Crypto market plunges, over 300,000 liquidated: key factors you need to know

TechFlow Selected TechFlow Selected

Crypto market plunges, over 300,000 liquidated: key factors you need to know

Determine the necessary conditions for the market to regain bullish sentiment.

Author: Alea Research

Translation: Tim, PANews

In yesterday's report, we discussed several structural changes that have occurred in the cryptocurrency market over the past few months. Today, with U.S. markets closed, the total market cap of the crypto sector has dropped nearly 9%, and Bitcoin has fallen over 7% in the past 24 hours. Although Bitcoin rebounded from a fresh low above $87,000 to reclaim the $89,000 level, current momentum already appears weak.

In today’s report, we revisit market movements, aiming to clarify the drivers behind the current downturn in cryptocurrencies and assess what conditions are necessary for bullish sentiment to return.

Current macro and crypto environment

Over the past year, the overall movement of the crypto market has been highly correlated with Bitcoin. Starting in Q2 2024, both Bitcoin and altcoins entered a roughly six-month period of sideways consolidation. With the catalyst of the November U.S. election, the entire crypto market rallied almost across the board. However, this trend has recently reversed sharply, evidenced by the rapid divergence between Bitcoin and altcoin performance.

This sell-off lacks a clear trigger specific to the crypto space. We’ve previously detailed in our subscriber newsletters and emails the collapse of the Libra token and Bybit’s recent security breach. The ripple effects from Libra have severely damaged the Solana ecosystem, with SOL plunging nearly 45% over the past month. The Bybit incident is now largely under control, with the exchange claiming it has raised enough ETH to cover its ~$1.4 billion shortfall.

There were even positive developments yesterday: Citadel Securities announced an expansion into crypto market-making, possibly reflecting increasing regulatory clarity.

Robinhood previously disclosed that one-third of its Q4 revenue came from crypto services and plans to continue expanding in this area, yet the market reacted indifferently to such news about traditional financial institutions entering crypto.

Citadel Securities announces increased focus on crypto market-making

The market may currently be more focused on signals from the U.S. government, treating any policy moves short of establishing a "Strategic Bitcoin Reserve" (SBR) with skepticism—even viewing them as opportunities to sell on the news. This tendency is evident in market reactions to statements and executive orders from President Trump, his crypto and AI advisor David Sacks, and Senator Cynthia Lummis.

Market volatility may largely stem from Trump-era policies and their unexpected consequences. In some respects, the former president's delivery on campaign promises has been polarized: some key market-related policies remain unfulfilled, while others have advanced beyond expectations—this contradiction intensifies market uncertainty.

1. Tariff policy

Trump has repeatedly reversed course since taking office: initially announcing tariffs on Canada and Mexico, then pausing implementation; later introducing new metal tariffs affecting those countries; and most recently indicating full tariffs will ultimately be imposed. This flip-flopping not only increases market uncertainty but risks creating a 'boy who cried wolf' scenario in terms of policy credibility.

2. Immigration policy

The Trump administration has deported fewer undocumented immigrants so far compared to previous administrations. This may be seen positively by markets, as large-scale, rapid deportations could disrupt labor-intensive sectors like agriculture, residential construction, and services.

3. Foreign policy

The Trump administration has shown a tendency to distance itself from Europe, engaging in direct negotiations with Russia while bypassing regional allies like Ukraine. While not necessarily a major bearish event triggering unilateral market reactions, this approach has surprised some observers.

Markets inherently dislike uncertainty, and the Trump administration has amply demonstrated its capacity to generate it within its first month. From年初to date, U.S. equities have underperformed European and Chinese stocks, with the Nasdaq nearly in negative territory. This may reasonably explain why cryptocurrencies have performed poorly in Q1: despite Michael Saylor's "strategic accumulation" providing liquidity support and ETF inflows that kept Bitcoin relatively strong, the broader crypto market has significantly lagged.

Target shift: debt over equity?

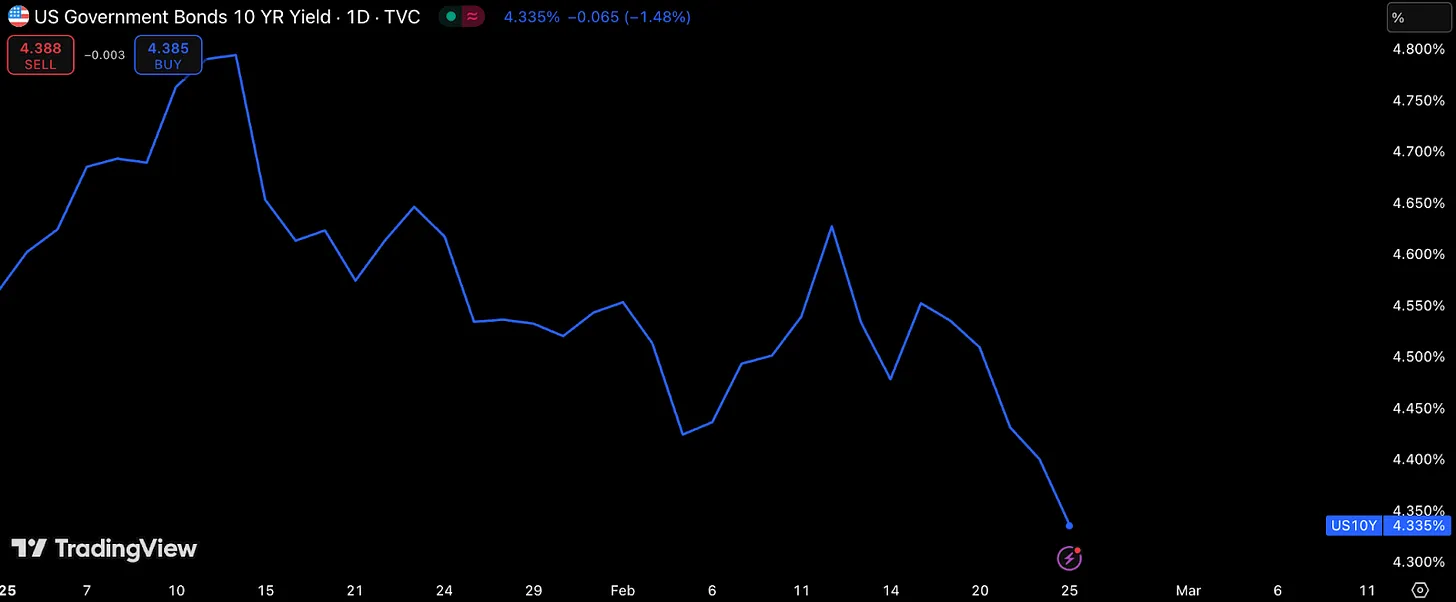

The simultaneous weakness in crypto and U.S. equities may be closely tied to the Trump administration's policy pivot toward lowering bond yields rather than boosting stock prices (let alone Bitcoin prices—White House attention to overall crypto performance remains minimal). If lowering bond yields is considered a benchmark for policy success, the current situation might appear more favorable than if judged solely by equity performance.

Since Trump took office, the yield on the U.S. 10-year Treasury note has declined significantly. This metric serves as an alternative gauge of long-term U.S. economic resilience: lower interest rates help reduce funding costs for homebuyers and large corporations.

Under the current macro backdrop, the U.S. government must balance short-term gains against long-term goals—stock market euphoria may simply not align with the Trump team’s definition of success. Over time, markets may gradually adapt to this administration’s unconventional approach. On the positive side, meaningful removal of regulatory barriers (as metaphorically suggested by DOGE) could unleash greater economic vitality. But in the medium term, large-scale federal layoffs and budget cuts may exert a contractionary effect on the economy and divert funds that might otherwise flow into markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News