Interpreting the Mint Blockchain Whitepaper: The Ambition and Future of an NFT-dedicated L2

TechFlow Selected TechFlow Selected

Interpreting the Mint Blockchain Whitepaper: The Ambition and Future of an NFT-dedicated L2

Mint Blockchain, as a Layer 2 infrastructure focused on NFTs and RWAs, is driving industry development through efficient, low-cost solutions.

Author: TechFlow

Introduction

Narratives in the crypto world always shift dramatically—while the meme frenzy on Solana cools down, public data shows capital quietly returning to the ETH ecosystem.

But what else is there to explore on Ethereum?

It inevitably leads us back to the two most crowded sectors: Layer2 and NFTs. Yet both seem trapped in an innovator's dilemma:

In the L2 arena, performance arms races have turned ZK-Rollup and OP-Rollup TPS figures into footnotes of "meaningless internal competition"; in the NFT space, the collectible narrative around PFP profile pictures is fading, with trading volume shrinking over 90% from its 2021 peak.

While the Ethereum ecosystem consumes itself between “faster chains” and “more expensive JPGs,” we’ve recently observed a project that appears to be breaking this cycle.

Mint Blockchain, the first NFT-dedicated L2 within the Optimism Superchain, avoids meaningless TPS competition and instead takes a more radical path: making NFTs the “value router” connecting the physical world and AI

When AI begins to own NFTs, what underlying protocol support is required? Beyond trading small images, which use cases can unlock the non-financial attributes of NFTs?

The answers to these long-standing questions are all embedded in Mint Blockchain’s recently released whitepaper.

Meanwhile, Mint’s official website has launched a series of marketing campaigns building momentum for the $MINT token airdrop, and the whitepaper partially reveals the tokenomics—an aspect most users care deeply about.

Therefore, seizing this moment, TechFlow attempts a deep dive into Mint’s whitepaper to answer the following question:

Can this seemingly unconventional L2 truly move beyond blind TPS worship and deliver scenario-specific services tailored for NFTs?

Key Highlights

Project Positioning:

-

Mint Blockchain is an Ethereum-based L2 focused on supporting the full lifecycle of NFTs, including creation, assetization, trading, cross-chain liquidity, and data analytics.

-

As a core member of the Optimism Superchain, Mint leverages OP Stack technology to provide efficient, low-cost blockchain infrastructure, driving widespread adoption of NFTs across consumption, finance, social, and real-world assets (RWA) sectors.

Value Propositions:

-

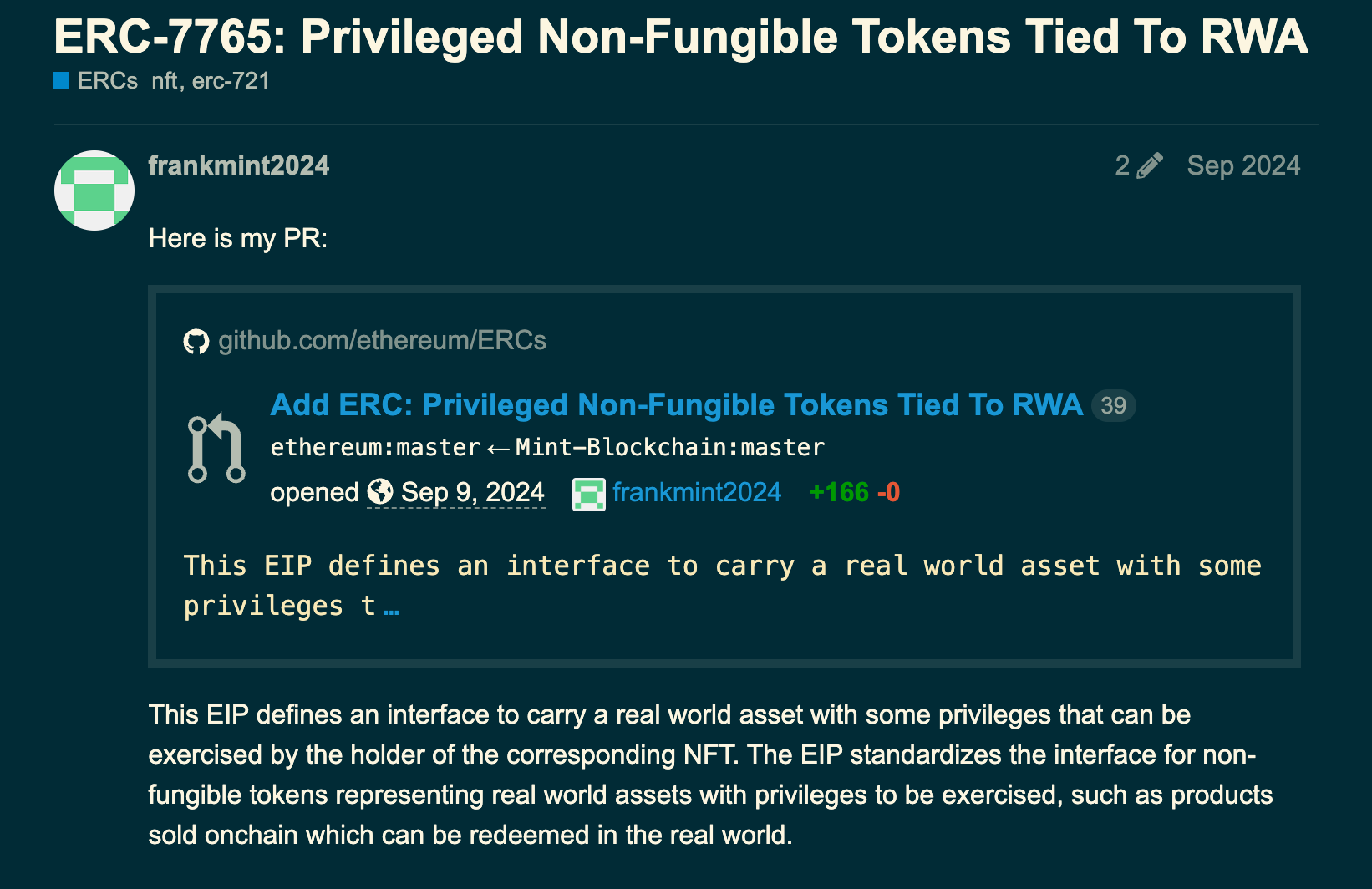

Innovative Protocol Standard: The ERC-7765 protocol enables seamless integration between NFTs and real-world assets, opening up an entirely new category for RWA NFTs.

-

Cross-chain Liquidity Aggregation: Mint Liquid provides liquidity aggregation for multi-chain NFTs and tokens, building the world’s largest NFT order routing network.

-

Multi-module Support: From Mint Studio’s NFT creation tools to RareShop’s RWA NFT marketplace, Mint offers full-stack NFT ecosystem support.

-

Efficient Economic Model: Through $MINT staking & restaking mechanisms, users can earn up to 15% annualized yield while sharing network revenue, enhancing capital efficiency.

-

Optimism Superchain Member: As a key part of the OP Superchain, Mint benefits from strong technical support and community resources.

Noteworthy Information:

-

$MINT Airdrop: In addition to participating in Mint Forest and mainnet activities or staking MintID to receive $MINT airdrops, Mint has launched the NFT Legends Season campaign, allocating 1% of total $MINT supply (10 million tokens) to NFT OG users, rewarding historical contributors.

-

Staking Rewards: $MINT holders can earn dual rewards through staking & restaking, including 15% annualized yield and a share of network revenue.

-

Early Ecosystem Benefits: As a rapidly growing Layer 2 network, Mint has already attracted over 400,000 active users and 100 ecosystem applications; early participants stand to gain significant first-mover advantages.

-

RWA NFT Opportunities: RareShop offers innovative use cases for tokenizing real-world assets, enabling users to participate in the world’s first RWA NFT marketplace via the Mint network.

Why Do NFTs Need a Dedicated Layer 2?

Today, when people talk about NFTs, they often only recall the frenzied scenes of “trading small pictures” and the subsequent market crash.

Talking about NFTs now may seem somewhat out of place, but speculation does not imply the end of value.

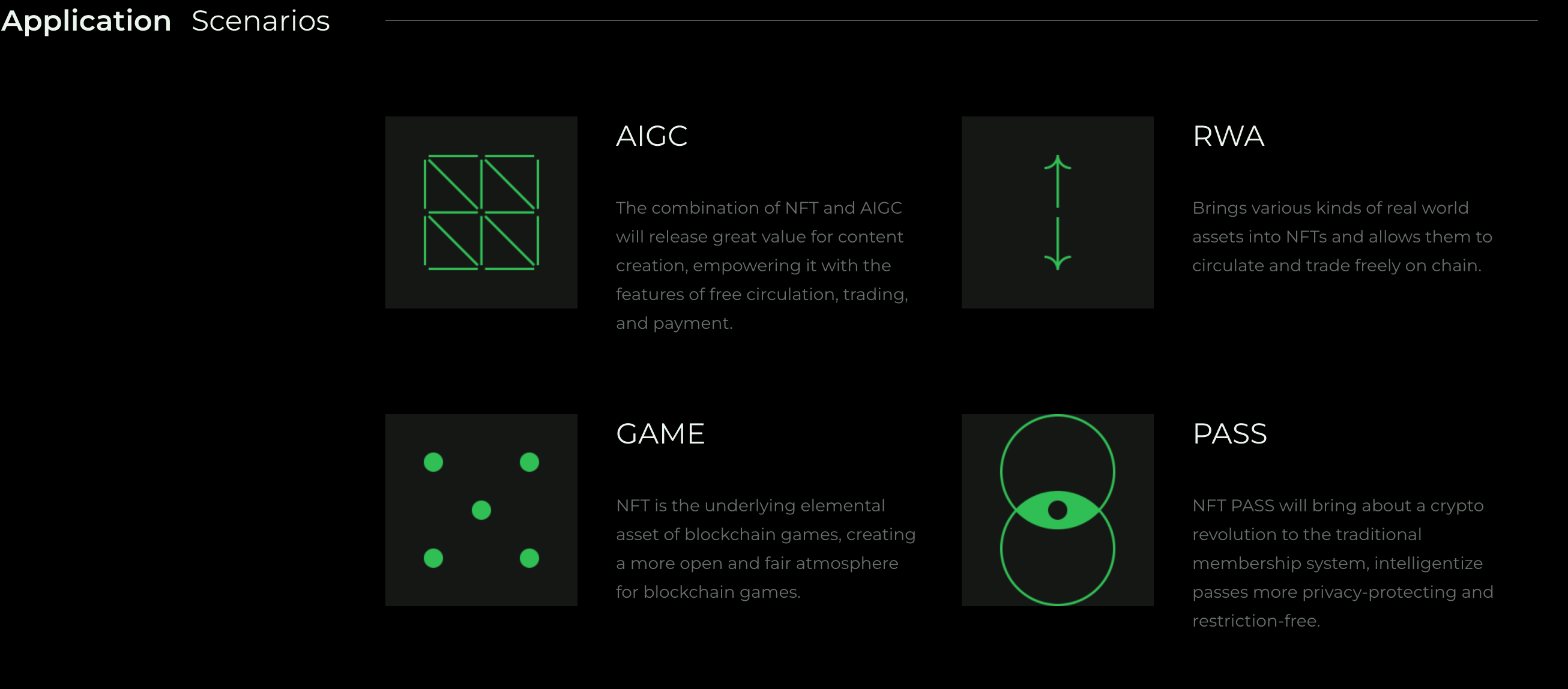

Beyond digital art, NFTs can serve serious purposes such as representing RWAs—acting as digital carriers for physical assets—and can also be used in identity verification, copyright protection, game asset management, and many other broader scenarios...

Yet these potentials remain largely untapped, partly because current infrastructure lacks dedicated support for NFTs.

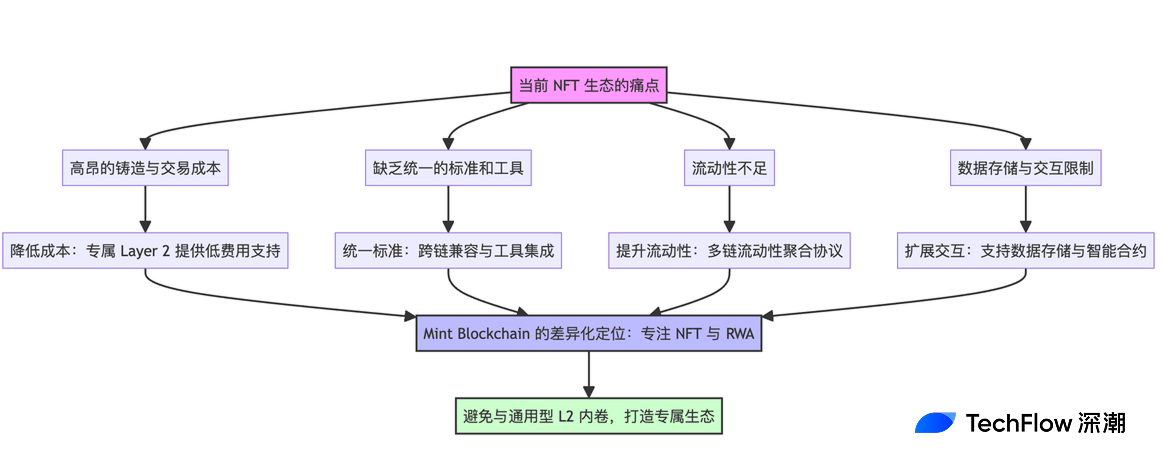

We’ve seen that NFTs face several persistent issues:

-

High minting and transaction costs: Minting and trading NFTs on the Ethereum mainnet remains prohibitively expensive, especially for small creators and average users.

-

Lack of unified standards and tools: Creating, managing, and transferring NFTs across chains is still complex, with developers and creators facing compatibility challenges across different blockchains.

-

Insufficient liquidity: Despite the expanding NFT market, liquidity remains far below that of token markets, making it difficult to quickly trade or realize value for many NFT assets.

-

Limits in data storage and interaction: Demand for data storage and interactive capabilities in the NFT ecosystem is growing, yet existing infrastructure offers limited support.

This creates a unique narrative and infrastructure gap that Mint Blockchain aims to fill—providing a dedicated Layer 2 solution for the NFT ecosystem.

Positioning matters, especially in the overcrowded L2 space.

Judging from the whitepaper, Mint does not attempt to directly compete with general-purpose L2s, but instead focuses exclusively on NFT and RWA domains, building customized infrastructure for these assets.

This differentiated positioning avoids the trap of meaningless performance competition and unlocks new possibilities for NFT creators, developers, and users.

Mint Blockchain: Layer 2 Infrastructure for the NFT World

According to official information in the whitepaper, Mint Blockchain is an Ethereum Layer 2 network jointly developed by NFTScan Labs and the MintCore team, initiated in October 2023 and launched its mainnet in May 2024, entering the phase of ecosystem development.

In traditional Layer 2 networks, NFTs are typically treated as an "added feature," lacking dedicated technical support.

Mint Blockchain, however, aims to unlock the true potential of NFTs through specialized infrastructure, facilitating their transition from "speculative tools" to "value tools."

Furthermore, Mint Blockchain is built on OP Stack, ensuring native EVM compatibility; however, its real innovation lies in optimizations specifically tailored for NFTs.

-

Dedicated Full Lifecycle Support for NFT and RWA: From minting to trading, liquidity management to cross-chain transfers, Mint Blockchain offers a complete suite of optimized tools and modules designed specifically for the NFT ecosystem.

-

Optimized Storage and Data Layer: Specifically enhanced for NFT storage, liquidity, and data management. For example, it supports efficient batch minting and transfer operations, solving the inefficiencies in NFT transactions seen on traditional blockchains.

Additionally, as mentioned earlier, NFTs can be applied in RWA contexts as proof of real-world ownership. But a single chain alone cannot realize this vision. Mint Blockchain introduces a unique ERC-7765 standard designed to solve technical hurdles in linking NFTs with real-world assets.

Through this standard, NFTs can be bound to real-world assets and carry exercisable rights. For instance, an NFT ticket can grant access to an offline event, and an NFT product can correspond to actual logistics delivery.

We won’t delve deeper into technical details here; interested readers can refer to the original whitepaper or the protocol documentation.

Beyond these technical aspects, Mint’s whitepaper also touches on the trending topic of AI Agents—suggesting using NFTs to link users and AI Agents, allowing every individual (including humans and AI Agents) to freely own NFT assets.

We will expand on this AI-related content in the next section.

Overall, Mint Blockchain is redefining the scope of L2 usage by focusing on NFT and RWA optimization, combining innovative architectures (such as OP Stack and the ERC-7765 standard) with intelligent tools (like AI Agents).

From Creators to Users: Exploring Mint Blockchain’s Ecosystem Toolkit

A blockchain exists—but how do specific applications materialize?

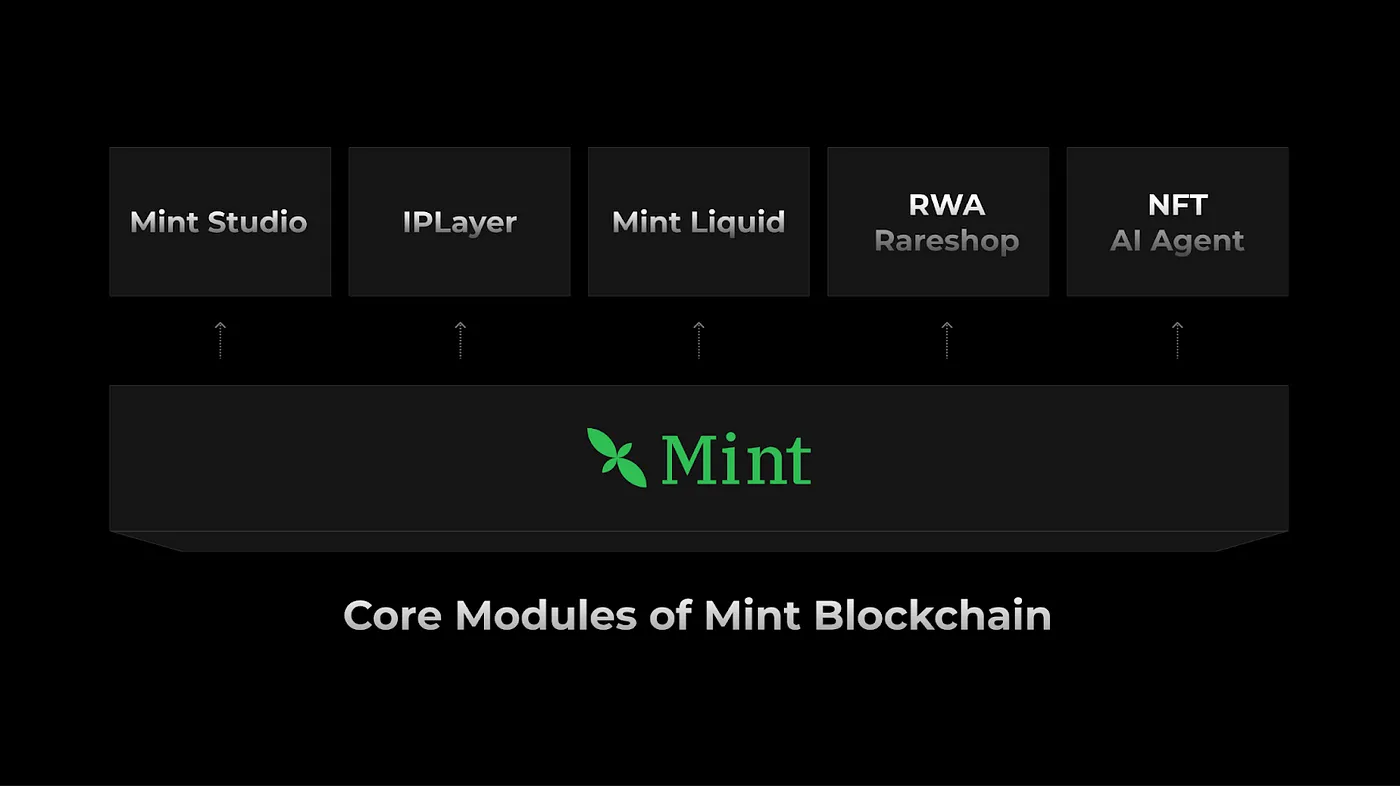

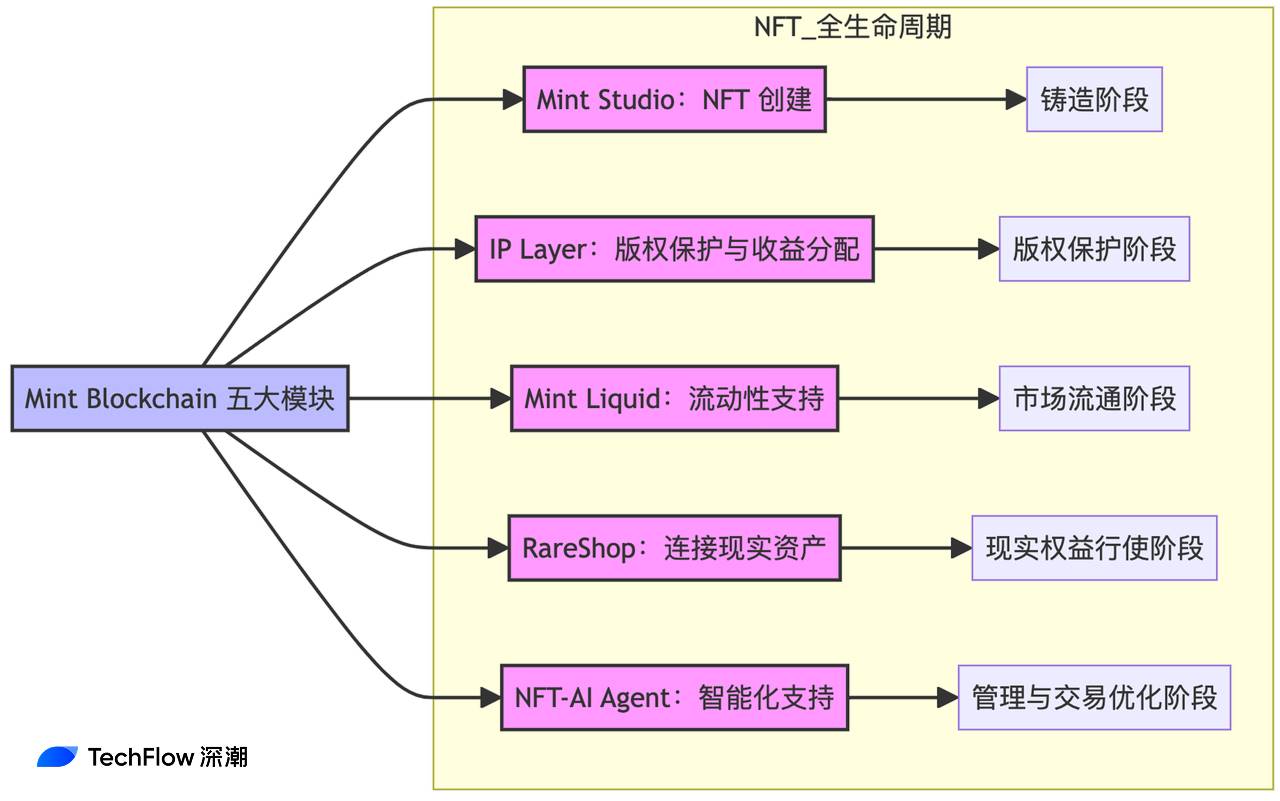

Beyond its L2, Mint Blockchain has designed five core modules covering the entire journey from NFT creation to circulation and real-world rights redemption, forming a complete NFT infrastructure.

-

Mint Studio: Cross-chain NFT Creation Tool for Creators

Mint Studio is one of Mint Blockchain’s core tools, designed specifically for NFT creators and supporting various forms of NFT creation (text, image, audio, video).

One of its key advantages is offering broader cross-chain flexibility.

Creators can mint NFTs across multiple blockchain networks (e.g., Berachain, Base, Optimism) via Mint Studio, enabling cross-chain asset deployment.

Additionally, the module features a user-friendly interface, allowing even non-technical creators to easily mint NFTs.

Overall, Mint Studio aims to lower the barrier to NFT creation and offer creators greater creative freedom and technical support.

-

IP Layer: Intellectual Property Assetization and Pricing Platform for NFTs

IP Layer is a module dedicated to NFT intellectual property management, helping creators transform digital assets into legally enforceable IP rights and implement revenue distribution via smart contracts.

Creators can register NFT copyrights on-chain, ensuring the uniqueness and legitimacy of their work. Through smart contracts, creators automatically receive royalties from secondary sales, avoiding copyright disputes common in traditional markets.

The core goal of this layer is to protect creators’ rights while introducing greater transparency and trust into the NFT market.

-

Mint Liquid: Multi-chain Liquidity Aggregation Protocol

Mint Liquid is Mint Blockchain’s liquidity solution, addressing fragmented trading and insufficient liquidity in the NFT market.

This module supports cross-chain trading of NFTs and tokens, enabling users to freely transfer assets across networks, while delivering a more efficient experience and reduced transaction costs.

Mint Liquid aims to create an efficient environment for circulating NFTs and RWAs, boosting market activity and trading efficiency.

-

RareShop: Consumer-Facing RWA NFT Marketplace

RareShop is an NFT marketplace focused on real-world assets (RWA), allowing users to purchase, trade, and exercise real-world rights through NFTs.

Users can acquire corresponding physical goods or services (e.g., limited-edition items, offline event tickets) by purchasing NFTs.

The marketplace also supports multiple cryptocurrency payment options, offering greater flexibility. From a privacy standpoint, it integrates zero-knowledge proofs and other technologies to ensure transaction privacy.

-

NFT-AI Agent: Intelligent Tool Integrating AI and NFT Data Analytics

Amid rising interest in AI Agents, Mint Blockchain offers an intelligent tool module leveraging AI to deliver comprehensive NFT data analytics and market insights.

For example, AI Agents can analyze NFT market data in real time to help users identify trends. By analyzing historical transaction data, AI Agents can also provide NFT pricing recommendations.

On the creative side, AI Agents can generate NFT creation suggestions based on user preferences or assist in completing artworks.

The goal of this module is to reduce decision-making costs for users and inspire creators with new ideas.

From the five modules outlined by Mint, we see that they are highly integrated and collectively cover the full lifecycle of NFTs:

-

Mint Studio handles NFT creation;

-

IP Layer ensures copyright protection and revenue distribution;

-

Mint Liquid provides liquidity support and promotes market circulation;

-

RareShop bridges NFTs with real-world assets;

-

NFT-AI Agent delivers intelligent support to optimize NFT management and trading.

Overall, whether it’s minting, trading, or exercising real-world rights, Mint Blockchain’s five core modules form a complete NFT infrastructure addressing these needs.

Current Ecosystem Progress

Since its mainnet launch last May, how has Mint performed? Let’s start with some fundamental metrics.

-

Active Wallet Addresses: Reached 590,000, with 276,000 classified as active users.

-

Daily Transaction Volume: Exceeds 330,000 transactions, primarily concentrated in NFT and RWA (real-world asset) related trades.

-

Number of Ecosystem Applications: Over 100 apps launched, including native apps like MintSwap Finance, Mint Forest, and RareShop.

-

Global Community: Supports 12 languages, with over 300,000 community members.

Additionally, in May 2024, the project secured a $5 million seed round from investors including Jsquare, BlockAI Ventures, SNZ, and Mask Network.

More notably, in October of last year, the project also received a $2 million strategic investment from the Optimism Foundation, along with 1 million $OP governance voting rights—clearly signaling strong backing from the OP ecosystem.

These milestones demonstrate that Mint Blockchain has not only achieved technological breakthroughs but also strengthened its ecosystem position through funding and partnerships.

Beyond the whitepaper, we found in the Roadmap document that the project will focus heavily on tokenomics and staking mechanisms this year.

The token TGE (Token Generation Event) is likely the focal point for most participants.

$MINT Tokenomics and Airdrop Campaign

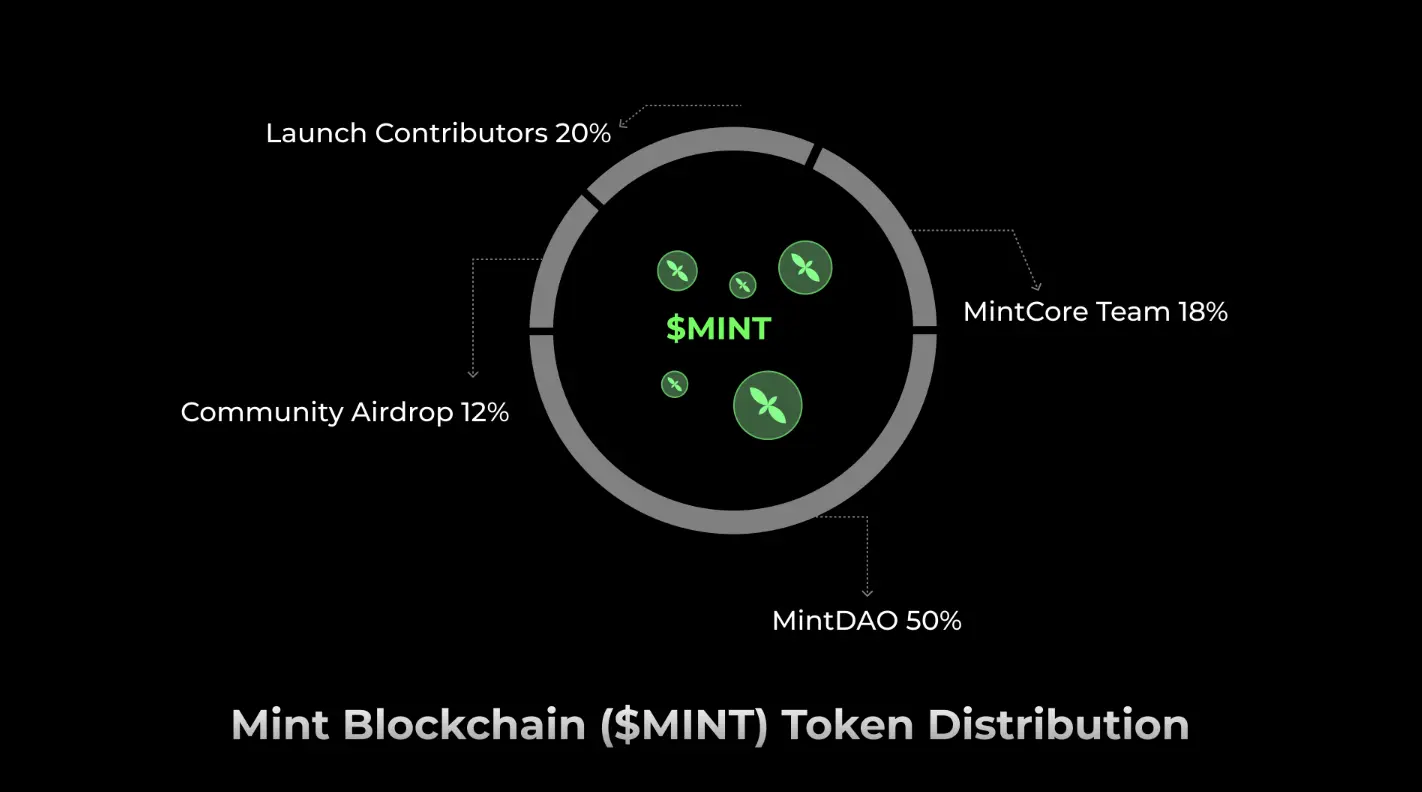

As the core value carrier of the ecosystem, $MINT’s allocation is designed to balance community incentives with long-term development. The whitepaper outlines the specific $MINT distribution plan:

-

Total Supply: 1 billion $MINT tokens.

-

Allocation Breakdown:

-

82% Allocated to Community Development:

-

MintDAO: 50%, used for ecosystem incentives, staking rewards, and infrastructure development.

-

Launch Contributors: 20%, rewarding early supporters and developers.

-

Community Airdrops: 12%, distributed through campaigns and incentive programs to grow the community.

-

-

18% Allocated to the MintCore Team for team development and long-term operations.

-

However, no further details are currently available regarding unlock conditions, ratios, or timelines; updates may come via official social channels.

In terms of utility, $MINT plays several critical roles within the ecosystem:

-

Governance Rights: $MINT holders can participate in network governance, including proposal voting and ecosystem decisions.

-

Ecosystem Incentives: Used to reward developers, creators, and users who contribute to ecosystem growth.

-

Network Transaction Asset: $MINT is the primary payment token on the network, used for transaction fees, asset issuance, and other on-chain activities.

-

Asset Pricing: $MINT serves as the pricing unit for RWAs, NFTs, tokens, and other assets, becoming a key value benchmark within the ecosystem.

-

Staking and Restaking: Through $MINT staking and restaking mechanisms, users earn network revenue shares and additional rewards.

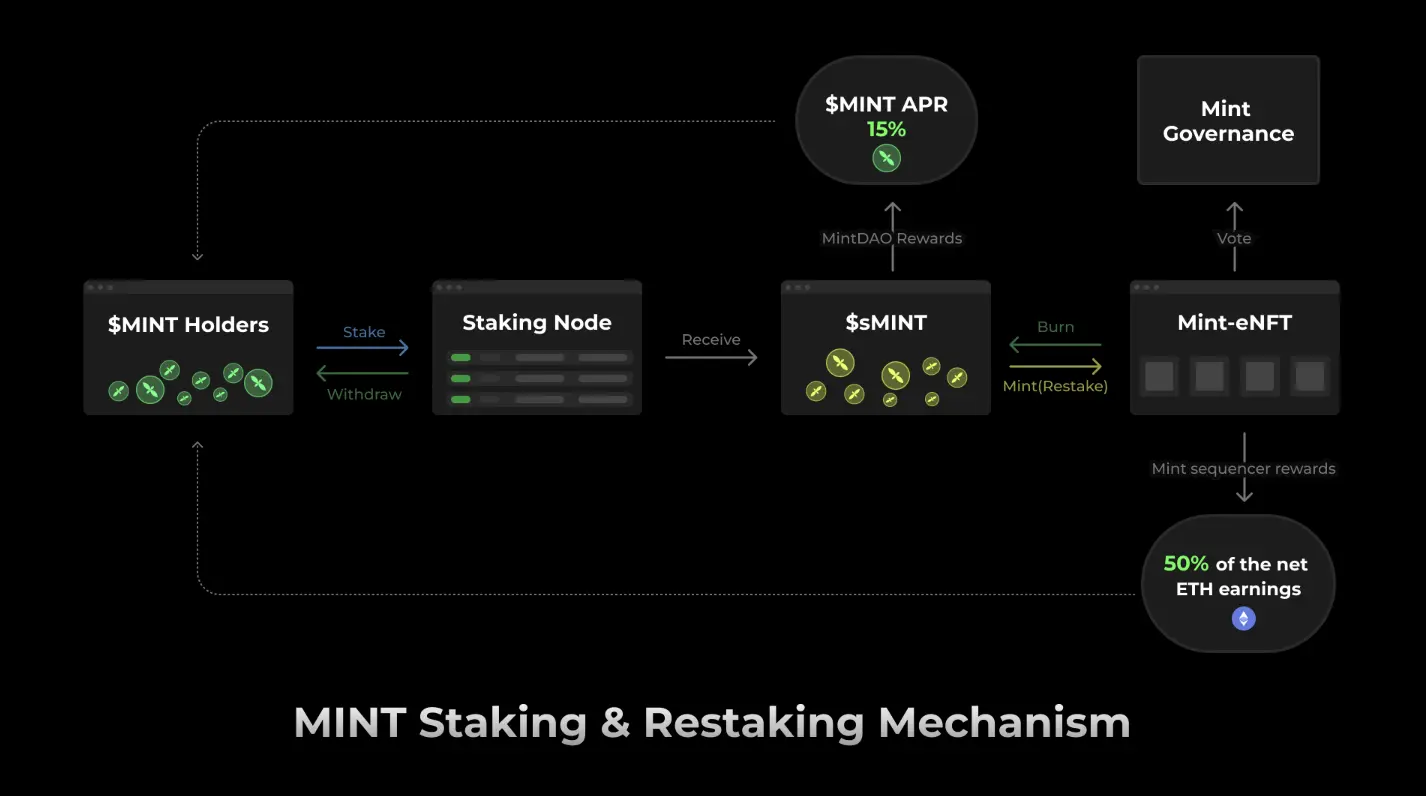

Among these, the restaking mechanism tied directly to earnings deserves deeper exploration.

-

Staking Mechanism:

-

Users can stake $MINT, $ETH, or NFT assets through the MintPool protocol.

-

After staking, users must select a staking node (either super node or basic node):

-

Super Nodes: Operated by ecosystem infrastructure providers and investment institutions, requiring large amounts of $MINT staked.

-

Basic Nodes: Run by community members and developers, with lower entry barriers and higher openness.

-

-

Staking Rewards: Users earn 15% APR (annual percentage rate) through staking, funded by MintDAO.

-

-

Restaking Mechanism:

-

After staking $MINT, users receive staking receipts called sMINT (Staked MINT Tokens).

-

Users holding sMINT can convert them into BC721 Mint-eNFTs (strategy NFTs based on bonding curves).

-

Holders of BC721 Mint-eNFTs will receive 50% of Mint Blockchain sequencer revenue (after deducting DA and Superchain fees).

-

Through staking and restaking, users not only earn token rewards but also share in network revenue. This mechanism significantly enhances $MINT’s capital efficiency and provides users with sustainable long-term returns.

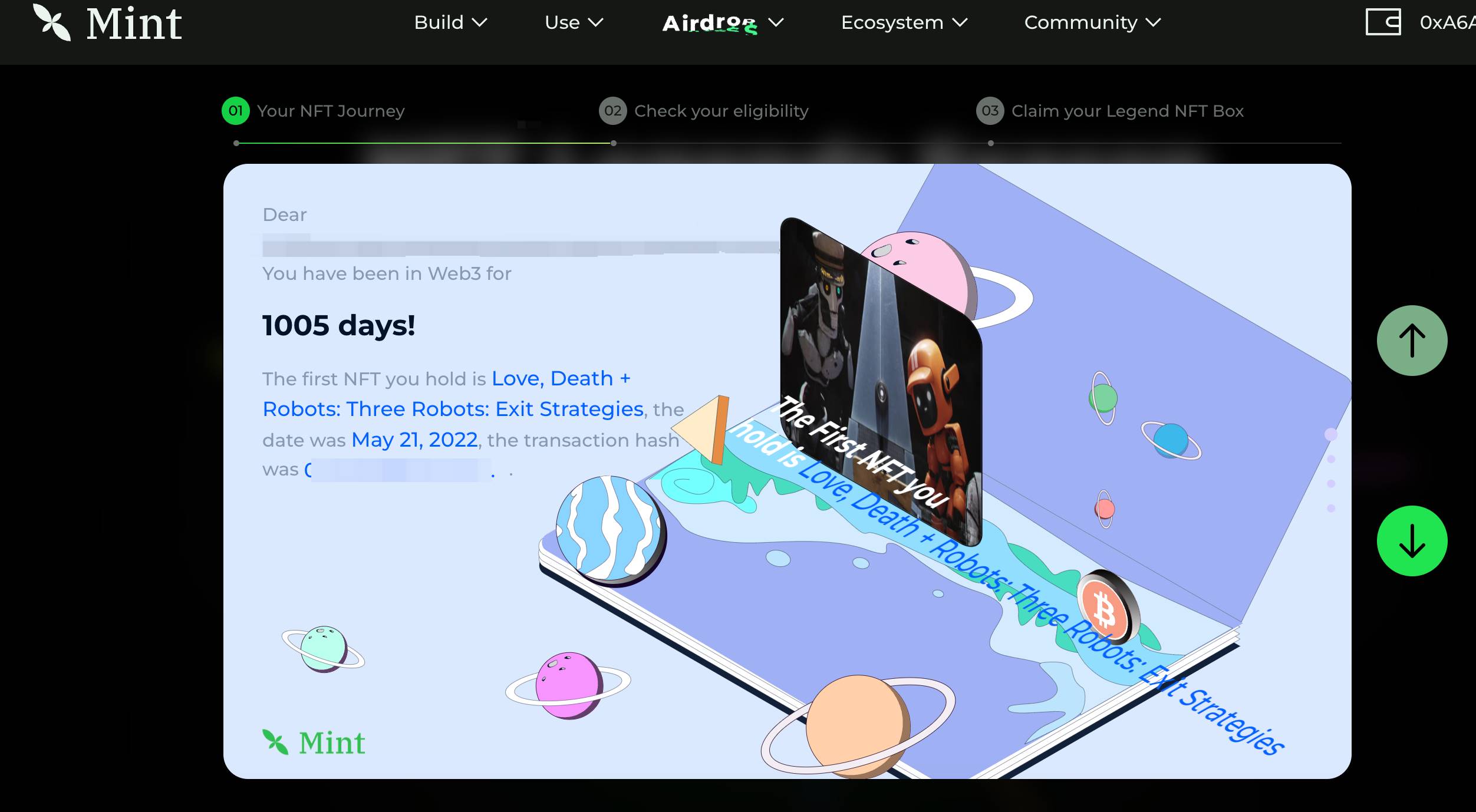

Airdrop Campaign: NFT Legends Season

On the much-anticipated airdrop front, Mint Blockchain has launched the NFT Legends Season to further incentivize community participation.

The NFT Legends Season airdrop allocates 1% of total $MINT supply (i.e., 10 million tokens), running from January 2, 2025, to February 15, 2025.

During this period, eligible users can claim NFT Legend Boxes. These boxes are central to the campaign, each containing rewards of varying tiers: A-tier (common rewards), S-tier (high-value rewards), SS-tier (rare rewards), and SSS-tier (legendary rewards). Among these, the SSS-tier rewards are the most coveted, offering the highest quantities of $MINT tokens.

Participation Criteria:

-

OG NFT Holders: Users holding specific NFT collections (e.g., CryptoPunks, BoredApeYachtClub) can claim different numbers of NFT Legend Boxes.

-

Main NFT Market Users: Users trading on platforms like OpenSea and Blur can claim Boxes based on trading volume.

-

NFTFi Platform Users: Users who have staked NFTs on platforms such as Blur Lending and BendDAO also qualify.

Users who have claimed boxes can now open them, with the process remaining open until February 28, locking in their $MINT airdrop allocations.

Unlimited Possibilities: From NFTs to Real-World Assets

Overall, Mint Blockchain, as a Layer 2 infrastructure dedicated to NFTs and RWAs, is driving industry progress through efficient, low-cost solutions.

With its five core modules and technical support from the Optimism Superchain, Mint not only addresses industry pain points like NFT standardization and liquidity but also lays a solid foundation for integrating NFTs with real-world assets.

Through innovative incentives like the $MINT airdrop campaign (NFT Legends Season), Mint has successfully attracted participation from OG users and new players alike, expanding its community size and ecosystem influence. Looking ahead, Mint aims to become the world’s largest NFT application network, bridging on-chain and off-chain assets through RWA support and unlocking new practical applications for blockchain technology.

From a crypto enthusiast’s perspective, Mint Blockchain offers excellent opportunities for user and developer engagement. Whether through early ecosystem benefits or airdrop campaigns, the incentives are broad and accessible.

Participating moderately could be a solid choice amid a market currently lacking clear trends and offering limited returns in secondary markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News