

-

– Consists of a central SMA and upper/lower bands that widen or narrow with volatility.

-

– When bands contract (“squeeze”), a volatility breakout may follow. Touching upper band may indicate overbought; touching lower band may mean oversold.

Image Credit: Pinterest

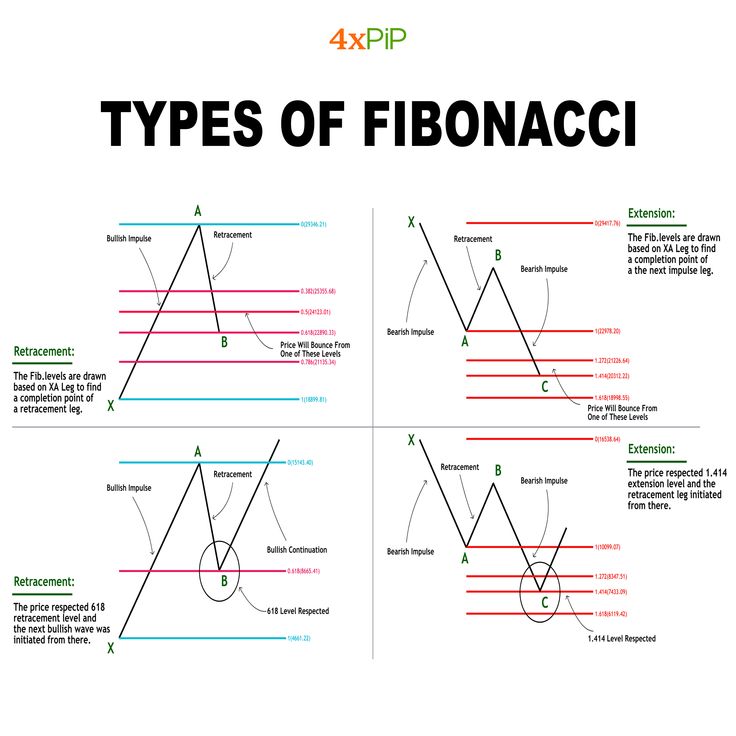

Fibonacci Retracement

-

– Used to identify potential support and resistance levels, especially key ratios like 38.2%, 50%, and 61.8%.

-

– Traders watch these levels for entry points or signs of trend reversal.

Image Credit: Pinterest

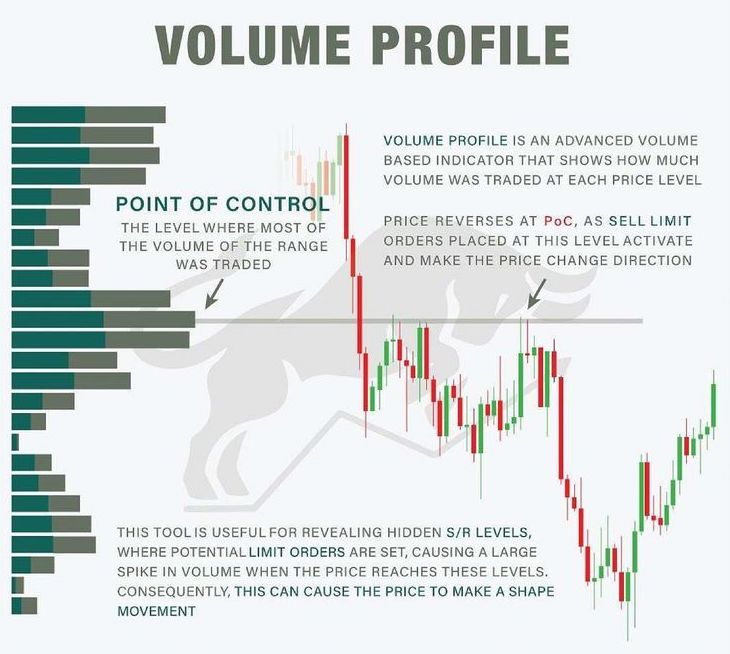

Volume Profile Analysis

-

– Analyzes volume at different price levels to identify support, resistance, and breakout zones.

-

– The Point of Control (POC), where volume is highest, often acts as a key future support/resistance level.

Image Credit: Pinterest

Fundamental Analysis Methods

While technical analysis (TA) relies on charts to predict price moves, fundamental analysis (FA) examines broader factors to assess a crypto’s long-term value.

Market News and Events

-

– Regulatory announcements, major partnerships, exchange listings, and macroeconomic news often trigger sharp market moves.

-

– Set alerts for key economic data (e.g., Fed rate decisions), as crypto often correlates with equity market sentiment.

Image Credit: Crypto Panic

On-Chain Data

-

– A unique advantage of crypto: public blockchains let anyone analyze transaction volume, active addresses, and token distribution.

-

– For example, the NVT ratio compares market cap to transaction volume to gauge overvaluation or undervaluation.

Image Credit: Glassnode

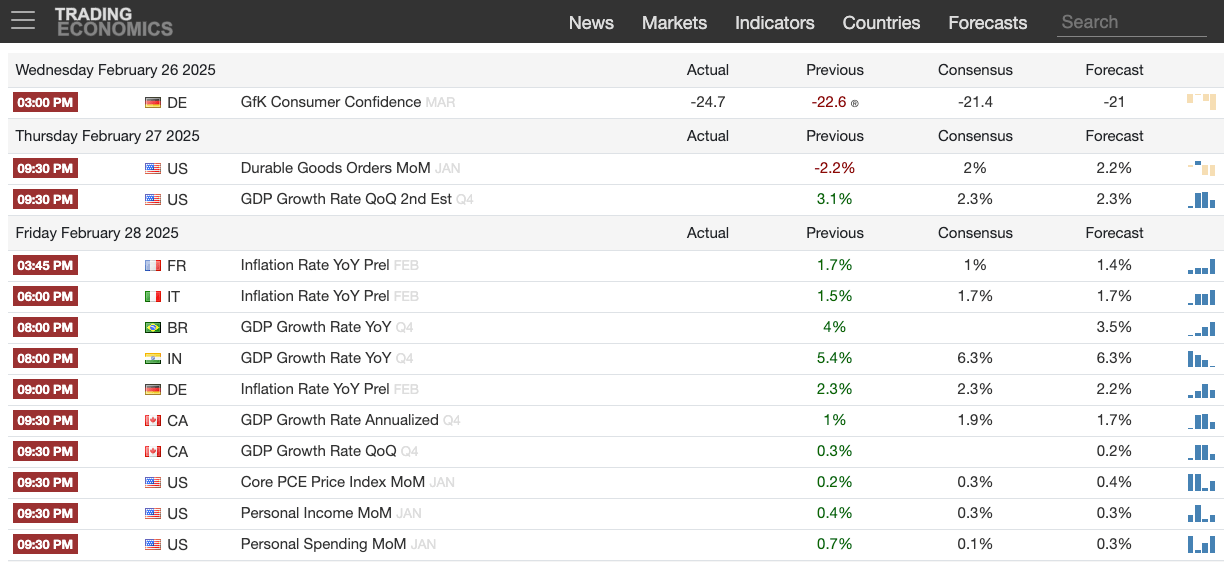

Macroeconomic Factors

-

– Interest rates, inflation, and global capital flows impact crypto. Tightening monetary policy (e.g., rate hikes) may pressure risk assets like crypto.

Image Credit: Trading Economics

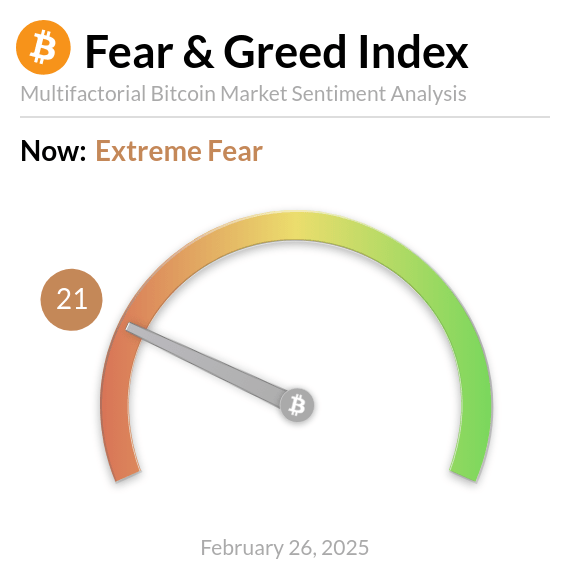

Market Sentiment Analysis

-

– Tools like the “Crypto Fear & Greed Index” measure overall market mood.

-

– Extreme greed may signal overheating and correction risk; extreme fear could indicate a bottom and rebound opportunity.

Image Credit: Crypto Briefing

Risk Management and Leverage Control

Crypto futures move fast and swing hard—risk management is essential. Without proper controls, leverage can wipe out your account in seconds.

Key Risk Management Strategies

-

– Set stop-loss orders: Always define your stop-loss based on your trading plan, not arbitrary percentages.

-

– Position sizing: Limit risk per trade to 1–2% of total capital. Adjust position size so a 5% price move won’t exceed your risk tolerance.

-

– Leverage control: Avoid excessive leverage. Stick to 2x–5x to reduce liquidation risk.

-

– Avoid liquidation: Set proactive stop-losses instead of waiting until liquidation. Use isolated margin to ensure one losing trade doesn’t drain your entire account.

-

– Risk/reward ratio: Aim for at least 2:1—your potential gain should outweigh potential loss.

-

– Emotion control: Avoid FOMO, panic trades, and greed. Stick to your plan regardless of market noise.

Common Mistakes and Pitfalls

-

– Over-leveraging: High leverage boosts gains but drastically increases liquidation risk.

-

– Impulsive trading: Acting on emotion leads to poor decisions and losses.

-

– No trading plan: Random entries without strategy rarely yield consistent profits.

-

– Counter-trend trading: Fighting strong trends is risky and often unsuccessful.

-

– Ignoring costs: Fees and funding rates can silently eat into profits over time.

-

– Overtrading: Too many trades increase error rates. Sometimes, doing nothing is the best move.

Mastering risk management and avoiding these common errors will improve trading stability, extend your survival in the market, and boost long-term profitability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News