Will the poor performance of the cryptocurrency market continue?

TechFlow Selected TechFlow Selected

Will the poor performance of the cryptocurrency market continue?

Due to a slowdown in the US economy, policy uncertainty under Trump, and negative sentiment in the crypto market, prices of Bitcoin and other cryptocurrencies have dropped sharply, with investors remaining cautious about the market outlook.

Author: Blockhead

Translation: Baicai Blockchain

Amid uncertainty over U.S. tariffs and following last week's $1.5 billion Ethereum hack at the Bybit exchange, cryptocurrency investor confidence has further eroded, pushing Bitcoin below $90,000 and to its lowest level since November 18 on Tuesday.

Bitcoin dropped more than 7% to around $87,200, falling over $20,000 from its peak of more than $109,000 reached on Donald Trump’s inauguration day last week.

1. Macroeconomic Environment

As signs of economic weakening emerge in the United States, recession concerns are resurfacing.

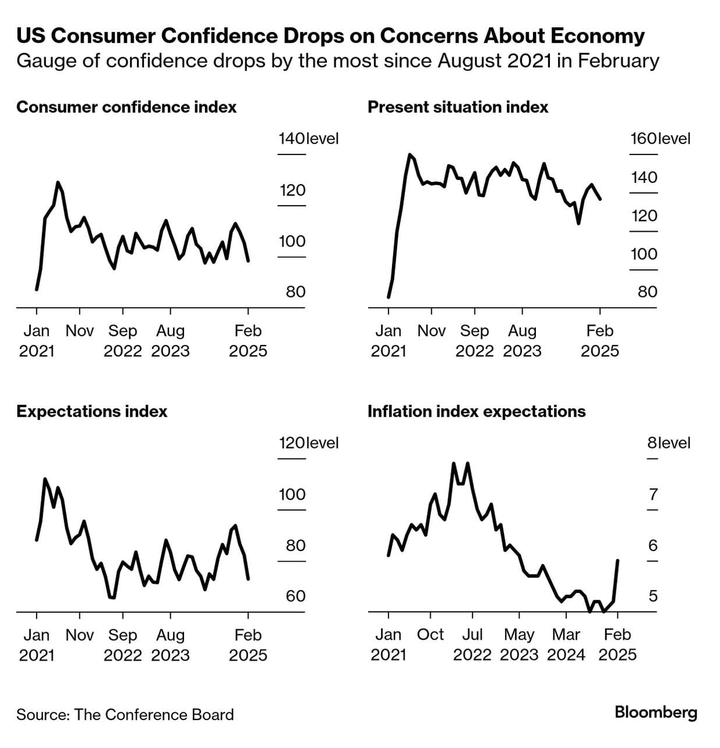

Mounting evidence suggests Americans' anxiety about the economic future is intensifying due to policy uncertainties under President Trump. U.S. consumer confidence plunged last month by the most since August 2021.

Americans are cutting spending: according to a recent Wells Fargo survey, over half of consumers have delayed major life decisions due to concerns about the economic outlook and the potential impact of Trump's tariff threats.

One in six people postponed plans for continuing education, one in eight delayed retirement plans, and about one-third put off home purchases.

In response to growing recession fears, safe-haven Treasury prices surged, driving yields to their lowest levels in two months.

These concerns were amplified when Trump reiterated on Monday, just before a deadline, that he would impose 25% tariffs on imports from Canada and Mexico—tariffs that had been delayed last month.

Smaller cryptocurrencies suffered far greater losses than Bitcoin, which declined about 8% over the past week. According to CoinGecko data, Dogecoin, Solana, and CardanoToken lost approximately 20% in value.

Sentiment across the crypto market has generally been weak since the beginning of the year, particularly exacerbated in recent weeks by meme coin volatility and the recent Bybit hack. The latest drop in cryptocurrency prices is not surprising after the largest hack in history.

The current macroeconomic environment is also pressuring crypto investments. Greater concern lies in a small but notably worrying trend emerging within risk assets, which could trigger broader sell-offs in the crypto market. Wall Street sentiment is also bleak, with the "Magnificent Seven" stocks now in correction territory.

Tuesday was turbulent for U.S. equities, which had traded near record highs for much of 2025. The seven tech giants that drove a 54% rally in U.S. stocks over two years have sharply reversed course.

On Tuesday, Bloomberg’s “Magnificent Seven” index fell 3.4%, now down more than 10% from its all-time high set on December 17. During this period, the combined market capitalization of these seven companies has shrunk by $1.6 trillion. Tesla was among the worst performers, dropping 37%.

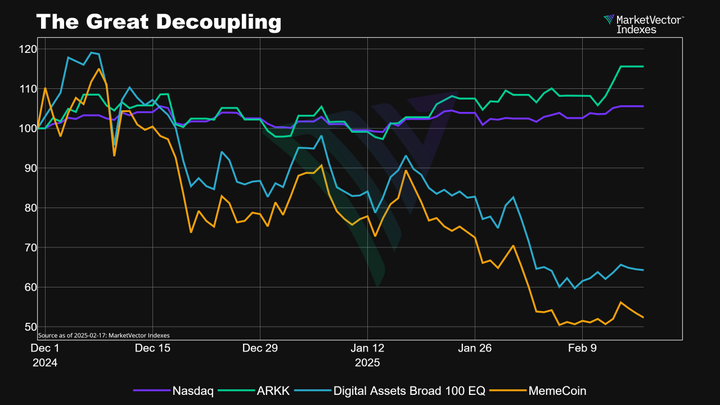

Despite the stock market decline, we are witnessing a notable decoupling between cryptocurrencies and U.S. equities. This year, Bitcoin’s correlation with the Nasdaq has significantly decreased, and overall market sentiment toward crypto remains negative.

“The crypto market is deeply entrenched in negative sentiment, primarily driven by a series of meme coin scandals and exit scams,” said Martin Leinweber, Digital Asset Research & Strategy Director at MarketVector Indexes and author of *Mastering Crypto Assets*. He added: “High-profile frauds such as Argentina’s Libra Coin, Trump Coin, and other meme tokens have severely damaged investor confidence, leading to sharp declines in Solana and other altcoins.”

Although Solana remains one of the most scalable, low-cost, and fast blockchains, it is now often referred to as the “Memecoin chain.” Due to widespread FUD (fear, uncertainty, and doubt), significant capital has flowed from Solana to Ethereum and other networks. Yet Solana’s core strengths remain: it hosts not only meme coins but also DeFi, AI applications, real-world assets (RWA), and next-generation financial tools.

In the days leading up to Tuesday’s plunge, Bitcoin prices fluctuated narrowly below $100,000, leading many traders to believe the crypto bull run had ended and prompting them to sell Bitcoin.

But is this really accurate?

Source: Total Return Index (base = 100), MarketVector Indexes

U.S. crypto policy changes failing to meet expectations have intensified shifts in market sentiment, further widening the “decoupling” between cryptocurrencies and traditional equity markets. “The breakdown in correlation between crypto and stock markets is highly unusual, especially given that the current macroeconomic backdrop still favors risk-taking,” said Leinweber.

With the U.S. dollar weakening, the head of MarketVector Indexes expects cryptocurrencies and other risk assets to benefit as they have in the past. “Given this context, it’s unlikely that cryptocurrencies will remain depressed for long. Capital flowing into equities will eventually return to digital asset markets,” he said.

2. Has Cryptocurrency Bottomed Out? Have We Reached the Bottom?

Leinweber noted that currently, over 93% of the top 100 crypto tokens are trading below their 90-day moving average. Such a severe market condition typically occurs near market bottoms rather than persisting long-term.

The Crypto Fear & Greed Index—a market indicator tracking social media activity, volatility, trends, and price—recently fell to 25, its lowest level in five months, reflecting increasingly pessimistic market sentiment. With ongoing uncertainty around Trump’s tariff policies, cryptocurrency prices continue to slide.

Some analysts are beginning to consider whether it’s time to “buy the dip.” In the longer term, Geoffrey Kendrick, Standard Chartered’s global head of digital asset research, said Bitcoin could benefit from declining U.S. Treasury yields—a shift driven by Friday’s PMI report, which triggered a risk-off move in markets—and may see a rebound in the medium term.

“But it’s not quite time to buy yet; the market might fall to around $80,000,” Kendrick added.

Analysts at Bernstein reaffirmed their forecast that Bitcoin will reach $200,000 by year-end. Traders are closely watching upcoming U.S. inflation data for potential bullish signals, especially if figures align closer to the Fed’s target.

However, Trump’s policies are already negatively impacting crypto assets and broader risk markets. Uncertainty over whether tariffs are negotiation tactics or actual threats is unsettling many investors.

Michael Hartnett, strategist at Bank of America, said skepticism over the S&P 500’s trajectory is growing amid rising market risks.

Even so, Wall Street’s benchmark index remains just 2.6% below its record high set last week.

In a recent interview with Bloomberg Television, Hartnett warned that if stock prices fall another 6%, the government might intervene to halt the decline.

Meanwhile, Elon Musk’s “Department of Government Efficiency” continues aggressively pursuing government roles and budget cuts in Washington. Investors are trying to quantify how this purge might affect the Fed’s interest rate path, and market pessimism is evident.

Bloomberg economist Anna Huang said if DOGE achieves $100 billion in budget cuts, it would reduce CPI by 0.2 percentage points. If cuts reach $600 billion, the reduction would be equivalent to 0.8 percentage points. She believes that under such scenarios, the Fed would have to cut rates further. “Rate cuts in 2026 = Underestimating Elon,” she stated.

Following Trump’s latest tough rhetoric on tariffs and Beijing, worries over stricter chip restrictions on China sent semiconductor stocks tumbling. Intel and Nvidia each fell 1.5%, while the Netherlands’ ASML and ASMI dropped 2%. Japan’s Tokyo Electron declined 4.9%. Stocks tied to cryptocurrencies also fell as Bitcoin dropped below $90,000, hitting its lowest point since mid-November—erasing some of the gains seen after Trump’s re-election. MicroStrategy shares fell over 6%, and Coinbase dropped more than 5%.

3. U.S. Treasury Yield Analysis

During Trump’s first term, the stock market was the most important barometer for the president, a former real estate tycoon. However, as his second term enters its second month, the White House’s focus has shifted to a new metric: the 10-year Treasury yield.

Musk and Treasury Secretary Scott Bessent have highlighted lowering market borrowing costs as a goal—a target reminiscent of policies during Bill Clinton’s presidency.

They must pay attention to the Treasury market, particularly the 10-year yield, because it directly affects mortgage and corporate borrowing costs in the U.S. It remains unclear how the market will respond to Bessent’s deficit-reduction proposals and Musk’s criticism of government bureaucracy. Investors still hold cautious optimism about the chances of success.

Over the past few weeks, U.S. Treasuries have outperformed interest rate swaps of the same maturity. However, most creditors are still waiting for observable, tangible results.

Risk-off trends persist, and overall macroeconomic dynamics show signs of pressure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News